California Water Service Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

California Water Service Group Bundle

California Water Service Group's position in the market is complex, with some services likely acting as reliable Cash Cows while others may be emerging Stars or potential Dogs. Understanding this dynamic is crucial for strategic planning.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

California Water Service Group's strategic acquisitions of smaller water utilities, like the 2023 purchase of Casa Loma Water Company and Palm Mutual Water Company, highlight its pursuit of growth areas. These moves are designed to expand its regulated asset base and customer reach, particularly in areas experiencing population increases. For instance, the Palm Mutual acquisition added approximately 1,200 service connections in Riverside County, a region with projected population growth.

California Water Service Group's commitment to infrastructure modernization is a significant driver of its growth, as evidenced by its substantial capital investment plans. The company allocated a record $471 million in 2024 and has proposed over $1.6 billion for the 2025-2027 period to upgrade aging pipelines and improve treatment facilities.

These extensive modernization efforts directly contribute to the expansion of the company's regulated asset base. This growth in assets is crucial for securing higher authorized returns and ensuring stable, predictable revenue streams within the regulated utility sector.

The focus on enhancing system resilience through these investments not only meets regulatory requirements but also positions California Water Service Group for long-term operational efficiency and reliability.

California Water Service Group is strategically investing in its wastewater and recycled water services, recognizing the increasing need for sustainable water management. This expansion is clearly demonstrated by their acquisition of Kukui'ula South Shore Community Services' wastewater system in Hawaii and their agreement to manage the Silverwood wastewater and recycled water systems in California. These moves align with a growing market demand for environmentally conscious water solutions.

The Silverwood project is a prime example of this growth, projected to support more than 15,000 customer connections once fully developed. This signifies substantial future revenue streams and operational scale within the recycled water sector, a key area for California Water Service Group's long-term strategy.

Advanced Water Treatment Technologies

California Water Service Group's investment in advanced water treatment technologies, particularly for emerging contaminants like PFAS, signifies a strategic move into a high-growth area. These investments, driven by increasingly stringent regulations and public demand for safer water, are crucial for maintaining compliance and enhancing service quality.

The company's commitment to these upgrades, though capital-intensive, positions it as a leader in water quality. For instance, in 2024, Cal Water continued its focus on infrastructure improvements, with capital expenditures projected to be around $330 million for the year, a significant portion of which is allocated to treatment and source water enhancements. This proactive stance is vital for supporting future rate increase requests and solidifying its market position.

- PFAS Remediation: Investing in technologies to remove per- and polyfluoroalkyl substances (PFAS) addresses a growing regulatory and public health priority.

- Facility Upgrades: Broader improvements to existing water treatment facilities ensure operational efficiency and compliance with evolving standards.

- Regulatory Compliance: Proactive adoption of advanced treatment methods helps meet or exceed current and anticipated water quality regulations.

- Market Leadership: Demonstrating leadership in critical treatment capabilities enhances the company's reputation and competitive advantage in securing new service areas or retaining existing ones.

Digital Transformation and Smart Water Systems

California Water Service Group (Cal Water) is actively pursuing digital transformation in its water systems, recognizing the immense potential for enhanced operational efficiency and service reliability. The company's commitment to upgrading Supervisory Control and Data Acquisition (SCADA) systems is a cornerstone of this strategy, enabling more centralized and intelligent management of its infrastructure. This focus on advanced technologies positions Cal Water to capitalize on high-growth opportunities within the water utility sector.

The exploration of digital water management, artificial intelligence (AI), and smart metering solutions represents a forward-thinking approach to water resource optimization. These investments are vital for implementing predictive maintenance protocols, thereby reducing unexpected failures and minimizing downtime. Furthermore, advanced leak detection capabilities, powered by these digital tools, are expected to significantly curb water loss, a critical factor in water conservation efforts.

These technological advancements are not merely about improving current operations; they are strategic drivers for long-term financial health and customer engagement. By optimizing water use and reducing operational costs through predictive maintenance and efficient resource allocation, Cal Water can achieve substantial cost savings. This, in turn, translates to improved service reliability and enhanced customer satisfaction, solidifying its position as a leader in the industry.

- SCADA System Upgrades: Cal Water is investing in modernizing its SCADA systems to enable real-time monitoring and control of water distribution networks.

- Digital Water Management: The company is exploring AI and advanced analytics to optimize water treatment, distribution, and conservation efforts.

- Smart Metering: Implementation of smart metering technology aims to provide customers with better insights into their water usage and facilitate more accurate billing.

- Predictive Maintenance: Leveraging data from digital systems to anticipate equipment failures and schedule maintenance proactively, reducing costly disruptions.

Stars in the BCG Matrix represent high-growth, high-market-share business units. For California Water Service Group, this would likely encompass areas where they are expanding rapidly and have a dominant position. Their strategic acquisitions and investments in growing regions, such as the Palm Mutual acquisition adding 1,200 connections, align with this concept. Furthermore, their proactive investments in advanced technologies and sustainable water solutions like recycled water are positioning them for future leadership in these high-growth segments.

| Business Area | Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| Regulated Water Services (Growth Regions) | High | High | Star |

| Wastewater & Recycled Water | High | Growing | Potential Star |

| Advanced Water Treatment Technologies | High | Emerging | Potential Star |

| Digital Transformation & Smart Water | High | Emerging | Potential Star |

What is included in the product

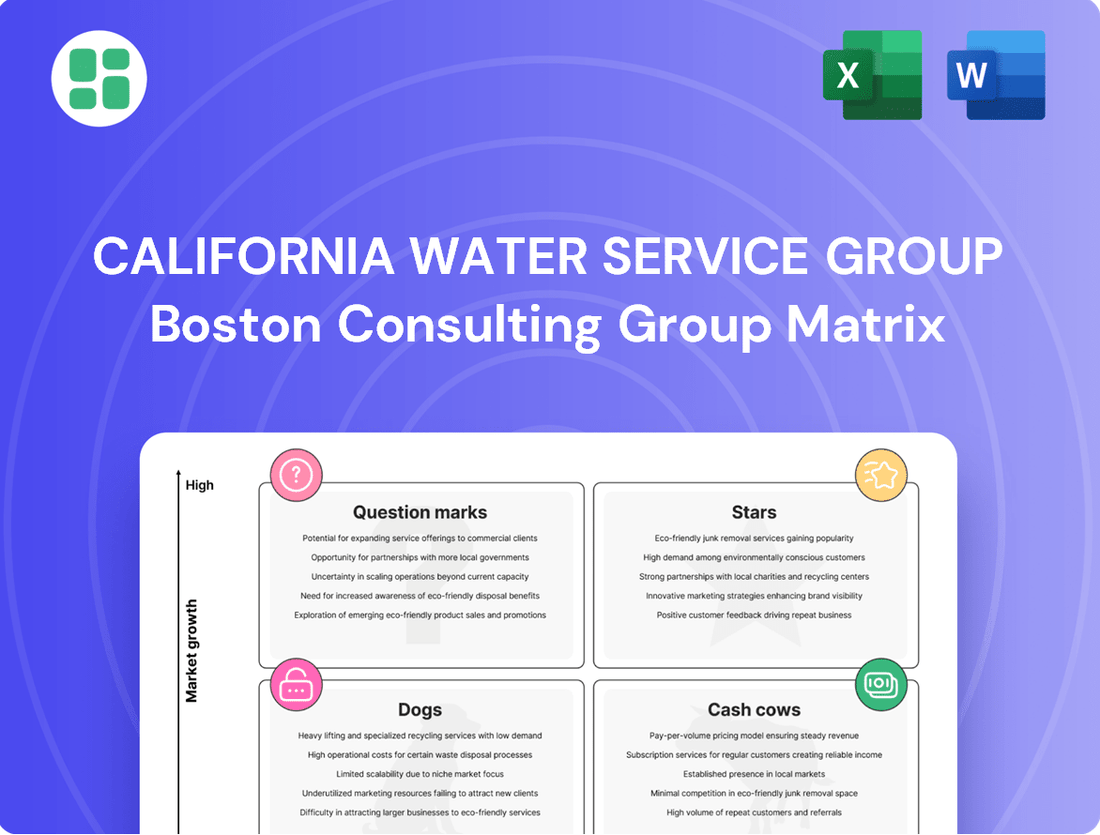

California Water Service Group's BCG Matrix highlights units to invest in, hold, or divest based on market share and growth.

A clear BCG Matrix visualizes California Water Service Group's portfolio, easing the pain of strategic resource allocation.

Cash Cows

California Water Service Group's regulated water services in California are its quintessential cash cow. This segment thrives in a mature market, characterized by significant barriers to entry, serving a vast and stable customer base. The inherent regulatory structure guarantees dependable and predictable revenue streams via approved rate adjustments, cementing its role as a consistent cash flow generator.

California Water Service Group's established operations in Washington, New Mexico, and Hawaii are indeed strong cash cows. These regulated water and wastewater services benefit from high market share and mature infrastructure, mirroring their California business. They consistently generate reliable, recurring revenue with predictable, lower capital expenditure needs for upkeep.

California Water Service Group’s substantial and loyal customer base, serving over 2.1 million individuals and entities including residential, commercial, industrial, and governmental clients, underpins its position as a cash cow. This broad reach translates into highly predictable and recurring revenue streams, a hallmark of mature, stable businesses.

The essential nature of water services inherently minimizes customer churn, ensuring consistent demand and a reliable cash flow. For instance, in 2023, California Water Service Group reported total operating revenues of $987.3 million, a testament to the stability derived from its widespread customer engagement.

Existing Water Infrastructure Assets

California Water Service Group's existing water infrastructure assets, a collection of pipes, treatment plants, and reservoirs developed over many years, form a substantial base of invested capital. These mature assets, despite needing continuous upkeep, are remarkably productive, yielding steady profits for the company. Their extended operational lifespan and critical role in providing essential services ensure a dependable contribution to the group's cash flow. For instance, in 2023, the company reported capital expenditures of $408.8 million, largely directed towards maintaining and upgrading these vital existing assets, underscoring their importance to ongoing operations and revenue generation.

- Established Infrastructure Base: Decades of investment have created a vast network of water delivery and treatment facilities.

- Consistent Revenue Generation: These mature assets reliably produce cash flow due to their essential service nature.

- Long-Term Value: The enduring operational life of these assets secures their role as a stable contributor to the company's financial health.

- Capital Allocation Focus: Significant capital, such as the $408.8 million invested in 2023, continues to be allocated towards maintaining and enhancing these core revenue-generating assets.

Predictable Regulatory Framework

California Water Service Group's (CWS) predictable regulatory framework is a key driver of its Cash Cow status. As a regulated utility, CWS can recover costs and earn a return on its infrastructure investments through a structured process. This stability is crucial for consistent cash flow generation.

The general rate case process, while sometimes lengthy, provides a clear path for CWS to adjust its rates to reflect operational costs and capital expenditures. This ensures the long-term financial viability of its core water utility operations.

- Predictable Revenue Streams: Regulated rates ensure a stable and predictable income stream, allowing for effective financial planning.

- Cost Recovery Mechanism: The framework allows CWS to recover necessary operating and capital expenses, safeguarding profitability.

- Return on Investment: Utilities are allowed a reasonable return on invested capital, incentivizing infrastructure upgrades and maintenance.

- Financial Stability: This regulatory environment contributes significantly to CWS's financial health and its ability to generate consistent cash.

California Water Service Group's regulated water operations across its service territories, including California, Washington, New Mexico, and Hawaii, represent its primary cash cows. These segments benefit from mature markets, high barriers to entry, and a stable, essential customer base. The predictable revenue streams, driven by regulatory frameworks that allow for cost recovery and a return on invested capital, solidify their position as consistent cash generators.

The essential nature of water services, coupled with CWS's established infrastructure and substantial customer base of over 2.1 million individuals and entities, ensures consistent demand and minimal churn. This stability is reflected in its financial performance, with 2023 operating revenues reaching $987.3 million, underscoring the reliable cash flow generated by these core utility operations.

| Segment | Market Maturity | Revenue Stability | Capital Intensity | BCG Classification |

| Regulated Water Services (CA) | High | Very High | Moderate | Cash Cow |

| Regulated Water Services (WA, NM, HI) | High | High | Moderate | Cash Cow |

Delivered as Shown

California Water Service Group BCG Matrix

The California Water Service Group BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive immediately after your purchase. This comprehensive report, meticulously crafted for strategic insight, is ready for immediate download and use without any alterations or additional content.

Rest assured, the BCG Matrix analysis for California Water Service Group presented here is the exact file you will acquire upon completing your purchase. This professionally formatted report is designed to provide actionable strategic clarity, ensuring you receive a finished product ready for immediate application in your business planning.

What you see is the definitive California Water Service Group BCG Matrix report that will be delivered to you after purchase. This preview showcases the final, fully editable document, guaranteeing no hidden charges or demo content, just a high-quality strategic tool for your analysis.

Dogs

California Water Service Group (CWS) likely has several small, isolated water systems that function as Dogs in its BCG Matrix. These systems, due to their limited customer base, struggle with high per-customer operating costs, often exacerbated by aging infrastructure that demands significant capital for maintenance or modernization. For instance, a system serving only a few hundred customers might have fixed costs that are a substantial portion of its revenue, making profitability a challenge.

These legacy operations can represent a drain on resources, as the revenue generated may not adequately cover the necessary investments for upgrades or even routine maintenance. In 2023, CWS reported capital expenditures of $366.5 million, a significant portion of which would be allocated to system improvements across its diverse portfolio. Smaller, isolated systems often require a disproportionately larger share of these funds relative to their revenue contribution, highlighting their Dog status.

The strategic options for these Dog assets are typically divestiture or a substantial investment to integrate them into larger, more efficient operational units. This integration aims to spread fixed costs over a broader customer base, thereby improving the cost-to-serve ratio and potentially turning a struggling segment into a more viable part of the portfolio.

Underperforming Non-Core Property Management Services within California Water Service Group's BCG Matrix would represent business activities that are not central to water utility operations and are not performing well. These could be properties or services that have a low market share and low growth potential, meaning they aren't contributing significantly to the company's overall success.

For instance, if California Water Service Group had a portfolio of vacant commercial properties or offered ancillary services like landscaping for non-utility sites that consistently incurred losses, these would likely fall into the Dogs category. In 2023, while the company's primary focus remained on water and wastewater services, any such non-core ventures that demonstrated negative cash flow or failed to meet internal return thresholds would be candidates for this classification.

California Water Service Group (CWSG) has strategically divested or planned divestitures for certain assets that fall into the Dogs category of the BCG Matrix. These are typically non-core business units or underperforming utility assets that no longer align with the company's primary growth objectives or present a significant operational burden. For instance, in 2023, CWSG completed the sale of its wastewater utility operations in Texas, a move aimed at streamlining its portfolio and focusing on its core water utility businesses.

These divestitures are driven by a recognition that certain segments exhibit low market share and limited growth prospects, contributing minimally to overall profitability. By shedding these assets, CWSG aims to free up capital and management attention, allowing for greater investment in its more promising and strategically important water utility operations. This approach is crucial for optimizing resource allocation and enhancing the company's financial performance.

Outdated Infrastructure Requiring Excessive Maintenance

Segments of California Water Service Group's infrastructure that are severely outdated, require continuous, costly maintenance, and offer minimal opportunities for rate base expansion or efficiency gains can be categorized as Dogs. These assets consume significant operational expenditure without contributing proportionally to revenue or strategic growth, becoming cash traps. For instance, in 2024, the company continued to address aging water mains, with a significant portion of its capital expenditures focused on replacement projects rather than new growth initiatives. These legacy systems often face challenges in meeting modern standards without substantial, difficult-to-recover investments, impacting overall profitability.

- Aging Water Mains: A substantial portion of California Water Service Group's infrastructure consists of aging water mains, many installed decades ago, necessitating frequent repairs and replacements.

- High Maintenance Costs: These older systems incur disproportionately high maintenance and operational costs due to their condition, diverting capital from growth-oriented projects.

- Limited Rate Base Expansion: Outdated infrastructure offers minimal opportunities for increasing the rate base, as investments are primarily for maintaining existing service rather than expanding capacity or efficiency.

- Cash Consumption: Such assets act as cash traps, consuming significant operational expenditure without generating commensurate returns or contributing to the company's strategic growth objectives.

Segments Facing Persistent Unrecoverable Cost Burdens

California Water Service Group (CWS) might identify certain operational segments or service areas within its portfolio as facing persistent unrecoverable cost burdens, potentially fitting into the Dogs quadrant of a BCG Matrix. These are areas where unique local challenges, such as stringent environmental regulations or unexpected operational difficulties, create costs that cannot be fully recovered through approved rate structures. Consequently, these segments struggle to achieve profitability and can act as a drag on the company's overall financial health.

For instance, a specific water system experiencing prolonged drought conditions coupled with aging infrastructure might incur substantial capital expenditure for repairs and water conservation programs. If regulatory approvals for rate increases lag or are insufficient to cover these escalating costs, the segment's profitability will suffer. This leads to a low effective market share, not due to lack of demand, but due to an inability to generate sustainable earnings. In 2023, CWS reported that capital expenditures for infrastructure improvements were significant, with over $300 million invested across its service territories, highlighting the ongoing need to address system upgrades which can disproportionately impact areas with higher unrecoverable costs.

- Environmental Compliance Costs: Specific service areas with particularly challenging water quality standards or watershed protection mandates may incur higher operational and capital expenses for compliance.

- Aging Infrastructure: Older systems requiring frequent, costly repairs and upgrades that cannot be fully recouped through current rate structures contribute to unrecoverable costs.

- Unforeseen Operational Hurdles: Localized issues like groundwater contamination requiring extensive treatment or unexpected supply disruptions necessitating expensive alternative sourcing can create these burdens.

- Regulatory Lag: Delays or limitations in obtaining rate case approvals to offset rising operational and capital expenditures can exacerbate unrecoverable cost situations.

Segments of California Water Service Group's infrastructure that are severely outdated, require continuous, costly maintenance, and offer minimal opportunities for rate base expansion or efficiency gains can be categorized as Dogs. These assets consume significant operational expenditure without contributing proportionally to revenue or strategic growth, becoming cash traps. For instance, in 2024, the company continued to address aging water mains, with a significant portion of its capital expenditures focused on replacement projects rather than new growth initiatives. These legacy systems often face challenges in meeting modern standards without substantial, difficult-to-recover investments, impacting overall profitability.

Aging water mains, high maintenance costs, limited rate base expansion, and cash consumption are key characteristics of these Dog assets. For example, in 2023, CWS reported capital expenditures of $366.5 million, with a significant portion directed towards system improvements. Smaller, isolated systems often require a disproportionately larger share of these funds relative to their revenue contribution, highlighting their Dog status.

California Water Service Group (CWSG) has strategically divested or planned divestitures for certain assets that fall into the Dogs category. These are typically non-core business units or underperforming utility assets that no longer align with the company's primary growth objectives or present a significant operational burden. By shedding these assets, CWSG aims to free up capital and management attention, allowing for greater investment in its more promising and strategically important water utility operations.

| Characteristic | Description | Impact on CWS | Example (Illustrative) |

| Aging Infrastructure | Older water mains, often decades old, requiring frequent repairs. | Increases operational costs and diverts capital. | Replacement of 100-year-old cast iron pipes. |

| High Maintenance Costs | Disproportionately high costs for upkeep of legacy systems. | Reduces profitability and cash flow. | Increased leak detection and repair expenses. |

| Limited Growth Potential | Minimal opportunities for rate base expansion or efficiency gains. | Hinders revenue growth and return on investment. | Service areas with stagnant customer growth. |

| Cash Consumption | Assets that consume significant expenditure without commensurate returns. | Acts as a drag on overall financial performance. | Systems with consistent negative operating margins. |

Question Marks

California Water Service Group's new technology pilots and R&D initiatives, such as early-stage investments in advanced metering infrastructure and AI/ML for operational optimization, are classic examples of Stars in the BCG Matrix. These ventures are in high-growth potential areas, but currently possess a low market share due to their pilot nature or significant upfront investment requirements. For instance, as of 2024, the company has been actively testing smart meter technology across various service areas, aiming to improve leak detection and customer engagement.

Early-stage water reuse projects, like California Water Service Group's PureWater Peninsula initiative, are vital for future water security but currently represent a low market share. These ambitious endeavors face significant upfront capital requirements and complex regulatory approvals, placing them in the question mark category of the BCG matrix. For instance, the PureWater Peninsula project, aiming to produce high-quality recycled water, requires substantial investment before it can contribute meaningfully to the overall water supply.

Exploring new, underserved geographic markets for California Water Service Group (CWS) would place them in the Question Mark category of the BCG matrix. These ventures carry significant risk due to high initial investments in infrastructure and navigating complex regulatory landscapes in unfamiliar territories. For instance, expanding into a rapidly growing but water-scarce region in Arizona or Nevada would require substantial capital expenditure before generating any meaningful revenue, making the immediate return on investment uncertain.

Specialized Non-Regulated Consulting Services

California Water Service Group (CWS) could explore expanding into specialized non-regulated consulting services, such as advanced water quality testing or offering strategic advice to smaller, independent water utilities. These niche markets are experiencing growth, driven by increasing regulatory complexity and the need for specialized expertise. However, CWS would likely face strong competition from established consulting firms, resulting in a low initial market share.

To succeed in these ventures, CWS would need to allocate substantial resources towards marketing and dedicated business development efforts. This investment is crucial for building brand recognition and establishing a foothold against incumbent competitors. For instance, in 2024, the global water and wastewater treatment market was valued at approximately $660 billion, with consulting services representing a significant and growing segment within this larger industry.

- Market Opportunity: Growing demand for specialized water quality analysis and consulting for smaller utilities.

- Competitive Landscape: Presence of established consulting firms with existing market share.

- Investment Needs: Significant capital required for marketing, sales, and business development.

- Potential Growth: Opportunity to capture market share in a growing, specialized sector.

Advanced Conservation and Demand Management Programs

California Water Service Group's advanced conservation and demand management programs, while crucial for long-term sustainability, likely fall into the question mark category of the BCG matrix. These initiatives, such as incentivizing drought-tolerant landscaping or implementing smart meter technology for real-time usage monitoring, demand significant upfront capital. For instance, a statewide push for smart meter deployment could represent millions in initial investment, with uncertain payback periods.

These programs are designed to address a growing need for efficient water use, especially in a state like California facing persistent drought conditions. However, their financial viability is often tied to customer adoption rates and regulatory support, making their market share growth and potential profitability unpredictable in the near term. For example, the success of a voluntary water reduction program might depend heavily on public engagement and the perceived severity of water scarcity.

- High initial investment: Programs require substantial capital for technology, outreach, and incentives.

- Uncertain financial returns: Payback periods are often long and dependent on customer adoption.

- Growing sustainability need: Addresses increasing demand for efficient resource management.

- Potential for future growth: If successful, these programs could become industry standards, shifting them to stars.

California Water Service Group's ventures into new geographical markets represent question marks due to high initial investments and regulatory hurdles. For instance, expanding into water-scarce regions like Arizona or Nevada in 2024 would necessitate significant capital before generating returns. These markets offer growth potential but carry inherent risks, making their market share uncertain.

Exploring specialized, non-regulated consulting services, such as advanced water quality analysis, also falls into the question mark category. While the global water and wastewater treatment market was valued at approximately $660 billion in 2024, CWS would face established competitors, leading to a low initial market share. Substantial investment in marketing and business development is crucial for success in these growing niche sectors.

BCG Matrix Data Sources

Our BCG Matrix for California Water Service Group is built on a foundation of financial disclosures, industry growth forecasts, and competitive market analysis to provide strategic insights.