Cambium Networks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cambium Networks Bundle

Curious about Cambium Networks' product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential growth, but it's just the tip of the iceberg.

Unlock the full strategic advantage by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed investment and resource allocation decisions.

Don't miss out on actionable insights that can shape your strategy. Invest in the full Cambium Networks BCG Matrix today for a clear roadmap to market leadership and sustained success.

Stars

Cambium Networks is making a significant play in the next-generation 6 GHz Fixed Wireless Access (FWA) market. This strategic focus is driven by the increasing demand for higher speeds and greater capacity in wireless broadband. The company's investment here is a clear indicator of its commitment to leading in this evolving landscape.

The introduction of products like the ePMP 4600 series directly targets the 6 GHz band, enabling multi-gigabit FWA services. This move positions Cambium to capitalize on the growing need for faster, more reliable internet access, especially in areas where fiber deployment is challenging or cost-prohibitive. The 6 GHz spectrum offers a substantial amount of new, uncongested bandwidth.

The global 5G FWA market, which encompasses solutions utilizing the 6 GHz spectrum, is experiencing robust growth. Projections indicate this market will continue to expand significantly in the coming years. For instance, some analysts forecast the fixed wireless access market to reach over $100 billion by 2028, with a substantial portion of that growth attributed to mid-band spectrum like 6 GHz.

Cambium Networks' Wi-Fi 7 enterprise access points are strategically positioned within the rapidly expanding enterprise WLAN market. The global Wi-Fi market, including enterprise solutions, was projected to reach over $15 billion in 2024, with Wi-Fi 7 expected to capture a significant share as adoption grows.

These newly certified Wi-Fi 7 access points are engineered for superior performance and efficiency, targeting a leadership role as the technology gains traction. While current market share is still emerging, this segment represents a high-growth opportunity for Cambium as businesses upgrade to next-generation wireless capabilities.

Cambium Networks is carving out a strong position in the enterprise Wi-Fi market with its ruggedized, high-performance outdoor Wi-Fi 6/6E solutions. Products like the XE3-4TN are specifically designed for demanding environments, catering to sectors such as government, defense, and industrial operations. This strategic focus taps into a high-growth segment of the market.

The activation of the 6 GHz spectrum for outdoor use further amplifies the growth potential for these specialized deployments. Cambium is actively investing in establishing its presence and proving its capabilities in these niche, yet expanding, outdoor connectivity scenarios.

5G Fixed Wireless Access Solutions

5G Fixed Wireless Access (FWA) solutions represent a significant growth opportunity, with the global market expected to surge. Projections indicate the 5G FWA market could reach over $100 billion by 2028, demonstrating its rapid expansion. Cambium Networks is actively investing in its 5G FWA portfolio, evidenced by recent funding rounds aimed at accelerating product development and market penetration.

Cambium's strategic focus on 5G FWA is designed to capitalize on this burgeoning market. Their technology offers a compelling alternative to traditional wired broadband, particularly for regions lacking robust fiber infrastructure. This approach aligns with the increasing demand for high-speed, reliable internet access across diverse geographic areas.

- Market Growth: The 5G FWA market is experiencing substantial expansion, with forecasts suggesting significant revenue increases in the coming years.

- Cambium's Investment: Cambium Networks has secured funding to enhance its 5G FWA offerings, signaling a commitment to capturing market share.

- Targeted Deployment: Their solutions are engineered to deliver high-speed internet to underserved communities by leveraging existing and expanding 5G networks.

- Competitive Advantage: By focusing on FWA, Cambium aims to provide a cost-effective and rapid deployment option compared to laying extensive fiber optic cables.

Cloud-Managed ONE Network Platform

Cambium Networks' Cloud-Managed ONE Network Platform is a crucial element supporting its growth initiatives, even though it's not a separate product. This platform offers unified cloud management for Cambium's various wireless and wired offerings, making it a key facilitator for their expanding product lines.

The market for cloud-managed WLAN solutions and AI-driven network management is experiencing significant growth. Cambium's ONE Network platform is positioned to capitalize on this trend by simplifying network operations for its customers, aiming for widespread adoption.

Key aspects of the ONE Network Platform include:

- Centralized Management: Provides a single pane of glass for managing Cambium's wireless (Wi-Fi, fixed wireless access) and wired (switching, security) devices.

- Cloud-Native Architecture: Leverages the cloud for scalability, accessibility, and simplified deployment of network services.

- AI-Powered Insights: Incorporates artificial intelligence for network optimization, anomaly detection, and predictive maintenance, enhancing operational efficiency.

- Enabler for Growth Products: Acts as a foundational technology that enhances the value proposition and ease of use for Cambium's high-growth product categories.

Cambium Networks' investment in the 6 GHz Fixed Wireless Access (FWA) market positions them as a Star in the BCG Matrix. The company is actively developing and deploying solutions like the ePMP 4600 series, which leverage the expanded bandwidth of the 6 GHz spectrum to deliver multi-gigabit speeds. This focus directly addresses the surging demand for faster, more reliable wireless broadband, especially in areas where traditional wired infrastructure is impractical.

The overall FWA market, particularly 5G FWA, is experiencing significant growth. Projections estimate the global FWA market could surpass $100 billion by 2028, with the 6 GHz band playing a crucial role. Cambium's strategic alignment with this high-growth segment, coupled with their technological advancements, solidifies their Star status.

Cambium's Wi-Fi 7 enterprise access points also represent a Star opportunity, targeting the rapidly expanding enterprise WLAN market. With the global Wi-Fi market projected to exceed $15 billion in 2024, and Wi-Fi 7 adoption on the rise, Cambium is well-positioned to capture significant market share in this high-growth area. Their commitment to next-generation wireless capabilities for businesses further reinforces this Star classification.

The company's ruggedized outdoor Wi-Fi 6/6E solutions, such as the XE3-4TN, are also strong contenders for Star status. These products cater to specialized, high-growth sectors like government, defense, and industrial operations, further enhanced by the activation of 6 GHz for outdoor use. Cambium's proactive investment in these niche yet expanding connectivity scenarios demonstrates their forward-thinking strategy.

| BCG Category | Cambium Networks Segment | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Star | 6 GHz Fixed Wireless Access (FWA) | High (Global FWA market projected >$100B by 2028) | Growing/Leading | Invest for continued growth and market leadership. |

| Star | Wi-Fi 7 Enterprise WLAN | High (Global Wi-Fi market >$15B in 2024, Wi-Fi 7 adoption increasing) | Emerging/Growing | Invest to capture early market share and establish dominance. |

| Star | Ruggedized Outdoor Wi-Fi | High (Niche but expanding sectors like defense, industrial) | Growing/Leading | Continue to innovate and expand presence in specialized environments. |

What is included in the product

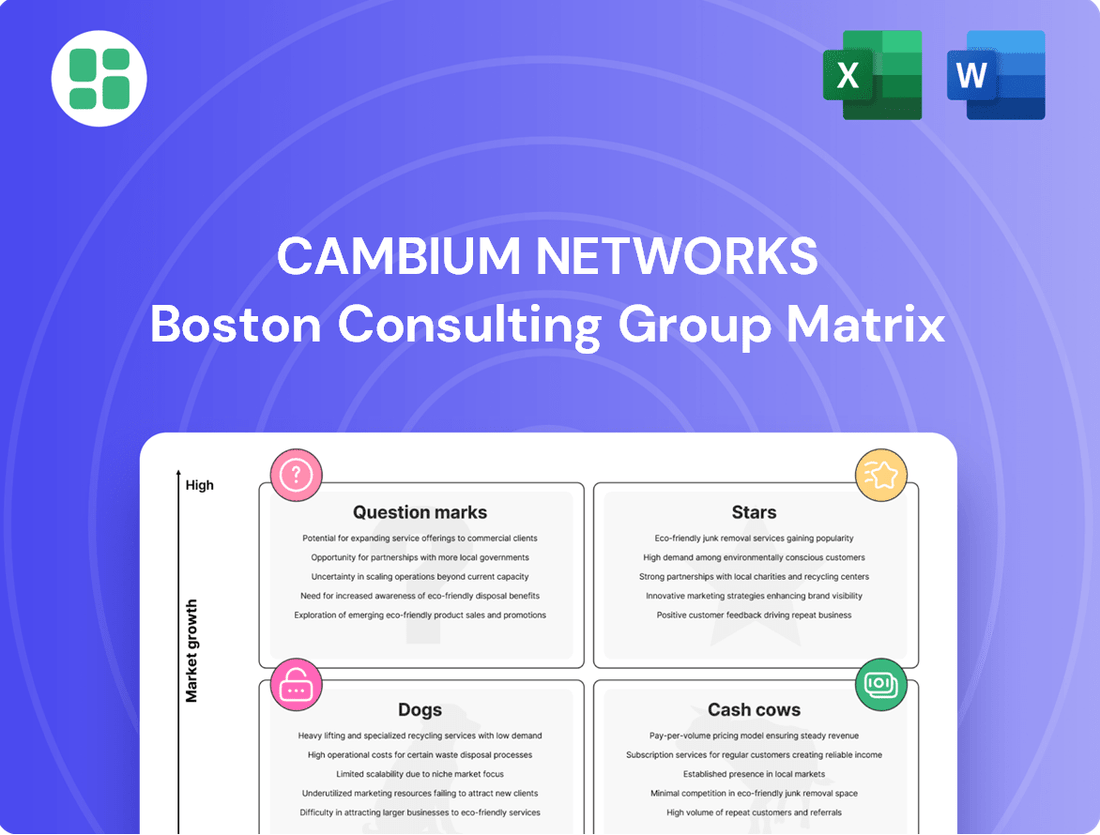

This BCG Matrix overview analyzes Cambium Networks' product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

Gain clarity on Cambium Networks' product portfolio with a BCG Matrix, simplifying strategic decisions.

Visualize Cambium Networks' product performance with a BCG Matrix, easing the burden of complex market analysis.

Cash Cows

The Established Point-to-Multipoint (PMP) 450 Platform from Cambium Networks, with millions of radios deployed globally, functions as a Cash Cow. This mature product line generates consistent, stable revenue from its vast existing customer base, including upgrades and essential maintenance contracts. While the fixed wireless access market continues to expand, the PMP 450's established presence means it requires minimal new investment, allowing it to efficiently convert its market share into profit.

Cambium's Point-to-Point (PTP) microwave backhaul solutions are a cornerstone of its portfolio, providing critical connectivity for wireless networks. This segment operates in a mature market, where demand for dependable, high-capacity links remains steady, ensuring consistent revenue generation.

These PTP products are likely positioned as Cash Cows within Cambium's business, generating stable cash flows from a loyal customer base and ongoing network expansion needs. The mature nature of this market means less investment is typically required for aggressive marketing or cutting-edge research and development compared to more nascent technologies.

Cambium Networks' legacy Wi-Fi 5/6 indoor enterprise access points are firmly positioned as Cash Cows. Even with the advent of Wi-Fi 7, the Wi-Fi 6 and 6E standards continue to be the workhorse for extensive network rollouts, largely due to their favorable balance of cost and dependable performance.

These established products, while not featuring the latest advancements, benefit from a substantial existing footprint within enterprise and educational sectors. This installed base translates into consistent revenue streams from ongoing support agreements and smaller, phased network enhancements.

For instance, in 2024, Cambium Networks reported that its enterprise segment, which heavily includes these Wi-Fi products, demonstrated stable revenue, underscoring their role as reliable cash generators. While in a mature market phase, these access points continue to contribute significantly to the company's financial health.

cnMaestro Network Management Platform (Existing Subscriptions)

The cnMaestro network management platform from Cambium Networks is a prime example of a cash cow. It currently manages millions of Cambium radios, acting as a vital central control point for these networks. This established user base, particularly those with stable, older deployments, generates a predictable and consistent recurring revenue through existing subscriptions.

While Cambium continuously innovates with new features for cnMaestro, the fundamental service provided to its existing subscriber base ensures a low-cost, high-margin cash flow. This stability is characteristic of a cash cow, where investment is minimal, and returns are maximized.

- Recurring Revenue: Existing cnMaestro subscriptions provide a dependable income stream.

- Low Investment: The platform's mature nature requires minimal ongoing development for the core service.

- High Profitability: Stable deployments translate to consistent, profitable cash generation.

- Market Dominance: Millions of managed radios highlight its established position.

Fixed Wireless Access in Established Rural Broadband Markets

Cambium Networks has a strong legacy in fixed wireless access (FWA) for rural broadband, establishing itself as a key provider in these areas. In markets where FWA infrastructure is already in place and competition is relatively stable, Cambium's offerings likely represent a reliable revenue stream.

These established rural markets benefit from consistent demand for dependable internet access, especially in regions where fiber deployment is less common. This segment of Cambium's business likely supports ongoing operations through long-term service contracts and maintenance agreements.

- Revenue Generation: Consistent income from existing service provider contracts.

- Market Position: Strong, established presence in rural and underserved broadband.

- Demand Drivers: Sustained need for reliable internet where fiber is limited.

- Financial Stability: Predictable revenue from maintenance and upgrades.

Cambium Networks' legacy Wi-Fi 5/6 indoor enterprise access points are firmly positioned as Cash Cows. These products benefit from a substantial existing footprint within enterprise and educational sectors, translating into consistent revenue streams from ongoing support agreements and smaller, phased network enhancements.

In 2024, Cambium Networks reported that its enterprise segment, which heavily includes these Wi-Fi products, demonstrated stable revenue, underscoring their role as reliable cash generators. While in a mature market phase, these access points continue to contribute significantly to the company's financial health.

| Product Segment | BCG Matrix Position | Key Characteristics | 2024 Data Insight |

|---|---|---|---|

| PMP 450 Platform | Cash Cow | Mature, stable revenue, minimal new investment needed | Millions of radios deployed globally, consistent upgrades and maintenance revenue |

| PTP Microwave Backhaul | Cash Cow | Mature market, steady demand for high-capacity links | Ensures consistent revenue generation from loyal customer base and network expansion |

| Legacy Wi-Fi 5/6 APs | Cash Cow | Established footprint, ongoing support and enhancements | Enterprise segment revenue stable in 2024, significant contribution to financial health |

| cnMaestro Management Platform | Cash Cow | Manages millions of radios, recurring subscription revenue | Low-cost, high-margin cash flow from established user base |

What You See Is What You Get

Cambium Networks BCG Matrix

The Cambium Networks BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. Upon purchase, this same document will be instantly downloadable, allowing you to immediately leverage its insights for your business planning and competitive analysis.

Dogs

Cambium's cnMatrix Ethernet switching products operate within a crowded enterprise switching market. These offerings face intense competition, and without distinct features or a substantial market presence, they risk yielding minimal returns. The broader enterprise data center switch market is projected to see no growth in 2025, further pressuring these products.

Legacy 4G/LTE fixed wireless solutions that don't offer a 5G upgrade path are likely candidates for the Dogs quadrant. These products face increasing pressure as 5G Fixed Wireless Access (FWA) gains significant traction, offering superior speeds and capacity. For instance, while 5G FWA deployments are rapidly expanding, older 4G systems are becoming less competitive, potentially leading to market share erosion.

Products in this category often serve markets with limited growth potential or where the cost of upgrading to 5G infrastructure is prohibitive for customers. This can result in declining revenue streams as newer, more advanced solutions become the preferred choice for consumers and businesses seeking higher performance. Cambium Networks' own portfolio might include such legacy offerings that require careful management or eventual phasing out.

Cambium Networks, like many technology companies, periodically retires older product lines. These discontinued or end-of-life (EOL) products, whether hardware or software, have reached their end-of-sale or end-of-support dates. While they might still require some level of residual support, they typically generate very little new revenue.

These EOL products often absorb valuable resources, including engineering and customer support time, without contributing to the company's future growth trajectory. For instance, in 2024, Cambium Networks continued its strategic focus on newer, more advanced solutions, meaning resources previously allocated to older platforms were redirected to support and develop their next-generation offerings.

Niche Industrial IoT Products with Limited Traction

Niche Industrial IoT products with limited traction, potentially within Cambium Networks' portfolio, might be categorized as Dogs in the BCG Matrix. These are offerings that, despite the broader Industrial IoT market's robust growth, have struggled to gain significant customer adoption or are navigating highly competitive niches. For instance, if a specific cnReach IIoT sensor solution for a very specialized industrial process has seen low sales figures, it could represent a Dog. Such products may continue to consume valuable development and marketing resources without generating substantial market share or contributing meaningfully to profitability.

The Industrial IoT market itself is projected for significant expansion. By 2028, it's estimated to reach $116.3 billion, growing at a compound annual growth rate of 14.8% from 2023. However, within this expansive market, individual product lines can underperform. For example, if a particular cnReach gateway designed for a legacy industrial communication protocol has only secured a handful of clients since its 2022 launch, it would likely be a candidate for the Dog quadrant. This situation highlights the importance of continuous market assessment and strategic pruning of underperforming product lines.

- Low Market Adoption: Products with minimal customer uptake, indicating a lack of market fit or competitive disadvantage.

- Resource Drain: Offerings that consume R&D, sales, and marketing resources without generating commensurate returns.

- Intense Niche Competition: Facing strong rivals in specialized segments, making it difficult to capture significant market share.

- Potential Divestment: Such products are often candidates for discontinuation or divestment to reallocate resources to more promising areas.

Products in Geographies with Minimal Market Penetration

Cambium Networks' products in geographies with minimal market penetration represent a potential 'Dog' category within the BCG Matrix. These are regions where Cambium operates but hasn't established a strong foothold, and there isn't a clear, aggressive plan for expansion.

These markets might demand substantial investment to achieve even modest gains, potentially diverting capital from more promising ventures. For instance, if Cambium's revenue from a particular emerging market in 2024 was less than 1% of its total global revenue, and the cost to develop and market there outpaced the revenue generated, it could fit this profile.

- Low Market Share: Products in these geographies likely hold a very small percentage of the total available market.

- Low Growth Potential (or High Investment Need): The cost to penetrate these markets might be disproportionately high relative to the expected returns, indicating slow or uncertain growth.

- Capital Drain: Resources allocated to these areas may not yield significant revenue or profit, potentially hindering investment in stronger market segments.

- Strategic Re-evaluation: Such products often warrant a review to determine if continued investment is justified or if resources should be reallocated.

Cambium Networks' legacy 4G/LTE fixed wireless solutions, lacking a 5G upgrade path, are prime candidates for the Dogs quadrant. These products face declining relevance as 5G FWA offers superior performance, leading to potential market share erosion. For example, while 5G FWA deployments are rapidly expanding, older 4G systems are becoming less competitive.

Discontinued or end-of-life (EOL) products, whether hardware or software, also fall into this category. These offerings, having reached their end-of-sale or end-of-support dates, generate minimal new revenue while consuming valuable resources. In 2024, Cambium Networks continued its strategic shift to newer solutions, redirecting resources from older platforms.

Niche Industrial IoT products with limited customer adoption, despite the broader market's growth, can also be Dogs. If a specific cnReach IIoT sensor solution for a specialized industrial process has low sales figures, it represents a Dog. The Industrial IoT market is projected to reach $116.3 billion by 2028, but individual product lines can underperform.

Products in geographies with minimal market penetration and no aggressive expansion plans also fit the Dog profile. These markets may require substantial investment for modest gains, potentially diverting capital from more promising ventures. For instance, if Cambium's 2024 revenue from an emerging market was less than 1% of its total global revenue, and development costs exceeded revenue, it would fit this profile.

| Product Category | Market Share | Growth Rate | Profitability | Strategic Recommendation |

| Legacy 4G/LTE FWA | Declining | Negative | Low/Negative | Phased Discontinuation |

| EOL Hardware/Software | Negligible | N/A | Negligible | End-of-Life Management |

| Underperforming IIoT Niche Products | Low | Low | Low | Divestment or Re-evaluation |

| Products in Low-Penetration Geographies | Very Low | Low | Low/Negative | Resource Reallocation |

Question Marks

Cambium Networks is strategically positioning its new 6 GHz Fixed Wireless Access (FWA) platforms, such as the ePMP 4600, to capitalize on the expanding availability of this spectrum. This move targets a high-growth market with significant potential for future expansion.

The 6 GHz FWA sector is experiencing rapid development, with projections indicating substantial growth in the coming years. For Cambium to solidify its position, it must aggressively capture market share in this burgeoning segment, transforming its current offerings into market Stars.

Wi-Fi 7 adoption is still in its early stages, especially in emerging markets, presenting a classic Question Mark scenario for Cambium Networks. While the technology promises substantial speed and efficiency gains, widespread deployment in these regions is not yet a reality.

Cambium's investment in Wi-Fi 7 access points positions them for future growth, but their current market share in this emerging segment remains small. This low market share, coupled with the high growth potential of Wi-Fi 7, firmly places these offerings in the Question Mark category.

The success of Cambium's Wi-Fi 7 products in emerging markets hinges on their ability to drive adoption and capture market share as the standard matures. For instance, by the end of 2024, Wi-Fi 7 device shipments are projected to reach millions globally, yet emerging markets will represent a smaller fraction of this initial uptake.

The Industrial IoT market is indeed a burgeoning field, with projections indicating substantial growth. For instance, the global IIoT market was valued at approximately $247 billion in 2023 and is anticipated to surge to over $1.1 trillion by 2030, reflecting a compound annual growth rate of around 24%. Cambium's cnReach IIoT solutions, while robust, are likely positioned as question marks in many of these expanding verticals, meaning they possess high growth potential but currently hold a low market share.

Entering these new industrial verticals, such as smart agriculture or advanced logistics, requires significant upfront investment. This capital is needed for targeted marketing, sales force expansion, and potentially product customization to meet the unique demands of each sector. Without this strategic investment, capturing a meaningful market share and moving these IIoT offerings out of the question mark phase will be challenging.

Hospitality Wi-Fi Solutions

Cambium Networks is actively pursuing the hospitality sector, evidenced by recent successful Wi-Fi upgrades. This vertical presents a significant growth opportunity due to its increasing demand for robust and dependable wireless connectivity.

The hospitality industry requires Wi-Fi that can handle high device density and provide seamless guest experiences, making specialized solutions like Cambium's increasingly valuable. For instance, in 2024, the global Wi-Fi services market in hospitality was projected to reach over $2.5 billion, with a compound annual growth rate of approximately 12% through 2028, highlighting the substantial potential.

While Cambium's focus is growing, its current market share within the broader hospitality Wi-Fi landscape is likely still developing. This necessitates substantial investment in sales, marketing, and product development to effectively compete and capture a larger portion of this expanding market.

- Strategic Focus: Cambium is emphasizing hospitality Wi-Fi solutions, showcasing recent successful deployments.

- Market Demand: The hospitality sector needs high-performance, reliable Wi-Fi, creating a strong demand for specialized offerings.

- Market Share & Investment: Cambium's share in the overall hospitality Wi-Fi market is likely modest, requiring significant investment for expansion.

New Cloud-Managed Services and AI-Driven Network Tools

The market for cloud-managed networking solutions and AI-driven network management is experiencing significant expansion, driven by organizations seeking to simplify and automate their network operations. Cambium Networks is actively investing in this high-growth segment, enhancing its cnMaestro platform with advanced AI capabilities and promoting its ONE Network strategy for more integrated management. These initiatives position Cambium to capture a larger share in these evolving service layers, though their current market penetration in these sophisticated areas is still in its growth phase.

Cambium's focus on AI-driven network tools and cloud-managed services is strategically aligned with industry trends. For instance, the global cloud networking market was valued at approximately $48.7 billion in 2023 and is projected to reach $130.6 billion by 2030, growing at a CAGR of 15.1%. This robust growth underscores the demand for solutions that offer enhanced efficiency and intelligence in network management.

- Market Growth: The demand for simplified and automated network operations is fueling the expansion of cloud-managed networking and AI-driven network management solutions.

- Cambium's Strategy: Cambium is enhancing its cnMaestro platform with AI capabilities and promoting its ONE Network for streamlined, integrated management.

- Investment Focus: These offerings represent high-growth areas where Cambium is making strategic investments to achieve differentiation in the market.

- Market Share Development: While these advanced service layers are promising, Cambium's market share in these specific segments is still in a developing stage.

Cambium's Wi-Fi 7 offerings in emerging markets are prime examples of Question Marks. While the technology itself holds immense future potential, its current adoption rate in these specific regions is low. This means Cambium is investing in a high-growth area but has a small market share, requiring strategic efforts to convert this potential into market dominance.

The Industrial IoT (IIoT) market, particularly in new verticals like smart agriculture, presents a similar Question Mark scenario for Cambium's cnReach solutions. The global IIoT market is projected to exceed $1.1 trillion by 2030, indicating substantial growth. However, Cambium's current penetration in these specialized industrial applications is likely limited, necessitating focused investment to capture market share.

Similarly, Cambium's expansion into the hospitality Wi-Fi sector, while strategically sound given the market's projected growth to over $2.5 billion in 2024, still positions their current market share as a Question Mark. Significant investment in sales and marketing is crucial to elevate their standing in this competitive landscape.

Cambium's investment in AI-driven network management and cloud-managed solutions also falls into the Question Mark category. The global cloud networking market is expected to reach $130.6 billion by 2030, yet Cambium's market share in these advanced service layers is still developing, requiring continued strategic investment to capitalize on this high-growth trend.

BCG Matrix Data Sources

Our Cambium Networks BCG Matrix leverages a blend of internal financial reports, market share data from industry analysts, and competitive landscape assessments to provide a comprehensive view.