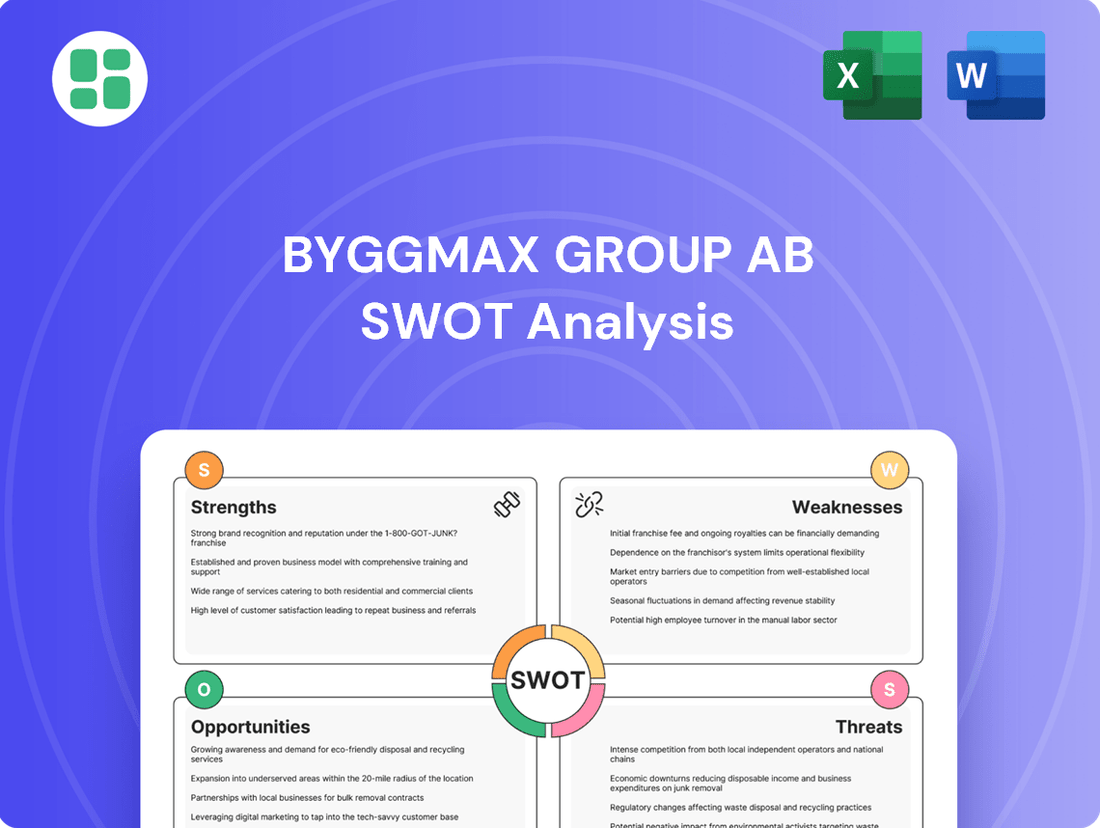

Byggmax Group AB SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Byggmax Group AB Bundle

Byggmax Group AB's strengths lie in its efficient, low-cost business model and strong brand recognition in the DIY market, but its reliance on a price-sensitive customer base presents a significant threat. Understanding these internal capabilities and external market forces is crucial for strategic planning. Discover the complete picture behind Byggmax's market position with our full SWOT analysis, revealing actionable insights and strategic takeaways ideal for investors and analysts.

Strengths

Byggmax Group AB holds a dominant position in the Nordic DIY retail sector, boasting over 210 stores across Sweden, Norway, Finland, and Denmark. This substantial physical footprint, complemented by a robust online presence, solidifies its market leadership in the region.

The company's strategy of offering quality building materials and DIY goods at competitive prices resonates strongly with consumers, driving significant customer loyalty. This approach has been a key factor in Byggmax's sustained growth and market penetration.

Byggmax's strength lies in its unwavering focus on affordability, positioning itself as a go-to for budget-conscious DIYers and tradespeople. This core strategy, offering high-quality building materials at the lowest possible prices, resonates strongly, particularly in markets sensitive to economic fluctuations. For instance, Byggmax reported a net sales increase of 4% in the first quarter of 2024 compared to the previous year, indicating continued customer demand for their value proposition.

The company enhances this affordability with a streamlined shopping experience. Features like drive-in facilities and self-service options in their physical stores, coupled with convenient digital ordering for pickup or delivery, significantly reduce friction for customers. This accessibility makes undertaking home improvement projects less daunting and more manageable for a wider audience, contributing to their market appeal.

Byggmax Group AB excels with a robust omnichannel strategy, seamlessly integrating its expansive physical store presence with a rapidly developing e-commerce platform. This approach provides customers with significant flexibility, enabling them to engage with the brand across various touchpoints, from browsing in-store to convenient online ordering and click-and-collect services.

The company's commitment to enhancing its digital infrastructure is evident in its ongoing investments in e-commerce logistics and capabilities. This strategic focus has directly contributed to a notable uplift in online sales and an improved overall customer experience, reinforcing Byggmax's competitive position in the DIY retail sector.

Improved Profitability and Financial Stability

Byggmax Group AB showcased resilience by achieving improved profitability and a more robust financial position throughout 2024, even amidst a demanding market. The company's strategic focus on operational efficiencies and effective inventory management paid dividends.

Key financial highlights from Q2 2025 underscore this positive trend, with the company reporting increased net sales and a notable uplift in its EBITA margin. This performance reflects a disciplined approach to cost control and a clear strategic direction centered on its core product segments.

- Increased Net Sales: Byggmax reported a significant rise in net sales for Q2 2025, indicating growing customer demand and effective market penetration.

- Higher EBITA Margin: The company achieved an improved EBITA margin in Q2 2025, demonstrating enhanced operational efficiency and profitability.

- Strengthened Balance Sheet: Byggmax's financial stability was bolstered by a stronger balance sheet, reflecting prudent financial management.

- Effective Inventory Management: Strategic improvements in inventory control contributed directly to the company's enhanced profitability and operational performance.

Commitment to Sustainability Initiatives

Byggmax Group AB demonstrates a strong commitment to sustainability, actively working to reduce its carbon footprint. This involves increasing the proportion of certified timber products in its offerings and enhancing energy efficiency across its retail and warehouse operations. For instance, as of their 2023 reporting, Byggmax aimed to increase the share of certified wood to 90% and had made progress in reducing energy consumption per square meter in their stores.

The company is also focused on developing circular material flows through strategic partnerships, aiming to minimize waste and maximize resource utilization. This dedication to sustainability resonates with increasing consumer demand for environmentally responsible products and aligns with evolving regulatory landscapes, thereby bolstering Byggmax's brand reputation and potentially leading to long-term operational cost savings.

- Reduced Carbon Emissions: Byggmax is actively pursuing strategies to lower its carbon footprint.

- Certified Timber Focus: Increasing the share of certified timber products is a key initiative.

- Energy Efficiency: The company prioritizes energy saving measures in its physical infrastructure.

- Circular Economy Partnerships: Byggmax seeks collaborations to establish circular material flows.

Byggmax's core strength is its unwavering focus on affordability, offering quality building materials at competitive prices. This value proposition, coupled with a strong omnichannel presence and efficient operations, drives customer loyalty and market penetration. The company's commitment to sustainability further enhances its brand appeal.

Byggmax reported a 4% increase in net sales in Q1 2024, demonstrating continued customer demand for its value-driven offerings. Furthermore, the company achieved an improved EBITA margin in Q2 2025, highlighting its success in enhancing operational efficiencies and cost control.

The company's strategic focus on increasing the share of certified wood products, aiming for 90% by 2023, and reducing energy consumption per square meter in stores underscores its dedication to sustainability, aligning with growing consumer preferences for environmentally responsible brands.

| Metric | Q1 2024 | Q2 2025 | Year-over-Year Change (Sales) |

|---|---|---|---|

| Net Sales | Reported 4% increase | Significant rise | N/A |

| EBITA Margin | N/A | Improved | N/A |

| Certified Wood Share (Target) | N/A | N/A | 90% by 2023 |

What is included in the product

Delivers a strategic overview of Byggmax Group AB’s internal and external business factors, highlighting its market position and potential for growth.

Offers a clear framework to identify and address Byggmax Group AB's internal weaknesses and external threats, thereby alleviating strategic planning pain points.

Weaknesses

Byggmax Group AB, as a retailer of building materials and DIY products, faces significant vulnerability to economic downturns. Periods of economic uncertainty, like the cautious consumer sentiment observed in early 2024, directly impact discretionary spending on home improvement projects. This sensitivity means that a slowdown in the broader economy can lead to a noticeable decrease in demand for Byggmax's offerings.

Byggmax Group AB's significant reliance on its Nordic markets, particularly Sweden, presents a notable weakness. This geographical concentration means the company is highly susceptible to localized economic fluctuations and regulatory changes within Sweden, Norway, Finland, and Denmark. For instance, a slowdown in the Swedish construction sector, which historically accounts for a substantial portion of Byggmax's sales, could have a magnified negative impact on its overall financial health.

This concentrated market exposure also makes Byggmax vulnerable to intensified competition within these specific regions. If competitors gain significant traction or introduce disruptive business models in the Nordic countries, Byggmax's market share and profitability could be disproportionately affected. The company's revenue in 2023, for example, was heavily weighted towards these core markets, underscoring the risk associated with this dependency.

Byggmax's commitment to offering the best prices on the market, a core tenet of its business, inherently cultivates a customer base that is highly attuned to price fluctuations. This reliance on price competitiveness means that any significant increase in their product costs, perhaps due to supply chain disruptions or rising raw material prices, could directly impact customer loyalty and purchasing decisions. For instance, if competitors manage to undercut Byggmax's pricing, even slightly, a substantial portion of their customer segment might easily switch.

The company's strategy, while effective in attracting cost-conscious consumers, also makes it vulnerable to intense price wars. In 2024, the DIY and home improvement sector has seen increased competition, with several players focusing on aggressive discounting. This environment means Byggmax must constantly balance its low-price promise with maintaining profitability. A shift in consumer sentiment towards valuing quality or sustainability over pure price could also pose a challenge, potentially eroding the advantage Byggmax has built, especially as economic conditions in 2025 remain uncertain for many households.

Supply Chain and Inventory Management Challenges

Effective inventory management is paramount for Byggmax, a building materials retailer, to guarantee product availability and manage operational costs. While Byggmax demonstrated strong inventory control in Q2 2025, the risk of global supply chain disruptions or unexpected shifts in consumer demand remains a persistent vulnerability, potentially leading to either overstocking or stockouts.

The logistical complexities of managing a broad assortment of bulky products across numerous physical store locations and its online platform present ongoing challenges for Byggmax. This intricate network requires robust systems to prevent inefficiencies and maintain customer satisfaction.

- Supply Chain Vulnerability: Potential disruptions in global supply chains, as seen with shipping delays impacting the construction sector in early 2025, could affect Byggmax's product availability and lead times.

- Demand Volatility: Unforeseen shifts in demand, influenced by economic conditions or seasonal trends, can strain inventory levels, leading to either excess stock or shortages.

- Logistical Complexity: Managing a wide range of bulky building materials across multiple sales channels (stores and online) requires sophisticated inventory tracking and distribution, increasing the risk of errors or inefficiencies.

Impact of Declining E-commerce Growth in Nordic Retail

Byggmax's ambition to grow its e-commerce segment faces headwinds from a broader Nordic retail trend. In 2024, the region saw a slowdown in e-commerce growth, with physical retail channels demonstrating more resilience and actually outpacing online sales expansion. This shift could challenge Byggmax's digital strategy.

This slowdown in e-commerce growth within the Nordic region, observed throughout 2024, means that Byggmax's investments in its online platform might not yield the anticipated returns if this trend persists. The company may need to adjust its digital investment strategy, potentially rebalancing resources between online and physical store operations.

- Nordic E-commerce Growth Slowdown: Reports indicated a deceleration in online sales growth across the Nordic retail sector in 2024.

- Physical Retail Outperformance: Brick-and-mortar stores in the region saw a more robust performance compared to their online counterparts during the same period.

- Strategic Re-evaluation Needed: Byggmax may need to reassess the allocation of capital between its digital initiatives and its physical store network.

- Impact on Online Ambitions: The sustained decline in e-commerce growth could hinder Byggmax's ability to achieve its online sales targets.

Byggmax's reliance on price competitiveness makes it susceptible to intense price wars, a trend evident in the DIY sector in 2024. This strategy can erode profit margins if product costs rise, as seen with supply chain disruptions impacting raw material prices. Furthermore, a shift in consumer preference towards quality or sustainability over price could undermine its core advantage, especially given the uncertain economic outlook for 2025.

Same Document Delivered

Byggmax Group AB SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive look at Byggmax Group AB's strategic positioning.

Opportunities

The Swedish DIY and home renovation market presents a significant opportunity for Byggmax. Projections indicate robust growth in this sector, fueled by a steady rise in homeownership and increasing consumer spending power. This trend is particularly strong in Sweden, where a cultural emphasis on home personalization translates directly into demand for building materials and renovation supplies.

Byggmax is well-positioned to capitalize on this renewed interest in DIY projects. The company's focus on providing accessible and affordable solutions for home improvement aligns perfectly with consumer desires to enhance their living spaces. As of early 2024, the Swedish construction materials market, which includes DIY segments, continues to show resilience and growth, with Byggmax's business model directly benefiting from this sustained consumer engagement.

Byggmax has a significant opportunity to broaden its product and service offerings, particularly by catering to the growing DIY market with easy-to-use kits and tailored solutions for novice home improvers. This approach addresses a clear market need for accessible project guidance and pre-portioned materials.

The company can also leverage its existing infrastructure and brand recognition to expand into adjacent categories, such as garden supplies and outdoor living products, mirroring the success of its Byggmax Trädgård concept. This diversification strategy can unlock new revenue streams and attract a wider customer base, further solidifying its market position.

Byggmax can capitalize on the growing online DIY trend by expanding its e-commerce capabilities, offering features like online ordering, home delivery, and digital project guides. This digital push is crucial as online sales in the home improvement sector are projected to grow significantly, with some estimates suggesting a compound annual growth rate of over 8% through 2027.

The integration of smart home technology and AI presents a unique opportunity for Byggmax to personalize customer interactions. For instance, AI-powered tools could help customers select the right materials based on project needs or even predict future product demand, enhancing customer loyalty and sales.

Focus on Sustainability and Eco-Friendly Products

Byggmax can capitalize on the increasing consumer demand for sustainable options. In 2024, reports indicated a significant rise in consumer willingness to pay a premium for eco-friendly home improvement goods, a trend expected to continue through 2025. This presents a clear opportunity for Byggmax to broaden its product range with certified sustainable materials and energy-efficient solutions.

Byggmax's existing commitment to sustainability provides a strong foundation for this expansion. The company has already implemented initiatives like reducing waste and optimizing logistics. Focusing on eco-friendly products will not only meet evolving customer expectations but also bolster Byggmax's brand reputation in a competitive market.

- Expand product lines with certified sustainable timber, recycled materials, and low-VOC paints.

- Highlight eco-credentials through clear labeling and marketing campaigns to attract environmentally conscious consumers.

- Partner with sustainable suppliers to ensure the integrity and traceability of eco-friendly offerings.

Strategic Acquisitions and Optimized Store Portfolio

Byggmax Group AB's strategy hinges on carefully chosen acquisitions and a dynamic approach to its store portfolio. This allows for expansion into new, strategically important markets and enhances customer reach, reinforcing its core low-price offering.

This inorganic growth complements organic expansion, enabling Byggmax to solidify its market position. For instance, in 2024, the company continued to evaluate opportunities that align with its growth objectives, aiming to optimize its geographical footprint and service capabilities.

- Strategic Acquisitions: Byggmax actively seeks acquisitions that bolster its market share and expand its geographical reach.

- Store Portfolio Optimization: Continuous evaluation and adaptation of the store network ensures efficient market presence and customer accessibility.

- Low-Price Concept Reinforcement: New store openings and strategic acquisitions are designed to strengthen Byggmax's competitive advantage in its core low-price segment.

- Inorganic Growth: This strategy acts as a crucial complement to organic growth, accelerating market penetration and brand development.

Byggmax has a significant opportunity to expand its e-commerce presence, targeting the growing online DIY market. Projections show the online home improvement sector growing at over 8% annually through 2027, making digital expansion a key growth driver.

The company can also leverage its brand to introduce new product categories, such as garden and outdoor living supplies, mirroring the success of its Trädgård concept. This diversification aims to capture new revenue streams and broaden its customer base.

Byggmax can capitalize on the increasing consumer demand for sustainable products, a trend where consumers are willing to pay more for eco-friendly options. This aligns with Byggmax's existing sustainability initiatives and offers a chance to enhance its brand reputation.

Strategic acquisitions and optimizing its store portfolio are crucial for Byggmax to enter new markets and reinforce its low-price strategy. In 2024, the company continued to pursue growth opportunities, aiming to enhance its geographical reach and service capabilities.

Threats

The DIY home improvement sector is a crowded space, with both long-standing retailers and emerging businesses constantly seeking to capture consumer attention. This heightened rivalry, particularly from online platforms and niche retailers, poses a significant threat by potentially triggering price wars that could squeeze Byggmax's profit margins and weaken its standing in the market. For instance, in 2024, the online DIY market saw significant growth, with platforms like Amazon and specialized e-commerce sites increasing their market share, putting pressure on traditional brick-and-mortar retailers to compete on price and convenience.

Byggmax's core strategy often hinges on its commitment to offering the lowest prices. However, in an environment of intensifying competition, upholding this promise while simultaneously ensuring financial health presents an ongoing and substantial hurdle. The challenge lies in balancing aggressive pricing with the need to maintain profitability, especially as input costs for building materials can fluctuate. In early 2025, reports indicated rising raw material costs for lumber and other key construction supplies, directly impacting the cost base for DIY retailers.

Ongoing economic uncertainty, characterized by persistent high inflation in 2024 and the possibility of further interest rate increases, poses a significant threat by potentially reducing consumer spending on discretionary home improvement projects. For instance, inflation in the Eurozone remained elevated in early 2024, impacting purchasing power.

Volatile utility costs and a general reduction in household disposable income could lead to a contraction in the overall market demand for building materials and home improvement products. This directly impacts Byggmax's sales volume and overall profitability, as consumers may postpone or scale back renovation plans.

Global supply chain vulnerabilities remain a significant concern, with potential import challenges from key regions like China posing a risk of increased costs or product shortages for Byggmax. In 2024, continued disruptions in shipping and manufacturing have already impacted various industries, and Byggmax is not immune to these pressures.

Geopolitical events and ongoing trade tensions could further complicate the flow of goods, directly affecting Byggmax's inventory levels and its capacity to maintain competitive pricing strategies in 2025.

Regulatory Changes and Increased Compliance Costs

Byggmax Group AB, like many Nordic retailers, is navigating a landscape of evolving regulations, particularly around environmental, social, and governance (ESG) standards. These changes, focusing on areas like waste management and supply chain ethics, present a significant threat. For instance, stricter requirements for product lifecycle assessments or increased demands for supply chain transparency can directly translate into higher operational costs and the need for new compliance systems. This regulatory shift could impact Byggmax's profitability and require substantial investment in adapting its business practices.

The increasing focus on ESG means that Byggmax must be prepared for more rigorous disclosure obligations. For example, upcoming EU directives on corporate sustainability reporting, like the Corporate Sustainability Reporting Directive (CSRD), will mandate more detailed and standardized reporting on environmental and social impacts. Failure to comply or the cost of implementing robust reporting mechanisms can create a competitive disadvantage. This could lead to increased administrative burdens and necessitate investments in specialized personnel or external consultancy services to ensure adherence to new legal frameworks.

The potential for increased compliance costs directly impacts Byggmax's bottom line. As regulations tighten, the resources required for monitoring, reporting, and implementing new environmental or ethical standards will rise. This could divert capital from other strategic initiatives, such as store expansion or product development. For example, if new waste reduction mandates require significant changes to packaging or logistics, the associated costs could be substantial, affecting pricing strategies and overall market competitiveness.

- Increased ESG Scrutiny: Retailers in the Nordics face growing pressure on environmental, social, and governance factors.

- Higher Compliance Costs: New environmental and ethical sourcing regulations can lead to increased operational expenses for Byggmax.

- Supply Chain Transparency Demands: Stricter disclosure obligations regarding supply chains add complexity and potential costs.

- Impact on Profitability: Failure to adapt to or the cost of complying with new regulations can negatively affect Byggmax's financial performance.

Shift in Consumer Preferences Away from DIY

A notable shift away from the do-it-yourself (DIY) movement towards professional home renovation services presents a significant threat to Byggmax. This trend, potentially driven by increasing consumer demand for convenience or a lack of time and expertise for complex projects, could directly impact Byggmax's primary customer base.

The growing preference for outsourced home improvements means fewer customers may turn to Byggmax for materials. For instance, while the DIY market has seen robust growth, reports from 2024 indicate a concurrent rise in demand for professional contracting services, particularly in larger renovation projects. This could mean a reduction in Byggmax's sales volume if consumers opt for full-service providers rather than sourcing materials themselves.

Furthermore, the ease of online purchasing might inadvertently reduce in-store traffic for Byggmax, especially for customers who previously relied on expert advice for more intricate projects. As online retail continues to expand its reach in the home improvement sector, Byggmax faces the challenge of maintaining customer engagement and loyalty in a digitally-driven landscape.

- Consumer Preference Shift: Growing demand for professional renovation services over DIY projects.

- Market Data: Increased demand for contractors observed in 2024, potentially diverting customers from DIY material purchases.

- Online Competition: E-commerce convenience could decrease in-store engagement, particularly for complex projects requiring expert advice.

Intensifying competition, particularly from online players and specialized retailers, poses a significant threat by potentially leading to price wars that could erode Byggmax's profit margins. For example, the online DIY market saw substantial growth in 2024, with increased market share for platforms like Amazon, pressuring traditional retailers on price and convenience.

Economic headwinds, including persistent inflation in 2024 and potential interest rate hikes, could dampen consumer spending on discretionary home improvement projects, directly impacting Byggmax's sales volumes.

Evolving regulations, especially concerning ESG standards, present a threat of increased compliance costs and operational complexity for Byggmax. For instance, new EU directives like the CSRD will mandate more detailed sustainability reporting, potentially increasing administrative burdens and requiring investments in new systems.

A shift in consumer preference towards professional renovation services over DIY projects could reduce Byggmax's core customer base. Reports from 2024 indicate a concurrent rise in demand for professional contracting services, potentially diverting customers from DIY material purchases.

SWOT Analysis Data Sources

This Byggmax Group AB SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-informed strategic overview.