California Water Service Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

California Water Service Group Bundle

California Water Service Group operates within a dynamic environment shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Gain a competitive edge by exploring these critical factors in our comprehensive PESTLE analysis.

Uncover the intricate web of political, economic, social, technological, legal, and environmental influences impacting California Water Service Group. This expertly crafted PESTLE analysis provides actionable intelligence to inform your investment decisions and business strategies. Download the full version now for a deep dive into the external forces shaping the company's future.

Political factors

California Water Service Group's operations are heavily influenced by regulatory bodies like the California Public Utilities Commission (CPUC) and the State Water Resources Control Board (SWRCB). These agencies set the rules for everything from how much the company can charge for water to the quality of service it must provide and the investments it needs to make in its infrastructure. For instance, the CPUC's decisions in General Rate Cases (GRCs) directly affect the company's revenue and its capacity to fund essential system upgrades.

New urban water conservation regulations taking effect January 1, 2025, will mandate significant adjustments for large urban water suppliers like California Water Service Group. These rules are designed to drive more efficient water usage across the state.

The goal is to achieve substantial water savings by 2040. This necessitates strategic planning and operational changes for companies such as California Water Service Group to meet these new efficiency targets.

California's political landscape shows a strong commitment to upgrading its water infrastructure. This focus is driven by the need for greater reliability and sustainability in water systems across the state.

California Water Service Company's proposed investment plan, exceeding $1.6 billion between 2025 and 2027, directly reflects this governmental emphasis. These substantial capital expenditures are designed to modernize aging infrastructure and improve the overall efficiency of water delivery.

Evolving Drought Management Directives

California's climate continues to present challenges, with significant shifts between drought and flood conditions influencing governmental directives. While many drought emergency provisions were lifted by the end of 2024, the state is still actively managing water supply deficits.

This ongoing need for flexible water management means that new or revised drought management directives can emerge, impacting water utilities like California Water Service Group. The state’s approach emphasizes adaptation to these unpredictable weather patterns.

- California experienced a significant reduction in drought conditions by late 2024, with only a small percentage of the state remaining in severe or exceptional drought.

- However, forecasts for the upcoming years still indicate a potential for below-average precipitation in certain regions.

- The State Water Resources Control Board continues to monitor water availability and may reintroduce conservation measures if conditions warrant.

Legislative Push for Water Affordability

Legislative bodies are increasingly focusing on water affordability, with discussions around creating permanent federal water assistance programs for low-income households. This political momentum signals a potential shift in how water services are priced and supported, directly impacting utilities like California Water Service Group. For instance, the proposed Water Affordability Act, which gained traction in 2024, aims to provide a consistent funding stream for such programs, potentially influencing rate structures and customer assistance initiatives.

These legislative efforts underscore a broader political commitment to ensuring equitable access to essential services. Such initiatives could lead to new regulatory requirements or incentives for water utilities to implement more robust customer support programs and explore innovative rate designs that better serve vulnerable populations. The ongoing debate in 2025 highlights the evolving political landscape concerning utility affordability.

- Federal Legislation: Proposed bills in 2024 and 2025 aim to establish permanent water assistance programs.

- Equitable Access: A growing political interest in ensuring all families can afford essential water services.

- Utility Impact: Potential influence on rate structures and customer support programs for water utilities.

California's political focus on water infrastructure modernization is substantial, with the state government emphasizing reliability and sustainability. This is evident in California Water Service Company's planned capital expenditures exceeding $1.6 billion between 2025 and 2027, aimed at upgrading aging systems. New conservation regulations effective January 1, 2025, will also require significant adjustments for water suppliers to meet efficiency targets by 2040.

The political climate also highlights a growing concern for water affordability, with legislative proposals in 2024 and 2025 aiming to establish permanent federal water assistance programs. This could influence utility rate structures and customer support initiatives, reflecting a commitment to equitable access to essential water services.

While drought conditions significantly eased by late 2024, with minimal severe drought remaining, forecasts suggest potential for below-average precipitation in some areas. This necessitates ongoing flexible water management, with the State Water Resources Control Board prepared to reintroduce conservation measures if water availability declines.

What is included in the product

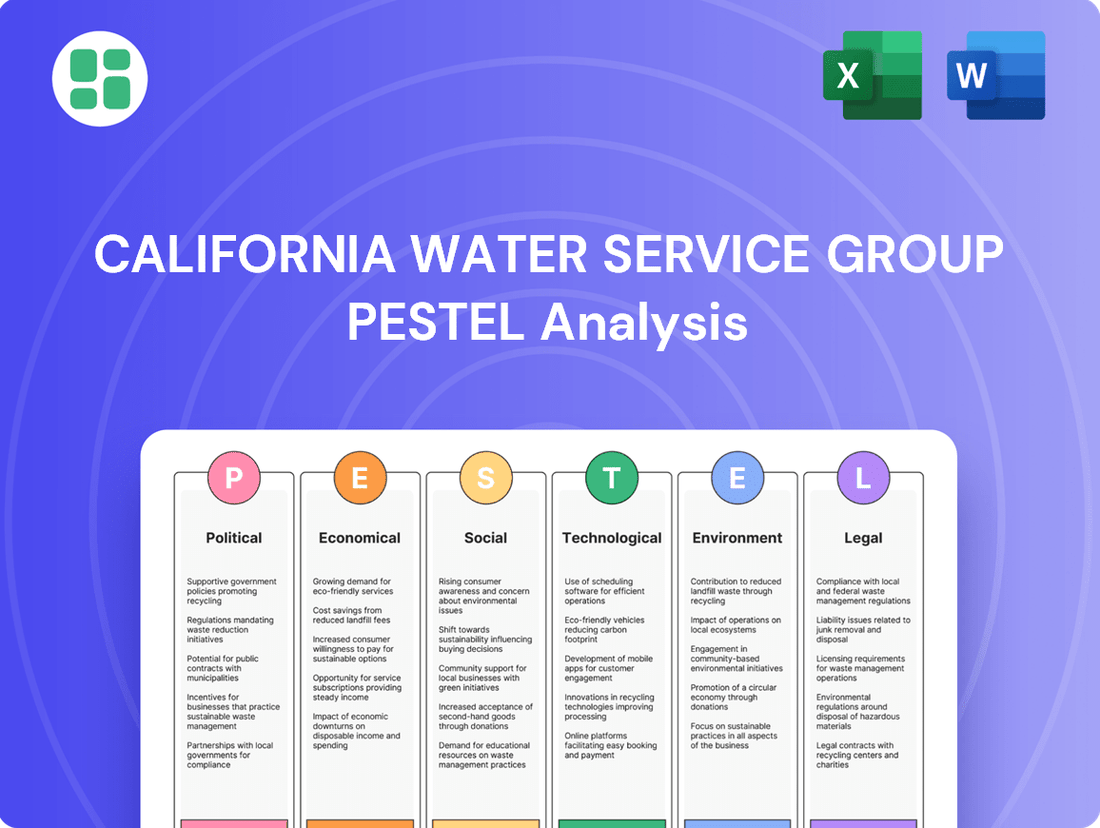

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting California Water Service Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's operational landscape and strategic decision-making.

This PESTLE analysis for California Water Service Group offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easy referencing during meetings and strategic planning.

It provides a concise, easily shareable summary format ideal for quick alignment across teams, helping to support discussions on external risks and market positioning during planning sessions.

Economic factors

California Water Service Group is grappling with escalating operating costs. Factors like increased wholesale water rates, a rise in labor expenses, and the necessity for sophisticated water quality treatment are contributing to this trend. For instance, in 2023, the company reported operating expenses of $785.5 million, a notable increase from the previous year, partly due to these inflationary pressures.

These mounting expenses directly impact the company's bottom line, creating pressure on profitability. To ensure continued financial stability and maintain high service standards for its customers, California Water Service Group frequently seeks adjustments in customer rates. These rate adjustments are crucial for covering the higher operational expenditures and funding necessary infrastructure improvements.

California Water Service Group is heavily investing in its infrastructure, with over $229.5 million already poured into water systems by mid-2025. This substantial capital expenditure is a cornerstone of their strategy to enhance system reliability and long-term sustainability.

Looking ahead, the company has outlined a significant capital investment plan of approximately $1.6 billion for its California districts spanning from 2025 through 2027. These investments are directly linked to a projected compounded annual rate base growth, reflecting the essential nature of these upgrades for future operations and revenue generation.

General Rate Case (GRC) outcomes from the California Public Utilities Commission (CPUC) are pivotal for California Water Service Group's financial health, directly impacting its revenue streams and cost recovery capabilities.

Recent GRC decisions have established new water rates for the 2025-2027 period, with authorized rate adjustments expected to drive revenue growth. For instance, the GRC decision for the Bear Valley Electric Service, a subsidiary, authorized an increase of approximately $1.7 million in revenue for 2025.

Challenges and Opportunities from Decoupling Mechanisms

The California Supreme Court's July 2024 ruling allows water utilities to pursue decoupling mechanisms, such as the Water Revenue Adjustment Mechanism (WRAM). This regulatory shift is significant for California Water Service Group as it decouples revenue from water sales volume. This aims to eliminate the financial penalty utilities faced for encouraging customer conservation, thereby promoting water-saving efforts and stabilizing revenue streams despite fluctuating sales.

Decoupling presents both challenges and opportunities. While it offers a path to more predictable revenue, it necessitates careful management of the mechanism itself and its impact on customer rates. For California Water Service Group, this could mean a more stable financial outlook, but it also requires adapting to a new revenue model that prioritizes conservation incentives over volumetric sales.

- Revenue Stability: Decoupling mechanisms like WRAM aim to ensure utilities recover costs and earn a fair return regardless of changes in water sales volume, which is crucial given California's ongoing drought concerns and conservation mandates.

- Conservation Incentives: By separating revenue from sales, utilities are no longer financially disincentivized from promoting water conservation, aligning utility financial health with public interest goals.

- Regulatory Adaptation: Utilities must adapt their financial modeling and operational strategies to effectively implement and manage these new rate-setting structures, ensuring they meet performance metrics tied to decoupling.

Water Affordability and Customer Bill Impacts

California Water Service Group (Cal Water) faces increasing scrutiny over water affordability as rate increases become necessary to fund critical infrastructure upgrades and meet evolving regulatory compliance costs. For instance, Cal Water's 2023 General Rate Case filing sought to recover costs associated with system improvements, impacting customer bills.

Conservation programs are a key strategy for mitigating bill impacts, but the utility must carefully balance cost recovery with the financial strain on households. This balancing act often involves exploring customer assistance programs and implementing equitable rate designs to ensure essential water access. As of early 2024, discussions around tiered rate structures and income-qualified assistance programs are prominent in California's water utility landscape.

- Rising Costs: Infrastructure investment and regulatory compliance are driving up operational expenses for water utilities like Cal Water.

- Affordability Concerns: Higher rates raise questions about water's affordability for low-income households and vulnerable populations.

- Conservation vs. Cost Recovery: Utilities must balance promoting water conservation with the need to recover costs for essential services.

- Assistance Programs: The development and funding of customer assistance programs are becoming increasingly important to address affordability challenges.

Economic factors significantly influence California Water Service Group's operations, particularly concerning rising costs and the need for rate adjustments. The company's 2023 operating expenses reached $785.5 million, reflecting increased labor and wholesale water rates. To address these pressures and fund necessary infrastructure, such as the $1.6 billion capital investment plan for 2025-2027, the company relies on regulatory approvals for rate increases.

The California Public Utilities Commission (CPUC) plays a crucial role through General Rate Cases (GRCs), which determine authorized revenue. For instance, a GRC decision for Bear Valley Electric Service authorized a $1.7 million revenue increase in 2025. Furthermore, a July 2024 California Supreme Court ruling permitting decoupling mechanisms like the Water Revenue Adjustment Mechanism (WRAM) is set to stabilize revenue by separating it from water sales volume, thereby supporting conservation efforts.

| Metric | 2023 (Actual) | Projected 2025-2027 |

|---|---|---|

| Operating Expenses | $785.5 million | Increasing due to inflation and infrastructure needs |

| Capital Investment (California Districts) | $229.5 million (mid-2025) | $1.6 billion |

| Authorized Revenue Increase (Bear Valley Electric) | N/A | $1.7 million (2025) |

Preview Before You Purchase

California Water Service Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of California Water Service Group offers a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its operations and strategic decisions.

Sociological factors

Californians are increasingly prioritizing water conservation, a trend amplified by the ongoing effects of climate change and stringent state regulations. This heightened public awareness directly influences how water utilities operate, encouraging the adoption of water-saving programs and technologies.

In 2023, California experienced a significant reduction in water usage, with statewide urban water consumption dropping by 6% compared to 2022, according to the California Department of Water Resources. This demonstrates a tangible shift in consumer behavior, with customers actively participating in conservation efforts, which in turn impacts the demand forecasts and operational strategies of companies like California Water Service Group.

Customers today have a heightened expectation for both a consistent water supply and superior drinking water quality, adhering to increasingly rigorous health and safety benchmarks. California Water Service Group (CWS) actively addresses this by performing comprehensive water quality testing, aiming for 100% compliance with all regulatory standards, which is crucial for building and maintaining customer confidence.

California's population, projected to reach over 40 million by 2025, continues to grow, placing increased demand on water resources. Demographic shifts, including an aging population and increasing urbanization in service areas like those of California Water Service Group (CWS), necessitate adaptive strategies for water management and infrastructure development.

CWS must proactively plan for evolving community needs, considering the impact of diverse and growing populations on water consumption patterns and the requirement for service expansions or upgrades. For instance, as of 2024, CWS serves over 1 million customer connections across California, Hawaii, and New Mexico, highlighting the broad demographic reach that requires tailored infrastructure planning.

Social Responsibility and Community Engagement

California Water Service Group (CWS) recognizes the growing demand for utilities to exhibit strong corporate social responsibility. This includes active participation in community development and providing support for local projects. CWS's commitment extends to significant contributions to community organizations, bolstering its reputation and social license to operate.

A key aspect of CWS's community engagement involves investments in crucial infrastructure projects. For instance, their wildfire-hardening initiatives are vital in California's fire-prone regions, directly addressing community safety and resilience. These efforts underscore a proactive approach to environmental stewardship and community well-being.

- Community Investment: CWS actively supports local non-profits and community programs, fostering positive relationships.

- Wildfire Resilience: Significant investment in wildfire-hardening projects enhances community safety and infrastructure durability.

- Social License: Demonstrating commitment to community well-being strengthens CWS's acceptance and operational legitimacy.

Water Affordability Concerns among Vulnerable Populations

The increasing cost of water services is a significant sociological concern, especially for vulnerable populations in California. Many low-income households are finding it harder to afford essential water, leading to difficult choices between paying utility bills and other necessities.

This societal pressure is prompting water utilities, including California Water Service Group, and regulatory bodies to actively seek solutions. These often involve developing and expanding customer assistance programs and designing more equitable rate structures.

- Customer Assistance Programs: California Water Service offers various assistance programs, such as the CARE (California Alternative Rates for Energy) program, which can also apply to water bills, providing discounts for eligible low-income customers. In 2023, the company reported assisting thousands of customers through these affordability initiatives.

- Equitable Rate Structures: The state is exploring tiered rate structures where higher water usage incurs a proportionally higher cost, aiming to make basic water needs more affordable for everyone. This approach seeks to balance the need for infrastructure investment with the financial realities faced by many Californians.

- Impact on Health and Well-being: Affordability concerns can indirectly impact public health, as families may reduce water consumption, potentially affecting hygiene and sanitation. This highlights the critical link between water access and overall community well-being.

Societal expectations for water utilities are evolving, with a growing emphasis on conservation and quality. Californians are increasingly mindful of their water usage, a trend reinforced by state efforts and climate change awareness. For instance, in 2023, urban water use across California saw a notable decrease of 6% compared to the previous year, underscoring a significant behavioral shift that utilities must accommodate.

Technological factors

California Water Service Group (Cal Water) is actively deploying smart metering infrastructure, a key technological advancement in the water utility industry. This adoption of advanced metering infrastructure, often called smart meters, allows for real-time water usage data collection and remote meter reading.

The benefits are substantial: quicker identification of leaks, which is crucial for conservation efforts, and empowering customers with detailed usage information to manage their consumption more effectively. For instance, Cal Water's investments in technology, including smart meters, are aimed at improving operational efficiency and customer service.

California Water Service Group (CWS) actively integrates advanced water quality monitoring and treatment technologies. This is crucial for navigating increasingly stringent regulations and tackling emerging contaminants such as per- and polyfluoroalkyl substances (PFAS). The company's commitment is underscored by its extensive testing regimen, performing hundreds of thousands of water quality tests each year to guarantee compliance and safeguard public health.

California Water Service Group (Cal Water) is increasingly embracing digital solutions to manage its water systems more effectively. This includes using data analytics to closely monitor water usage patterns across its service areas, allowing for better demand forecasting and resource allocation. For instance, in 2024, utilities nationwide reported an average of 15% improvement in operational efficiency through the adoption of smart grid technologies, a trend Cal Water is actively pursuing.

The digitalization push also involves implementing predictive maintenance for aging infrastructure. By analyzing sensor data, Cal Water can anticipate potential failures in pipes and treatment plants, enabling proactive repairs. This approach is crucial for minimizing service disruptions and reducing water loss. Studies from 2023 indicated that utilities employing predictive maintenance saw a reduction in infrastructure-related leaks by as much as 20%.

Furthermore, these digital tools optimize water distribution networks, ensuring water reaches customers efficiently and with minimal waste. This enhanced responsiveness and improved system resilience are critical, especially in a state like California facing ongoing water scarcity challenges. The integration of advanced metering infrastructure (AMI) by many utilities, including Cal Water's ongoing rollout, is a key component in achieving these operational gains.

Innovation in Infrastructure Materials and Construction

Technological advancements in materials science and construction methods are significantly enhancing the durability and resilience of critical water infrastructure. Innovations like advanced polymer linings for pipelines and self-healing concrete for treatment facilities are extending asset lifespans, directly supporting California Water Service Group's extensive capital investment plans focused on system modernization.

These technological shifts are crucial for California Water Service Group's ongoing capital expenditure, which in 2023 reached $325 million, with a projected $1.3 billion planned for 2024-2026. Such investments are vital for replacing aging infrastructure and incorporating more robust materials that can withstand environmental stresses and operational demands.

- Pipeline Longevity: New materials can extend pipeline service life by an estimated 50-100 years compared to traditional methods.

- Resilience Enhancement: Innovations like seismic-resistant designs for treatment plants improve operational continuity during natural events.

- Efficiency Gains: Advanced construction techniques can reduce project timelines and labor costs for infrastructure upgrades.

- Smart Infrastructure: Integration of sensors and IoT technologies within new infrastructure allows for predictive maintenance and real-time performance monitoring.

Energy Efficiency and Renewable Energy Integration

California Water Service Group (CWS) is actively pursuing technological advancements in energy efficiency to curb its environmental impact and lower operating expenses. Recent initiatives include widespread LED lighting retrofits across its facilities, the installation of electric vehicle (EV) charging stations to support its fleet transition, and the implementation of advanced HVAC controls for optimized energy consumption. These efforts are crucial for managing energy costs, which represent a significant operational expenditure for water utilities.

Furthermore, CWS is strategically exploring renewable energy integration to diversify its power sources and reduce reliance on fossil fuels. A key development is a 20-year solar power agreement, demonstrating a commitment to long-term sustainability and potentially securing more stable energy pricing. This move aligns with broader industry trends and regulatory pressures pushing for cleaner energy solutions in the utility sector.

- Energy Efficiency Investments: CWS is implementing LED lighting, EV chargers, and new HVAC controls.

- Renewable Energy Partnerships: A 20-year solar power agreement is in place.

- Operational Cost Reduction: Energy efficiency measures aim to lower operational expenditures.

- Environmental Footprint Reduction: Investments support the company's sustainability goals.

California Water Service Group is enhancing operational efficiency through smart metering, enabling real-time data collection and leak detection, which is vital for conservation. The company is also investing in advanced water quality monitoring and treatment technologies to meet stringent regulatory standards and address emerging contaminants.

Digitalization efforts include using data analytics for better demand forecasting and implementing predictive maintenance for infrastructure, aiming to reduce service disruptions and water loss. For example, utilities adopting predictive maintenance saw up to a 20% reduction in infrastructure leaks in 2023.

Technological advancements in materials science are improving pipeline longevity and infrastructure resilience, with new materials extending service life by an estimated 50-100 years. These upgrades are supported by significant capital investments, with $1.3 billion planned for 2024-2026.

Furthermore, CWS is focusing on energy efficiency through LED lighting and advanced HVAC controls, alongside exploring renewable energy, such as a 20-year solar power agreement, to reduce operational costs and environmental impact.

Legal factors

California Water Service Group's (CWS) operational landscape is significantly shaped by General Rate Case (GRC) proceedings overseen by the California Public Utilities Commission (CPUC). These crucial, multi-year regulatory processes dictate the company's authorized revenues, capital investment plans, and the very structure of its customer rates. Recent GRC filings and decisions are progressing through 2024 and into 2025, directly impacting CWS's financial performance and strategic planning.

New state regulations, known as Making Conservation a California Way of Life, become effective January 1, 2025. These laws legally mandate urban water suppliers to achieve specific, personalized water-use targets.

Failure to comply with these stringent conservation mandates can result in significant civil liabilities for water utilities. This necessitates substantial operational and reporting adjustments to meet the new standards.

California's Proposition 218 imposes strict requirements for public hearings and protest periods before water rate adjustments can be enacted, directly affecting utilities like California Water Service Group. These legal mandates ensure customer input, potentially delaying or altering proposed rate increases.

Recent court rulings, particularly in 2024, have clarified the administrative remedies that must be exhausted before rate challenges can be formally litigated. This means utilities must meticulously follow specific procedural steps, as demonstrated by the ongoing scrutiny of rate-setting practices across the state's water sector.

Environmental Regulations and Water Quality Standards

California Water Service Group operates under a complex web of federal and state environmental laws, particularly those governing water quality. These regulations, such as the Safe Drinking Water Act and Clean Water Act, dictate stringent limits on contaminants and wastewater discharge. For instance, the U.S. Environmental Protection Agency (EPA) has been developing national primary drinking water regulations for per- and polyfluoroalkyl substances (PFAS), a group of chemicals that often require advanced treatment technologies.

Compliance with these evolving standards demands substantial capital investment in water treatment infrastructure and ongoing operational expenses. In 2023, California Water Service Group reported capital expenditures of $266.3 million, a portion of which is directly allocated to upgrading systems to meet or exceed these environmental mandates. The company actively monitors and adapts its treatment processes to address emerging contaminants, ensuring the safety and quality of the water it provides to its customers.

- Federal and State Environmental Laws: Compliance with the Safe Drinking Water Act and Clean Water Act is paramount.

- Emerging Contaminants: Managing substances like PFAS necessitates investment in advanced treatment solutions.

- Capital Investment: In 2023, California Water Service Group invested $266.3 million in capital expenditures, with environmental compliance being a significant driver.

- Water Quality Standards: Adherence to strict drinking water contaminant limits and wastewater discharge regulations is a continuous operational focus.

Decoupling Mechanism Legal Rulings

A significant legal development occurred in July 2024 when the California Supreme Court overturned a previous prohibition by the California Public Utilities Commission (CPUC) on water utilities employing decoupling mechanisms, such as the Water Revenue Adjustment Mechanism (WRAM). This ruling provides crucial legal backing for innovative rate structures.

This legal clarity is a game-changer for water utilities aiming to promote conservation. By allowing revenue decoupling, utilities can now more effectively separate their financial stability from the sheer volume of water sold. This removes a key financial disincentive to conservation efforts, as reduced water sales no longer automatically translate to reduced revenue for the utility.

- Legal Precedent: California Supreme Court ruling in July 2024 allows water utilities to use decoupling mechanisms like WRAM.

- Conservation Incentive: Decoupling separates utility revenue from water sales volume, encouraging efficiency.

- Financial Stability: This mechanism helps ensure revenue stability for utilities even with reduced water consumption.

- Regulatory Impact: The decision provides regulatory certainty for implementing conservation-focused rate designs.

The legal landscape for California Water Service Group (CWS) is dynamic, heavily influenced by regulatory decisions and evolving state mandates. The California Public Utilities Commission (CPUC) plays a pivotal role, with General Rate Case (GRC) proceedings in 2024 and 2025 directly shaping CWS's revenue and investment strategies. Furthermore, new conservation laws effective January 1, 2025, impose strict water-use targets, with non-compliance carrying significant civil liabilities.

California's Proposition 218 mandates public hearings for rate adjustments, potentially delaying changes. A significant July 2024 California Supreme Court ruling overturned a CPUC prohibition on decoupling mechanisms like the Water Revenue Adjustment Mechanism (WRAM), providing legal support for conservation-focused rate structures and enhancing utility financial stability.

| Legal Factor | Impact on CWS | Key Dates/Data |

|---|---|---|

| CPUC General Rate Cases | Dictate authorized revenues, capital plans, and rates. | Proceedings ongoing through 2024-2025. |

| Conservation Mandates (Making Conservation a California Way of Life) | Legally requires personalized urban water-use targets. | Effective January 1, 2025. Non-compliance incurs civil liabilities. |

| Proposition 218 | Requires public hearings and protest periods for rate adjustments. | Affects the timeline and approval of rate changes. |

| Water Revenue Adjustment Mechanism (WRAM) Ruling | Allows revenue decoupling, separating utility revenue from water sales volume. | California Supreme Court ruling in July 2024. |

Environmental factors

California's water supply faces significant disruption from climate change, characterized by extreme weather swings known as 'climate whiplash,' oscillating between severe droughts and intense floods. This variability, coupled with diminishing Sierra Nevada snowpack, a crucial water source, and hotter, drier conditions, directly impacts the reliability of water availability for communities and businesses.

These environmental shifts necessitate robust adaptive strategies for water sourcing, storage, and distribution to ensure long-term supply resilience. For instance, in 2023, California experienced a historic snowpack, but the preceding years were marked by severe drought, highlighting the volatility. The state's Department of Water Resources continues to invest in infrastructure upgrades and water conservation programs to mitigate these impacts.

California is confronting a significant water challenge, with projections indicating a 10% water supply shortfall by 2040. This looming deficit directly amplifies the urgency for widespread water conservation efforts across the state.

California Water Service Group (CWS) is particularly susceptible to these environmental pressures. The company must navigate stringent regulations mandating substantial reductions in customer water usage. Consequently, CWS is channeling resources into enhancing operational efficiency and launching comprehensive customer education campaigns to promote conservation.

California Water Service Group is actively addressing climate change by setting ambitious greenhouse gas emission reduction targets. They aim to cut Scope 1 and 2 emissions by 63% by 2035, using 2021 as their baseline year. This commitment aligns with scientific recommendations for climate action.

Achieving these targets necessitates significant investment in energy-efficient technologies and sustainable operational practices across their water systems. For example, upgrades to pumping stations and water treatment facilities are crucial for reducing energy consumption.

Water Quality Protection and Contaminant Management

Maintaining high water quality is a paramount environmental consideration for California Water Service Group, especially with the increasing focus on emerging contaminants such as per- and polyfluoroalkyl substances (PFAS). The company is committed to rigorous water quality testing to ensure adherence to all federal and state regulatory standards.

California Water Service Group has actively engaged in litigation concerning PFAS, securing settlements that underscore the persistent challenges and costs associated with managing these contaminants. For instance, in 2023, the company reported receiving $10.5 million in settlements related to PFAS contamination, demonstrating a tangible financial impact of this environmental factor.

- PFAS Mitigation Investments: The company continues to invest in advanced treatment technologies to remove PFAS and other contaminants, ensuring safe drinking water for its customers.

- Regulatory Compliance: Strict adherence to evolving water quality regulations, including those for PFAS, is a core operational priority.

- Litigation and Settlements: Settlements from PFAS litigation, like the $10.5 million received in 2023, reflect the financial implications of environmental contamination.

- Emerging Contaminant Monitoring: Ongoing monitoring and research into emerging contaminants are crucial for proactive water quality management.

Sustainable Groundwater Management and Recharge

California's Sustainable Groundwater Management Act (SGMA) mandates addressing critically overdrafted aquifers, a significant environmental challenge. California Water Service Group, like other utilities, must actively participate in balancing groundwater extraction with recharge initiatives to guarantee long-term water availability.

This focus on recharge is crucial for aquifer health. For instance, as of 2024, many regions in California continue to grapple with the impacts of prolonged drought, underscoring the urgency of SGMA implementation and groundwater recharge projects. California Water Service Group's investments in infrastructure and practices that support groundwater recharge are therefore directly tied to environmental sustainability and operational resilience.

- SGMA Compliance: Utilities must align operations with SGMA goals for aquifer sustainability.

- Groundwater Recharge: Investing in projects that replenish groundwater basins is a key environmental strategy.

- Water Availability: Balancing extraction and recharge directly impacts the long-term availability of water resources.

- Drought Resilience: Effective groundwater management enhances a utility's ability to withstand drought conditions.

California's water supply is increasingly volatile due to climate change, experiencing extreme shifts between drought and flood, impacting reliability. Diminishing Sierra Nevada snowpack and hotter conditions further strain resources, necessitating adaptive strategies for sourcing and storage.

California Water Service Group (CWS) faces stringent regulations for water usage reduction and is investing in efficiency and conservation education. The company is also committed to reducing greenhouse gas emissions by 63% by 2035 (from a 2021 baseline), requiring investments in energy-efficient technologies.

Maintaining water quality, particularly concerning emerging contaminants like PFAS, is a key environmental focus for CWS. The company has secured significant settlements, such as $10.5 million in 2023, related to PFAS contamination, highlighting the financial impact of environmental challenges.

Compliance with California's Sustainable Groundwater Management Act (SGMA) is critical for CWS to address aquifer overdraft and ensure long-term water availability. Investments in groundwater recharge projects are vital for drought resilience and environmental sustainability.

| Environmental Factor | Impact on CWS | Action/Response | Relevant Data/Year |

|---|---|---|---|

| Climate Change (Drought/Flood) | Water supply reliability | Adaptive sourcing, storage, conservation | 2023 historic snowpack vs. prior drought years |

| Greenhouse Gas Emissions | Operational costs, regulatory pressure | 63% reduction target by 2035 (2021 baseline) | Investment in energy-efficient tech |

| PFAS Contamination | Water quality compliance, litigation costs | Advanced treatment, litigation settlements | $10.5M settlement in 2023 |

| Groundwater Overdraft (SGMA) | Water availability, regulatory compliance | Groundwater recharge initiatives | Ongoing SGMA implementation |

PESTLE Analysis Data Sources

Our California Water Service Group PESTLE Analysis is built on data from official state and federal regulatory bodies, comprehensive environmental impact reports, and leading economic and demographic trend analyses. We incorporate insights from industry associations, public utility commission filings, and reputable news sources to ensure a holistic view.