Camil Alimentos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camil Alimentos Bundle

Camil Alimentos, a major player in the food industry, boasts strong brand recognition and a diversified product portfolio, yet faces intense competition and fluctuating commodity prices. Understanding these internal capabilities and external pressures is crucial for navigating its market.

Want the full story behind Camil Alimentos' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Camil Alimentos boasts significant market leadership, holding top positions in essential food categories like rice, beans, and refined sugar throughout Brazil, Uruguay, Chile, and Peru. This dominance is underpinned by a portfolio of highly recognized and trusted brands, including Camil, União, Coqueiro, Saman, Tucapel, and Costeño.

The company's strong brand equity translates into a distinct competitive advantage, enabling Camil Alimentos to implement price premiums and solidify its market standing. For instance, in 2023, Camil's net revenue reached R$17.7 billion, reflecting the consumer trust and market penetration of its established brands.

Camil Alimentos boasts a significantly diversified product portfolio, encompassing staples like rice, beans, sugar, coffee, pasta, and seafood. This broad offering is a key strength, reducing reliance on any single market segment and allowing the company to meet a wide array of consumer demands. For instance, in the first quarter of 2024, Camil reported net revenue of R$1.5 billion, with its diverse segments contributing to this robust performance.

Camil Alimentos boasts a formidable distribution network spanning South America, with a presence in Brazil, Uruguay, Chile, Peru, Argentina, and Ecuador. This extensive reach is supported by 33 processing plants and 23 distribution centers, enabling efficient product flow to a broad consumer and retail base.

Strategic Acquisitions and Growth History

Camil Alimentos boasts a robust history of strategic acquisitions, consistently fueling its growth trajectory. This approach has not only diversified its geographical footprint but also broadened its product portfolio, strengthening its market position. For instance, the company's continued integration of past acquisitions, such as Santa Amália and Seleto, alongside recent moves into markets like Ecuador, underscores a deliberate strategy for market consolidation and increased market share.

This strategic acquisition model has been a key driver in Camil's expansion. By integrating acquired businesses effectively, Camil has been able to leverage synergies and achieve economies of scale. This has been particularly evident in its performance over the past few years, with reported revenue growth bolstered by these strategic integrations.

The company's ability to successfully integrate acquired entities is a significant strength. This operational capability ensures that the value generated from acquisitions is realized, contributing to sustained earnings growth. For example, the successful integration of Santa Amália, acquired in 2010, has been a cornerstone of Camil's diversification into pasta and cookies, significantly enhancing its revenue streams and market penetration in these segments.

Camil's growth strategy is clearly demonstrated by its consistent expansion. The company has a proven ability to identify, acquire, and integrate businesses that complement its existing operations or open new avenues for growth. This foresight has allowed Camil to navigate market complexities and emerge as a leading player in its various operating segments.

Commitment to Sustainability and ESG

Camil Alimentos demonstrates a robust commitment to sustainability and Environmental, Social, and Governance (ESG) principles. Initiatives such as the 'Clean Fishing Project' and investments in renewable energy, like generating power from rice husks, underscore this dedication. These efforts are recognized through its inclusion in B3's Corporate Sustainability Index (ISE), reinforcing its standing among ethically-minded investors and consumers.

The company's consistent publication of sustainability reports further solidifies its transparency regarding ethical operations, responsible sourcing, and environmental stewardship. This focus not only enhances Camil's brand reputation but also appeals to a growing market segment prioritizing sustainable business practices.

- ESG Integration: Camil actively integrates ESG factors into its business strategy.

- Renewable Energy: Investments in renewable energy, such as using rice husks, reduce environmental impact.

- Market Recognition: Inclusion in B3's ISE highlights its leadership in corporate sustainability.

- Stakeholder Appeal: Strong ESG performance attracts conscious consumers and investors.

Camil Alimentos possesses significant market leadership across key food categories in South America, notably in rice, beans, and sugar, bolstered by a portfolio of trusted brands like Camil and União. This strong brand equity allows for price premiums, as evidenced by its net revenue of R$17.7 billion in 2023, reflecting deep consumer trust.

The company's diversified product range, including rice, beans, sugar, coffee, and seafood, reduces dependency on single segments and caters to broad consumer needs. This diversity contributed to a robust net revenue of R$1.5 billion in Q1 2024.

Camil's extensive distribution network, comprising 33 processing plants and 23 distribution centers across seven South American countries, ensures efficient market reach. Furthermore, its successful track record of strategic acquisitions, such as the integration of Santa Amália, consistently fuels growth and market share expansion.

A strong commitment to ESG principles, including renewable energy initiatives and inclusion in B3's ISE, enhances its reputation and appeals to ethically-minded stakeholders.

What is included in the product

Delivers a strategic overview of Camil Alimentos’s internal and external business factors, highlighting its market position and potential for growth.

Identifies key competitive advantages and potential market threats for Camil Alimentos, enabling proactive strategy development.

Weaknesses

Camil Alimentos' significant reliance on staple agricultural commodities like rice and beans makes it inherently vulnerable to price swings. For instance, a substantial drop in rice prices in Brazil during early 2024 directly squeezed Camil's revenue streams and profitability, highlighting the impact of raw material cost volatility on its financial performance.

Camil Alimentos' financial position in the first quarter of 2025 showed a net debt of BRL 3.6 billion, with a net debt to EBITDA ratio of 4x. This level of leverage suggests a significant reliance on borrowed funds.

While the company utilizes debenture issuances to manage its debt, this substantial leverage could constrain its financial agility. It might limit Camil's capacity for new investments or strategic acquisitions and makes it more vulnerable to fluctuations in interest rates.

Camil Alimentos faced significant headwinds in its core Brazilian market, with domestic volumes dropping by more than 13% in the first quarter of 2025. This downturn was particularly pronounced in the grains and sugar segments, often referred to as 'Alto Giro'.

The decline suggests a strong consumer shift towards more budget-friendly alternatives, directly impacting Camil's ability to maintain both sales volume and pricing power in its most crucial market. Intense competition, especially within the sugar sector, further exacerbates these challenges.

Seasonal Working Capital Needs

Camil Alimentos' operations, especially in its core rice and fish segments, are heavily influenced by seasonal working capital demands. This means the company needs more cash at certain times of the year than others, which can be a challenge.

The early part of the year, specifically the first quarter, typically requires Camil to spend more cash to fund its operations. Conversely, the fourth quarter often results in a freeing up of working capital as sales pick up and inventory is sold. This ebb and flow can strain the company's liquidity.

For instance, in the first quarter of 2024, Camil likely faced increased inventory purchases and production costs before the main selling seasons. Managing these fluctuations requires robust financial planning to ensure sufficient cash is available when needed and excess cash is deployed effectively during lighter periods.

- Seasonal Cash Flow: Camil's business model, centered on agricultural products like rice, inherently creates significant swings in its need for working capital throughout the year.

- Q1 Cash Consumption: The first quarter (January-March) typically sees higher cash outflows as the company invests in inventory and production ahead of peak demand periods.

- Q4 Working Capital Release: By the fourth quarter (October-December), sales often increase, leading to a reduction in inventory and a subsequent release of working capital back into the business.

- Liquidity Management: These seasonal patterns necessitate careful financial management to avoid liquidity shortages during high-demand periods and to optimize cash use during slower months.

Underutilized Capacity in High-Value Categories

Camil Alimentos faces a challenge with underutilized capacity in its high-value product lines, such as pasta, biscuits, and coffee. Despite strategic efforts to boost these segments, the installed production capacity is currently only about 50% utilized.

This situation can create operational inefficiencies and increase the cost of producing each unit. To improve profitability, Camil Alimentos needs to find ways to increase sales volumes for these premium products.

- Underutilization: High-value segments like pasta, biscuits, and coffee are operating at roughly 50% of their installed production capacity.

- Efficiency Impact: This underutilization can lead to higher per-unit production costs, potentially hindering profitability.

- Growth Opportunity: Increasing sales volumes in these categories is crucial to leverage existing capacity and improve financial performance.

Camil Alimentos' significant reliance on staple agricultural commodities like rice and beans makes it inherently vulnerable to price swings, impacting revenue and profitability. For instance, a substantial drop in rice prices in Brazil during early 2024 directly squeezed Camil's financial performance.

The company's substantial net debt of BRL 3.6 billion in Q1 2025, with a net debt to EBITDA ratio of 4x, indicates a significant reliance on borrowed funds. This leverage could constrain financial agility, limiting new investments and increasing vulnerability to interest rate fluctuations.

Camil faced a significant challenge with domestic volume drops exceeding 13% in Q1 2025, particularly in grains and sugar, suggesting a consumer shift to budget alternatives and intense competition impacting sales and pricing power.

Furthermore, high-value product lines like pasta, biscuits, and coffee are operating at only 50% of their installed capacity, leading to potential operational inefficiencies and higher per-unit production costs, highlighting a need to boost sales in these segments.

Full Version Awaits

Camil Alimentos SWOT Analysis

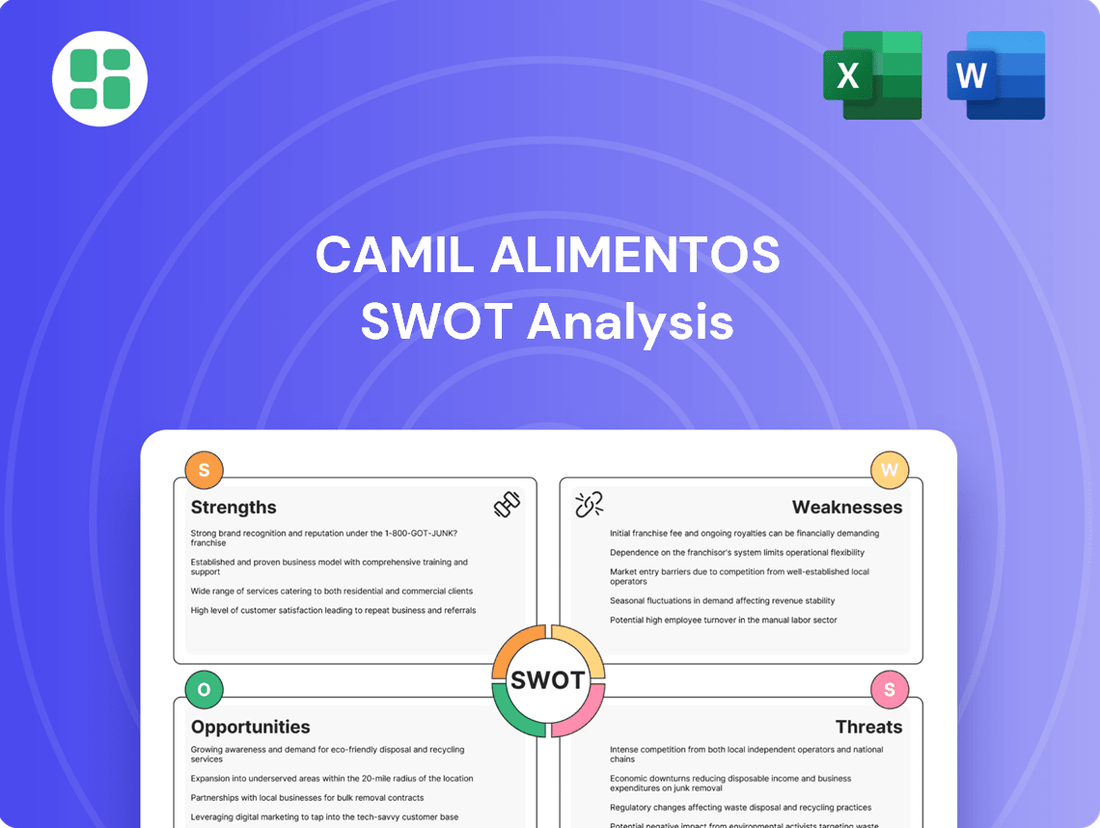

This is the actual Camil Alimentos SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This detailed analysis is crucial for strategic planning.

Opportunities

Camil Alimentos possesses considerable untapped production capacity within its higher-margin product lines, including pasta, biscuits, and coffee. This presents a clear opportunity to boost sales and capture greater market share in these lucrative segments.

By introducing innovative offerings, such as premium gourmet coffee blends and specialized pasta varieties, Camil can effectively utilize its existing manufacturing infrastructure. This strategic expansion is poised to enhance overall profitability and strengthen its competitive position in the market.

Camil Alimentos actively pursues geographic expansion and mergers and acquisitions (M&A) to solidify its role as a key consolidator within the South American food industry. This strategy involves identifying and integrating businesses in new territories or those offering synergistic product lines.

For instance, recent reports in early 2024 indicated Camil's engagement in discussions for a potential acquisition within the Paraguayan rice market, highlighting a concrete step towards diversification and market penetration. This move aims to broaden the company's operational footprint and revenue streams.

Camil Alimentos' robust dedication to sustainability, demonstrated through initiatives like renewable energy investments and its presence in key sustainability indices, presents a prime opportunity for brand differentiation. For instance, in 2023, Camil reported that 40% of its energy consumption came from renewable sources, a figure projected to rise. This strong ESG profile can resonate deeply with a growing segment of consumers prioritizing ethical and environmental considerations.

By effectively communicating its sustainability efforts, Camil can cultivate stronger brand loyalty and capture greater market share. This strategic marketing approach, highlighting its ESG achievements, can attract consumers willing to support companies aligned with their values, potentially translating into premium pricing opportunities and enhanced competitive positioning in the food industry.

Digital Transformation and E-commerce Growth

The Latin American e-commerce market is booming, with projections indicating continued growth in online sales, including cross-border transactions. This presents a significant opportunity for Camil Alimentos to expand its reach and customer engagement.

Camil can leverage this digital shift by enhancing its online platforms and exploring direct-to-consumer strategies. For instance, in 2024, e-commerce in Latin America was expected to reach over $150 billion, with a substantial portion driven by food and beverage categories, a sector where Camil is a key player.

- Expand Digital Footprint: Invest in user-friendly e-commerce websites and mobile applications.

- Optimize Online Channels: Streamline the online purchasing process and improve logistics for faster delivery.

- Explore Direct-to-Consumer (DTC): Launch or expand DTC initiatives to build brand loyalty and capture higher margins.

- Data-Driven Marketing: Utilize customer data from online interactions to personalize offers and improve marketing effectiveness.

Responding to Evolving Consumer Preferences

Latin American consumers are showing a stronger preference for personalized nutrition and functional foods that support overall well-being. This shift creates an opportunity for Camil Alimentos to innovate its product portfolio. For instance, by introducing options that cater to specific dietary needs or incorporate beneficial ingredients, Camil can tap into a growing market segment.

The demand for unique flavors and indulgent experiences is also on the rise. Camil can leverage this by developing new product lines featuring novel flavor combinations or premium ingredients. This strategy could attract new customers and increase sales by offering differentiated products in a competitive landscape.

Camil Alimentos has the chance to capitalize on these evolving consumer preferences through strategic product development. By focusing on healthier options, fortified foods, or innovative flavor profiles, the company can effectively capture new market segments and stimulate demand. For example, a 2024 market report indicated a 15% year-over-year growth in the functional food sector across key Latin American markets.

Key opportunities for Camil Alimentos include:

- Developing personalized nutrition solutions to meet individual dietary needs.

- Introducing functional foods fortified with vitamins and minerals for enhanced health benefits.

- Launching products with unique and indulgent flavor profiles to cater to evolving tastes.

- Expanding into niche markets by offering specialized product lines that align with consumer wellness trends.

Camil Alimentos can leverage its untapped production capacity in higher-margin products like pasta and coffee to increase sales and market share. The company's strategic pursuit of geographic expansion and mergers, evidenced by early 2024 discussions for a Paraguayan rice market acquisition, aims to solidify its position as a consolidator in South America.

The booming Latin American e-commerce market, projected to exceed $150 billion in 2024, offers Camil a significant avenue for growth through enhanced online platforms and direct-to-consumer strategies. Furthermore, the increasing consumer demand for personalized nutrition and functional foods, with the sector growing 15% year-over-year in key Latin American markets as of 2024, presents an opportunity for product portfolio innovation.

| Opportunity Area | Description | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Product Line Expansion | Utilize existing capacity for higher-margin products (pasta, biscuits, coffee) and introduce premium/specialty items. | Untapped capacity in higher-margin segments offers clear sales growth potential. |

| Geographic Expansion & M&A | Consolidate market position through acquisitions and entry into new territories. | Early 2024 discussions for Paraguayan rice market acquisition indicate active pursuit. |

| E-commerce Growth | Capitalize on the expanding Latin American online market for food and beverages. | Latin American e-commerce projected to surpass $150 billion in 2024. |

| Functional Foods & Personalization | Innovate product portfolio to meet growing demand for health-focused and customized nutrition. | Functional food sector in Latin America saw 15% YoY growth in 2024. |

Threats

Camil Alimentos operates in Brazil's staple food markets, such as rice, beans, and sugar, which are intensely competitive. This fierce rivalry, particularly in the domestic retail sector, often forces companies into price wars, squeezing profit margins. For instance, the Brazilian rice market saw significant price volatility in early 2024 due to supply dynamics and competition.

Economic instability, including rising inflation and potential recessions in Brazil, poses a significant threat to Camil Alimentos. For instance, Brazil's inflation rate hovered around 4.62% in 2023, a slight decrease from previous years but still impacting consumer budgets. This economic pressure directly reduces consumer purchasing power, making everyday food items less affordable.

Consequently, consumers are likely to shift towards lower-priced alternatives, a trend that could disproportionately affect Camil's sales volumes and revenue. This is particularly concerning for its 'Alto Giro' segment, which often caters to more price-sensitive consumers. The company's performance is thus closely tied to the economic health of its primary markets.

Camil Alimentos' heavy dependence on agricultural inputs exposes it to the significant threat of unfavorable weather patterns. Events like prolonged droughts or excessive rainfall, including potential El Niño impacts, can severely disrupt planting schedules and hinder harvesting operations. For instance, the 2023-2024 Brazilian soybean harvest, a key commodity for many food processors, faced delays and quality issues due to unseasonable rains in some regions, impacting yield expectations and raw material availability.

These climate-related disruptions directly translate into operational challenges for Camil. Supply chain interruptions can lead to shortages of essential raw materials, forcing the company to seek alternative, potentially more expensive, sources. This, in turn, drives up raw material costs, squeezing profit margins and potentially necessitating price increases for consumers. Furthermore, unpredictable yields can create significant price volatility in the commodities market, making financial planning and cost management more complex for Camil.

Regulatory and Trade Policy Changes

Changes in government regulations, import/export taxes, and trade policies across South America pose a significant threat to Camil Alimentos. For instance, a decision by a key government to eliminate import taxes on rice, as seen in some markets to alleviate price pressures, can drastically alter competitive landscapes and impact Camil's pricing strategies and market share. Navigating these diverse and often fluctuating regulatory environments across multiple operating countries adds considerable complexity and potential cost.

The company must remain vigilant regarding potential shifts in trade agreements and tariffs. For example, a sudden increase in import duties on agricultural inputs or finished goods in Brazil, a major market for Camil, could directly increase operational costs. Similarly, changes in export policies in countries like Peru or Paraguay could affect Camil's ability to access international markets or repatriate profits.

- Regulatory Uncertainty: Fluctuating government policies in key South American markets create an unpredictable operating environment.

- Trade Policy Impact: Changes in import/export taxes and trade agreements can directly affect Camil's cost of goods and market access.

- Compliance Costs: Adhering to diverse and evolving regulatory frameworks across multiple countries necessitates ongoing investment in compliance and legal expertise.

Supply Chain Disruptions and Logistics Costs

Camil Alimentos faces significant threats from escalating supply chain disruptions and logistics costs. Events like the devastating floods in Rio Grande do Sul in May 2024 directly impacted operations, leading to increased port and freight expenses. These rising costs strain the company's profitability.

Further complicating matters are internal operational challenges. Power outages and disruptions to invoicing systems can impede the smooth flow of goods and financial transactions, creating bottlenecks within the supply chain. These vulnerabilities highlight the ongoing risks to Camil Alimentos' efficiency.

- Increased Freight Costs: Logistics expenses have risen, particularly in regions like Rio Grande do Sul affected by natural disasters.

- Operational Interruptions: Power outages and invoicing system failures pose direct threats to daily operations.

- Supply Chain Vulnerabilities: The company remains susceptible to external shocks and internal system weaknesses.

Camil Alimentos operates in highly competitive Brazilian staple food markets like rice and beans, where price wars can compress profit margins. For instance, the Brazilian rice market experienced significant price volatility in early 2024, driven by supply and competitive pressures.

Economic instability, including Brazil's inflation rate, which was around 4.62% in 2023, directly impacts consumer purchasing power, potentially shifting demand towards cheaper alternatives and affecting Camil's sales volumes.

The company's reliance on agricultural inputs makes it vulnerable to climate change and adverse weather events, such as droughts or floods, which can disrupt supply chains, increase raw material costs, and lead to price volatility, as seen with the 2023-2024 Brazilian soybean harvest facing issues from unseasonable rains.

Changes in government regulations, trade policies, and import/export taxes across South America, such as potential import tax eliminations on rice, can alter competitive dynamics and affect Camil's pricing and market share. Escalating supply chain and logistics costs, exacerbated by events like the May 2024 floods in Rio Grande do Sul, also strain profitability and introduce operational risks.

SWOT Analysis Data Sources

This SWOT analysis for Camil Alimentos is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and expert commentary from industry analysts to provide a well-rounded and accurate assessment.