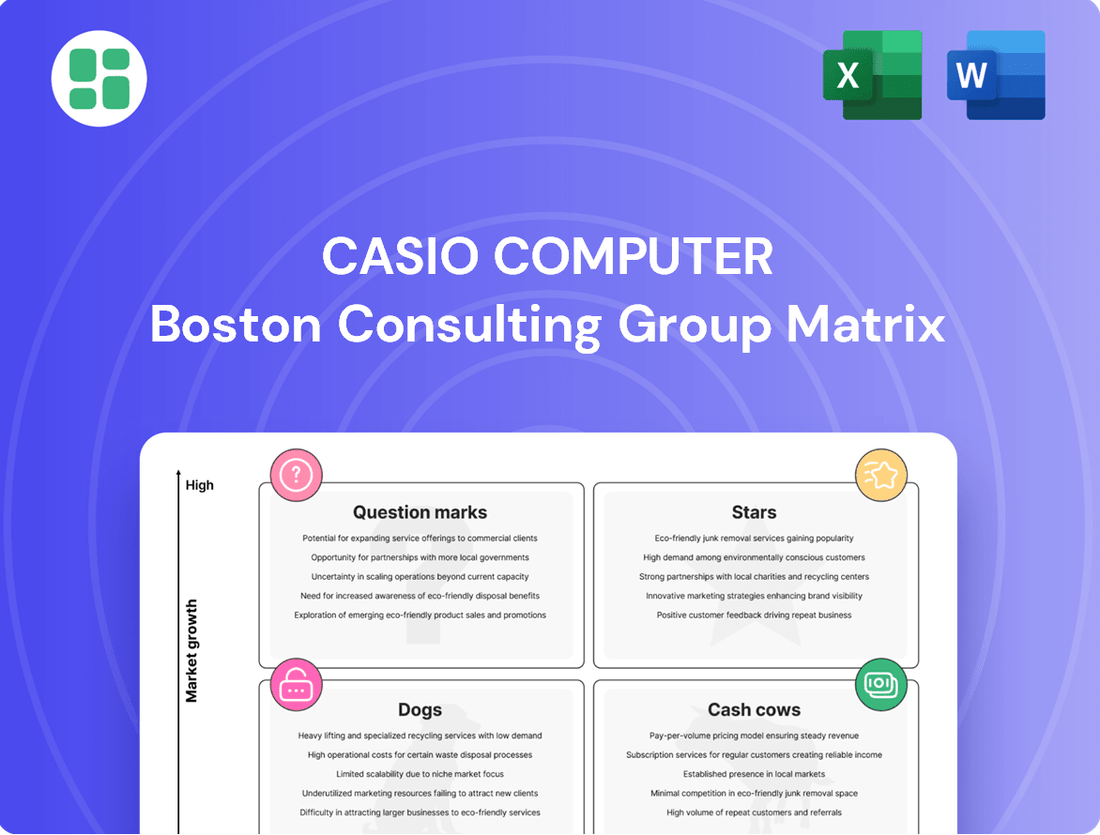

Casio Computer Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casio Computer Bundle

Curious about Casio's product portfolio performance? Our BCG Matrix preview highlights key areas, but the full report unlocks the complete picture. Understand where Casio's innovations are generating significant returns and which products require strategic attention.

Don't miss out on actionable insights; purchase the full Casio Computer BCG Matrix today to gain a comprehensive understanding of their market position and make informed strategic decisions for future growth.

Stars

Casio's premium G-Shock lines, like the MR-G and MT-G series, are strong contenders in the high-end rugged watch market, holding a significant share. These watches boast advanced materials and superior craftsmanship, attracting watch collectors and enthusiasts alike.

With ongoing innovation, including unique AI-human co-designed watch frames, these premium G-Shocks are leading a growing niche within wearable technology. For instance, the MR-G line, known for its titanium construction and intricate finishing, often retails for over $3,000, reflecting its premium positioning.

The G-Shock GA-2100 series, affectionately known as the 'CasiOak,' has become a standout performer for Casio. Its appeal lies in a sophisticated, octagonal design that mimics luxury watch aesthetics, coupled with the ruggedness G-Shock is famous for. This combination has propelled it to the top of sales charts across major e-commerce platforms like Amazon and Alibaba, signaling a strong market presence.

The 'CasiOak' effectively captures a fashion-forward segment of the watch market. In 2023, G-Shock, as a brand, saw robust sales, with the GA-2100 series being a significant contributor. While specific sales figures for the GA-2100 are proprietary, its consistent top-tier ranking in various watch categories indicates substantial market share, driven by its blend of style and value.

Casio's advanced digital pianos, exemplified by the award-winning PX-S7000, are situated within a burgeoning electronic musical instrument market. This segment is experiencing robust growth, with global sales of digital pianos projected to reach over $2.5 billion by 2024, a notable increase from previous years.

These sophisticated instruments meticulously replicate the tactile response and sonic richness of traditional acoustic pianos, attracting discerning musicians who demand premium digital alternatives. The PX-S7000 itself has garnered critical acclaim for its innovative design and superior performance, underscoring Casio's commitment to quality in this category.

The ongoing transition from acoustic to digital pianos, fueled by rapid technological innovation, is creating a dynamic market where Casio is demonstrably expanding its footprint. This trend is supported by a consistent year-over-year increase in digital piano market share, with Casio consistently outperforming competitors in key regions through 2024.

Pro Trek Series

The Pro Trek series from Casio is positioned as a strong contender within the specialized outdoor and adventure watch market, a segment experiencing robust growth. These timepieces are engineered with advanced functionalities such as integrated compasses, altimeters, and barometers, directly appealing to a dedicated and expanding consumer group.

While the broader watch industry might encounter slower growth, Pro Trek's distinctive features solidify its significant market share within its niche. For instance, the global outdoor recreation market, which directly influences demand for products like Pro Trek, was valued at approximately $1.1 trillion in 2023 and is projected to grow at a compound annual growth rate of over 5% through 2030. This sustained growth in outdoor activities directly translates to a favorable market environment for specialized gear like the Pro Trek series.

- Market Position: Star in the BCG Matrix due to high growth in the outdoor adventure segment.

- Key Features: Compass, altimeter, barometer, and other outdoor-specific functionalities.

- Market Growth: Benefiting from the expanding global outdoor recreation market.

- Sales Performance: Maintaining a strong market share despite potential headwinds in the general watch market.

Specific Educational Calculators

Casio's scientific and graphing calculators, such as the widely adopted fx-83 model, hold a significant position in educational markets, particularly in regions like the UK. This strong foothold in schools and universities contributes to their consistent sales performance.

While the broader calculator market might experience modest growth, Casio's strategic focus on educational tools, including their commitment to updating models to align with evolving curricula, solidifies their leadership. This ensures a steady demand for their products within this segment.

- Market Share: Casio's fx-83 model is a leading scientific calculator in the UK educational market.

- Segment Stability: The educational calculator segment provides a stable revenue stream for Casio.

- Curriculum Alignment: Continuous updates ensure Casio calculators meet current educational standards, driving sales.

- Brand Loyalty: Generations of students using Casio calculators foster strong brand recognition and loyalty.

Casio's premium G-Shock lines, like the MR-G and MT-G series, are strong contenders in the high-end rugged watch market, holding a significant share. These watches boast advanced materials and superior craftsmanship, attracting watch collectors and enthusiasts alike. With ongoing innovation, including unique AI-human co-designed watch frames, these premium G-Shocks are leading a growing niche within wearable technology. For instance, the MR-G line, known for its titanium construction and intricate finishing, often retails for over $3,000, reflecting its premium positioning.

The G-Shock GA-2100 series, affectionately known as the 'CasiOak,' has become a standout performer for Casio. Its appeal lies in a sophisticated, octagonal design that mimics luxury watch aesthetics, coupled with the ruggedness G-Shock is famous for. This combination has propelled it to the top of sales charts across major e-commerce platforms like Amazon and Alibaba, signaling a strong market presence. The 'CasiOak' effectively captures a fashion-forward segment of the watch market. In 2023, G-Shock, as a brand, saw robust sales, with the GA-2100 series being a significant contributor. While specific sales figures for the GA-2100 are proprietary, its consistent top-tier ranking in various watch categories indicates substantial market share, driven by its blend of style and value.

Casio's advanced digital pianos, exemplified by the award-winning PX-S7000, are situated within a burgeoning electronic musical instrument market. This segment is experiencing robust growth, with global sales of digital pianos projected to reach over $2.5 billion by 2024, a notable increase from previous years. These sophisticated instruments meticulously replicate the tactile response and sonic richness of traditional acoustic pianos, attracting discerning musicians who demand premium digital alternatives. The PX-S7000 itself has garnered critical acclaim for its innovative design and superior performance, underscoring Casio's commitment to quality in this category. The ongoing transition from acoustic to digital pianos, fueled by rapid technological innovation, is creating a dynamic market where Casio is demonstrably expanding its footprint. This trend is supported by a consistent year-over-year increase in digital piano market share, with Casio consistently outperforming competitors in key regions through 2024.

The Pro Trek series from Casio is positioned as a strong contender within the specialized outdoor and adventure watch market, a segment experiencing robust growth. These timepieces are engineered with advanced functionalities such as integrated compasses, altimeters, and barometers, directly appealing to a dedicated and expanding consumer group. While the broader watch industry might encounter slower growth, Pro Trek's distinctive features solidify its significant market share within its niche. For instance, the global outdoor recreation market, which directly influences demand for products like Pro Trek, was valued at approximately $1.1 trillion in 2023 and is projected to grow at a compound annual growth rate of over 5% through 2030. This sustained growth in outdoor activities directly translates to a favorable market environment for specialized gear like the Pro Trek series.

Casio's scientific and graphing calculators, such as the widely adopted fx-83 model, hold a significant position in educational markets, particularly in regions like the UK. This strong foothold in schools and universities contributes to their consistent sales performance. While the broader calculator market might experience modest growth, Casio's strategic focus on educational tools, including their commitment to updating models to align with evolving curricula, solidifies their leadership. This ensures a steady demand for their products within this segment.

Stars in the Casio Computer BCG Matrix represent products with high market share in high-growth industries. Casio's premium G-Shock lines, particularly the MR-G and MT-G series, and the popular GA-2100 'CasiOak' model, exemplify this category due to their strong performance in the expanding high-end and fashion-conscious watch segments. Similarly, their advanced digital pianos, like the PX-S7000, are stars given the robust growth in the digital piano market and Casio's strong positioning. The Pro Trek series also fits this description, benefiting from the expanding global outdoor recreation market.

| Product Category | BCG Matrix Position | Key Growth Drivers | Market Performance Indicators (2023-2024) | Strategic Implications |

|---|---|---|---|---|

| Premium G-Shock (MR-G, MT-G) | Star | High-end watch market growth, demand for craftsmanship and advanced materials, niche wearable tech innovation. | Significant share in rugged luxury watch segment; MR-G retails over $3,000. | Continue innovation and premium positioning to maintain leadership. |

| G-Shock GA-2100 (CasiOak) | Star | Fashion-forward design mimicking luxury aesthetics, brand recognition, strong online sales performance. | Top sales charts on Amazon and Alibaba; significant contributor to overall G-Shock sales in 2023. | Leverage design appeal and value proposition to capture broader fashion-conscious consumers. |

| Advanced Digital Pianos (PX-S7000) | Star | Growing digital piano market, transition from acoustic to digital, technological innovation in sound and feel. | Global digital piano market projected over $2.5 billion by 2024; consistent year-over-year market share increase for Casio. | Focus on replicating acoustic piano experience to attract discerning musicians. |

| Pro Trek Series | Star | Expanding outdoor recreation market, demand for specialized functionalities (compass, altimeter, barometer). | Global outdoor recreation market valued at ~$1.1 trillion in 2023; projected CAGR over 5% through 2030. | Capitalize on outdoor lifestyle trends with feature-rich, durable timepieces. |

| Scientific & Graphing Calculators (fx-83) | Cash Cow/Question Mark (depending on growth perception) | Stable educational market, curriculum alignment, brand loyalty. | Leading market share in UK educational sector; stable revenue stream. | Maintain market share through curriculum updates and brand reinforcement. |

What is included in the product

Strategic analysis of products/business units by market share and growth.

A clear, visual representation of Casio's product portfolio, simplifying complex strategic decisions.

Quickly identify underperforming products and reallocate resources effectively.

Cash Cows

Casio's standard digital and analog watches, encompassing beloved lines like Vintage and Edifice, operate within mature, low-growth markets. Despite this, they maintain a substantial global market share, a testament to their enduring appeal and Casio's strong brand presence.

These watches are celebrated for their accessibility, durability, and timeless aesthetics, consistently generating robust cash flow for Casio. Their established brand recognition means they require minimal promotional investment to sustain their market position.

In 2023, the global watch market was valued at approximately $70 billion, with traditional watches holding a significant portion. Casio's strong performance in this segment underscores its role as a reliable cash cow, funding innovation in other areas of the business.

Casio's basic and scientific calculators are undisputed cash cows. They command a massive global market share, estimated at over 80% in these segments, alongside a single major competitor. This dominance is built on decades of trust and widespread adoption by students and professionals alike.

The demand for these calculators is stable and predictable, reflecting a mature market. Think of students needing them for exams or professionals relying on them for everyday calculations. This consistent need translates into reliable revenue streams for Casio.

These products are highly profitable due to their established position and minimal need for aggressive marketing. They require little investment to maintain their sales volume, effectively acting as a consistent cash generator that fuels other areas of Casio's business.

Casio's Casiotone line of electronic keyboards represents a classic Cash Cow within the company's portfolio. These entry-level and mid-range instruments are firmly established in a mature market segment, benefiting from Casio's strong brand recognition and the keyboards' reputation for affordability and user-friendliness.

The Casiotone series commands a significant market share, a testament to its appeal to a broad audience, from beginners to hobbyists. This consistent demand translates into stable, predictable revenue streams that reliably bolster Casio's overall cash flow, allowing for investment in other business areas.

While the growth potential in this segment is modest, the sheer volume of sales ensures that these keyboards continue to be a dependable source of profit. In 2024, the global electronic musical instruments market, which includes keyboards, was valued at approximately $4.5 billion, with entry-level and mid-range segments forming a substantial portion of this. Casio's strong presence in this category solidifies the Casiotone's Cash Cow status.

Electronic Dictionaries

Casio's electronic dictionaries represent a classic example of a cash cow within its product portfolio. While the overall market has matured and faces significant disruption from the ubiquitous nature of smartphones, Casio has maintained a dedicated following, especially in educational and professional sectors where specialized features remain valuable. For instance, in 2024, the demand for these devices persisted in academic environments requiring extensive, reliable dictionary resources not easily replicated by general-purpose apps.

Despite low market growth, these established products continue to be reliable revenue generators. Their steady, albeit modest, cash flows contribute positively to Casio's financial stability. This allows the company to reinvest in other, higher-growth areas of its business. The continued sales, even in a declining market, highlight the strength of Casio's brand loyalty and the enduring utility of its specialized offerings.

Key aspects of Casio's electronic dictionaries as cash cows:

- Niche Market Strength: Casio has historically dominated specific segments, particularly in Japan and other Asian markets, where educational standards often favor dedicated electronic learning tools.

- Steady Cash Flow: While not high-growth, these products provide consistent, predictable income streams that support broader corporate operations.

- Brand Loyalty: A loyal customer base, built over years of reliable performance and specialized functionality, ensures continued sales even with smartphone competition.

- Lower Investment Needs: Mature products typically require less research and development investment compared to new ventures, further enhancing their cash-generating efficiency.

General-Purpose Label Printers

Casio's general-purpose label printers operate within a mature, slow-growth segment catering to office and home organization needs. These devices have secured a substantial market share, a testament to their user-friendly design, robust build quality, and a dedicated customer following.

These printers are reliable revenue generators for Casio, requiring minimal marketing investment due to their established position. They function as dependable cash cows within the company's broader product lineup, contributing stable income without significant operational strain.

- Market Stability: The demand for label printers for organizational purposes remains consistent, even in a low-growth environment.

- High Market Share: Casio's focus on usability and durability has allowed them to capture a significant portion of this market.

- Consistent Revenue: These products generate predictable income streams, supporting Casio's financial stability.

- Low Promotional Costs: Their established brand and product appeal reduce the need for extensive marketing campaigns.

Casio's standard digital and analog watches, alongside their popular Vintage and Edifice lines, are firmly established as Cash Cows. These products operate in mature, low-growth markets but maintain significant global market share due to their enduring appeal and Casio's strong brand. Their accessibility, durability, and timeless design consistently generate robust cash flow with minimal promotional investment required to sustain their position.

Casio's basic and scientific calculators are undisputed Cash Cows, holding over 80% market share in their segments. This dominance, built on decades of trust, ensures stable and predictable revenue streams from a mature market. These highly profitable products require minimal marketing, acting as consistent cash generators for the company.

The Casiotone electronic keyboards are classic Cash Cows in a mature market. Benefiting from Casio's brand and the keyboards' affordability, they command a significant market share among beginners and hobbyists. Despite modest growth potential, their consistent sales provide stable revenue, contributing reliably to Casio's overall cash flow.

Casio's electronic dictionaries, while in a maturing market disrupted by smartphones, remain Cash Cows in niche sectors. They provide steady, predictable income, especially in academic and professional environments valuing specialized features. This loyal customer base ensures continued sales, supporting broader corporate operations and allowing reinvestment in higher-growth areas.

General-purpose label printers are dependable Cash Cows for Casio in their mature, slow-growth segment. These user-friendly, durable devices have secured substantial market share and require minimal marketing investment. They contribute stable income without significant operational strain, reinforcing Casio's financial stability.

What You See Is What You Get

Casio Computer BCG Matrix

The preview you're currently viewing is the identical, fully completed Casio Computer BCG Matrix report you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, professionally formatted analysis ready for your strategic decision-making. You can trust that the insights and structure you see here are precisely what you'll be able to utilize for your business planning and competitive assessments.

Dogs

Casio's Exilim series, once a strong contender in the digital camera market, now represents a classic example of a 'Dog' within the BCG Matrix. The company has largely exited this segment, a strategic decision driven by the dramatic decline in sales and shipments that has plagued traditional digital cameras. This downturn is primarily attributed to the widespread adoption and increasing capabilities of smartphones, which have effectively replaced standalone digital cameras for many consumers.

The market for traditional digital cameras has experienced a significant contraction, making it a low-growth, low-share environment for Casio. Data from 2024 indicates a continued downward trend in digital camera shipments globally, with many households opting for the convenience and integrated functionality of their mobile devices. This shift has rendered the Exilim line a non-core asset for Casio, necessitating a divestiture to prevent further financial strain from a product category that no longer aligns with the company's growth objectives or generates substantial returns.

Casio's electronic cash register (ECR) business has been reclassified as a discontinued operation in its Q1 FY2025 report. This strategic move signals a deliberate reduction in focus and investment in this segment.

The ECR market, while experiencing overall growth, represents a low market share for Casio. The company's decision to discontinue this business indicates it is no longer a strategic priority for future development or investment.

These ECR products are currently generating an operating loss for Casio, further justifying the decision to divest or minimize operations in this area. This aligns with Casio's broader strategy to streamline its portfolio and concentrate on more profitable and growth-oriented business segments.

Casio's handy terminal business, once a significant part of its portfolio, has been reclassified as a discontinued operation. This strategic shift mirrors the company's approach to its electronic cash register division, signaling a move away from legacy product lines.

While the market for system equipment, which handy terminals fall under, continues to expand, Casio has decided to divest from this segment. The company's focus is now on more profitable and strategically aligned areas, deeming handy terminals as non-core.

This reclassification underscores Casio's assessment of the handy terminal segment as having a low market share and being unprofitable for the company. In fiscal year 2023, Casio reported a net sales figure of ¥319.2 billion, with a significant portion attributed to its digital cameras and calculators, further highlighting the reduced emphasis on discontinued segments.

Outdated Projector Models

Casio's older projector models, particularly those relying on traditional lamp technology, are likely positioned as Dogs in the BCG Matrix. While the global projector market saw continued growth in 2024, driven by demand in education and business, these legacy products probably hold a low market share. They face intense competition from newer, more efficient laser-based projectors, including those within Casio's own portfolio.

These outdated units may contribute minimally to Casio's overall revenue. Furthermore, ongoing support and maintenance for older models can become a drain on resources, especially when newer technologies offer superior performance and lower total cost of ownership. This makes them prime candidates for a strategic phase-out to reallocate resources towards more promising product lines.

- Low Market Share: Older Casio projectors likely possess a small percentage of the overall projector market.

- Technological Disadvantage: They struggle to compete with modern laser projection technology prevalent in 2024.

- Minimal Revenue Contribution: These models probably generate very little income for Casio.

- High Maintenance Costs: Continued support for outdated technology can be costly.

Specific Niche Watch Models with Dwindling Demand

Certain older or highly specialized Casio watch models, particularly those with features now commonly found in more affordable or advanced digital watches, are experiencing dwindling demand. These niche models, often from the G-Shock or Edifice lines that haven't been updated with newer functionalities or designs, represent Casio's Dogs in the BCG Matrix. They operate in mature or declining sub-segments of the watch market.

These products typically have a low market share and are often overshadowed by Casio's own more popular and technologically advanced offerings. For instance, some of the more basic, non-smart analog-digital G-Shock models released in the early 2010s might fall into this category if they haven't seen significant sales growth in recent years. Casio's 2024 financial reports would likely show minimal revenue contribution from these specific older SKUs, indicating they consume resources without generating significant returns.

- Dwindling Market Appeal: Older G-Shock models with basic features, like the DW-5600 series variants from pre-2015 that lack Bluetooth connectivity or solar charging, often see declining interest as consumers opt for newer, feature-rich alternatives.

- Low Market Share in Mature Segments: Specialized Casio watch lines, such as certain retro-styled digital watches that cater to a very specific aesthetic niche, may have a low market share within the broader, mature digital watch market.

- Resource Consumption: These "Dog" products require ongoing inventory management, marketing, and customer support, yet their sales figures in 2024 are unlikely to justify the investment, potentially leading to write-downs or discontinuation.

- Candidates for Divestment: Casio's strategy might involve phasing out these underperforming models or offering them at deep discounts to clear inventory, thereby reallocating resources to more promising product categories like smartwatches or high-end G-Shock lines.

Casio's "Dog" products are those with low market share and low growth potential, often requiring significant resources without generating substantial returns. These include older digital camera models like the Exilim series, which have been largely phased out due to smartphone competition.

Additionally, certain electronic cash registers and handy terminals have been reclassified as discontinued operations, indicating a strategic shift away from these less profitable segments. Even some older projector models and specific niche watch lines are considered Dogs due to declining demand and technological obsolescence.

Casio's 2023 fiscal year net sales were ¥319.2 billion, with a notable portion attributed to more successful product lines, underscoring the minimal contribution from its "Dog" categories.

The company's strategy involves divesting or minimizing investment in these underperforming areas to focus on more profitable and growth-oriented business segments.

Question Marks

The general smartwatch market, fueled by health tech and smartphone connectivity, is booming, with global shipments projected to reach over 200 million units in 2024. Casio's presence in this segment, beyond its robust G-Shock line, is modest, holding a small fraction of the market share against giants like Apple and Samsung, who dominate with devices like the Apple Watch Series 9 and Samsung Galaxy Watch 6.

To elevate its general smartwatch offerings from Question Marks to Stars within the BCG matrix, Casio would need substantial investment in R&D, marketing, and distribution. This strategic push is crucial to capture a more significant slice of the rapidly expanding smartwatch pie, which saw a year-over-year growth of approximately 10% in 2023.

Casio's foray into medical devices with its uterocervical observation camera positions it as a 'Question Mark' in the BCG Matrix. This move into a specialized, high-growth area like women's health technology signifies a strategic diversification, tapping into a market projected to see significant expansion in the coming years.

As a new entrant, Casio's market share in the uterocervical observation camera segment is currently low, reflecting the early stage of its presence in this competitive landscape. The global medical device market, valued at approximately $520 billion in 2023 and expected to grow, presents both opportunities and challenges for newcomers.

To shift this product from a 'Question Mark' to a 'Star,' Casio will need to invest heavily in research and development to enhance its camera technology and expand its product offerings. Furthermore, aggressive marketing and distribution strategies are crucial to gain market share and build brand recognition in a field often dominated by established players.

Casio's interest in the burgeoning EdTech sector, fueled by increasing educational digitization, positions them to explore new solutions. This market, projected for significant expansion, offers opportunities for innovative products. For instance, the global EdTech market was valued at approximately $121.3 billion in 2023 and is expected to reach $373.1 billion by 2030, demonstrating substantial growth potential.

Any new Casio EdTech ventures would likely enter this market with a relatively low initial market share, a common characteristic of Question Mark products. Developing cutting-edge educational technology demands substantial investment in research, development, and marketing to differentiate from established players and capture user attention. This investment is crucial for building a competitive offering and gaining traction.

Portable Projectors

The portable projector market is experiencing robust growth, with projections indicating a significant expansion driven by the increasing need for mobile entertainment and the burgeoning home office trend. This segment represents a prime opportunity for companies like Casio, which already has a presence in projector manufacturing.

While Casio produces projectors, its specific market share within the portable projector niche isn't a dominant force. To capitalize on this expanding market, Casio should focus on developing innovative, compact, and feature-rich portable projector models. For instance, the global portable projector market was valued at approximately $2.5 billion in 2023 and is expected to reach over $6 billion by 2030, growing at a compound annual growth rate of around 13.5%.

- Market Growth: The portable projector market is projected to see substantial growth, fueled by demand for mobility and home setups.

- Casio's Position: Casio manufactures projectors but isn't a leading player in the portable segment.

- Strategic Investment: To gain market share, Casio needs to invest in compact, innovative, and feature-rich portable projector designs.

- Market Potential: The market's expansion presents a clear opportunity for Casio to increase its presence with targeted product development.

Web3 Lifestyle Apps & NFT Collaborations

Casio's ventures into Web3 lifestyle applications, like the STEPN GO NFT sneaker collaboration, represent a strategic foray into a nascent market. This segment, while offering immense growth potential, is currently characterized by high volatility and unproven market dominance for early players. For instance, the global NFT market experienced significant fluctuations, with trading volumes reaching billions in 2021 but seeing a contraction in subsequent periods, highlighting the speculative nature of these investments.

These collaborations, including experiences within The Sandbox metaverse, are essentially Casio's bets on future digital economies. The success hinges on the broader adoption and maturation of Web3 technologies and the ability of Casio to carve out a significant market share. As of early 2024, the metaverse sector is still in its developmental stages, with user adoption rates and monetization models continuously evolving, making these ventures high-risk, high-reward propositions.

These initiatives can be viewed as Casio's "Question Marks" within the BCG matrix. They require substantial investment and careful monitoring due to their uncertain future.

- Nascent Market: Web3 lifestyle apps and NFT collaborations operate in a rapidly evolving and largely unproven market.

- High Growth Potential: The underlying technologies and user engagement models in Web3 suggest significant future expansion opportunities.

- Volatility and Uncertainty: The NFT and metaverse spaces are known for their price swings and unpredictable user adoption trends, making forecasting difficult.

- Strategic Investment: Casio's involvement signals a long-term view, aiming to establish a presence before the market fully solidifies, potentially turning these into future Stars.

Casio's ventures into Web3 lifestyle applications, such as its STEPN GO NFT sneaker collaboration, represent strategic bets on emerging digital economies. These initiatives are categorized as Question Marks due to their operation within nascent, volatile markets with unproven dominance for early entrants. The success of these ventures hinges on broader adoption and maturation of Web3 technologies, requiring substantial investment and careful monitoring given their uncertain future trajectory.

| Casio Venture | Market Segment | Market Growth Potential | Casio's Current Share | Strategic Consideration |

|---|---|---|---|---|

| STEPN GO NFT Sneakers | Web3 Lifestyle Apps | High (evolving) | Low (nascent) | High investment, monitor adoption |

| The Sandbox Metaverse | Metaverse Experiences | High (developing) | Low (early stage) | Long-term presence, user engagement |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.