CapitaLand Investment Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CapitaLand Investment Bundle

CapitaLand Investment faces moderate bargaining power from buyers due to the diverse real estate options available, while supplier power is relatively low thanks to the industry's fragmented nature. The threat of new entrants is a significant concern, as the barriers to entry, while present, are not insurmountable in the dynamic property market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore CapitaLand Investment’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of key suppliers for CapitaLand Investment (CLI) is a dynamic factor, heavily influenced by the specific asset class and geographical market. In sectors requiring highly specialized components, such as advanced construction materials for premium developments or cutting-edge technology for data centers, CLI might face a limited pool of qualified suppliers, thereby enhancing supplier bargaining power.

For instance, in 2024, the global supply chain for specialized data center cooling systems saw consolidation, with a few key manufacturers dominating the market. This concentration means these suppliers can command higher prices or dictate terms, especially for large-scale projects CLI undertakes.

Conversely, for more standardized inputs like general construction labor or common building materials in established markets, CLI's substantial procurement volume and established relationships often allow it to negotiate favorable terms, mitigating supplier leverage.

Switching costs for CapitaLand Investment (CLI) can be substantial, especially when long-term construction agreements or specialized technology providers for smart building features are involved. These costs, encompassing time, effort, and potential operational disruptions, can give suppliers more leverage.

For instance, breaking a complex, multi-year debt agreement with a financial institution could incur significant penalties and require extensive renegotiation, highlighting high switching costs. CLI's 2023 annual report indicates a robust pipeline of development projects, many of which would likely involve such long-term supplier relationships.

The uniqueness of what suppliers offer significantly impacts their ability to negotiate. If a supplier has something special, like exclusive access to prime properties for CapitaLand Investment (CLI) or proprietary technology for developing new economy assets, they can often charge more.

Conversely, when suppliers provide common goods like standard building materials or routine services, their offerings are not unique. This lack of differentiation means they have less leverage to demand higher prices from CLI.

For instance, in 2024, the demand for specialized sustainable building materials, often sourced from a limited number of suppliers, has given those suppliers greater bargaining power in certain construction projects. This contrasts with the readily available and standardized nature of traditional concrete or steel, where supplier power is considerably weaker.

CLI mitigates this by fostering internal innovation and building relationships with a broad base of suppliers. This diversification reduces the company's reliance on any single supplier's unique, and potentially costly, offerings.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into CapitaLand Investment's (CLI) business is generally low. This is because real estate development, investment management, and operational oversight demand substantial capital, a broad range of specialized skills, and a deep understanding of complex regulatory environments. For instance, while a construction company might build a property, it's highly improbable they could effectively manage a global portfolio of real estate funds or diverse lodging assets like CLI does.

This limited capacity for forward integration by suppliers significantly curtails their bargaining power. Suppliers typically lack the financial muscle and operational breadth to compete directly with CLI across its multifaceted operations. For example, a materials supplier would find it difficult to transition into managing a REIT or a global fund, thus maintaining CLI's advantage.

Consider the capital requirements: CLI's assets under management (AUM) stood at approximately S$134 billion as of December 31, 2023. This scale of capital deployment and management is a significant barrier for most potential supplier entrants.

- Low Capital Barrier Replication: Suppliers face immense capital hurdles in replicating CLI's diverse real estate investment and management capabilities.

- Expertise Gap: The specialized knowledge required for global fund management and lodging operations is beyond the typical scope of suppliers.

- Regulatory Complexity: Navigating international real estate regulations and financial compliance is a significant challenge for most suppliers.

- Scale of Operations: CLI's substantial AUM of S$134 billion (as of end-2023) creates an insurmountable scale advantage for potential supplier competitors.

Importance of CLI to Suppliers

CapitaLand Investment's (CLI) significant scale and substantial investments within the real estate ecosystem make it a highly valuable client for many suppliers. For smaller or niche providers, a contract with a global entity like CLI can represent a substantial portion of their revenue and offer considerable prestige, thereby diminishing their individual bargaining power.

However, the dynamic shifts for very large, diversified suppliers. If CLI constitutes only a small fraction of their overall business, these suppliers possess greater leverage due to their numerous other client relationships. For instance, in 2023, CLI's total procurement spend across various categories would be a key metric for assessing its influence on different supplier segments.

- CLI's significant investment scale makes it a key customer for many in the real estate supply chain.

- For smaller suppliers, securing CLI as a client can be crucial for revenue and reputation, reducing their bargaining power.

- Larger, diversified suppliers may have more leverage if CLI represents a smaller portion of their total business.

The bargaining power of suppliers for CapitaLand Investment (CLI) is influenced by supplier concentration and the uniqueness of their offerings. In 2024, consolidation in specialized sectors like data center cooling systems meant a few key players could command higher prices, increasing their leverage. Conversely, for standard inputs, CLI's large procurement volume and established relationships often allow for favorable terms.

Switching costs are a significant factor; long-term agreements for specialized technology or construction can make it costly and disruptive for CLI to change suppliers, thus empowering those suppliers. The uniqueness of a supplier's product or service, such as exclusive access to prime land or proprietary development technology, also grants them greater negotiation power, as seen with specialized sustainable building materials in 2024.

The threat of suppliers integrating forward into CLI's business is generally low due to the immense capital, diverse skills, and regulatory expertise required for global real estate investment and management. CLI's substantial assets under management, around S$134 billion as of December 31, 2023, create significant barriers to entry for potential supplier competitors.

CLI's scale makes it a crucial client for many suppliers, potentially reducing their individual bargaining power. However, for very large, diversified suppliers, CLI might represent a smaller portion of their business, giving them more leverage.

| Factor | Impact on Supplier Bargaining Power | CLI's Mitigation Strategy |

| Supplier Concentration | High for specialized inputs (e.g., data center cooling in 2024) | Diversifying supplier base, fostering internal capabilities |

| Uniqueness of Offering | High for exclusive land access or proprietary technology | Focusing on standardized inputs, building strong relationships |

| Switching Costs | Substantial for long-term tech or construction agreements | Careful contract negotiation, exploring flexible arrangements |

| Forward Integration Threat | Generally Low due to capital and expertise barriers | Leveraging scale and operational breadth as a competitive advantage |

| Importance of CLI as a Customer | Reduces power for smaller suppliers; increases for large, diversified ones | Strategic supplier relationship management |

What is included in the product

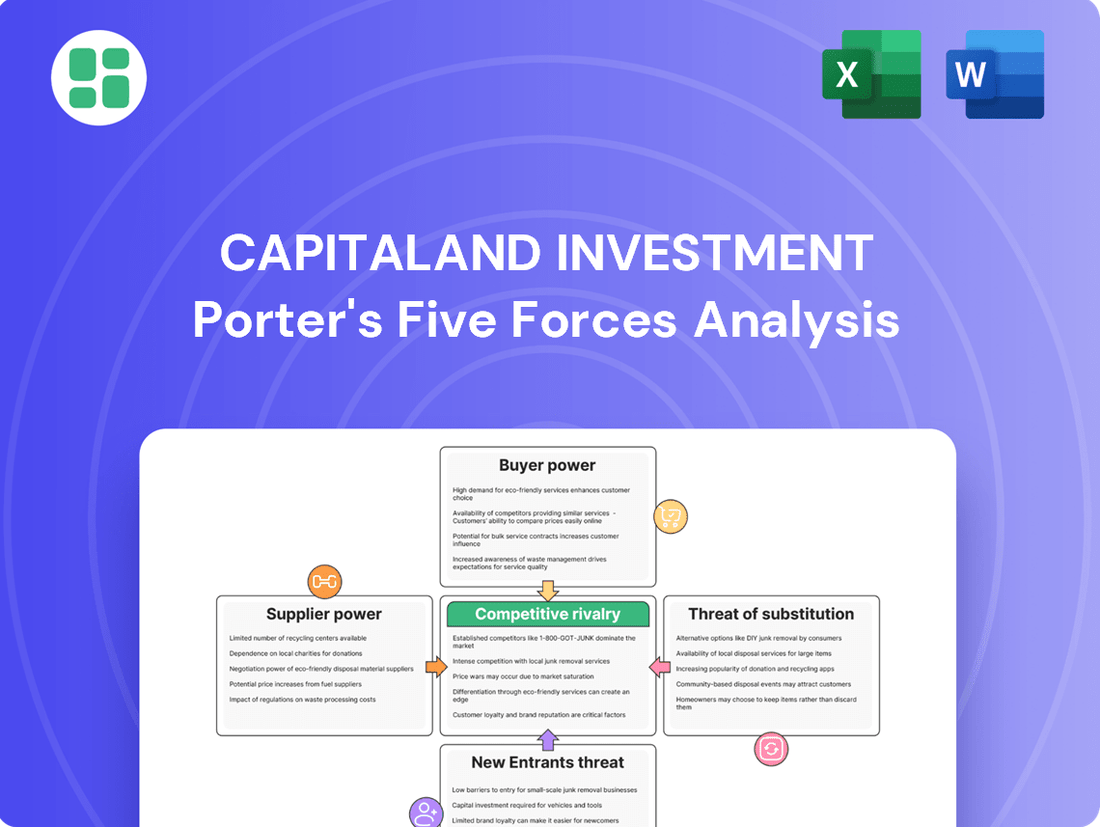

This Porter's Five Forces analysis meticulously examines the competitive landscape for CapitaLand Investment, assessing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Gain instant clarity on competitive pressures with a visual Porter's Five Forces analysis, simplifying complex market dynamics for CapitaLand Investment's strategic planning.

Customers Bargaining Power

CapitaLand Investment (CLI) faces a mixed bag when it comes to customer bargaining power, largely shaped by the concentration or fragmentation of its client base. For instance, in its fund management arm, large institutional investors, deploying significant capital, naturally hold substantial sway due to the sheer volume of their investments.

Conversely, the retail and lodging segments see a much more dispersed customer base. Millions of individual shoppers and hotel guests, while collectively important, individually possess very little bargaining power. This fragmentation means CLI can often dictate terms more effectively in these areas, as no single customer can exert significant pressure.

This dynamic is evident in CLI's diverse portfolio. While a single large pension fund might negotiate favorable terms for a multi-million dollar investment, a single shopper at a CapitaLand mall or a guest at a Citadines serviced residence has minimal leverage. This segmentation is key to understanding the varying levels of customer power across CLI’s operations.

The price sensitivity of CapitaLand Investment's (CLI) customers varies significantly across its diverse portfolio. Institutional investors, a key customer segment, are acutely price-sensitive. They meticulously evaluate management fees and historical fund performance, particularly when capital is abundant and competition for fundraising is fierce. For instance, in 2024, the global real estate investment market saw increased competition, putting pressure on fund managers to offer competitive fee structures.

Commercial tenants, especially in markets experiencing oversupply, also demonstrate considerable price sensitivity. They actively seek favorable rental rates and flexible lease terms, making rental pricing a critical factor in tenant acquisition and retention. This was evident in several Asia-Pacific office markets in early 2024, where vacancy rates pushed landlords to offer incentives.

However, certain customer segments exhibit lower price sensitivity. Those seeking premium locations, specialized assets like data centers, or unique hospitality experiences may prioritize quality and convenience over cost. For example, demand for well-located, modern logistics facilities or high-quality serviced apartments often allows for less price negotiation.

CapitaLand Investment (CLI) faces significant bargaining power from its customers due to the wide array of substitute products and services available. For investors, this means alternatives like other real estate investment trusts (REITs), direct property purchases, or even non-real estate investments such as bonds or equities offer comparable avenues for capital deployment. In 2024, the global REIT market continued to offer diverse options, with particular growth in specialized sectors like data centers and logistics, providing investors with more granular choices beyond traditional office or retail spaces.

Tenants also wield considerable power. They can choose to lease space from competing landlords who might offer more favorable lease terms, better amenities, or more strategic locations. The rise of flexible workspace providers and the ongoing trend of remote or hybrid work models further empower tenants, reducing their reliance on traditional long-term leases. This flexibility allows them to adapt their space needs more readily, increasing pressure on landlords like CLI to remain competitive on pricing and service offerings.

For CLI's lodging segment, the availability of substitutes is even more pronounced. Guests have a vast selection of options, ranging from global hotel chains and boutique hotels to burgeoning short-term rental platforms like Airbnb and private accommodation providers. In 2024, the hospitality sector saw continued innovation in guest experiences and pricing models, making it easier for travelers to switch between providers based on cost, convenience, or unique offerings. This broad competitive landscape directly amplifies the bargaining power of lodging customers.

Customer Information Asymmetry

Customer information asymmetry is generally low for institutional investors. These sophisticated entities possess access to extensive market data and employ professional advisors, which significantly bolsters their bargaining power when engaging with companies like CapitaLand Investment (CLI).

For individual tenants and lodging guests, the landscape is evolving. While readily available information through online reviews and property listings has increased, CLI's strong brand reputation and well-established operational platforms can effectively mitigate this asymmetry. This allows CLI to maintain a degree of advantage in negotiations.

- Institutional investors benefit from deep market insights and expert counsel, enhancing their negotiation leverage.

- Individual customers have more access to information than ever before, but brand strength can still be a differentiator.

- CLI's brand equity and operational scale help to level the playing field against increased customer information access.

Threat of Backward Integration by Customers

The threat of backward integration by CapitaLand Investment's (CLI) customers is generally low. While significant institutional investors could potentially acquire and manage real estate assets directly, they are unlikely to possess or replicate CLI's extensive global operational expertise across various property types and services, such as lodging and integrated development management.

For instance, while a large pension fund might invest in a portfolio of office buildings, it's improbable they would develop the in-house capabilities to manage a global serviced residence portfolio, which is a core competency for CLI. This inability to easily replicate CLI's integrated service offering significantly curtails the bargaining power of these customers to demand lower fees or more favorable terms.

- Low Threat of Backward Integration: Customers, including institutional investors and end-users like tenants or guests, generally lack the scale and expertise to replicate CLI's complex, global real estate investment and management operations.

- Limited Replication of Capabilities: Even large investors typically focus on asset acquisition and ownership rather than developing the operational management capabilities across diverse sectors like lodging, which CLI excels at.

- Customer Segments: Tenants in commercial properties or guests in serviced residences are even less likely to integrate backward, as their core business is not real estate investment or management.

- Impact on Bargaining Power: This low threat of backward integration means customers have less leverage to negotiate pricing or terms, thereby strengthening CLI's position.

CapitaLand Investment's (CLI) customers exhibit varying degrees of bargaining power, influenced by factors like customer concentration, price sensitivity, and the availability of substitutes. Institutional investors, due to their significant capital deployment, possess considerable leverage, especially in a competitive fundraising environment like that seen in 2024. Conversely, individual retail shoppers and lodging guests, while numerous, have minimal individual power, allowing CLI greater flexibility in setting terms.

The price sensitivity of CLI's customer base is a key determinant of their bargaining power. Institutional investors and commercial tenants are highly attuned to pricing, particularly in markets with ample capital or oversupply, as observed in early 2024. However, segments seeking premium offerings or specialized assets demonstrate less price sensitivity, granting CLI more pricing control.

The broad availability of substitutes significantly amplifies customer bargaining power across CLI's portfolio. Investors can choose from a wide array of REITs and other investment vehicles, while tenants have numerous leasing options. In the lodging sector, the proliferation of alternative accommodation providers, including short-term rentals, further empowers guests to switch providers based on cost and convenience.

The threat of backward integration by CLI's customers remains low. Few investors possess the scale or specialized operational expertise required to replicate CLI's integrated global real estate management capabilities across diverse sectors like lodging. This limitation curtails their ability to exert significant downward pressure on fees or terms.

Same Document Delivered

CapitaLand Investment Porter's Five Forces Analysis

This preview offers a comprehensive Porter's Five Forces analysis for CapitaLand Investment, detailing the competitive landscape and strategic implications. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate investment sector.

Rivalry Among Competitors

The real estate investment management arena is intensely competitive, populated by a wide array of entities. These range from massive global players such as Blackstone and Brookfield, managing trillions in assets, to more localized developers, influential sovereign wealth funds, and highly specialized niche investment firms. This sheer volume and variety of competitors mean CapitaLand Investment (CLI) encounters distinct rivals in each market segment and asset class it participates in.

For instance, in the logistics sector, CLI might compete with Prologis or GLP, while in the retail space, it could face off against Unibail-Rodamco-Westfield. This broad and diverse competitive environment significantly amplifies the rivalry CLI experiences across its global operations.

The industry growth rate plays a crucial role in shaping competitive rivalry within the real estate investment sector. While the global real estate investment market is anticipated to experience a slow recovery with new prospects emerging by 2025, overall expansion could be restrained by economic instability, increasing interest rates, and global political changes. This slower growth environment often leads to heightened competition as companies battle for a limited number of attractive investment opportunities and market share.

CapitaLand Investment (CLI) actively counters intense competition by emphasizing product and service differentiation. CLI’s strategy hinges on its broad portfolio spanning integrated developments, retail, office, lodging, new economy assets, and data centers. This diversification, coupled with its end-to-end value chain capabilities and a pronounced commitment to sustainability and ESG principles, sets it apart.

Furthermore, CLI leverages its established track record and extensive global presence to attract investors. The company’s ability to craft bespoke investment solutions, tailored to specific client needs, also acts as a significant differentiator in a market where rivals are equally keen to carve out unique value propositions.

Exit Barriers for Competitors

Exit barriers in real estate investment management are substantial, largely due to the inherent illiquidity of property assets and the long-term nature of these investments. This means that companies find it difficult and expensive to sell off their holdings or dissolve their investment funds quickly.

These high exit barriers can trap competitors in the market, even when economic conditions are unfavorable. For instance, the process of divesting a large real estate portfolio can take years and incur significant transaction costs. This reluctance or inability to exit easily fuels ongoing competition, as firms are less inclined to withdraw from the sector.

- Illiquid Assets: Real estate, unlike stocks, cannot be sold instantaneously, creating a barrier to rapid exit.

- Long Investment Horizons: Funds are often structured with multi-year lock-up periods, preventing quick divestment.

- Complex Fund Structures: Unwinding intricate fund arrangements and contractual obligations is costly and time-consuming.

- Transaction Costs: Significant fees associated with selling large property portfolios or exiting fund commitments deter immediate departures.

Strategic Commitments of Competitors

Competitors in real estate investment management, much like CapitaLand Investment (CLI), often demonstrate substantial strategic commitments. These include managing vast sums of capital, typically in the billions of dollars, and maintaining extensive, long-term development pipelines that can span years and multiple projects. For instance, by the end of 2023, major global players managed portfolios exceeding $100 billion, reflecting their deep-seated market presence and future growth plans.

Many rivals are also actively pursuing asset-light strategies and geographical diversification, mirroring CLI's own strategic direction. This approach allows them to expand their reach and manage a broader array of assets without the heavy capital outlay of direct ownership. This shared strategic focus intensifies the competition for capital, desirable assets, and skilled talent across the industry.

- Significant Funds Under Management: Competitors often manage substantial capital, with many global REIT managers overseeing portfolios well over $50 billion as of 2023.

- Long-Term Development Pipelines: Industry players maintain multi-year development plans, committing significant resources to future projects and market expansion.

- Geographical Diversification: A common strategy involves expanding into new international markets to spread risk and capture growth opportunities.

- Aggressive Market Defense: Due to these deep commitments, competitors are highly motivated to defend their market share, leading to robust rivalry for investment opportunities and talent.

The competitive rivalry for CapitaLand Investment (CLI) is intense, driven by a vast number of global and local players, including large asset managers and sovereign wealth funds. This crowded landscape means CLI faces distinct competitors in every market segment and asset class it operates in, from logistics to retail. The anticipated slow recovery of the global real estate market by 2025, potentially hampered by economic instability and rising interest rates, further intensifies this competition as firms vie for limited attractive opportunities.

CLI differentiates itself through its diverse portfolio, encompassing integrated developments, retail, office, lodging, and new economy assets, alongside a strong commitment to sustainability. Its ability to offer bespoke investment solutions and leverage its global presence and track record are key strategies to stand out against rivals also focused on unique value propositions and geographical diversification.

High exit barriers in real estate investment management, stemming from asset illiquidity and long investment horizons, trap competitors in the market. This difficulty in quick divestment means firms are less likely to withdraw during unfavorable economic periods, thereby sustaining ongoing, robust rivalry. Transaction costs and complex fund structures further deter immediate departures, solidifying the competitive pressure.

Competitors, much like CLI, demonstrate significant strategic commitments, managing billions in capital and maintaining extensive, long-term development pipelines. Many are also adopting asset-light strategies and geographical diversification, intensifying the competition for capital, assets, and talent. This deep market presence and commitment to future growth mean rivals are highly motivated to defend their existing market share.

| Competitor Type | Example Competitors | Assets Under Management (Approx. 2023) | Strategic Focus |

|---|---|---|---|

| Global Asset Managers | Blackstone, Brookfield | >$1 Trillion | Diversified Real Estate, Private Equity |

| Specialized Real Estate Firms | Prologis (Logistics), GLP (Logistics) | >$100 Billion | Sector-Specific, Logistics/Industrial |

| Retail Real Estate Groups | Unibail-Rodamco-Westfield | >$50 Billion | Prime Retail Assets, Mixed-Use |

| Sovereign Wealth Funds | GIC, ADIA | Varies (Significant) | Long-Term, Global Diversification |

SSubstitutes Threaten

Capital partners, the lifeblood of real estate investment vehicles, possess a wide array of choices beyond CapitaLand Investment's (CLI) offerings. They can opt for direct property acquisitions, bypass CLI's managed funds to invest in publicly traded Real Estate Investment Trusts (REITs) from other sponsors, or even diversify into entirely different asset classes such as private equity, infrastructure projects, or debt instruments. This broad spectrum of alternatives directly impacts CLI's ability to attract and retain capital.

The allure of these substitutes is heavily influenced by their perceived attractiveness, which is a dynamic calculation of potential returns, the ease with which capital can be accessed (liquidity), and the inherent risks involved. For instance, in 2024, while global REITs experienced varied performance, some sectors saw significant growth, potentially drawing capital away from private real estate funds if perceived risk-adjusted returns were more favorable.

For tenants, traditional lease agreements with CapitaLand Investment (CLI) properties face substitutes like direct property ownership or flexible office spaces. The rise of co-working spaces, offering agility and reduced commitment, presents a significant alternative. In 2024, the flexible workspace sector continued its expansion, with reports indicating a substantial increase in demand, particularly from small and medium-sized enterprises seeking cost-effective and adaptable solutions.

Furthermore, the persistent trend towards hybrid work models encourages tenants to reduce their physical office footprint. This can lead them to opt for smaller, more efficient spaces or even entirely remote operations, bypassing the need for traditional long-term leases. As of mid-2024, many companies were re-evaluating their real estate needs, prioritizing flexibility and sustainability, which could steer them away from conventional leasing if CLI's portfolio doesn't align with these evolving preferences.

CapitaLand Investment (CLI) faces a significant threat from substitute lodging options. The rise of online short-term rental platforms like Airbnb has provided consumers with a vast and often more affordable alternative to traditional hotels and serviced residences. In 2024, the short-term rental market continued its robust growth, with platforms reporting millions of active listings globally, offering unique experiences and localized stays that directly compete with CLI's offerings.

Technological Advancements Enabling Substitutes

Technological advancements, especially in proptech and AI, are a significant driver of substitute threats for real estate investment. For instance, AI-powered platforms are emerging that democratize real estate analysis, allowing individuals to bypass traditional fund managers and invest more directly and efficiently. This trend is gaining momentum, with venture capital funding for proptech companies reaching over $40 billion globally by the end of 2023, indicating a strong belief in these disruptive technologies.

These innovations can redefine how real estate is accessed and utilized, potentially diminishing the need for traditional investment vehicles. For example, virtual reality and enhanced remote collaboration tools could lessen the demand for physical office spaces, a core asset class for many investors. Similarly, the rise of fractional ownership platforms, facilitated by blockchain technology, allows for smaller, more accessible real estate investments, creating substitutes for larger, institutional-style funds.

The increasing sophistication of these technological substitutes presents a clear challenge. By 2024, it's estimated that over 70% of commercial real estate firms are exploring or implementing AI solutions, aiming to improve operational efficiency and investment analysis. This widespread adoption underscores the growing competitive pressure from alternative, technology-enabled investment strategies and property utilization models.

Key technological advancements enabling substitutes include:

- AI-driven investment analysis platforms reducing reliance on traditional real estate fund managers.

- Virtual and augmented reality potentially decreasing the demand for physical office and retail footprints.

- Proptech solutions facilitating fractional ownership and direct real estate investment.

- Advanced communication technologies enabling remote work and reducing the necessity for traditional office spaces.

Shifting Preferences Towards Non-Traditional Real Estate Models

The rise of non-traditional real estate models presents a significant threat of substitutes for CapitaLand Investment (CLI). Co-living spaces, build-to-rent communities, and data centers are gaining traction, offering alternatives to conventional property offerings. For instance, the global co-living market was projected to reach over $15 billion by 2025, indicating a substantial shift in consumer preference.

If CLI fails to diversify its portfolio or adapt its existing assets to cater to these evolving demands, it risks losing market share. Customers are increasingly seeking flexibility and specialization, which these alternative models often provide more effectively. This could lead to a decline in demand for traditional real estate segments where CLI has a strong presence.

- Growing Demand for Co-living: The global co-living market is expanding rapidly, with significant growth expected in major urban centers.

- Build-to-Rent Sector Expansion: This segment offers a stable rental income stream and appeals to renters seeking professional management and community amenities.

- Digital Infrastructure Needs: Data centers are crucial for the digital economy, representing a specialized real estate asset class with high demand.

- Customer Preference Shift: Consumers are increasingly valuing flexibility, community, and specialized services over traditional property ownership or long-term leases.

Capital partners have numerous alternatives to investing with CapitaLand Investment (CLI), including direct property purchases, other REITs, private equity, and infrastructure. In 2024, global REIT performance varied, with some sectors offering potentially higher risk-adjusted returns, drawing capital away from private real estate funds.

Tenants also have substitutes like direct ownership or flexible office spaces. Co-working spaces, offering agility, saw significant demand growth in 2024, especially from SMEs seeking cost-effective solutions.

Technological advancements, such as AI-driven analysis platforms and fractional ownership via blockchain, are creating more direct and accessible real estate investment opportunities, potentially bypassing traditional fund managers.

The rise of non-traditional models like co-living and build-to-rent communities, alongside specialized assets like data centers, offers alternatives to CLI's conventional property offerings, catering to evolving consumer preferences for flexibility and specialization.

Entrants Threaten

The real estate investment management sector inherently requires immense capital. Entrants need substantial funds to acquire properties, undertake development projects, and establish the operational infrastructure for managing large investment portfolios. This high capital demand acts as a significant barrier, particularly for those aiming to compete on a global scale.

For instance, CapitaLand Investment (CLI) manages a considerable S$117 billion in assets as of the close of 2024. This sheer scale underscores the financial muscle required to enter and thrive in this market, making it difficult for smaller or less capitalized entities to challenge established players.

Operating globally as a real estate investment manager means grappling with intricate regulatory landscapes across various countries. New entrants face substantial barriers due to the need for deep expertise in diverse financial regulations, property laws, and environmental mandates, making compliance a costly and complex undertaking.

For instance, the European Union's stringent Alternative Investment Fund Managers Directive (AIFMD) requires significant capital and operational compliance for fund managers, a hurdle many smaller entities struggle to clear. CapitaLand Investment (CLI) itself, with its extensive global footprint, demonstrates a strong commitment to navigating these complexities, as evidenced by its robust corporate governance, which is crucial for maintaining investor confidence and operational stability in regulated markets.

CapitaLand Investment's (CLI) strong brand reputation and proven track record are significant barriers to new entrants. Establishing this level of trust and credibility with institutional investors, who are critical for securing high-quality assets, takes years of consistent performance. For instance, CLI's extensive history in real estate investment management, managing over S$120 billion in assets under management as of December 31, 2023, demonstrates a deep understanding of market cycles and a capacity to deliver stable returns, making it difficult for newcomers to compete for capital.

Access to Prime Assets and Deal Flow

New entrants face a significant hurdle in accessing prime real estate assets and proprietary deal flow. This access is typically built on years of cultivated relationships, a profound understanding of local markets, and extensive professional networks. For instance, in 2024, major global real estate investment firms continued to leverage their established networks to secure off-market deals, often outbidding newer players for premium properties.

CapitaLand Investment (CLI), with its global footprint and integrated approach spanning investment management, asset management, and development, possesses a distinct advantage in sourcing and executing attractive investment opportunities. This integrated value chain allows CLI to identify and secure prime assets more effectively than many newcomers. In the first half of 2024, CLI reported securing several key development sites in growth markets through its existing relationships, highlighting this competitive edge.

- Established Networks: Access to prime assets often relies on long-standing relationships with sellers, brokers, and local authorities, which new entrants lack.

- Proprietary Deal Flow: Information on attractive investment opportunities frequently comes through exclusive channels, making it difficult for outsiders to compete.

- Market Intelligence: Deep, nuanced market insights, crucial for identifying undervalued or high-potential assets, are hard-won and not easily replicated by new entrants.

- Capital Deployment: While capital is important, the ability to deploy it effectively on the best opportunities is hindered by a lack of established deal sourcing capabilities.

Economies of Scale and Operational Efficiency

Existing large players like CapitaLand Investment (CLI) leverage substantial economies of scale across their operations. This includes fund management, property development, and technology implementation, which translate into significant cost advantages and enhanced operational efficiency. For instance, in 2023, CLI managed a substantial S$133.1 billion in assets under management, a scale that allows for more favorable terms with suppliers and efficient capital deployment.

New entrants face considerable hurdles in replicating these efficiencies. Without a comparable portfolio size and established infrastructure, they struggle to achieve the same cost savings or service levels. This makes it difficult for them to compete effectively on price or offer the same breadth of services as incumbents like CLI, thus posing a barrier to entry.

- Economies of Scale: CLI's S$133.1 billion AUM in 2023 provides a significant cost advantage in fund management and operations.

- Operational Efficiency: Large-scale operations enable CLI to achieve greater efficiency in property management and technology adoption.

- Barriers to Entry: New entrants find it challenging to match the cost structures and service capabilities of established players.

- Competitive Disadvantage: Lack of scale limits new entrants' ability to compete on price and service quality.

The threat of new entrants in real estate investment management, particularly for a firm like CapitaLand Investment (CLI), is generally considered moderate. Significant capital requirements, stringent regulatory compliance, and the need for established networks to access prime assets present substantial barriers.

CLI's substantial asset under management (AUM) of S$117 billion at the end of 2024 highlights the scale required to compete effectively. Newcomers must overcome these hurdles to gain traction against established players with proven track records and deep market penetration.

The ability to source proprietary deal flow and leverage economies of scale further solidifies the position of incumbents. These factors make it challenging for new entities to replicate the operational efficiencies and competitive advantages that firms like CLI possess.

| Factor | Impact on New Entrants | CLI's Position |

| Capital Requirements | High barrier; requires substantial funding for acquisitions and operations. | S$117 billion AUM (end of 2024) demonstrates significant financial capacity. |

| Regulatory Compliance | Complex and costly, especially across multiple jurisdictions. | Extensive experience navigating global regulations, supported by robust governance. |

| Access to Deal Flow | Challenging due to reliance on established relationships and market intelligence. | Integrated value chain and global footprint facilitate prime asset sourcing. |

| Economies of Scale | Difficult to achieve, leading to higher operational costs. | S$133.1 billion AUM (2023) provides significant cost advantages and efficiency. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CapitaLand Investment is built upon a foundation of comprehensive data, including CapitaLand's annual reports, investor presentations, and official company disclosures. We also incorporate insights from reputable industry research firms and financial news outlets to capture the competitive landscape.