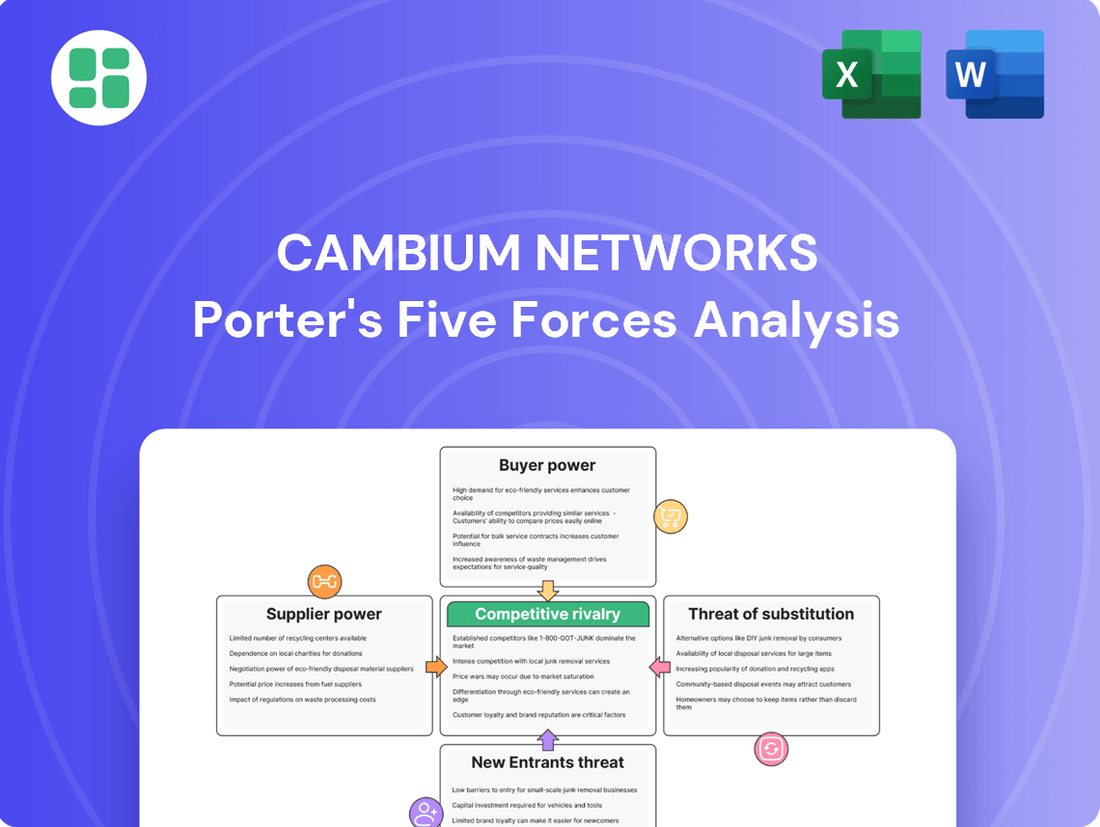

Cambium Networks Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cambium Networks Bundle

Cambium Networks operates in a dynamic market shaped by intense competition, significant buyer power, and the looming threat of new entrants. Understanding these forces is crucial for navigating the wireless connectivity landscape. Our analysis delves into the intricate interplay of these factors, revealing the underlying pressures and opportunities.

The complete report reveals the real forces shaping Cambium Networks’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The wireless networking infrastructure sector, where Cambium Networks operates, depends heavily on specialized components such as advanced chips, high-performance antennas, and sophisticated software. The availability and cost of these essential inputs are directly influenced by the supplier landscape.

A market characterized by a limited number of dominant suppliers for these critical components grants those suppliers significant bargaining power. For Cambium Networks, this concentration means potential for increased input costs or constraints on component availability, particularly for unique or proprietary technologies that lack readily available alternatives.

Cambium Networks relies on high-performance wireless communication components for its product suite. The uniqueness of these inputs significantly shapes supplier bargaining power.

If Cambium sources highly specialized or custom-designed components, suppliers of these unique parts can command greater leverage, potentially leading to higher prices or less favorable terms. For instance, if a specific chipset is only available from a single vendor, that vendor’s power is amplified.

Conversely, when Cambium can source components that are more commoditized and readily available from multiple suppliers, its negotiating position strengthens. In 2023, Cambium Networks reported its cost of goods sold was $341.4 million, indicating the substantial volume of components it procures and the importance of favorable supplier terms.

The switching costs for Cambium Networks' suppliers can significantly influence their bargaining power. If Cambium has heavily integrated a supplier's specialized technology or relies on long-term, exclusive agreements, the effort, time, and expense involved in transitioning to a new provider become substantial. This integration can create a dependency, making it difficult and costly for Cambium to switch, thereby increasing the supplier's leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Cambium Networks' market is a significant concern. If key component suppliers were to develop their own wireless networking solutions, they could directly compete with Cambium, potentially leveraging their existing supply chain advantages. This possibility underscores the importance of maintaining strong supplier relationships and competitive pricing to mitigate this risk.

Consider the semiconductor industry, a critical supplier for wireless technology. In 2024, major semiconductor manufacturers have been increasingly exploring vertical integration, moving beyond component supply to offer more complete solutions. For instance, some have announced partnerships or acquisitions aimed at developing end-to-end networking platforms. This trend highlights the tangible risk for companies like Cambium if their suppliers decide to become direct rivals.

- Supplier Forward Integration: Suppliers may develop their own wireless networking solutions, becoming direct competitors to Cambium Networks.

- Competitive Pressure: This threat compels Cambium to foster strong relationships and offer competitive pricing to its suppliers.

- Market Dynamics: In 2024, increased vertical integration within the semiconductor sector, a key supplier base, signals a growing potential for this threat.

- Strategic Implications: Cambium must continuously assess supplier strategies to preemptively address potential competitive encroachment.

Impact of Input on Product Differentiation

The quality and unique features of components supplied directly influence Cambium Networks' capacity to differentiate its wireless networking solutions. If a supplier offers specialized or high-performance parts essential for Cambium's product functionality, that supplier gains considerable leverage in dictating terms and impacting Cambium's competitive edge.

For instance, if a key supplier of advanced radio frequency chips used in Cambium's 6 GHz fixed wireless access equipment experiences production issues or price hikes, it can directly affect Cambium's ability to deliver its latest, high-throughput products. This dependency means suppliers of critical, hard-to-replicate technology can exert significant bargaining power.

- Component Uniqueness: Suppliers providing proprietary or highly specialized components, like advanced chipset technology or unique antenna designs, have greater power.

- Switching Costs: High costs associated with changing suppliers for critical components increase supplier leverage.

- Supplier Concentration: A limited number of suppliers for essential inputs concentrates power in their hands.

- Input Importance: The more crucial a component is to the final product's performance and differentiation, the stronger the supplier's bargaining position.

Suppliers of critical components for wireless infrastructure, such as advanced chipsets and specialized antennas, hold significant bargaining power over Cambium Networks. This power is amplified when there are few suppliers for these unique inputs, as seen in the semiconductor industry where major players increasingly control specialized technology. For example, in 2024, the trend of vertical integration among semiconductor manufacturers means some suppliers are moving towards offering complete solutions, potentially competing directly with their customers like Cambium.

Cambium's reliance on these specialized components, coupled with high switching costs if a supplier's technology is deeply integrated, further strengthens supplier leverage. The importance of these components to Cambium's product performance means suppliers of hard-to-replicate parts can dictate terms. In 2023, Cambium's cost of goods sold reached $341.4 million, underscoring the substantial volume of component procurement and the critical need for favorable supplier agreements.

| Factor | Impact on Cambium | 2024 Trend/Data |

|---|---|---|

| Supplier Concentration | Limited suppliers increase their power. | Continued consolidation in semiconductor manufacturing. |

| Component Uniqueness | Proprietary tech gives suppliers leverage. | Demand for advanced chips for 5G and Wi-Fi 7 solutions. |

| Switching Costs | High integration makes changing suppliers difficult. | Increased complexity of wireless hardware requires specialized components. |

| Forward Integration Threat | Suppliers may become direct competitors. | Semiconductor firms exploring end-to-end networking solutions. |

What is included in the product

This analysis unpacks the competitive forces shaping Cambium Networks' market, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

Effortlessly assess competitive pressures and identify strategic opportunities with a dynamic, customizable Porter's Five Forces model tailored for the wireless networking landscape.

Customers Bargaining Power

Cambium Networks caters to a diverse client base including service providers, enterprises, and industrial sectors. If a few major clients represent a substantial chunk of Cambium's revenue, their ability to negotiate for lower prices or better terms significantly increases, thereby enhancing their bargaining power.

The enterprise Wi-Fi market experienced a downturn in 2024, but projections indicate a rebound in 2025. This recovery is expected to be driven by the increasing adoption of cloud-managed services and the rollout of Wi-Fi 7 technology, which could shift how customers approach purchasing decisions and potentially amplify their leverage.

The cost and complexity for customers to switch from Cambium's wireless solutions to a competitor's offerings directly impact their bargaining power. If these switching costs are low, meaning minimal effort or expense is required to change providers, customers can more easily demand better pricing or service from Cambium.

Consider the expense of re-training IT staff on new systems, re-configuring existing network infrastructure, or dealing with potential compatibility issues with other technologies. These factors represent significant hurdles that can lock customers into Cambium's ecosystem, thereby reducing their leverage.

The ongoing evolution in wireless technology, such as the increasing adoption of Wi-Fi 6E and the emerging Wi-Fi 7 standards, plays a role here. While these advancements drive market growth, they also require businesses to invest in new hardware and infrastructure. This investment can further solidify a customer's commitment to their current provider if the transition to a new vendor for these upgrades is perceived as overly burdensome, thus potentially increasing switching costs.

The bargaining power of customers for wireless networking infrastructure is significantly influenced by the availability of substitutes and the intensity of competition. When numerous alternative providers or substitute technologies exist, customers gain leverage, as they can easily switch to a different vendor if pricing or service is not satisfactory.

Cambium Networks operates in a market with robust competition, facing established players such as Cisco Systems, Ubiquiti, HPE/Aruba Networking, and Juniper Networks. This competitive landscape offers customers a wide array of choices for their wireless networking needs, thereby increasing their bargaining power.

For instance, in 2023, the global wireless backhaul market, a key area for Cambium, was valued at approximately USD 11.5 billion and is projected to grow. This growth indicates a dynamic market with multiple vendors vying for market share, further empowering customers with options and negotiation capabilities.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Cambium Networks, especially concerning service providers and large enterprises in the wireless infrastructure sector. These customers often face their own cost pressures, making them keenly aware of pricing. For instance, in 2024, many telecommunications companies continued to navigate tight capital expenditure budgets, directly impacting their purchasing decisions for network equipment.

The degree of price sensitivity is further influenced by how Cambium's offerings are perceived in the market. If its products are viewed as interchangeable or commoditized rather than uniquely differentiated, customers gain more leverage. This perception can lead to intense price negotiations, as buyers can more easily switch to competitors if price is the primary deciding factor. The market trend towards cost-efficiency and demonstrable economic benefits in wireless deployments reinforces this customer focus on price.

- High Price Sensitivity: Service providers and large enterprises often prioritize cost-effectiveness due to their own financial constraints.

- Commoditization Risk: If Cambium's solutions are perceived as commodities, customers have greater power to demand lower prices.

- Economic Focus: The ongoing emphasis on economic viability and cost efficiency in the wireless infrastructure market amplifies customer price sensitivity.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly large ones like major service providers or enterprises, poses a significant threat to Cambium Networks. These substantial clients could opt to develop their own wireless networking solutions internally, thereby diminishing their dependence on external suppliers. This capability for in-house development, especially in areas like software-defined networking or custom integrations, grants these customers considerable leverage in negotiations.

While outright backward integration into complex hardware manufacturing is less frequent, the potential for customers to build proprietary software or integrate existing components in unique ways remains a potent threat. For instance, a large enterprise might leverage open-source software and custom development to create a network management system that bypasses the need for Cambium's proprietary software features. This can significantly weaken Cambium's pricing power and force concessions.

The ability of customers to bring development in-house means they can exert pressure on pricing and service terms. If a major client perceives Cambium's offerings as too expensive or inflexible, they might explore the feasibility of developing a comparable solution internally. This threat is amplified in markets where standardization is increasing or where customers possess strong internal engineering capabilities. For example, if a large telecommunications provider has a robust R&D department, the cost-benefit analysis of developing their own Wi-Fi management platform might become attractive, impacting Cambium's market share.

- Customer Leverage: Large enterprise clients and major service providers possess significant bargaining power.

- In-house Development Threat: Customers may develop their own wireless networking solutions, reducing reliance on vendors.

- Software Integration Risk: Backward integration is more feasible with software-defined networking and specialized integrations.

- Negotiation Impact: This capability strengthens customer negotiation positions on pricing and terms.

Cambium Networks faces considerable customer bargaining power due to several factors. The availability of numerous competitors and substitute technologies means clients can easily switch providers if pricing or service falters, a situation exacerbated by the competitive landscape featuring giants like Cisco and HPE/Aruba. Furthermore, customers' price sensitivity, particularly among large service providers and enterprises managing tight capital expenditure budgets in 2024, compels them to seek cost-effective solutions. If Cambium's offerings are perceived as commoditized rather than uniquely differentiated, this amplifies customer leverage, leading to more intense price negotiations.

| Factor | Impact on Cambium | Supporting Data/Trend |

|---|---|---|

| Competitive Landscape | Increases customer leverage | Presence of Cisco, HPE/Aruba, Ubiquiti, Juniper Networks |

| Price Sensitivity | Drives demand for lower prices | Tight CapEx budgets for telcos in 2024 |

| Perceived Differentiation | Weakens if commoditized | Market focus on cost-efficiency and economic benefits |

| Switching Costs | Low switching costs empower customers | Potential for re-training, re-configuration, compatibility issues |

Preview Before You Purchase

Cambium Networks Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Cambium Networks, detailing the competitive landscape, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitute products. The document you see here is precisely the same professionally written and formatted analysis you'll receive instantly after purchase, offering actionable insights into Cambium's strategic positioning. You're looking at the final version; what you preview is exactly what you get, ready for immediate use without any surprises or placeholders.

Rivalry Among Competitors

Cambium Networks operates in a fiercely competitive wireless networking infrastructure market. The landscape is populated by numerous established players, making it a fragmented yet highly contested space.

Key rivals for Cambium Networks include giants like Cisco Systems, HPE/Aruba Networking, Ubiquiti, Huawei, Juniper Networks, and Commscope. This diverse group of competitors ensures a dynamic and challenging environment for market share and innovation.

The enterprise WLAN market saw a dip in 2024, largely due to inventory adjustments. However, this segment is expected to rebound strongly, with forecasts indicating a compound annual growth rate (CAGR) of 25.9% through 2025 and a substantial 31.2% CAGR extending to 2029. This robust expansion fuels competitive rivalry as businesses battle for dominance in a rapidly growing sector.

Cambium Networks, like many in its industry, focuses on differentiating its wireless networking solutions. Key differentiators include the adoption of cutting-edge Wi-Fi 7 technology, robust cloud-managed services, AI-driven network intelligence, and advanced security features. These innovations aim to create distinct value propositions for customers.

When products are highly differentiated, and customers face significant switching costs, the intensity of competitive rivalry tends to decrease. For example, if a business has deeply integrated Cambium's cloud management platform into its operations, migrating to a competitor could involve substantial time, expense, and operational disruption. This inertia can lessen the pressure for aggressive price competition.

However, the risk of commoditization remains a constant threat. If competitors offer similar feature sets and the perceived value of unique offerings diminishes, the market can shift towards price-based competition. For instance, if multiple vendors offer comparable Wi-Fi 7 capabilities with similar cloud management interfaces, customers may prioritize cost, leading to increased rivalry as companies compete on price to win market share.

Exit Barriers

Cambium Networks faces significant competitive rivalry, partly due to high exit barriers. These barriers, like substantial investments in specialized wireless infrastructure and R&D, make it difficult and costly for companies to leave the market, even if they are not profitable.

For instance, the development and manufacturing of advanced wireless networking equipment require considerable capital outlay. This means that even underperforming firms may continue to operate, potentially engaging in aggressive pricing strategies to maintain market share. This dynamic intensifies the pressure on all players in the sector.

- High Capital Investment: The cost of developing and producing sophisticated wireless networking hardware, including R&D and manufacturing facilities, represents a significant sunk cost for companies like Cambium Networks.

- Specialized Technology: The proprietary nature of much of the wireless technology used in this industry creates a barrier, as specialized knowledge and infrastructure are not easily transferable or redeployable.

- Long-Term Contracts: Many telecommunication and enterprise clients enter into multi-year agreements for network services and equipment, locking companies into ongoing commitments that are difficult to exit prematurely.

Strategic Stakes

The wireless infrastructure market is a critical battleground, as robust connectivity is essential for everything from the Internet of Things (IoT) to the development of smart cities. This inherent importance means companies are heavily invested in securing their position.

The high strategic stakes in this sector often drive aggressive competition. Companies are willing to make substantial investments and employ intense tactics to secure market dominance, sometimes prioritizing long-term leadership over immediate financial gains. For instance, in 2023, global spending on wireless infrastructure, including 5G deployment, continued to rise, reflecting this strategic imperative.

- Strategic Importance: The wireless infrastructure market is fundamental to enabling various industries and future technologies like IoT and smart cities.

- Aggressive Tactics: High stakes encourage significant investments and competitive maneuvers to achieve or retain market leadership.

- Investment Focus: Companies may prioritize market share and strategic positioning, even if it impacts short-term profitability.

- Market Growth: Continued global investment in wireless infrastructure, such as 5G, underscores the high strategic value placed on this sector.

Cambium Networks faces intense competition from established giants like Cisco and HPE/Aruba, as well as emerging players. Despite a dip in the enterprise WLAN market in 2024 due to inventory adjustments, the sector is projected for significant growth, with a CAGR of 25.9% through 2025 and 31.2% through 2029, fueling fierce rivalry.

Cambium differentiates through Wi-Fi 7, cloud management, and AI, which can reduce rivalry if customers face high switching costs. However, the risk of commoditization looms, potentially shifting competition to price if offerings become too similar.

High exit barriers, including substantial capital investment in specialized technology and long-term contracts, keep companies locked in, contributing to sustained competitive pressure even for less profitable firms. The strategic importance of wireless infrastructure for IoT and smart cities further intensifies this rivalry.

| Competitor | Key Product Areas | 2024 Market Position (Estimated) |

| Cisco Systems | Enterprise WLAN, Switching, Routing | Market Leader |

| HPE/Aruba Networking | Enterprise WLAN, Edge Networking | Major Player |

| Ubiquiti | Wireless Access Points, Networking Hardware | Strong Challenger |

| Huawei | Broad Networking Portfolio (subject to geopolitical factors) | Significant Global Presence |

SSubstitutes Threaten

The primary threat of substitutes for Cambium Networks stems from alternative ways to provide high-speed internet and network connectivity. Fiber optic broadband, with its superior bandwidth and minimal delay, presents a strong alternative.

Furthermore, advanced cellular technologies like 5G Fixed Wireless Access (FWA) are becoming increasingly competitive. Projections indicate that 5G FWA will account for over 35% of new fixed broadband connections by 2030, directly challenging Cambium's market share by offering a comparable service quality.

The threat of substitutes for Cambium Networks' wireless solutions is a significant consideration, with their viability hinging on performance and cost-effectiveness. While Cambium excels in flexibility and quick deployment, alternatives like fiber optics offer superior reliability in highly congested areas, a crucial factor for certain enterprise and carrier deployments.

Furthermore, Fixed Wireless Access (FWA) powered by 5G represents a potent substitute, especially for mobile network operators. In 2024, the global 5G FWA market is projected to reach approximately $20 billion, demonstrating its growing appeal. This technology leverages existing cellular infrastructure, potentially offering substantial cost advantages to carriers compared to building out entirely new wireless networks or deploying extensive fiber backhaul, thereby presenting a competitive challenge to Cambium's offerings.

Customer willingness to switch to alternatives hinges on how they perceive the benefits, how easy it is to implement these substitutes, and what's currently trending in the market. For instance, while Wi-Fi 7 is on the horizon, its widespread use is anticipated around late 2025, suggesting a gradual shift rather than an immediate disruption.

In contrast, 5G Fixed Wireless Access (FWA) has experienced a surge in adoption, particularly in regions where traditional broadband infrastructure is less developed. This rapid uptake by consumers and businesses alike highlights a significant threat from readily available and increasingly capable alternative connectivity solutions.

Regulatory and Infrastructure Developments

Government initiatives and substantial investments in broadband infrastructure, such as widespread fiber optic deployments and the ongoing rollout of 5G networks, can significantly accelerate the adoption of substitute technologies. For instance, increased public and private sector investment in 5G networks, particularly in mid-band spectrum, has made 5G Fixed Wireless Access (FWA) a considerably more attractive and competitive alternative to traditional fixed-line broadband. This trend was evident in 2024, with numerous countries announcing ambitious broadband expansion plans. For example, the United States' Broadband Equity, Access, and Deployment (BEAD) program allocated $42.45 billion to expand broadband access, potentially fueling the growth of competing wireless solutions.

The accelerating pace of 5G deployment directly impacts the threat of substitutes for Cambium Networks. As more areas gain access to high-speed 5G FWA, the appeal of fixed wireless solutions over traditional wired broadband increases. This is particularly true in underserved or rural areas where deploying fiber can be cost-prohibitive. By mid-2024, global 5G subscriptions had surpassed 1.5 billion, indicating a strong market shift towards wireless technologies.

- Government Funding: Programs like the BEAD initiative in the US are channeling billions into broadband, which can inadvertently support competing wireless technologies.

- 5G Spectrum Availability: Increased availability and deployment of mid-band 5G spectrum (e.g., C-band) enhance the performance and reach of 5G FWA.

- Market Penetration: The rapid growth in global 5G subscriptions, exceeding 1.5 billion by mid-2024, signifies a growing acceptance and preference for wireless connectivity solutions.

Emerging Technologies

Emerging technologies present a significant long-term threat of substitution for Cambium Networks' current offerings. Future iterations like 6G are anticipated to offer substantially higher speeds and incorporate advanced AI-driven network functionalities, potentially rendering existing wireless solutions less competitive.

Satellite internet services are also gaining traction, particularly as a substitute for traditional terrestrial networks in underserved or rural areas. Companies are investing heavily in these technologies; for instance, Starlink, a prominent satellite internet provider, continued its global expansion throughout 2024, aiming to reach more remote regions.

- 6G Development: Ongoing research and development in 6G promise enhanced performance metrics, potentially impacting demand for current 5G and LTE solutions.

- Satellite Internet Growth: The increasing accessibility and performance of satellite internet offer an alternative for connectivity, especially in areas lacking robust ground infrastructure.

- AI Integration: Future network technologies are expected to deeply integrate AI, which could lead to entirely new service delivery models that bypass traditional wireless infrastructure.

The threat of substitutes for Cambium Networks is substantial, driven by advancements in both wired and wireless technologies. Fiber optic broadband remains a primary substitute, offering superior speed and latency, particularly appealing for high-demand enterprise and carrier applications. Meanwhile, 5G Fixed Wireless Access (FWA) is rapidly evolving, presenting a direct challenge by leveraging existing cellular infrastructure. By 2024, the global 5G FWA market was estimated to be around $20 billion, highlighting its growing competitive presence.

Customer adoption of substitutes is influenced by perceived benefits, ease of implementation, and market trends. While technologies like Wi-Fi 7 are emerging, their widespread adoption is expected around late 2025, indicating a more gradual shift. However, the increasing global 5G subscription base, surpassing 1.5 billion by mid-2024, signifies a strong market preference for advanced wireless solutions, directly impacting Cambium's market position.

Government initiatives and infrastructure investments can accelerate the adoption of substitute technologies. For instance, the US BEAD program, with its $42.45 billion allocation for broadband expansion, could indirectly bolster competing wireless solutions. Furthermore, the expansion of mid-band 5G spectrum availability enhances 5G FWA's performance and reach, making it a more attractive alternative to traditional fixed-line broadband.

| Substitute Technology | Key Advantage | Market Trend/Data Point (2024-2025) | Impact on Cambium |

| Fiber Optic Broadband | Superior speed, low latency | Continued infrastructure build-out globally | Direct competition for high-bandwidth applications |

| 5G Fixed Wireless Access (FWA) | Leverages existing cellular infrastructure, cost-effective for carriers | Global market ~$20 billion (2024); >1.5 billion 5G subscriptions (mid-2024) | Strong competitor, especially in areas with less developed wired infrastructure |

| Satellite Internet | Broad coverage in underserved/remote areas | Continued global expansion of services like Starlink | Alternative for specific geographic markets |

Entrants Threaten

Entering the wireless networking infrastructure market demands substantial upfront capital. Companies need to invest heavily in research and development, setting up manufacturing plants, and building robust distribution networks. This high barrier to entry discourages many potential newcomers.

For instance, Cambium Networks, a key player, reported a net loss of $27.5 million in the first quarter of 2024, highlighting the capital intensity and ongoing investment required to compete effectively in this sector.

The wireless networking industry, where Cambium Networks operates, is intensely technology-driven. Continuous advancements in Wi-Fi standards, such as the rollout of Wi-Fi 6E and the upcoming Wi-Fi 7, alongside the expansion of 5G and the integration of AI, demand significant ongoing investment. For instance, the global Wi-Fi market size was valued at approximately $25.5 billion in 2023 and is projected to grow, indicating a vibrant but also R&D-intensive landscape.

New entrants face a considerable hurdle due to the necessity of robust research and development capabilities and the acquisition or development of substantial intellectual property to compete effectively. The market's rapid evolution, marked by trends like AI-driven network management and the increasing adoption of cloud-managed Wireless Local Area Network (WLAN) solutions, further elevates the barrier to entry for those without established technological expertise and innovation pipelines.

Established companies like Cambium Networks have already cultivated robust distribution channels, reaching key customers such as service providers, enterprises, and industrial sectors through a network of resellers and managed service providers. Newcomers would struggle to replicate this extensive reach and earn the necessary trust from these established customer bases.

Gaining access to these crucial distribution channels presents a significant hurdle for potential new entrants. While the growing trend towards cloud-managed services might reshape how products are delivered, building the infrastructure and partnerships required still demands substantial capital investment, making it difficult for new players to compete effectively.

Brand Loyalty and Reputation

Brand loyalty is a significant barrier for new entrants in the wireless networking space, particularly for enterprise and service provider customers. These clients typically demand high levels of reliability, robust security features, and consistently proven performance. This often translates into a reluctance to switch from established vendors with a track record of delivery. For instance, in 2024, the average enterprise IT decision-maker reported that vendor reliability was a top three factor when selecting new network solutions, often outweighing initial cost considerations.

New companies entering the market must therefore commit substantial resources to building a strong reputation and fostering trust. This is not a quick process; it requires consistent delivery of quality products and services, coupled with effective customer support. Cambium Networks, through its ONE Network platform, actively works to simplify network management and enhance the overall customer experience, aiming to solidify its existing customer base and attract new ones by highlighting ease of use and integrated solutions.

- Customer Priority: Reliability, security, and proven performance are paramount for enterprise and service provider clients.

- Loyalty Factor: Existing strong brand reputations create a significant hurdle for new market entrants.

- Investment Need: New companies must invest heavily in reputation building and trust establishment.

- Cambium's Strategy: The ONE Network platform is designed to simplify management and improve customer experience, reinforcing loyalty.

Regulatory Hurdles and Spectrum Availability

The wireless communication sector, particularly for fixed wireless access and cellular-like services, is heavily influenced by stringent regulatory frameworks. Obtaining the necessary licenses and adhering to compliance standards presents a significant barrier to entry for potential new competitors.

Spectrum availability is another critical factor. These radio frequencies, essential for wireless transmission, are finite and often allocated through costly auctions or licensing processes. For instance, in 2024, the FCC continued its efforts to make more mid-band spectrum available, but the demand and associated costs remain high, making it a substantial hurdle.

- Regulatory Compliance: Navigating complex licensing and operational rules requires substantial investment and expertise.

- Spectrum Scarcity: Limited availability of crucial radio frequencies drives up acquisition costs and limits operational scope for new entrants.

- High Capital Outlay: Securing spectrum and meeting regulatory requirements necessitates significant upfront financial commitment, deterring smaller players.

The threat of new entrants in the wireless networking infrastructure market is moderate, primarily due to high capital requirements and established brand loyalty. Significant investments in R&D, manufacturing, and distribution channels are essential. For example, Cambium Networks reported a net loss of $27.5 million in Q1 2024, underscoring the capital intensity of the industry. New players must also overcome the challenge of building trust and proving reliability, as enterprise clients prioritize proven performance over initial cost.

Regulatory hurdles and spectrum availability also act as significant deterrents. Obtaining necessary licenses and adhering to compliance standards demands substantial expertise and financial commitment. Furthermore, the scarcity of radio frequencies, often acquired through costly auctions, presents a considerable barrier. The global Wi-Fi market, valued at approximately $25.5 billion in 2023, demonstrates the sector's growth potential but also its competitive intensity driven by rapid technological evolution like Wi-Fi 7.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment in R&D, manufacturing, and distribution. | Significant deterrent due to substantial financial outlay. |

| Brand Loyalty & Trust | Enterprise clients prioritize reliability and proven performance from established vendors. | New entrants must invest heavily in reputation building, a lengthy process. |

| Intellectual Property & Technology | Need for robust R&D and IP to keep pace with rapid advancements (e.g., Wi-Fi 7, AI). | Requires continuous, significant investment in innovation. |

| Distribution Channels | Established networks of resellers and managed service providers are difficult to replicate. | Limits market reach and customer access for newcomers. |

| Regulatory & Spectrum | Complex licensing, compliance, and costly spectrum acquisition are essential. | Adds substantial cost and expertise requirements, limiting smaller players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Cambium Networks is built upon a foundation of industry-specific market research reports, financial disclosures from publicly traded competitors, and data from reputable technology analytics firms.