Burke & Herbert Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Burke & Herbert Financial Services Bundle

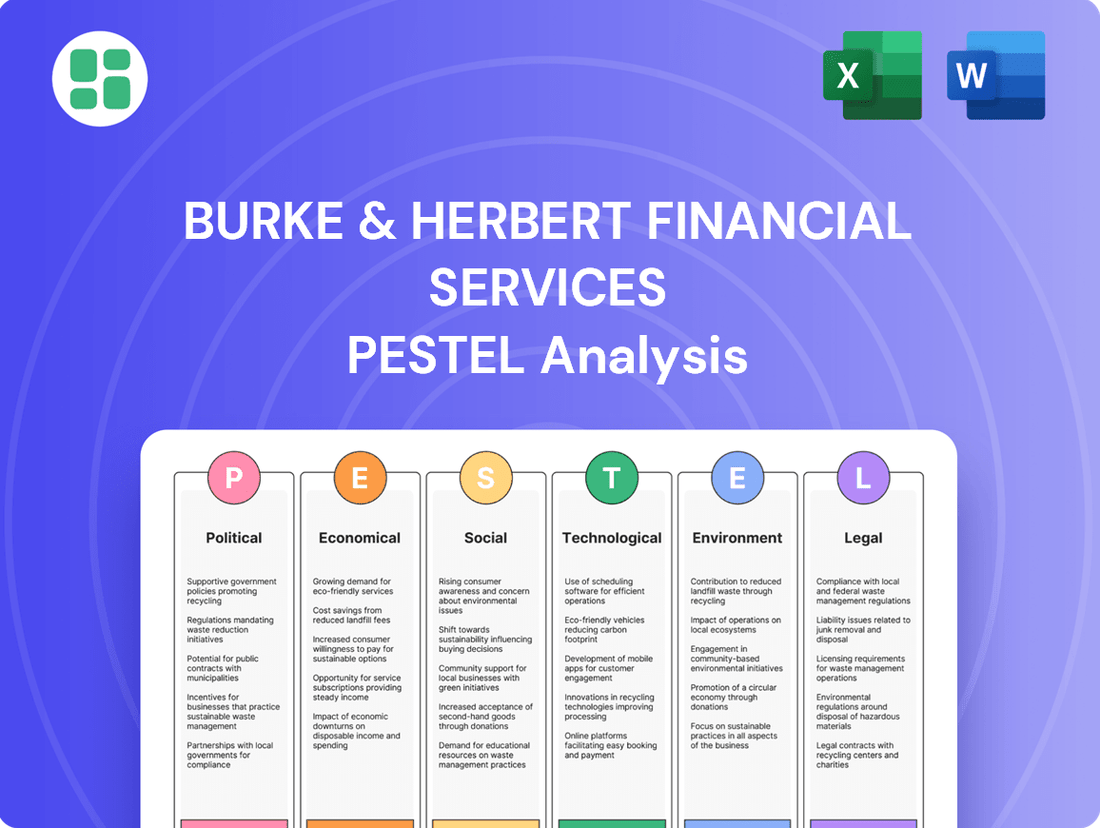

Gain a strategic advantage with our comprehensive PESTLE analysis of Burke & Herbert Financial Services. Understand the intricate web of political, economic, social, technological, legal, and environmental factors shaping their operational landscape and future growth. Unlock actionable insights to inform your investment decisions and market strategies. Download the full analysis now for a deeper understanding.

Political factors

The banking sector, particularly community banks such as Burke & Herbert Financial Services, is deeply affected by shifts in regulatory frameworks. Recent proposals, including potential adjustments to US Basel III capital rules and updated FDIC advertising guidelines, highlight a constantly changing landscape. Staying ahead of these developments is crucial for compliance and maintaining operational effectiveness.

Government fiscal policies, such as changes in government spending and taxation, significantly impact the overall economic landscape, which in turn affects the demand for financial services like those offered by Burke & Herbert. These policies can stimulate or dampen economic growth, influencing consumer and business confidence and their willingness to engage in financial transactions.

Monetary policies, primarily managed by the Federal Reserve, play a crucial role in shaping Burke & Herbert's profitability. The Fed's decisions on interest rates directly affect the bank's net interest margin, influencing both the cost of deposits and the revenue generated from loans. For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early to mid-2025, a period marked by economic uncertainty.

Looking ahead, market expectations for the latter half of 2025 suggest a potential shift towards interest rate cuts. This anticipated easing of monetary policy could lead to lower borrowing costs for consumers and businesses, potentially boosting loan demand, but it would also compress lending margins for institutions like Burke & Herbert.

Political stability within the Northern Virginia and Greater Washington, D.C. region is a cornerstone for Burke & Herbert Financial Services. A stable political climate fosters business confidence, directly translating to increased loan demand and investment activity, crucial drivers for a financial institution. For instance, the region's consistent economic growth, with a projected GDP increase of 2.5% for 2024 according to the Bureau of Economic Analysis, is underpinned by this stability.

Broader national trade policies, while not local, carry significant weight. Changes in tariffs or trade agreements can impact inflation rates and overall economic growth trajectories. For 2024, the US inflation rate has hovered around 3.1% as of early 2024, a figure that can be influenced by such policies, thereby indirectly shaping the interest rate environment and market conditions for Burke & Herbert.

Government Support Programs

Government support programs, particularly those targeting small businesses and community development, can significantly boost lending opportunities for institutions like Burke & Herbert. For instance, the Small Business Administration (SBA) loan programs, such as the 7(a) and 504 loans, offer guarantees that reduce the risk for lenders, making it more attractive to extend credit to local enterprises. As of late 2024, the SBA reported a substantial volume of loan approvals, indicating ongoing demand and lender participation in these federally backed initiatives. These programs often align with a community bank's mission to foster local economic stability and growth.

The specific focus of government initiatives can directly impact Burke & Herbert's strategic planning. Programs designed to stimulate housing markets, such as mortgage credit certificates or down payment assistance initiatives, can create a more robust environment for mortgage lending. Furthermore, federal and state grants aimed at revitalizing underserved communities or supporting specific industries can open new avenues for business lending and investment. The continuity and evolution of these programs are closely tied to the prevailing political landscape and administrative priorities, which can change with new administrations.

- SBA Loan Guarantees: These reduce lender risk, encouraging more small business lending.

- Housing Market Initiatives: Programs like mortgage credit certificates can boost housing finance.

- Community Development Grants: Funding for local revitalization efforts can create new lending opportunities.

- Political Stability: Changes in government can alter the availability and focus of these crucial support programs.

Bank Merger and Acquisition Scrutiny

The landscape for bank mergers and acquisitions is experiencing heightened regulatory oversight. Agencies such as the Department of Justice (DOJ), Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) have introduced updated guidelines, signaling a more rigorous review process for consolidation deals.

While Burke & Herbert successfully navigated a merger in May 2024, its implications for future strategic moves are significant. The evolving antitrust considerations will undoubtedly influence the feasibility and structure of any further consolidation opportunities or responses to competitive pressures in the banking sector.

- Increased DOJ Scrutiny: The DOJ has signaled a tougher stance on bank mergers, focusing on potential impacts on competition and consumer choice, particularly for smaller banks.

- OCC and FDIC Guidelines: These agencies are also refining their review processes, emphasizing capital, management, and community needs in merger applications.

- Impact on Future Consolidation: Stricter antitrust reviews could slow down or alter the terms of future bank M&A activity, potentially affecting strategic growth plans for institutions like Burke & Herbert.

- Competitive Pressures: Despite scrutiny, competitive pressures may still drive consolidation, requiring banks to carefully balance growth ambitions with regulatory compliance.

Political stability in the Greater Washington, D.C. region underpins Burke & Herbert's operations, fostering confidence that drives loan demand. National trade policies, impacting inflation and economic growth, indirectly shape the interest rate environment. Government support programs, like SBA loan guarantees, directly enhance lending opportunities for community banks.

The political climate dictates the availability and focus of government initiatives, such as housing market stimulation programs and community development grants, which can create new lending avenues for Burke & Herbert.

Heightened regulatory oversight from the DOJ, OCC, and FDIC on bank mergers, as evidenced by updated guidelines, signifies a more rigorous review process for consolidation. This increased scrutiny impacts strategic growth plans and responses to competitive pressures in the banking sector.

| Factor | Impact on Burke & Herbert | 2024/2025 Data/Trend |

|---|---|---|

| Political Stability (Regional) | Fosters business confidence, increasing loan demand. | Region's projected GDP growth of 2.5% for 2024 supports this. |

| National Trade Policies | Influences inflation and economic growth, indirectly affecting interest rates. | US inflation around 3.1% in early 2024, subject to policy shifts. |

| Government Support Programs (e.g., SBA) | Reduces lender risk, encouraging small business lending. | Ongoing high volume of SBA loan approvals in late 2024. |

| Regulatory Oversight (M&A) | Increases scrutiny on bank mergers, potentially slowing consolidation. | DOJ, OCC, FDIC signaling tougher review processes for deals. |

What is included in the product

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Burke & Herbert Financial Services, offering strategic insights for navigating the external landscape.

A concise Burke & Herbert Financial Services PESTLE analysis that highlights key external factors, offering a clear roadmap to navigate market complexities and mitigate potential business disruptions.

Economic factors

Interest rate fluctuations, primarily influenced by the Federal Reserve's monetary policy, significantly affect Burke & Herbert Financial Services' net interest margin. The Federal Reserve maintained a steady interest rate environment through the first half of 2025. However, projections for the latter half of 2025 suggest a potential for rate cuts.

These anticipated rate adjustments could impact Burke & Herbert by altering both the cost of funds through deposit yields and the revenue generated from lending activities. For instance, if rates decrease, the bank might see lower interest expenses on deposits but also potentially lower interest income on loans, compressing margins if not managed proactively.

The economic health of the Northern Virginia and Greater Washington, D.C. metropolitan area is paramount for Burke & Herbert Financial Services. By early 2024, the region had largely recovered from pandemic-induced job losses, though employment in Washington D.C. itself remained below pre-pandemic figures.

Sustained regional GDP growth and robust job creation are essential drivers for increasing loan demand and bolstering deposit growth for the financial institution. For instance, the Washington-Arlington-Alexandria, DC-VA-WV MSA's GDP grew by an estimated 3.1% in 2023, signaling continued economic expansion.

Inflationary pressures directly impact Burke & Herbert Financial Services by affecting both its operational expenses and its customers' ability to spend. While inflation has moderated, it continues to hover slightly above the Federal Reserve's desired 2% target, creating an uncertain economic environment.

Persistent inflation erodes consumer purchasing power, potentially leading to reduced savings and a higher likelihood of loan defaults. This scenario poses a direct risk to the bank's profitability and the overall quality of its loan portfolio.

For instance, the Consumer Price Index (CPI) in the U.S. showed an annual increase of 3.4% as of April 2024, indicating that while the rate has slowed from its peak, it remains elevated. This sustained higher cost of living can strain household budgets, making it harder for customers to meet their financial obligations.

Housing Market Trends

The housing market in the Northern Virginia and D.C. metro area is a critical factor for Burke & Herbert Financial Services, directly impacting its mortgage and real estate loan portfolios. A slowdown occurred in 2023 due to elevated mortgage interest rates, which reached averages around 7% for a 30-year fixed loan.

While permit approvals for new housing units saw a decline in 2024, the overall stability of this regional market remains paramount. This stability dictates the bank's lending opportunities and the quality of its loan assets.

- 2023 Mortgage Rate Impact: Average 30-year fixed mortgage rates hovered around 6.8% to 7.5% for much of 2023, dampening buyer demand and slowing transaction volumes.

- Permit Approvals: Data for early 2024 indicated a dip in new residential building permits compared to the previous year, suggesting potential headwinds for new construction lending.

- Market Stability: The resilience of home prices and rental demand in the D.C. metro area influences the collateral value for Burke & Herbert's real estate loans.

- Lending Opportunities: Fluctuations in housing demand and affordability directly affect the volume and profitability of mortgage originations for the bank.

Employment and Consumer Spending

Low unemployment rates and strong labor market conditions within Burke & Herbert Financial Services' service area are significant drivers of consumer confidence and the capacity for loan repayment. As of May 2024, the U.S. unemployment rate stood at a remarkably low 3.9%, indicating a healthy demand for labor. This robust employment landscape directly translates into greater financial stability for households, making them more likely to engage with financial institutions for loans and other services.

Consumer spending and saving habits are intrinsically linked to economic stability and wage growth, which in turn directly impact deposit levels and the demand for financial products. In the first quarter of 2024, U.S. real disposable personal income increased at an annual rate of 1.1%, supporting consumer spending. This consistent growth in income, coupled with a stable economic outlook, encourages higher deposit levels as consumers feel more secure about their financial futures and are thus more inclined to save.

- U.S. Unemployment Rate (May 2024): 3.9%

- U.S. Real Disposable Personal Income Growth (Q1 2024): 1.1% (annualized)

- Impact on Deposits: Higher consumer confidence and wage growth typically lead to increased savings and thus higher deposit levels for financial institutions.

- Impact on Loan Demand: A strong labor market supports consumers' ability to service debt, fostering demand for mortgages, auto loans, and personal credit.

Economic factors significantly shape Burke & Herbert Financial Services' operating environment. Interest rate policies by the Federal Reserve, with potential cuts anticipated in late 2025, directly influence net interest margins by affecting borrowing and lending costs. Regional economic health, marked by a 3.1% GDP growth in the Washington-Arlington-Alexandria MSA in 2023, fuels loan and deposit expansion.

Inflation, while moderating, remains a concern. The U.S. CPI at 3.4% (April 2024) can strain consumer budgets, potentially increasing loan default risks and operational costs. The housing market, experiencing a slowdown in 2023 due to average 7% mortgage rates, impacts the bank's real estate loan portfolio, with permit approvals also showing a dip in early 2024.

A strong labor market, evidenced by a 3.9% U.S. unemployment rate in May 2024, bolsters consumer confidence and loan repayment capacity. Furthermore, a 1.1% increase in U.S. real disposable personal income in Q1 2024 supports consumer spending and encourages higher deposit levels, benefiting the bank's funding base.

Full Version Awaits

Burke & Herbert Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Burke & Herbert Financial Services PESTLE Analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape affecting their operations and future growth.

Sociological factors

Customer expectations for digital banking are rapidly evolving, with a strong preference for intuitive mobile apps and online platforms that offer convenience akin to other digital services. For instance, a 2024 survey indicated that over 70% of banking customers use mobile banking apps at least weekly, highlighting the demand for seamless digital interactions.

However, this digital shift doesn't negate the need for traditional services. While self-service options are popular, a substantial segment of the population, particularly older demographics, still values in-person interactions at physical branches. A 2025 report by the American Bankers Association noted that while digital adoption is high, branch traffic for complex transactions or personalized advice remains consistent for a significant minority of customers.

Demographic shifts in Northern Virginia and the Greater Washington D.C. area are significantly influencing financial service demand. Population growth, particularly fueled by international migration into D.C., is creating a more diverse customer base with varied financial needs and preferences.

Understanding these evolving demographics allows Burke & Herbert to strategically tailor its product offerings and marketing efforts. For instance, a growing younger population might necessitate more digital banking solutions, while a culturally diverse community could require multilingual customer support and culturally relevant financial products.

The region's economic dynamism, attracting professionals across various sectors, also means a demand for sophisticated wealth management and investment services. As of early 2024, the Washington D.C. metropolitan area continues to see robust population growth, with estimates suggesting an increase of over 50,000 residents annually, many of whom are skilled professionals and international migrants.

Burke & Herbert's identity as a community bank is a significant sociological asset, emphasizing relationship building and local welfare. This approach cultivates strong community ties and deepens trust among residents and businesses.

The establishment of The Burke & Herbert Bank Foundation in 2024 underscores this commitment. This initiative directly invests in local well-being, fostering enhanced loyalty and a positive brand perception within the communities it serves.

Financial Literacy and Education Needs

Financial literacy is a significant factor influencing customer engagement with financial services. Burke & Herbert needs to consider that varying levels of financial knowledge among its diverse customer base will shape the types of products and services sought and the understanding of complex financial instruments. For instance, a 2023 survey indicated that only 57% of American adults felt confident managing their finances, highlighting a substantial segment that may require more accessible and educational product offerings.

To effectively serve its clientele, Burke & Herbert may need to adapt its communication and educational strategies. This could involve developing resources tailored to different knowledge levels, from basic budgeting tools to more sophisticated investment guidance. The goal is to empower customers, ensuring they can make informed decisions about their financial future.

- Impact on Product Demand: Lower financial literacy can lead to a preference for simpler, more transparent financial products, while higher literacy may drive demand for complex investment vehicles.

- Communication Strategy: Tailoring marketing messages and customer support to address different levels of financial understanding is crucial for effective outreach.

- Educational Initiatives: Investing in financial education programs can build customer trust and loyalty, fostering long-term relationships.

- Regulatory Compliance: Ensuring clear and understandable disclosure of financial products is essential, especially for customers with lower financial literacy, to meet regulatory requirements.

Workforce Trends and Talent Acquisition

Sociological shifts significantly impact Burke & Herbert Financial Services' workforce. Employees increasingly prioritize work-life balance, with a growing demand for flexible work arrangements. In 2024, surveys indicated that over 60% of employees would consider leaving a job that didn't offer flexibility. This trend necessitates a review of traditional office-centric models to attract and retain top talent.

Furthermore, a strong emphasis on diversity, equity, and inclusion (DEI) is paramount. Companies with robust DEI initiatives are often seen as more attractive employers. For instance, research from 2024 showed that companies with diverse leadership teams were 35% more likely to outperform their peers financially. Burke & Herbert must actively foster an inclusive environment to tap into a wider talent pool and enhance its employer brand.

The availability of skilled labor in the financial services sector presents another critical sociological factor. As technology advances, the demand for specialized skills, such as in data analytics and cybersecurity, continues to rise. A 2025 projection suggests a 15% increase in demand for financial analysts with advanced digital skills. This underscores the need for Burke & Herbert to invest in continuous training and development programs to ensure its workforce remains competitive.

- Work-Life Balance Expectations: Post-pandemic, employee demand for flexible work arrangements and better integration of personal and professional lives remains high.

- DEI Imperative: A commitment to diversity, equity, and inclusion is no longer optional but a critical factor in attracting and retaining talent, directly impacting company reputation and performance.

- Skilled Labor Shortages: The financial sector faces challenges in sourcing talent with specialized digital and analytical skills, requiring proactive talent development strategies.

- Employee Value Proposition: A strong organizational culture, competitive compensation, and comprehensive benefits are essential to differentiate Burke & Herbert and secure a high-quality service team.

Customer expectations are shifting towards digital convenience, yet a segment of the population still values in-person banking, necessitating a hybrid approach. Demographic changes, particularly in the D.C. area, are creating a more diverse customer base with varied financial needs, requiring tailored product offerings and multilingual support. Financial literacy levels vary widely, impacting product demand and communication strategies, with a need for clear, educational resources.

Sociological factors are reshaping the workforce, with employees prioritizing work-life balance and demanding flexible arrangements, a trend highlighted by over 60% of employees considering leaving jobs without flexibility in 2024. A strong commitment to diversity, equity, and inclusion (DEI) is crucial for attracting talent, as companies with diverse leadership were 35% more likely to outperform financially in 2024. The demand for specialized digital and analytical skills is increasing, with a projected 15% rise in demand for financial analysts with advanced digital skills by 2025, emphasizing the need for continuous training.

| Sociological Factor | Trend/Observation | Implication for Burke & Herbert |

|---|---|---|

| Digital Banking Preference | 70%+ weekly app usage (2024 survey) | Enhance mobile and online platforms |

| Value of In-Person Services | Consistent branch traffic for complex needs (ABA 2025 report) | Maintain accessible branch services for specific demographics |

| Demographic Diversity (D.C. Area) | Population growth over 50,000 annually (early 2024 estimates) | Tailor products and support for diverse needs |

| Financial Literacy | 57% of US adults confident in finances (2023 survey) | Develop accessible educational resources and clear product communication |

| Work-Life Balance Demand | 60%+ employees would leave jobs without flexibility (2024 surveys) | Offer flexible work arrangements to attract and retain talent |

| DEI Importance | Diverse leadership teams 35% more likely to outperform financially (2024 research) | Foster inclusive environment to enhance employer brand and talent pool |

| Skilled Labor Demand | 15% projected increase in demand for digitally skilled financial analysts (2025 projection) | Invest in employee training and development for in-demand skills |

Technological factors

The ongoing shift towards digital banking necessitates that Burke & Herbert Financial Services consistently upgrades its mobile and online platforms. This ensures user-friendly experiences and swift transaction processing to meet evolving customer expectations.

With the number of digital banking users in the US projected to hit 217 million by 2025, the demand for sophisticated and reliable digital financial tools is substantial. Burke & Herbert must therefore invest in robust digital infrastructure to remain competitive and cater to this growing user base.

Financial institutions like Burke & Herbert are increasingly targeted by sophisticated cyber threats such as phishing, ransomware, and distributed denial-of-service (DDoS) attacks. The financial impact of data breaches is substantial, with the global average cost of a data breach reaching $4.35 million in 2022, a figure expected to rise.

To counter these escalating risks, Burke & Herbert must invest in and implement advanced cybersecurity measures. This includes leveraging AI-powered threat detection and response systems, alongside robust end-to-end encryption protocols, to safeguard sensitive customer information and preserve the critical trust placed in them by their clientele.

Artificial intelligence and machine learning are increasingly vital for financial institutions like Burke & Herbert to bolster fraud detection, refine lending risk assessments, and craft more personalized customer interactions. For instance, in 2024, the global AI in banking market was valued at approximately $10.5 billion and is projected to grow significantly, highlighting its adoption.

Burke & Herbert can harness AI to optimize internal processes, driving greater efficiency and enabling the delivery of more bespoke financial advice. This strategic integration also necessitates careful consideration of potential risks, particularly concerning AI fair use policies and data privacy, ensuring responsible deployment.

Fintech Partnerships and Competition

The burgeoning fintech sector is significantly altering how customers interact with financial services, driving up expectations for seamless digital experiences and intensifying competition for established institutions like Burke & Herbert. This dynamic necessitates a proactive approach to technological adoption.

Burke & Herbert can leverage strategic alliances with fintech innovators to bolster its service offerings, improve customer engagement through advanced digital platforms, and incorporate embedded finance options. For instance, in 2024, the global fintech market was valued at over $1.1 trillion, showcasing the immense growth and potential for collaboration. However, these partnerships require diligent oversight to mitigate associated third-party risks.

- Fintech Market Growth: The global fintech market is projected to reach $3.5 trillion by 2030, indicating a strong trend towards digital financial solutions.

- Customer Expectation Shift: A significant majority of consumers now expect digital-first banking services, with features like instant payments and personalized financial advice.

- Partnership Opportunities: Collaborations can range from integrating payment gateways to co-developing AI-driven wealth management tools.

- Risk Management Focus: Banks must implement robust due diligence and ongoing monitoring for fintech partners to ensure data security and regulatory compliance.

Data Analytics for Personalized Services

Burke & Herbert Financial Services can significantly enhance customer engagement by leveraging data analytics. This allows the bank to move beyond routine transactions and foster deeply personalized, value-added interactions. By meticulously analyzing transaction history and customer behavior patterns, the institution can proactively identify and address customer needs, thereby offering precisely tailored products and services. This strategic approach is key to cultivating enduring customer relationships, boosting loyalty, and ultimately fueling sustainable growth.

The ability to anticipate customer needs through data insights is becoming a competitive imperative in the financial sector. For instance, a report from McKinsey in late 2024 indicated that banks effectively using AI and advanced analytics saw a 10-15% increase in customer retention compared to those who did not. Burke & Herbert can implement predictive models to identify customers likely to need a mortgage refinance or a new savings account, allowing for timely and relevant outreach.

Key applications of data analytics for personalized services at Burke & Herbert include:

- Predictive Customer Needs: Identifying customers likely to require specific financial products, such as loans or investment advice, based on their financial journey.

- Personalized Product Recommendations: Offering tailored product bundles or upgrades that align with individual spending habits and financial goals.

- Proactive Customer Support: Detecting potential customer issues or dissatisfaction through behavioral analysis and intervening before problems escalate.

- Enhanced Loyalty Programs: Designing reward structures and communication strategies that resonate with individual customer preferences, increasing engagement and lifetime value.

The increasing reliance on advanced technologies like AI and machine learning is reshaping financial services, offering significant opportunities for enhanced efficiency and personalized customer experiences. Burke & Herbert must embrace these innovations to remain competitive.

The global AI in banking market was valued at approximately $10.5 billion in 2024, with projections indicating substantial growth, underscoring the strategic importance of AI adoption for institutions like Burke & Herbert. This technology can optimize fraud detection, refine risk assessments, and tailor customer interactions.

The fintech sector's rapid expansion, with the global market valued at over $1.1 trillion in 2024, necessitates that Burke & Herbert consider strategic partnerships to integrate innovative digital solutions and improve customer engagement. These collaborations, however, require careful management of third-party risks.

| Technology Area | 2024 Market Value (Approx.) | Projected Growth Driver | Burke & Herbert Opportunity |

|---|---|---|---|

| AI in Banking | $10.5 billion | Enhanced personalization, fraud detection, risk assessment | Streamline operations, offer tailored advice |

| Fintech Sector | >$1.1 trillion | Digital transformation, new service delivery models | Strategic partnerships for enhanced digital offerings |

| Cybersecurity Spending | Global average cost of data breach: $4.35 million (2022) | Increasing threat sophistication, data privacy regulations | Robust investment in advanced security measures |

Legal factors

Burke & Herbert Financial Services operates within a stringent regulatory environment, necessitating strict adherence to federal and state banking laws. Key oversight bodies include the FDIC, Federal Reserve Board, and the OCC, all of which impose specific operational and compliance mandates.

The landscape of banking regulations is dynamic. For instance, updated Community Reinvestment Act (CRA) thresholds and revised FDIC signage requirements, set to take effect in 2025, demand continuous monitoring and proactive adjustments to maintain full compliance and avoid potential penalties.

Consumer protection laws significantly shape Burke & Herbert's operational landscape, influencing everything from fair lending practices to data privacy and the structure of fees like those for overdrafts. The Consumer Financial Protection Bureau's (CFPB) actions, such as its late 2024 move to close an overdraft loophole previously available to larger financial institutions, signal a robust trend toward enhanced consumer safeguards. This regulatory momentum suggests a potential for stricter oversight and evolving compliance requirements that could extend to community banks like Burke & Herbert in the near future.

Burke & Herbert Financial Services operates within a stringent legal framework, particularly concerning Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules demand substantial investment in compliance systems to prevent financial crime. For instance, in 2023, the Financial Action Task Force (FATF) continued to emphasize global efforts to combat money laundering and terrorist financing, impacting how institutions like Burke & Herbert onboard and monitor clients.

Adherence to these regulations requires robust internal procedures for detecting and reporting suspicious transactions, a critical aspect of safeguarding the institution and maintaining its license to operate. Failure to comply can result in severe penalties, including significant fines and reputational damage, underscoring the importance of ongoing vigilance and investment in compliance technology.

Data Privacy Regulations

Data privacy regulations are a significant legal factor for Burke & Herbert. With the increasing volume of digital customer interactions, compliance with state-level laws, such as those in Virginia, and potential federal initiatives is paramount. Ensuring the secure handling and protection of customer information is crucial to mitigate the risks associated with data breaches and to adhere to evolving privacy standards.

Burke & Herbert must navigate a complex legal landscape concerning data privacy.

- Compliance Burden: Adhering to regulations like the Virginia Consumer Data Protection Act (VCDPA) requires robust data governance frameworks.

- Risk Mitigation: Non-compliance can lead to substantial fines; for instance, under the VCDPA, violations can incur penalties of up to $7,500 per violation.

- Customer Trust: Demonstrating a commitment to data privacy is essential for maintaining customer confidence in an era of heightened cybersecurity awareness.

Lending Laws and Mortgage Regulations

Specific laws governing loan products, particularly mortgage regulations and appraisal requirements for higher-priced loans, directly shape Burke & Herbert's lending operations. These regulations are dynamic, with adjustments like the anticipated increase in the threshold for certain appraisal requirements in 2025, reflecting an evolving regulatory landscape for financial institutions.

The Consumer Financial Protection Bureau (CFPB) continues to oversee and enforce regulations impacting mortgage lending, including those related to disclosures and fair lending practices. For instance, the TILA-RESPA Integrated Disclosure (TRID) rule, implemented to streamline mortgage disclosures, remains a key compliance area for lenders.

- Mortgage Origination Standards: Adherence to federal and state laws like the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE Act) is crucial for loan originator licensing and consumer protection.

- Appraisal Thresholds: The upcoming 2025 adjustment to appraisal requirements for higher-priced mortgage loans will necessitate updated compliance protocols for Burke & Herbert.

- Fair Lending Enforcement: Ongoing scrutiny by bodies like the CFPB means strict adherence to fair lending laws, such as the Equal Credit Opportunity Act (ECOA), is paramount to avoid penalties and maintain reputation.

Burke & Herbert Financial Services must navigate evolving consumer protection laws, with the CFPB's late 2024 action on overdraft loopholes indicating a trend toward stricter safeguards. This regulatory environment requires continuous adaptation to maintain compliance and protect customer interests.

The institution faces significant compliance burdens related to data privacy, with state laws like Virginia's VCDPA imposing up to $7,500 per violation for non-compliance. Maintaining customer trust hinges on demonstrating a strong commitment to data security in an era of heightened cybersecurity awareness.

Mortgage lending operations are directly impacted by regulations such as the SAFE Act for licensing and the TRID rule for disclosures. Anticipated 2025 adjustments to appraisal requirements for higher-priced loans necessitate updated compliance protocols, underscoring the dynamic nature of these legal frameworks.

Environmental factors

Burke & Herbert Financial Services, while a community bank, faces indirect exposure to climate-related financial risks. Extreme weather events, such as those increasingly impacting the Mid-Atlantic region where the bank operates, can affect the value of real estate collateral securing its loans. For instance, increased flood risk in coastal or riverine areas could devalue properties, impacting the bank's loan portfolio.

The broader financial industry, including banks like Burke & Herbert, is experiencing growing pressure from regulators and investors to quantify and mitigate 'financed emissions.' This involves understanding the carbon footprint associated with the activities financed by the bank's lending and investment portfolios. Integrating climate risk into financial decision-making is becoming a critical component of responsible banking practices, with institutions like Burke & Herbert needing to adapt their risk assessment frameworks to account for these evolving environmental factors.

Investors and customers increasingly expect financial institutions to showcase robust ESG performance, a trend that significantly influences strategic decisions. Burke & Herbert's 2024 establishment of The Burke & Herbert Bank Foundation directly addresses the 'Social' component of ESG by fostering community support, and the company is likely to expand its environmental initiatives in the future.

Burke & Herbert Financial Services, like many institutions, faces growing pressure to embed sustainability into its operational fabric. Implementing energy-efficient technologies in its branches and focusing on waste reduction are not just good for the planet; they directly translate to lower overheads. For instance, many banks are seeing significant savings, with some reporting up to 15% reduction in utility costs through targeted efficiency programs.

The financial sector is actively investing in technology to bolster Environmental, Social, and Governance (ESG) reporting and integration. By 2024, the global market for ESG reporting software was projected to reach over $1.5 billion, reflecting a strong commitment to transparency. This trend allows banks like Burke & Herbert to better track and communicate their sustainability efforts, appealing to a broader investor base and customer segment increasingly prioritizing ethical practices.

Green Finance Initiatives and Products

The financial sector is experiencing a notable shift towards green finance, with increasing demand for products like green bonds and investments in eco-friendly infrastructure. For instance, the global green bond market reached approximately $577 billion in issuance in 2023, a significant increase from previous years.

While Burke & Herbert Financial Services operates primarily in local markets, this trend presents an opportunity. Introducing green loan products or sustainable investment options could resonate with an evolving customer base and align with broader market preferences for environmental, social, and governance (ESG) considerations.

- Growing Green Bond Market: Global green bond issuance was projected to exceed $600 billion in 2024, indicating strong investor appetite.

- Customer Demand for ESG: Surveys in 2024 revealed that over 60% of retail investors consider ESG factors when making investment decisions.

- Potential for Local Impact: Offering green financing could support local renewable energy projects or energy-efficient home improvements, benefiting the community.

Reputational Risks from Environmental Practices

Burke & Herbert Financial Services, like all financial institutions, faces reputational risks if its environmental practices are perceived as inadequate. Public scrutiny of corporate sustainability is increasing, and a failure to meet expectations can damage trust. For Burke & Herbert, with its strong ties to the local community, maintaining a positive public image is paramount.

The company's emphasis on community engagement means that its environmental and social responsibility efforts are closely watched. Proactive and transparent communication about its sustainability initiatives is therefore crucial to mitigate potential reputational damage. For instance, in 2024, many financial firms are highlighting their investments in green bonds and sustainable portfolios, a trend Burke & Herbert may need to mirror.

- Reputational Impact: Negative perceptions of environmental stewardship can erode customer loyalty and investor confidence.

- Community Sensitivity: Burke & Herbert's local focus makes it particularly vulnerable to shifts in public opinion regarding environmental issues.

- Proactive Communication: Demonstrating commitment to environmental and social governance (ESG) through clear reporting is essential.

- Industry Trends: Aligning with growing investor demand for sustainable finance options, such as those seen in the 2024 green finance market, is key.

Burke & Herbert Financial Services must navigate increasing environmental regulations and the growing demand for sustainable financial products. The bank's exposure to climate-related financial risks, such as the impact of extreme weather on collateral values, necessitates adaptation. Furthermore, pressure from investors and regulators to address financed emissions and demonstrate robust ESG performance is a significant environmental factor influencing strategic decisions.

| Environmental Factor | Impact on Burke & Herbert | Relevant Data/Trends (2024-2025) |

|---|---|---|

| Climate-Related Financial Risks | Potential devaluation of real estate collateral due to extreme weather events. | Increased frequency of severe weather events in the Mid-Atlantic region. |

| Regulatory & Investor Pressure (ESG) | Need to quantify and mitigate financed emissions; growing expectation for ESG reporting. | Global ESG reporting software market projected to exceed $1.5 billion in 2024; over 60% of retail investors consider ESG factors. |

| Green Finance Market Growth | Opportunity to offer green loan products and sustainable investment options. | Global green bond market issuance projected to exceed $600 billion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Burke & Herbert Financial Services is built on a foundation of data from reputable sources, including official government publications, leading financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.