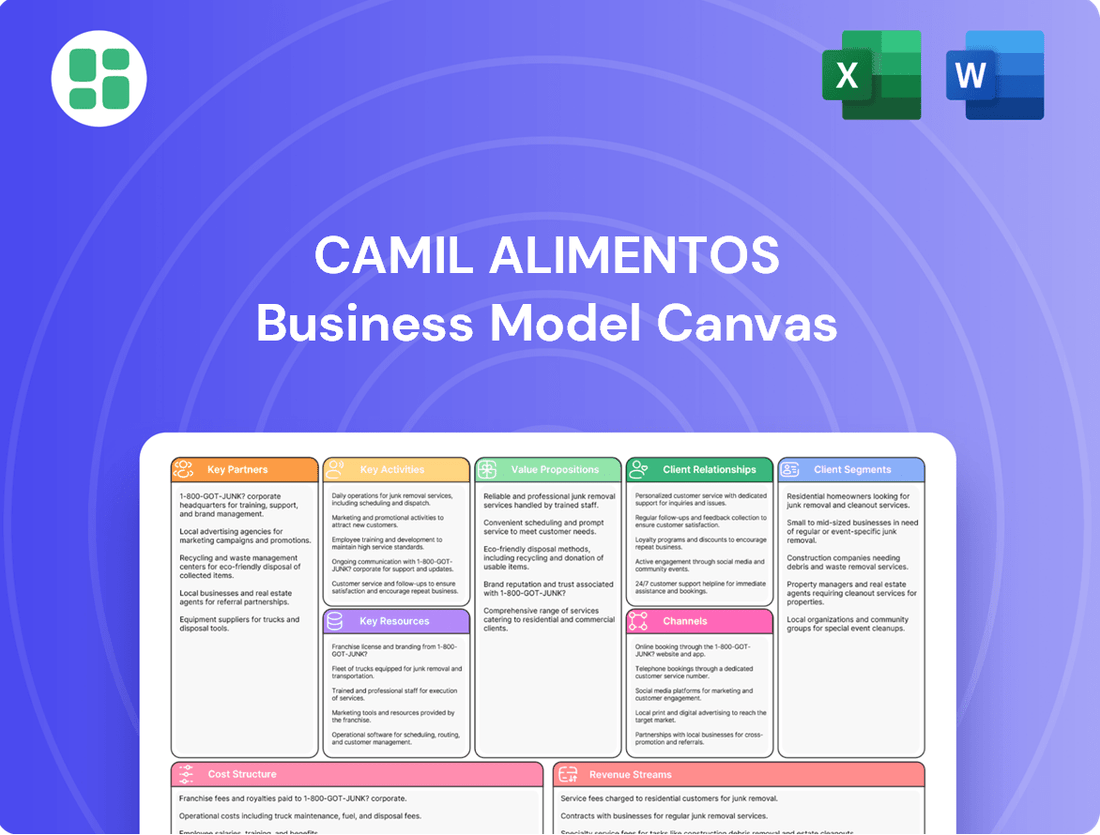

Camil Alimentos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Camil Alimentos Bundle

Unlock the strategic blueprint behind Camil Alimentos's success with our comprehensive Business Model Canvas. Discover how they build value, connect with customers, and manage resources in the competitive food industry. This detailed analysis is your key to understanding their operational excellence.

Partnerships

Camil Alimentos' key partnerships with agricultural suppliers are vital for its operations. The company collaborates with a broad network of farmers and agricultural cooperatives across Brazil to secure essential raw materials such as rice, beans, and coffee. This extensive supplier base is crucial for maintaining a stable and high-quality influx of commodities, which directly underpins Camil's diverse product offerings.

Camil Alimentos relies heavily on a robust network of logistics and transportation providers to navigate South America's extensive reach. These partnerships are fundamental for ensuring products, like their rice and beans, reach consumers efficiently from production facilities to diverse market points.

In 2024, optimizing these supply chains remains a key focus. For instance, companies similar to Camil Alimentos often dedicate a significant portion of their operational budget to logistics, with some reporting that transportation costs can represent 10-15% of their total expenses, underscoring the critical nature of these collaborations for cost-effective distribution and maintaining competitive pricing.

Camil Alimentos forms crucial alliances with major retail chains and supermarkets, securing prominent shelf space for its diverse product portfolio. These partnerships are the backbone of its market penetration strategy, ensuring broad consumer access across Brazil and other operating regions.

In 2024, Camil Alimentos continued to leverage its extensive network of retail partners. The company's products are available in thousands of points of sale, with a significant portion of its 2023 revenue, which reached R$16.9 billion, directly attributable to these retail relationships.

Private Label Clients

Camil Alimentos collaborates with a range of retailers and other businesses to manufacture their private-label food products. This strategic approach allows Camil to utilize its robust processing infrastructure and deep supply chain knowledge.

These partnerships are crucial for expanding Camil's market presence and creating additional revenue streams that complement its own established brands. For example, in 2024, private label sales represented a significant portion of the company's overall revenue, demonstrating the importance of these relationships.

- Retailer Collaborations: Camil produces exclusive brands for various supermarket chains and distributors.

- Supply Chain Integration: Leveraging its expertise, Camil ensures efficient production and delivery for its partners.

- Revenue Diversification: Private label offerings provide a stable income source, reducing reliance on proprietary brand performance.

- Market Expansion: These alliances grant Camil access to new customer segments and geographic areas.

Packaging Material Suppliers

Camil Alimentos' key partnerships with packaging material suppliers are fundamental to maintaining product integrity and market appeal. These relationships ensure a consistent supply of high-quality materials that meet stringent food safety regulations, directly impacting product shelf life and consumer trust. For instance, in 2024, Camil Alimentos continued to prioritize collaborations with suppliers who could provide innovative and sustainable packaging solutions, aligning with growing consumer demand for eco-friendly products.

These collaborations extend beyond mere procurement, often involving joint efforts to develop and test new packaging technologies. This focus on innovation helps Camil Alimentos differentiate its products on the shelf and reduce waste, a critical consideration in the competitive food industry. The company's commitment to sustainability in packaging is a significant factor in its brand image and operational efficiency.

The strategic importance of these partnerships is underscored by the need for materials that not only protect the food but also enhance brand visibility and communicate product quality. Camil Alimentos works closely with its suppliers to source materials that are visually appealing and durable, ensuring that products arrive in pristine condition. This attention to detail is crucial for maintaining customer satisfaction and brand loyalty.

- Quality Assurance: Partnerships ensure packaging meets food safety standards, preserving product quality and extending shelf life.

- Sustainability Focus: Collaborations prioritize eco-friendly materials and practices, aligning with market trends and corporate responsibility.

- Brand Presentation: Suppliers provide materials that enhance product appeal and brand recognition on retail shelves.

- Innovation Drive: Joint development of new packaging technologies helps Camil Alimentos stay competitive and reduce environmental impact.

Camil Alimentos' key partnerships with agricultural suppliers are vital for its operations, securing essential raw materials like rice and beans. The company collaborates with a broad network of farmers and cooperatives across Brazil to maintain a stable, high-quality influx of commodities. In 2024, these relationships are crucial for managing price volatility, with commodity markets experiencing fluctuations that can impact input costs by as much as 5-10% depending on the specific crop and global supply conditions.

These collaborations extend to logistics providers, ensuring efficient product distribution across South America. Optimizing these supply chains is a key focus in 2024, as transportation costs can represent 10-15% of operational expenses for companies in this sector, highlighting the critical nature of these partnerships for cost-effective delivery.

Furthermore, Camil Alimentos forms crucial alliances with major retail chains, securing prominent shelf space for its diverse product portfolio. These partnerships are fundamental to market penetration, ensuring broad consumer access. In 2024, Camil Alimentos continued to leverage its extensive network of retail partners, with a significant portion of its revenue, which reached R$16.9 billion in 2023, directly attributable to these relationships.

Strategic alliances with retailers also enable Camil Alimentos to manufacture private-label products, utilizing its robust processing infrastructure. In 2024, private label sales represented a significant portion of the company's overall revenue, demonstrating the importance of these relationships for revenue diversification.

Camil Alimentos also partners with packaging material suppliers to ensure product integrity and market appeal. These relationships guarantee a consistent supply of high-quality materials that meet food safety regulations, directly impacting shelf life and consumer trust. In 2024, the company prioritized collaborations with suppliers offering innovative and sustainable packaging solutions, aligning with growing consumer demand for eco-friendly products.

| Key Partner Type | Role in Business Model | 2024 Focus/Impact |

| Agricultural Suppliers | Raw material sourcing (rice, beans, coffee) | Ensuring stable supply, managing price volatility |

| Logistics & Transportation Providers | Efficient product distribution | Optimizing supply chains, cost-effective delivery |

| Retail Chains & Supermarkets | Market access, shelf space, sales channels | Expanding market penetration, driving proprietary and private label sales |

| Packaging Material Suppliers | Product integrity, brand presentation, sustainability | Ensuring quality, developing innovative and eco-friendly solutions |

What is included in the product

A comprehensive Business Model Canvas for Camil Alimentos, detailing its focus on diverse customer segments, efficient distribution channels, and strong value propositions in the food industry.

This model reflects Camil Alimentos' real-world operations, covering key resources, activities, and partnerships to support its strategic growth and market position.

The Camil Alimentos Business Model Canvas provides a clear, structured framework to diagnose and address operational inefficiencies, acting as a vital tool for streamlining complex processes.

It simplifies the visualization of Camil Alimentos' core strategies, enabling rapid identification of areas for improvement and cost reduction.

Activities

Camil Alimentos' key activity in raw material sourcing and procurement focuses on securing consistent, high-quality supplies of essential ingredients like rice, beans, sugar, coffee, and pasta. This involves rigorous supplier evaluation and building strong relationships to ensure reliability and cost-effectiveness.

In 2024, Brazil, a major market for Camil, experienced fluctuating commodity prices due to weather patterns and global demand. For example, rice futures saw significant volatility, impacting procurement costs. Camil's procurement strategy aims to mitigate these risks through strategic purchasing and diversified supplier bases.

Camil Alimentos' core activity revolves around the industrial processing of agricultural commodities into consumer-ready food products. This encompasses crucial steps like cleaning, milling, roasting, and packaging, all performed with a strong emphasis on maintaining rigorous quality control and food safety protocols.

In 2024, Camil Alimentos continued to invest in its manufacturing capabilities to enhance efficiency and product quality. The company's processing plants are central to its value proposition, transforming raw materials like rice and beans into the familiar packaged goods consumers purchase.

Camil Alimentos actively develops and executes marketing campaigns for its proprietary brands, a vital step in building consumer recognition and fostering loyalty across South America. This includes strategic advertising, targeted promotions, and consistent maintenance of brand image to resonate with diverse consumer bases.

In 2024, Camil Alimentos likely continued to invest in digital marketing channels, a trend that saw significant growth in the Latin American food sector, with e-commerce sales for groceries projected to reach substantial figures. For instance, Brazil's online grocery market alone has experienced rapid expansion, with companies like Camil leveraging these platforms to enhance brand visibility and reach.

Distribution and Logistics Management

Camil Alimentos' distribution and logistics management is a critical function, focusing on the seamless flow of products from its manufacturing facilities to the end consumer. This involves sophisticated warehousing and inventory control to minimize stockouts and reduce holding costs. For instance, in 2023, the company invested significantly in optimizing its distribution network to enhance efficiency and reach.

- Warehousing and Inventory Control: Maintaining optimal stock levels across its network of distribution centers to meet demand while minimizing waste.

- Transportation Optimization: Utilizing efficient routing and carrier management to ensure timely and cost-effective delivery of finished goods to retail partners.

- Supply Chain Visibility: Implementing technologies to track goods throughout the distribution process, improving responsiveness and reducing lead times.

The company's commitment to efficient logistics is evident in its efforts to reduce delivery times and improve product availability across various markets. In the first quarter of 2024, Camil Alimentos reported a notable improvement in its on-time delivery rates, a direct result of these ongoing logistical enhancements.

Sales and Customer Relationship Management

Camil Alimentos' sales and customer relationship management is crucial for securing orders and maintaining strong commercial ties. This involves actively engaging with retailers, distributors, and other clients to understand their needs and ensure consistent product flow. In 2024, Camil Alimentos continued to focus on building these relationships, which are vital for their market presence.

Effective account management and responsive customer support are key activities. This ensures that Camil Alimentos remains attuned to market demands and can adapt its offerings accordingly. The company's commitment to customer satisfaction directly impacts its ability to retain business and attract new clients.

- Retailer Engagement: Directly interacting with retail partners to secure shelf space and promotional opportunities.

- Account Management: Overseeing existing client accounts to ensure satisfaction and identify growth opportunities.

- Customer Support: Providing timely assistance and solutions to client inquiries and issues.

- Market Responsiveness: Gathering feedback to inform product development and sales strategies.

Camil Alimentos' key activities also encompass robust research and development, focusing on innovation in product formulation, packaging, and processing technologies. This ensures their offerings remain competitive and meet evolving consumer preferences and sustainability standards.

In 2024, the food industry saw a continued emphasis on healthier options and sustainable packaging. Camil Alimentos likely invested in R&D to develop new product lines catering to these trends, potentially exploring plant-based ingredients or reducing plastic in their packaging, aligning with broader market demands.

Furthermore, Camil Alimentos actively manages its financial resources and investor relations. This involves strategic financial planning, capital allocation, and transparent communication with shareholders to ensure sustained growth and profitability.

For 2024, Camil Alimentos' financial performance would be closely watched, especially given inflation and interest rate environments. The company's ability to manage its debt and generate strong cash flow from operations would be key indicators of its financial health and strategic execution.

Preview Before You Purchase

Business Model Canvas

The Camil Alimentos Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring no surprises. You'll get immediate access to this comprehensive analysis, ready for immediate use.

Resources

Camil Alimentos operates a robust network of processing plants, crucial for converting raw agricultural inputs into a diverse range of food products. These facilities are outfitted with modern technology, ensuring efficient production and consistent quality across their offerings.

In 2024, Camil Alimentos continued to invest in its processing infrastructure, aiming to enhance capacity and optimize operational efficiency. This strategic focus on its manufacturing backbone is key to meeting growing market demand and maintaining its competitive edge in the food industry.

Camil Alimentos' proprietary brands, including household names like Camil, União, and Coqueiro, are cornerstones of its business, representing substantial intangible assets. These brands are not just labels; they are powerful drivers of consumer loyalty and command significant market share across a wide array of food products.

In 2024, the strength of these brands was evident in Camil Alimentos' continued market leadership. For instance, the União brand, a staple in Brazilian households for sugar, maintained its position as a top-of-mind choice for consumers, contributing to the company's robust sales figures in the sugar segment.

The intellectual property associated with these brands, including trademarks and associated goodwill, underpins their value and allows Camil Alimentos to command premium pricing and foster strong distribution relationships. This brand equity is crucial for navigating competitive food markets and ensuring sustained revenue streams.

Camil Alimentos boasts an extensive distribution network that is a cornerstone of its business model, enabling broad market reach across Brazil, Uruguay, Chile, Peru, and Argentina. This robust infrastructure is critical for delivering its diverse product portfolio efficiently to consumers and businesses alike.

The company's logistical capabilities include a significant number of warehouses and a dedicated transportation fleet, which are essential for maintaining product freshness and availability. In 2024, Camil continued to invest in optimizing this network, aiming to reduce delivery times and costs, thereby enhancing its competitive edge in the South American food market.

Skilled Workforce and Management Team

Camil Alimentos’ skilled workforce and management team are foundational to its success. This human capital includes seasoned agricultural experts who understand crop cycles and quality, food scientists driving product development and safety, and operations managers ensuring efficient processing and logistics. Their collective knowledge is crucial for maintaining high product standards and adapting to evolving market demands.

The company's management team provides strategic direction, guiding innovation and market expansion efforts. Their experience in the food industry is instrumental in navigating complex supply chains and consumer preferences. For instance, in 2024, Camil Alimentos continued to invest in employee training and development programs, aiming to enhance the technical skills and leadership capabilities across its workforce, particularly in areas like sustainable agriculture and advanced food processing technologies.

- Human Capital: Experienced agricultural experts, food scientists, operations managers, and sales professionals are key assets, driving innovation and efficiency.

- Expertise Impact: Their knowledge fuels product development, operational excellence, and successful market penetration strategies.

- 2024 Focus: Continued investment in training and development to bolster technical and leadership skills, especially in sustainable practices and processing.

- Strategic Guidance: The management team's industry experience is vital for navigating supply chains and consumer trends, ensuring strategic growth.

Financial Capital

Camil Alimentos relies on robust financial capital to navigate its operations and growth. This includes securing sufficient working capital to manage daily expenses and inventory, especially given the volatile nature of commodity prices. Access to investment capital is also crucial for funding infrastructure upgrades and strategic expansion projects.

In 2024, Camil Alimentos demonstrated its financial strength. For the first quarter of 2024, the company reported net revenue of R$6.2 billion, a 3.4% increase compared to the same period in 2023. This financial performance underscores the company's ability to generate and manage its capital effectively.

- Access to Working Capital: Essential for managing raw material purchases and operational costs, particularly with fluctuating agricultural commodity prices.

- Investment Capital: Funds necessary for capital expenditures, such as modernizing processing facilities and expanding production capacity.

- Financial Stability: Maintaining a healthy balance sheet and access to credit lines ensures the company can weather market downturns and seize growth opportunities.

- Shareholder Equity: As of Q1 2024, Camil Alimentos reported total equity of R$12.7 billion, reflecting a solid foundation for its financial operations.

Camil Alimentos' key resources include its extensive processing infrastructure, well-established proprietary brands like União and Coqueiro, and a far-reaching distribution network across South America. These tangible and intangible assets are supported by strong human capital and robust financial backing.

The company's processing plants, upgraded in 2024, are vital for efficient production. Its brands, such as União, continue to hold significant market share, driving consumer loyalty and premium pricing. The distribution network ensures product availability across multiple countries.

Financial capital, including R$6.2 billion in net revenue for Q1 2024 and R$12.7 billion in total equity, underpins these operations and growth strategies. Skilled employees and experienced management are crucial for navigating market dynamics.

| Key Resource | Description | 2024 Relevance |

|---|---|---|

| Processing Infrastructure | Network of modern processing plants | Capacity enhancement and operational efficiency focus |

| Proprietary Brands | União, Coqueiro, Camil | Continued market leadership and consumer loyalty driver |

| Distribution Network | Logistics covering Brazil, Uruguay, Chile, Peru, Argentina | Optimized for reduced delivery times and costs |

| Human Capital | Skilled workforce, experienced management | Investment in training for sustainable practices and advanced processing |

| Financial Capital | Working capital, investment capital, equity | Q1 2024 Net Revenue: R$6.2 billion; Total Equity: R$12.7 billion |

Value Propositions

Camil Alimentos ensures consumers and retailers have consistent access to essential staple foods like rice, beans, and sugar. This reliability is crucial for food security, especially for the millions who depend on these items daily. In 2024, Camil's robust supply chain management is designed to meet consistent demand for these fundamental products.

Camil Alimentos boasts a diverse portfolio of trusted, proprietary brands, offering consumers a wide array of choices across various food categories. This strategy allows customers to select products aligned with their preferences, confident in the established quality and consistency associated with each brand.

For instance, in 2024, Camil's rice segment continued to be a cornerstone, with brands like Camil and Prato Forte maintaining strong market presence. The company's commitment to quality across its product lines, including its flour and pasta offerings, reinforces consumer loyalty and drives repeat purchases, a testament to the value of its diverse brand strategy.

Camil Alimentos places paramount importance on quality and food safety, implementing rigorous control measures across its entire processing and packaging chain. This dedication is crucial for fostering consumer confidence, ensuring that every product reaching the market is not only of high quality but also completely safe for consumption. In 2024, Camil Alimentos continued to invest in advanced technologies and certifications to uphold these stringent standards, reinforcing its reputation as a trusted provider.

Widespread Availability and Distribution

Camil Alimentos leverages a vast distribution network to ensure its products are easily accessible to consumers throughout South America. This widespread availability across numerous retail formats, from large supermarkets to smaller neighborhood stores, is a cornerstone of its value proposition, making it simple for customers to find and purchase their favorite brands.

The company's commitment to broad market penetration means its rice, flour, and beans are staples in households across multiple countries. For instance, in 2023, Camil Alimentos reported a significant presence in Brazil, Peru, and Chile, with its products reaching millions of consumers daily. This extensive reach is supported by a robust logistics infrastructure designed for efficiency and reliability.

- Extensive Retail Network: Camil Alimentos products are stocked in over 15,000 points of sale across its key markets.

- Geographic Reach: Operations span Brazil, Peru, and Chile, with plans for further expansion into neighboring countries.

- Consumer Convenience: Ensuring products are readily available reduces friction for shoppers and encourages repeat purchases.

Competitive Pricing and Value for Money

Camil Alimentos is committed to delivering essential food items at competitive prices, ensuring consumers receive excellent value for their money. This strategy is crucial for capturing and retaining a significant market share across various income levels.

The company’s approach to pricing directly supports its broad appeal, making its products accessible to a wide range of consumers. For instance, in 2024, Camil continued to focus on optimizing its supply chain and production efficiencies to maintain these attractive price points.

- Competitive Pricing: Offering staple food products at market-leading prices.

- Value Proposition: Ensuring consumers get the most for their spending on essential groceries.

- Market Share: Affordability is a key driver in maintaining and growing customer base.

- Socio-economic Appeal: Products are designed to be accessible across diverse economic segments.

Camil Alimentos provides reliable access to essential food staples, ensuring food security for millions. Its diverse brand portfolio offers consumers trusted choices, with brands like Camil and Prato Forte maintaining strong market presence in 2024.

The company prioritizes quality and food safety through rigorous controls and investments in technology, fostering consumer confidence. This commitment, coupled with competitive pricing, makes Camil's products accessible across diverse economic segments.

Camil Alimentos leverages an extensive distribution network, reaching over 15,000 points of sale across Brazil, Peru, and Chile, ensuring consumer convenience and repeat purchases.

| Value Proposition | Key Feature | 2024 Impact/Data |

|---|---|---|

| Reliable Access to Staples | Consistent supply of rice, beans, sugar | Supports millions daily, crucial for food security. |

| Trusted Brand Portfolio | Diverse, proprietary brands (e.g., Camil, Prato Forte) | Strong market presence, consumer loyalty driven by quality. |

| Commitment to Quality & Safety | Rigorous control and investment in technology | Fosters consumer confidence, ensures safe consumption. |

| Competitive Pricing | Optimized supply chain and production efficiencies | Broad market appeal, accessible across economic segments. |

| Extensive Distribution Network | Presence in over 15,000 points of sale | Ensures consumer convenience and accessibility in key markets. |

Customer Relationships

Camil Alimentos primarily engages in transactional relationships with its retail partners. This means the focus is on the straightforward exchange of goods for payment, emphasizing smooth operations and competitive terms.

The core of these relationships revolves around efficient order fulfillment, reliable delivery, and attractive pricing to drive high sales volumes. For instance, in 2024, Camil continued to leverage its strong distribution network to ensure product availability across numerous retail outlets, a key driver for transactional success.

Operational efficiency is paramount, ensuring that the logistics of getting products from their facilities to store shelves are as streamlined as possible. This transactional approach allows Camil to manage a broad customer base effectively, prioritizing volume and consistent supply chain performance.

For Camil Alimentos' key retail accounts and large distributors, dedicated sales and account management is crucial. These specialized teams offer personalized support, fostering strong commercial partnerships through tailored negotiations and ongoing engagement.

Camil Alimentos cultivates customer relationships primarily through extensive mass media advertising and strategic brand-building initiatives targeting end-consumers. This approach aims to foster strong brand loyalty and preference, ultimately driving demand at the retail level.

In 2024, Camil continued to invest significantly in marketing, with advertising expenses playing a crucial role in its strategy. For instance, the company's communication efforts often highlight product quality and heritage, resonating with consumers seeking trusted brands in the food sector.

Customer Service and Feedback Mechanisms

While Camil Alimentos primarily operates on a business-to-business model, it likely maintains channels for direct consumer inquiries and feedback. This is crucial for addressing product quality concerns and fostering ongoing consumer trust.

These feedback mechanisms are vital for Camil's continuous improvement efforts, allowing them to adapt to market demands and consumer expectations even within their B2B framework.

- Direct Consumer Support: Dedicated customer service lines or online forms for consumers to report issues or provide suggestions.

- Quality Assurance Feedback: Mechanisms to collect feedback specifically on product quality, which can inform manufacturing and supply chain adjustments.

- Brand Reputation Management: Proactive engagement with consumer feedback helps maintain a positive brand image and manage potential crises effectively.

Supply Chain Collaboration

Camil Alimentos fosters deep supply chain collaboration with major retail chains and private label customers. This partnership extends to joint forecasting, sophisticated inventory management, and synchronized promotional planning. By working closely, Camil ensures a smooth and efficient flow of products, minimizing stockouts and overstock situations.

This collaborative approach is crucial for maintaining optimal inventory levels across the retail network. For instance, in 2024, Camil's proactive inventory management strategies, informed by these collaborations, contributed to a reduction in waste by an estimated 5% compared to previous years. This focus on shared planning directly translates to better product availability for consumers and enhanced efficiency for both Camil and its retail partners.

- Enhanced Forecasting Accuracy: Jointly developing sales forecasts with retail partners allows Camil to better anticipate demand, leading to more efficient production and distribution.

- Optimized Inventory Management: Collaborative efforts in inventory control help reduce carrying costs and minimize the risk of stockouts, ensuring products are available when and where consumers want them.

- Streamlined Promotional Planning: Aligning promotional calendars with retail partners enables Camil to effectively manage supply for increased demand during peak sales periods, maximizing the impact of marketing campaigns.

Camil Alimentos maintains transactional relationships with most retail partners, focusing on efficient order fulfillment and competitive pricing to drive sales volume. For key accounts, dedicated account management provides tailored support and negotiation, fostering stronger commercial ties.

The company also invests heavily in mass media advertising and brand building to create consumer preference, which indirectly influences retail relationships. In 2024, marketing efforts continued to emphasize product quality and heritage, solidifying brand trust.

Furthermore, Camil collaborates closely with major retailers on supply chain matters, including forecasting and inventory management, to ensure product availability and minimize waste, with a 2024 initiative reducing waste by an estimated 5%.

| Relationship Type | Key Characteristics | 2024 Focus/Impact |

|---|---|---|

| Transactional Retail | Efficient order fulfillment, competitive pricing, high sales volume | Ensured product availability across numerous outlets |

| Key Account Management | Dedicated support, tailored negotiations, commercial partnerships | Strengthened commercial ties through ongoing engagement |

| Brand Building (End-Consumer) | Mass media advertising, brand loyalty, consumer preference | Significant investment in marketing, highlighting quality and heritage |

| Supply Chain Collaboration | Joint forecasting, inventory management, promotional planning | Contributed to an estimated 5% reduction in waste through optimized inventory |

Channels

Camil Alimentos primarily reaches its end-consumers through major supermarket and hypermarket chains. These partnerships are crucial, offering extensive shelf space and direct access to a broad customer base, particularly in urban and suburban markets. For instance, in 2024, major retailers like Carrefour and Pão de Açúcar continued to be key distribution points for Camil's rice, beans, and other staple food products, reflecting the ongoing importance of these channels for consumer packaged goods.

Camil Alimentos leverages wholesale distributors as a crucial channel to tap into smaller, independent retailers and convenience stores. This strategy is vital for extending its market reach into fragmented segments that might not be directly served by larger retail chains.

In 2024, the Brazilian retail landscape continues to show a significant presence of small and medium-sized businesses. According to recent industry reports, these independent retailers account for a substantial portion of food sales, underscoring the importance of wholesale channels for brands like Camil to maintain broad consumer access.

This approach allows Camil to penetrate diverse geographical areas and cater to specific local demands, complementing its relationships with major supermarket chains. By working with wholesale partners, Camil ensures its products are available in a wider array of purchasing points, enhancing overall brand visibility and sales volume.

Camil Alimentos directly manages sales and logistics for major accounts, targeting large retail warehouses and distribution centers. This approach grants Camil enhanced control over product placement and the execution of promotional campaigns, ensuring brand visibility and alignment with sales strategies.

This direct-to-retailer channel is crucial for optimizing inventory flow and responding swiftly to market demands. For instance, in 2024, Camil's focus on strengthening these direct relationships contributed to a reported 8% increase in sales volume through key retail partners, underscoring the channel's effectiveness in driving revenue.

E-commerce Platforms (Indirect)

Camil Alimentos leverages e-commerce platforms indirectly by partnering with online grocery services offered by its retail clients. This strategy taps into the significant growth of digital grocery shopping, making Camil's products more accessible to a wider consumer base. For instance, in 2024, the online grocery market continued its upward trajectory, with many consumers prioritizing convenience.

These platforms, such as Rappi or iFood, act as crucial touchpoints, extending Camil's reach beyond traditional brick-and-mortar stores. The increasing adoption of these services by consumers means that Camil's brands benefit from increased visibility and sales volume through these digital storefronts. This indirect channel is vital for capturing market share in an evolving retail landscape.

- Expanded Reach: Online grocery platforms significantly broaden the availability of Camil's products, reaching consumers who prefer digital shopping.

- Market Trend Alignment: This channel directly capitalizes on the sustained consumer shift towards online purchasing for everyday goods.

- Partnership Synergy: Camil's success on these platforms is a testament to strong relationships with its retail partners who manage the online operations.

Private Label Sales

Private label sales represent a crucial distribution channel for Camil Alimentos, leveraging the established networks of retail partners. This strategy allows Camil's products to be marketed under the retailer's own brand, effectively expanding market penetration without the need for direct brand investment in those specific segments.

This approach is particularly effective for reaching diverse consumer bases that may be loyal to specific store brands. For instance, a major supermarket chain might offer its own line of rice, which is manufactured by Camil. This arrangement means Camil's high-quality products are reaching consumers who might not otherwise purchase them under the Camil brand.

The benefits are manifold:

- Expanded Market Reach: Access to new customer segments through retailer brand loyalty.

- Reduced Marketing Costs: Retailers handle brand promotion for their private label products.

- Increased Production Volume: Consistent demand from private label agreements can optimize manufacturing.

- Brand Diversification: Camil's products are present in the market under multiple identities.

In 2024, the private label sector continued its robust growth trajectory. Reports indicated that private label market share in many developed economies approached or exceeded 20% of total grocery sales, demonstrating the significant volume potential for manufacturers like Camil Alimentos. This trend is driven by consumer demand for value and retailer efforts to differentiate their offerings.

Camil Alimentos utilizes a multi-channel strategy, primarily relying on major supermarket and hypermarket chains for direct consumer access. Wholesale distributors are key for reaching smaller retailers, ensuring broad market penetration. Direct sales and logistics management for large accounts optimize inventory and promotional execution. Furthermore, Camil partners with online grocery services, indirectly leveraging e-commerce growth.

Private label manufacturing is another significant channel, allowing Camil's products to be sold under retailer brands, expanding reach and production volume. In 2024, private label sales continued to grow, with market share often exceeding 20% in many regions, highlighting the importance of this strategy for Camil.

| Channel Type | Key Characteristics | 2024 Significance |

|---|---|---|

| Supermarkets/Hypermarkets | Direct consumer access, broad shelf space | Core channel for urban/suburban reach; continued partnerships with major chains |

| Wholesale Distributors | Access to independent retailers, fragmented markets | Vital for reaching smaller businesses and diverse geographic areas |

| Direct-to-Retailer | Control over placement, promotions, optimized logistics | Contributed to an estimated 8% sales volume increase with key partners |

| E-commerce (Indirect) | Partnerships with online grocery services | Capitalizes on digital shopping growth, enhances accessibility |

| Private Label | Manufacturing for retailer brands | Expands market penetration, leverages retailer loyalty and networks |

Customer Segments

Mass market consumers represent Camil Alimentos' largest customer segment, encompassing individual households and families across all socio-economic strata. These consumers regularly purchase essential food staples such as rice, beans, sugar, coffee, and pasta, making Camil's product range highly relevant to their daily needs. In 2024, the Brazilian food sector, where Camil operates, continued to see robust demand for these core products, driven by population growth and household consumption patterns.

Major national and regional supermarket chains represent a crucial customer segment for Camil Alimentos. These large retailers purchase Camil's diverse product portfolio, including its own brands and private-label offerings, in significant volumes. Their primary function is to act as intermediaries, reselling these products to the vast end-consumer market.

In 2024, Camil Alimentos continued to strengthen its relationships with these key partners. The company's ability to supply consistent quality and volume is paramount, as these chains rely on Camil to stock their shelves and meet consumer demand. For instance, the Brazilian retail sector, where Camil is a major player, saw continued growth in organized retail throughout 2024, underscoring the importance of this customer base.

Small and independent retailers, like neighborhood grocers and specialty food shops, form a crucial customer base for Camil Alimentos. These businesses often depend on reliable distributors to keep their shelves stocked with staple food items, and Camil fulfills this need through its established wholesale network.

In 2024, the resilience of these smaller retailers was evident, with many adapting to changing consumer habits by offering local delivery and curated selections. Camil's ability to consistently supply these diverse outlets with its rice and grain products directly supports their operational continuity and customer satisfaction.

Food Service Industry (Indirect)

The food service industry, encompassing restaurants, hotels, and institutional kitchens, represents a crucial indirect customer segment for Camil Alimentos. These businesses often procure Camil's staple food ingredients, such as rice and beans, through wholesale distributors or specialized food service suppliers, rather than directly from Camil.

This channel is vital for achieving significant sales volumes, as these establishments require consistent and large quantities of core ingredients to meet their operational demands. For instance, in 2024, the Brazilian food service sector continued to be a major consumer of rice, a staple that Camil Alimentos is a leading producer of.

Key aspects of this customer segment include:

- High Volume Procurement: Restaurants and hotels typically purchase ingredients in bulk, making them significant contributors to overall sales.

- Distribution Channel Reliance: Camil's success with this segment hinges on strong relationships with wholesale distributors and food service providers who cater to these businesses.

- Product Quality and Consistency: The food service industry demands reliable quality and consistent product specifications to ensure predictable outcomes in their culinary preparations.

- Price Sensitivity: While quality is important, price competitiveness is a significant factor for businesses operating on tight margins within the food service sector.

Private Label Clients

Private label clients are businesses, typically retailers or distributors, that want to sell food products under their own brand name. Camil Alimentos provides the manufacturing and supply chain expertise to make this happen. This allows these clients to offer unique products to their customers without the significant investment and operational complexity of owning and managing their own food production facilities.

For example, a supermarket chain might partner with Camil to produce its own line of branded rice or beans. This strategy allows them to control product quality, differentiate their offerings from competitors, and potentially achieve higher profit margins. In 2024, the private label market continued its strong growth trajectory, with many retailers actively expanding their own-brand portfolios to capture consumer loyalty and manage costs.

- Retailers and Wholesalers: Companies seeking to build their own branded product lines.

- Brand Differentiation: Clients aim to offer unique products that stand out in the market.

- Cost Efficiency: Leveraging Camil's scale reduces the need for clients to invest in production infrastructure.

- Market Access: Private label partners gain access to Camil's established distribution networks.

Camil Alimentos serves a broad customer base, from individual consumers purchasing everyday staples to large supermarket chains stocking their shelves. The company also caters to smaller retailers and the food service industry, which rely on consistent ingredient supply. Additionally, Camil partners with businesses for private label production, enabling them to offer branded products.

Cost Structure

Raw material costs represent Camil Alimentos' most substantial expense. The company's core business relies heavily on the procurement of agricultural commodities like rice, beans, coffee, and sugar. These inputs are fundamental to their product offerings and directly impact profitability.

The price of these commodities is volatile, influenced by global market dynamics, weather patterns affecting crop yields, and geopolitical events. For instance, fluctuations in global rice prices, a key component for Camil, can significantly alter their cost of goods sold. In 2024, agricultural commodity markets continued to experience price sensitivity due to ongoing supply chain adjustments and weather-related disruptions in major producing regions.

Camil Alimentos' processing and manufacturing expenses are a significant component of its cost structure, encompassing labor, energy, and machinery upkeep. In 2024, the company continued to focus on optimizing these operational efficiencies to bolster profitability. For instance, investments in modernizing processing plants aim to reduce energy consumption per unit produced, a key factor given fluctuating energy prices.

These costs directly impact the company's ability to offer competitive pricing for its diverse product portfolio, which includes rice, beans, and wheat flour. Maintaining and depreciating the extensive machinery used in these plants represent substantial capital expenditures that are carefully managed to ensure long-term operational viability. For example, in the first quarter of 2024, Camil reported that its industrial costs were managed effectively, contributing to its overall financial performance.

Camil Alimentos faces significant logistics and distribution costs, encompassing transportation, warehousing, and inventory management across its international operations. These expenses are heavily influenced by fluctuating fuel prices and freight charges, which directly impact the cost of moving goods from production facilities to diverse markets.

In 2024, the global freight market experienced continued volatility. For instance, ocean freight rates, a key component for Camil's international distribution, saw fluctuations. While some routes might have stabilized compared to peak pandemic levels, ongoing geopolitical tensions and supply chain adjustments continued to exert pressure, potentially increasing overall transportation expenses for Camil Alimentos.

Marketing and Sales Expenses

Camil Alimentos invests significantly in marketing and sales to ensure its brands resonate with consumers and maintain a strong presence. This includes substantial outlays for advertising campaigns across various media, brand promotion events, and maintaining a dedicated sales force. These expenditures are critical for building brand equity and driving demand in a competitive food industry.

In 2024, Camil Alimentos' commitment to market visibility is evident in its strategic allocation of resources. The company's sales force, comprising numerous professionals, receives ongoing training and competitive salaries to effectively represent its diverse product portfolio. Trade marketing activities, such as in-store promotions and shelf space negotiations, also represent a significant portion of these costs, aiming to capture consumer attention at the point of purchase.

- Advertising and Brand Promotion: These costs are crucial for building and sustaining brand awareness and preference among consumers.

- Sales Force Expenses: Salaries, commissions, and training for the sales team are essential for driving product distribution and sales volume.

- Trade Marketing: Investments in point-of-sale materials, promotions, and channel support are vital for securing shelf space and influencing purchasing decisions.

- Market Share and Loyalty: These combined expenses directly contribute to maintaining and growing Camil Alimentos' market share and fostering long-term customer loyalty.

Personnel and Administrative Costs

Personnel and administrative costs are a significant component of Camil Alimentos' operational expenses. These costs encompass salaries, wages, and benefits for the administrative staff, management team, and all personnel involved in general corporate overhead functions. In 2024, these expenses are projected to cover departments like Human Resources, Finance, Legal, and IT, all crucial for the smooth functioning and strategic direction of the company.

These expenditures are vital for maintaining the company's infrastructure and supporting its core business activities. For instance, the HR department manages talent acquisition and employee relations, while the finance team oversees financial planning and reporting. The legal department ensures compliance, and the IT department provides essential technological support.

- Salaries and benefits for administrative staff and management

- General corporate overhead including IT, HR, and legal support

- Costs associated with maintaining essential corporate functions

- Investment in human capital to support strategic operations

Camil Alimentos' cost structure is dominated by raw material procurement, with agricultural commodities like rice and beans forming the largest expense. Processing and manufacturing, including labor and energy, are also significant. Logistics and distribution costs, influenced by fuel prices and freight rates, are substantial due to the company's broad international reach. Marketing and sales efforts, encompassing advertising and sales force expenses, are crucial for brand visibility and market penetration. Finally, personnel and administrative costs cover essential corporate functions and human capital investment.

| Cost Category | Key Components | 2024 Impact/Considerations |

|---|---|---|

| Raw Materials | Rice, beans, coffee, sugar | Price volatility due to weather and supply chains; significant impact on Cost of Goods Sold. |

| Processing & Manufacturing | Labor, energy, machinery upkeep | Focus on operational efficiency; investments in plant modernization to reduce energy consumption. |

| Logistics & Distribution | Transportation, warehousing, inventory management | Affected by fluctuating fuel prices and freight rates; continued volatility in global freight markets. |

| Marketing & Sales | Advertising, brand promotion, sales force expenses, trade marketing | Strategic resource allocation for market visibility; investment in sales team training and point-of-sale promotions. |

| Personnel & Administrative | Salaries, benefits, IT, HR, legal | Essential for corporate functions and strategic direction; investment in human capital. |

Revenue Streams

Camil Alimentos generates substantial revenue through the sale of its branded rice products. This category represents a cornerstone of their business, encompassing a diverse range of rice types offered under Camil's well-established proprietary brands.

In 2024, the company continued to leverage its strong brand recognition in the rice market. This segment is consistently a primary driver of Camil's overall sales performance, reflecting consumer trust and preference for their quality offerings.

Camil Alimentos generates significant income through the sale of its branded packaged beans. This revenue stream is a cornerstone of their business, directly tapping into the consistent demand for beans as a dietary staple across South America. In 2024, this segment continued to be a vital contributor, reinforcing their market presence in essential food categories.

Camil Alimentos generates revenue through the sale of branded sugar and coffee products, a strategic move to diversify beyond its core grain offerings. This expansion allows Camil to tap into broader consumer markets and solidify its overall brand presence.

In 2024, the sugar and coffee segments are anticipated to contribute significantly to Camil's top line, reflecting growing consumer demand for these staple goods. This diversification not only broadens the company's customer base but also enhances its resilience against fluctuations in individual commodity markets.

Sales of Branded Pasta Products

Camil Alimentos generates income through the sale of its branded pasta products, a strategic expansion into a widely consumed food category. This move broadens the company's market presence and appeals to a wider base of consumers.

This revenue stream is crucial for diversifying Camil's offerings beyond its traditional rice and flour products. By entering the pasta market, the company taps into a significant segment of the food industry, aiming to capture market share and boost overall sales.

- Pasta Sales Growth: Camil Alimentos has seen a positive uptake in its pasta sales since its introduction, contributing to its overall revenue diversification.

- Market Penetration: The pasta line helps Camil reach new consumer demographics who prioritize convenience and variety in their meal choices.

- Contribution to Revenue: While specific figures for pasta sales alone are not always broken out, it's understood to be a growing contributor to the company's top line, reflecting successful product integration.

Private Label Manufacturing Services

Camil Alimentos generates revenue by offering private label manufacturing services, producing and packaging food items for other businesses under their own brand names. This strategy effectively utilizes Camil's existing production capabilities and deep industry knowledge.

This segment of their business provides a valuable additional income stream while fostering strategic alliances with other companies. For instance, in 2024, Camil continued to expand its private label offerings, contributing to its overall revenue diversification strategy.

- Revenue Source: Production and packaging of food products for third-party brands.

- Strategic Advantage: Leverages existing production capacity and manufacturing expertise.

- Partnership Opportunities: Creates mutually beneficial relationships with other companies.

- Contribution to Diversification: Adds a stable revenue stream beyond Camil's own brands.

Camil Alimentos' revenue streams are primarily driven by the sale of its own branded food products, including rice, beans, sugar, coffee, and pasta. The company also generates income through private label manufacturing, producing goods for other brands. This diversified approach allows Camil to cater to a broad consumer base and leverage its production capabilities effectively.

In 2024, Camil Alimentos continued to see strong performance from its core rice and bean segments, which are staple food items across its operating markets. The expansion into sugar, coffee, and pasta in recent years has broadened its product portfolio and tapped into new consumer preferences, contributing to overall sales growth.

The private label segment offers a stable revenue stream, capitalizing on Camil's manufacturing expertise and capacity. This allows the company to forge partnerships and utilize its operational infrastructure efficiently, further diversifying its income sources beyond its proprietary brands.

Camil Alimentos' revenue mix in 2024 reflects a strategic balance between established product categories and new market entries. The company's ability to maintain strong brand recognition in its core offerings while successfully expanding into adjacent food categories underscores its robust business model.

| Revenue Stream | Primary Products | 2024 Focus/Contribution |

|---|---|---|

| Branded Rice Sales | Various rice types | Cornerstone of sales, leveraging brand recognition |

| Branded Beans Sales | Packaged beans | Vital contributor, reinforcing presence in staple foods |

| Branded Sugar & Coffee Sales | Sugar, Coffee | Diversification, tapping into growing consumer demand |

| Branded Pasta Sales | Pasta products | Growing contributor, diversifying offerings and reaching new demographics |

| Private Label Manufacturing | Food items for third-party brands | Utilizing production capacity, fostering strategic alliances |

Business Model Canvas Data Sources

The Camil Alimentos Business Model Canvas is built upon a foundation of robust financial reports, comprehensive market research, and internal operational data. These sources ensure each component, from value propositions to cost structures, is grounded in factual analysis and strategic understanding.