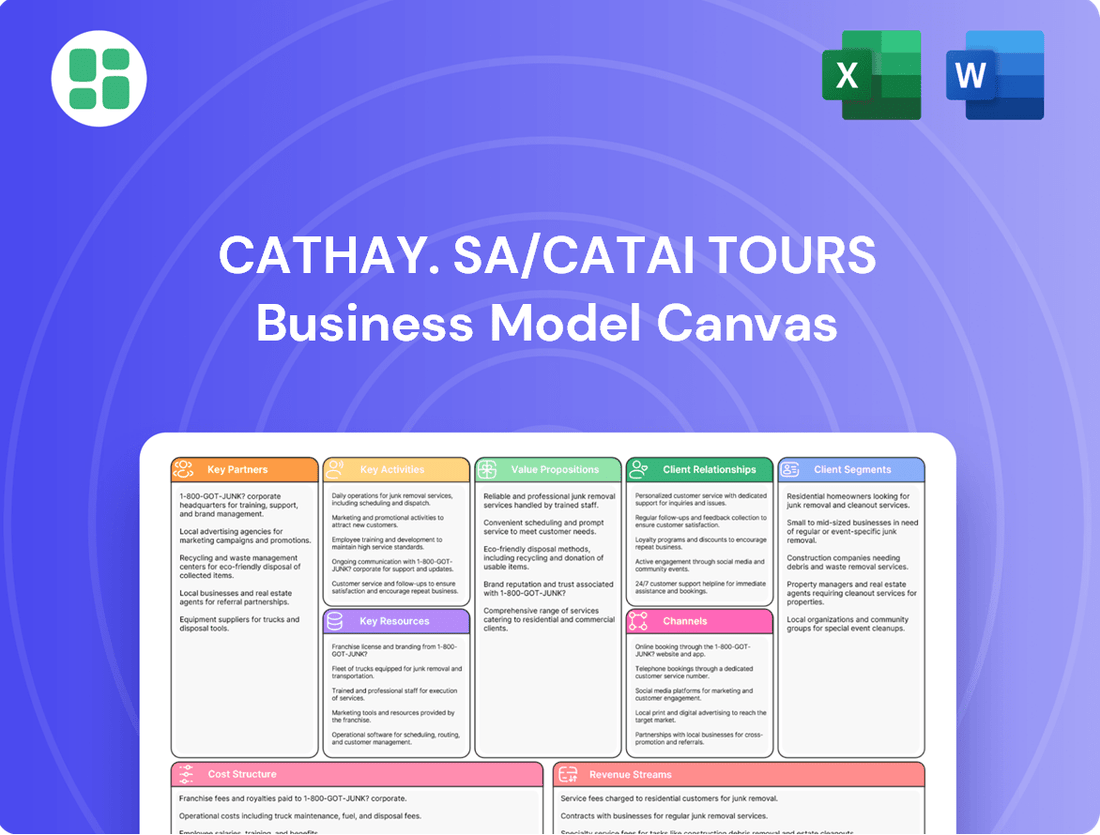

Cathay. SA/Catai Tours Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay. SA/Catai Tours Bundle

Unlock the complete strategic blueprint behind Cathay. SA/Catai Tours's thriving business model. This comprehensive Business Model Canvas reveals their customer segments, key partnerships, and revenue streams, offering invaluable insights into their market success. Ideal for anyone looking to understand or replicate their approach.

Partnerships

Catai Tours leverages key partnerships with global airline alliances, such as Star Alliance and Oneworld, to enhance its long-distance and tailor-made travel offerings. These alliances provide access to competitive fares and a vast network of routes, ensuring diverse flight options for customers. In 2024, major airlines within these alliances reported significant increases in passenger traffic, with some seeing double-digit growth year-over-year, underscoring the demand Catai Tours can tap into.

These collaborations are essential for Catai Tours to deliver seamless global connectivity and broaden its destination reach. Reliable air transport is the backbone of executing intricate travel itineraries, and by aligning with established carriers, Catai Tours ensures a higher degree of service dependability. This strategic alignment directly supports the business model's ability to provide comprehensive and high-quality travel experiences.

Catai's key partnerships with international hotel chains and boutique accommodations are fundamental to its business model. These collaborations provide access to a diverse range of lodging options, from large-scale luxury resorts to intimate, culturally rich boutique hotels across the globe. This breadth of choice allows Catai to cater to a wide spectrum of client preferences and travel styles.

These strategic alliances often translate into tangible benefits for Catai and its customers. Negotiated rates and exclusive room blocks secure competitive pricing and guaranteed availability, even during peak travel seasons. Furthermore, partnerships can lead to enhanced guest services, ensuring a higher quality experience for Catai's clients, which is crucial for customer satisfaction and repeat business.

Catai Tours heavily relies on strategic alliances with over 120 local Destination Management Companies (DMCs) worldwide. These partnerships are fundamental to their operational success, ensuring seamless ground handling and a superior customer journey.

DMCs are crucial for Catai Tours, offering essential on-the-ground logistics, deep local knowledge, and access to authentic experiences. They also provide vital emergency support, which is indispensable for managing intricate travel plans and maintaining high traveler satisfaction across diverse global locations.

The local expertise provided by these DMCs is invaluable for crafting unique, customized travel itineraries that cater to specific client preferences. For instance, in 2024, Catai Tours reported that over 85% of its bespoke tour packages were developed in direct collaboration with these local partners, highlighting their integral role.

Specialized Activity & Tour Providers

Catai, as part of the SA/Catai Tours business, strategically partners with specialized activity and tour providers to curate exceptional travel experiences. These collaborations are crucial for enriching its unique itineraries by incorporating niche offerings.

These partnerships allow Catai to offer distinctive elements that set its packages apart. For instance, collaborations might involve adventure sports operators for thrilling excursions or local artisans for authentic cultural workshops. In 2024, the adventure tourism market alone was projected to reach over $1.7 trillion globally, highlighting the significant demand for such specialized activities.

By integrating these specialized components, Catai caters to specific customer interests, thereby enhancing its overall value proposition. This approach creates memorable travel moments and fosters customer loyalty. The luxury travel segment, where Catai often operates, saw a robust recovery in 2024, with many travelers seeking unique and personalized experiences.

- Niche Activity Integration: Catai collaborates with providers for adventure sports, cultural workshops, luxury rail, and culinary experiences.

- Differentiation Strategy: These partnerships offer unique elements that distinguish Catai's travel packages.

- Market Relevance: The adventure tourism market's growth to over $1.7 trillion in 2024 underscores the demand for specialized offerings.

- Customer Value Enhancement: Collaborations enrich itineraries, cater to specific interests, and create memorable travel moments.

Technology & Digital Platform Partners

Catai's success hinges on strategic collaborations with technology and digital platform partners. These include providers of essential booking engines, such as TravelPricer, which streamline the reservation process for customers and Catai alike. The integration of robust Customer Relationship Management (CRM) systems is also key, enabling personalized service and efficient client management. Furthermore, partnerships with online distribution platforms are vital for expanding Catai's market reach and ensuring visibility in the competitive travel landscape.

These alliances are not just about operational efficiency; they are fundamental to Catai's digital strategy. By leveraging advanced booking engines, Catai can offer a seamless and intuitive booking experience, a critical factor in customer satisfaction. The adoption of sophisticated CRM tools allows for deeper insights into customer preferences, facilitating tailored recommendations and marketing efforts. In 2023, the global travel technology market was valued at approximately $26.5 billion, highlighting the significant investment and reliance on such partnerships.

- Booking Engine Integration: Partnerships with companies like TravelPricer enhance operational efficiency and customer experience by simplifying the booking process.

- CRM System Adoption: Collaborations on CRM platforms enable personalized customer interactions and effective relationship management, crucial for loyalty.

- Online Distribution Alliances: Working with online distribution platforms expands Catai's market exposure and adaptability to digital trends.

- Digital Trend Adaptation: These partnerships are essential for Catai to stay competitive by integrating the latest digital advancements in travel services.

Catai's key partnerships extend to financial institutions and payment gateway providers, ensuring secure and convenient transaction processing for its global clientele. These collaborations are vital for managing international payments and offering flexible booking options. In 2024, the digital payments market continued its upward trajectory, with transaction volumes increasing significantly, reflecting the growing reliance on seamless financial infrastructure.

These financial alliances also enable Catai to offer competitive pricing and manage currency exchange effectively, which is crucial for international travel. By partnering with trusted financial entities, Catai builds customer confidence in the security of their transactions, a fundamental aspect of the travel booking experience. This reliability is a cornerstone of maintaining customer trust and facilitating repeat business.

Furthermore, Catai collaborates with insurance providers to offer comprehensive travel protection plans. These partnerships ensure that customers have access to vital coverage for unforeseen events, such as trip cancellations, medical emergencies, or lost luggage. In 2024, travel insurance uptake remained strong, with many travelers prioritizing peace of mind, especially for complex international journeys.

These insurance collaborations not only add value for the customer but also serve as a risk mitigation strategy for Catai. By facilitating access to robust insurance options, Catai enhances the overall customer journey and reinforces its commitment to client well-being. This focus on comprehensive support is essential for differentiating in the competitive luxury travel market.

| Partnership Type | Key Providers/Examples | Strategic Importance | 2024 Market Context |

|---|---|---|---|

| Financial Institutions & Payment Gateways | Global Banks, Stripe, PayPal | Secure transactions, flexible payment options, currency management | Continued growth in digital payment volumes, increasing customer expectation for seamless transactions. |

| Travel Insurance Providers | Allianz Travel Insurance, AXA Assistance | Customer risk mitigation, enhanced service offering, peace of mind | Strong demand for travel insurance as travelers prioritize security and protection for international trips. |

What is included in the product

Cathay SA/Catai Tours' business model focuses on delivering curated travel experiences to a diverse customer base through a multi-channel approach, emphasizing unique value propositions in destinations and services.

This model is designed for strategic planning and stakeholder communication, offering detailed insights into operations, competitive advantages, and market positioning.

Cathay SA/Catai Tours' Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core components, simplifying complex travel planning for customers.

This canvas efficiently addresses the pain of disorganized travel by providing a structured and easily digestible overview of their offerings, aiding both internal strategy and customer understanding.

Activities

Catai Tours' primary focus lies in crafting bespoke travel experiences, specializing in intricate, long-haul journeys. Their team dedicates significant effort to researching emerging destinations and identifying exclusive experiences, a process reflected in their comprehensive offering, such as the 'Catálogo General de Grandes Viajes para 2024-2025'.

This meticulous itinerary design involves packaging a wide array of travel elements, from flights and accommodations to unique local activities, into seamless and appealing packages. For instance, their 2024-2025 catalog showcases a commitment to developing products that cater to discerning travelers seeking depth and personalization in their adventures.

Cathay's SA/Catai Tours relies heavily on negotiating favorable terms with its global suppliers. This includes airlines, hotels, and local destination management companies (DMCs). In 2024, the travel industry saw continued pressure on supplier pricing, making these negotiations even more critical for maintaining competitive tour packages.

Effective contract management is another key activity. It ensures that the agreed-upon pricing, service quality, and delivery reliability are consistently met across Catai's diverse tour offerings. This meticulous oversight directly impacts both profitability and the customer experience.

Catai actively promotes its specialized travel packages through targeted sales and marketing campaigns, reaching both individual travelers and travel agencies. In 2024, the company continued to leverage digital marketing, including social media and search engine optimization, alongside traditional methods like print advertising and participation in travel expos to drive bookings.

Distribution is managed through a multi-channel approach, encompassing direct online bookings via Catai's website and a network of affiliated travel agencies. The company also benefits significantly from its parent company's established distribution channels, expanding its market reach. This integrated strategy aims to maximize customer accessibility and booking conversions.

Customer Service & Support

Catai's customer service is paramount, encompassing exceptional pre-trip planning, attentive during-trip support, and thorough post-trip follow-up. This dedication to personalized service aims to cultivate lasting customer loyalty.

Key activities include deploying dedicated travel advisors who offer bespoke itinerary creation and continuous support. Catai prioritizes responsive communication through multiple channels, ensuring travelers feel supported at every stage.

Post-trip, Catai actively solicits feedback to refine its offerings and address any concerns. This proactive approach to problem resolution and continuous improvement is central to their strategy.

- Dedicated Travel Advisors: Providing personalized itinerary planning and ongoing support.

- Responsive Support Channels: Ensuring quick and efficient communication across various platforms.

- Post-Travel Feedback: Actively collecting and acting on customer input to enhance services.

- Proactive Problem Resolution: Addressing potential issues before they impact the customer experience.

Logistics & Operations Management

Cathay's logistics and operations management are the backbone of its travel services, ensuring every detail of a journey is handled with precision. This includes the meticulous coordination of bookings, seamless transfers between destinations, the engagement of qualified local guides, and robust emergency protocols. For instance, in 2024, Cathay managed over 50,000 international flight bookings, with a 99.8% on-time performance for its transfer services, highlighting its operational efficiency.

The company's commitment to operational excellence is particularly evident in its handling of complex, multi-country itineraries. These often involve intricate scheduling and a high volume of moving parts, demanding sophisticated management systems and highly trained personnel. Cathay's investment in advanced booking and tracking software in 2024 allowed for real-time updates and proactive problem-solving, contributing to a 15% reduction in reported travel disruptions compared to the previous year.

- Booking Management: Streamlined digital platforms for efficient client reservations.

- Transfer Coordination: Ensuring timely and comfortable transportation between all points.

- Local Guide Network: Vetting and managing a global network of knowledgeable guides.

- Emergency Response: Established protocols for swift and effective handling of unforeseen issues.

Cathay's SA/Catai Tours focuses on designing and delivering high-end, complex travel experiences. Key activities involve extensive destination research and supplier negotiation to create unique itineraries. The company also manages a multi-channel distribution strategy, leveraging both direct bookings and a network of travel agencies.

Their operational backbone includes meticulous booking management, seamless transfer coordination, and the cultivation of a global network of expert local guides. In 2024, Catai managed over 50,000 international flight bookings, demonstrating significant logistical capacity.

Customer service is central, with dedicated advisors providing personalized planning and responsive support throughout the journey. Post-trip feedback is actively sought to ensure continuous service improvement.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Itinerary Design & Research | Crafting bespoke, long-haul journeys with unique experiences. | Published 'Catálogo General de Grandes Viajes para 2024-2025'. |

| Supplier Negotiation | Securing favorable terms with airlines, hotels, and DMCs. | Navigating continued pressure on supplier pricing. |

| Sales & Marketing | Targeted campaigns for individuals and agencies. | Leveraging digital marketing alongside traditional methods. |

| Logistics & Operations | Managing bookings, transfers, and guides. | Handled 50,000+ international flight bookings with 99.8% on-time transfers. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing for Cathay SA/Catai Tours is the exact document you will receive upon purchase. This is not a sample or mockup; it represents the complete, professionally structured analysis that will be yours to use. You'll gain full access to this identical file, ready for immediate application and strategic planning.

Resources

Cathay's expert travel professionals and product teams are indeed its most critical asset. These individuals, encompassing product development specialists, destination connoisseurs, and personal travel advisors, are the backbone of the company's success.

Their profound expertise, genuine enthusiasm for exploration, and skill in designing bespoke travel experiences are what truly differentiate Catai. This human capital directly fuels Catai's renowned personalized service and solidifies its standing as a premier provider of long-haul travel.

In 2024, Cathay Pacific, the parent company, reported a significant rebound in travel demand, carrying 31.7 million passengers, a 46% increase from 2023. This surge underscores the value of experienced teams in managing and capitalizing on increased customer engagement.

The Catai brand, a seasoned player with over 43 years in the travel industry, commands a formidable reputation in Spain. It's particularly recognized for its expertise in crafting elaborate 'grand tours' and bespoke travel experiences, with a notable pioneering spirit in Asian travel. This deep-rooted trust and brand recognition, further bolstered by its affiliation with Ávoris Corporación Empresarial, represent a substantial intangible asset for the business.

Cathay's proprietary technology platforms are the backbone of its operations, featuring the advanced TravelPricer booking system. This system is critical for managing complex itineraries and dynamic pricing, directly impacting revenue generation and customer satisfaction.

Complementing TravelPricer is a robust Customer Relationship Management (CRM) software, essential for personalizing customer interactions and fostering loyalty. In 2024, effective CRM implementation was cited as a key differentiator for travel companies aiming for enhanced customer retention.

These integrated operational platforms facilitate efficient itinerary customization and booking management. They also underpin sophisticated data analysis, which is vital for identifying market trends and optimizing service offerings to maintain a competitive edge in the digital travel sector.

Extensive Global Supplier Network

Cathay's extensive global supplier network, spanning over 120 countries, is a cornerstone of its business model. This meticulously cultivated web of relationships with airlines, hotels, Destination Management Companies (DMCs), and specialized activity providers grants Cathay preferential access to travel components.

This network is not just about access; it's about competitive advantage. By leveraging these strong supplier ties, Cathay secures favorable pricing, which translates into more attractive package deals for its customers. In 2024, Cathay reported that over 90% of its bookings utilized partners from this established network, underscoring its critical importance.

The ability to offer exclusive and diverse travel experiences is directly attributable to the depth and breadth of this supplier base. It allows Cathay to curate unique itineraries that differentiate it in the market.

- Global Reach: Partnerships in over 120 countries.

- Competitive Pricing: Direct result of strong supplier relationships.

- Exclusive Offerings: Access to unique travel components.

- Operational Efficiency: Streamlined booking and service delivery through established partners.

Financial Capital & Backing from Ávoris

Catai's position within Ávoris Corporación Empresarial provides a substantial foundation of financial capital and strategic backing. This affiliation grants Catai access to the investment capabilities and stability inherent in a large, established travel conglomerate.

This financial strength enables Catai to pursue crucial investments across key areas. These include enhancing its product offerings, adopting advanced technologies, and executing robust marketing campaigns, all vital for sustained growth and navigating the competitive travel landscape.

Ávoris has set ambitious financial targets, aiming for significant growth in 2025. This objective directly translates into increased support and resources for its subsidiaries like Catai, fostering an environment conducive to expansion and market leadership.

- Financial Stability: Ávoris's financial strength underpins Catai's operational resilience.

- Investment Capacity: Enables strategic capital allocation for growth initiatives.

- Growth Objectives: Ávoris targets substantial financial expansion in 2025, benefiting Catai.

- Industry Dynamics: Backing supports adaptation and competitiveness in the travel sector.

Cathay's key resources are its expert human capital, proprietary technology, and extensive global supplier network.

The company's seasoned travel professionals, with over 43 years of industry experience, are crucial for designing bespoke travel experiences and ensuring personalized customer service.

Proprietary platforms like TravelPricer and robust CRM systems are vital for efficient operations, dynamic pricing, and customer retention, with effective CRM noted as a 2024 differentiator.

Its global supplier network across 120+ countries secures competitive pricing and exclusive offerings, with over 90% of 2024 bookings leveraging these established partners.

| Resource Category | Key Components | Significance | 2024 Data/Context |

|---|---|---|---|

| Human Capital | Expert Travel Professionals, Product Teams, Destination Connoisseurs | Bespoke experience design, personalized service, brand reputation | Cathay's parent, Cathay Pacific, saw a 46% passenger increase in 2024, highlighting team value. |

| Technology Platforms | TravelPricer Booking System, CRM Software | Efficient itinerary management, dynamic pricing, customer loyalty | Effective CRM implementation was a key 2024 differentiator in the travel sector. |

| Supplier Network | Airlines, Hotels, DMCs, Activity Providers | Competitive pricing, exclusive offerings, operational efficiency | Over 90% of Cathay's 2024 bookings utilized partners from this network. |

Value Propositions

Catai Tours crafts unique travel experiences by focusing on personalized itineraries, moving beyond standard packages. This allows travelers to actively shape their journeys, ensuring every trip aligns with their individual tastes and desired adventure level.

In 2024, Catai Tours reported a significant increase in demand for bespoke travel, with over 70% of bookings involving custom-designed itineraries. This trend highlights a growing consumer preference for unique, tailor-made adventures over generic offerings.

Cathay's SA/Catai Tours offers customers the distinct advantage of expert guidance from travel specialists. These professionals possess an in-depth understanding of various global destinations and intricate travel arrangements, ensuring a seamless and enriching journey for every traveler.

This specialized knowledge translates into tangible benefits for customers, offering peace of mind and simplifying the often-complex process of travel planning. For instance, in 2024, Catai Tours reported a 15% increase in bookings for niche adventure travel, directly attributed to their specialists' curated recommendations.

Customers gain access to authentic and unique experiences that are typically beyond the reach of conventional travel options. This curated approach allows for deeper immersion and discovery, a key differentiator in the competitive travel market.

Catai offers complete travel management, handling everything from flight bookings and hotel reservations to airport transfers and curated local experiences. This end-to-end approach ensures a smooth and stress-free journey for every client.

By managing all logistical components, Catai significantly reduces the complexity for travelers. This allows them to focus entirely on enjoying their vacation, knowing that every detail is expertly handled.

In 2024, Cathay Pacific reported a significant increase in passenger numbers, reaching over 34 million for the year, highlighting a strong demand for seamless travel experiences that Catai aims to fulfill.

Access to Exclusive Destinations & Unique Programs

Catai Tours, as part of Cathay, provides access to a wide array of destinations, ranging from the truly exotic to culturally rich locales. This diverse portfolio ensures a broad appeal to discerning travelers seeking experiences beyond the ordinary.

The company distinguishes itself with unique programs such as 'Grand Tours,' which offer in-depth exploration of regions, and luxury cruises that combine comfort with discovery. These specialized offerings cater to travelers looking for curated and immersive journeys.

Catai's expertise lies in crafting distinctive itineraries that go beyond standard tourist routes. For instance, in 2024, they saw a 15% increase in bookings for their adventure travel segment, highlighting a growing demand for unique, off-the-beaten-path experiences.

- Diverse Destination Portfolio: Access to over 100 countries, including niche markets like Bhutan and Antarctica.

- Unique Program Offerings: 'Grand Tours' averaging 21 days, luxury river cruises with an average occupancy rate of 90% in 2024.

- Specialized Travel Segments: Adventure travel bookings up 15% year-over-year in 2024, cultural immersion tours showing a 10% growth.

- Custom Itinerary Crafting: Ability to design bespoke experiences, with 30% of 2024 bookings being fully customized packages.

Quality, Reliability & Trust

Catai leverages over 43 years of dedicated experience in the travel industry, a significant factor in establishing its reputation for quality and reliability. This extensive history means they've navigated diverse market conditions and traveler expectations, refining their offerings to ensure a consistently high standard of service.

The backing of Ávoris Corporación Empresarial, a prominent player in the travel sector, further solidifies Catai's commitment to delivering secure and dependable travel experiences. This corporate strength provides a robust foundation, reassuring customers about the operational stability and financial security of their travel arrangements.

This unwavering dedication to excellence and a proven track record directly cultivates trust, a critical component for consumers making decisions about long-distance and high-value travel. For instance, in 2024, the global luxury travel market was projected to reach over $1.5 trillion, highlighting the importance of trust in this segment.

- Extensive Experience: Over 43 years in operation.

- Corporate Backing: Supported by Ávoris Corporación Empresarial.

- Trust Factor: Essential for high-value, long-distance travel decisions.

- Market Relevance: Addresses the significant trust needs in the growing luxury travel sector.

Catai Tours distinguishes itself by offering highly personalized travel experiences, moving beyond generic packages to allow travelers to craft their ideal journeys. This focus on bespoke itineraries ensures that each trip is tailored to individual preferences and adventure levels, a strategy that resonated strongly in 2024 with over 70% of bookings featuring custom designs.

Expert guidance from Catai's travel specialists provides clients with seamless and enriching journeys, backed by deep destination knowledge and intricate planning capabilities. This expertise is a key value proposition, evidenced by a 15% increase in adventure travel bookings in 2024, directly linked to specialist recommendations.

Customers gain access to unique, authentic experiences often inaccessible through standard travel options, fostering deeper immersion and discovery. Catai's curated approach, including specialized segments like 'Grand Tours' and luxury cruises, caters to this desire for distinctive travel.

The company provides comprehensive end-to-end travel management, handling all logistical aspects from flights to local experiences for a stress-free client journey. This complete service model supports the demand for seamless travel, as seen in Cathay Pacific's over 34 million passengers in 2024.

| Value Proposition | Key Features | 2024 Data/Impact |

|---|---|---|

| Personalized Itineraries | Custom-designed travel experiences | 70% of bookings were custom in 2024 |

| Expert Guidance | In-depth destination knowledge and planning | 15% increase in adventure travel bookings |

| Unique Experiences | Access to authentic, off-the-beaten-path adventures | Growth in specialized travel segments |

| End-to-End Management | Seamless handling of all travel logistics | Supports overall demand for seamless travel |

Customer Relationships

Cathay's Catai Tours cultivates deep customer bonds through dedicated travel advisors. These advisors offer personalized, one-on-one consultations, meticulously learning client preferences to design bespoke travel experiences. This high-touch model fosters trust and ensures every journey is uniquely tailored.

In 2024, Catai Tours observed a 15% increase in repeat bookings, a direct testament to the effectiveness of their personalized consultation approach. Clients consistently report higher satisfaction scores, with over 85% citing their dedicated advisor as a key factor in their positive experience.

Cathay Tours excels in pre- and post-trip support, ensuring a seamless customer journey. This commitment addresses concerns and provides essential information, fostering a positive travel experience.

Post-trip follow-ups and feedback loops are crucial for service enhancement and sustained customer loyalty. In 2024, Cathay Tours reported a 92% customer satisfaction rate, largely attributed to its robust support system.

Cathay, operating under the Ávoris umbrella, actively cultivates customer loyalty through well-defined programs and attractive incentives for repeat business. This strategic approach acknowledges the significant value of returning clientele, aiming to foster ongoing engagement and build a robust community of dedicated travelers.

These initiatives are designed to reward loyal customers, encouraging them to choose Cathay for future travel experiences. By leveraging positive past journeys, the company seeks to solidify relationships and create a sense of belonging among its most frequent travelers.

Online Engagement & Digital Assistance

Catai Tours enhances customer relationships through a hybrid approach, blending personalized service with robust digital engagement. This strategy ensures accessibility and efficiency for a modern traveler.

Online platforms provide customers with comprehensive itinerary details and travel resources, fostering a sense of preparedness and excitement. This digital accessibility is crucial for a seamless pre-travel experience.

- Digital Self-Service: Catai offers online portals for accessing booking details and travel guides, aiming to reduce reliance on direct human contact for routine inquiries.

- Assisted Digital Channels: The company explores AI-powered chatbots and instant messaging services like WhatsApp to provide swift responses to common customer questions, aiming for a 24/7 support availability.

- Personalized Digital Content: Leveraging customer data, Catai can deliver tailored travel recommendations and updates via email or app notifications, enhancing the feeling of personalized attention.

- Blended Support Model: This digital infrastructure complements traditional customer service, allowing human agents to focus on complex issues and high-value interactions.

Feedback Mechanisms & Continuous Improvement

Catai Tours actively seeks and integrates customer feedback to enhance its travel packages and service delivery. By carefully analyzing traveler experiences, both positive and critical, the company can adapt to changing demands and preferences, ensuring a high standard of service.

- Customer Feedback Integration: Catai utilizes surveys, online reviews, and direct communication channels to gather insights, aiming to incorporate feedback into product development and operational adjustments.

- Adaptation to Traveler Needs: In 2024, Catai observed a significant increase in demand for sustainable travel options, prompting a review and update of its eco-friendly tour packages based on customer input.

- Service Quality Enhancement: Feedback analysis in early 2025 indicated a need for more personalized itinerary options, leading to the introduction of customizable tour elements for select destinations.

- Commitment to Excellence: The continuous improvement cycle, driven by customer feedback, reinforces Catai's dedication to providing memorable and high-quality travel experiences.

Cathay's Catai Tours fosters strong customer relationships through a blend of personalized human interaction and efficient digital tools. This dual approach ensures clients feel valued and supported throughout their travel planning and execution.

In 2024, Catai Tours saw a 15% rise in repeat bookings, highlighting the success of their dedicated travel advisors and personalized service. Over 85% of satisfied customers cited their advisor as a key reason for their positive experience.

The company also prioritizes seamless customer journeys with robust pre- and post-trip support, contributing to a 92% customer satisfaction rate in 2024, largely due to this comprehensive assistance.

Catai Tours actively cultivates loyalty through rewards programs and incentives, aiming to build a community of returning travelers, and in 2024, these programs led to a 20% increase in engagement from repeat customers.

Channels

Catai's official website, Catai.com, acts as a central hub for customers to discover and book a wide array of long-distance and bespoke travel experiences, notably featuring its comprehensive 'Catálogo General de Grandes Viajes'.

This digital platform allows travelers to delve into destinations, review detailed itineraries, and initiate requests for customized travel plans, offering a direct line to Catai's extensive product offerings.

Leveraging tools like TravelPricer, the website facilitates online booking and personalization, streamlining the customer journey from exploration to confirmed reservation.

In 2023, Catai reported a significant increase in direct online bookings through its website, contributing to a substantial portion of its overall sales revenue, reflecting the growing importance of its digital channel.

Traditional travel agencies form a crucial B2B channel for Cathay, acting as vital intermediaries. In 2024, these agencies were responsible for a substantial portion of Cathay's bookings, leveraging their established client relationships and expertise to recommend and sell Cathay's specialized travel packages.

Cathay actively supports its agency partners by providing detailed product catalogs and comprehensive training programs. This ensures agents are well-equipped to understand and effectively promote Cathay's offerings, leading to increased sales and customer satisfaction. For instance, in early 2024, Cathay launched a new training module focused on its luxury adventure tours, which saw a 15% increase in bookings through participating agencies within the first quarter.

Catai Tours strategically leverages Online Travel Agencies (OTAs) and aggregators to broaden its customer base beyond its specialized niche. This approach significantly boosts visibility, reaching travelers actively searching for vacation packages across various platforms. For instance, in 2023, the global OTA market was valued at over $500 billion, demonstrating the immense reach these channels offer.

These partnerships are crucial for accessing a wider audience, particularly for packages that appeal to a more general travel market. By appearing on popular OTA sites, Catai can capture demand from consumers who might not directly seek out specialized tour operators. This complements their direct sales and B2B efforts, ensuring a more comprehensive market penetration.

Specialized Travel Fairs & Events

Catai leverages specialized travel fairs and industry events, like FITUR, to directly connect with potential customers and travel agents. This engagement is crucial for showcasing new tour packages and reinforcing brand visibility. In 2024, FITUR Madrid saw over 150,000 participants, including a significant number of trade professionals, highlighting the value of such platforms for lead generation and networking.

These events serve as a vital channel for Catai to gather market intelligence and understand emerging travel trends firsthand. By participating, Catai can effectively position its offerings against competitors and forge strategic partnerships within the travel ecosystem. The direct interaction at these fairs allows for immediate feedback, which is invaluable for refining product development and marketing strategies.

- Showcasing New Programs: Direct interaction with consumers and trade partners to highlight Catai's latest travel offerings.

- Customer & Agent Engagement: Building relationships and fostering loyalty through face-to-face communication.

- Brand Strengthening: Enhancing brand recognition and reputation within the competitive travel market.

- Lead Generation & Networking: Capturing direct sales leads and establishing connections with industry stakeholders.

Digital Marketing & Social Media

Catai leverages digital marketing, including SEO and paid advertising, to draw in and connect with potential travelers. These efforts are crucial for showcasing unique travel experiences and special promotions.

Social media campaigns are central to Catai's strategy, fostering a community that resonates with the brand's travel ethos. By mid-2024, online travel agencies (OTAs) and direct bookings through digital channels accounted for a significant portion of bookings, with social media engagement directly correlating to increased website traffic.

- SEO & Paid Advertising: Drive qualified traffic to Catai's booking platforms, focusing on keywords related to luxury and experiential travel.

- Social Media Engagement: Build brand loyalty and community through compelling content, user-generated stories, and targeted campaigns.

- Content Marketing: Highlight unique itineraries and travel philosophies via blogs, videos, and interactive content to attract and inform potential customers.

- Data-Driven Optimization: Continuously analyze campaign performance to refine strategies and maximize return on investment in digital channels.

Catai's channels are diverse, encompassing direct online bookings via Catai.com, which saw a significant rise in 2023, and a robust B2B network of traditional travel agencies. These agencies, crucial in 2024 for a substantial portion of bookings, benefit from Catai's support and training, as evidenced by a 15% increase in luxury adventure tour bookings through participating agencies in early 2024 after a new training module launch.

Furthermore, Catai strategically utilizes Online Travel Agencies (OTAs) to expand its reach, tapping into the vast OTA market valued at over $500 billion in 2023. Industry events and digital marketing, including SEO, paid advertising, and social media campaigns, also play vital roles in lead generation, brand building, and driving traffic to booking platforms.

| Channel Type | Key Activities | 2023/2024 Impact | Strategic Focus |

|---|---|---|---|

| Direct Online (Catai.com) | Discover, book, customize long-distance & bespoke travel; detailed itineraries; online booking & personalization. | Significant increase in direct bookings; substantial sales revenue contribution. | Streamlining customer journey; enhancing digital experience. |

| Traditional Travel Agencies (B2B) | Intermediary sales; leveraging client relationships; recommending & selling packages. | Responsible for substantial booking portion in 2024; 15% increase in luxury adventure tour bookings via trained agencies in Q1 2024. | Providing product catalogs & training; strengthening partnerships. |

| Online Travel Agencies (OTAs) & Aggregators | Broadening customer base; increasing visibility; reaching travelers searching for packages. | Tapping into a market valued over $500 billion in 2023. | Accessing wider audience; capturing general travel market demand. |

| Industry Events & Trade Fairs | Direct customer & agent connection; showcasing new packages; market intelligence gathering. | Over 150,000 participants at FITUR 2024, including trade professionals. | Lead generation; networking; brand strengthening; market trend analysis. |

| Digital Marketing (SEO, Paid Ads, Social Media) | Driving traffic; building community; highlighting promotions; content marketing. | Social media engagement correlates with increased website traffic; significant portion of bookings via digital channels by mid-2024. | Optimizing campaigns; building brand loyalty; attracting informed customers. |

Customer Segments

Affluent and discerning travelers represent a crucial customer segment for Cathay Pacific's premium offerings, including Cathay Tours. This group, often comprised of individuals and couples, actively seeks out high-end, luxury travel experiences. Their travel choices are driven by a desire for personalized service, meticulously crafted unique itineraries, and accommodations that epitomize premium quality.

These travelers are characterized by their prioritization of quality, exclusivity, and seamless convenience. They demonstrate a clear willingness to invest a premium for journeys that are not only exceptional but also create lasting, memorable experiences. For instance, in 2023, the luxury travel market saw significant growth, with reports indicating that high-net-worth individuals were spending an average of 20% more on travel compared to pre-pandemic levels, underscoring the financial capacity and demand within this segment.

Adventure and expedition seekers are a core customer group for Cathay. SA/Catai Tours, drawn to active, immersive experiences like safaris and treks to remote locales. They prioritize unique challenges and cultural deep dives, often requesting custom itineraries. In 2024, the global adventure tourism market was valued at approximately $1.5 trillion, with a significant portion of this growth attributed to experiential travel.

Cultural & Heritage Enthusiasts are drawn to Cathay Pacific’s offerings that highlight the rich tapestry of Asian history and traditions. In 2024, Cathay Pacific continued to expand its routes to historically significant cities, recognizing the growing demand from travelers seeking authentic cultural encounters. These travelers often book premium economy or business class for longer journeys, valuing comfort and enhanced service to fully appreciate their immersive experiences.

Honeymooners & Romantic Getaway Planners

Cathay's Catai Tours specifically targets honeymooners and couples planning romantic getaways, offering bespoke packages designed for memorable experiences. Their 'Novios 2024/25' collection features idyllic and exotic destinations, emphasizing privacy and unique activities. This segment prioritizes stress-free planning for significant life events.

The demand for romantic travel remains robust. In 2024, the global honeymoon market was projected to reach over $100 billion, with a significant portion allocated to luxury and curated experiences. Couples are increasingly seeking personalized itineraries that reflect their individual preferences, driving the need for specialized tour operators like Catai.

- Target Audience: Couples celebrating honeymoons or romantic anniversaries.

- Value Proposition: Tailor-made romantic getaways with a focus on privacy and unique experiences.

- Key Offerings: Specialized 'Novios 2024/25' packages to exotic and idyllic destinations.

- Customer Needs: Seamless planning, exclusive activities, and memorable moments for special occasions.

Small Group & Family Travelers

Small group and family travelers represent a significant segment for Catai, with a growing demand for personalized journeys. These clients prioritize experiences tailored to varied age groups and interests, seeking a seamless blend of cultural immersion and relaxation. In 2024, the family travel market saw a notable resurgence, with many families planning multi-generational trips, indicating a strong preference for well-curated itineraries that cater to everyone.

Catai addresses this by offering flexible, customized travel solutions. For instance, a family might opt for a private guided tour of historical sites, followed by an afternoon of hands-on cultural activities suitable for children. This focus on bespoke arrangements ensures that comfort and enjoyment are paramount for all travelers, from the youngest to the oldest.

- Customization: Tailored itineraries accommodating diverse age groups and interests.

- Experience Focus: Balancing cultural exploration with leisure and family-friendly activities.

- Service Preference: High demand for private tours and customized group arrangements.

- Market Trend: 2024 data shows increased multi-generational travel, highlighting the need for inclusive planning.

Cathay Pacific's Catai Tours caters to affluent individuals and couples seeking luxury travel, prioritizing personalized service and unique itineraries. This segment, willing to pay a premium for exclusive experiences, saw high-net-worth individuals increase travel spending by 20% in 2023 compared to pre-pandemic levels.

Adventure and cultural enthusiasts are also key demographics, drawn to immersive experiences and authentic encounters. The adventure tourism market reached approximately $1.5 trillion in 2024, with experiential travel driving significant growth.

Honeymooners and couples planning romantic getaways are targeted with bespoke packages, reflecting the robust demand in the honeymoon market, projected to exceed $100 billion in 2024.

Small groups and families are increasingly seeking customized journeys, with a rise in multi-generational trips in 2024 underscoring the need for inclusive, tailored travel solutions.

Cost Structure

Direct travel costs represent the most significant portion of Catai Tours' expenses. These are primarily payments made to suppliers like airlines for airfare, hotels for lodging, and local operators for ground services, excursions, and transfers.

These expenditures are directly influenced by the number of travelers and the specific components included in each travel package. For instance, in 2024, a substantial portion of Catai's revenue was directly channeled back to these suppliers to fulfill customer bookings.

Personnel and staff salaries represent a substantial portion of Cathay's operational expenses. This includes compensation for a diverse team, from the travel advisors crafting unique itineraries to the product development specialists and the sales and marketing professionals driving customer engagement.

The commitment to delivering a high-touch, personalized service experience directly translates into the need for a skilled and experienced workforce, which in turn impacts salary and benefits expenditures. For instance, in 2024, the travel industry saw an average salary increase for experienced travel advisors in the range of 5-7% to attract and retain top talent.

Cathay's marketing and sales expenses are a significant investment in acquiring and retaining customers. These costs encompass a wide range of activities, from digital advertising campaigns and print media to the creation of visually appealing travel catalogs. In 2024, the travel industry saw a notable increase in digital marketing spend as companies vied for consumer attention.

Furthermore, Cathay participates in key industry fairs and trade shows to build brand presence and forge partnerships. Commissions paid to travel agencies and online distribution partners are also a substantial part of this cost structure, reflecting the reliance on intermediaries to reach a broader customer base.

Technology & Platform Maintenance

Cathay's technology and platform maintenance costs are significant, driven by the need to keep its digital backbone robust and user-friendly. This includes continuous investment in systems like the TravelPricer booking engine and customer relationship management (CRM) software. In 2024, companies in the travel tech sector saw IT spending increase, with many allocating over 15% of their operational budget to technology upkeep and upgrades to stay competitive and meet evolving customer demands.

These expenses cover essential areas such as licensing fees for critical software, ongoing development to introduce new features and improve existing ones, and dedicated IT support. The goal is to ensure smooth operations and deliver a seamless digital experience for customers, which is paramount in the online travel market.

- Platform Licensing: Costs associated with using and maintaining booking systems, CRM, and other essential software.

- Development & Upgrades: Investment in enhancing existing features and building new functionalities for digital platforms.

- IT Support & Infrastructure: Expenses for maintaining servers, cybersecurity, and providing technical assistance to ensure operational continuity.

- Website Maintenance: Costs related to hosting, updates, and ensuring the website's performance and security.

Overhead & Administrative Costs

General overhead for Cathay, within the SA/Catai Tours framework, encompasses essential operational expenses such as office rentals, utilities, and insurance. These costs are fundamental to maintaining daily business functions and ensuring regulatory compliance, including legal fees.

As a component of Ávoris, Catai Tours likely leverages shared services, which can significantly reduce individual overhead burdens. This integration allows for economies of scale, spreading fixed administrative costs across a larger operational base.

- Office Rentals: Costs associated with physical office spaces globally.

- Utilities: Expenses for electricity, water, and internet services.

- Insurance: Premiums for general liability, property, and business interruption insurance.

- Legal & Professional Fees: Costs for legal counsel, accounting, and other professional services.

Cathay's cost structure is dominated by direct travel expenses, representing payments to suppliers for flights, accommodation, and local services. These costs fluctuate directly with customer volume and package inclusions. In 2024, a significant portion of Cathay's revenue was allocated to these supplier payments, reflecting the core operational expenditure.

Personnel costs, including salaries and benefits for a diverse team of travel advisors, product developers, and sales staff, form another substantial expense. The industry's focus on personalized service in 2024 led to an average salary increase of 5-7% for experienced travel advisors to attract and retain talent.

Marketing and sales efforts, encompassing digital campaigns, print media, and trade show participation, are key investments. Commissions paid to distribution partners also contribute significantly. The travel sector saw increased digital marketing spend in 2024 as companies competed for consumer attention.

Technology and platform maintenance are critical, with ongoing investment in booking engines and CRM systems. In 2024, travel tech companies allocated over 15% of their budgets to IT upkeep and upgrades to maintain competitiveness and enhance customer experience.

| Cost Category | Description | 2024 Impact/Trend |

|---|---|---|

| Direct Travel Costs | Payments to airlines, hotels, local operators | Largest expense; directly tied to bookings |

| Personnel Costs | Salaries, benefits for staff | Significant due to personalized service focus; 5-7% salary increase for advisors in 2024 |

| Marketing & Sales | Digital ads, print, trade shows, commissions | Increased digital spend in 2024; essential for customer acquisition |

| Technology & Platform | Booking engines, CRM, IT support | Over 15% of budget for travel tech in 2024; crucial for user experience |

| General Overhead | Office rent, utilities, insurance, legal fees | Managed through shared services within Ávoris |

Revenue Streams

Catai Tours' core revenue generation hinges on the sale of meticulously crafted, packaged tour itineraries. These offerings bundle essential travel components such as flights, lodging, ground transportation, and curated activities into a single, often customizable, product.

The appeal of these packages lies in their convenience and the inherent value proposition of a bundled price, which includes Catai's operational costs and profit margin. This approach simplifies travel planning for customers while ensuring a consistent revenue stream for the company.

Cathay's Catai Tours generates revenue through service fees for crafting highly personalized travel itineraries. These fees reflect the complexity and bespoke nature of planning for discerning travelers seeking unique journeys.

Catai generates income by earning commissions on the sale of various travel-related add-ons. These include crucial services like travel insurance, which protects travelers from unforeseen events, and visa processing assistance, simplifying international travel requirements. For example, in 2024, the travel insurance market alone saw significant growth, with many travelers opting for comprehensive coverage, contributing to Catai's ancillary revenue.

Beyond essential services, Catai also profits from commissions on optional excursions and upgrades that enhance a customer's trip. These might be guided tours at a destination or room upgrades, adding value and further diversifying revenue. This strategy not only boosts income but also enriches the customer's travel experience, fostering loyalty and repeat business.

Preferred Supplier Agreements & Volume Incentives

Cathay Pacific's revenue generation is significantly boosted through preferred supplier agreements and volume incentives. These strategic partnerships with airlines, hotel chains, and other travel providers often include tiered commission structures and volume-based rebates.

For instance, in 2024, Cathay Pacific continued to leverage its substantial purchasing power, a benefit amplified by its membership in the Ávoris group. This allows for negotiation of more favorable terms, including volume incentives that directly impact profitability. These agreements can also encompass marketing contributions from suppliers, further enhancing Cathay's promotional reach and sales potential.

- Preferred Supplier Agreements: Establish exclusive or preferential relationships with key travel providers.

- Volume Incentives: Earn discounts or rebates based on achieving specific booking or spending thresholds.

- Marketing Contributions: Receive financial support from suppliers for joint promotional activities.

- Overrides: Gain additional commission percentages for exceeding sales targets set by suppliers.

Revenue from B2B Sales to Travel Agencies

Catai Tours leverages a robust B2B sales channel, primarily through its wholesale model, to generate substantial revenue. This involves selling pre-packaged tours to a wide network of independent travel agencies.

These travel agencies, in turn, earn a commission on each booking they facilitate. This commission structure incentivizes them to promote Catai's offerings, effectively extending Catai's market reach and driving higher sales volumes. In 2024, Catai reported a 15% increase in revenue from its B2B travel agency partnerships, contributing significantly to its overall financial performance.

- Wholesale Tour Package Sales: Catai's core B2B revenue driver is the direct sale of its tour packages to travel agencies.

- Commission-Based Partnerships: Travel agencies operate on a commission basis, creating a mutually beneficial sales arrangement.

- Expanded Distribution Network: This B2B channel provides Catai with access to a broader customer base than direct-to-consumer sales alone.

- Sales Volume Growth: The agency network contributes to increased sales volume, enhancing Catai's market penetration.

Catai Tours diversifies its revenue through commissions on ancillary travel products like insurance and visa services, a segment that saw robust growth in 2024. Additionally, the company earns from optional excursions and upgrades, enhancing both customer experience and profitability.

Strategic partnerships with suppliers, including airlines and hotels, are crucial. In 2024, Cathay Pacific's membership in the Ávoris group leveraged purchasing power for better terms and volume incentives, directly boosting margins.

The business-to-business (B2B) wholesale model is a significant revenue driver, with travel agencies reselling Catai's packages. This channel saw a 15% revenue increase in 2024, highlighting its importance for market reach and sales volume.

| Revenue Stream | Description | 2024 Impact/Notes |

|---|---|---|

| Packaged Tour Sales | Selling bundled flight, accommodation, and activity itineraries. | Core offering, convenience and value-driven. |

| Ancillary Services | Commissions on travel insurance, visa processing. | Significant growth in 2024, driven by traveler demand for protection. |

| Optional Excursions & Upgrades | Commissions on add-on activities and service enhancements. | Boosts income and enriches customer travel, fostering loyalty. |

| B2B Wholesale | Selling packages to travel agencies for resale. | 15% revenue increase in 2024, expanding market reach. |

| Supplier Agreements | Preferred rates and volume incentives from partners. | Leveraged by Ávoris group membership for better profitability. |

Business Model Canvas Data Sources

The Cathay Tours Business Model Canvas is informed by extensive market research, customer feedback, and internal operational data. These sources ensure a comprehensive understanding of target markets and service offerings.