Casio Computer Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casio Computer Bundle

Casio Computer navigates a competitive landscape where buyer power is significant, particularly in consumer electronics, while the threat of new entrants is moderate due to brand loyalty and R&D costs. The threat of substitutes, however, looms large with the constant emergence of new technologies and product categories. Understanding these dynamics is crucial for any strategic decision-making concerning Casio.

The complete report reveals the real forces shaping Casio Computer’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Casio’s reliance on a global supply chain for components like semiconductors and display panels means supplier concentration is a key factor. When a few specialized suppliers dominate the market for critical parts, their ability to dictate terms increases significantly.

The semiconductor industry, for example, has faced persistent capacity constraints and potential shortages. In 2024, this dynamic continued to empower major semiconductor manufacturers, potentially giving them greater leverage over electronics companies like Casio when negotiating prices and supply volumes.

The availability of substitute inputs directly impacts supplier bargaining power for Casio. If Casio can easily switch to alternative raw materials or components without significant cost or performance degradation, the power of existing suppliers diminishes. For instance, if Casio's calculators commonly use standard electronic components with numerous manufacturers, it can leverage competition among these suppliers to negotiate better terms.

However, Casio's reliance on highly specialized or proprietary components, such as unique watch movements or custom-designed calculator integrated circuits, can significantly increase supplier leverage. If only a few suppliers can produce these critical parts, Casio has fewer alternatives, making it more susceptible to price increases or supply disruptions. For example, in 2023, the global semiconductor shortage highlighted how dependence on a limited number of chip manufacturers could grant substantial power to those suppliers, impacting production timelines and costs across various industries, including electronics.

For Casio, the bargaining power of suppliers is significantly influenced by switching costs. If changing a supplier for key components necessitates substantial expenses like redesigning products, retooling manufacturing processes, or undergoing rigorous requalification of new parts, suppliers naturally gain leverage. This is particularly true for Casio's diverse product lines, from its popular digital watches to its musical instruments, where component integration is critical.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while generally low for Casio, could emerge if key component providers decide to manufacture finished consumer electronics themselves. This would position them as direct competitors, potentially eroding Casio's market share.

While it's uncommon for suppliers of specialized electronic components to undertake the broad product development and marketing efforts required to compete across Casio's diverse portfolio, the possibility exists in niche markets. For instance, a highly specialized sensor manufacturer might consider producing its own advanced wearable devices.

In 2024, the global consumer electronics market saw continued consolidation, with some component manufacturers actively exploring value-added services and even finished product lines to capture a larger portion of the supply chain. This trend, driven by a desire for higher margins and greater control, presents a subtle but persistent risk for companies like Casio.

- Potential Niche Competition: Suppliers of specific, high-margin components could integrate forward into specialized product segments where their expertise is paramount.

- Market Dynamics: Increased profitability in finished goods might incentivize some suppliers to bypass intermediaries and enter Casio's direct market.

- Industry Trends: The ongoing push for vertical integration across various manufacturing sectors, including electronics, heightens the general risk of supplier forward integration.

Impact of Input on Casio's Product Cost/Quality

Suppliers of critical components that define Casio's product performance and durability, such as the specialized materials used in its G-Shock watches, wield significant bargaining power. These suppliers can influence Casio's cost structure and the perceived quality of its offerings.

For instance, a disruption in the supply chain for a unique resin compound essential for G-Shock's shock resistance, or a sudden price hike for a high-precision quartz movement, could directly impact Casio's production costs and its ability to maintain competitive pricing. In 2023, the global semiconductor shortage, while easing, still presented challenges for many electronics manufacturers, highlighting the vulnerability to key component suppliers.

- Impact of Component Quality: Suppliers of advanced display technologies or robust casing materials can command higher prices if these inputs are crucial to a product's premium positioning, like in Casio's higher-end Edifice or Pro Trek lines.

- Supply Chain Dependencies: Casio's reliance on specialized electronic components, particularly for its advanced calculators and digital cameras, means suppliers of these niche items have leverage.

- Price Sensitivity: While Casio aims for value, significant cost increases from essential component suppliers, especially if few alternatives exist, can squeeze profit margins or necessitate price adjustments for consumers.

Casio's bargaining power with suppliers is influenced by the concentration of suppliers for critical components. For instance, the market for advanced microcontrollers, essential for its sophisticated calculators and digital cameras, is dominated by a few key players.

In 2024, ongoing supply chain recalibrations, following the disruptions of previous years, continued to empower suppliers of specialized semiconductors. This meant that companies like Casio faced the possibility of increased prices or stricter supply terms from these dominant manufacturers.

The availability of substitutes for components like LCD screens or specific sensor technologies can reduce supplier leverage. However, if Casio relies on proprietary or highly specialized parts, such as unique watch movements or custom-designed processors, the few suppliers capable of producing them gain significant bargaining power.

Switching costs also play a crucial role; if redesigning products or retooling manufacturing for alternative components is prohibitively expensive or time-consuming, suppliers of the original parts can exert more influence over pricing and terms.

| Factor | Impact on Casio | Example/Data (2024 Trends) |

|---|---|---|

| Supplier Concentration | High for specialized components | Dominance of a few firms in advanced microcontroller production |

| Availability of Substitutes | Moderate for standard components, low for proprietary ones | Easier to find alternative suppliers for basic calculator displays than for unique G-Shock watch modules |

| Switching Costs | Potentially high for integrated systems | Costs associated with redesigning complex circuit boards for new processors |

| Supplier Forward Integration Threat | Low overall, but possible in niche segments | Potential for high-margin component makers to enter specialized device markets |

What is included in the product

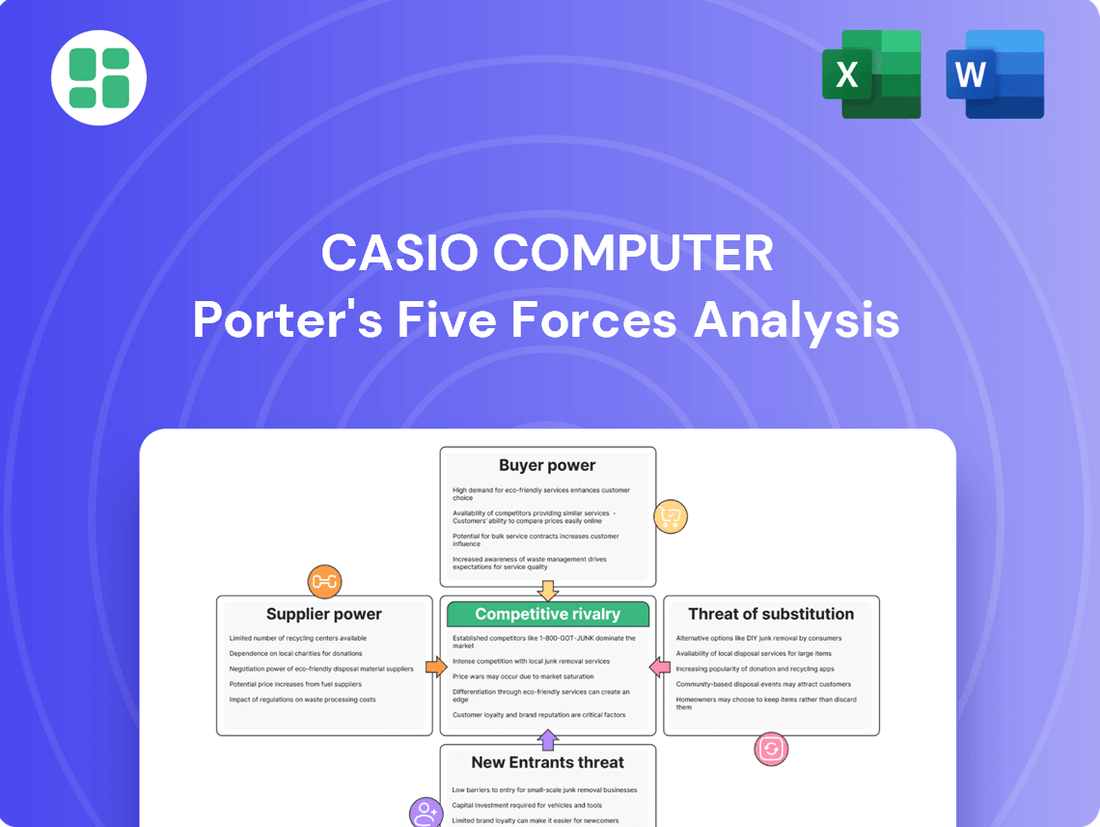

This analysis dissects the competitive forces impacting Casio Computer, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its diverse product markets.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a dynamic, interactive dashboard.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Casio, particularly in its more established product lines like calculators and basic watches. In 2024, the consumer electronics market continues to see intense competition, with many brands offering similar functionalities at various price points.

The ease with which consumers can compare prices online in 2024 directly amplifies their bargaining power. This means Casio must remain vigilant about its pricing strategies to stay competitive, potentially limiting its ability to command premium prices for these mature products.

Casio faces significant customer bargaining power due to the sheer availability of substitute products across its varied product lines. For instance, in the watch segment alone, consumers can choose from a vast spectrum of brands like Seiko, Citizen, Timex, and numerous fashion-oriented labels, alongside smartwatches from Apple and Samsung. This abundance of choice means customers can easily switch if Casio's pricing or features don't meet their expectations.

For many of Casio's product lines, including calculators and basic digital watches, the barriers for customers to switch to a competitor are quite low. This means consumers can easily opt for a different brand without incurring significant costs or facing much hassle.

For example, a student looking for a new scientific calculator can readily choose between brands like Texas Instruments or Sharp, often based on minor price differences or feature preferences, rather than brand loyalty. Similarly, the smartwatch market, where Casio competes, is characterized by rapid innovation and a wide array of choices, making it simple for consumers to explore alternatives like Apple Watch or Samsung Galaxy Watch.

This low switching cost directly translates to increased bargaining power for customers. They can leverage the availability of numerous alternatives to demand better prices, enhanced features, or superior service from Casio. In 2024, the consumer electronics market continues to see intense competition, with brands frequently offering promotions and new models, further reinforcing the customer's ability to dictate terms.

Customer Information and Transparency

The internet has dramatically shifted the landscape for consumers, offering unprecedented access to information. This means customers can easily compare Casio's products, pricing, and features against competitors, significantly boosting their ability to negotiate or seek better deals. For instance, by mid-2024, online price comparison tools are ubiquitous, allowing consumers to see if Casio's offerings are competitive in real-time.

This wealth of readily available data empowers customers, making them less reliant on a single brand or retailer. They can readily access detailed product specifications, read user reviews, and even view expert analyses, all of which contribute to a more informed purchasing decision. This transparency directly translates into increased bargaining power for the customer.

- Increased Information Access: Consumers can easily find detailed product specifications, user reviews, and pricing comparisons for Casio products online.

- Price Transparency: E-commerce platforms and comparison websites make it simple for customers to identify the best prices, putting pressure on Casio to remain competitive.

- Informed Decision-Making: Access to extensive product information allows customers to thoroughly evaluate Casio's offerings against alternatives, strengthening their negotiating position.

Volume of Purchases by Key Customers

The volume of purchases by key customers significantly influences Casio's bargaining power. Large retail chains and major online distributors, such as Amazon and Best Buy, often account for a substantial portion of Casio's sales volume. For instance, in fiscal year 2024, these channels were critical for distributing Casio's diverse product lines, from calculators to digital cameras and musical instruments.

- Significant Order Sizes: The sheer scale of orders placed by these major clients allows them to negotiate more favorable pricing and payment terms.

- Concentration of Buyers: A few key retailers or distributors can represent a large percentage of Casio's revenue, giving them considerable leverage.

- Price Sensitivity: These large buyers are often highly sensitive to price fluctuations, pushing Casio to maintain competitive pricing to secure their business.

- Access to Alternatives: If Casio does not meet their demands, these customers have the purchasing power to switch to competing brands, further strengthening their position.

Casio's customers wield considerable bargaining power, largely driven by the widespread availability of substitutes across its diverse product portfolio. In 2024, the consumer electronics landscape is flooded with alternatives, from affordable calculators to feature-rich smartwatches.

The ease with which consumers can compare prices and features online in 2024 significantly amplifies their leverage. This price transparency, coupled with low switching costs for many product categories, compels Casio to maintain competitive pricing and continuous product innovation to retain market share.

Major retail partners and distributors, representing substantial sales volumes for Casio in 2024, also exert significant bargaining power. Their ability to negotiate favorable terms, driven by the sheer scale of their orders and their own sensitivity to pricing, directly impacts Casio's profit margins.

| Casio Product Segment | Key Competitors (2024) | Customer Bargaining Power Factor |

|---|---|---|

| Calculators | Texas Instruments, Sharp | High (Low switching cost, price sensitivity) |

| Digital Watches | Seiko, Citizen, Timex, Fossil | Moderate to High (Brand variety, price competition) |

| Smartwatches | Apple, Samsung, Garmin | High (Rapid innovation, feature parity, strong brand loyalty to competitors) |

| Musical Instruments | Yamaha, Roland | Moderate (Specialized features, brand reputation) |

What You See Is What You Get

Casio Computer Porter's Five Forces Analysis

This preview showcases the complete Casio Computer Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

Casio faces intense competition across its diverse product lines. In the global watch market, it contends with established brands such as Seiko and Citizen, which also offer a wide range of timepieces. The digital camera sector sees Casio competing against giants like Canon and Sony, both of which hold significant market share and innovation capabilities.

The musical instrument segment presents another competitive arena where Casio's products are up against established players like Yamaha and Roland, known for their extensive portfolios and brand loyalty. This broad competitive landscape means Casio must constantly innovate and differentiate its offerings to maintain its market position.

The consumer electronics sector is generally expanding, fueled by innovation and the increasing popularity of smart devices. For instance, the global consumer electronics market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a positive overall trend.

However, growth within Casio's specific product lines shows considerable variation. While some areas, like digital cameras and calculators, might see more modest or even declining growth due to market saturation and evolving consumer preferences, other segments could experience higher growth rates.

This disparity means that while the broader industry offers opportunities, Casio faces intense competition in mature product categories where capturing market share requires significant differentiation and strategic pricing.

Casio enjoys significant brand recognition, especially with its robust G-Shock line, which fosters considerable customer loyalty. However, in the fast-paced electronics sector, maintaining distinct product features is a constant battle. For instance, in 2024, the smartwatch market saw intense competition, with new models frequently launched by rivals like Apple and Samsung, requiring Casio to keep pace with innovation.

Exit Barriers

Casio faces significant competitive rivalry stemming from high exit barriers in certain product segments. These barriers, which can include specialized manufacturing equipment, strong brand loyalty built over years, and substantial investments in research and development, make it challenging and costly for companies to leave a market even when facing low profitability. This reluctance to exit can prolong periods of intense competition as firms strive to maintain their market share.

For Casio, while its diversified product portfolio, spanning calculators to musical instruments and digital cameras, offers some flexibility in reallocating resources, exiting deeply entrenched markets presents its own difficulties. For instance, the calculator market, where Casio has a long-standing reputation, might involve specialized production lines and established distribution networks that are not easily transferable. In 2023, Casio reported net sales of ¥290.2 billion (approximately $1.9 billion USD), indicating the scale of operations across its various divisions.

- Specialized Assets: Casio's manufacturing facilities for products like electronic calculators or digital musical instruments often require highly specific machinery, making them difficult to repurpose or sell at a favorable price if exiting a particular segment.

- Contractual Obligations: Long-term supply agreements with component manufacturers or distribution contracts can create financial penalties for early termination, acting as a disincentive to exit.

- Brand Reputation: A strong brand reputation in a specific product category, like Casio's in scientific calculators, represents a significant intangible asset that would be difficult to recoup if the company were to withdraw from that market.

- Market Inertia: Even in declining segments, companies may remain due to the sunk costs already invested and the hope of a market turnaround, contributing to sustained rivalry.

Strategic Stakes and Aggressiveness of Competitors

Casio operates in highly competitive landscapes where rivals, often large and well-resourced global entities, engage in aggressive tactics. These include intense price competition, swift product development, and substantial marketing expenditures. For instance, in the consumer electronics sector, companies like Samsung and Sony are formidable competitors with extensive R&D budgets and established brand loyalty, frequently introducing new models and engaging in promotional pricing. This necessitates Casio to maintain a high degree of strategic flexibility and responsiveness to safeguard its market share.

The financial performance of key competitors often reflects this aggressive stance. In 2024, the global consumer electronics market saw significant investment in R&D and marketing by major players. For example, Samsung reported substantial revenue growth driven by new product launches and aggressive market penetration strategies. Similarly, competitors in the calculator and musical instrument segments, such as Texas Instruments and Yamaha respectively, also exhibit strong competitive drives, investing heavily in innovation and distribution networks to maintain their edge.

- Aggressive Market Strategies: Competitors frequently employ price wars and rapid innovation to gain market share.

- Multinational Competitors: Large, well-funded global corporations present a significant competitive challenge.

- Need for Responsiveness: Casio must be agile to defend its market position against these aggressive rivals.

- Financial Muscle of Rivals: Competitors' substantial R&D and marketing budgets underscore the intensity of the rivalry.

Casio operates in highly competitive markets with numerous rivals across its product lines, from watches to musical instruments and digital cameras. Established global brands like Seiko, Citizen, Canon, Sony, Yamaha, and Roland represent significant competitive threats due to their market share, innovation capabilities, and brand loyalty. This widespread rivalry demands continuous innovation and strategic differentiation from Casio to maintain its standing.

The intensity of this rivalry is amplified by aggressive market strategies employed by competitors, including price wars, rapid product development, and substantial marketing investments. For example, in 2024, major players in the consumer electronics sector like Samsung and Sony continued to invest heavily in R&D and marketing, launching new models and employing aggressive penetration strategies. This necessitates Casio's agility and responsiveness to defend its market share.

Furthermore, high exit barriers in certain segments, such as specialized manufacturing equipment and strong brand reputations, can prolong periods of intense competition. Casio's net sales in fiscal year 2023 reached ¥290.2 billion (approximately $1.9 billion USD), highlighting the scale of operations it must manage amidst these competitive pressures.

| Competitor | Key Product Segments | Competitive Tactics |

| Seiko | Watches | Brand heritage, diverse price points, technological innovation |

| Canon | Digital Cameras | Extensive product range, strong R&D, global distribution |

| Yamaha | Musical Instruments | Brand loyalty, broad product portfolio, artist endorsements |

| Samsung | Consumer Electronics | Aggressive pricing, rapid product cycles, marketing spend |

SSubstitutes Threaten

Smartphones have dramatically altered the landscape for devices like digital cameras and calculators. Many consumers now find the integrated features of their phones sufficient, making standalone gadgets less appealing, especially given the competitive pricing of smartphones. For instance, in 2024, global smartphone shipments continued to be robust, with many models offering advanced camera capabilities that rival dedicated point-and-shoot cameras for everyday use.

Casio's traditional watch business also faces pressure from emerging technologies. Smartwatches, which offer functionalities far beyond simple timekeeping, present a direct substitute for many of Casio's core watch products. The smartwatch market saw significant growth in 2024, with major tech companies expanding their offerings, further intensifying this competitive pressure.

Customer propensity to substitute for Casio's products, particularly in the calculator and digital watch segments, is influenced by the perceived value and convenience of alternatives. The widespread availability and increasing capabilities of smartphones, for instance, have significantly reduced the need for many consumers to carry dedicated calculators for basic functions. In 2024, smartphone penetration rates continue to climb globally, with over 7 billion users expected, making their calculator apps a readily accessible substitute for many casual users.

Rapid technological progress, particularly in cloud-based software and AI, continuously introduces new substitutes that challenge established products. For example, the rise of cloud-based Point of Sale (POS) systems directly competes with Casio's traditional electronic cash registers, offering more integrated and flexible solutions.

These advancements mean that functionalities previously exclusive to dedicated hardware, like those offered by Casio, are now readily available through software or multi-functional devices. This innovation cycle accelerates the threat of substitution, as consumers and businesses can often find more versatile and cost-effective alternatives.

The market for business equipment, including calculators and POS systems, is particularly susceptible. In 2023, the global POS market was valued at approximately $25.5 billion and is projected to grow significantly, indicating a strong shift towards software-centric and mobile POS solutions that can serve as substitutes for traditional hardware.

Relative Price of Substitutes

The threat of substitutes for Casio's products is significant, particularly when these substitutes offer comparable functionality at a lower price point. For instance, the widespread availability of free or low-cost calculator applications on smartphones directly competes with Casio's standalone calculators.

Furthermore, general-purpose computing devices, including tablets and laptops, can run sophisticated musical instrument software, thereby diminishing the market appeal for Casio's dedicated digital pianos and keyboards. This substitution trend is amplified by the increasing computational power and versatility of these alternative devices.

- Smartphone calculator apps: Offer basic to advanced calculation features for free, directly impacting the demand for entry-level Casio calculators.

- Digital Audio Workstations (DAWs) on PCs/Tablets: Provide professional-grade music creation tools, posing a threat to Casio's higher-end keyboards and synthesizers by offering more flexibility and a wider sound palette.

- Gaming consoles with music software: Some consoles offer music creation or performance games that can serve as a substitute for casual music learning or entertainment, potentially diverting consumers from dedicated Casio instruments.

Switching Costs to Substitutes

The threat of substitutes for Casio's calculators is significant, primarily due to low switching costs for consumers. When it's easy and inexpensive for customers to switch to an alternative, the threat increases. For example, the shift from dedicated physical calculators to smartphone applications is virtually seamless. This ease of transition means consumers can readily adopt these digital alternatives without incurring substantial costs or effort.

The ubiquity of smartphones and the availability of free or low-cost calculator apps on app stores further amplify this threat. In 2024, the global smartphone user base surpassed 6.9 billion, indicating a vast potential market for substitute calculator solutions. This widespread access to powerful computing devices means that specialized calculator hardware faces constant pressure from readily available software alternatives.

- Low Switching Costs: Consumers can easily switch from physical calculators to smartphone apps or other digital tools without significant financial or learning burdens.

- Ubiquitous Technology: Smartphones, which offer calculator functionality, are widely adopted globally, providing a readily accessible substitute.

- Digitalization Trend: The ongoing trend towards digital solutions across various industries makes it natural for consumers to seek calculator functions within their existing devices.

The threat of substitutes for Casio's products is substantial, particularly as integrated devices like smartphones offer comparable functionalities, often at a lower perceived cost. For instance, in 2024, the widespread adoption of smartphones, with billions of users globally, means many consumers already possess a capable calculator and digital camera, reducing the need for dedicated Casio devices. This trend is further fueled by the ease with which users can access these functions on their existing devices, leading to lower switching costs and a diminished market for standalone gadgets.

Casio's traditional watch business also faces significant substitution threats from smartwatches. These wearable devices offer a broader range of features, including health tracking and communication, making them an attractive alternative to basic digital or analog watches. The smartwatch market continued its expansion in 2024, with major technology firms introducing new models and enhancing existing ecosystems, thereby intensifying the competitive pressure on traditional watch manufacturers.

Furthermore, the digitalization of various functions previously handled by specialized equipment presents another layer of substitution risk. Cloud-based software and advanced computing platforms can now replicate or even surpass the capabilities of traditional hardware. For example, sophisticated music production software running on personal computers or tablets can serve as a substitute for Casio's digital pianos and keyboards, offering greater flexibility and a wider array of sound options to users.

| Product Category | Primary Substitute | Key Substitute Feature | Impact on Casio |

|---|---|---|---|

| Calculators | Smartphone Calculator Apps | Free, ubiquitous, integrated functionality | Reduced demand for standalone calculators |

| Digital Cameras | Smartphone Cameras | Convenience, multi-functionality, improving quality | Declining market share for basic digital cameras |

| Digital Watches | Smartwatches | Advanced features (health, communication), connectivity | Pressure on traditional watch sales |

| Electronic Keyboards/Pianos | Music Production Software (DAWs) | Flexibility, wider sound libraries, professional capabilities | Threat to higher-end instrument sales |

Entrants Threaten

Established players like Casio benefit significantly from economies of scale in production, research and development, and marketing. For example, in 2023, Casio's revenue was approximately ¥273.2 billion, allowing for substantial investment in large-scale manufacturing and efficient R&D processes, which new entrants would struggle to match without considerable capital outlay.

Furthermore, Casio's economies of scope enable it to spread costs across its diverse product portfolio, which includes calculators, digital cameras, musical instruments, and watches. This diversification allows Casio to utilize existing manufacturing facilities, distribution networks, and brand recognition more effectively, creating a cost advantage that new, specialized entrants would find challenging to overcome.

Entering the consumer electronics manufacturing space, like Casio's, demands significant upfront capital. Think about the costs for research and development, building and equipping factories, and establishing robust distribution channels. These substantial financial hurdles act as a strong deterrent for many aspiring competitors.

For instance, in 2024, the average cost to establish a new semiconductor fabrication plant, a critical component for many electronics, can easily exceed $10 billion. This immense financial commitment effectively raises the barrier to entry, protecting established players like Casio.

Casio has successfully built strong brand loyalty, especially with iconic product lines like G-Shock watches. This loyalty means new competitors face a steep uphill battle.

To attract Casio's established customer base, new entrants would need to invest heavily in marketing and promotional campaigns. This significant expenditure is necessary to overcome existing customer preferences and persuade them to switch brands, a task made more challenging by any associated switching costs.

Access to Distribution Channels

Casio benefits from deeply entrenched relationships with a vast array of retailers, both brick-and-mortar and online. These established connections ensure prominent placement and consistent sales, a significant barrier for newcomers. For instance, in 2024, a significant percentage of consumer electronics sales still occur through traditional retail channels where brand loyalty and existing partnerships are paramount.

New entrants often struggle to gain access to these vital distribution channels. Securing shelf space in major electronics stores or getting featured on popular e-commerce platforms requires substantial investment and proven sales history, which emerging companies typically lack. This difficulty in accessing distribution can severely limit a new product's reach and market penetration.

The threat of new entrants is therefore moderated by the difficulty of replicating Casio’s extensive and well-established distribution network.

- Established Retailer Relationships: Casio's long-standing partnerships provide preferential access and visibility.

- Global Distribution Reach: A broad network across diverse markets is difficult and costly for new firms to replicate.

- Securing Shelf Space: Limited prime retail space and online visibility present a significant hurdle for new entrants.

- Cost of Market Entry: Building a comparable distribution infrastructure can require millions in investment.

Proprietary Technology and Patents

Casio's robust portfolio of patents and proprietary technologies, particularly in areas like shock-resistant construction for its G-Shock line and advanced miniaturization techniques, significantly deters new entrants. These intellectual property rights act as formidable barriers, making it exceedingly difficult and costly for newcomers to develop comparable products. For instance, the unique resin-casing technology and multi-point G-Shock protection, patented over decades, represent a substantial competitive advantage that is not easily replicated.

The threat of new entrants is further mitigated by Casio's established brand reputation, built on decades of reliable and innovative products. Potential competitors face the challenge of overcoming this ingrained trust and recognition in the market.

- Proprietary Technology: Casio holds patents for shock-resistant designs and miniaturization, crucial for its watch and electronic product lines.

- Patent Protection: These intellectual property rights create significant hurdles for new companies seeking to enter the market with similar offerings.

- G-Shock Innovation: The G-Shock series, a prime example, benefits from patented shock-absorption mechanisms that are difficult and expensive to reverse-engineer.

The threat of new entrants for Casio is generally low due to substantial capital requirements and established brand loyalty. Significant investment is needed for R&D, manufacturing, and marketing, making it difficult for newcomers to compete. For instance, the cost to establish a new semiconductor plant in 2024 can exceed $10 billion, a clear deterrent.

Casio's strong brand recognition, particularly with its G-Shock line, and its extensive, entrenched relationships with retailers worldwide present formidable barriers. New entrants would need to invest heavily in marketing to overcome existing customer preferences and secure vital distribution channels, which is a costly and time-consuming endeavor.

Intellectual property, such as Casio's patents on shock-resistant technology for G-Shock watches, further protects its market position. These proprietary innovations are difficult and expensive to replicate, significantly raising the barrier to entry for potential competitors.

| Barrier Type | Description | Impact on New Entrants | Casio's Advantage | Example Data (2024) |

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Significant financial hurdle. | Economies of scale and scope. | Semiconductor plant costs > $10 billion. |

| Brand Loyalty | Established customer trust and preference. | Steep uphill battle to attract customers. | Decades of reliable products (e.g., G-Shock). | High repeat purchase rates for iconic lines. |

| Distribution Channels | Entrenched relationships with retailers. | Difficulty securing shelf space and market access. | Global network and preferential placement. | Dominance in traditional retail for electronics. |

| Intellectual Property | Patents on unique technologies. | Challenges in developing comparable products. | Proprietary shock-resistance and miniaturization. | Patented G-Shock protection mechanisms. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Casio Computer is built upon a foundation of reliable data, including Casio's annual reports, investor presentations, and financial filings. We also incorporate industry-specific market research from firms specializing in consumer electronics and business technology, alongside macroeconomic data to understand broader market trends.