Credit Agricole Nord de France PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Credit Agricole Nord de France Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Credit Agricole Nord de France's future. This comprehensive PESTLE analysis provides actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full report to gain a competitive edge.

Political factors

The stability of the French government and its economic policies is a crucial factor for Crédit Agricole Nord de France. A predictable policy environment, particularly concerning fiscal and monetary measures, allows the bank to confidently plan its long-term investments and lending strategies. For instance, the French government's commitment to fiscal consolidation and its monetary policy alignment with the European Central Bank in 2024 provided a degree of certainty for the financial sector.

The banking sector in France, and by extension for Crédit Agricole Nord de France, operates under a robust regulatory framework. The European Central Bank (ECB) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR) are key supervisory bodies, enforcing stringent prudential regulations such as Basel III and the upcoming CRR3/CRD6 package. These rules dictate capital adequacy, liquidity buffers, and comprehensive risk management practices for all credit institutions.

Compliance with these evolving mandates necessitates continuous adaptation of operational procedures and reporting systems for Crédit Agricole Nord de France. For instance, the latest Basel III reforms, often referred to as Basel IV, aim to further enhance the resilience of the banking system by refining risk-weighted asset calculations. As of early 2024, the implementation timeline for these final Basel III elements is being closely monitored, with significant impacts expected on capital requirements for various asset classes.

Crédit Agricole Nord de France, as a cooperative bank, is significantly shaped by regional development policies within the Nord and Pas-de-Calais areas. These policies often focus on enhancing local economies through targeted investments and support programs.

Government backing for crucial infrastructure, like the Canal Seine-Nord Europe project, directly impacts the bank's lending opportunities. This waterway, aiming to connect Northern France to continental Europe, received a €4.7 billion investment commitment from the French government and the European Union as of early 2024, presenting substantial financing avenues for Crédit Agricole Nord de France to support related businesses and economic expansion.

Furthermore, policies promoting agricultural modernization and industrial transition, particularly in regions historically reliant on traditional industries, create demand for specialized financial products. The bank can leverage these initiatives to provide capital for innovation, sustainability upgrades, and diversification efforts within these key sectors.

Geopolitical Risks and Economic Fragmentation

Broader geopolitical tensions and increasing economic fragmentation within the EU are compelling financial institutions like Crédit Agricole Nord de France to bolster their resilience against macro-financial shocks. This environment demands a proactive approach to risk management.

The European Central Bank (ECB) has specifically highlighted the critical need for banks to rigorously reassess their credit exposures and enhance operational resilience, directly impacting Crédit Agricole Nord de France's strategic planning and risk mitigation efforts in the face of global uncertainties.

- Geopolitical Tensions: Ongoing conflicts and trade disputes contribute to market volatility, affecting investment climates and creditworthiness.

- Economic Fragmentation: Divergent economic policies and national interests within the EU can create uneven growth patterns and regulatory challenges for cross-border banking operations.

- ECB Guidance: The ECB's focus on resilience underscores the importance of robust capital buffers and diversified funding sources for banks operating in this complex landscape.

- Risk Management Focus: Crédit Agricole Nord de France must continually adapt its risk assessment frameworks to account for these evolving geopolitical and economic dynamics, ensuring its strategic decisions are well-informed.

Cooperative Banking Support

The French government and the European Union actively support cooperative banking models, acknowledging their vital contribution to regional economic development and community cohesion. These supportive policies often translate into a more advantageous regulatory and financial landscape for institutions like Crédit Agricole Nord de France, bolstering its distinct cooperative identity and objectives.

This backing can manifest in various forms, potentially including:

- Preferential regulatory treatment, such as simplified compliance procedures for cooperative structures.

- Access to specific funding programs designed to bolster local and regional financial institutions.

- Government-backed guarantees or incentives that encourage lending to small and medium-sized enterprises (SMEs) and local projects.

- Favorable tax treatments that recognize the mutualistic nature of cooperative banks.

For instance, the French state has historically championed the cooperative banking sector, with initiatives aimed at strengthening their resilience and their role in financing the real economy. In 2024, discussions around enhancing the role of cooperative banks in the transition to a greener economy are expected to continue, potentially leading to new support mechanisms.

Government stability and consistent economic policies in France are vital for Crédit Agricole Nord de France's strategic planning, with the French government's fiscal and monetary approach in 2024 offering a degree of predictability.

Support for regional development, exemplified by the €4.7 billion investment in the Canal Seine-Nord Europe project by early 2024, creates significant lending opportunities for the bank.

The French state's historical support for cooperative banking, including potential new mechanisms in 2024 for green transition financing, reinforces Crédit Agricole Nord de France's unique position and objectives.

What is included in the product

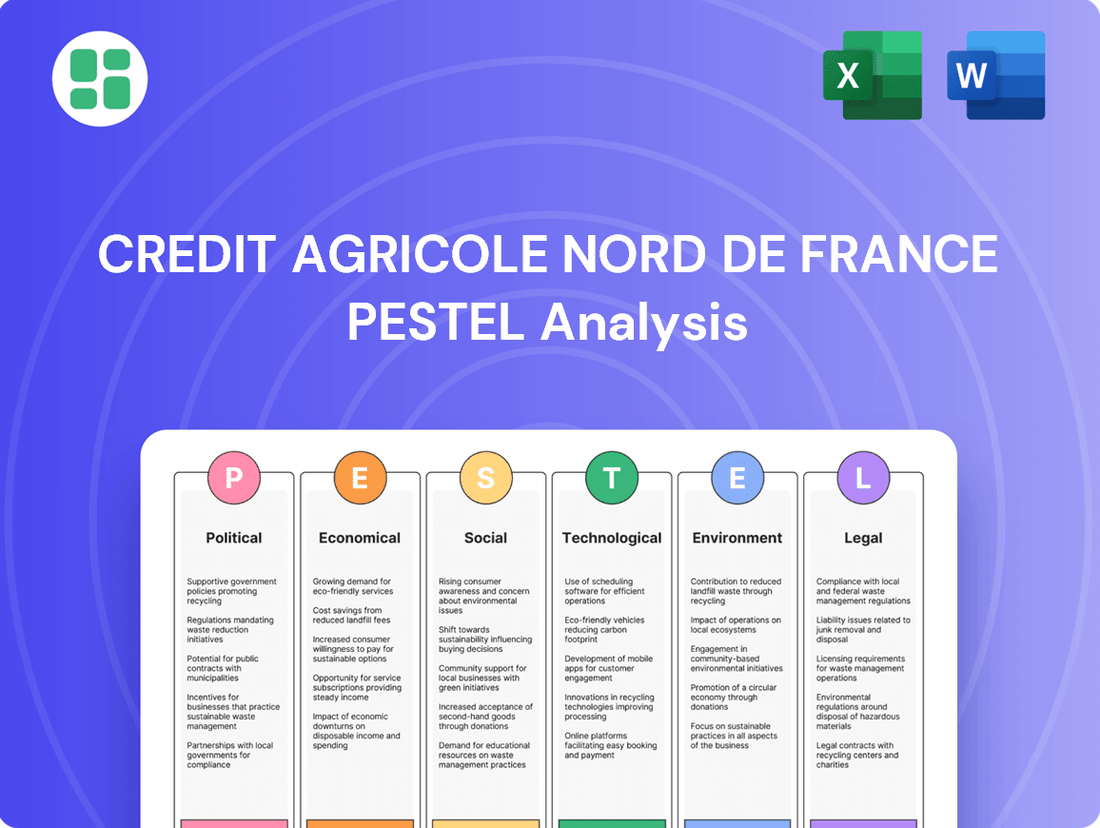

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Credit Agricole Nord de France, providing actionable insights for strategic decision-making.

Provides a concise version of the Credit Agricole Nord de France PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Economic factors

Changes in interest rates, especially those guided by the European Central Bank (ECB), significantly impact Crédit Agricole Nord de France's net interest margin and overall profitability. For instance, the ECB's key interest rates remained at 4.50% as of early 2024, a level that has influenced lending costs and deposit yields.

A projected environment of declining rates through 2024 and 2025 could offer a beneficial redressing of the intermediation margin, which faced pressure from earlier rate hikes. This shift will directly influence the bank's strategies for its lending and savings product portfolios.

The economic health of the Nord and Pas-de-Calais regions is a key driver for Crédit Agricole Nord de France. Strong GDP growth and robust employment figures translate directly into higher demand for banking and financial services, from business loans to mortgages.

France's economic recovery is a positive signal. With projected GDP growth of 1.0% in 2024 and an anticipated 1.3% in 2025, the environment is becoming more conducive for increased lending activity and overall commercial expansion for the bank.

The employment landscape in these northern regions is crucial. A healthy job market fuels consumer spending and business investment, both of which are vital for the bank's loan portfolios and fee-based income streams.

Inflation in France has been a significant factor influencing household consumption throughout 2024 and into 2025. While inflation peaked in 2023, with the annual rate reaching 5.7% in December 2023 according to INSEE, a trend of disinflation is expected to continue. This easing of price pressures is crucial for household purchasing power, directly impacting how much people can spend and save.

As inflation moderates, a projected rebound in household consumption is anticipated. This is good news for the banking sector, as increased consumer spending often translates into higher demand for credit, supporting loan growth and overall banking activity. For instance, consumer spending saw a modest increase in early 2024, and with continued disinflation, this trend is expected to strengthen.

Real Estate Market Dynamics

The real estate market's vitality is a crucial driver for Crédit Agricole Nord de France, directly influencing its mortgage and real estate financing operations. A robust market translates to increased loan origination and a healthier portfolio for the bank.

Evidence points to a positive shift, with housing credit showing a notable recovery. This trend, observed from the latter half of 2024 and projected to continue into 2025, signifies a growing demand for habitat loans. This resurgence is expected to bolster the bank's credit origination volumes significantly.

- Housing credit recovery: Significant progression in habitat loans observed in H2 2024, continuing into 2025.

- Impact on originations: This upward trend is anticipated to boost Crédit Agricole Nord de France's new loan volumes.

- Regional market health: The overall strength of the regional real estate sector directly correlates with the bank's financial performance in this segment.

Competitive Landscape

The French banking sector is a dynamic arena, with Crédit Agricole Nord de France navigating intense competition. Traditional rivals like BNP Paribas and Société Générale, alongside a growing contingent of online-only banks such as Boursorama and N26, are constantly vying for market share. This pressure forces constant adaptation in pricing, product development, and customer service.

Fintech disruptors are also a significant factor, introducing innovative solutions that challenge established players. These agile companies often focus on niche services, from payment processing to peer-to-peer lending, pushing traditional banks to enhance their digital offerings. For Crédit Agricole Nord de France, staying ahead means embracing technological advancements and offering compelling digital experiences to retain and attract customers.

Key competitive dynamics include:

- Market Share Erosion: Online banks and fintechs are steadily gaining ground, particularly among younger demographics, potentially impacting traditional banks' customer bases.

- Price Sensitivity: Increased competition often leads to more aggressive pricing on loans, savings accounts, and transaction fees, squeezing profit margins.

- Digital Innovation Race: Banks must invest heavily in digital platforms, mobile apps, and AI-driven services to meet evolving customer expectations and remain competitive.

In 2024, the French banking market continued to see significant investment in digital transformation, with major banks allocating billions to upgrade IT infrastructure and develop new digital products. This trend is expected to intensify as fintechs continue to innovate, making the competitive landscape even more challenging for established institutions like Crédit Agricole Nord de France.

The economic outlook for France, and specifically the Nord de France region, presents a mixed but generally improving picture for Crédit Agricole Nord de France. Projected GDP growth of 1.0% for 2024 and 1.3% for 2025 suggests a gradual expansion, which should translate into increased demand for banking services. Furthermore, the continued disinflation trend, with inflation expected to ease further from its 2023 peak, will bolster household purchasing power and potentially spur greater consumer spending and credit uptake.

The real estate market's recovery, particularly in housing credit, is a significant positive. With observed progression in habitat loans from the latter half of 2024 and anticipated continuation into 2025, the bank is poised for increased loan origination volumes. This, coupled with a healthy job market in the region, underpins the demand for mortgages and other financial products, directly benefiting the bank's core business.

Interest rate dynamics, largely influenced by the ECB, remain a critical factor. While key rates stood at 4.50% in early 2024, the projected decline through 2024 and 2025 could improve the bank's net interest margin. This environment, characterized by moderate economic growth and easing inflation, is generally supportive of the banking sector's performance.

| Economic Indicator | 2024 Projection | 2025 Projection | Impact on Crédit Agricole Nord de France |

|---|---|---|---|

| France GDP Growth | 1.0% | 1.3% | Increased demand for loans and financial services |

| Inflation (Annual Rate) | Moderating from 2023 peak (5.7% in Dec 2023) | Continued disinflation | Improved household purchasing power, potential for higher spending and savings |

| ECB Key Interest Rates | 4.50% (Early 2024) | Projected decline | Potential improvement in net interest margin |

| Housing Credit Market | Recovery observed H2 2024 | Continued recovery expected | Increased mortgage origination volumes |

Same Document Delivered

Credit Agricole Nord de France PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Crédit Agricole Nord de France.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

Customer preferences are increasingly leaning towards digital channels for everyday banking. This shift is prompting Crédit Agricole Nord de France to re-evaluate its physical branch network. For instance, in 2024, a significant portion of routine transactions, such as balance inquiries and transfers, were already being handled through mobile apps and online platforms.

In response, the bank is strategically consolidating smaller branches into larger, more comprehensive service centers. These modernized locations are designed to offer enhanced advisory services, catering to the evolving need for specialized human interaction alongside digital convenience. This strategy reflects a broader societal trend observed across France, where digital adoption for transactional banking continues to grow, with projections indicating further increases in digital engagement for financial services in 2025.

As a cooperative bank, Crédit Agricole Nord de France's success is intrinsically linked to its deep roots in local communities and its member-owner structure. This model fosters a strong sense of shared purpose and mutual benefit, aligning with societal preferences for financial institutions that prioritize community well-being over pure profit maximization.

The bank's commitment to reinvesting profits directly back into the regional economy and actively supporting community development initiatives, such as sponsoring local events and cultural programs, demonstrates its dedication to being a responsible corporate citizen. For example, in 2023, Crédit Agricole Nord de France allocated over €5 million to local projects, reinforcing its role as a key patron and contributor to regional vitality.

The Nord and Pas-de-Calais regions are experiencing significant demographic shifts. An aging population, with a median age likely to continue rising beyond the national average, may increase demand for retirement planning and wealth management services. Conversely, youth unemployment, though showing some signs of improvement, remains a key concern, influencing the need for accessible credit and financial literacy programs for younger demographics.

Migration patterns also play a crucial role, potentially bringing new customer segments with distinct financial needs and preferences. For instance, integrating newcomers might require tailored banking solutions and multilingual support. Credit Agricole Nord de France must adapt its product portfolio and outreach strategies to effectively serve this evolving and diverse regional client base.

Financial Literacy and Inclusion

Societal efforts to boost financial literacy and inclusion directly influence how people interact with banking services. For instance, initiatives aimed at improving financial education can lead to greater uptake of digital banking tools and investment products. This trend is evident in France, where efforts to enhance financial knowledge are ongoing, impacting the customer base for institutions like Crédit Agricole Nord de France.

Crédit Agricole Nord de France, by its nature as a universal bank, plays a crucial role in developing solutions that are both accessible and inclusive. This means creating banking products and services that cater to a wide range of customers, including those with lower incomes or less financial experience. The bank's commitment to financial inclusion addresses a clear societal need for broader access to essential financial tools and knowledge.

The impact of these societal efforts is measurable. For example, in 2023, the Banque de France reported that 85% of adults in France had basic financial literacy skills, a figure that continues to be a focus for improvement. Crédit Agricole Nord de France actively supports these national goals by offering:

- Personalized financial advice services

- Online educational resources on budgeting and saving

- Simplified account management tools for vulnerable populations

- Partnerships with local community organizations to reach underserved groups

Trust and Reputation in Banking

Public trust is foundational in the banking sector, heavily shaped by historical events like the 2008 financial crisis, a bank's ethical framework, and its perceived role in community development. A recent survey in France indicated that 62% of consumers consider a bank's ethical practices as a key factor in their choice of financial institution. This underscores the importance of transparency and responsible operations.

As a cooperative bank, Crédit Agricole Nord de France's commitment to its core values of utility, universality, and local engagement significantly bolsters its standing. This model inherently fosters trust by aligning the bank's success with that of its members and the region it serves. In 2024, customer satisfaction scores for cooperative banks in France averaged 8.5 out of 10, a testament to this relationship.

The bank's reputation is further enhanced by its active participation in local economic initiatives and its support for regional development projects. For instance, in 2024, Crédit Agricole Nord de France invested over €50 million in small and medium-sized enterprises within its operational area, directly contributing to local employment and economic vitality. This tangible contribution reinforces its image as a reliable and community-focused partner.

- Public trust in banks is paramount, influenced by ethical conduct and societal contribution.

- Crédit Agricole Nord de France's cooperative model strengthens its reputation and client trust.

- In 2024, French consumers cited ethical practices as a critical factor in selecting a bank.

- The bank's local investments in 2024 exceeded €50 million, supporting regional economic growth.

Societal shifts towards digital banking are reshaping customer interactions, prompting Crédit Agricole Nord de France to adapt its service model. This includes consolidating branches into larger advisory hubs to meet demand for personalized financial guidance, a trend supported by increasing digital adoption for routine transactions nationwide.

The bank's cooperative structure, emphasizing community well-being and reinvestment, resonates with societal preferences for responsible financial institutions. This model, coupled with tangible support for local projects, such as over €5 million invested in community initiatives in 2023, solidifies its role as a trusted regional partner.

Demographic changes, including an aging population and youth unemployment in the Nord and Pas-de-Calais regions, influence service demand, necessitating tailored offerings for retirement planning and financial literacy programs. Migration also presents opportunities for new customer segments requiring adaptable financial solutions.

Efforts to enhance financial literacy are driving greater engagement with digital banking and investment products, with national initiatives supporting this trend. Crédit Agricole Nord de France actively contributes by providing personalized advice and educational resources, aiming to improve financial inclusion.

Technological factors

Crédit Agricole Nord de France is actively pursuing digital transformation, aiming for fully digital customer journeys complemented by human assistance, a key component of the Crédit Agricole Group's 'Ambitions 2025' strategy. This initiative focuses on refining online and mobile banking services, ensuring a cohesive customer experience across all touchpoints.

The bank is investing in advanced digital tools and platforms to meet evolving customer expectations for seamless, omnichannel interactions. This strategic shift is crucial for remaining competitive in a market increasingly dominated by digital-first financial services, with digital banking adoption continuing to rise globally.

The escalating complexity of cyber threats demands ongoing investment in advanced cybersecurity and data protection. For Crédit Agricole Nord de France, safeguarding customer information and financial transactions is critical, particularly with the advent of regulations like DORA, to uphold trust and ensure operational continuity.

In 2023, the European Union reported a significant rise in ransomware attacks targeting financial institutions, with average recovery costs exceeding €1 million. Crédit Agricole, as a major European bank, must allocate substantial resources to combat these evolving risks, ensuring compliance with DORA's stringent operational resilience requirements by January 2025.

The banking sector's embrace of artificial intelligence is a significant technological shift. Crédit Agricole Nord de France can leverage AI for enhanced credit scoring, more robust fraud detection, and improved customer service interactions. This aligns with the broader Crédit Agricole Group's 'IT2025' initiative, which aims to responsibly integrate AI to boost operational efficiency and deliver more tailored customer experiences.

Fintech Competition and Collaboration

The financial technology (fintech) landscape is rapidly evolving, with new players offering specialized, agile solutions that challenge traditional banking models. For Crédit Agricole Nord de France, this presents a dual dynamic: a competitive threat and a potential avenue for growth. By 2024, fintech investment globally reached over $200 billion, indicating the sector's significant momentum.

To remain competitive, Crédit Agricole Nord de France may need to forge strategic partnerships with fintech firms or invest in its own internal innovation. Leveraging fintech capabilities, such as AI-driven customer service or blockchain-based payment systems, could significantly enhance its service offerings and customer experience. For instance, a partnership could provide access to advanced data analytics for personalized financial advice, a growing demand among consumers.

- Fintech investment surge: Global fintech funding surpassed $200 billion in 2024, highlighting intense competition and innovation.

- Partnership potential: Collaborating with fintechs can offer access to specialized technologies like AI and blockchain.

- Service enhancement: Integrating fintech solutions can improve customer experience through personalized services and efficient transactions.

- Competitive necessity: Adapting to or adopting fintech advancements is crucial for maintaining market relevance and customer loyalty.

IT Infrastructure Modernization and Operational Resilience

Modernizing core IT infrastructure and establishing strong operational resilience are paramount for banks like Crédit Agricole Nord de France to effectively manage the inherent risks of digital service delivery. This involves upgrading legacy systems and implementing robust frameworks to ensure continuous operation even during disruptions.

The European Central Bank's supervisory priorities for 2024-2026 underscore the urgency for financial institutions to advance their digital transformation and bolster operational resilience. This focus reflects the growing reliance on technology and the need to safeguard against cyber threats and operational failures.

- Digital Transformation Progress: Banks are expected to demonstrate tangible progress in their digital strategies, impacting customer experience and operational efficiency.

- Operational Resilience Frameworks: Implementing and testing comprehensive resilience plans are key to meeting regulatory expectations and ensuring business continuity.

- Cybersecurity Enhancements: Continuous investment in advanced cybersecurity measures is crucial to protect sensitive data and maintain customer trust in an increasingly digital environment.

Technological advancements are reshaping Crédit Agricole Nord de France's operations, driving digital transformation and necessitating robust cybersecurity. The bank's strategy, aligned with the Crédit Agricole Group's 'Ambitions 2025', focuses on enhancing digital customer journeys and investing in AI for improved efficiency and customer service.

The rapid growth of fintech, with over $200 billion invested globally in 2024, presents both competitive challenges and opportunities for partnerships. Crédit Agricole Nord de France must leverage these innovations, such as AI and blockchain, to enhance its service offerings and maintain relevance in a dynamic market.

Ensuring operational resilience and upgrading IT infrastructure are critical priorities, especially with evolving cyber threats and regulatory demands like DORA by January 2025. The European Central Bank's 2024-2026 priorities emphasize digital progress and resilience, underscoring the need for continuous investment in security and system modernization.

| Technological Factor | Impact on Crédit Agricole Nord de France | Key Data/Trend |

|---|---|---|

| Digital Transformation | Enhancing customer experience, operational efficiency | Crédit Agricole Group's 'Ambitions 2025' strategy |

| Artificial Intelligence (AI) | Improved credit scoring, fraud detection, customer service | Integration into 'IT2025' initiative |

| Fintech Innovation | Competitive pressure, partnership opportunities | Global fintech investment exceeded $200 billion in 2024 |

| Cybersecurity & Resilience | Protection against threats, regulatory compliance | DORA regulation effective January 2025 |

Legal factors

The upcoming implementation of Basel III finalization, known as CRR3 and CRD6, starting January 1, 2025, will significantly impact banks like Crédit Agricole Nord de France. These regulations mandate higher capital requirements and more stringent internal control frameworks. For instance, the minimum Common Equity Tier 1 (CET1) ratio, a key measure of a bank's financial strength, is expected to be maintained at robust levels, though specific updated percentages will be closely monitored by the European Banking Authority.

The Digital Operational Resilience Act (DORA), effective January 17, 2025, imposes significant obligations on financial entities like Crédit Agricole Nord de France. This regulation demands robust cybersecurity measures, comprehensive IT risk management frameworks, and diligent oversight of third-party service providers. Failure to comply could lead to substantial penalties and operational disruptions.

Crédit Agricole Nord de France must therefore meticulously assess and fortify its digital infrastructure and all outsourcing agreements. This proactive approach is crucial for safeguarding against and effectively managing potential cyber threats or IT-related failures, ensuring business continuity in an increasingly digital financial landscape.

Crédit Agricole Nord de France, like all financial institutions, faces stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) laws. These regulations are constantly evolving, with a notable trend towards real-time reporting of suspicious transactions and more rigorous customer due diligence processes. For instance, in 2024, the EU continued to implement measures aimed at strengthening AML/CFT frameworks, placing increased operational and technological demands on banks to ensure compliance and prevent illicit financial activities.

Consumer Protection Laws (e.g., New Consumer Credit Directive)

New directives, like the Consumer Credit Directive, set to be transposed by November 2025, are bringing more robust consumer protection rules. These changes will particularly impact how credit is advertised and what information is provided before a contract is signed. For Crédit Agricole Nord de France, this means a necessary adjustment in its consumer lending operations and the disclosures it offers to align with these strengthened protections.

Compliance with these evolving regulations is crucial. For instance, the directive mandates clearer information on annual percentage rates (APRs) and total credit costs, aiming to prevent consumer confusion and potential over-indebtedness. Financial institutions must ensure their marketing materials and pre-contractual documents are transparent and easily understandable to meet these new standards.

- Enhanced Transparency: New rules will likely require more detailed pre-contractual information, including clearer explanations of interest rates, fees, and repayment schedules.

- Advertising Standards: Advertising for credit products will face stricter scrutiny, with a focus on preventing misleading or aggressive sales tactics.

- Adaptation Costs: Crédit Agricole Nord de France may incur costs related to updating IT systems, training staff, and revising marketing materials to meet the directive's requirements.

Data Privacy Regulations (e.g., GDPR and AI Act)

Compliance with stringent data privacy regulations, such as the General Data Protection Regulation (GDPR), is paramount for Crédit Agricole Nord de France, especially when managing sensitive customer financial data. The upcoming EU AI Act, expected to be fully applicable between 2025 and 2026, will further shape the financial sector by regulating AI applications. This legislation introduces risk-based governance, directly impacting how the bank can leverage advanced analytics to mitigate potential AI bias.

This regulatory landscape necessitates robust data protection measures and careful implementation of AI technologies. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, underscoring the financial implications of non-compliance. The AI Act’s focus on risk categories means that AI systems used for credit scoring or fraud detection will likely face higher scrutiny.

- GDPR Fines: Non-compliance penalties can amount to 4% of global annual turnover or €20 million.

- AI Act Applicability: Expected to be fully in force between 2025 and 2026, impacting AI use in financial services.

- Risk-Based Governance: The AI Act mandates frameworks to manage AI risks, including bias in financial applications.

- Impact on Analytics: Crédit Agricole Nord de France must adapt its advanced analytics strategies to align with new AI regulations.

Crédit Agricole Nord de France must navigate evolving banking regulations like Basel III finalization (CRR3/CRD6) from January 1, 2025, which will likely maintain robust capital requirements, such as the Common Equity Tier 1 (CET1) ratio. The Digital Operational Resilience Act (DORA), effective January 17, 2025, mandates strengthened cybersecurity and IT risk management, with non-compliance posing significant penalties. Furthermore, heightened Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) measures, including real-time reporting and stricter customer due diligence, are being implemented across the EU in 2024 and beyond. New consumer protection rules, such as the Consumer Credit Directive to be transposed by November 2025, will demand greater transparency in credit advertising and pre-contractual information, impacting lending practices and marketing strategies.

Environmental factors

Crédit Agricole Nord de France is a key player in the region's economic and ecological shifts, channeling significant investment into low-carbon energy and sustainable infrastructure projects. This commitment is underscored by their pledge to achieve carbon neutrality by 2050, actively guiding clients through their energy transition strategies in line with evolving societal and regulatory demands.

The banking sector, including Crédit Agricole Nord de France, is increasingly prioritizing Environmental, Social, and Governance (ESG) factors. This shift necessitates embedding ESG risks into core governance, remuneration structures, and capital adequacy calculations. For instance, the EU’s Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024 for large companies, mandates detailed sustainability disclosures, impacting how banks like Crédit Agricole report and manage their environmental impact.

Clients are increasingly seeking green financing, sustainable investments, and products tied to Environmental, Social, and Governance (ESG) criteria. This trend is particularly strong, with sustainable investment funds in Europe seeing significant inflows; for instance, in 2023, sustainable funds attracted over €150 billion in net new assets, a substantial increase from previous years.

Crédit Agricole Nord de France is well-positioned to capitalize on this demand by developing and actively promoting financial solutions that back environmentally conscious projects and sustainable business practices. This strategic move aligns perfectly with the bank's societal commitment and the prevailing market direction, offering a clear avenue for growth and differentiation.

Physical and Transition Risks of Climate Change

Credit Agricole Nord de France must navigate the dual threats of climate change: physical risks, such as increased flooding or droughts impacting regional agriculture and businesses, and transition risks, stemming from evolving regulations and market shifts away from carbon-intensive industries. The European Central Bank (ECB) has made it clear that managing these climate-related and environmental risks is a priority for all financial institutions.

For instance, the bank's exposure to sectors like agriculture in Northern France, which is particularly vulnerable to changing weather patterns, requires robust risk assessment. Furthermore, as the EU pushes for decarbonization, sectors heavily reliant on fossil fuels within the bank's lending base will face significant transition risks. In 2024, the ECB's stress tests continued to highlight the potential financial impact of climate scenarios on bank portfolios.

- Physical Risk Example: Increased frequency of hailstorms in the Hauts-de-France region in 2024 has already impacted agricultural yields, potentially affecting loan repayments from farming clients.

- Transition Risk Example: A significant portion of Credit Agricole Nord de France's commercial lending might be concentrated in industries facing stricter carbon emission regulations in the coming years, necessitating portfolio adjustments.

- ECB Focus: The ECB's 2024 supervisory review emphasized the need for banks to integrate climate risk into their governance and risk management frameworks, with a particular focus on forward-looking assessments.

- Data Requirement: Banks are increasingly expected to quantify their exposure to both physical and transition risks, providing granular data on assets and clients impacted by climate change scenarios.

Biodiversity and Nature-Related Risks

Beyond climate change, the financial sector is increasingly scrutinizing biodiversity loss and nature-related risks. Given Crédit Agricole Nord de France's deep ties to agriculture, understanding its exposure to and impact on natural capital is becoming crucial. This includes assessing how its lending and investment portfolios might affect ecosystems and biodiversity.

The bank could face reputational and financial risks if its activities contribute to habitat destruction or species decline. For instance, the EU's Biodiversity Strategy for 2030 aims to significantly expand protected areas and restore degraded ecosystems, which could influence agricultural practices and the associated financial services. Crédit Agricole Nord de France might need to adapt its risk assessment frameworks to incorporate these nature-related dependencies.

Engaging in initiatives that promote biodiversity preservation could mitigate these risks and create new opportunities. This might involve supporting sustainable farming methods that enhance biodiversity, investing in ecological restoration projects, or offering financial products tailored to businesses that prioritize nature-positive practices. For example, as of 2024, there's growing investor interest in nature-based solutions, with markets for carbon credits and biodiversity offsets showing potential for growth.

- Exposure Assessment: Crédit Agricole Nord de France needs to evaluate how its agricultural loan portfolio impacts local biodiversity and natural resources.

- Risk Mitigation: Implementing stricter environmental due diligence for loans to sectors with high biodiversity impact is essential.

- Sustainable Finance: Developing financial products that incentivize biodiversity-friendly agricultural practices can align with evolving regulatory and market expectations.

- Industry Trends: Staying abreast of initiatives like the Taskforce on Nature-related Financial Disclosures (TNFD) is critical for future compliance and strategic positioning.

Environmental factors present both risks and opportunities for Crédit Agricole Nord de France. The bank must manage physical risks like extreme weather events impacting regional agriculture, a key sector for them. Simultaneously, transition risks arise from the shift away from carbon-intensive industries, requiring proactive portfolio adjustments. The European Central Bank (ECB) has clearly signaled its focus on these climate-related risks for all financial institutions, including Crédit Agricole Nord de France.

Furthermore, the increasing demand for green financing and sustainable investments, evidenced by over €150 billion in net new assets flowing into European sustainable funds in 2023, presents a significant growth avenue. Crédit Agricole Nord de France is strategically positioned to meet this demand by offering financial solutions that support environmentally conscious projects and sustainable business models.

Biodiversity loss and nature-related risks are also gaining prominence, particularly given the bank's strong ties to agriculture. The EU's Biodiversity Strategy for 2030, aiming to expand protected areas, will likely influence agricultural practices and the financial services supporting them. Crédit Agricole Nord de France needs to integrate these nature-related dependencies into its risk assessment frameworks to mitigate potential reputational and financial impacts.

| Environmental Factor | Impact on Crédit Agricole Nord de France | Key Data/Trend (2023-2024) |

|---|---|---|

| Climate Change (Physical Risks) | Increased loan default risk from agriculture due to extreme weather. | 2024: Increased hailstorms in Hauts-de-France impacting agricultural yields. |

| Climate Change (Transition Risks) | Need to de-risk portfolios from carbon-intensive sectors. | ECB's 2024 supervisory review emphasizes integrating climate risk into management. |

| Sustainable Finance Demand | Opportunity for growth through green lending and investments. | 2023: Over €150 billion in net new assets for European sustainable funds. |

| Biodiversity Loss | Reputational and financial risk if lending contributes to habitat destruction. | Growing investor interest in nature-based solutions and biodiversity offsets. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Crédit Agricole Nord de France is built upon a comprehensive review of data from official French government agencies, the European Union, and reputable financial and economic institutions. This includes reports on economic performance, regulatory changes, and demographic trends relevant to the region.