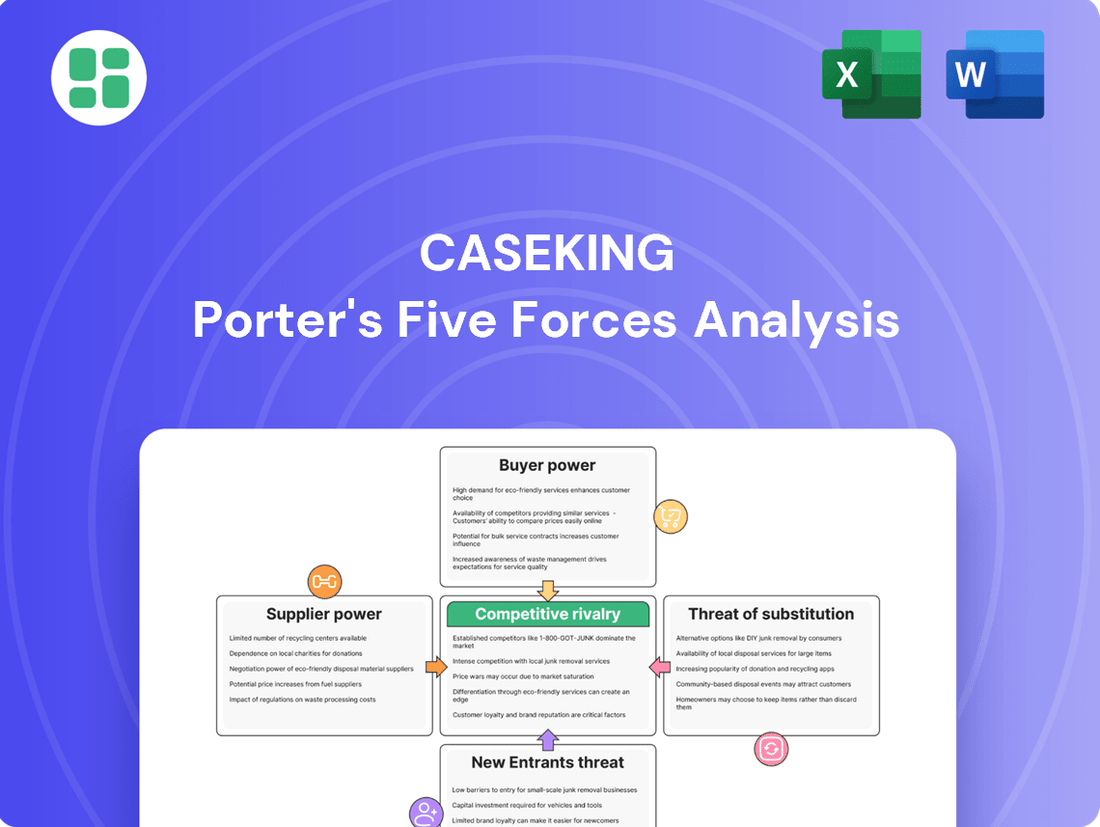

Caseking Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caseking Bundle

Caseking faces significant competitive rivalry, with numerous players vying for market share in the PC hardware and gaming niche. Understanding the bargaining power of their suppliers and the threat of new entrants is crucial for their sustained success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Caseking’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Component manufacturers like Intel, AMD, and Nvidia wield substantial bargaining power. Their specialized technology and strong brand recognition mean Caseking is heavily reliant on them for critical parts, making it difficult to negotiate favorable pricing or secure consistent supply. For instance, in 2024, the global GPU market, dominated by Nvidia and AMD, saw continued demand outstripping supply for high-end models, reinforcing supplier leverage.

For highly specialized or enthusiast-grade components, the number of viable suppliers is often quite limited. This scarcity directly increases the leverage these suppliers hold over retailers like Caseking, impacting their ability to negotiate favorable terms.

Caseking's strategic focus on these niche markets necessitates maintaining robust relationships with a select group of manufacturers. This inherent dependency can translate into less advantageous purchasing agreements or difficulties in securing sufficient inventory during periods of peak consumer demand, a common challenge in specialized electronics sectors.

The fast-paced innovation in computer hardware, particularly with new CPUs and GPUs, puts significant power in the hands of suppliers. Caseking, like other retailers, often finds itself adapting its inventory and marketing to these supplier-driven release schedules. This reliance means suppliers can dictate terms, influencing what products are available and at what price points.

Volume-Based Pricing Structures

While Caseking's substantial order volumes can provide some negotiating advantage, suppliers frequently employ volume-based pricing structures that are more heavily influenced by global demand and their own production capacities. This means that even a large retailer like Caseking may find its individual purchasing power insufficient to significantly sway the pricing strategies of major global technology manufacturers.

Consequently, the pricing for components and finished goods is often determined by the supplier's overarching global market strategy and supply-demand dynamics, rather than being solely a result of individual retailer negotiations. For instance, in 2024, the average selling price for graphics cards, a key product category for Caseking, remained sensitive to global chip shortages and cryptocurrency mining demand, demonstrating the limited impact of a single retailer's volume on these broader market forces.

- Supplier pricing is often dictated by global demand and production capacity.

- Caseking's purchasing volume may not be enough to alter global pricing structures.

- Supplier pricing is largely set by their global strategy, not individual retailer leverage.

Brand Strength of Suppliers

The brand strength of suppliers significantly impacts Caseking's bargaining power. Many of Caseking's key products are sourced from highly recognized brands such as ASUS, MSI, Corsair, Logitech, and Razer. This brand loyalty means customers often specifically request products from these manufacturers, limiting Caseking's ability to negotiate better terms by switching to less established, potentially lower-cost alternatives.

This customer-driven demand for specific brands directly enhances the suppliers' negotiating leverage. For instance, in the PC components market, brands like NVIDIA and AMD often dictate terms due to the immense consumer desire for their latest graphics cards and processors. In 2024, the continued high demand for advanced GPUs, coupled with supply chain constraints that persisted into early 2024 for some components, meant that brands like NVIDIA could command premium pricing and favorable distribution agreements, reducing Caseking's room for negotiation.

- High Brand Recognition: Suppliers like ASUS and Corsair benefit from strong consumer recognition, fostering direct customer demand.

- Limited Substitution: Customers frequently insist on specific brands, reducing Caseking's flexibility to substitute with less-known suppliers.

- Supplier Pricing Power: The strong brand pull allows these suppliers to maintain pricing power, impacting Caseking's cost of goods sold.

The bargaining power of suppliers is a significant factor for Caseking, primarily due to the concentrated nature of the PC component market and the strong brand equity of key manufacturers. Companies like Intel, AMD, and Nvidia hold considerable sway, as their innovative technologies and established reputations make them indispensable to retailers like Caseking. This reliance limits Caseking's ability to negotiate favorable pricing or ensure consistent supply, especially when demand outstrips production, a scenario frequently observed in 2024 for high-end GPUs.

Furthermore, the limited number of suppliers for highly specialized or enthusiast-grade components amplifies their leverage. Caseking's strategic focus on these niche markets means it must cultivate strong relationships with a select group of manufacturers, often resulting in less advantageous purchasing agreements and challenges in securing adequate inventory during peak demand periods. This dependency is further underscored by the rapid pace of hardware innovation, where suppliers dictate release schedules and product availability, influencing Caseking's inventory and marketing strategies.

Even Caseking's substantial order volumes may not fully offset the suppliers' pricing power, as global demand and production capacities often dictate pricing structures. For instance, the average selling price of graphics cards in 2024 remained highly sensitive to global chip shortages and demand from cryptocurrency mining, demonstrating that a single retailer's volume has limited impact on these broader market forces. Consequently, supplier pricing is largely determined by their global strategies rather than individual retailer negotiations.

The brand strength of suppliers like ASUS, MSI, Corsair, Logitech, and Razer also plays a crucial role. Strong customer loyalty to these brands means consumers often specifically request their products, restricting Caseking's ability to substitute with lesser-known alternatives. This customer-driven demand directly enhances supplier negotiating leverage, allowing them to maintain pricing power and influence Caseking's cost of goods sold.

| Supplier | Brand Strength | Customer Demand | Impact on Caseking |

|---|---|---|---|

| Intel | High | Strong for CPUs | Limited negotiation on pricing |

| AMD | High | Strong for GPUs & CPUs | Reduced flexibility in sourcing |

| Nvidia | Very High | Dominant for GPUs | Significant pricing power |

| Corsair | High | Strong for peripherals & components | Influences product mix |

What is included in the product

Tailored exclusively for Caseking, this analysis dissects the five forces shaping its competitive environment, from supplier and buyer power to the threat of new entrants and substitutes.

Instantly identify and address competitive threats with a visual breakdown of each Porter's Five Forces, making strategic planning more efficient.

Customers Bargaining Power

Customers in the online PC hardware market exhibit significant price sensitivity. They actively compare prices across numerous retailers, utilizing various websites and comparison tools to identify the most advantageous deals. This ease of access to pricing information directly translates into enhanced bargaining power for consumers.

For Caseking, this means a constant pressure to remain competitive on pricing. The ability for customers to effortlessly find lower prices elsewhere compels the company to adjust its own pricing strategies to avoid losing sales. In 2024, the average online shopper spent an estimated 15% less on PC components compared to the previous year, a clear indicator of this heightened price sensitivity.

The sheer volume of online retailers offering computer hardware significantly amplifies customer bargaining power. With countless direct and indirect competitors vying for attention, customers possess a wealth of alternatives. If Caseking fails to offer competitive pricing or falters in service, consumers can readily shift their business elsewhere, a testament to the power of choice in this digital marketplace.

Customers today are incredibly well-informed, thanks to readily available product information, detailed reviews, and active community forums. This accessibility means they can easily compare specifications, read about real-world performance, and understand potential issues before making a purchase. For instance, a 2024 survey indicated that over 85% of online shoppers consult reviews before buying electronics, directly impacting retailers like Caseking.

This deep well of knowledge empowers customers to make highly informed decisions, effectively holding retailers accountable for the accuracy of their product claims and the overall quality delivered. Caseking, therefore, must ensure its product descriptions are precise and that it upholds high standards to meet these informed expectations, as customers can quickly identify discrepancies or poor performance.

Low Switching Costs for Customers

For customers looking to buy PC hardware online, switching from one retailer to another is incredibly simple. It typically involves just a few clicks, meaning there are no substantial barriers preventing them from exploring different options. This lack of friction means customers can easily shop around for the best prices and deals available.

Retailers like Caseking don't typically have strong loyalty programs or proprietary systems that would make it difficult or costly for customers to leave. This absence of lock-in further amplifies customer power. In 2024, the online retail landscape continues to emphasize price comparison, with platforms making it easier than ever for consumers to find the lowest prices. For instance, price comparison websites are widely used by consumers seeking PC components, indicating a strong customer inclination to switch for better value.

- Low Switching Costs: Customers can easily move between online PC hardware retailers.

- Absence of Lock-in: Few loyalty programs or proprietary systems tie customers to a single vendor.

- Price Sensitivity: Customers actively seek the best value, empowered by easy comparison.

Influence of PC Enthusiast Communities

PC enthusiasts and gamers, a core demographic for Caseking, heavily rely on online communities and forums for product recommendations and discussions. This collective intelligence means that negative experiences or uncompetitive pricing can spread rapidly, significantly impacting Caseking's reputation and sales.

The amplified bargaining power of these communities stems from their ability to quickly share information and coordinate purchasing decisions. For instance, a widespread complaint about a specific product or service offered by Caseking could lead to a substantial drop in demand, forcing the company to address the issue or risk losing market share.

- Community Influence: Online forums and social media platforms are critical for product research and purchasing decisions among PC enthusiasts.

- Reputation Damage: Negative feedback shared within these communities can swiftly damage Caseking's brand image and deter potential customers.

- Price Sensitivity: Enthusiast communities are often highly price-aware, making Caseking vulnerable to competitors offering better value.

- Collective Action: The ability of these groups to collectively voice concerns or boycott products gives them significant leverage.

Customers in the online PC hardware market possess substantial bargaining power due to readily available price comparisons and a vast array of alternative retailers. This forces companies like Caseking to maintain competitive pricing and excellent service to retain business.

The ease with which customers can switch between vendors, coupled with the lack of significant switching costs, further empowers them. In 2024, the prevalence of price comparison websites and online marketplaces means consumers can effortlessly find the best deals, putting pressure on retailers to offer attractive pricing.

Informed consumers, actively engaging with reviews and community discussions, can quickly identify product strengths and weaknesses. This knowledge base means Caseking must ensure product accuracy and quality, as deviations can lead to swift negative feedback and lost sales.

| Factor | Customer Impact | Implication for Caseking |

|---|---|---|

| Price Sensitivity | High; actively compare prices | Constant pressure to offer competitive pricing |

| Availability of Alternatives | Numerous online retailers | Risk of losing customers to competitors |

| Information Access | Easy access to reviews and product details | Need for accurate product descriptions and high quality |

| Switching Costs | Low; minimal barriers to changing vendors | Customers can easily shift loyalty |

Preview the Actual Deliverable

Caseking Porter's Five Forces Analysis

The document you see here is the complete, professionally crafted Caseking Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. What you are previewing is precisely the same document you will receive instantly after completing your purchase, ensuring no surprises and immediate usability. This detailed analysis is ready for your strategic planning needs, providing actionable insights without any need for further customization.

Rivalry Among Competitors

The online PC hardware market is a battleground for prices, with retailers like Caseking constantly tweaking their pricing strategies to capture customer attention and loyalty. This intense rivalry means margins on popular, high-volume products are often squeezed, making it a challenge to maintain profitability.

In 2024, the average gross margin for online electronics retailers hovered around 20-25%, highlighting the thin profit potential in this price-sensitive sector. Caseking, like its competitors, must navigate this environment by offering compelling deals, which can lead to significant price wars on components like GPUs and CPUs, where price drops of 10-15% are not uncommon during promotional periods.

Caseking faces intense competition from broad e-commerce platforms like Amazon, which offer vast product selections and competitive pricing. In specific regions, players such as Newegg also present a significant challenge. This forces Caseking to focus on specialized offerings and customer service to stand out.

Within the niche of PC hardware and customization, numerous specialized online retailers, including Mindfactory and Alternate in the European market, directly vie for Caseking's customer base. The market's fragmentation means many smaller, agile competitors can emerge, further intensifying rivalry.

Furthermore, direct-to-consumer sales initiatives by manufacturers themselves add another layer of competition. This trend, observed across various tech sectors, allows brands to control the customer experience and pricing, potentially bypassing retailers like Caseking.

Operating an online hardware retailer like Caseking is inherently capital-intensive. Significant fixed costs are tied to maintaining warehouses, sophisticated logistics networks, and robust IT systems. In 2024, the e-commerce sector continues to see substantial investment in these areas to ensure efficient order fulfillment and a seamless customer experience.

The challenge of managing a vast and constantly updating inventory of hardware components, which are prone to rapid obsolescence, adds another layer of complexity. This necessitates aggressive pricing and promotional strategies to clear stock, as seen across the PC component market where new generations of CPUs and GPUs launch frequently, pushing older models down in price.

These high fixed costs and the pressure to manage inventory effectively intensify rivalry. Competitors are compelled to chase sales volume, often leading to price wars and aggressive marketing campaigns to capture market share in a competitive landscape where margins can be thin on popular items.

Differentiation Through Service, Selection, and Niche Focus

While price is a significant battlefield, many competitors in the PC hardware space differentiate themselves by excelling in customer service and offering a vast product selection. Companies also carve out niches, catering to specialized groups like extreme overclockers or those building custom PCs. Caseking faces the task of balancing its wide product range with the appeal of these specialized segments, competing on more than just price alone.

Building a robust brand reputation centered on expertise and reliable support is crucial for standing out. For instance, in 2024, the global PC hardware market saw continued growth, with specialized retailers often commanding higher margins due to their focused offerings and perceived value-added services. This highlights the importance of differentiation beyond mere cost.

- Customer Service Excellence: Competitors differentiate by offering superior support, including expert advice and efficient issue resolution.

- Product Breadth and Depth: An extensive selection of components and peripherals allows companies to cater to a wider customer base.

- Niche Market Specialization: Focusing on specific segments like custom PC builders or enthusiasts provides a competitive edge through tailored offerings.

- Brand Reputation: Cultivating a reputation for expertise, reliability, and community engagement is vital for customer loyalty and premium pricing.

Rapid Product Innovation and Obsolescence

The PC hardware market is a whirlwind of innovation, with new components like graphics cards and processors hitting the shelves at a breakneck pace. For instance, in 2024, we saw multiple generations of CPUs and GPUs released, pushing previous models into obsolescence much faster than in prior years. This constant churn means retailers like Caseking must continuously refresh their stock and marketing efforts to stay relevant.

This rapid product cycle creates intense rivalry. Companies that lag in adopting and promoting the newest technology risk being left behind. In 2024, the average product lifecycle for high-end PC components shortened, with some key products seeing significant performance jumps and price drops within 12-18 months of their initial release. This forces aggressive pricing and promotional strategies among competitors.

- Rapid Innovation: The PC hardware sector experiences constant technological advancements, leading to frequent product introductions.

- Quick Obsolescence: Older PC components become outdated quickly, pressuring companies to update their offerings.

- Inventory Management Challenges: Retailers must constantly manage inventory turnover to avoid holding obsolete stock, impacting profitability.

- Marketing Agility: Competitors must be agile in their marketing to highlight the latest features and attract consumers, especially in 2024 where new product launches were highly competitive.

Competitive rivalry in the PC hardware market is fierce, driven by numerous online retailers and direct-to-consumer sales from manufacturers. Caseking faces pressure from broad platforms like Amazon and specialized competitors such as Mindfactory and Alternate, particularly in Europe. The rapid pace of technological innovation, with new CPU and GPU generations frequently released, shortens product lifecycles and necessitates aggressive pricing and marketing to maintain market share.

| Competitor Type | Key Differentiators | 2024 Market Trend Impact |

|---|---|---|

| Broad E-commerce Platforms (e.g., Amazon) | Vast selection, competitive pricing, fast shipping | High volume sales, price pressure on standardized components |

| Specialized Online Retailers (e.g., Mindfactory, Newegg) | Niche product focus, expert advice, community building | Captures enthusiast market, potentially higher margins on specialized items |

| Direct-to-Consumer (DTC) by Manufacturers | Brand control, direct customer relationship, potential for exclusive offers | Bypasses traditional retail channels, impacts retailer margins |

| Smaller, Agile Competitors | Flexibility, targeted promotions, unique product bundles | Can quickly adapt to market shifts, challenge established players on specific deals |

SSubstitutes Threaten

For many consumers, particularly those who prefer convenience over customization, pre-built gaming PCs and powerful gaming laptops represent a significant threat of substitutes. These ready-made systems eliminate the need for users to source and assemble individual components, a core offering of Caseking. This convenience factor is crucial, as evidenced by the strong market presence of companies like Alienware and HP Omen, which cater to a broad audience seeking immediate gaming performance without the DIY hassle.

The appeal of pre-built systems is amplified by integrated warranties that cover the entire machine, offering peace of mind that individual component warranties do not. This holistic support can outweigh the potential cost savings or customization benefits of a DIY build for a substantial segment of the gaming market. For instance, in 2024, the global gaming laptop market alone was projected to reach over $15 billion, highlighting the significant demand for these convenient alternatives.

Gaming consoles like the PlayStation 5 and Xbox Series X, which launched in late 2020, present a significant threat of substitutes for the high-end PC gaming market. These consoles offer a complete entertainment ecosystem, providing a powerful gaming experience without requiring users to assemble or upgrade individual PC components. For many consumers, particularly those seeking ease of use and a more streamlined gaming setup, consoles are a more attractive and often more affordable alternative.

The appeal of consoles is amplified by their accessibility and often lower entry cost compared to building a gaming PC capable of running the latest titles at high settings. For instance, while a high-end gaming PC can easily exceed $2,000, the PlayStation 5 and Xbox Series X typically retail around $499-$599, making them a more budget-friendly option for a large segment of the gaming population. This cost-effectiveness, coupled with exclusive titles and a user-friendly interface, makes consoles a compelling substitute for PC gaming.

The continuous innovation in console technology, with new generations and mid-cycle refreshes, ensures that this threat remains dynamic. As of early 2024, both Sony and Microsoft continue to push the boundaries of console performance, offering features like ray tracing and faster loading times, directly competing with the capabilities of mid-to-high-tier gaming PCs. This ongoing evolution means that consoles will likely continue to capture a substantial portion of the gaming market, diverting potential customers from the PC hardware sector.

Cloud gaming services like NVIDIA's GeForce NOW and Microsoft's Xbox Cloud Gaming present a significant threat of substitutes for Caseking. These platforms enable users to play graphically intensive games on lower-spec devices by streaming them, bypassing the need for powerful, expensive local hardware that Caseking typically sells. For instance, GeForce NOW offers a free tier, and paid tiers start at $9.99/month, making high-end gaming accessible without a substantial upfront hardware investment.

Refurbished or Used Hardware Market

The refurbished or used PC hardware market presents a significant threat of substitutes for Caseking. For budget-conscious consumers or those searching for specific, perhaps discontinued, components, platforms like eBay, specialized online forums, and local second-hand electronics stores offer a viable, lower-cost alternative to purchasing new items from Caseking. This segment of the market, prioritizing affordability, can divert potential sales away from new product offerings.

This secondary market is particularly relevant for price-sensitive customers. For instance, in 2024, the global market for refurbished electronics was estimated to be worth over $60 billion, demonstrating a substantial consumer base actively seeking these alternatives. Caseking, focusing on new, high-performance components, faces competition from these established channels where older or pre-owned parts are readily available at a fraction of the original cost.

- Lower Price Points: Used and refurbished components are significantly cheaper, attracting customers with limited budgets.

- Availability of Older Components: This market provides access to parts no longer manufactured or readily available new, catering to niche upgrade needs.

- Environmental Considerations: Some consumers opt for used hardware as a more sustainable choice, reducing electronic waste.

- Market Size: The growing global market for refurbished electronics, projected to reach over $100 billion by 2027, indicates a strong and expanding consumer preference for these alternatives.

Mobile Gaming and Tablets

The rise of sophisticated mobile gaming on smartphones and tablets presents a significant threat of substitution for traditional PC gaming. These devices offer a convenient and accessible platform for a vast casual gaming audience, often requiring less initial investment than a dedicated PC. In 2023, the global mobile gaming market was valued at an estimated $107 billion, demonstrating its substantial reach and appeal.

For many consumers, particularly those in the casual gaming segment, the capabilities of modern smartphones and tablets are sufficient for their entertainment needs. This accessibility means a large pool of potential customers may opt for mobile gaming experiences instead of investing in or upgrading PC gaming hardware. This trend is expected to continue as mobile technology advances.

- Ubiquity of Mobile Devices: Smartphones and tablets are owned by a significant portion of the global population, making mobile gaming readily accessible.

- Lower Barrier to Entry: Compared to high-end gaming PCs, mobile devices are more affordable for many consumers.

- Growing Mobile Game Sophistication: Mobile games are increasingly complex and engaging, mirroring experiences previously found only on PCs.

- Casual Gaming Dominance: The casual gaming sector, which mobile platforms excel at serving, represents a massive segment of the overall gaming market.

The threat of substitutes for Caseking is multifaceted, encompassing pre-built PCs, gaming consoles, cloud gaming, refurbished hardware, and mobile gaming. Each of these alternatives offers varying degrees of convenience, cost-effectiveness, and accessibility, directly competing for consumer spending within the gaming hardware market.

Pre-built gaming PCs and laptops, exemplified by brands like Alienware and HP Omen, offer convenience and integrated warranties, appealing to a broad audience. In 2024, the gaming laptop market alone was projected to exceed $15 billion, underscoring the significant demand for these ready-to-use solutions.

Gaming consoles, such as the PlayStation 5 and Xbox Series X, provide a powerful and user-friendly gaming experience at a lower entry cost, typically around $499-$599, compared to high-end PCs exceeding $2,000. This makes them a compelling substitute for a large segment of gamers seeking affordability and ease of use.

Cloud gaming services like NVIDIA's GeForce NOW, with subscription tiers starting at $9.99 per month, allow users to play demanding games on less powerful devices, bypassing the need for expensive local hardware. The refurbished PC hardware market, valued globally at over $60 billion in 2024, also presents a significant lower-cost alternative for budget-conscious consumers.

| Substitute Type | Key Appeal | Market Example/Data (2023-2024) |

| Pre-built Gaming PCs/Laptops | Convenience, Integrated Warranty | Gaming Laptop Market > $15 Billion (2024 Projection) |

| Gaming Consoles (PS5, Xbox Series X) | Lower Entry Cost, Ease of Use, Exclusive Titles | Console Price: ~$499-$599 |

| Cloud Gaming Services (GeForce NOW) | Access on Low-Spec Devices, Subscription Model | GeForce NOW Tiers: Starting at $9.99/month |

| Refurbished/Used PC Hardware | Affordability, Availability of Older Parts | Refurbished Electronics Market > $60 Billion (2024 Estimate) |

| Mobile Gaming | Ubiquity, Lower Barrier to Entry, Sophistication | Mobile Gaming Market: $107 Billion (2023) |

Entrants Threaten

Entering the online PC hardware retail market demands significant upfront capital. Companies need to invest heavily in inventory, warehousing facilities, and efficient logistics to compete effectively. For instance, maintaining a broad and current selection of components, from high-end graphics cards to specialized cooling solutions, requires substantial financial resources. This can tie up millions in unsold or rapidly depreciating stock, acting as a considerable deterrent to new players.

Established players like Caseking benefit from deep-rooted relationships with major hardware manufacturers, securing preferential pricing and guaranteed access to sought-after components. For instance, in 2024, Caseking continued to leverage these partnerships, which are crucial for managing inventory and offering competitive pricing, a significant barrier for newcomers.

New entrants would find it exceedingly difficult to replicate these established supplier agreements or gain comparable access to in-demand products, creating an immediate competitive hurdle. Building such robust distribution networks and supplier trust is a time-consuming and capital-intensive process, often taking years to develop.

Caseking has cultivated significant brand loyalty among PC enthusiasts and gamers, a testament to its years of specialized knowledge and dedicated customer service. This deep-rooted trust is a formidable barrier for newcomers. For instance, in 2024, customer retention rates for established brands in the PC hardware market often exceed 70%, driven by positive word-of-mouth and community endorsements, which new entrants struggle to replicate quickly.

Economies of Scale in Purchasing and Logistics

Established players in the PC hardware and gaming peripherals market, like Caseking, leverage significant economies of scale in purchasing. This allows them to secure bulk discounts from manufacturers, which translates into lower cost of goods sold. For instance, in 2024, major electronics retailers often negotiate discounts ranging from 5% to 15% or more on high-volume orders, a level inaccessible to new, smaller entrants.

These scale advantages extend to logistics and fulfillment. Optimized warehousing, efficient shipping contracts, and sophisticated inventory management systems reduce operational costs per unit. A new entrant would face substantially higher per-unit costs for warehousing, shipping, and managing inventory, making it challenging to match the pricing and delivery speeds of incumbents.

Consequently, new entrants struggle to compete on price and operational efficiency. The initial investment required to build comparable purchasing power and logistical infrastructure is substantial, creating a significant barrier to entry. This disparity in cost structure means new businesses must find niche markets or offer highly differentiated products to gain traction.

- Purchasing Power: Larger retailers in 2024 can achieve 5-15% better pricing on components due to bulk orders.

- Logistics Efficiency: Established firms benefit from optimized supply chains, reducing shipping and warehousing costs by an estimated 10-20% per unit compared to startups.

- Cost Disadvantage: New entrants face higher initial operating costs, making price-based competition extremely difficult.

- Scalability Hurdle: Achieving the necessary scale to overcome these cost disadvantages requires significant capital investment and time.

Regulatory and Compliance Complexities

Operating an international online retail business like Caseking means navigating a complex web of regulations. This includes import/export rules, consumer protection laws, and varying tax obligations across different countries. For instance, in 2024, the European Union continued to refine its digital services regulations, impacting cross-border e-commerce operations.

New players entering this market would face a substantial learning curve and considerable legal expenses to ensure they comply with all applicable laws. This regulatory burden acts as a significant barrier, deterring potential entrants who may not have the resources or expertise to manage these complexities effectively.

- Navigating diverse legal frameworks

- Significant upfront investment in legal and compliance teams

- Risk of penalties for non-compliance

- Ongoing costs for staying updated with regulatory changes

The threat of new entrants into the online PC hardware retail market is moderate. Significant capital is required for inventory and logistics, with established players like Caseking benefiting from strong supplier relationships and brand loyalty. For instance, in 2024, securing access to high-demand graphics cards was challenging for newcomers due to existing partnerships. Economies of scale in purchasing and logistics also provide incumbents with a substantial cost advantage, estimated at 10-20% per unit.

| Barrier Type | Impact on New Entrants | Example (2024 Data) |

| Capital Requirements | High (Inventory, Warehousing) | Millions required for a comprehensive product range. |

| Supplier Relationships | Strong for Incumbents | Preferential pricing and guaranteed component access for established retailers. |

| Brand Loyalty | Difficult to Replicate | Customer retention rates for established PC hardware brands often exceed 70%. |

| Economies of Scale | Significant Cost Advantage | Bulk order discounts of 5-15% for large retailers. |

| Regulatory Complexity | High (International Operations) | Navigating diverse import/export and consumer laws. |

Porter's Five Forces Analysis Data Sources

Our Caseking Porter's Five Forces analysis is built upon a foundation of robust data, including Caseking's own financial reports, industry-specific market research from firms like Statista and Newzoo, and competitor financial disclosures.