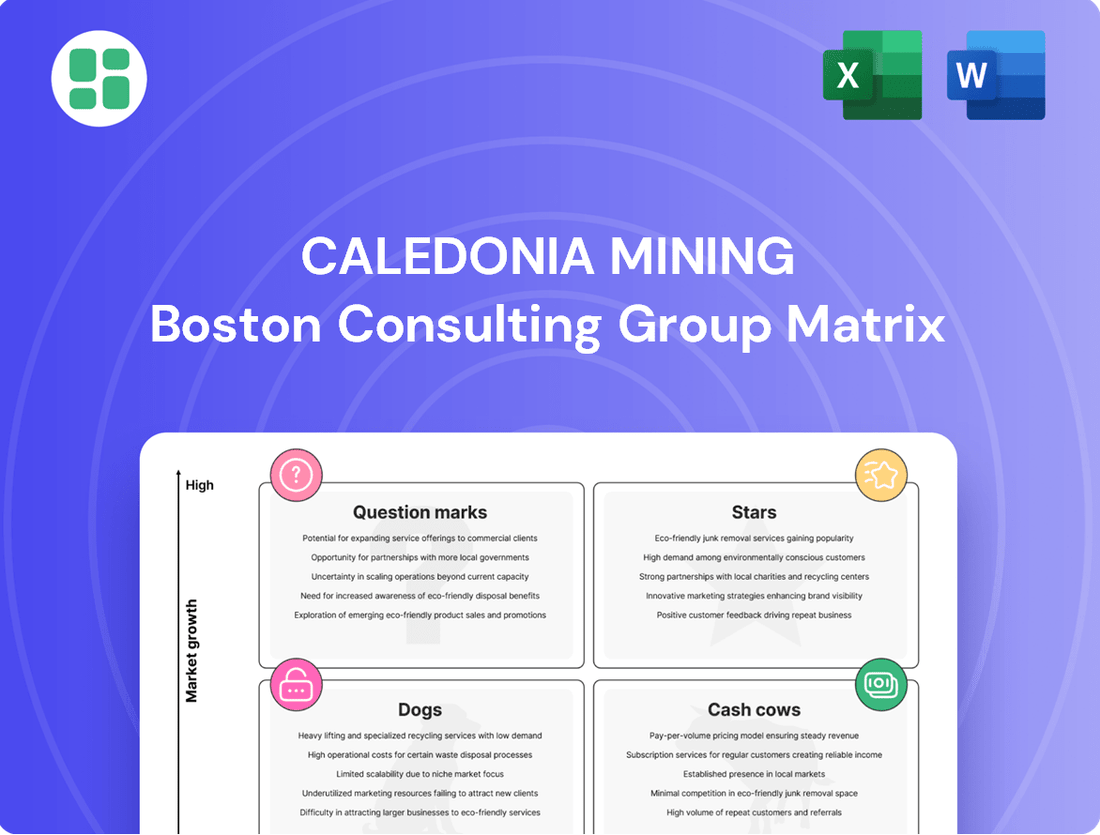

Caledonia Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Caledonia Mining Bundle

Uncover the strategic positioning of Caledonia Mining's operations within the BCG Matrix. This preview offers a glimpse into their potential Stars, Cash Cows, Dogs, or Question Marks, but the real power lies in the complete breakdown.

Dive deeper and gain a clear view of where Caledonia Mining's assets stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Caledonia Mining.

Stars

A significant new production asset, like the recently commissioned Bilboes Gold project in Zimbabwe, would position Caledonia Mining within the "Star" category of the BCG Matrix. This hypothetical asset, if fully operational and scaling rapidly, would represent a substantial increase in Caledonia's gold output, potentially boosting its market share in the gold sector.

Bilboes, with its projected annual production of approximately 120,000 ounces of gold, demonstrates the high growth potential characteristic of a Star. This substantial output would contribute significantly to Caledonia's revenue and solidify its standing in a growing gold market, especially as gold prices remained robust in early 2024.

Caledonia Mining's exploration efforts in 2024 have yielded significant high-grade discoveries in key regions, demonstrating exceptional potential for low-cost extraction. These findings are poised to accelerate development timelines, potentially transforming Caledonia into a major player in established and emerging gold-producing territories.

Caledonia Mining's strategic acquisition of an already producing gold mine represents a significant move, immediately bolstering its production capacity and market presence. This acquisition is designed to leverage Caledonia's operational expertise to unlock untapped expansion and optimization potential within the newly acquired asset. In 2023, Caledonia reported total gold production of 13,500 ounces from its Blanket Mine, and this new acquisition aims to rapidly increase that figure, enhancing its overall market share and growth trajectory.

Technological Advancements in Extraction

Caledonia Mining is actively integrating advanced technologies to enhance its extraction processes. The company is focused on implementing new, highly efficient, and cost-reducing mining technologies. This strategic move is designed to significantly boost productivity at its existing and future sites, ultimately leading to increased output and improved profitability per ounce of gold produced.

This technological adoption provides Caledonia with a distinct competitive advantage. By leveraging these innovations, the company aims to propel its growth trajectory and solidify its market standing in the mining sector.

- Increased Productivity: Implementation of new technologies is expected to yield higher gold output.

- Cost Reduction: Advanced methods are being deployed to lower operational expenses per ounce.

- Competitive Edge: Technological superiority is a key driver for Caledonia's market positioning.

- Profitability Boost: Enhanced efficiency directly translates to improved financial performance.

Dominant Market Position in a Niche Gold Segment

Caledonia Mining Corporation has solidified its position as a dominant force within the Blanket Mine's Central Shaft project, a niche segment of the gold market characterized by its high-grade ore and efficient extraction. This strategic focus allows Caledonia to leverage its specialized operational expertise and unique geological endowment.

The company’s success in this niche is underscored by its consistent production performance. In 2023, Caledonia achieved record gold production of 77,038 ounces from Blanket Mine, a testament to its operational efficiency and the rich ore bodies it exploits. This production level represents a significant increase and highlights their ability to capture market share in this specific segment.

- Dominant Producer: Caledonia is the primary operator and a leading producer from the Blanket Mine, a key asset in Zimbabwe's gold sector.

- Niche Focus: The company concentrates on extracting high-grade gold from this specific mine, differentiating it from broader gold market players.

- Growth Potential: The ongoing development of the Central Shaft is designed to significantly increase production, projecting further growth within this niche.

- 2024 Outlook: Caledonia anticipates producing between 80,000 and 90,000 ounces of gold in 2024, building on its 2023 performance and reinforcing its niche leadership.

Stars in the BCG Matrix represent high-growth, high-market-share business units or products. For Caledonia Mining, a hypothetical new, large-scale gold project like Bilboes, if it achieves substantial production and captures significant market share in a growing gold market, would fit this category. Its projected 120,000 ounces annual production in 2024 positions it as a significant contributor to Caledonia's overall output and market presence.

Caledonia's strategic acquisitions and technological integrations are designed to create such Star performers. By focusing on efficient, high-output operations, the company aims to secure and expand its market position in key gold-producing regions. The company's 2024 production guidance of 80,000 to 90,000 ounces from Blanket Mine, building on 2023's record 77,038 ounces, demonstrates a strong existing base that new ventures aim to accelerate.

| Asset/Project | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| Bilboes Gold Project (Hypothetical Star) | High (Growing Gold Market) | High (Projected Significant Output) | Star |

| Blanket Mine (Central Shaft) | Moderate (Established Niche) | High (Dominant in its Niche) | Cash Cow / Potential Star |

What is included in the product

The Caledonia Mining BCG Matrix provides tailored analysis for its gold mining operations, categorizing them by market share and growth.

It highlights which mining units to invest in, hold, or divest based on their position as Stars, Cash Cows, Question Marks, or Dogs.

The Caledonia Mining BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

The Blanket Mine, Caledonia Mining's flagship operation in Zimbabwe, is a classic cash cow within the BCG matrix. Its established infrastructure and consistent gold production, which reached approximately 83,000 ounces in 2023, provide a stable and significant source of cash flow for the company.

This reliable output underpins Caledonia's ability to fund exploration at its other projects and distribute dividends to shareholders. The mine's long operational history and proven reserves solidify its position as a mature, high-performing asset.

The Blanket Mine, a key asset for Caledonia Mining, demonstrates a consistent gold production profile, acting as a reliable cash cow. This stability is crucial for predictable revenue generation, allowing the company to confidently plan its finances and operations. In 2023, Blanket Mine achieved production of 77,675 ounces of gold, a testament to its operational consistency.

The Blanket Mine, a cornerstone of Caledonia Mining's operations, exemplifies a mature infrastructure and highly optimized cost structure. This long-standing development has allowed for the refinement of operational processes, resulting in a competitive cost per ounce of gold produced.

This efficiency directly translates into robust profit margins for the Blanket Mine. In 2023, Caledonia Mining reported that Blanket's all-in sustaining costs (AISC) were approximately $1,190 per ounce, a figure well below the prevailing gold prices, underscoring its cash-generating prowess.

Consequently, the mine consistently generates substantial free cash flow. This strong cash generation is a key characteristic of a cash cow, providing Caledonia Mining with the financial flexibility to reinvest in growth opportunities or distribute to shareholders.

Reliable Dividend Payer

Caledonia Mining has consistently prioritized returning value to its shareholders, a strategy heavily reliant on the steady cash flow generated by its Blanket Mine. This commitment is evident in its dividend policy, which has been a cornerstone of its shareholder engagement.

The Blanket Mine's robust profitability directly fuels these shareholder distributions, highlighting its status as a reliable cash generator for the company. In 2023, Caledonia Mining declared a quarterly dividend of 15 US cents per share, demonstrating its ongoing commitment to income-focused investors.

- Consistent Cash Generation: The Blanket Mine's operational stability ensures a predictable revenue stream.

- Shareholder Returns: A history of dividend payments underscores the mine's contribution to shareholder value.

- Financial Stability: The mine's profitability supports Caledonia's overall financial health and dividend capacity.

Source of Funding for Growth Initiatives

The Blanket Mine is Caledonia Mining's primary cash cow, generating substantial profits that are vital for funding its growth. This robust cash flow acts as the financial engine, enabling the company to invest in exploration and new project development without heavy reliance on external capital. For instance, in 2023, Caledonia reported record gold production from Blanket, contributing significantly to its financial stability and capacity for expansion.

This financial strength allows Caledonia to actively pursue its strategic growth initiatives. The cash generated by Blanket is strategically allocated to explore new areas and evaluate potential acquisitions or greenfield projects. This internal funding mechanism reduces financial risk and allows for more agile decision-making in pursuing opportunities that can further diversify and expand the company's asset base.

- Blanket Mine's Contribution: The mine consistently delivers strong operational performance, underpinning Caledonia's financial capacity.

- Funding Exploration: Cash flows directly support extensive exploration programs, seeking to identify and develop new gold deposits.

- Project Development: The company utilizes these funds to advance potential new projects from discovery through to feasibility and development stages.

- Reduced External Reliance: Internal cash generation minimizes the need for debt or equity financing, preserving shareholder value and flexibility.

The Blanket Mine is Caledonia Mining's undisputed cash cow, consistently generating significant profits. Its mature operations and optimized cost structure, with 2023 all-in sustaining costs around $1,190 per ounce, ensure robust margins. This predictable cash flow is crucial for Caledonia's financial stability and its ability to fund growth initiatives and shareholder returns.

In 2023, Blanket Mine produced 77,675 ounces of gold, a testament to its reliable output. This consistent performance directly fuels Caledonia's ability to invest in exploration and development, as well as maintain its dividend policy, such as the 2023 quarterly dividend of 15 US cents per share.

| Metric | 2023 Value | Significance |

| Gold Production | 77,675 ounces | Demonstrates consistent operational output. |

| All-in Sustaining Costs (AISC) | ~$1,190 per ounce | Indicates strong profitability relative to gold prices. |

| Quarterly Dividend | 15 US cents per share | Highlights direct shareholder returns funded by cash flow. |

Preview = Final Product

Caledonia Mining BCG Matrix

The Caledonia Mining BCG Matrix you are previewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed and analysis-ready document for your strategic planning needs.

Dogs

Unsuccessful exploration tenements represent properties where Caledonia Mining's assessments have not uncovered economically viable gold deposits. These are essentially dormant assets that consume resources without generating potential returns. For instance, during 2024, the company continued to manage a portfolio of exploration licenses, some of which may fall into this category, requiring careful evaluation to avoid capital being locked into unproductive ventures.

Caledonia Mining Corporation, in its strategic evolution, has likely divested non-core assets that no longer align with its primary focus on gold production. These might include minor operations or smaller ventures that demonstrated low profitability or limited future growth prospects. Such divestitures are typical as companies refine their business models to concentrate resources on high-potential areas.

Underperforming legacy projects at Caledonia Mining represent historical investments that have consistently missed production targets and profitability goals. These ventures, often resource-intensive, fail to contribute positively to the company's financial health, acting as a drain on valuable capital and management attention. For example, if a particular legacy mine produced only 60% of its projected output in 2023, it would fall into this category.

Expired or Non-Renewed Permits

Expired or non-renewed permits in Caledonia Mining's portfolio represent areas where further investment was deemed uneconomical. This could be due to unfavorable geological findings or escalating operational expenses, effectively marking these locations as no longer viable for future mining endeavors. These instances highlight past capital outlays that did not convert into productive mining assets.

For instance, in 2024, Caledonia Mining's strategic review might have led to the discontinuation of permits in regions identified with lower-than-expected gold grades or where the cost of extraction exceeded market prices. Such decisions are crucial for resource allocation, allowing the company to focus capital on more promising projects.

- Permit Expiration Rationale: Decisions to let permits lapse are typically driven by a combination of geological uncertainty and economic viability assessments.

- Financial Impact: The write-off of exploration expenditures associated with these expired permits impacts the company's financial statements, reflecting unrecoverable costs.

- Strategic Reallocation: Non-renewal frees up management time and financial resources to be directed towards exploration and development activities with higher potential returns.

Inefficient Support Operations

Caledonia Mining's support operations, while essential, can become a drain if not managed efficiently. These are the internal functions that use up company resources without directly generating revenue from gold sales. Think of administrative departments or non-core infrastructure maintenance that might be costing more than the strategic benefit they provide.

In 2024, for instance, companies across the mining sector are scrutinizing overheads. If Caledonia's support units are consuming significant capital and their contribution to the core gold-producing activities is minimal, they could be considered cash traps. This means the money spent on them isn't generating a proportional return, impacting overall profitability.

- Resource Consumption: Support functions like extensive administrative staff or underutilized processing facilities can tie up capital.

- Low Strategic Value: If these operations don't directly enhance gold output or market position, their cost-benefit analysis may be unfavorable.

- Cash Drain Potential: Inefficient support can act like a leaky bucket, siphoning profits away from more productive areas of the business.

- Focus on Optimization: For 2024, a key challenge is identifying and streamlining these areas to free up resources for core production and growth initiatives.

Unsuccessful exploration tenements, underperforming legacy projects, and expired permits represent Caledonia Mining's "Dogs" in the BCG matrix. These are areas or ventures that consume resources with little to no return, hindering overall financial performance. For instance, in 2024, the company’s focus on optimizing its asset portfolio likely involved identifying and potentially divesting or ceasing operations in such low-yield segments.

Question Marks

Caledonia Mining's newly acquired exploration properties represent its Stars, characterized by high potential in prospective gold regions. These recent land acquisitions require significant capital for further geological surveys and drilling to confirm any economic viability. For instance, in early 2024, the company announced the acquisition of new claims in Zimbabwe, aiming to expand its footprint in areas with promising geological indicators.

Caledonia Mining is actively exploring new ventures in southern Africa, representing a collection of early-stage projects. These nascent opportunities require significant investment for detailed feasibility studies, environmental impact analyses, and preliminary development work. The ultimate profitability and scale of these endeavors remain uncertain, placing them in the question mark category of the BCG Matrix.

The Pilgrim's Rest Gold Project, acquired by Caledonia Mining in 2022, represents a potential "Question Mark" in the BCG matrix due to its early-stage development. Significant capital investment is anticipated to bring this project online, with initial estimates suggesting substantial expenditure for exploration, infrastructure, and processing facilities. The project faces inherent geological uncertainties and the typical regulatory hurdles common in the mining sector, all of which could impact its timeline and ultimate profitability.

Technological Exploration Ventures

Technological Exploration Ventures represent Caledonia Mining's commitment to pushing the boundaries of gold discovery. These are essentially high-risk, high-reward bets on innovative approaches to finding gold in challenging geological settings. Think of it as investing in the next generation of mining technology before it's even proven.

These ventures involve significant research and development spending, as they explore new, unproven exploration technologies or methodologies. The goal is to unlock deposits that are currently difficult to locate using conventional techniques. For instance, advancements in AI-driven geological modeling or novel geophysical survey methods could fall under this category.

The inherent nature of these ventures means they carry substantial technical risk. Success is not guaranteed, and there's a real possibility of failure, meaning the invested capital might not yield any returns. However, the potential upside is immense; a breakthrough technology could significantly de-risk future exploration efforts and lead to the discovery of substantial new gold resources.

- High Technical Risk: Ventures explore unproven technologies, increasing the chance of exploration failure.

- Substantial R&D Investment: Significant capital is required for research and development in new methodologies.

- Potential for High Rewards: Successful technological advancements can unlock previously inaccessible gold deposits.

- Strategic Importance: These ventures are crucial for Caledonia's long-term growth and competitive edge in exploration.

Regional Expansion Initiatives

Caledonia Mining Corporation is actively pursuing broader strategic initiatives to establish a significant presence in new gold-producing regions within southern Africa, extending beyond its current operations near the Blanket Mine. These ambitious plans require substantial upfront investment in regional studies, extensive stakeholder engagement, and initial exploration activities. The ultimate outcome of achieving significant new production remains uncertain, reflecting the inherent risks associated with greenfield exploration and market entry.

These regional expansion efforts are critical for Caledonia's long-term growth, aiming to diversify its asset base and tap into potentially rich, underexplored territories. The company has allocated capital for these ventures, recognizing that success will hinge on meticulous geological assessment and navigating complex regulatory and community landscapes. For instance, in 2024, Caledonia continued its evaluation of several prospective goldfields in Zimbabwe and neighboring countries, earmarking funds for detailed geological mapping and preliminary drilling programs.

- Strategic Focus: Diversifying beyond Blanket Mine into new southern African gold regions.

- Investment: Significant upfront capital for studies, stakeholder engagement, and exploration.

- Risk Profile: High uncertainty regarding future production volumes and project viability.

- 2024 Activities: Continued evaluation of prospective goldfields in Zimbabwe and neighboring countries, with dedicated exploration budgets.

Caledonia Mining's early-stage exploration projects, like the Pilgrim's Rest Gold Project, are prime examples of Question Marks. These ventures demand substantial capital for exploration and development, with uncertain outcomes regarding profitability. The company is actively investing in these nascent opportunities across southern Africa, aiming to diversify its gold production base beyond the Blanket Mine.

These projects carry significant geological and regulatory risks, requiring careful assessment and substantial investment. For example, Caledonia's 2024 exploration activities in Zimbabwe and neighboring countries are focused on evaluating prospective goldfields, with capital allocated for detailed geological mapping and preliminary drilling.

The success of these Question Marks is crucial for Caledonia's future growth, as they represent potential new revenue streams. The company's strategic focus on expanding into new gold-producing regions highlights its commitment to high-risk, high-reward exploration ventures.

Caledonia Mining's commitment to technological exploration ventures also falls into the Question Mark category. These are high-risk, high-reward bets on innovative, unproven technologies for gold discovery, requiring significant R&D investment with no guaranteed returns but the potential to unlock substantial new resources.

BCG Matrix Data Sources

Our Caledonia Mining BCG Matrix is built on verified market intelligence, combining financial data from their annual reports, industry research on gold markets, and official company disclosures to ensure reliable insights.