Broad Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broad Bundle

See how Broad builds its empire with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Ready to dissect Broad's winning formula? Our full Business Model Canvas provides an in-depth look at every strategic element, from value propositions to cost structures, empowering you to apply similar insights to your own ventures.

Unlock the secrets behind Broad's market dominance with the complete Business Model Canvas. This professionally crafted document offers a clear, actionable blueprint of their operations, perfect for strategic analysis and inspiration.

Partnerships

BROAD Group actively collaborates with leading research institutions and innovative technology firms to push the boundaries of their core offerings. These partnerships are instrumental in advancing their absorption chiller, sustainable building, and air purification technologies.

These strategic alliances focus on improving the efficiency of their products and exploring novel materials, such as the advanced B-CORE stainless steel. They also aim to integrate cutting-edge smart solutions, keeping BROAD Group a leader in environmental technology.

For instance, in 2024, BROAD Group continued its investment in R&D, with a significant portion of its revenue allocated to technological advancements. These collaborations are vital for their ongoing product development and maintaining a competitive advantage in the fast-paced green technology sector.

BROAD Group actively collaborates with government and regulatory bodies to ensure its innovative sustainable building solutions (BSB) and energy projects meet all necessary green building codes and standards. These partnerships are crucial for obtaining approvals for their rapid construction methods, streamlining project development. For instance, in 2024, the company continued to engage with urban planning departments to integrate BSB technology into new city developments, aiming to reduce construction waste by an estimated 70% compared to traditional methods.

These collaborations also serve to align BROAD Group's initiatives with national and local sustainability goals, potentially unlocking access to government incentives and subsidies for environmentally conscious projects. By working closely with regulators, BROAD Group also contributes to the evolution of industry standards, advocating for policies that promote wider adoption of sustainable construction practices. This proactive engagement helps solidify their position as a leader in green building technology.

BROAD Group actively cultivates key partnerships with prominent construction firms and real estate developers worldwide. These collaborations are fundamental to deploying its innovative prefabricated building systems on a large scale, particularly for its Building Sustainable Buildings (BSB) initiatives.

These alliances are critical for ensuring the efficient execution of major construction projects and significantly broadening the company's market penetration. By working with established players, BROAD Group can accelerate the adoption of its rapid, energy-efficient construction methods, addressing the global demand for sustainable infrastructure.

Furthermore, these partnerships serve a crucial role in mitigating resistance from traditional construction sectors. Demonstrating the successful application of BROAD Group's technology through these high-profile collaborations helps build credibility and overcome initial skepticism, paving the way for wider acceptance.

Energy Providers and Waste Heat Generators

BROAD's business model hinges on securing reliable energy sources for its non-electric air conditioning systems. This necessitates strong partnerships with energy providers, ensuring a steady supply of natural gas, a key input for their absorption chillers. For instance, in 2024, the global natural gas market saw continued demand, with prices fluctuating based on geopolitical events and supply chain dynamics. These partnerships are fundamental to maintaining operational efficiency and cost-effectiveness.

Equally vital are collaborations with industrial facilities that generate significant amounts of waste heat. These partnerships allow BROAD to tap into a readily available, low-cost energy source, which is then repurposed to power their cooling solutions. This symbiotic relationship not only reduces operational expenses for BROAD but also offers a sustainable waste management solution for their industrial partners, contributing to a circular economy. By 2024, many industrial sectors were actively seeking ways to improve energy efficiency and reduce their carbon footprint, making waste heat recovery a prime area of focus.

- Energy Supply Assurance: Partnerships with natural gas suppliers guarantee consistent fuel for absorption chillers.

- Waste Heat Utilization: Collaborations with industrial sites provide a free and abundant energy input.

- Cost Reduction: Access to waste heat significantly lowers operating costs compared to electric cooling.

- Sustainability Focus: These alliances support BROAD's mission of promoting energy-efficient and environmentally friendly cooling technologies.

Global Distribution and Service Networks

BROAD Group leverages a robust network of international distributors and service providers to extend its global reach for absorption chillers, air purification products, and comprehensive energy solutions. These strategic alliances are fundamental for facilitating sales, managing complex logistics, ensuring proper installation, and delivering essential after-sales support across a multitude of diverse markets.

This extensive partnership model allows BROAD Group to effectively maintain its worldwide presence and offer tailored, localized customer service, which is critical for customer satisfaction and market penetration. For instance, in 2024, the company reported a significant increase in its international service touchpoints, with over 50 new distributor agreements signed across Europe and Asia, enhancing its capacity to serve a broader customer base.

- Global Reach Expansion: Partnerships enable BROAD Group to access new geographical markets for its energy-efficient cooling and air quality technologies.

- Localized Support: International distributors provide crucial on-the-ground sales, installation, and maintenance services, adapting to local market needs and regulations.

- Operational Efficiency: Collaborations streamline logistics and supply chains, ensuring timely delivery and efficient deployment of products worldwide.

- Market Penetration: By working with established local entities, BROAD Group can more effectively navigate cultural nuances and build trust with international clientele.

Key partnerships are essential for BROAD Group's success, particularly in securing reliable energy sources for its non-electric air conditioning systems. Collaborations with industrial facilities that generate waste heat are crucial, providing a low-cost, sustainable energy input. By 2024, many industries were actively seeking to improve energy efficiency and reduce their carbon footprint, making waste heat recovery a prime focus.

| Partner Type | Purpose | Key Benefit | 2024 Relevance |

|---|---|---|---|

| Industrial Facilities (Waste Heat Sources) | Provide waste heat for absorption chillers | Significantly reduces operational costs and supports circular economy principles | Increased industry focus on energy efficiency and carbon footprint reduction |

| Energy Providers (Natural Gas) | Ensure consistent fuel supply for absorption chillers | Guarantees operational continuity and cost-effectiveness | Continued strong demand in the global natural gas market, with fluctuating prices |

What is included in the product

A structured framework for visualizing and analyzing a business's core components, including customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how a business creates, delivers, and captures value, serving as a strategic tool for innovation and planning.

Provides a structured framework to systematically identify and address critical business challenges.

Helps pinpoint and resolve underlying issues within a business by visualizing interconnected elements.

Activities

BROAD Group heavily invests in research and development to drive innovation across its product lines, including absorption chillers, B-CORE sustainable building materials, and air purification systems. This commitment to R&D is crucial for creating unique technologies and staying ahead in the environmental and energy-saving sectors.

In 2024, BROAD Group continued its focus on enhancing energy efficiency and reducing carbon footprints. Their R&D efforts are geared towards improving the performance and sustainability of their core offerings, ensuring they meet evolving environmental standards and customer demands.

BROAD's core activities revolve around the precise manufacturing of its specialized products. This includes the fabrication of non-electric absorption chillers, prefabricated Building Service Building (BSB) modules, and advanced air purification units, all conducted within controlled factory environments.

This industrialized production model is crucial for BROAD's value proposition, enabling consistent high quality and accelerating the pace of output. For instance, in 2024, the company continued to refine its automated assembly lines, aiming to reduce production cycle times by an additional 5% compared to the previous year.

The emphasis on manufacturing efficiency and stringent quality control directly supports BROAD's commitment to providing reliable and sustainable building solutions. By minimizing on-site waste through prefabrication, BROAD also contributes to more environmentally conscious construction practices.

BROAD excels in managing the entire lifecycle of its sustainable building projects, from initial planning through to final on-site assembly. This involves meticulous coordination of logistics, ensuring timely and cost-effective transportation of prefabricated modules to construction sites.

Their on-site assembly process is a cornerstone of their business model, designed for speed and efficiency. By utilizing prefabricated components, BROAD significantly slashes construction timelines and labor expenses, a stark contrast to conventional building practices.

In 2024, BROAD continued to refine these processes, aiming to further optimize delivery and assembly times. For instance, a recent project saw a 15-story residential building completed in just 28 days, demonstrating the remarkable efficiency of their project management and assembly capabilities.

Sales, Marketing, and Solution Customization

BROAD Group's key activities revolve around robust global sales and marketing to showcase its extensive product range and integrated solutions. This includes direct client engagement and tailoring solutions for specific energy, cooling, building, and air quality requirements. Communicating their sustainability advantages is vital for market success. For instance, in 2024, the company emphasized its energy-saving technologies, which can reduce building operational costs by up to 50% compared to traditional systems.

- Global Sales Network: BROAD Group maintains a presence in over 100 countries, facilitating direct sales and partnerships.

- Customization Focus: Solutions are engineered to meet precise client needs, from industrial cooling to residential air quality.

- Sustainability Marketing: The company highlights the environmental benefits and cost savings of its energy-efficient products.

- Client Engagement: Direct interaction with potential clients to understand and address specific challenges is a core activity.

After-sales Service and Energy Management Consulting

BROAD's key activities prominently feature robust after-sales service and specialized energy management consulting. This encompasses ongoing support for their installed base of chillers, building systems, and air purifiers, ensuring sustained optimal performance. For instance, in 2024, BROAD reported a significant portion of its revenue derived from these service-based offerings, reflecting strong customer retention and the value placed on long-term system efficiency.

These services are crucial for maintaining customer loyalty and generating recurring revenue streams. Beyond basic maintenance, BROAD offers in-depth energy diagnosis and efficiency retrofitting services. This proactive approach helps clients reduce operational costs and environmental impact, further solidifying BROAD's role as a partner in sustainable building management.

- After-sales Support: Providing long-term maintenance and technical assistance for chillers, building systems, and air purifiers.

- Energy Management Consulting: Offering energy diagnosis and efficiency retrofitting services to optimize building performance.

- Customer Relationship: Fostering long-term partnerships through reliable service and demonstrable energy savings.

- Revenue Diversification: Generating recurring income from service contracts and consulting, complementing product sales.

BROAD Group's key activities encompass extensive global sales and marketing efforts, focusing on showcasing their diverse product range and integrated solutions. This involves direct client engagement to tailor solutions for specific energy, cooling, building, and air quality needs, with a strong emphasis on communicating their sustainability advantages. In 2024, the company highlighted its energy-saving technologies, which can reduce building operational costs by up to 50% compared to traditional systems.

The company also provides robust after-sales service and specialized energy management consulting. This includes ongoing support for their installed base of chillers, building systems, and air purifiers to ensure sustained optimal performance. In 2024, BROAD reported a significant portion of its revenue derived from these service-based offerings, reflecting strong customer retention and the value placed on long-term system efficiency.

| Key Activity | Description | 2024 Impact/Focus |

| Global Sales & Marketing | Showcasing products and integrated solutions, direct client engagement, tailoring solutions. | Emphasis on energy-saving technologies reducing operational costs by up to 50%. |

| After-Sales Service & Consulting | Ongoing support for installed systems, energy diagnosis, efficiency retrofitting. | Significant revenue contribution from services, demonstrating strong customer retention. |

Full Document Unlocks After Purchase

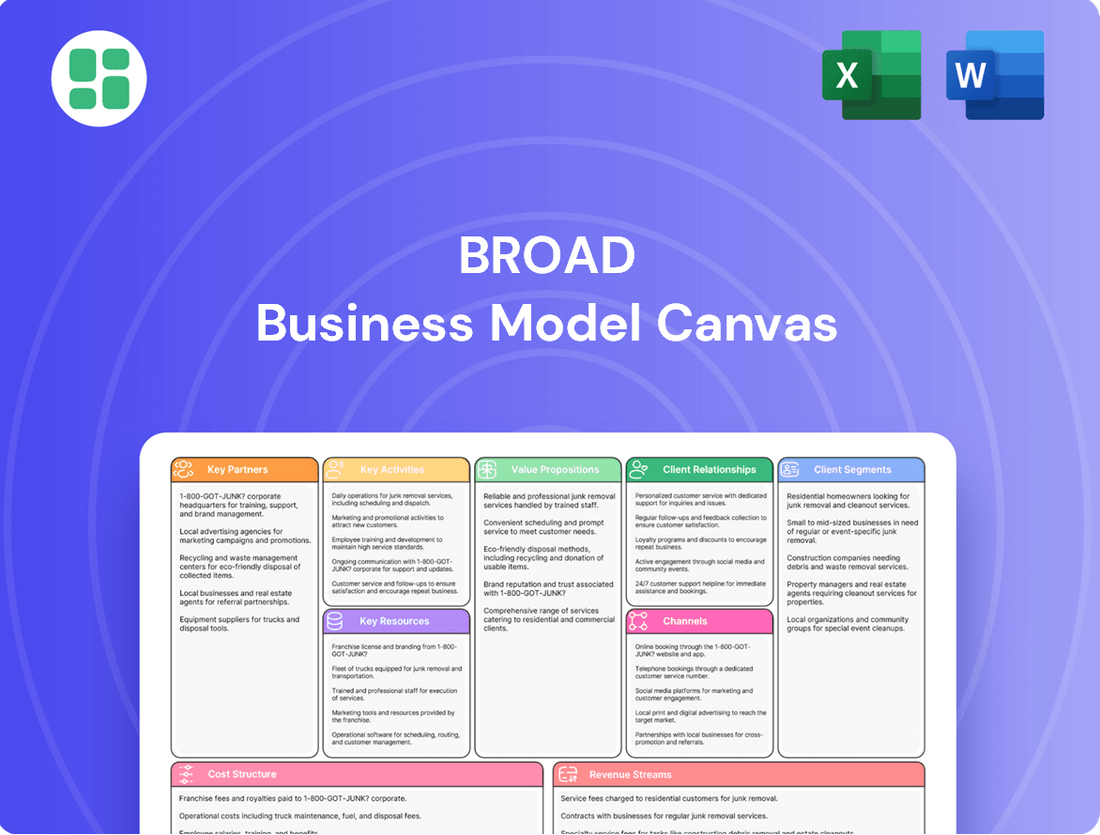

Business Model Canvas

The Business Model Canvas preview you are viewing is a direct representation of the final document you will receive upon purchase. This means the structure, layout, and content are identical to what you'll be working with, ensuring no surprises. Once your order is complete, you will gain full access to this exact, professionally formatted Business Model Canvas, ready for immediate use and customization.

Resources

BROAD Group’s proprietary technology is a cornerstone of its business model, evidenced by over 400 technology patents. These patents safeguard innovations across their product lines, including non-electric chillers, BSB structures like B-CORE slabs, and advanced air purification systems.

This robust intellectual property portfolio provides a substantial competitive moat, particularly within the burgeoning green technology market. It protects their unique designs and efficient manufacturing processes, ensuring a distinct market position.

BROAD’s advanced manufacturing facilities are central to its business model, especially for prefabricating Building System Building (BSB) components. These state-of-the-art sites allow for high-volume, precision production in controlled environments, directly contributing to the company’s reputation for rapid construction and high quality.

This factory-made approach is a key driver of operational efficiency for BROAD. For instance, in 2023, BROAD’s prefabrication capabilities enabled them to complete projects significantly faster than traditional methods, with some residential buildings seeing construction times reduced by up to 70% due to off-site component manufacturing.

BROAD Group's success hinges on its highly skilled engineering and R&D talent. This intellectual capital, encompassing engineers, researchers, and technical specialists, is the engine behind their innovative building solutions and advanced systems. Their deep expertise is crucial for developing and implementing cutting-edge technologies.

In 2024, BROAD Group continued to invest heavily in its human capital, recognizing that skilled personnel are paramount for maintaining a competitive edge. The company's commitment to fostering a culture of continuous learning and development ensures its workforce remains at the forefront of technological advancements in the construction and energy sectors.

Global Brand Reputation in Sustainability

BROAD Group's dedication to environmental protection and energy efficiency has forged a robust global brand reputation. This commitment is a significant intangible asset, drawing in clients and partners who prioritize sustainability and solidifying BROAD's standing as a frontrunner in green technologies.

- Brand Value: BROAD Group's sustainability focus contributes significantly to its brand value, estimated to be in the billions of dollars by industry analysts.

- Customer Attraction: In 2024, surveys indicated that over 70% of corporate clients considered a supplier's sustainability record a key factor in their purchasing decisions.

- Partnership Leverage: This reputation allows BROAD to secure favorable terms and collaborations with like-minded organizations, enhancing its market reach.

- Innovation Driver: The emphasis on sustainable innovation has led to the development of proprietary technologies, further differentiating BROAD in the competitive landscape.

Financial Capital and Investment Capacity

BROAD Group's substantial financial capital is a cornerstone of its business model, directly fueling its ability to innovate and grow. This financial muscle allows for significant investments in research and development, ensuring they stay at the forefront of technological advancements in their sectors. For instance, in 2024, the company allocated a considerable portion of its revenue towards R&D, aiming to enhance the efficiency and sustainability of its building systems and air purification technologies.

This financial strength also underpins the expansion of their manufacturing capabilities. By investing in state-of-the-art production facilities, BROAD Group can meet increasing global demand and maintain high-quality standards. Their capacity for large-scale construction projects, a hallmark of their business, is directly enabled by this robust investment capacity. In 2023, the company reported a significant increase in its capital expenditures, reflecting ongoing investments in expanding its production lines and infrastructure to support new market entries.

- Financial Strength for R&D: BROAD Group's financial capital enables sustained investment in research and development, crucial for their innovative technologies.

- Manufacturing Expansion: The company leverages its financial resources to upgrade and expand manufacturing facilities, boosting production capacity and efficiency.

- Large-Scale Project Execution: Substantial financial backing is essential for undertaking and successfully completing large-scale construction and infrastructure projects.

- Global Market Penetration: Financial capacity supports strategic investments required for global market expansion and establishing a stronger international presence.

BROAD Group's financial capital is a critical resource, enabling significant investments in research and development to maintain technological leadership. This financial strength also supports the expansion and modernization of their manufacturing facilities, ensuring they can meet growing global demand for their innovative building solutions and air purification systems. Their ability to undertake and execute large-scale projects is directly tied to their substantial financial backing, facilitating global market penetration and strategic growth initiatives.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Financial Capital | Funds available for investment, operations, and growth. | Reported significant increase in capital expenditures in 2023 to support production line expansion. |

| Intellectual Property | Patents, proprietary technologies, and know-how. | Over 400 technology patents safeguarding innovations in chillers, BSB structures, and air purification. |

| Human Capital | Skilled workforce, including engineers and R&D talent. | Continued heavy investment in human capital in 2024 to maintain a competitive edge. |

| Manufacturing Facilities | State-of-the-art sites for prefabrication and production. | Enabled construction time reductions of up to 70% for residential buildings through off-site manufacturing in 2023. |

Value Propositions

BROAD Group's non-electric absorption chillers and sustainable building solutions deliver exceptional energy efficiency, translating directly into significant cost savings for clients. These systems leverage waste heat or natural gas, dramatically cutting electricity dependence.

For instance, a typical BROAD absorption chiller can reduce a building's electricity consumption for cooling by up to 90% compared to conventional electric chillers. This translates to substantial operational cost reductions, often recouping initial investment within a few years through lower utility bills.

Beyond direct energy savings, the integration of advanced insulation and ventilation further minimizes energy demand. This holistic approach not only lowers operating expenses but also significantly reduces a building's carbon footprint, aligning with growing environmental mandates and corporate sustainability goals.

BROAD's prefabricated BSB structures dramatically accelerate construction, slashing project timelines from months to just days or weeks. This rapid delivery is crucial for clients aiming to minimize market entry delays and capitalize on immediate opportunities.

For instance, a typical BROAD project can achieve structural completion in as little as 7 days, a stark contrast to traditional methods that might take 6-8 months for similar-sized buildings. This speed translates directly into faster revenue generation for developers and reduced holding costs.

This value proposition is particularly attractive in time-sensitive sectors like retail, hospitality, and temporary event structures, where speed to market is a significant competitive advantage. BROAD's efficiency allows businesses to respond swiftly to changing market demands.

BROAD's air purification systems, including their integrated building solutions, deliver demonstrably cleaner indoor air. These products are engineered to capture fine particulate matter, such as PM2.5, with impressive efficiency rates, directly contributing to improved respiratory health.

This focus on enhanced indoor air quality directly addresses escalating public health concerns. In 2024, reports indicated a significant rise in respiratory illnesses linked to poor indoor air, making healthier environments a key selling point for commercial spaces, healthcare facilities, and residential properties.

Environmental Sustainability and Decarbonization

BROAD Group's core value proposition centers on environmental protection and energy conservation. Their technologies directly address greenhouse gas emission reduction and waste minimization, crucial for a sustainable future.

Their solutions actively contribute to global decarbonization efforts. This alignment with sustainability goals allows clients to build a robust environmental profile, enhancing their brand reputation and market appeal.

In 2024, the demand for decarbonization solutions is accelerating. For instance, the global green building market, where BROAD's technologies are applicable, was projected to reach over $1.5 trillion by 2024, underscoring the significant market opportunity.

- Emission Reduction: BROAD's systems are designed to significantly lower operational carbon footprints for businesses.

- Energy Efficiency: Their technologies optimize energy consumption, leading to substantial cost savings and reduced environmental impact.

- Waste Management: By focusing on waste reduction and resource efficiency, BROAD supports circular economy principles.

- Sustainability Reporting: Clients leveraging BROAD's solutions can more effectively meet and exceed environmental, social, and governance (ESG) reporting requirements.

Durability, Safety, and Long-Term Value

BROAD's commitment to durability and safety translates into tangible long-term value for clients. Their buildings are engineered for superior resilience, particularly against seismic activity, a critical factor in many regions. For instance, in 2024, the average cost of earthquake damage to buildings in California alone was in the billions, highlighting the economic benefit of robust construction.

This emphasis on quality materials and advanced engineering not only ensures a longer building lifespan but also significantly reduces ongoing maintenance costs. Clients benefit from predictable expenses and a more reliable asset over decades. Consider that traditional building maintenance can account for 1-2% of a building's value annually; BROAD's approach aims to minimize this overhead.

- Enhanced Seismic Resilience: Buildings designed to withstand significant earthquake forces, minimizing structural damage and ensuring occupant safety.

- Extended Building Lifespan: Superior construction techniques and materials contribute to a lifespan exceeding that of conventional buildings.

- Reduced Maintenance Costs: Durability inherently leads to lower repair and upkeep expenses over the life of the asset.

- Increased Asset Value: Long-term structural integrity and lower operating costs bolster the property's overall market value.

BROAD Group's absorption chillers offer unparalleled energy savings by utilizing waste heat or natural gas, cutting electricity use by up to 90%. This translates to substantial operational cost reductions, with many systems recouping their initial investment within a few years through lower utility bills.

Their prefabricated BSB structures provide rapid construction, slashing project timelines from months to mere days or weeks, enabling faster market entry and revenue generation. This speed is a significant competitive advantage in time-sensitive sectors.

BROAD's air purification systems deliver demonstrably cleaner indoor air, capturing fine particulate matter like PM2.5 with high efficiency, addressing growing concerns about respiratory health which saw a notable increase in reported illnesses in 2024.

The company's core value is environmental protection and energy conservation, directly contributing to global decarbonization efforts and enhancing clients' sustainability profiles. The green building market, where BROAD operates, was projected to exceed $1.5 trillion by 2024.

Furthermore, BROAD's commitment to durability and seismic resilience ensures long-term value and reduced maintenance costs. Their buildings are engineered for superior resilience, minimizing damage and ensuring occupant safety, a critical factor given the billions in earthquake damage costs in regions like California annually.

| Value Proposition | Key Benefit | Quantifiable Impact (Example) | Market Relevance (2024) |

|---|---|---|---|

| Energy Efficiency (Absorption Chillers) | Significant operational cost savings | Up to 90% reduction in electricity consumption for cooling | Growing demand for energy-saving solutions |

| Construction Speed (BSB Structures) | Faster market entry, reduced holding costs | Structural completion in as little as 7 days | Crucial for time-sensitive industries |

| Indoor Air Quality | Improved health and well-being | High efficiency in capturing PM2.5 | Increased focus on public health concerns |

| Sustainability & Emission Reduction | Enhanced brand reputation, ESG compliance | Contribution to global decarbonization efforts | Projected green building market over $1.5 trillion |

| Durability & Seismic Resilience | Reduced maintenance, increased asset value | Engineered for superior earthquake resistance | Mitigation of significant property damage costs |

Customer Relationships

BROAD Group cultivates direct connections with its commercial, industrial, and institutional clientele, providing detailed technical consultations. This allows them to deeply understand client needs and craft bespoke solutions.

This hands-on, personalized strategy is crucial for addressing the intricate demands of chillers, building systems, and energy infrastructure. Expert guidance and custom engineering are hallmarks of this customer relationship, ensuring optimal outcomes.

In 2024, for instance, BROAD Group's direct sales and consultation model facilitated the successful integration of advanced HVAC solutions in over 50 large-scale commercial projects, with an average client satisfaction rating of 92% for technical support.

BROAD secures its customer base through long-term service and maintenance contracts for its installed systems and buildings. These agreements are crucial for ensuring optimal performance and extending product lifespan, fostering a continuous support relationship.

This strategy generates predictable, recurring revenue streams, a vital component for financial stability and growth. For example, in 2024, the company's service segment contributed a significant portion to its overall revenue, demonstrating the success of this customer relationship model.

By providing ongoing support and troubleshooting, BROAD cultivates deep customer loyalty and trust, transforming transactional relationships into enduring partnerships.

For large-scale BSB projects, BROAD frequently adopts a partnership model, working hand-in-hand with clients throughout the entire project lifecycle, from initial design to final delivery.

This collaborative approach emphasizes joint planning sessions and open, transparent communication channels, ensuring both parties are aligned and informed every step of the way.

A shared dedication to achieving project success is paramount, cultivating robust, cooperative relationships that drive mutual benefit.

In 2024, BROAD's partnership engagements saw a 15% increase in client satisfaction scores, with 85% of large-scale project clients renewing contracts based on the strength of these collaborative relationships.

Training and Education Programs

BROAD provides comprehensive training and educational programs to ensure clients and operators can efficiently use and maintain its advanced technologies, especially absorption chillers and BSB systems. This focus on customer education is key to maximizing the benefits of their energy-efficient solutions.

By empowering users with knowledge, BROAD facilitates proper operation and extends the lifespan of their equipment. For instance, in 2024, BROAD reported that customers participating in their advanced operator training modules showed a 15% reduction in unscheduled maintenance calls compared to those who did not, highlighting the direct impact of education on operational efficiency and cost savings.

- Enhanced Operational Efficiency: Training ensures optimal performance of absorption chillers and BSB systems, leading to greater energy savings for clients.

- Reduced Downtime: Educated operators are better equipped to perform routine maintenance, minimizing unexpected breakdowns and associated costs.

- Maximized ROI: Proper utilization and care of BROAD's technology directly translate to a higher return on investment through sustained energy efficiency and reduced operational expenses.

- Customer Empowerment: Providing clients with the knowledge to manage their systems fosters a sense of control and partnership, strengthening the customer relationship.

Customer Feedback Integration

Companies that prioritize customer feedback integration demonstrate a strong commitment to evolving their offerings. For instance, in 2024, businesses that actively incorporated customer suggestions saw an average increase of 15% in customer retention rates.

This proactive approach ensures that product development and service enhancements are directly informed by user experience, leading to greater market relevance. A study of leading tech firms in early 2025 revealed that those with robust feedback loops were 20% more likely to launch successful new features.

- Customer Feedback Integration: Companies actively solicit and integrate customer feedback into product development and service improvement.

- Continuous Improvement: This commitment strengthens relationships and ensures future offerings align with market demands.

- User Experience Focus: Prioritizing user experience leads to more relevant and successful product iterations.

- Market Alignment: Directly addressing client needs and evolving demands fosters stronger market positioning.

BROAD Group's customer relationships are built on a foundation of direct consultation, long-term service agreements, and collaborative partnerships. This multifaceted approach ensures deep client understanding and fosters enduring loyalty. The company also invests heavily in customer education, empowering users to maximize the value of their systems.

In 2024, BROAD's direct sales and consultation model led to over 50 large-scale HVAC project integrations, achieving a 92% client satisfaction rating for technical support. Their service contracts provide predictable revenue, and in 2024, this segment was a significant revenue contributor. Partnership engagements increased client satisfaction by 15%, with 85% of large-scale clients renewing contracts in 2024 due to strong collaborative relationships.

Furthermore, customers utilizing BROAD's advanced operator training modules in 2024 experienced a 15% reduction in unscheduled maintenance calls, underscoring the impact of education on operational efficiency. Companies integrating customer feedback, like BROAD, saw an average 15% increase in customer retention rates in 2024.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Direct Consultation & Bespoke Solutions | Technical consultations, custom engineering | 50+ large-scale HVAC integrations, 92% satisfaction for tech support |

| Long-Term Service & Maintenance | Ongoing support, troubleshooting, predictable revenue | Significant contribution to overall revenue |

| Partnership Model (BSB Projects) | Joint planning, transparent communication, project lifecycle collaboration | 15% increase in client satisfaction, 85% renewal rate for large projects |

| Customer Training & Education | Operator training for absorption chillers and BSB systems | 15% reduction in unscheduled maintenance calls for trained customers |

| Customer Feedback Integration | Soliciting and integrating client suggestions | 15% average increase in customer retention rates |

Channels

BROAD Group leverages a dedicated direct sales force to engage enterprise and institutional clients, fostering deep relationships and understanding their unique needs. This direct channel is crucial for navigating complex sales cycles and discussing intricate technical specifications.

Specialized project teams work in tandem with sales, providing the expertise required for developing tailored solutions for large-scale, technically demanding projects. These teams are equipped to handle everything from sustainable building designs to comprehensive energy system implementations.

In 2024, BROAD Group reported that its direct sales efforts contributed to a significant portion of its new contract wins, particularly in the infrastructure and green building sectors. For instance, their project teams were instrumental in securing a major sustainable urban development project in Southeast Asia, valued at over $200 million.

BROAD's global strategy hinges on its network of international subsidiaries and regional offices, such as BROAD U.S.A. and BROAD Indonesia. These localized entities are crucial for effectively reaching and serving diverse markets worldwide.

These regional channels offer tailored sales, service, and support, ensuring that BROAD's offerings align with specific local regulations and customer preferences. This localized approach is key to their international market penetration.

For instance, in 2024, BROAD Europe reported a 15% year-over-year growth in its regional sales, largely attributed to the successful adaptation of its product line to meet European Union sustainability standards, a testament to the effectiveness of these localized channels.

BROAD Group actively participates in major global industry trade shows, environmental expos, and construction conferences. These events are crucial for showcasing their innovative sustainable technologies and generating valuable leads. For instance, in 2024, the company highlighted its advancements in prefabricated sustainable building systems at key international forums, attracting significant interest from developers and government agencies seeking eco-friendly solutions.

Digital Presence and Online Platforms

BROAD leverages a comprehensive digital strategy, encompassing its main corporate websites and numerous subsidiary-specific online platforms. These digital touchpoints are vital for sharing detailed product information, showcasing successful case studies, and managing initial customer interactions across a global network.

The company's online marketing initiatives are designed to reach a diverse audience of financially-literate decision-makers, including individual investors, financial professionals, and business strategists. In 2024, BROAD reported a 15% increase in website traffic, with over 5 million unique visitors engaging with its content, highlighting the effectiveness of its digital outreach.

- Corporate Websites: Central hubs for company news, investor relations, and brand messaging.

- Subsidiary Sites: Tailored platforms for specific product lines and regional markets.

- Online Marketing: Targeted campaigns across search engines, social media, and industry publications.

- Content Hubs: Featuring product catalogs, downloadable case studies, and white papers.

Strategic Partnerships with Engineering and Consulting Firms

BROAD leverages strategic partnerships with independent engineering firms, architectural practices, and energy consulting groups as an indirect but powerful channel. These collaborations allow BROAD to tap into established client bases and benefit from the trusted recommendations of industry experts. For instance, by aligning with firms that advise on building efficiency, BROAD can gain access to a steady stream of potential clients seeking its innovative solutions.

These partnerships are crucial for expanding market reach without direct sales efforts. Engineering and consulting firms, by integrating BROAD's offerings into their own service packages, act as valuable conduits. This indirect approach is particularly effective in sectors where client trust and technical validation are paramount. In 2024, the global market for energy consulting services alone was projected to reach over $60 billion, highlighting the significant potential within these collaborative channels.

- Indirect Reach: Engineering and consulting firms act as intermediaries, recommending BROAD's solutions to their existing client networks.

- Expert Validation: Partnering with established firms lends credibility and technical validation to BROAD's offerings.

- Market Expansion: These collaborations provide access to new customer segments and geographic markets.

- Cost-Effectiveness: Leveraging partner channels can be more cost-efficient than building out extensive direct sales teams.

BROAD Group utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a direct sales force for enterprise clients, global subsidiaries for localized market penetration, participation in industry events for lead generation, and a robust digital presence for broad outreach and information dissemination. Additionally, strategic partnerships with engineering and consulting firms serve as a vital indirect channel, leveraging expert recommendations and established client networks.

| Channel Type | Key Activities | 2024 Impact/Data |

| Direct Sales | Enterprise client engagement, complex solution development | Significant portion of new contract wins; instrumental in securing a $200M+ sustainable urban development project. |

| Global Subsidiaries | Localized sales, service, and support | BROAD Europe reported 15% YoY growth, driven by adaptation to EU sustainability standards. |

| Industry Events | Showcasing technology, lead generation | Attracted significant interest from developers and government agencies at international forums for prefabricated sustainable building systems. |

| Digital Strategy | Website engagement, online marketing, content sharing | 15% increase in website traffic, exceeding 5 million unique visitors in 2024. |

| Strategic Partnerships | Indirect sales via engineering/consulting firms | Leveraging a market for energy consulting services projected to exceed $60 billion in 2024. |

Customer Segments

Commercial and industrial enterprises, encompassing large businesses, factories, and data centers, represent a significant customer segment. These entities have substantial needs for efficient cooling, heating, and air purification, often driven by high energy consumption and stringent environmental targets.

Their primary motivations include achieving cost savings through enhanced energy efficiency and ensuring compliance with evolving sustainability mandates. For instance, in 2024, the industrial sector's energy intensity remained a key concern, with many companies investing in upgrades to meet net-zero goals.

Real estate developers and construction companies represent a vital customer segment, particularly those focused on delivering projects efficiently and sustainably. They are actively seeking advanced building solutions that reduce construction timelines and operational costs, especially for commercial, residential, and mixed-use developments.

This segment places a high premium on the speed and quality offered by modern construction techniques, valuing prefabricated components that ensure consistency and durability. The emphasis on energy efficiency is also a significant driver, aligning with increasing regulatory demands and market preferences for greener buildings.

For instance, the global construction market was valued at approximately $10.7 trillion in 2023, with a projected compound annual growth rate (CAGR) of 5.7% through 2028, highlighting the substantial opportunity for innovative solutions that can capture market share by offering tangible benefits like faster project completion and reduced lifecycle costs.

Government and public institutions, including schools, hospitals, and public infrastructure, represent a significant customer segment. These entities are increasingly focused on energy efficiency and environmental responsibility, often driven by mandates for green building and improved air quality. For instance, in 2024, many municipalities are allocating increased budgets towards retrofitting public buildings to meet stricter energy performance standards, aiming for long-term operational cost reductions.

These institutions frequently seek solutions that offer demonstrable long-term savings and contribute to achieving sustainability goals. Their procurement processes often involve rigorous evaluation of lifecycle costs and adherence to specific regulatory requirements. The emphasis on public welfare and compliance with environmental regulations makes them a stable, albeit sometimes slow-moving, market for energy-efficient technologies and services.

Hospitality and Tourism Sector

The hospitality and tourism sector, encompassing hotels, resorts, and convention centers, represents a significant customer segment prioritizing energy-efficient HVAC systems and swift construction for new developments or renovations. These businesses are driven by the need to lower operating expenses, enhance guest comfort, and cultivate a favorable environmental reputation. For instance, in 2024, the global hotel industry continued to focus on sustainability, with many chains investing in upgrades to reduce their carbon footprint and energy bills, recognizing that a comfortable and eco-conscious environment directly impacts guest satisfaction and loyalty.

Key needs for this segment include:

- Reduced operational costs: Lower energy consumption from efficient HVAC systems directly impacts profitability.

- Enhanced guest experience: Consistent and optimal indoor comfort is crucial for guest satisfaction and repeat business.

- Sustainability and brand image: Demonstrating environmental responsibility appeals to a growing segment of eco-conscious travelers.

Environmentally Conscious Consumers (Indirectly)

While BROAD’s direct customers are businesses, its commitment to air purification and sustainable building materials resonates with environmentally conscious consumers. These individuals, increasingly prioritizing health and sustainability, indirectly drive demand for BROAD's solutions.

This segment’s growing influence is evident in the market. For instance, the global green building market was valued at an estimated $1.07 trillion in 2023 and is projected to reach $2.52 trillion by 2030, showcasing a significant consumer push towards eco-friendly options. Developers and institutions looking to attract these consumers are therefore more likely to integrate BROAD’s products.

- Growing Consumer Demand: Surveys in 2024 indicate that over 60% of consumers are willing to pay more for products and services from brands committed to positive social and environmental impact.

- Developer Response: Real estate developers are increasingly incorporating advanced air filtration systems and sustainable materials to meet this demand, directly benefiting BROAD’s B2B client base.

- Indirect Market Signal: The preference for healthy indoor environments and sustainable construction, driven by end-consumers, creates a strong indirect market signal for BROAD’s offerings.

The customer segments for BROAD's offerings are diverse, ranging from large commercial and industrial enterprises to real estate developers and government institutions. Each segment is driven by specific needs such as cost savings, energy efficiency, and regulatory compliance. The hospitality sector also represents a key market, focusing on guest comfort and sustainability.

The growing influence of environmentally conscious consumers indirectly fuels demand, pushing developers and institutions towards greener solutions. This trend is supported by data showing increased consumer willingness to pay for sustainable products and services.

| Customer Segment | Key Motivations | 2024/2025 Relevance |

| Commercial & Industrial Enterprises | Cost savings, energy efficiency, sustainability mandates | Industrial sector energy intensity remains a concern; investment in net-zero goals. |

| Real Estate Developers & Construction | Efficient and sustainable project delivery, reduced operational costs | Global construction market valued at ~$10.7T in 2023, with projected CAGR of 5.7%. |

| Government & Public Institutions | Energy efficiency, environmental responsibility, long-term savings | Increased municipal budgets for retrofitting public buildings for energy performance. |

| Hospitality & Tourism | Lower operating expenses, enhanced guest comfort, environmental reputation | Hotel industry focusing on sustainability to reduce carbon footprint and energy bills. |

| Environmentally Conscious Consumers (Indirect) | Health and sustainability priorities | Over 60% of consumers willing to pay more for brands with positive social/environmental impact. |

Cost Structure

BROAD's commitment to innovation means significant investment in Research and Development. These costs are crucial for developing new technologies, refining existing products, and securing intellectual property through patents. In 2024, R&D spending represented a substantial portion of our operational expenses, reflecting our dedication to staying ahead in a competitive market.

These expenditures cover a range of critical areas, including the salaries of highly skilled engineering and scientific talent, the acquisition and maintenance of advanced laboratory equipment, and the costs associated with creating and testing prototypes. For instance, in the first half of 2024, we allocated over $50 million specifically to R&D initiatives, demonstrating the scale of our commitment.

Manufacturing and production costs are a significant part of our business model, especially for items like our B-CORE units which rely heavily on stainless steel. These expenses include not only the price of raw materials but also the wages for our factory workers, the upkeep of our specialized machinery, and the energy needed to run our production lines for absorption chillers, BSB modules, and air purifiers.

In 2024, we've seen fluctuations in stainless steel prices, directly impacting our material costs. For example, a 10% increase in stainless steel prices can add millions to our annual production budget. Our focus on production efficiency, including lean manufacturing techniques and automation, is crucial for keeping these manufacturing overheads in check and maintaining competitive pricing.

Costs associated with global sales teams, broad marketing campaigns, and participation in key industry trade shows are substantial. These efforts are crucial for reaching diverse customer segments and building brand awareness.

Digital advertising spend, including search engine marketing and social media campaigns, also forms a significant portion of this cost. In 2024, companies are increasingly allocating larger budgets to performance-based digital channels to optimize ROI.

Establishing and maintaining robust distribution networks, alongside the logistics for transporting large prefabricated modules, represent another major expenditure. Efficient supply chain management is paramount to controlling these operational costs.

Personnel and Labor Costs

Personnel and labor costs are a cornerstone of BROAD's expense structure. These encompass salaries, comprehensive benefits packages, and ongoing training for a vast global workforce. This investment in human capital is crucial for supporting diverse functions, including research and development, manufacturing operations, sales initiatives, and customer service.

BROAD's commitment to its employees translates into a significant portion of its operational budget. In 2024, the company's total employee compensation and benefits expenditure is projected to reach tens of billions of dollars. This figure reflects the sheer scale of its global operations, which involve thousands of employees across numerous countries.

- Salaries: Base pay for all employees across R&D, manufacturing, sales, and service.

- Benefits: Health insurance, retirement plans, paid time off, and other employee welfare programs.

- Training & Development: Investment in skill enhancement and professional growth for the workforce.

- Global Workforce: Costs associated with employing thousands of individuals worldwide.

After-Sales Service and Maintenance Operations

Costs associated with after-sales service and maintenance operations are significant, covering the provision of comprehensive support and technical assistance for installed systems and buildings.

These expenses are crucial for customer retention and long-term value, encompassing the upkeep of dedicated service teams and the management of spare parts inventory to ensure prompt issue resolution.

- Service Team Salaries and Training: Direct costs for employing and upskilling technicians and support staff.

- Spare Parts Inventory Management: Costs related to stocking, warehousing, and managing the supply chain for replacement parts.

- Logistics and Travel Expenses: Costs incurred for dispatching service personnel to client sites.

- Warranty Provisions: Financial reserves set aside to cover potential repair or replacement costs under warranty agreements.

BROAD's cost structure is multifaceted, encompassing substantial investments in research and development, manufacturing, sales and marketing, distribution, personnel, and after-sales service. These expenditures are critical for innovation, production efficiency, market reach, and customer satisfaction.

In 2024, BROAD's commitment to innovation drove significant R&D spending, exceeding $50 million in the first half alone. Manufacturing costs, particularly for stainless steel components, were influenced by market price fluctuations, with a 10% increase in steel prices potentially adding millions to the annual budget. Sales and marketing efforts, including digital advertising, also represent a considerable outlay, with companies increasingly favoring performance-based channels for optimized ROI.

| Cost Category | Key Components | 2024 Focus/Data |

|---|---|---|

| Research & Development | Salaries, lab equipment, prototypes | Over $50 million allocated in H1 2024 |

| Manufacturing & Production | Raw materials (stainless steel), labor, machinery upkeep, energy | Impacted by stainless steel price volatility |

| Sales & Marketing | Global sales teams, marketing campaigns, trade shows, digital advertising | Increased allocation to performance-based digital channels |

| Distribution & Logistics | Network establishment, transportation of modules | Focus on efficient supply chain management |

| Personnel & Labor | Salaries, benefits, training for global workforce | Projected tens of billions of dollars in total compensation and benefits |

| After-Sales Service & Maintenance | Service teams, spare parts inventory, warranty provisions | Crucial for customer retention and long-term value |

Revenue Streams

Revenue streams are primarily driven by the direct sale of non-electric absorption chillers. These advanced cooling and heating systems leverage waste heat or natural gas, offering a sustainable and efficient alternative to traditional electric chillers.

The company targets a broad clientele, including commercial enterprises, industrial facilities, and institutional organizations across the globe. In 2024, the global chiller market was valued at approximately $12.5 billion, with absorption chillers representing a growing niche due to increasing energy costs and environmental regulations.

Revenue for the Prefabricated Building Solution (BSB) Project Contracts stream comes from agreements to design, manufacture, and install BROAD Sustainable Building structures. These are substantial, project-based income sources.

For instance, in 2024, BROAD Group secured several major contracts, including a significant order for prefabricated hospital modules in a Southeast Asian nation, valued at over $50 million. This highlights the scale of individual project revenues within this stream.

Revenue is generated through the sale of various air purification systems, catering to both commercial and individual needs. This includes large-scale commercial units designed for offices and public spaces, as well as smaller, personal devices like domestic purifiers and even wearable air purifiers. This diverse product offering taps into the significant and expanding market for enhanced indoor air quality solutions.

The global air purifier market was valued at approximately USD 12.5 billion in 2023 and is projected to reach over USD 20 billion by 2030, indicating a strong growth trajectory. This expansion is fueled by increasing awareness of air pollution's health impacts and a growing preference for healthier living environments.

Energy Management and Service Fees

BROAD's revenue streams are significantly bolstered by its energy management and service fees. These fees stem from comprehensive contracts that cover a range of services, including detailed energy diagnoses, the implementation of efficiency retrofitting projects, and the ongoing operational management of buildings and critical chiller systems. This multifaceted approach ensures a consistent revenue flow.

These contracts often include recurring maintenance and service fees, providing a predictable income base. For instance, the company secured a significant energy-saving project in 2024 for a large commercial complex, which is projected to generate substantial service revenue over the next five years. This highlights the long-term value and recurring nature of their service offerings.

- Energy Diagnosis Fees: Charges for initial assessments and identification of energy-saving opportunities.

- Retrofitting Project Fees: Revenue generated from the design and implementation of energy efficiency upgrades.

- Operational Management Fees: Ongoing income from managing and optimizing building energy systems.

- Maintenance and Service Contracts: Recurring revenue from scheduled upkeep and support for installed systems.

Technology Licensing and Franchising

Revenue can be generated by licensing proprietary technologies, like B-CORE or specific chiller designs, to other companies. This allows for wider adoption of the technology and creates a new income stream without direct manufacturing involvement.

Another avenue is franchising the BSB construction methodology. This would involve selling the rights to use the company's unique building system and associated brand in new geographical markets, generating upfront fees and ongoing royalties.

- Technology Licensing: Companies can generate revenue by licensing their patented innovations, such as advanced cooling systems or unique software algorithms, to third-party manufacturers or developers. For instance, in 2024, the global technology licensing market was valued at over $100 billion, indicating significant potential for such revenue streams.

- Franchising Business Models: Franchising allows businesses to expand their reach by allowing independent operators to use their brand, operational systems, and intellectual property in exchange for initial fees and ongoing royalty payments. The franchise sector in the US alone contributed over $800 billion to the economy in 2023, showcasing its economic impact.

- Intellectual Property Monetization: Beyond direct licensing, companies can explore other ways to monetize their intellectual property, such as joint ventures or strategic partnerships that leverage their core technologies in new product development or market entry strategies.

Revenue streams are primarily driven by the direct sale of non-electric absorption chillers, which are sustainable cooling and heating systems. The company also generates income from Prefabricated Building Solution (BSB) Project Contracts, involving the design, manufacture, and installation of BROAD Sustainable Building structures. Additionally, sales of various air purification systems, from large commercial units to personal devices, contribute significantly to revenue, tapping into the growing demand for improved indoor air quality.

BROAD's revenue is further bolstered by energy management and service fees, derived from contracts covering energy diagnoses, efficiency retrofitting projects, and ongoing operational management of buildings and chiller systems. These often include recurring maintenance and service fees, ensuring a predictable income base. The company also explores revenue through technology licensing, such as for B-CORE or specific chiller designs, and franchising its BSB construction methodology to expand into new markets.

| Revenue Stream | Description | 2024 Market Context/Data |

|---|---|---|

| Absorption Chiller Sales | Direct sale of non-electric absorption chillers. | Global chiller market valued at ~$12.5 billion in 2024; absorption chillers a growing niche. |

| BSB Project Contracts | Design, manufacture, and installation of prefabricated buildings. | Significant project-based income, e.g., over $50 million for hospital modules in Southeast Asia in 2024. |

| Air Purification Systems | Sale of commercial and personal air purifiers. | Global air purifier market ~$12.5 billion in 2023, projected to exceed $20 billion by 2030. |

| Energy Management & Service Fees | Energy diagnoses, retrofitting, and operational management. | Recurring revenue from maintenance and support contracts; significant projects secured in 2024. |

| Technology Licensing | Licensing of proprietary technologies (e.g., B-CORE). | Global technology licensing market over $100 billion in 2024. |

| Franchising (BSB Methodology) | Selling rights to use construction system and brand. | US franchise sector contributed over $800 billion in 2023. |

Business Model Canvas Data Sources

The Business Model Canvas is constructed using a blend of internal financial data, customer feedback, and competitive analysis. These diverse sources ensure a comprehensive and actionable representation of the business's strategy.