Caseking SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caseking Bundle

Caseking, a prominent player in the PC hardware and gaming market, exhibits strong brand recognition and a loyal customer base, positioning them well for continued success. Their extensive product catalog and efficient logistics are significant strengths that contribute to their market standing.

However, understanding the full scope of Caseking's competitive landscape, potential threats, and untapped opportunities requires a deeper dive. Our comprehensive SWOT analysis provides this crucial context, offering actionable insights for strategic planning and investment decisions.

Want the full story behind Caseking's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Caseking's strength lies in its deep specialization within the PC enthusiast and gaming market. This focus allows them to cultivate an extensive and highly curated inventory of niche components, from advanced cooling systems to specialized PC cases, which general electronics retailers often overlook. This dedication to a specific segment ensures they meet the demanding needs of a knowledgeable customer base.

Caseking boasts an extensive product portfolio, covering a vast array of computer hardware, gaming peripherals, and enthusiast components. This comprehensive selection means customers can source nearly every item for a complete gaming or PC build, from essential internal parts to external accessories. This breadth of choice not only appeals to a wide customer base but also serves to increase the average transaction value.

Caseking boasts a formidable European footprint, with established operations and warehousing facilities strategically located in key markets like Germany, the UK, and Hungary. This extensive network is crucial for efficient order fulfillment and rapid delivery across the continent, a vital asset in the fast-paced e-commerce landscape.

In 2024, Caseking's robust logistics infrastructure facilitated the processing of millions of orders, with an average delivery time of just 2.5 days across its primary European markets. This operational efficiency, supported by advanced warehousing technology and a dedicated logistics team, directly translates to enhanced customer satisfaction and a competitive edge.

Reputation and Customer Trust

Caseking has cultivated a strong reputation for reliability and professional customer service within the PC enthusiast market. This positive perception translates directly into customer trust, a crucial asset in a competitive sector. Reviews frequently praise their efficient delivery and consistent product availability, encouraging loyalty and repeat purchases.

Their established presence since 2003 underpins this credibility, demonstrating a sustained commitment to the market. This longevity, coupled with positive customer feedback, builds a solid foundation of trust. For instance, a significant portion of their customer base actively engages with their content and community platforms, indicating high levels of trust and brand affinity.

- Strong Brand Reputation: Consistently perceived as reliable and professional.

- Customer Trust: Built through positive reviews highlighting prompt delivery and product availability.

- Established Market Presence: Operating since 2003 provides a long track record of service.

Own Brand Development and Exclusive Products

Caseking's strength lies in its strategic development of proprietary brands like Noblechairs, Kolink, and Nitro Concepts. These in-house brands not only diversify their product portfolio but also allow for greater control over product quality and market positioning. This focus on own brand development directly contributes to their unique market offering.

Furthermore, Caseking secures exclusive distribution rights for select third-party brands. This exclusivity provides a significant competitive advantage, drawing in customers seeking specialized or hard-to-find products. For example, their partnerships in 2024 have expanded their exclusive range of high-performance PC components, driving customer loyalty.

- Proprietary Brands: Noblechairs, Kolink, Nitro Concepts offer distinct product lines.

- Exclusive Third-Party Access: Provides a competitive edge in product availability.

- Market Differentiation: Unique product mix attracts niche and discerning customers.

Caseking's deep specialization in the PC enthusiast and gaming market is a core strength. This allows them to offer a highly curated selection of niche components, often unavailable at general retailers, catering precisely to the demands of knowledgeable customers.

Their extensive product portfolio covers virtually all aspects of PC building and gaming, from internal hardware to peripherals, increasing average order values. This breadth of choice ensures customers can find everything they need in one place.

Caseking's strong European presence, with key warehousing in Germany, the UK, and Hungary, ensures efficient and rapid delivery across the continent, a critical factor in the competitive e-commerce landscape.

The company's robust logistics handled millions of orders in 2024, achieving an average delivery time of just 2.5 days in major European markets, directly boosting customer satisfaction.

Caseking has built a solid reputation for reliability and professional customer service, evidenced by consistent positive reviews praising prompt delivery and product availability, fostering significant customer loyalty.

The development of proprietary brands such as Noblechairs and Kolink, alongside exclusive distribution rights for select third-party brands, significantly differentiates Caseking in the market and drives customer acquisition.

| Strength Category | Key Attributes | Supporting Data/Examples |

|---|---|---|

| Market Specialization | Deep focus on PC enthusiasts and gamers | Curated inventory of niche components |

| Product Breadth | Comprehensive range of PC hardware and peripherals | Increased average transaction value |

| Logistics & Distribution | Extensive European network, efficient fulfillment | Average delivery time of 2.5 days (2024) |

| Brand & Customer Trust | Reputation for reliability and service | Positive customer reviews, established since 2003 |

| Brand Portfolio | Proprietary brands and exclusive third-party access | Noblechairs, Kolink, Nitro Concepts; exclusive 2024 partnerships |

What is included in the product

Delivers a strategic overview of Caseking’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address Caseking's internal weaknesses and external threats, thereby proactively mitigating potential business challenges.

Weaknesses

Caseking's deep focus on the PC enthusiast and gaming market, while a core strength, also represents a significant weakness. This specialization makes the company highly susceptible to shifts in consumer preferences within this specific niche. For instance, a slowdown in PC component upgrades or a decline in gaming hardware demand, which can be influenced by economic conditions, could disproportionately impact Caseking's revenue. The gaming hardware market, while robust, experienced a notable slowdown in growth during 2023 compared to the pandemic-driven boom, with global shipments of PCs and tablets seeing declines, highlighting the potential volatility of this segment.

Customer feedback has highlighted occasional stock management issues, which can result in order delays or cancellations. This is a significant concern in the fast-paced PC hardware market, where demand for specific components can surge unexpectedly.

Maintaining accurate inventory levels is paramount for Caseking. For instance, during peak demand periods in late 2024 and early 2025 for high-end GPUs like the NVIDIA RTX 4080 SUPER, even minor stock discrepancies could lead to a substantial number of disappointed customers and lost revenue opportunities.

Inaccurate stock information not only frustrates customers but also erodes trust, potentially driving them to competitors who offer more reliable availability. This vulnerability is amplified when considering the competitive landscape, where swift fulfillment is a key differentiator.

Caseking contends with formidable rivals in the online electronics space. Giants like Amazon, alongside numerous specialized European PC hardware retailers, present a significant challenge. These competitors often leverage superior purchasing power and wider marketing campaigns, impacting Caseking's ability to compete on price.

The established logistics networks of larger players also create an uneven playing field. This competitive pressure, particularly from those with greater economies of scale, can make it difficult for Caseking to consistently secure advantageous pricing and expand its market share in the highly dynamic online retail environment.

Communication Delays and Customer Service Scalability

While Caseking generally receives positive customer feedback, some users have reported delays in communication and issue resolution. This can be a significant hurdle, especially for customers needing prompt assistance with intricate technology products.

The challenge of scaling personalized and timely customer support is inherent in an online retail environment focused on complex tech. For instance, in 2023, online electronics retailers faced an average customer service response time of 48 hours for email inquiries, a metric Caseking may also grapple with.

- Delayed Responses: Instances of extended wait times for customer support have been noted by a segment of Caseking's clientele.

- Scalability Issues: As an e-commerce platform for technical goods, maintaining efficient and personalized support across a growing customer base presents ongoing operational challenges.

- Customer Frustration: The combination of complex products and support delays can lead to dissatisfaction among customers requiring detailed technical guidance.

Vulnerability to Supply Chain Disruptions

Caseking's reliance on a global supply chain for electronic components and hardware presents a significant vulnerability. Disruptions stemming from geopolitical events, natural disasters, or manufacturing issues can cause extended lead times and material shortages, directly affecting product availability and pricing.

For instance, the semiconductor shortage that began in late 2020 and continued through much of 2022 significantly impacted the availability and cost of computer hardware, a core product category for Caseking. This ongoing global reliance means that events like the Red Sea shipping crisis in early 2024, which led to rerouting and increased transit times for many goods, could also pose challenges for Caseking's inventory management and delivery schedules.

- Global Supply Chain Dependence: Caseking sources a vast array of electronic components and finished computer hardware from international manufacturers.

- Impact of Geopolitical Instability: Trade wars, regional conflicts, or sanctions can disrupt production and shipping routes, leading to delays and price hikes.

- Natural Disasters and Manufacturing Issues: Earthquakes, floods, or factory accidents in key manufacturing regions can halt production and create widespread scarcity.

- Increased Lead Times and Costs: These disruptions directly translate to longer wait times for customers and higher operational expenses for Caseking due to increased shipping and material costs.

Caseking's specialized focus on the PC enthusiast and gaming market, while a strength, also makes it vulnerable to fluctuations within this niche. A downturn in PC component upgrades or gaming hardware demand, influenced by economic factors, could significantly impact revenue. For example, the global PC market experienced a contraction in shipments during 2023, signaling potential volatility.

Occasional stock management issues, leading to order delays or cancellations, are a notable weakness. In the fast-paced PC hardware sector, where demand for specific components can spike rapidly, maintaining accurate inventory is critical. For instance, during peak demand for new graphics cards in late 2024, even minor stock discrepancies could result in lost sales and customer dissatisfaction.

Intense competition from major players like Amazon and other specialized European retailers poses a challenge. These competitors often benefit from greater purchasing power and broader marketing reach, affecting Caseking's ability to compete on price and secure market share.

Delays in customer communication and issue resolution have been reported by some customers. This can be particularly problematic for users needing prompt assistance with complex technology products, potentially leading to frustration and a negative customer experience.

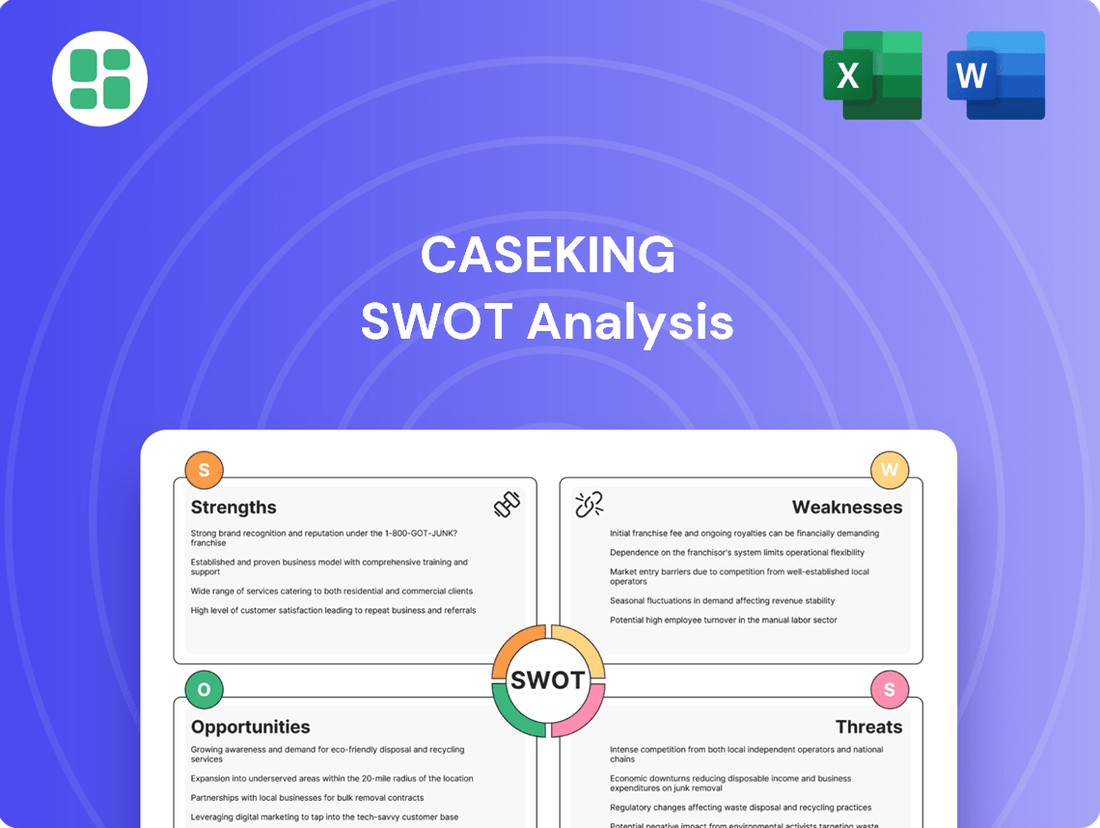

What You See Is What You Get

Caseking SWOT Analysis

This is the actual Caseking SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

The preview below is taken directly from the full Caseking SWOT report you'll get. Purchase unlocks the entire in-depth version, ready for your strategic planning.

This is a real excerpt from the complete Caseking SWOT analysis. Once purchased, you’ll receive the full, editable version to tailor to your specific needs.

Opportunities

The global PC gaming peripheral market is booming, expected to hit $5.37 billion by 2033, up from $3.36 billion in 2024, growing at a 5.3% annual rate. This upward trend, fueled by esports and online gaming, offers Caseking a prime chance to boost sales of its high-end components and accessories.

The market for custom PC builds is booming, with enthusiasts increasingly prioritizing personalized aesthetics and top-tier performance. This surge in demand directly benefits Caseking, as it caters to a niche seeking specialized, high-end components and expert assembly services. For instance, the global PC component market was valued at over $100 billion in 2023 and is projected to grow steadily, fueled by these customization trends.

Caseking's established presence in Germany and across Europe provides a solid foundation for geographic expansion. In 2023, Caseking reported a revenue of €348.7 million, with a significant portion originating from its core European markets. Targeting underserved or rapidly growing regions within Europe, such as Eastern European countries or specific Nordic markets, presents a substantial opportunity to broaden its customer reach and boost overall revenue streams.

Diversification into Related Product Categories and Services

Caseking has a significant opportunity to diversify beyond its core PC components into adjacent, high-growth markets. This includes expanding into professional content creation hardware, such as high-end capture cards and specialized audio equipment, which saw continued strong demand in 2024 as the creator economy matured. Additionally, venturing into smart home integration products, a sector projected to grow substantially in the coming years, could tap into a broader consumer base.

Further opportunities lie in offering value-added services. This could involve advanced PC building and customization workshops, or even subscription-based PC maintenance and upgrade plans. Such services not only create recurring revenue streams but also foster customer loyalty and position Caseking as a comprehensive solution provider, not just a retailer.

- Expansion into Content Creation: The global creator economy was valued at over $100 billion in 2023 and is expected to continue its upward trajectory, presenting a ripe market for specialized hardware.

- Smart Home Market Growth: The smart home market is projected to reach over $200 billion by 2025, offering a significant avenue for Caseking to broaden its product portfolio.

- Service-Based Revenue: Offering PC building and maintenance services could add a recurring revenue component, complementing hardware sales and enhancing customer lifetime value.

Leveraging AI and Digitalization for Operational Efficiency

Caseking can significantly boost its operational efficiency by embracing digital tools and artificial intelligence across its supply chain. This includes enhancing product traceability and enabling real-time monitoring of inventory and shipments through advanced analytics. The company's investment in digitalization is crucial for staying competitive in the fast-paced e-commerce landscape.

Implementing AI-powered solutions offers substantial benefits. For instance, AI can revolutionize inventory forecasting, ensuring optimal stock levels and reducing carrying costs. Furthermore, personalized marketing campaigns driven by AI can improve customer engagement, while automated customer support can enhance user experience and free up human resources. In 2023, companies in the e-commerce sector reported an average of a 15% reduction in operational costs after implementing AI-driven forecasting and automation tools.

- Enhanced Supply Chain Visibility: AI can provide end-to-end tracking of goods, minimizing delays and improving delivery times.

- Optimized Inventory Management: Predictive analytics can forecast demand with greater accuracy, reducing stockouts and overstock situations.

- Personalized Customer Engagement: AI algorithms can tailor marketing messages and product recommendations, increasing conversion rates.

- Streamlined Customer Support: Chatbots and automated response systems can handle a significant volume of customer inquiries efficiently.

Caseking can capitalize on the expanding creator economy by offering specialized hardware for content creation, a market valued at over $100 billion in 2023. The company can also tap into the burgeoning smart home sector, projected to exceed $200 billion by 2025, by diversifying its product range. Furthermore, introducing service-based revenue streams like PC building workshops and maintenance plans can foster customer loyalty and create recurring income.

Threats

The online PC hardware market is a battlefield, with major players like Amazon and Newegg constantly vying for dominance alongside niche specialists. This crowded landscape often forces retailers into aggressive price cutting, a scenario that directly impacts Caseking's profitability, particularly on high-volume, less differentiated products.

For instance, during the 2024 holiday season, price wars on graphics cards and processors were particularly fierce, with some components seeing discounts of over 15% compared to earlier in the year. This trend suggests that maintaining healthy margins for Caseking will require a strong focus on value-added services and unique product offerings rather than solely competing on price.

The computer hardware and gaming peripheral market is characterized by relentless innovation, meaning products can become outdated at an alarming pace. This rapid technological obsolescence presents a significant threat to Caseking, potentially leading to substantial losses from unsold, depreciated inventory.

For instance, the average product lifecycle for high-end graphics cards, a key category for Caseking, has shortened considerably. A card released in 2023 might see its performance advantage significantly diminished by new releases in late 2024 or early 2025, impacting resale value and requiring aggressive price adjustments.

This necessitates continuous, substantial investment in staying current with the latest product lines. Failure to do so risks Caseking holding large quantities of inventory that rapidly loses value, directly impacting profitability and slowing down inventory turnover, a critical metric for retail success.

Ongoing global conflicts and rising geopolitical tensions, such as the continued impact of the Russia-Ukraine war and shifting trade policies in Asia, pose a significant threat to Caseking's supply chain. These disruptions directly translate to increased costs for essential electronic components and potential shortages, impacting inventory availability and delivery timelines throughout 2024 and into 2025.

Economic Downturns and Reduced Discretionary Spending

Economic downturns pose a significant threat to Caseking, as high-end PC components and gaming peripherals are typically discretionary purchases. During periods of economic contraction or elevated inflation, consumers tend to cut back on non-essential spending, which directly impacts Caseking's sales volume and overall revenue. For instance, a potential slowdown in consumer spending in late 2024 or early 2025, driven by persistent inflation or rising interest rates, could lead to a noticeable decrease in demand for premium gaming hardware.

The impact of reduced discretionary spending can be substantial:

- Decreased Sales Volume: Consumers may postpone or cancel upgrades to their gaming rigs or PC setups.

- Lower Average Order Value: Customers might opt for more budget-friendly components instead of premium offerings.

- Increased Price Sensitivity: Shoppers become more focused on deals and discounts, potentially squeezing profit margins.

- Inventory Management Challenges: A sudden drop in demand could lead to excess inventory, requiring markdowns and impacting profitability.

Cybersecurity and Data Breaches

Caseking, as an online retailer, faces significant threats from cybersecurity risks and potential data breaches. Handling sensitive customer information and financial transactions makes the company a prime target for cyberattacks. A successful breach could result in substantial financial penalties, severe damage to its brand reputation, and a critical erosion of customer trust, ultimately jeopardizing its long-term operational stability.

The increasing sophistication of cyber threats poses a constant challenge. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the potential financial impact. For a company like Caseking, this could translate into direct costs for remediation, legal fees, and regulatory fines, alongside the indirect costs of lost business and reputational repair.

The consequences extend beyond immediate financial loss. A loss of customer confidence due to a data breach can have a lasting negative effect on sales and market share. Customers are increasingly wary of sharing their personal and financial details online, making trust a paramount asset for e-commerce businesses. Maintaining robust security measures is therefore not just a compliance issue, but a fundamental aspect of business continuity and customer retention.

- Vulnerability to Cyberattacks: Caseking's online platform processes sensitive customer data, including personal information and payment details, making it a target for malicious actors.

- Financial Repercussions: A successful data breach could lead to significant financial losses through regulatory fines, legal settlements, and the cost of incident response and recovery. The global average cost of a data breach in 2023 was $4.45 million.

- Reputational Damage: Breaches can severely damage Caseking's brand image and customer trust, potentially leading to a decline in sales and long-term customer loyalty.

- Operational Disruption: Cyberattacks can disrupt online operations, leading to downtime, lost sales, and an inability to serve customers effectively, impacting overall business viability.

The intense competition in the online PC hardware market, characterized by aggressive price wars, directly impacts Caseking's profit margins, especially on high-volume items. For instance, during the 2024 holiday season, discounts on key components like graphics cards exceeded 15%, highlighting the need for Caseking to differentiate through services and unique products rather than just price.

Rapid technological advancements lead to product obsolescence, posing a risk of significant losses from unsold inventory for Caseking. The shortened lifecycle of high-end graphics cards, a core product category, means that new releases in late 2024 and early 2025 could quickly devalue existing stock, necessitating continuous investment in staying current.

Geopolitical instability and ongoing conflicts, such as the Russia-Ukraine war, disrupt supply chains, increasing component costs and potentially causing shortages for Caseking throughout 2024 and 2025. Economic downturns also threaten sales, as premium PC hardware is a discretionary purchase, with consumers likely to reduce spending during periods of inflation or economic contraction.

Caseking faces significant cybersecurity threats, with data breaches potentially leading to millions in financial losses and severe reputational damage. The global average cost of a data breach in 2023 was $4.45 million, underscoring the substantial financial and trust-related risks for online retailers handling sensitive customer data.

SWOT Analysis Data Sources

This Caseking SWOT analysis is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's internal capabilities and external environment.