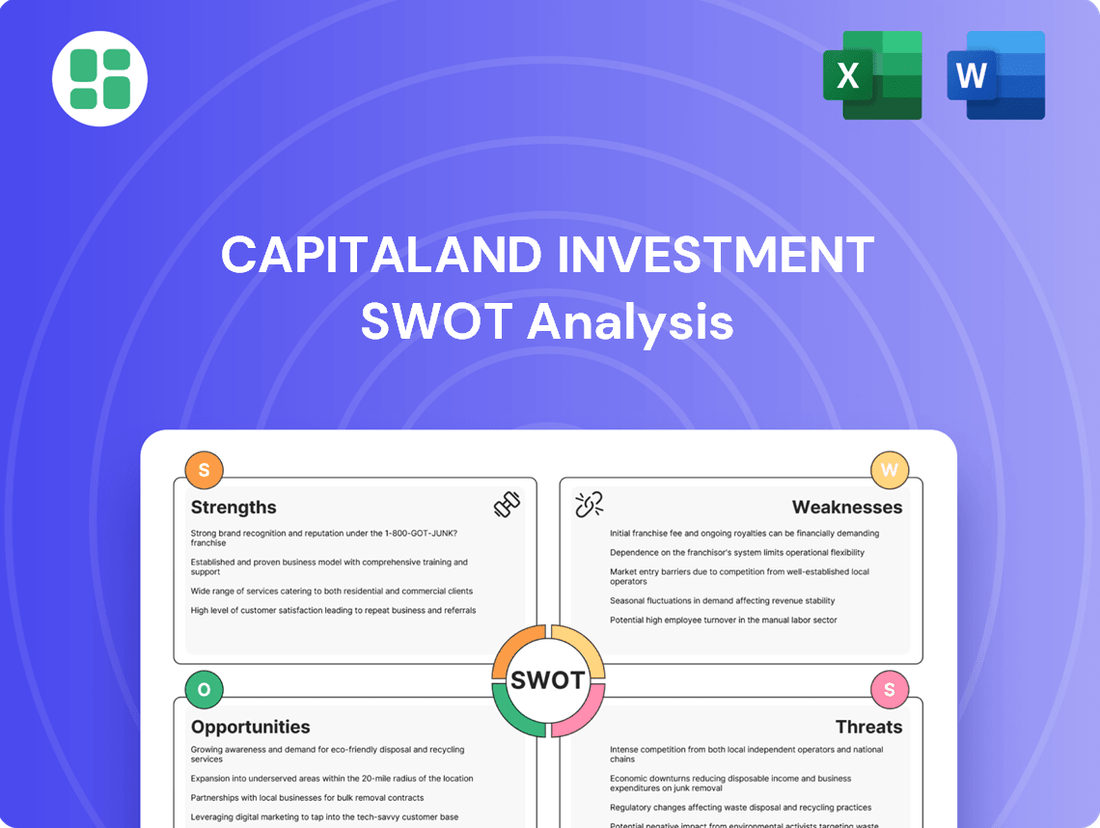

CapitaLand Investment SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CapitaLand Investment Bundle

CapitaLand Investment's strengths lie in its diversified portfolio and strong regional presence, but it faces threats from economic volatility and increased competition. Our comprehensive SWOT analysis delves into these crucial factors, providing you with actionable intelligence.

Want the full story behind CapitaLand Investment's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

CapitaLand Investment boasts a remarkably diversified global real asset portfolio, encompassing a wide array of property types. This strategic breadth, covering integrated developments, retail, office, lodging, industrial, logistics, business parks, wellness, self-storage, and data centers, across 270 cities in 45 countries, significantly reduces reliance on any single sector or geography.

CapitaLand Investment's (CLI) strategic pivot to an asset-light approach has been a major driver of its Fee-Related Business (FRB) growth. This includes key areas like managing listed funds, private funds, and providing lodging and commercial management services.

In fiscal year 2024, CLI saw its FRB revenue climb by 9% compared to the previous year, reaching S$1.169 billion. This performance highlights the company's success in building robust recurring income streams and its commitment to capital efficiency.

CapitaLand Investment Limited (CLI) demonstrates robust fund management expertise, evidenced by its Funds Under Management (FUM) reaching S$117 billion in FY2024. This strong performance is underpinned by a strategic capital recycling initiative, which saw S$5.5 billion in assets divested during 2024. This active capital management allows CLI to consistently reinvest in opportunities with higher return potential and explore emerging growth avenues, reinforcing its financial agility and strategic foresight.

Strategic Alignment with Global Megatrends

CapitaLand Investment (CLI) strategically aligns its investment focus with three powerful global megatrends: Demographics, Disruption, and Digitalisation. This proactive stance positions CLI to effectively tap into evolving market demands and future growth sectors.

By concentrating on these secular trends, CLI is well-equipped to capitalize on emerging opportunities. This includes areas such as age-suitable living solutions, the growing private credit market, and critical infrastructure like logistics and data storage assets, ensuring sustained relevance and expansion.

For instance, CLI's commitment to demographics is evident in its expanding portfolio of senior living communities, a sector projected for significant growth. In 2024, the global senior living market is expected to reach hundreds of billions, with demand driven by aging populations worldwide.

Furthermore, CLI's focus on digitalisation supports its investments in data centres, a rapidly expanding asset class fueled by increasing data consumption and cloud computing. The global data centre market size was valued at over $200 billion in 2023 and is anticipated to grow substantially through 2030.

- Demographics: Targeting growth in sectors like senior living due to aging populations.

- Disruption: Investing in areas like private credit, which offers alternative financing solutions.

- Digitalisation: Expanding presence in data centres, driven by digital transformation and data growth.

- Growth Potential: These alignments position CLI to benefit from long-term, structural shifts in the global economy.

Commitment to Sustainability and ESG Leadership

CapitaLand Investment (CLI) shows a deep commitment to sustainability and ESG leadership, setting ambitious goals like achieving Net Zero carbon emissions by 2050. This focus is woven into the fabric of its operations, demonstrating a forward-thinking approach to business.

In 2024, CLI significantly boosted its renewable energy usage and successfully secured S$4.3 billion in sustainable financing. These actions not only bolster its environmental credentials but also enhance its reputation, making it more attractive to investors prioritizing ESG principles.

- Net Zero Target: Aims for Net Zero carbon emissions by 2050, integrating sustainability across all business activities.

- Renewable Energy Expansion: Increased its use of renewable energy sources in 2024.

- Sustainable Financing: Secured S$4.3 billion in sustainable financing in 2024, reinforcing its commitment.

- Investor Appeal: Enhanced attractiveness to ESG-focused investors through its demonstrated sustainability efforts.

CapitaLand Investment's (CLI) diversified global real asset portfolio, spanning 45 countries, mitigates sector-specific risks and offers stability. Its strategic shift to an asset-light model has successfully grown Fee-Related Business (FRB) revenue by 9% to S$1.169 billion in FY2024, demonstrating a strong focus on recurring income and capital efficiency.

CLI's robust fund management capabilities are highlighted by its S$117 billion in Funds Under Management (FUM) as of FY2024, supported by active capital recycling of S$5.5 billion in asset divestments during the same year. This approach allows for strategic reinvestment in higher-return opportunities and emerging growth areas.

| Metric | FY2024 Value | FY2023 Value | Change |

|---|---|---|---|

| Fee-Related Business (FRB) Revenue | S$1.169 billion | S$1.073 billion | +9% |

| Funds Under Management (FUM) | S$117 billion | S$115 billion | +1.7% |

| Assets Divested (Capital Recycling) | S$5.5 billion | S$4.8 billion | +14.6% |

What is included in the product

This SWOT analysis maps out CapitaLand Investment’s market strengths, operational gaps, and potential threats.

Identifies key risks and opportunities, enabling proactive mitigation and strategic advantage for CapitaLand Investment.

Weaknesses

CapitaLand Investment's (CLI) continued reliance on its Real Estate Investment Business (REIB) presents a notable weakness. Despite efforts towards an asset-light model, the REIB still accounted for a substantial 66% of total revenue in FY2024. This dependence exposes the company to the inherent cyclicality and potential volatility of the property market, as evidenced by a 3.4% year-on-year revenue dip in FY2024 and a further 6% decline in 1Q2025, suggesting the transition away from direct property ownership is progressing slower than anticipated.

CapitaLand Investment (CLI) is susceptible to macroeconomic challenges. For instance, elevated interest rates globally, as seen through 2024 and projected into 2025, can significantly increase borrowing costs, impacting CLI's ability to finance new projects and potentially reducing property valuations.

The pace of economic recovery in crucial markets, particularly China, presents another significant headwind. A slower-than-anticipated rebound in China could dampen investor sentiment towards the region, affecting leasing demand and capital appreciation for CLI's extensive portfolio there.

These macroeconomic pressures can collectively dampen investor appetite for real estate assets, making fundraising more difficult and potentially hindering CLI's strategic expansion initiatives. For example, global real estate investment volumes saw a notable dip in 2023, a trend that could persist if macroeconomic uncertainty continues into 2025.

CapitaLand Investment (CLI) experienced a notable miss on analyst expectations in fiscal year 2024. Specifically, the company's revenue fell short by 2.6%, and its earnings per share (EPS) missed estimates by a significant 33%, even with an overall increase in total profit after tax and minority interests (PATMI).

This discrepancy between reported results and market forecasts can foster investor skepticism regarding CLI's future profitability and growth trajectory. Such sentiment could negatively impact the company's stock performance as confidence in its financial projections wanes.

Geographical Concentration Risk in China

CapitaLand Investment (CLI) faces a significant weakness due to its geographical concentration risk in China. Despite active capital recycling, over 75% of CLI's remaining balance sheet assets were still located in China as of the first quarter of 2025. This substantial exposure means the company is particularly vulnerable to the unique economic shifts and evolving regulatory landscape within China.

This concentration presents a clear challenge:

- Heightened Sensitivity to Chinese Economic Conditions: Fluctuations in China's GDP growth, consumer spending, or property market performance directly and disproportionately impact CLI's asset values and income streams.

- Regulatory Uncertainty: Changes in Chinese government policies, such as those affecting the real estate sector or foreign investment, can create significant operational and financial headwinds for CLI.

- Limited Diversification Benefits: While CLI aims to optimize its China portfolio, the high percentage of assets concentrated there limits the benefits of geographical diversification in mitigating overall risk.

Execution Risk in Ambitious Growth Targets

CapitaLand Investment (CLI) has set a bold objective to double its Funds Under Management (FUM) to S$200 billion by 2028, alongside a substantial increase in operating earnings. This aggressive growth strategy, which relies on a mix of organic expansion, new fund launches, strategic acquisitions, and potential new listings, faces significant execution risks.

The primary challenge lies in navigating a dynamic global economic landscape, which can impact the pace and success of these initiatives. For instance, securing new capital commitments and completing M&A deals in a fluctuating interest rate environment or during periods of geopolitical uncertainty presents considerable hurdles.

The sheer scale of CLI's ambition means that any misstep in executing its growth plans could have a material impact on its financial performance and investor confidence. Successfully integrating acquired assets or launching new funds requires meticulous planning and efficient operational execution.

- Ambitious FUM Target: Aiming for S$200 billion FUM by 2028 requires substantial fundraising and deployment of capital.

- M&A Integration: Successfully integrating acquired entities and assets is crucial for realizing projected synergies and growth.

- Market Volatility: Global economic and geopolitical uncertainties can disrupt fundraising efforts and M&A valuations.

- Operational Capacity: Scaling operations to manage a significantly larger FUM and portfolio requires robust execution capabilities.

CapitaLand Investment's (CLI) substantial exposure to China, with over 75% of its balance sheet assets located there as of Q1 2025, presents a significant concentration risk. This heavy reliance makes CLI particularly vulnerable to China's economic fluctuations and evolving regulatory policies. Any downturn in the Chinese market or adverse policy changes could disproportionately affect CLI's asset values and income streams, limiting diversification benefits.

Same Document Delivered

CapitaLand Investment SWOT Analysis

The file shown below is not a sample—it’s the real CapitaLand Investment SWOT analysis you'll download post-purchase, in full detail. This comprehensive report provides a thorough examination of the company's Strengths, Weaknesses, Opportunities, and Threats, offering valuable insights for strategic decision-making.

Opportunities

CapitaLand Investment (CLI) is strategically expanding into high-growth asset classes such as private credit, logistics, and data centers. This move directly addresses the global shifts driven by digitalization and evolving economic landscapes, positioning CLI to capture emerging opportunities. For instance, in 2024, CLI announced its intention to raise a significant fund dedicated to private credit, aiming to capitalize on increased demand for alternative financing solutions.

Furthermore, CLI is actively diversifying its geographical footprint beyond its traditional Asian strongholds. The company is accelerating its entry into key markets including Australia, Japan, Korea, the United States, and Europe. This strategic diversification aims to mitigate risks associated with over-reliance on any single region and tap into new growth potentials. By 2025, CLI expects these new markets to contribute a substantial percentage to its overall assets under management.

CapitaLand Investment (CLI) is actively pursuing mergers and acquisitions (M&A) as a core strategy to boost its Funds Under Management (FUM). This commitment is backed by substantial capital allocation aimed at accelerating growth and broadening its operational expertise.

A prime example of this strategy in action is CLI's recent investment in SC Capital Partners Group. This move is designed to open doors to new markets, specifically targeting Japan's burgeoning REIT sector, and to further diversify its investment portfolio.

CapitaLand Investment's lodging segment demonstrated robust performance in FY2024, achieving a record with 11,700 new unit openings. The company has set an ambitious target to generate S$500 million in fee income from this segment by 2028, highlighting significant growth potential.

The Commercial Management business is also experiencing a positive trajectory, securing new third-party contracts. This expansion suggests a strong opportunity for increased fee-based revenue, extending beyond CapitaLand's existing property portfolio and diversifying its income streams.

Technological Adoption and Innovation for Efficiency

CapitaLand Investment (CLI) is strategically embracing technological advancements, particularly artificial intelligence, to sharpen its competitive edge. The company has set an ambitious target of implementing 100 AI-driven projects by the year 2025. This initiative is designed to significantly boost investment insights, refine smart building technologies, and elevate customer engagement across its portfolio.

This proactive approach to digitalization and innovation is poised to unlock substantial operational efficiencies. Furthermore, it creates opportunities for CLI to develop novel value propositions that can differentiate it in the market. For instance, AI can optimize energy consumption in buildings, leading to cost savings and improved sustainability metrics, a key concern for investors in 2024 and beyond.

- AI-Driven Projects: Targeting 100 AI projects by 2025.

- Efficiency Gains: Enhancing operational performance through technology.

- Value Creation: Developing new revenue streams and customer experiences.

- Market Positioning: Strengthening competitive advantage via innovation.

Increasing Demand for Sustainable Real Estate Investments

Investor appetite for Environmental, Social, and Governance (ESG) principles is significantly boosting the demand for sustainable real estate. CapitaLand Investment (CLI) is well-positioned to capitalize on this trend, given its deep-rooted commitment to sustainability and its portfolio of green building certifications. This focus helps CLI attract a growing pool of capital from investors prioritizing responsible asset management.

CLI's proactive approach is further evidenced by its proprietary 'Return on Sustainability' model, which quantifies the financial benefits of sustainable practices. Additionally, the company's successful engagement in sustainable financing, such as green loans and sustainability-linked bonds, directly addresses the market's increasing demand for environmentally conscious investment opportunities. These initiatives underscore CLI's alignment with evolving investor preferences.

For instance, in 2023, CLI announced it secured S$1.2 billion in sustainability-linked loans, further demonstrating its ability to tap into the growing sustainable finance market. The company's commitment is also reflected in its target to achieve 75% of its portfolio by value with green building certifications by 2030, a clear signal of its strategic direction towards sustainable real estate.

Key aspects of this opportunity include:

- Growing ESG Investment Flows: Global sustainable investment assets are projected to reach over US$50 trillion by 2025, with real estate being a significant beneficiary.

- CLI's Sustainability Framework: The 'Return on Sustainability' model and green building certifications provide a competitive edge in attracting ESG-focused capital.

- Sustainable Financing Access: CLI's track record in securing sustainable financing demonstrates its ability to leverage market trends for capital raising.

- Market Alignment: CLI's strategic focus on sustainability directly aligns with the increasing investor demand for responsible and impact-driven real estate investments.

CapitaLand Investment (CLI) is strategically expanding into high-growth asset classes like private credit and data centers, aligning with global digitalization trends. In 2024, CLI announced a significant private credit fund to meet rising demand for alternative financing.

CLI is also diversifying geographically, accelerating its entry into markets like the US and Europe to mitigate risk and tap new growth. By 2025, these new regions are expected to contribute substantially to its assets under management.

The company's lodging segment achieved a record 11,700 new unit openings in FY2024, targeting S$500 million in fee income by 2028, showcasing strong growth potential.

CLI is actively pursuing M&A to boost Funds Under Management, as demonstrated by its investment in SC Capital Partners Group to access Japan's REIT sector.

Threats

Ongoing geopolitical turmoil, like the prolonged Russia-Ukraine conflict and the escalating Middle East crisis, continues to fuel global economic uncertainty. These persistent conflicts disrupt supply chains and energy markets, contributing to inflationary pressures and higher interest rates. For instance, the IMF revised its global growth forecast for 2024 down to 2.7% in its October 2023 report, citing these very geopolitical risks.

A slower-than-expected economic recovery in China, a key market for many global businesses, also presents a significant threat. Reduced consumer spending and investment in China can directly impact demand for real estate and other assets, affecting companies with substantial exposure there. China's property sector, in particular, has faced ongoing challenges, with major developers struggling, which can have ripple effects across the broader economy.

This combined instability can significantly dampen investor and consumer sentiment worldwide. When confidence is low, people and businesses tend to postpone major spending and investment decisions, leading to lower property demand, reduced transaction volumes, and a general slowdown in business growth. This cautious environment makes it harder for companies like CapitaLand Investment to secure new projects and achieve projected returns.

Rising interest rates significantly increase borrowing costs for real estate projects, directly impacting the profitability and feasibility of new developments for CapitaLand Investment (CLI). This can lead to lower net returns on invested capital, making it harder to deploy funds effectively in a high-rate environment.

While CLI maintained a healthy low debt-to-equity ratio, as of the first half of 2024, standing at 0.34 times, sustained elevated interest rates could still exert pressure on its earnings. This could potentially limit the company's capacity for future expansion and strategic acquisitions.

The real asset management sector is a crowded space, with many international firms competing fiercely for investment capital and properties. This intense competition puts pressure on management fees, potentially impacting CapitaLand Investment's (CLI) ability to meet its substantial Funds Under Management (FUM) growth objectives and sustain current profit levels.

In 2023, global real estate investment volumes saw a notable decline, making the competition for available assets even more pronounced. For instance, while specific fee compression figures for CLI aren't publicly detailed, industry-wide trends suggest that managers are increasingly needing to demonstrate superior performance and unique value propositions to attract and retain capital in such a challenging environment.

Valuation and Fair Value Losses in Real Estate Portfolio

CapitaLand Investment (CLI) faced a challenge in FY2024 with lower operating PATMI, partly due to divested properties and the potential for real estate portfolio valuation and fair value losses. This can impact overall profitability even with reported PATMI growth.

Market volatility and financing challenges are significant threats, particularly in markets like China. These pressures can directly translate into fair value losses for CLI's real estate assets, affecting its financial performance.

- Market Dislocations: Increased uncertainty in real estate markets, especially in China, can lead to downward pressure on property valuations.

- Financing Pressures: Rising interest rates and tighter credit conditions can make it more expensive for CLI to finance its properties, potentially impacting cash flows and asset values.

- Revaluation Impact: A decline in the fair value of its extensive real estate portfolio, as indicated by potential revaluation losses, directly reduces the company's net asset value and reported earnings.

Regulatory Changes and Increased Scrutiny in Diverse Markets

CapitaLand Investment (CLI) operates across 45 countries, making it susceptible to a wide array of evolving regulatory landscapes. Shifts in real estate laws, tax structures, or foreign investment rules in any of these markets can significantly impact operations and profitability. For instance, 2024 has seen increased focus on environmental, social, and governance (ESG) regulations globally, which could necessitate additional compliance measures and investment in sustainable practices for CLI's diverse portfolio.

These regulatory changes can introduce operational complexities and escalate compliance costs. For example, new data privacy laws in Europe or stricter building codes in Asia could require substantial adjustments to existing properties and future developments. CLI's extensive international presence means navigating these diverse and often conflicting regulations is a constant challenge, potentially affecting project timelines and investment returns.

- Exposure to 45 Jurisdictions: CLI's global footprint means it must adhere to a multitude of national and regional regulations.

- Increased Compliance Costs: Evolving real estate, tax, and investment laws necessitate ongoing investment in compliance infrastructure and expertise.

- Potential for Operational Disruption: Changes in regulations can lead to project delays, altered development plans, or increased operational burdens.

- Impact on Investment Returns: Unfavorable regulatory shifts can directly affect property valuations, rental income, and capital appreciation across CLI's portfolio.

CapitaLand Investment (CLI) faces significant threats from escalating geopolitical tensions and a slower-than-expected economic recovery, particularly in China, which impacts global demand and investor sentiment. Rising interest rates also increase borrowing costs, potentially squeezing profitability and limiting expansion. Intense competition in the real asset management sector and market dislocations, especially in China, put pressure on fees and asset valuations.

| Threat Area | Description | Potential Impact on CLI | Supporting Data/Trend |

| Geopolitical & Economic Uncertainty | Ongoing global conflicts and slower economic growth | Reduced investor confidence, dampened demand for real estate, inflationary pressures | IMF global growth forecast revised down to 2.7% for 2024 (October 2023) |

| Rising Interest Rates | Increased cost of borrowing | Higher financing costs for projects, reduced profitability, potential strain on earnings | CLI's debt-to-equity ratio was 0.34x in H1 2024, but sustained high rates can still pressure earnings. |

| Market Competition & Dislocations | Crowded real asset management sector, market volatility | Pressure on management fees, difficulty meeting FUM growth targets, potential for fair value losses | Global real estate investment volumes declined in 2023, intensifying competition for assets. |

| Regulatory Landscape | Evolving laws across 45 operating countries | Increased compliance costs, operational complexities, potential impact on investment returns | Growing focus on ESG regulations in 2024 necessitates additional compliance measures. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from CapitaLand Investment's official financial filings, comprehensive market intelligence reports, and expert industry analyses to provide a well-rounded and actionable strategic overview.