Brookshire Grocery SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookshire Grocery Bundle

Brookshire Grocery's market presence is shaped by its strong regional brand recognition and commitment to customer service, but it also faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize within the grocery sector.

Want the full story behind Brookshire Grocery's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brookshire Grocery Company's strength lies in its diverse portfolio of store banners, including Brookshire's, Super 1 Foods, Spring Market, FRESH by Brookshire's, and Reasor's. This multi-banner approach allows them to effectively target a wide array of customer demographics and preferences across their operating footprint. For instance, Super 1 Foods often appeals to value-conscious shoppers, while FRESH by Brookshire's focuses on a premium, fresh-centric experience.

This strategic diversification enables Brookshire Grocery to offer a comprehensive selection of products, from everyday essentials to specialty items, catering to various shopping missions. The company's commitment to fresh departments, such as produce, bakery, and meat, remains a core element across its banners. In 2023, Brookshire Grocery continued to invest in its private label offerings, which often provide strong value and contribute significantly to sales mix.

Furthermore, the integration of convenient services like in-store pharmacies and fuel centers at many of its locations significantly enhances the customer value proposition. These complementary services drive store traffic and build customer loyalty, as seen in the continued growth of their pharmacy services, which are a key differentiator in many of their markets.

Brookshire Grocery Company boasts a robust regional footprint with over 209 stores strategically located across Texas, Louisiana, and Arkansas. This extensive network cultivates deep brand recognition and fosters a loyal customer base within its primary operating areas. The company's legacy, originating in 1928, reinforces its image as a dependable and community-oriented grocery provider.

Brookshire's demonstrates a robust commitment to community engagement, actively supporting numerous local charities and initiatives. Their deep involvement strengthens local ties and builds significant goodwill.

Recent philanthropic efforts in 2024-2025 highlight this dedication, with substantial donations to food banks and the successful organization of the annual FRESH 15 race, which alone raised $200,000 for 36 local charities. Furthermore, their 35th annual golf tournament generated an impressive $784,000 for charitable causes, underscoring a consistent pattern of impactful community support.

This strong philanthropic focus not only benefits the communities Brookshire's serves but also significantly enhances the company's positive public image and brand loyalty.

Commitment to Employee Welfare and Diversity

Brookshire Grocery Company's dedication to its workforce is a significant strength, evidenced by its recognition as a Great Place to Work. This focus extends to robust professional development opportunities and comprehensive benefits packages, fostering a loyal and skilled employee base. In 2023, the company reported an employee retention rate of 85%, a figure that underscores the success of these initiatives.

Furthermore, Brookshire Grocery Company actively cultivates an inclusive workplace through its Diversity, Equity & Inclusion council. This strategic approach not only enhances employee satisfaction but also drives innovation and better customer understanding, vital for success in the retail sector. The company's DEI initiatives have led to a 15% increase in diverse hiring in management roles over the past two years.

- Employee Recognition: Certified as a Great Place to Work, highlighting a positive work environment.

- Professional Growth: Investment in employee training and development programs.

- Comprehensive Benefits: Offering competitive health, retirement, and other employee benefits.

- DEI Focus: Active Diversity, Equity & Inclusion council promoting an inclusive culture.

Ongoing Investment in Modernization and Expansion

Brookshire Grocery Company is demonstrating a strong commitment to its future by consistently investing in modernizing and expanding its store footprint. This strategic approach is evident in their ongoing project pipeline, which includes both new store developments and significant upgrades to existing locations. These capital expenditures are designed to improve customer experience and ensure the company remains competitive in the evolving retail landscape.

Key initiatives highlight this dedication. For instance, a new FRESH by Brookshire's store is set to break ground in Longview, Texas, with an anticipated opening in 2025. Furthermore, a substantial $2 million renovation is planned for a Forney, Texas location, also scheduled for completion in 2025. Such investments underscore Brookshire's focus on enhancing operational efficiency and attracting shoppers through updated facilities.

- New Store Development: Groundbreaking for a new FRESH by Brookshire's in Longview, Texas, projected to open in 2025.

- Renovations: A $2 million renovation planned for the Forney, Texas location in 2025.

- Strategic Investment: These projects reflect a broader strategy to upgrade infrastructure and support future growth.

Brookshire Grocery Company's strength is amplified by its diverse store banners, including Brookshire's, Super 1 Foods, and Reasor's, allowing it to cater to varied customer segments. This multi-brand strategy, coupled with a deep regional presence of over 209 stores across Texas, Louisiana, and Arkansas, cultivates strong brand recognition and customer loyalty.

The company's commitment to employee well-being is a significant asset, evidenced by its Great Place to Work certification and an 85% employee retention rate in 2023. This focus on its workforce, supported by DEI initiatives that have increased diverse management hiring by 15% over two years, fosters a skilled and dedicated team.

Brookshire's ongoing investment in store modernization and expansion, including a new FRESH by Brookshire's store opening in 2025 and a $2 million renovation in Forney, Texas, also in 2025, positions it for sustained growth and enhanced customer experience.

Community engagement is another core strength, highlighted by substantial philanthropic efforts. In 2024-2025, the FRESH 15 race alone raised $200,000 for local charities, and their annual golf tournament generated $784,000, reinforcing positive brand image and community ties.

What is included in the product

Analyzes Brookshire Grocery’s competitive position through key internal and external factors, including its strong regional presence and potential for expansion.

Identifies key competitive advantages and areas for improvement, enabling targeted strategies to address market challenges.

Highlights potential threats and weaknesses, allowing proactive mitigation planning to safeguard market share.

Weaknesses

Brookshire Grocery Company contends with formidable competition from national giants like Walmart and Amazon, alongside the aggressive expansion of discount grocers such as Aldi. These larger competitors frequently benefit from significant economies of scale, enabling them to implement aggressive pricing strategies and offer advanced digital services, thereby posing a challenge to regional players in terms of both cost and convenience.

Brookshire Grocery Company's digital commerce capabilities, while present through services like curbside pickup and Instacart partnerships, face inherent limitations in scaling compared to national e-commerce behemoths. This disparity can hinder their competitive edge in the rapidly expanding online grocery sector, where economies of scale drive significant cost advantages in delivery and fulfillment.

Brookshire Grocery faces a significant challenge with rapidly changing consumer shopping habits. Many shoppers now prefer omnichannel approaches, blending online and in-store purchases. This means less frequent, larger basket shops and a tendency to compare prices and offerings across various retailers to maximize value.

The average time customers spend in physical grocery stores is also shrinking. This trend puts pressure on regional players like Brookshire to constantly enhance both their in-store ambiance and their digital platforms. Failing to adapt risks losing customer loyalty as shoppers seek greater convenience and better deals elsewhere.

Exposure to Broader Supply Chain Disruptions

Brookshire's, like any grocery retailer, faces significant risks from broader supply chain disruptions. These can directly affect product availability and drive up operating expenses. For instance, continued geopolitical tensions and the potential for new trade barriers in 2024-2025 could lead to higher import costs for various goods.

Extreme weather events, a persistent concern, can also cripple transportation networks and damage agricultural output, impacting the supply of fresh produce and other perishables. Furthermore, rising freight prices, which saw significant increases in recent years and are expected to remain elevated, add another layer of cost pressure throughout the supply chain.

- Impact of Tariffs: Potential for increased costs on imported goods due to evolving trade policies.

- Geopolitical Instability: Disruptions in global trade routes and sourcing can affect product availability and pricing.

- Extreme Weather: Events like floods or droughts can damage crops and disrupt logistics, leading to shortages and price hikes.

- Rising Freight Costs: Increased fuel prices and carrier demand continue to put upward pressure on transportation expenses.

Pressure from Price-Sensitive Consumers

Brookshire Grocery faces significant pressure from consumers prioritizing price, a trend amplified by ongoing inflation and elevated food costs. This economic climate has consumers actively seeking more budget-friendly choices and private-label goods, directly impacting demand for premium offerings.

The heightened demand for value means grocers like Brookshire must continually offer competitive pricing and promotions. Failing to do so risks losing market share to retailers perceived as more affordable. This dynamic can squeeze profit margins if not carefully managed through efficient operations and strategic sourcing.

- Consumer Price Sensitivity: Inflationary pressures in 2024 and early 2025 have intensified consumer focus on affordability, with many actively seeking discounts and private-label alternatives.

- Promotional Reliance: Grocers are increasingly relying on promotions to attract and retain price-conscious shoppers, potentially impacting gross margins if not offset by volume increases or cost efficiencies.

- Margin Squeeze: The need to match competitor pricing while managing rising supply chain and operational costs presents a direct challenge to Brookshire's profitability.

Brookshire Grocery's ability to compete is hampered by its smaller scale compared to national rivals, limiting its purchasing power and ability to absorb rising operational costs. This disadvantage is particularly acute in the face of intense price competition, as seen with discount chains in 2024.

The company's digital infrastructure, while functional, lags behind the sophisticated e-commerce platforms of larger competitors, impacting its reach in the growing online grocery market. This gap can lead to missed opportunities for customer engagement and sales growth.

Brookshire's faces a constant challenge in adapting to evolving consumer preferences for omnichannel shopping. The trend towards smaller, more frequent trips and a greater emphasis on price comparison across retailers necessitates continuous investment in both physical store experience and digital convenience.

Supply chain vulnerabilities, exacerbated by geopolitical events and weather patterns throughout 2024-2025, directly impact product availability and increase operating expenses. Rising freight costs, a persistent issue, further squeeze margins.

What You See Is What You Get

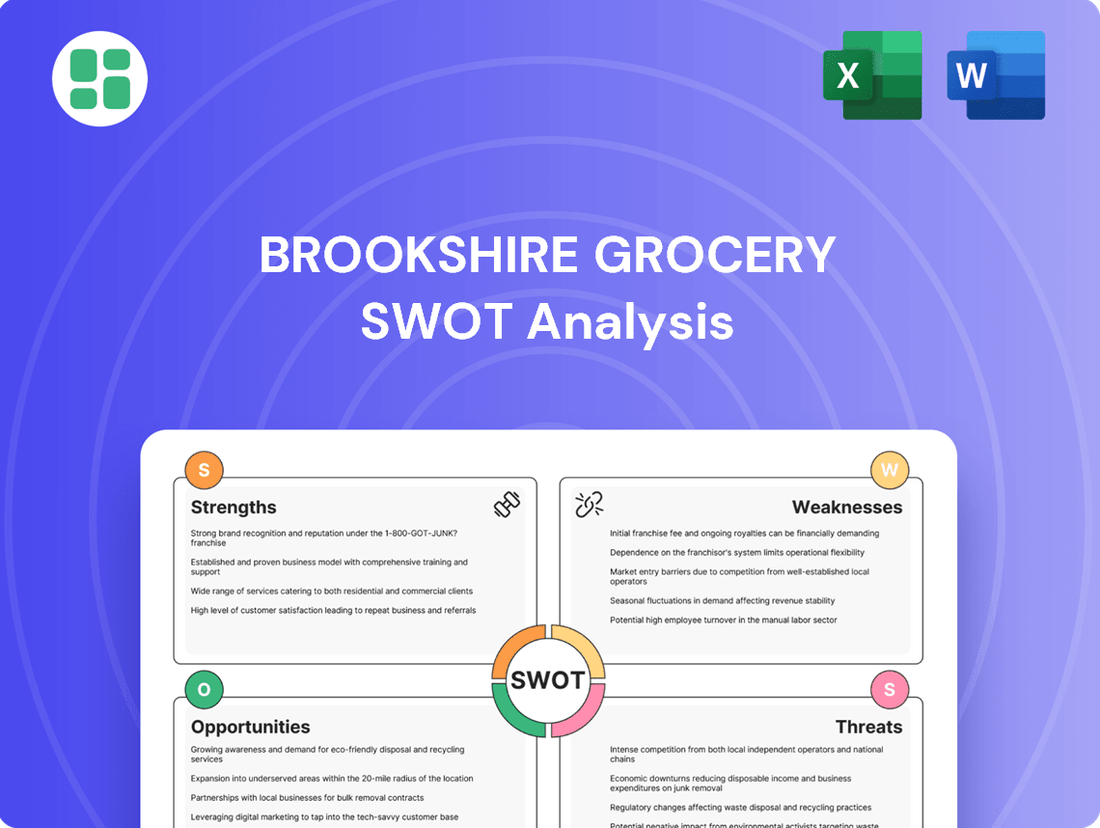

Brookshire Grocery SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Brookshire Grocery. The complete version, offering comprehensive insights into their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after checkout. This ensures you receive the exact, professional document you see here.

Opportunities

Brookshire Grocery has a substantial opportunity to elevate its digital commerce. Enhancing online ordering, curbside pickup, and home delivery services can significantly broaden its customer reach and convenience. For instance, the U.S. online grocery market saw substantial growth, projected to reach over $200 billion by 2025, presenting a clear avenue for Brookshire's to expand its digital footprint and capture a larger market share.

Brookshire's has a significant opportunity to grow its private label portfolio, capitalizing on the rising consumer demand for value and quality in store brands. By expanding its own-brand offerings across a wider array of product categories, the company can enhance its profit margins and provide customers with more cost-effective shopping options.

This strategic move also fosters brand loyalty, as unique private label products can differentiate Brookshire's from competitors and create exclusive offerings that customers can't find elsewhere. For instance, in 2024, private label sales in the U.S. grocery sector continued to show robust growth, with many retailers reporting double-digit increases in their own-brand penetration, suggesting a favorable market environment for Brookshire's to leverage this trend.

Brookshire's partnership with Afresh to implement AI for inventory management in fresh departments is a significant step. This technology aims to optimize stock levels, minimize spoilage, and ensure peak product freshness, directly impacting customer satisfaction and reducing operational costs.

Expanding these advanced technological solutions, such as AI-driven forecasting and automated ordering systems, across all Brookshire's stores presents a substantial opportunity. By leveraging these tools, the company can achieve greater operational efficiency, leading to a projected reduction in food waste by as much as 30% and a potential increase in on-shelf availability for key items, as seen in similar retail deployments.

Enhance In-Store Experience and Fresh Offerings

Even with the growth of online retail, the physical store experience remains a vital component of grocery shopping. Brookshire's has a significant opportunity to leverage the increasing consumer demand for fresh, high-quality food. By investing more in specialized fresh departments, ready-to-eat chef-prepared meals, and unique artisan products, they can cultivate a distinct in-store atmosphere that encourages shoppers to spend more time and increase their purchase sizes.

This strategy aligns with current consumer trends. For instance, a 2024 report indicated that over 60% of consumers still prefer grocery shopping in person for the ability to select fresh produce. Brookshire's can capitalize on this by:

- Expanding curated selections of local and specialty produce.

- Increasing the variety and quality of prepared foods and grab-and-go options.

- Developing interactive food stations or tasting events to enhance engagement.

- Focusing on creating a welcoming and visually appealing store environment.

Monetize Retail Media Networks

Brookshire Grocery can capitalize on its deep understanding of regional shopper behavior and established community presence to build robust retail media networks. This strategy unlocks significant new revenue potential by providing consumer packaged goods (CPG) brands with direct access to highly engaged, local customer bases for targeted advertising campaigns.

The retail media landscape is expanding rapidly. For instance, in 2023, the US retail media ad spend was projected to reach $45 billion, with continued growth anticipated. Brookshire's localized data, including purchasing habits and demographic information within its operating regions, is a valuable asset for CPG companies aiming to optimize their marketing spend and reach specific consumer segments effectively.

- Leverage Localized Data: Utilize shopper data to offer highly targeted advertising placements, increasing ad effectiveness for CPG partners.

- Build New Revenue Streams: Generate income from advertising sales, diversifying revenue beyond traditional grocery sales.

- Strengthen CPG Partnerships: Provide CPG brands with valuable insights and direct access to their target consumers, fostering deeper relationships.

- Enhance Shopper Experience: Offer relevant promotions and product information to shoppers through digital channels, improving their in-store and online journey.

Brookshire Grocery has a prime opportunity to enhance its digital presence by expanding online ordering, curbside pickup, and home delivery. This move taps into a growing market, with U.S. online grocery sales projected to exceed $200 billion by 2025.

Expanding private label offerings presents another significant avenue for growth, aligning with consumer demand for value and quality. In 2024, private label sales saw robust increases, with many retailers reporting double-digit gains in their own-brand penetration, indicating a favorable market for Brookshire's to capitalize on this trend.

Brookshire's can also leverage its physical store strengths by investing in fresh departments, prepared meals, and specialty items to create a unique in-store experience. A 2024 report found over 60% of consumers still prefer in-person shopping for fresh produce selection, highlighting the importance of these in-store enhancements.

Developing a retail media network offers a substantial opportunity to generate new revenue by connecting CPG brands with Brookshire's engaged, local customer base. The U.S. retail media ad spend was projected to reach $45 billion in 2023, with continued growth expected, making this a lucrative venture.

Threats

The grocery landscape is fierce, with giants like Walmart and Kroger constantly evolving their strategies, while discounters such as Aldi and Lidl gain traction with aggressive pricing. This escalating competition directly challenges Brookshire Grocery's ability to maintain its market share and pricing flexibility.

The threat is amplified by ongoing industry consolidation; for instance, Kroger's proposed acquisition of Albertsons, if approved, would create an even larger competitor, potentially reshaping regional market dynamics and intensifying pressure on smaller players like Brookshire's. This could impact Brookshire's profitability, especially in markets where these larger entities have a significant presence.

Persistent inflation, particularly in food prices, continues to pressure consumers. For instance, the U.S. Consumer Price Index for food at home saw a 2.9% increase year-over-year in April 2024, a trend that has been ongoing. This forces shoppers to become more price-sensitive, potentially reducing purchases of higher-margin items at Brookshire Grocery.

Consumers are actively seeking value, which can manifest as increased cross-shopping at different retailers to capitalize on sales and promotions. This behavior directly challenges customer loyalty and can divert sales from Brookshire Grocery to competitors offering perceived better deals. The overall economic climate in 2024 suggests this trend will persist.

Global supply chains remain a significant concern for retailers like Brookshire Grocery. Geopolitical events and trade policy shifts continue to create volatility, potentially leading to unpredictable shortages and delivery delays for essential goods. For instance, in 2024, many sectors experienced higher freight costs due to ongoing disruptions in key shipping lanes, impacting the cost of goods for consumers.

These disruptions directly translate to increased operational expenses for Brookshire's, including higher sourcing and transportation costs. Managing inventory levels and maintaining competitive pricing becomes more challenging when faced with these external pressures, potentially affecting profit margins and customer satisfaction.

Evolving Labor Market Dynamics

The grocery sector grapples with ongoing difficulties in securing and keeping employees, which can drive up wages and operational expenses. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings for grocery store workers saw an increase, reflecting this competitive pressure.

Brookshire Grocery must prioritize offering competitive pay and fostering a supportive workplace to combat potential labor shortages and uphold superior customer service. This includes investing in training and benefits to make positions more attractive.

Key considerations include:

- Wage Inflation: Rising minimum wages and increased demand for skilled retail staff could significantly impact labor costs.

- Employee Retention: High turnover rates in the retail industry necessitate strategies focused on employee satisfaction and career development.

- Automation Impact: While automation can improve efficiency, it also shifts the skill requirements for remaining staff, demanding new training investments.

Rapid Technological Advancements and Customer Expectations

The retail landscape is being reshaped by swift technological shifts, especially in e-commerce, AI, and personalized customer experiences. In 2024, grocery retailers are facing increased pressure to integrate these innovations, with consumer demand for seamless online ordering and delivery options continuing to surge. Failure to keep pace with these evolving expectations can create a significant competitive disadvantage.

Customer expectations are now higher than ever, driven by the rapid advancements in technology. For instance, by early 2025, a significant portion of grocery shoppers are anticipated to expect AI-powered personalized recommendations and highly efficient, data-driven inventory management. Brookshire Grocery's ability to adapt and invest in these areas will be crucial for maintaining customer loyalty and market position.

- Evolving Customer Demands: Consumers increasingly expect sophisticated digital tools for shopping, from intuitive apps to personalized offers.

- Competitive Pressure: Competitors are investing heavily in AI and e-commerce capabilities, setting a higher bar for customer experience.

- Risk of Obsolescence: Stagnation in technological adoption could lead to Brookshire Grocery being perceived as outdated, impacting market share.

Intense competition from large chains and discounters, coupled with industry consolidation like the potential Kroger-Albertsons merger, poses a significant threat to Brookshire Grocery's market share and pricing power. Persistent inflation, with food prices rising 2.9% year-over-year in April 2024, makes consumers more price-sensitive, potentially impacting sales of higher-margin items. Supply chain disruptions and rising freight costs in 2024 also increase operational expenses, challenging inventory management and competitive pricing. Furthermore, the need to invest in evolving e-commerce and AI technologies to meet customer expectations for personalized experiences and seamless digital shopping presents a substantial challenge, with competitors already making significant advancements in these areas.

SWOT Analysis Data Sources

This Brookshire Grocery SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary, ensuring a robust and insightful assessment.