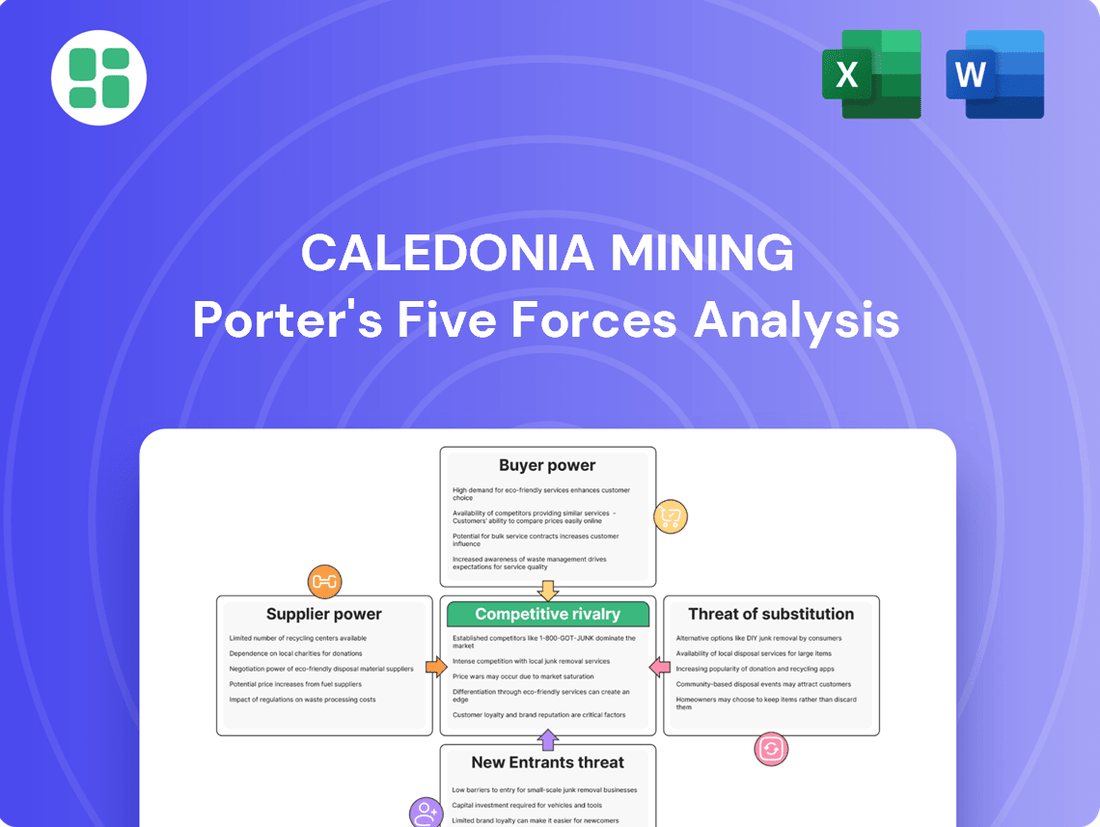

Caledonia Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Caledonia Mining operates within a dynamic gold mining landscape, facing significant bargaining power from suppliers of essential equipment and consumables. The threat of new entrants, while potentially moderated by high capital requirements, remains a factor to consider. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Caledonia Mining’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration is a key factor in Caledonia Mining's operational costs. For instance, the market for specialized underground mining equipment, like continuous miners and haul trucks, is often dominated by a small number of global manufacturers. If Caledonia relies heavily on these few suppliers, those suppliers gain significant leverage to increase prices or impose less favorable contract terms. In 2023, the global market for mining equipment saw continued consolidation, with major players like Caterpillar and Komatsu holding substantial market share, potentially limiting options for buyers like Caledonia.

Caledonia Mining could encounter significant switching costs when changing suppliers for essential materials or equipment. These costs can encompass expenses related to adapting existing machinery, training personnel on new operational procedures, and the administrative burden of re-validating new suppliers, all of which can make a transition prohibitively expensive.

For instance, if Caledonia relies on specialized mining equipment from a particular manufacturer, switching to a different brand might necessitate substantial capital investment in new machinery and extensive retraining for their operational teams. This financial and operational hurdle effectively locks Caledonia into existing supplier agreements, even when more advantageous alternatives might become available in the market.

The uniqueness of inputs for gold mining, particularly for an underground operation like Caledonia Mining's Blanket Mine, significantly bolsters supplier bargaining power. Specialized drilling equipment, advanced ventilation systems, and proprietary geological software are often sourced from a select few providers, limiting Caledonia's options for finding readily available substitutes.

Threat of Forward Integration

The threat of forward integration by suppliers in the gold mining sector, particularly for Caledonia Mining, is generally low. This is due to the significant capital investment and specialized expertise required to operate a mine, making it impractical for most suppliers of consumables or equipment to enter gold production directly. For instance, in 2024, the average capital expenditure for developing a new gold mine can range from hundreds of millions to over a billion dollars, a barrier most suppliers cannot overcome.

However, there's a nuanced consideration regarding specialized service providers or technology vendors. These entities might offer integrated solutions that effectively absorb certain mining processes, thereby reducing a miner's direct control. While not direct production competition, this can shift the value chain. For example, a company providing advanced ore processing technology might also offer toll processing services, potentially limiting a mine's internal processing capabilities.

- Low Likelihood of Direct Forward Integration: Suppliers of raw materials, explosives, or general equipment typically lack the capital and operational expertise to engage in gold extraction and processing, a barrier exemplified by the high upfront costs of mining operations.

- Potential for Service Integration: Specialized technology and service providers may offer end-to-end solutions that encompass processing or logistics, indirectly impacting a miner's operational autonomy.

- Limited Competitive Threat: Direct competition from suppliers entering gold production is minimal, allowing mining companies like Caledonia Mining to maintain primary control over their core extraction and refining activities.

Importance of Supplier to Buyer

The significance of Caledonia Mining as a customer directly impacts its suppliers' bargaining power. If Caledonia constitutes a minor fraction of a supplier's total sales, that supplier might be less inclined to provide accommodating terms or special pricing. For instance, if a key supplier's business is heavily diversified across many clients, Caledonia's individual purchasing volume may not be substantial enough to leverage significant concessions.

Conversely, when Caledonia represents a substantial portion of a supplier's revenue, it gains considerable leverage. This allows Caledonia to negotiate more favorable pricing, payment terms, or even influence product development. In 2024, for example, mining equipment suppliers often prioritize clients that represent a significant portion of their order book, especially in a market where demand for specialized machinery can fluctuate.

- Supplier Dependence: If a supplier relies heavily on Caledonia for its business, Caledonia's bargaining power increases.

- Revenue Contribution: The percentage of a supplier's total revenue that Caledonia represents is a key factor in determining leverage.

- Market Conditions: In a seller's market for mining supplies, suppliers generally have more power; in a buyer's market, Caledonia's power grows.

- Contractual Agreements: Long-term supply contracts can lock in terms, potentially limiting the immediate bargaining power of either party.

The bargaining power of suppliers for Caledonia Mining is influenced by several factors, including supplier concentration and the uniqueness of inputs. For specialized underground mining equipment, a concentrated market with few dominant manufacturers like Caterpillar and Komatsu, as seen in 2023, can give suppliers significant leverage. High switching costs, associated with retraining and equipment adaptation, further strengthen this position.

The limited availability of substitutes for critical mining inputs and the high capital requirements for forward integration by suppliers generally keep their direct competitive threat low. However, specialized service providers offering integrated solutions can indirectly impact operational autonomy.

Caledonia's significance as a customer also plays a crucial role. If Caledonia represents a substantial portion of a supplier's revenue, as is often prioritized by equipment suppliers in 2024's fluctuating market, Caledonia gains considerable negotiation power for more favorable terms.

| Factor | Impact on Caledonia Mining | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier bargaining power | Few global manufacturers dominate specialized mining equipment market (e.g., Caterpillar, Komatsu market share in 2023). |

| Switching Costs | Increases supplier bargaining power | High costs for retraining, equipment adaptation, and administrative processes. |

| Uniqueness of Inputs | Increases supplier bargaining power | Reliance on specialized drilling, ventilation, and software from limited providers. |

| Forward Integration Threat | Generally Low | High capital investment (hundreds of millions to over $1 billion for new gold mine development in 2024) deters suppliers. |

| Caledonia's Customer Significance | Decreases supplier bargaining power (if Caledonia is a major client) | Suppliers prioritize clients representing significant order book portions in 2024. |

What is included in the product

This analysis delves into the competitive forces impacting Caledonia Mining, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk posed by substitute products within the gold mining sector.

Instantly identify and mitigate competitive threats with a dynamic Porter's Five Forces analysis, providing clear insights into Caledonia Mining's market landscape.

Customers Bargaining Power

Caledonia Mining's customer base is highly fragmented and global, primarily comprising gold refiners, central banks, and industrial users. This widespread distribution of buyers means no single customer holds significant sway over pricing or terms. For instance, in 2023, Caledonia's sales were distributed across numerous entities, with no single buyer representing more than 10% of total revenue, a pattern consistent with previous years.

In the gold market, product uniqueness is virtually non-existent. One ounce of pure gold is fundamentally the same as any other, making origin irrelevant to the customer. This means buyers are primarily driven by price, seeking the most competitive supplier for their needs.

Because gold is a commodity, Caledonia Mining cannot leverage product differentiation to charge a premium. Instead, its ability to attract and retain customers hinges on its production efficiency and cost competitiveness. For instance, in 2024, the average all-in sustaining cost for gold producers globally hovered around $1,300 per ounce, a key benchmark for price sensitivity.

Customers in the gold market, especially major institutional investors and refiners, have a wealth of knowledge about global supply, demand, and price movements. This transparency means they are well-informed, reducing Caledonia's leverage in setting prices through less clear methods. For instance, readily accessible global gold prices, tracked by numerous financial outlets, empower buyers to negotiate effectively.

Threat of Backward Integration

The threat of customers integrating backward into gold mining for Caledonia Mining is exceptionally low. The sheer scale of capital required, estimated in the hundreds of millions for new mine development, coupled with the highly specialized geological and engineering expertise, presents formidable barriers. For instance, establishing a new gold mine typically involves extensive exploration, feasibility studies, and securing permits, a process that can take years and significant upfront investment, making it impractical for downstream players like refiners or jewelry makers.

This lack of backward integration capability significantly limits the bargaining power of Caledonia's customers. They are unlikely to acquire or develop their own gold mining operations, meaning they must rely on external suppliers like Caledonia for their raw material needs. This dynamic strengthens Caledonia's position, as customers cannot easily bypass the company to secure their gold supply chain.

- Immense Capital Requirements: Developing a new gold mine can cost upwards of $500 million to over $1 billion, a prohibitive expense for most customers.

- Specialized Expertise: Gold mining demands deep knowledge in geology, metallurgy, engineering, and environmental management, which downstream customers typically lack.

- Regulatory Hurdles: Obtaining mining permits and adhering to stringent environmental and safety regulations is a complex and time-consuming process.

- Limited Customer Capability: Refiners and jewelry manufacturers are focused on processing and marketing, not primary extraction, making backward integration unfeasible.

Price Sensitivity

Given gold's status as a commodity, customer price sensitivity is naturally high. Buyers are focused on securing gold at or below the prevailing market rate. This means Caledonia's profitability hinges significantly on its operational cost efficiency and the global gold price, rather than its capacity to negotiate premium prices with individual buyers.

- Gold Price Volatility: The average gold price in 2024 has fluctuated, impacting buyer willingness to pay above market rates.

- Cost of Production: Caledonia's ability to maintain a low cost per ounce is crucial for profitability when customers are price-sensitive.

- Market Influence: As a commodity, gold prices are set by global supply and demand, limiting any single producer's pricing power.

Caledonia Mining faces limited customer bargaining power due to the fragmented nature of its global customer base, which includes refiners and industrial users. No single customer typically accounts for a significant portion of Caledonia's revenue, preventing any individual buyer from dictating terms. This is reinforced by gold's commodity status, where product differentiation is minimal, and buyers prioritize price competitiveness.

The lack of backward integration by customers, who would need immense capital and specialized expertise to mine gold themselves, further reduces their leverage. For instance, establishing a new gold mine can cost hundreds of millions, a prohibitive barrier for downstream players. This reliance on external suppliers like Caledonia bolsters the company's position in negotiations.

| Customer Type | Market Share Influence | Price Sensitivity |

| Gold Refiners | Low (fragmented) | High |

| Central Banks | Low (diversified sourcing) | Moderate |

| Industrial Users | Low (niche applications) | Moderate to High |

Preview the Actual Deliverable

Caledonia Mining Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Caledonia Mining Corporation, providing an in-depth examination of industry competition, supplier and buyer power, threat of new entrants, and the availability of substitutes. The document you see here is precisely what you will receive immediately after purchase, ensuring you get the full, professionally formatted analysis without any alterations or missing sections.

Rivalry Among Competitors

The global gold mining sector is quite crowded, featuring a wide array of players from massive international firms to smaller, localized operations. Caledonia Mining, operating as a mid-tier producer, faces competition from this diverse global landscape, including companies with a significant presence in Southern Africa.

While global gold demand, driven by investment and central bank acquisitions, has shown upward trends, the pace of new gold discoveries and mine output expansion is often constrained. This dynamic within a more mature industry can heighten competitive rivalry as firms aggressively pursue existing market share.

The slower growth in new supply, coupled with robust demand, contributed to gold prices reaching record highs in early 2024, with some analysts projecting continued strength into 2025. For instance, gold prices surpassed $2,400 per ounce in April 2024, creating a more advantageous operational landscape for established producers.

Gold mining is inherently capital-intensive, meaning companies like Caledonia Mining face substantial fixed costs. These include significant expenses for exploration, developing new mine sites, and the ongoing operational costs of running existing mines. These high upfront and ongoing investments create a strong incentive for producers to maximize output to spread these fixed costs over a larger volume of production.

This drive for high production levels can intensify competitive rivalry, particularly when global gold prices are under pressure. Companies are less likely to cut back production when prices fall if they need to cover their substantial fixed overheads. Caledonia Mining’s projected capital expenditure for 2025, estimated at $30 million, underscores the continuous investment required in this sector, contributing to the pressure to maintain operational levels and thus influencing competitive dynamics.

Product Differentiation and Switching Costs

Gold, being a commodity, offers minimal product differentiation, forcing competitors like Caledonia Mining to focus heavily on price and cost efficiency. This lack of unique features means that competition often boils down to who can extract and refine gold at the lowest cost. In 2023, the average all-in sustaining cost for gold producers globally hovered around $1,300 per ounce, highlighting the pressure to maintain lean operations.

Switching costs for customers, whether they are refiners, jewelers, or investors, are virtually non-existent. Gold from one mine is essentially the same as gold from another, making it easy for buyers to shift their business based solely on price. This interchangeability directly fuels the intense price-based competition observed across the mining sector.

- Low Product Differentiation: Gold's commodity nature means little distinction between producers' offerings.

- Price-Based Competition: Rivalry centers on cost efficiency and the ability to offer gold at competitive prices.

- Negligible Switching Costs: Customers can easily switch suppliers without incurring significant costs or losing value.

- Intensified Rivalry: The combination of low differentiation and switching costs heightens competitive pressures among gold miners.

Strategic Stakes and Exit Barriers

Caledonia Mining's strategic stakes are substantial, reflecting the immense capital and time required for mine development, often spanning decades. For instance, Blanket Mine, Caledonia's flagship asset, has undergone significant investment to reach its current production levels, with ongoing capital expenditure for expansion. This long-term commitment inherently raises the stakes for all players in the gold mining sector.

Exit barriers for mining companies like Caledonia are notably high. These are driven by the specialized nature of mining equipment and infrastructure, which have limited alternative uses. Furthermore, significant environmental rehabilitation obligations and ongoing social commitments to local communities create substantial costs and complexities for any company considering divesting its operations, thereby intensifying competition among existing participants.

- High Strategic Stakes: Mining operations demand long-term, significant capital investment, making strategic commitment crucial for companies like Caledonia Mining.

- Elevated Exit Barriers: Specialized assets, environmental remediation, and social responsibilities create substantial hurdles for companies looking to leave the mining market.

- Intensified Rivalry: The combination of high stakes and exit barriers naturally leads to increased competitive rivalry as firms are less likely to withdraw, pushing them to compete more aggressively for market share and profitability.

- 2024 Outlook: As of early 2024, the gold mining industry continues to face these persistent challenges, with companies focusing on operational efficiency and cost management to navigate the competitive landscape.

Competitive rivalry in the gold mining sector is fierce due to the commodity nature of gold, leading to minimal product differentiation and virtually non-existent switching costs for buyers. This forces companies like Caledonia Mining to compete primarily on price and operational efficiency. The industry's capital-intensive nature and high exit barriers further entrench existing players, intensifying the pressure to maximize production and maintain market share, especially as gold prices reached record highs above $2,400 per ounce in early 2024.

| Metric | Value (Approximate) | Year | Source/Context |

|---|---|---|---|

| Global Gold Price | >$2,400/ounce | April 2024 | Record highs, driving revenue for producers |

| Average All-in Sustaining Cost (Global Gold Producers) | ~$1,300/ounce | 2023 | Highlights pressure for cost efficiency |

| Caledonia Mining's Projected Capex | $30 million | 2025 | Indicates ongoing investment needs |

SSubstitutes Threaten

The threat of substitutes for gold, and by extension Caledonia Mining's primary product, is significant as investors have a growing array of alternative assets to consider. For instance, in 2024, U.S. Treasury bonds, a traditional safe-haven, offered attractive yields, potentially drawing capital away from gold. Real estate also continues to be a popular alternative, with housing markets showing resilience in many developed economies.

Furthermore, the increasing institutional adoption and accessibility of cryptocurrencies, particularly Bitcoin, present a modern substitute for gold as a store of value and inflation hedge. While gold's historical gravitas is undeniable, the digital asset space's rapid growth and innovation in 2024 mean investors have more choices than ever to diversify their portfolios away from traditional commodities.

While gold's unique properties like exceptional conductivity and corrosion resistance make widespread substitution difficult in industrial uses, there are potential threats from alternative materials. In the electronics sector, for instance, cheaper or more efficient conductive materials are being explored for niche applications, potentially impacting demand for gold in specific components.

Other precious metals, such as silver, platinum, and palladium, present a notable threat of substitution for gold across various sectors. In the jewelry market, these alternatives can be chosen based on aesthetic appeal and price sensitivity, directly impacting gold's demand. For instance, while gold prices have seen fluctuations, silver's price can be significantly lower, making it an attractive substitute for many consumers.

In investment portfolios, investors may allocate capital to silver or platinum as hedges against inflation or as alternative stores of value, especially when gold's premiums become too high. Industrial applications, which utilize gold for its conductivity and corrosion resistance, can also pivot to platinum or palladium if their performance characteristics are comparable and their cost-effectiveness improves. For example, catalytic converters in vehicles often use platinum and palladium, showcasing their viability in industrial contexts.

Consumer Preferences and Trends

Changes in consumer preferences significantly influence the demand for gold, a key factor in assessing the threat of substitutes for Caledonia Mining. For instance, evolving tastes in the jewelry market, a primary driver of gold consumption, can either bolster or diminish its appeal. A notable trend in recent years has been a move towards more minimalist or ethically sourced jewelry, which could potentially reduce demand for traditional, heavier gold pieces.

While shifts towards alternative materials like lab-grown diamonds or sustainable metals might seem like substitutes, gold jewelry’s enduring appeal as a store of value and a symbol of luxury remains strong. In 2024, the global gold jewelry market was valued at approximately $200 billion, underscoring its continued significance. This indicates that while alternatives exist, gold's established position in consumer desire and investment portfolios provides a degree of resilience against substitution.

The threat of substitutes is also influenced by the perceived value and emotional connection consumers have with gold. Despite the rise of other precious metals and gemstones, gold’s historical significance and its role as a safe-haven asset in uncertain economic times continue to support its demand. This multifaceted appeal means that direct substitution is not always straightforward, especially when considering gold's dual role as both an adornment and an investment vehicle.

Key considerations regarding substitutes for gold demand include:

- Shifts in Jewelry Design: A move towards less ornate or alternative metal jewelry could reduce gold consumption.

- Rise of Lab-Grown Gems: The increasing popularity of lab-grown diamonds and other gemstones might divert consumer spending from gold jewelry.

- Investment Alternatives: While gold is a store of value, other assets like cryptocurrencies or real estate can also serve this purpose, potentially acting as substitutes for investment demand.

- Ethical Sourcing Trends: Growing consumer demand for ethically sourced materials could favor alternatives if gold mining practices are perceived as problematic.

Macroeconomic Factors and Investor Sentiment

The threat of substitutes for gold, and by extension Caledonia Mining's primary product, is significantly shaped by macroeconomic conditions and how investors feel about the economy. When the economy is stable and inflation is low, gold may not seem as attractive, and people might put their money into other investments that offer potentially higher returns. For instance, in 2024, as inflation showed signs of moderating in many developed economies, interest in assets like bonds and equities saw renewed interest, potentially drawing capital away from gold.

However, the opposite is also true. Times of global political tension or rising inflation often make gold a more appealing choice for investors looking to protect their wealth. This safe-haven demand can increase the price of gold, making it a more competitive substitute for other assets that are perceived as riskier. In late 2023 and early 2024, ongoing geopolitical conflicts and persistent inflation concerns in certain regions did indeed bolster gold prices, demonstrating this dynamic.

- Economic Stability vs. Uncertainty: Low inflation and stable economies can reduce gold's safe-haven appeal.

- Inflationary Pressures: Rising inflation typically increases demand for gold as an inflation hedge.

- Geopolitical Risks: Global instability often drives investors towards gold, increasing its attractiveness relative to other assets.

- Investor Sentiment Shifts: Changes in overall market confidence directly impact the perceived value of gold as a store of wealth.

The threat of substitutes for gold, Caledonia Mining's primary product, remains a persistent challenge as investors have a widening array of alternative assets. In 2024, for example, U.S. Treasury bonds offered competitive yields, drawing capital that might otherwise flow into gold. Similarly, real estate markets demonstrated resilience, continuing to be a popular alternative for wealth preservation.

Cryptocurrencies, particularly Bitcoin, have emerged as a significant modern substitute, increasingly viewed as a digital store of value and an inflation hedge by institutional investors. The rapid innovation and growing accessibility within the digital asset space in 2024 provided investors with more options to diversify away from traditional commodities like gold.

| Substitute Asset | 2024 Investor Appeal Factor | Potential Impact on Gold Demand |

|---|---|---|

| U.S. Treasury Bonds | Attractive yields, perceived safety | Draws capital away from gold as a safe haven |

| Real Estate | Tangible asset, inflation hedge potential | Offers diversification and wealth preservation |

| Cryptocurrencies (e.g., Bitcoin) | Digital store of value, inflation hedge narrative | Attracts younger investors, offers alternative to gold's traditional role |

| Other Precious Metals (Silver, Platinum) | Lower price points, industrial applications | Competes in jewelry and industrial sectors based on cost and utility |

Entrants Threaten

The gold mining sector demands immense capital, creating a formidable barrier to entry. Caledonia Mining's substantial investments, such as the ongoing capital expenditure at Blanket Mine and its development of new ventures like Bilboes and Motapa, highlight the significant financial commitment required. These high upfront costs deter many potential new players from entering the market.

The threat of new entrants due to access to scarce resources and reserves is a significant concern for Caledonia Mining. Identifying and acquiring economically viable gold deposits is becoming increasingly difficult, as the most accessible, high-grade deposits have largely been discovered. For instance, global gold discoveries have been on a downward trend for years, making it harder for newcomers to establish a foothold.

The mining sector is heavily regulated, with strict rules on environmental protection, social impact, and obtaining necessary permits. For instance, in 2024, the World Bank's Doing Business report highlighted that obtaining a mining license in many African nations can take over 100 days, involving multiple government agencies.

These complex and often lengthy approval processes, especially in regions like Zimbabwe where Caledonia Mining operates, demand substantial time and financial investment. This creates a significant barrier, deterring potential new competitors from entering the market.

Economies of Scale and Experience Curve

Established players like Caledonia Mining leverage significant economies of scale, particularly in their Blanket Mine operations. This scale translates to lower per-ounce production costs due to more efficient procurement of materials and optimized processing. For instance, in 2023, Caledonia reported an all-in sustaining cost (AISC) of $1,286 per ounce, a figure difficult for a new, smaller operation to replicate immediately.

New entrants would face substantial hurdles in matching Caledonia's cost efficiencies. Building a mining operation of comparable scale requires immense capital investment and time to develop the necessary operational experience. The learning curve in mining is steep, and early-stage producers often bear higher initial costs before achieving the efficiencies seen in mature operations.

- Economies of Scale: Caledonia's existing infrastructure and production volume at Blanket Mine provide a cost advantage over potential new entrants.

- Experience Curve: Years of operational experience have allowed Caledonia to refine its processes, further reducing production costs.

- Capital Intensity: The high capital requirement to establish a new mine of similar scale acts as a significant barrier.

- Cost Efficiency Gap: New entrants would likely operate at a higher cost per ounce initially, making it challenging to compete with Caledonia's established cost structure.

Access to Distribution Channels and Expertise

Even though gold is a commodity, new companies entering the market must forge crucial relationships with refiners and buyers. These established networks are not easily accessed by newcomers, creating a barrier to entry.

More critically, attracting and retaining the highly specialized technical and operational expertise needed for underground gold mining presents a substantial hurdle. This deep knowledge base, encompassing geological surveying, extraction techniques, and safety protocols, is not readily available or easily replicated.

- Distribution Networks: New entrants face challenges in securing access to established gold refiners and offtake agreements, vital for selling their product.

- Specialized Expertise: The scarcity of skilled geologists, mining engineers, and operational managers with underground gold mining experience is a significant deterrent.

- Capital Intensity: The high upfront capital required for exploration, development, and specialized equipment further limits the threat of new entrants.

The threat of new entrants in the gold mining sector, particularly for Caledonia Mining, is generally considered low due to several significant barriers. These include the substantial capital required for exploration and development, the difficulty in accessing new, high-grade gold reserves, and the complex regulatory environment. Furthermore, the need for specialized expertise and established distribution networks presents additional challenges for potential new players.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Establishing a new gold mine requires billions of dollars for exploration, infrastructure, and equipment. For example, the development costs for a medium-sized underground gold mine can easily exceed $500 million. | Deters smaller companies and individuals from entering the market. |

| Resource Scarcity | Discovering economically viable gold deposits is increasingly challenging. Global gold discoveries have been declining, with fewer large deposits found annually. | Makes it difficult for new entrants to secure a competitive resource base. |

| Regulatory Hurdles | Obtaining mining permits and licenses involves lengthy processes and compliance with environmental and social regulations. In 2024, obtaining a mining license in many African countries averaged over 100 days, involving multiple agencies. | Increases time and cost for new entrants, favoring established players with experience navigating these systems. |

| Economies of Scale & Experience | Established miners like Caledonia benefit from lower per-ounce production costs due to scale and operational experience. Caledonia's 2023 AISC of $1,286 per ounce is a benchmark difficult for new operations to match initially. | New entrants face higher initial operating costs, hindering their ability to compete on price. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Caledonia Mining is built upon a foundation of robust data, including the company's annual reports and SEC filings, alongside industry-specific research from reputable mining sector analysts and market intelligence providers.