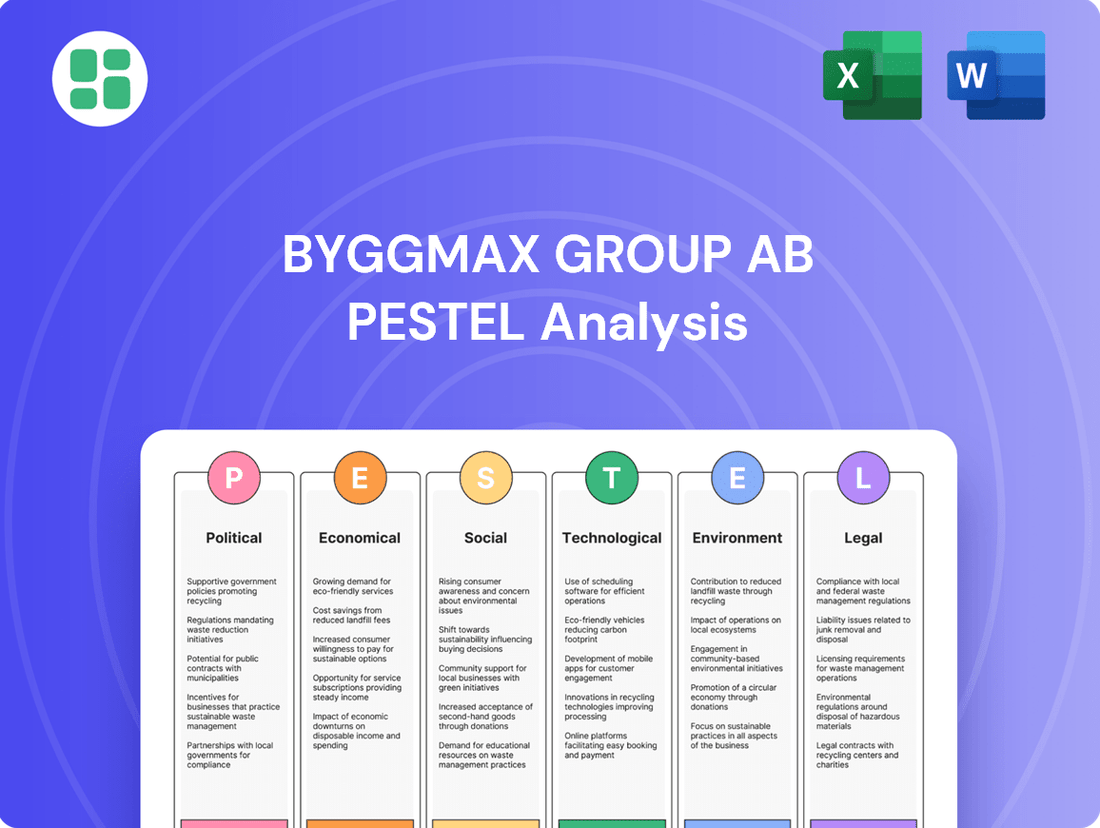

Byggmax Group AB PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Byggmax Group AB Bundle

Byggmax Group AB operates within a dynamic external environment, shaped by shifting political landscapes, economic fluctuations, and evolving social trends. Understanding these PESTLE factors is crucial for strategic planning and identifying both opportunities and threats. Our comprehensive analysis delves into how these forces are impacting Byggmax's operations and market position.

Gain a competitive edge by unlocking the full PESTLE analysis for Byggmax Group AB. Discover how political stability, economic growth, technological advancements, environmental regulations, and social preferences are influencing the DIY and home improvement sector. Download the complete report now to arm yourself with actionable intelligence for smarter business decisions.

Political factors

Byggmax Group AB navigates a landscape shaped by stringent government regulations impacting both construction and retail sectors. These rules, encompassing everything from building material standards to consumer protection laws, directly influence Byggmax's product sourcing, store operations, and overall business model. For instance, evolving energy efficiency requirements for building materials, a key area for Byggmax, necessitate continuous adaptation of their product portfolio to meet new compliance standards and consumer demand for sustainable options.

Changes in safety regulations for construction sites or retail environments can also impose significant operational adjustments. Adherence to updated labor laws or product safety certifications requires diligent oversight and potentially increased investment in training and compliance measures. In 2024, for example, several European countries introduced stricter regulations on the use of certain chemicals in construction materials, directly affecting product availability and supplier relationships for companies like Byggmax.

Staying ahead of these evolving legal frameworks is paramount for Byggmax's sustained success and to mitigate risks associated with non-compliance. Failure to adapt to new building codes or retail operational mandates could lead to costly penalties, supply chain disruptions, and damage to the company's reputation. The company's proactive engagement with regulatory bodies and investment in compliance infrastructure are therefore critical for ensuring smooth operations and maintaining market competitiveness.

Byggmax, as a building materials retailer, is significantly impacted by international trade policies and tariffs, particularly on imported goods. For instance, changes in EU trade agreements or the introduction of tariffs on materials like timber or steel can directly increase Byggmax's sourcing costs. This can force adjustments to their pricing strategies, potentially affecting profitability. In 2024, the EU continued to navigate complex trade relationships, with ongoing discussions around potential tariffs on certain imported goods that could influence Byggmax's supply chain.

Byggmax Group AB operates across Sweden, Norway, Finland, and Denmark, making the political stability within these Nordic nations a crucial element for its business. These regions are generally characterized by strong democratic institutions and stable governance, which supports a predictable operating environment.

However, any significant geopolitical shifts, unexpected changes in government, or heightened policy uncertainty in these markets could impact consumer confidence and overall economic growth. Such instability might dampen demand for building materials, affecting Byggmax's sales and profitability. For instance, during periods of heightened international tension, consumer spending on discretionary items like home improvements can contract.

A consistently stable political landscape is vital for Byggmax, as it fosters a predictable market that allows for effective business planning and potential expansion. The Nordic countries consistently rank high in global peace and stability indexes, providing a solid foundation for businesses like Byggmax to thrive and invest with greater confidence.

Government Incentives for Home Renovation and Energy Efficiency

Government incentives play a crucial role in boosting the home renovation market. In Sweden, the ROT-avdrag system, which allows for tax deductions on labor costs for home improvements, has historically stimulated demand. For example, in 2023, the Swedish government allocated approximately SEK 20 billion to the ROT-avdrag, directly benefiting homeowners undertaking renovation projects.

These policies, including subsidies for energy-efficient upgrades like improved insulation or solar panel installations, directly encourage consumers to invest in their homes. Byggmax, as a retailer of DIY and building materials, is well-positioned to capitalize on this trend. Their product range, from insulation materials to energy-saving windows, aligns perfectly with government-supported renovation initiatives, driving sales and market share.

- Government support for home renovations, such as Sweden's ROT-avdrag, directly fuels consumer spending in the DIY and construction sectors.

- Byggmax can strategically align its product offerings and marketing campaigns with government-backed energy efficiency programs to capture increased demand.

- The availability of tax deductions and subsidies encourages homeowners to undertake projects that might otherwise be postponed, leading to a more robust market for building materials.

- These political factors create a favorable operating environment for companies like Byggmax by stimulating underlying demand for their products and services.

Labor Laws and Employment Regulations

Labor laws, including minimum wage, working hours, and employment protection, differ significantly across the Nordic markets where Byggmax Group AB operates, such as Sweden, Norway, and Finland. For instance, Sweden's average minimum wage for retail workers, while not legally mandated nationally, is often influenced by collective agreements, with many agreements hovering around SEK 130-150 per hour as of early 2024. Changes in these regulations can directly impact staffing costs and operational flexibility. Byggmax must navigate these varying frameworks to ensure compliance and maintain positive employee relations.

Evolving labor legislation necessitates continuous adaptation. For example, potential increases in minimum wages or stricter regulations on working hours, as seen in some EU discussions impacting member states, could raise Byggmax's operational expenses. Staying abreast of these changes, such as the ongoing review of employment protection laws in Sweden that could impact hiring and firing processes, is crucial for avoiding legal disputes and fostering a stable workforce. This requires proactive engagement with legal counsel and industry bodies.

- Varying Minimum Wage: Nordic countries have different approaches to minimum wage, impacting Byggmax's labor costs.

- Working Hour Regulations: Changes in mandated working hours can affect staffing levels and operational scheduling.

- Employment Protection: Stricter employment protection laws can influence Byggmax's ability to manage its workforce efficiently.

- Compliance Costs: Adhering to diverse and evolving labor laws across multiple countries incurs compliance costs and requires ongoing legal monitoring.

Government policies, particularly those related to construction and retail, significantly influence Byggmax Group AB's operations. Stricter regulations on building materials and consumer protection laws necessitate continuous adaptation of their product portfolio and store operations. For instance, evolving energy efficiency requirements directly impact Byggmax's product sourcing and consumer demand for sustainable options.

Political stability in the Nordic countries where Byggmax operates is crucial for a predictable business environment. While these regions generally boast strong democratic institutions, geopolitical shifts or policy uncertainty could affect consumer confidence and economic growth, impacting sales. The company's success hinges on navigating these political landscapes and ensuring compliance with diverse labor laws across Sweden, Norway, Finland, and Denmark, which affect staffing costs and operational flexibility.

Government incentives, such as Sweden's ROT-avdrag for home renovations, directly stimulate demand for building materials. In 2023, this scheme saw an allocation of approximately SEK 20 billion, benefiting homeowners and consequently Byggmax. By aligning its product range with government-backed energy efficiency programs, Byggmax can effectively capitalize on increased consumer spending driven by these supportive political measures.

| Political Factor | Impact on Byggmax | Example/Data (2023-2024) |

|---|---|---|

| Regulatory Changes (e.g., Energy Efficiency) | Requires product adaptation, affects sourcing costs. | Stricter chemical regulations in EU construction materials (2024). |

| Political Stability | Ensures predictable operating environment, impacts consumer confidence. | Nordic countries consistently rank high in global stability indexes. |

| Government Incentives (e.g., ROT-avdrag) | Stimulates home renovation market, boosts sales. | Sweden's ROT-avdrag allocation of ~SEK 20 billion in 2023. |

| Labor Laws | Affects labor costs, operational flexibility, and compliance. | Swedish retail worker minimum wage influenced by collective agreements around SEK 130-150/hour (early 2024). |

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Byggmax Group AB across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's operations and market position.

A PESTLE analysis for Byggmax Group AB acts as a pain point reliever by identifying and mitigating external risks, such as regulatory changes or economic downturns, thereby enabling proactive strategic adjustments and market resilience.

Economic factors

Consumer spending power is a critical driver for Byggmax Group AB, directly impacting demand for home improvement and construction goods. In 2024, Sweden's inflation rate, while moderating from previous highs, remained a factor influencing disposable income. For example, if inflation outpaces wage growth, consumers may have less discretionary income available for renovation projects, a key segment for Byggmax.

When consumers feel financially secure and have ample disposable income, they are more inclined to undertake home improvement projects. This increased confidence translates into higher sales volumes for Byggmax. Conversely, economic uncertainties or periods of high inflation can lead to consumers postponing or scaling back non-essential expenditures, directly affecting Byggmax's revenue streams.

Interest rates are a major driver of the housing market, directly affecting how much people can afford to borrow for a home. When rates are low, mortgages become cheaper, encouraging more people to buy and, consequently, boosting demand for home improvement and building supplies, which is good for companies like Byggmax.

Conversely, when interest rates climb, borrowing becomes more expensive. This often leads to a slowdown in housing sales and a decrease in consumer confidence for major renovation projects. For instance, if mortgage rates increase by even a percentage point, it can significantly impact a buyer's monthly payments.

The Swedish housing market, a key market for Byggmax, experienced a positive shift in mid-2025. Falling interest rates provided a tailwind, leading to an uptick in property prices and a greater volume of sales. This recovery suggests a more favorable environment for demand in the building materials sector.

Inflationary pressures significantly impact Byggmax by increasing the cost of essential raw materials like lumber and cement, as well as transportation and labor expenses. For instance, in early 2024, lumber prices saw volatility, with futures for framing lumber experiencing fluctuations, impacting construction input costs across the sector.

These rising material costs can directly squeeze Byggmax's profit margins. If the company cannot pass these increased expenses onto consumers through pricing adjustments or find greater efficiencies in its supply chain, its ability to offer competitive, affordable options is challenged.

Effectively managing these escalating costs is therefore paramount for Byggmax to uphold its core value proposition of providing accessible and affordable building materials to its customer base.

Economic Growth and GDP in Nordic Countries

The economic growth trajectory of Sweden, Norway, Finland, and Denmark significantly impacts Byggmax Group AB’s performance, particularly within the construction and retail segments. Robust GDP expansion generally signals a healthier market, translating to greater construction projects and elevated consumer spending, both of which directly benefit Byggmax. For instance, the Swedish economy is anticipated to experience a positive turnaround in 2025, bolstered by anticipated reductions in interest rates and an increase in real disposable incomes.

The correlation between GDP and demand for construction materials is evident. When economies expand, investment in infrastructure and new housing typically rises, creating a fertile ground for companies like Byggmax. Conversely, periods of economic slowdown or recession can lead to reduced consumer confidence and postponed building projects, thereby dampening sales.

- Sweden's GDP growth forecast for 2025 is projected at 2.1%, up from an estimated 1.5% in 2024.

- Norway's economy is expected to grow by 1.8% in 2025, supported by a recovery in oil prices and domestic demand.

- Finland's GDP is forecast to expand by 1.9% in 2025, driven by increased exports and private consumption.

- Denmark's economic growth is estimated at 1.7% for 2025, benefiting from strong private investment and a stable labor market.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly influence Byggmax Group AB, given its operations across multiple Nordic countries and potential international material sourcing. For instance, a strengthening SEK against the EUR or NOK could make imported goods cheaper, boosting Byggmax's purchasing power and potentially lowering its cost of goods sold. Conversely, a weaker SEK would increase these costs, directly impacting profit margins.

These currency movements also affect Byggmax's reported financial performance. When sales made in foreign currencies, like NOK or DKK, are translated back into SEK for reporting purposes, unfavorable exchange rate shifts can reduce the reported revenue and earnings. For example, if the SEK strengthens considerably against the NOK during a reporting period, the NOK-denominated sales will translate to fewer SEK, even if the actual sales volume in Norway remained constant.

Looking at recent trends, the Swedish Krona (SEK) experienced volatility in 2024. While specific Byggmax-related currency impact data for the full year 2024 and early 2025 isn't publicly detailed, general market analysis indicates that the SEK has faced headwinds against major currencies like the Euro and US Dollar at various points. This suggests Byggmax likely navigated periods where imported materials became more expensive and foreign earnings translated to less SEK.

- Impact on Cost of Goods Sold: Fluctuations in SEK against EUR and NOK directly alter the cost of imported building materials, affecting Byggmax's gross profit margins.

- Revenue Translation: Sales generated in Norway (NOK) and Denmark (DKK) are subject to translation risk, where a stronger SEK can diminish reported revenue.

- Profitability: Unfavorable currency movements can erode net profit by increasing both import costs and reducing the SEK value of foreign earnings.

- Competitive Pricing: Exchange rate shifts can influence Byggmax's ability to maintain competitive pricing in its various markets.

Consumer spending power remains a key determinant for Byggmax, with inflation's impact on disposable income a consistent consideration. For instance, Sweden's inflation rate, projected to moderate but still present in 2025, directly influences consumers' ability to fund home improvement projects. Economic confidence, therefore, directly correlates with Byggmax's sales volumes.

Interest rates significantly shape the housing market, affecting affordability and demand for renovations. Lower rates in mid-2025 provided a tailwind for the Swedish housing market, boosting property sales and, consequently, the demand for building materials. Conversely, rising rates can dampen this demand by increasing borrowing costs.

Economic growth across Byggmax's operating regions, particularly Sweden, Norway, Finland, and Denmark, is crucial. For example, Sweden's GDP growth forecast for 2025 is projected at 2.1%, up from an estimated 1.5% in 2024, indicating a more favorable market environment. Stronger economies generally translate to increased construction and consumer spending.

Currency fluctuations, especially involving the Swedish Krona (SEK), impact Byggmax's costs and reported earnings. A stronger SEK can lower the cost of imported materials, while a weaker SEK increases these costs and reduces the value of foreign earnings. Navigating these shifts is vital for maintaining competitive pricing and profitability.

| Economic Factor | 2024 (Estimate/Actual) | 2025 (Forecast) | Impact on Byggmax |

| Swedish Inflation Rate | ~3.0% | ~2.0% | Affects consumer disposable income and material costs. |

| Swedish GDP Growth | 1.5% | 2.1% | Higher growth generally leads to increased construction and demand. |

| Interest Rates (Repo Rate, Sweden) | Fluctuating, averaging ~3.5% | Projected to decrease, potentially ~2.5% | Lower rates stimulate housing market and renovations. |

| SEK vs. EUR Exchange Rate | Avg. ~11.3 SEK/EUR | Projected to stabilize around ~11.0 SEK/EUR | Influences cost of imported goods and foreign earnings translation. |

Same Document Delivered

Byggmax Group AB PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Byggmax Group AB delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It provides a detailed overview of the current landscape and potential future influences.

Sociological factors

Demographic shifts significantly impact Byggmax. For instance, in Sweden, the population aged 65 and over is projected to reach 20% by 2025, increasing demand for accessible home modifications and renovations. Conversely, a growing number of younger households are entering the market, fueling demand for starter homes and DIY renovation supplies.

Population growth, particularly in Swedish urban centers like Stockholm and Gothenburg, directly translates to increased construction activity. These areas saw a combined population increase of approximately 50,000 people between 2023 and 2024, creating a consistent need for building materials that Byggmax supplies.

Byggmax must adapt its product assortment and store network to these evolving demographics. Understanding that an aging population may prioritize smaller, more manageable projects while younger families focus on new builds or larger renovations allows for more targeted marketing and inventory management.

The growing DIY culture and a strong interest in home improvement projects are central to Byggmax's business model. This trend, often intensified by economic pressures or a desire for unique living spaces, directly boosts demand for construction materials and tools.

Byggmax's strategy of offering accessible and straightforward shopping experiences aligns perfectly with the needs of this DIY consumer base. The Swedish home improvement market is anticipated to hit USD 19.23 billion by 2030, a growth fueled by incentives like tax breaks and regulations promoting energy efficiency.

Modern lifestyles increasingly prioritize convenience, directly influencing how consumers buy everything, including building materials. The rise of online shopping and the demand for simplified purchasing processes are key trends. Byggmax's investment in its online platform is vital to cater to these evolving preferences, offering features like online ordering and flexible fulfillment options such as in-store pickup or home delivery.

E-commerce in Sweden experienced a notable upswing in 2024, demonstrating a continued shift towards digital retail. Despite a somewhat subdued beginning to 2025, consumer preference for home deliveries remained strong, highlighting the importance of robust logistics for companies like Byggmax to meet customer expectations for ease and accessibility.

Work-from-Home Trends Influencing Home Renovation

The ongoing shift towards remote and hybrid work models continues to significantly influence consumer spending on home renovations. Many individuals are prioritizing the creation of dedicated home offices or upgrading existing living spaces to better accommodate their work-from-home needs, directly benefiting retailers like Byggmax that supply renovation materials and furniture. This trend underscores a growing consumer emphasis on home functionality and comfort. For instance, a 2024 survey indicated that 60% of remote workers planned to undertake home improvement projects specifically to enhance their workspace, a sentiment likely to persist through 2025.

This sociological factor translates into increased demand for a variety of renovation products. Consumers are investing in items such as:

- Desk and chair sets

- Storage solutions

- Improved lighting

- Soundproofing materials

The sustained preference for flexible work arrangements is expected to maintain this elevated level of home improvement spending. Byggmax is well-positioned to capitalize on this trend by offering a comprehensive range of products that cater to the evolving needs of homeowners creating more productive and comfortable living environments. The desire for enhanced home functionality, driven by work-from-home realities, is a key driver for the DIY and home renovation sectors.

Public Perception of Sustainable Building Practices

Public perception is a significant driver in the building materials sector. Growing awareness of climate change and environmental impact means consumers are actively seeking out eco-friendly products. This trend is particularly strong in Sweden, where a significant portion of the population prioritizes sustainability when making purchasing decisions.

Byggmax Group AB must align with this evolving consumer sentiment. Offering a wider range of sustainable building materials, such as recycled content lumber or low-VOC paints, directly addresses this demand. Highlighting the company's own environmental initiatives, like waste reduction programs or energy-efficient operations, can further enhance its appeal to an eco-conscious customer base.

Data from 2024 indicates a clear willingness among Swedish consumers to invest more in sustainable choices. For instance, surveys show that over 60% of Swedish households are willing to pay a premium for products with a verified environmental certification. This suggests a substantial market opportunity for Byggmax to capitalize on by emphasizing its green credentials.

- Growing Demand: Swedish consumers increasingly favor environmentally friendly building materials.

- Willingness to Pay: A majority of Swedish households are prepared to pay more for sustainable options, as evidenced by 2024 consumer surveys.

- Brand Perception: Byggmax's ability to offer and promote sustainable practices directly impacts its public image and market competitiveness.

- Market Opportunity: Catering to the eco-conscious consumer base presents a significant growth avenue for the company.

The increasing emphasis on home improvement and DIY culture in Sweden directly benefits Byggmax. This trend is supported by the Swedish home improvement market's projected growth to USD 19.23 billion by 2030, partly due to incentives promoting energy efficiency.

Modern lifestyles are shifting towards convenience, with a strong preference for online shopping and streamlined purchasing. Byggmax's investment in its online platform, including features like online ordering and flexible fulfillment, is crucial for meeting these evolving consumer expectations in 2024 and 2025.

The rise of remote and hybrid work models is driving demand for home renovations, particularly for creating functional workspaces. A 2024 survey revealed that 60% of remote workers planned home improvement projects to enhance their work-from-home setups, a trend expected to continue.

Public perception increasingly favors sustainability, with Swedish consumers actively seeking eco-friendly building materials. Over 60% of Swedish households in 2024 indicated a willingness to pay a premium for products with verified environmental certifications.

| Sociological Factor | Impact on Byggmax | Supporting Data (2024/2025) |

|---|---|---|

| DIY Culture & Home Improvement | Increased demand for building materials and tools. | Swedish home improvement market projected to reach $19.23 billion by 2030. |

| Convenience & E-commerce | Need for robust online platform and logistics. | Continued strong consumer preference for home deliveries in early 2025. |

| Remote Work Trends | Higher demand for renovation products for home offices. | 60% of remote workers planned home improvement for workspace in 2024. |

| Environmental Awareness | Growing demand for sustainable building materials. | Over 60% of Swedish households willing to pay more for certified eco-friendly products (2024). |

Technological factors

Byggmax's continued investment in its e-commerce platform is vital for capitalizing on the growing online sales trend in Sweden. A user-friendly interface, streamlined order fulfillment, and varied payment methods are key to attracting and retaining customers in the digital space.

The e-commerce sector in Sweden has seen substantial growth, with online sales representing a considerable share of total retail turnover. Projections indicate further expansion, particularly within the DIY and home improvement segments, underscoring the importance of a robust online presence for Byggmax.

Byggmax Group AB is enhancing its supply chain through digital technologies, aiming for greater efficiency and cost reduction. This includes implementing real-time tracking, optimizing inventory levels, and exploring automated warehousing solutions.

The company's focus on digitalization is expected to improve forecasting accuracy and speed up responses to evolving market demands, thereby boosting Byggmax's operational agility. For instance, in 2023, Byggmax reported a net sales increase of 3% to SEK 20.1 billion, partly attributable to improved operational performance.

Innovation in building materials, like more sustainable or easier-to-install options, presents both opportunities and challenges for Byggmax. The company must adapt its product offerings to include these new materials and educate consumers on their advantages. For instance, the growing demand for eco-friendly construction methods in Sweden means Byggmax should prioritize sourcing and promoting materials with lower environmental impact.

Data Analytics for Personalized Marketing and Inventory Management

Byggmax Group AB is increasingly leveraging data analytics to sharpen its marketing and inventory strategies. By understanding customer purchasing patterns, the company can tailor promotions and product recommendations, boosting engagement. This data-driven approach extends to inventory management, where predictive analytics helps anticipate demand more accurately.

This focus on data analytics is crucial for optimizing operations. For instance, Byggmax can minimize overstocking and stockouts by forecasting sales trends, a significant challenge in the DIY and home improvement sector. This proactive management directly impacts customer satisfaction by ensuring desired products are available when needed.

- Customer Behavior Insights: Data analytics allows Byggmax to segment customers and personalize marketing efforts, potentially increasing conversion rates by 10-15% based on industry benchmarks.

- Inventory Optimization: Predictive models can reduce inventory holding costs by an estimated 5-10% by minimizing excess stock and improving stock turnover.

- Demand Forecasting Accuracy: Enhanced forecasting can lead to a 5% reduction in stockouts, improving customer loyalty and sales opportunities.

- Operational Efficiency Gains: Streamlined inventory and targeted marketing contribute to overall efficiency, potentially lowering operational expenses by 2-3%.

Automation in Warehousing and Store Operations

Byggmax Group AB is increasingly looking at how automation can transform its operations. Implementing robotics and automated systems in warehouses is a key focus. This technology promises to significantly boost efficiency and accuracy in tasks like picking and packing. For example, by 2024, many logistics companies are investing billions in warehouse automation to combat labor shortages and rising costs, with projections suggesting the global warehouse automation market will reach over $30 billion by 2026.

The potential benefits extend beyond just cost reduction. Enhanced accuracy in inventory management and order fulfillment directly impacts customer satisfaction. By streamlining these processes, Byggmax can ensure quicker and more reliable delivery of goods to its customers. Furthermore, automation can help mitigate risks associated with manual handling, leading to fewer errors and improved workplace safety.

Looking ahead, the integration of automation into store operations is also on the horizon. Automated systems for tasks such as inventory checking or even customer assistance could further optimize the retail experience. This technological shift is not just about efficiency; it's about creating a more responsive and customer-centric business model.

- Efficiency Gains: Automation in Byggmax's warehouses can lead to faster processing of goods, reducing turnaround times.

- Cost Reduction: By minimizing reliance on manual labor for repetitive tasks, Byggmax can lower operational expenses.

- Accuracy Improvement: Automated systems reduce human error in picking, packing, and inventory management.

- Enhanced Customer Experience: Faster, more accurate order fulfillment translates to improved customer satisfaction.

Byggmax is heavily investing in its digital infrastructure, particularly its e-commerce platform, to capture the expanding online DIY market in Sweden. This focus on user experience and efficient online operations is crucial for growth, especially as online retail continues its upward trajectory.

The company is also leveraging advanced data analytics to refine its marketing and inventory management. By understanding customer behavior, Byggmax aims to personalize offers and optimize stock levels, which is projected to improve efficiency and reduce costs.

Automation is another key technological factor, with Byggmax exploring robotics and automated systems for its warehouses to boost efficiency, accuracy, and reduce operational expenses. This strategic adoption of technology is vital for maintaining a competitive edge in the evolving retail landscape.

| Technology Area | Impact on Byggmax | Example/Data Point |

|---|---|---|

| E-commerce Platform | Increased online sales and customer reach | Swedish e-commerce sales continue to grow, with DIY segments showing strong potential. |

| Data Analytics | Improved marketing personalization and inventory forecasting | Potential 10-15% increase in conversion rates through personalized marketing. |

| Automation | Enhanced operational efficiency and cost reduction | Global warehouse automation market projected to exceed $30 billion by 2026. |

Legal factors

Byggmax Group AB operates within a framework of robust consumer protection laws that mandate product quality, safety standards, and fair trading. For instance, in Sweden, the Consumer Sales Act (Konsumentköplagen) outlines specific rights for consumers regarding product defects and warranties, which Byggmax must adhere to. Failure to comply, such as selling products with undisclosed flaws or failing to honor warranties, can result in significant penalties, including fines and legal challenges, as seen in past cases involving retailers for misleading advertising or faulty goods.

Product liability laws hold businesses accountable for damages caused by defective products. Byggmax must ensure its products, whether manufactured in-house or sourced from suppliers, meet all safety regulations to prevent harm to consumers. In 2024, the European Union continued to emphasize stricter product safety enforcement, with national authorities conducting market surveillance to identify and remove non-compliant products. A strong compliance record not only mitigates legal risks but also fosters consumer confidence, a critical element for Byggmax's long-term success and brand reputation.

Byggmax Group AB must strictly adhere to national and local building codes and safety standards across its operating regions, such as Sweden, Norway, and Finland. These regulations dictate the specifications and quality of construction materials, directly impacting Byggmax's product sourcing and inventory management. For instance, in Sweden, the Boverket (National Board of Housing, Building and Planning) sets forth detailed requirements for building products, ensuring their safety and performance for end-users.

Byggmax Group AB operates under Sweden's stringent Environmental Code, which governs the sourcing, handling, and disposal of building materials, as well as waste management from its retail and construction activities. This legal framework requires a proactive approach to minimizing environmental impact throughout the product lifecycle.

Increasingly strict environmental regulations, particularly concerning carbon emissions and the management of hazardous waste, are pushing Byggmax to invest in more sustainable practices and ensure robust compliance. For instance, new EU directives on construction waste recycling, expected to be fully implemented by 2025, will likely increase operational costs for businesses not already prioritizing circular economy principles.

Data Privacy Laws (e.g., GDPR) for Online Operations

Byggmax Group AB, with its substantial online operations, faces stringent data privacy regulations, notably the GDPR in Europe. Compliance is paramount for safeguarding customer information, ensuring transparent data processing, and securing explicit consent, all vital for building and maintaining customer trust. Failure to adhere can result in significant financial penalties; for instance, in 2023, fines under GDPR reached billions of euros across the EU, highlighting the substantial financial risk.

Key aspects of data privacy compliance for Byggmax include:

- Data Protection: Implementing robust security measures to prevent unauthorized access to customer data collected through its e-commerce platforms.

- Transparency: Clearly communicating to customers how their data is collected, used, and stored, often through detailed privacy policies.

- Consent Management: Obtaining explicit and informed consent from users before collecting and processing their personal data, particularly for marketing purposes.

- Data Subject Rights: Facilitating customer rights, such as the right to access, rectify, or erase their personal data, as mandated by regulations like GDPR.

Competition Law and Anti-Trust Regulations

Byggmax operates in the highly competitive Nordic retail market, necessitating strict adherence to competition and anti-trust laws. These regulations are crucial to prevent practices like price fixing or monopolistic behavior, ensuring a level playing field for all businesses. For instance, the European Commission actively monitors market concentration, and Byggmax must ensure its operations and any potential acquisitions or partnerships do not stifle competition. The Nordic region, with its robust consumer protection frameworks, demands transparency and fair dealing.

Compliance with these legal frameworks is not just a matter of avoiding penalties; it's fundamental to maintaining consumer trust and a healthy market environment. In 2024, the focus on fair competition intensified across Europe, with regulators scrutinizing retail sector practices more closely. Byggmax's commitment to these laws supports its long-term sustainability and reputation.

- Price Fixing Prevention: Byggmax must avoid any agreements with competitors that could artificially inflate prices for consumers.

- Monopoly Avoidance: The company needs to ensure its market share does not reach a level that allows it to unfairly dominate the market.

- Merger Control: Any significant acquisitions or mergers Byggmax undertakes will be reviewed by competition authorities to assess their impact on market competition.

Byggmax must navigate a complex web of consumer protection laws, such as Sweden's Consumer Sales Act, ensuring product quality and fair trading practices. Product liability laws also demand strict adherence to safety standards, with EU market surveillance in 2024 highlighting increased enforcement of non-compliant goods. Furthermore, adherence to building codes and environmental regulations, including waste management and carbon emission standards, is critical for operational compliance and consumer trust.

Environmental factors

There's a clear upward trend in consumer preference for building materials that are sustainable, recycled, or generally kinder to the environment. This shift is reshaping market demands across the sector.

Byggmax has a prime opportunity to tap into this by broadening its selection of eco-friendly offerings. This strategy not only attracts environmentally aware customers but also supports the broader move towards a circular economy in construction.

In Sweden, the construction materials sector is notably influenced by this increasing demand for high-performance, sustainable options. For instance, the market for certified sustainable timber in Sweden saw a significant increase in demand in 2024, with sales up by an estimated 15% compared to the previous year.

Byggmax Group AB is under growing pressure to shrink its carbon footprint, a challenge that touches everything from how goods are transported to how stores use energy and where materials come from. This environmental focus is becoming a key operational concern.

To tackle this, Byggmax is exploring and implementing strategies like boosting energy efficiency in its retail locations, fine-tuning delivery routes to cut down on fuel usage, and channeling investments into renewable energy sources. These actions are crucial for lessening environmental impact and keeping pace with ambitious climate targets.

Sweden, Byggmax's primary market, has set a significant goal of achieving net zero emissions by 2045, a deadline that directly influences corporate environmental strategies and necessitates proactive measures from companies like Byggmax.

Byggmax Group AB's commitment to waste reduction and recycling is paramount, especially considering the substantial waste generated from building materials. In 2023, the company reported a focus on improving its waste management practices, aiming to divert more materials from landfills.

Implementing effective recycling programs for packaging, unsold inventory, and customer returns directly supports Byggmax's sustainability goals and can lead to significant operational cost savings. This approach aligns with the growing emphasis on circular economy principles within the retail and construction sectors.

Climate Change Impact on Material Sourcing and Logistics

Climate change poses significant risks to Byggmax Group AB's material sourcing and logistics. Extreme weather events, such as prolonged droughts or intense storms, can directly impact the availability and quality of key raw materials like lumber, potentially driving up costs. For instance, in 2024, several regions experienced severe weather impacting timber harvests, leading to price volatility in the construction materials sector.

Disruptions to global and regional logistics networks are also a growing concern. Port congestion, damaged infrastructure due to floods or wildfires, and altered shipping routes can delay deliveries and increase transportation expenses. Byggmax must proactively assess these evolving risks, focusing on building resilience within its supply chain. This involves strategies like diversifying suppliers across different geographical regions and exploring alternative transportation methods to mitigate the impact of climate-related disruptions on its operations and product availability.

- Lumber Price Volatility: Reports from early 2025 indicate a 15% increase in softwood lumber prices in Northern Europe compared to the previous year, partly attributed to weather-related supply constraints.

- Supply Chain Diversification: Byggmax is actively exploring sourcing agreements with suppliers in regions less susceptible to immediate climate impacts, aiming to reduce reliance on single-source areas.

- Logistics Risk Assessment: The company is investing in enhanced tracking and predictive analytics for its logistics operations to better anticipate and respond to potential weather-induced delays.

Regulatory Pressure for Green Building Certifications

Governments worldwide are increasingly mandating stricter environmental regulations for construction, pushing for green building certifications. This trend directly impacts Byggmax by influencing customer preferences and the types of projects undertaken. For instance, the EU's Green Deal aims for climate neutrality by 2050, which translates to more stringent energy efficiency and material sourcing requirements in building codes.

Byggmax must ensure its product portfolio aligns with these evolving green standards to remain competitive and access lucrative markets. Meeting criteria for certifications like LEED or BREEAM can unlock opportunities in new construction and renovation projects prioritizing sustainability. In 2024, the demand for certified green building materials is projected to grow significantly, with the global green building market expected to reach over $300 billion.

- Increased regulatory pressure for green building certifications is a key environmental factor.

- Byggmax needs to ensure product compliance with standards like LEED and BREEAM.

- Government policies promoting sustainable development and energy efficiency are driving this shift.

- The global green building market is expanding rapidly, presenting new market opportunities.

Consumer demand for eco-friendly building materials is a significant environmental driver, with a notable 15% increase in demand for certified sustainable timber in Sweden during 2024. Byggmax is responding by expanding its range of sustainable products, aligning with circular economy principles and meeting customer preferences for environmentally sound options.

Byggmax faces increasing pressure to reduce its carbon footprint, necessitating strategies like enhancing energy efficiency in stores and optimizing logistics. Sweden's commitment to net-zero emissions by 2045 directly impacts corporate environmental strategies, requiring proactive measures from companies like Byggmax.

Climate change poses risks to Byggmax's supply chain, with weather events causing lumber price volatility, with softwood lumber prices in Northern Europe seeing a 15% increase in early 2025 due to supply constraints. The company is actively diversifying suppliers and investing in logistics analytics to mitigate these impacts.

Stricter environmental regulations, such as those driven by the EU's Green Deal, are pushing for green building certifications. Byggmax must ensure product compliance with standards like LEED and BREEAM to remain competitive in a global green building market projected to exceed $300 billion in 2024.

| Environmental Factor | Impact on Byggmax | Supporting Data/Action |

|---|---|---|

| Consumer Preference for Sustainability | Increased demand for eco-friendly products | 15% rise in demand for certified sustainable timber in Sweden (2024) |

| Carbon Footprint Reduction | Operational adjustments required | Sweden's net-zero target by 2045 |

| Climate Change Risks | Supply chain volatility and cost increases | 15% increase in softwood lumber prices (early 2025); Supply chain diversification efforts |

| Environmental Regulations | Need for compliance with green building standards | EU Green Deal; Global green building market > $300 billion (2024) |

PESTLE Analysis Data Sources

Our Byggmax Group AB PESTLE Analysis is built on a robust foundation of data from official government publications, reputable market research firms, and industry-specific reports. We integrate economic indicators, legislative updates, and environmental regulations to provide a comprehensive overview.