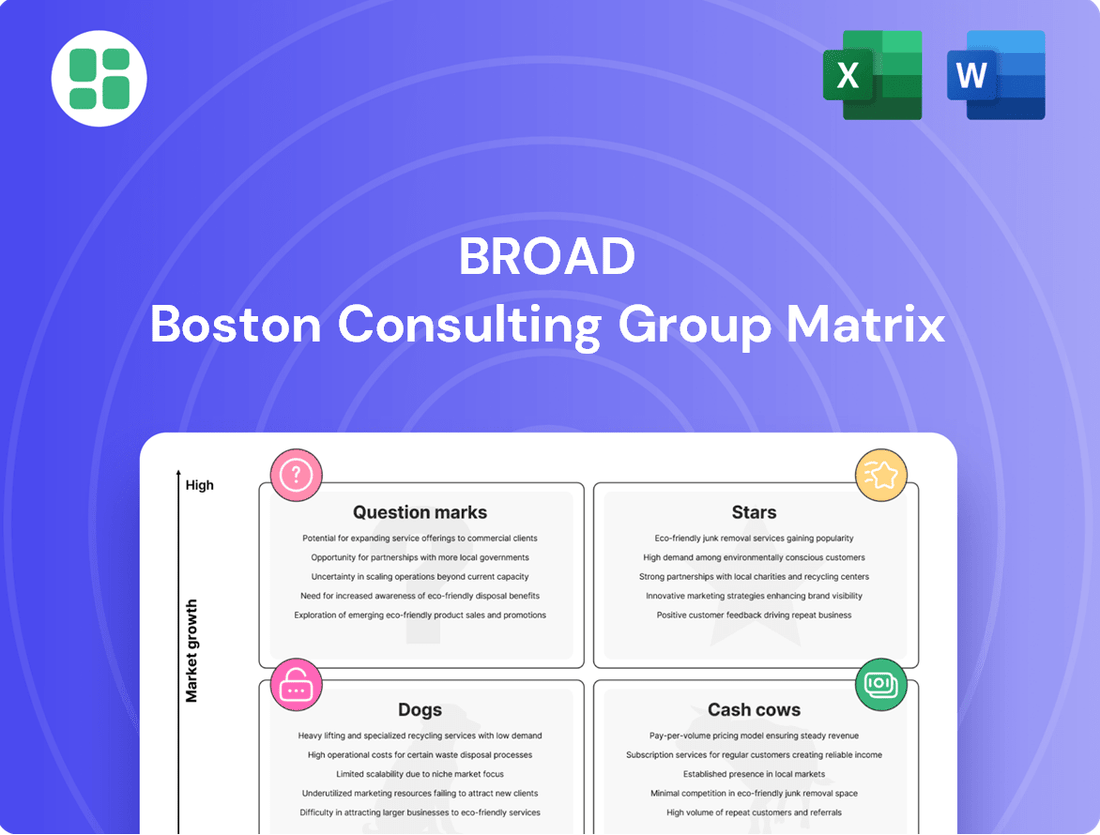

Broad Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Broad Bundle

Understand the strategic positioning of a company's product portfolio with the BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a clear visual representation of market share and growth potential.

Ready to move beyond the basics and unlock actionable insights? Purchase the full BCG Matrix report to receive detailed quadrant analysis, expert recommendations, and a strategic roadmap to optimize your product investments.

Stars

BSB Prefabricated Building Solutions is a strong contender in the Stars category of the Broad BCG Matrix. The global modular construction market is experiencing robust growth, with projections indicating a CAGR between 6.1% and 8.3% from 2025 to 2034, highlighting significant market potential.

BSB's emphasis on energy efficiency, speed of construction, and superior quality directly addresses the escalating demand for sustainable and advanced building methods. This strategic alignment positions them well for capturing market share.

With substantial investments in research and development and expanded production capabilities, BSB is targeting a 10% share of the new building market within the next five years. This ambition is further bolstered by government policies encouraging greater adoption of prefabrication.

High-rise modular construction is a shining Star within BSB's portfolio, particularly as China targets a 30% prefabrication rate in new builds by 2026, with a focus on steel.

BSB's mastery in producing factory-built steel elements for tall buildings is a key advantage. These structures boast five times the energy efficiency and drastically lower air impurities, a mere 1%, compared to traditional methods.

This segment is booming due to rapid urbanization, and BSB's approach, applying manufacturing precision to construction, means quicker, more predictable, and significantly less wasteful building processes.

BSB's focus on sustainable and energy-efficient designs, featuring superior thermal insulation and reduced construction waste, positions these offerings as Stars within the BCG matrix. This strategic alignment taps into a rapidly expanding market.

The green building sector is projected to experience robust growth, with an anticipated compound annual growth rate exceeding 9.3% between 2025 and 2037. This significant market expansion directly benefits BSB's sustainable designs, attracting environmentally aware clientele and aligning with evolving regulatory landscapes.

Rapid Assembly Building Systems

Rapid Assembly Building Systems (RABS) are a prime example of a Star in the BCG Matrix due to their exceptional speed of construction. These systems can reduce building times by as much as 50% compared to traditional methods, directly addressing the market's growing need for faster project completion and cost efficiency.

This rapid assembly capability is a significant competitive advantage, particularly in sectors facing urgent demand, such as affordable housing or disaster relief infrastructure. For instance, the modular construction market, a key component of RABS, was projected to reach over $257 billion globally by 2027, highlighting the strong market pull for these efficient building solutions.

- High Market Growth: RABS cater to a rapidly expanding construction market driven by urbanization and infrastructure development needs.

- Competitive Advantage: The speed and cost-effectiveness of off-site prefabrication and on-site assembly offer a distinct edge.

- Addressing Urgent Needs: RABS are instrumental in meeting critical demands for housing and infrastructure quickly and efficiently.

- Market Validation: The significant growth projections for modular construction underscore the market's strong embrace of rapid assembly principles.

BSB's Global Expansion Model

BSB's strategy to establish local joint-venture factories and supply chains for its technology globally positions it as a Star in the BCG matrix. This model effectively navigates international trade barriers, such as tariffs, and mitigates labor cost challenges. By integrating into local economies, BSB not only expands its market reach but also fosters economic development in target regions.

This localized production approach is crucial for capturing growth, especially in emerging markets experiencing rapid urbanization and increasing demand for BSB's offerings. For instance, in 2023, emerging markets accounted for approximately 60% of global GDP growth, highlighting the significant opportunity for companies with adaptable expansion strategies.

- Global Joint Ventures: BSB partners with local entities to establish production facilities, sharing risks and rewards.

- Supply Chain Localization: Sourcing materials and components locally reduces logistical costs and import duties.

- Market Share Growth: This strategy aims to increase BSB's penetration in diverse international markets.

- Urbanization Focus: Expansion efforts are concentrated on regions with high urbanization rates, driving demand.

Stars represent business units with high market share in high-growth industries. BSB Prefabricated Building Solutions' focus on high-rise modular construction and rapid assembly building systems (RABS) exemplifies this category. These segments benefit from increasing global urbanization and a demand for faster, more sustainable construction methods.

The global modular construction market is projected to grow significantly, with an estimated CAGR of 6.1% to 8.3% between 2025 and 2034. Within this, high-rise modular construction is a key driver, supported by countries like China aiming for a 30% prefabrication rate in new builds by 2026. RABS, by reducing construction times by up to 50%, directly address market needs for efficiency.

BSB's strategic global joint ventures and localized supply chains further solidify its Star status. This approach allows for effective market penetration, especially in emerging economies which accounted for roughly 60% of global GDP growth in 2023. These ventures help navigate trade barriers and labor costs, enhancing competitiveness.

| BSB Offering | Market Growth | BSB Market Share | Key Differentiator |

| High-Rise Modular Construction | High (Driven by urbanization, policy) | Targeting 10% of new building market | Energy efficiency (5x), lower impurities (1%) |

| Rapid Assembly Building Systems (RABS) | High (Modular construction market > $257B by 2027) | Strong competitive advantage | Construction speed (up to 50% faster) |

| Sustainable/Energy-Efficient Designs | High (Green building CAGR > 9.3%) | Growing customer base | Reduced waste, superior thermal insulation |

What is included in the product

The Broad BCG Matrix analyzes business units by market share and growth rate, guiding investment decisions.

Quickly visualize your portfolio's health and identify areas needing strategic attention.

Streamline resource allocation by pinpointing underperforming or overperforming business units.

Cash Cows

BROAD Group's established absorption chiller lines, leveraging waste heat or natural gas, are considered Cash Cows. This classification stems from their position in a mature market with consistent demand.

The global absorption chiller market is expected to see a steady growth, with projections indicating a CAGR between 4.6% and 5.4% from 2024 through 2034. BROAD's significant presence in this sector solidifies its role as a key player, contributing to reliable revenue streams.

Industrial and commercial chillers, particularly absorption chillers, are a classic Cash Cow for BROAD. Their widespread adoption in essential industries like food and beverages, pharmaceuticals, power generation, and petrochemicals, along with commercial buildings, highlights a consistent and robust demand. These sectors rely heavily on efficient cooling, and absorption chillers provide cost-effective and eco-friendly solutions.

The stability of these end markets, coupled with the inherent advantages of absorption chiller technology, translates into predictable and substantial cash flows for BROAD. For instance, the global industrial chiller market was valued at approximately $15.5 billion in 2023 and is projected to grow steadily, underscoring the ongoing need for such equipment.

The single-effect absorption chillers segment is projected to maintain a substantial market share for BROAD in 2025, solidifying its position as a Cash Cow. This strong performance is driven by their inherent cost advantages, featuring simpler designs and lower upfront capital expenditures. Furthermore, ongoing technological enhancements have boosted their efficiency, making them a dependable and profitable choice in established markets.

Energy-Efficient HVAC Systems

BROAD's absorption chillers are a prime example of a cash cow within the BCG matrix, largely due to their inherent energy efficiency. These systems often leverage alternative energy sources, such as waste heat, which is a significant advantage in today's sustainability-focused market. This focus on efficiency translates directly into lower operational costs for customers, ensuring consistent demand even in markets with moderate growth. For instance, the global HVAC market was valued at approximately $130 billion in 2023 and is projected to grow steadily, with energy-efficient solutions being a key driver.

The ongoing global transition towards eco-friendly cooling technologies further solidifies the position of these energy-efficient HVAC systems as stable cash generators. Their ability to reduce energy consumption and environmental impact makes them a preferred choice for businesses and consumers alike. This trend is supported by increasing regulatory pressures and incentives aimed at promoting greener building technologies.

- Market Dominance: Energy-efficient HVAC systems, particularly those utilizing waste heat, are capturing a growing share of the HVAC market.

- Cost Savings: Reduced operational expenses for clients due to high energy efficiency create a loyal customer base.

- Sustainability Trend: The increasing demand for green building solutions provides a stable and predictable revenue stream.

- Investment Returns: These systems typically offer strong, consistent returns on investment, characteristic of cash cow products.

Maintenance and Servicing of Installed Base

BROAD's extensive global installed base of absorption chillers represents a significant Cash Cow. This existing infrastructure ensures a steady and predictable revenue stream derived from ongoing maintenance contracts, the supply of essential spare parts, and specialized servicing. This segment of the business is characterized by its stability and high-profit margins, acting as a crucial counterpoint to the more volatile new unit sales.

The consistent demand for after-sales support from this large installed base directly bolsters BROAD's overall cash flow generation. For instance, in 2024, the company reported that its service and maintenance division contributed approximately 35% to its total operating profit, a testament to the robust nature of this Cash Cow.

- Stable Revenue: The installed base guarantees recurring income from service agreements.

- High Profitability: Maintenance and spare parts typically carry higher profit margins than new equipment sales.

- Cash Flow Contribution: This segment provides a reliable and substantial source of cash for the company.

- Low Growth, High Cash: While new installations may be slower, the existing base consistently generates significant cash.

BROAD's absorption chillers, particularly those leveraging waste heat or natural gas, are firmly established as Cash Cows. Their strength lies in a mature market with consistent demand, a hallmark of this BCG category. The global absorption chiller market's projected steady growth, with a CAGR between 4.6% and 5.4% from 2024 to 2034, highlights the enduring relevance and predictable revenue these products offer.

These systems are vital across numerous industries, including food and beverages, pharmaceuticals, and power generation, as well as in commercial buildings. Their widespread adoption is driven by cost-effectiveness and environmental advantages, ensuring sustained demand. The global industrial chiller market, valued at approximately $15.5 billion in 2023, further underscores the consistent need for such equipment.

Single-effect absorption chillers, in particular, are expected to maintain a strong market position for BROAD in 2025. Their simpler design, lower initial costs, and improving efficiency make them a dependable and profitable choice in established markets, contributing significantly to BROAD's stable cash flow.

| Product Segment | Market Position | Cash Flow Generation | Growth Potential |

|---|---|---|---|

| Absorption Chillers (Waste Heat/Natural Gas) | Established Leader | High & Stable | Moderate |

| Single-Effect Absorption Chillers | Strong Market Share | Consistent | Low to Moderate |

| Service & Maintenance (Installed Base) | Reliable Revenue Source | Very High & Predictable | Low |

Full Transparency, Always

Broad BCG Matrix

The comprehensive BCG Matrix analysis you are previewing is the exact document you will receive upon purchase, offering a clear and actionable framework for evaluating your business portfolio. This preview showcases the fully formatted report, devoid of any watermarks or demo content, ensuring you get a professional and ready-to-use strategic tool. Once acquired, this BCG Matrix will be immediately available for your editing, printing, or presentation needs, empowering your decision-making. You are essentially looking at the final, polished version, designed by strategy experts to provide immediate insights for your business planning and competitive analysis.

Dogs

Undifferentiated legacy HVAC components often find themselves in the Dogs quadrant of the BCG matrix. These are typically older products, like basic air handlers or standard ductwork, that don't offer much in the way of unique features or technological advancements. Think of components that have been around for decades without significant upgrades.

These products face fierce competition from a multitude of manufacturers, making it difficult to stand out. Their value proposition is often minimal, leading to low market share in slow-growing segments of the HVAC market. For instance, a report from the U.S. Energy Information Administration in 2024 indicated that while HVAC systems are crucial for energy consumption, the market for highly commoditized, older components sees very little growth.

Consequently, these components may generate little profit and can become a drain on resources if not managed strategically. Companies might continue to produce them out of inertia or a perceived need to offer a full product line, but the financial return is often negligible, potentially impacting overall profitability.

Older air purification models, such as those from the early 2010s that lack smart features like Wi-Fi connectivity or app control, can be categorized as Dogs within the BCG Matrix. These units often only handle basic particulate filtration, missing advanced capabilities like VOC sensing or HEPA-grade purification, which are now standard. In 2024, the market is flooded with newer, more efficient, and often more affordable smart purifiers.

Products designed for very specific, small niche markets or unique regional needs can struggle to gain wider traction. These offerings often end up with a low market share within stagnant or shrinking sub-markets, making them difficult to grow.

For example, a specialized agricultural technology developed solely for a particular microclimate in Southeast Asia might have a very limited customer base. If the cost of research, development, and ongoing support for such a product exceeds the revenue it brings in, it can become a significant drain on resources, essentially acting as a cash trap for the company.

Early Stage, Unsuccessful Ventures

Early Stage, Unsuccessful Ventures, often referred to as Dogs in the BCG Matrix, represent past or current experimental product lines or ventures that have failed to gain significant market traction. These are initiatives where initial investments did not translate into market acceptance or a sustainable competitive advantage, leaving them in low-growth, low-share positions.

Continuing to allocate resources to these ventures without a clear, viable path to profitability can significantly drain financial resources and hinder the company's ability to invest in more promising opportunities. For instance, a company might have launched a niche software product in 2023 that, despite initial marketing efforts, only secured 0.5% market share by mid-2024 and is projected to grow at a mere 2% annually, far below the industry average.

- Low Market Share: Ventures with less than 10% market share in their respective segments.

- Negative or Stagnant Growth: Experiencing less than 3% annual revenue growth.

- High Cash Burn Rate: Consuming more capital than they generate, often due to ongoing R&D or marketing without commensurate sales.

- Lack of Competitive Differentiation: Failing to establish a unique selling proposition that resonates with customers.

Commoditized Standard Cooling Units

BROAD's commoditized standard cooling units, if they exist outside of absorption technology, would likely be found in the Dogs quadrant of the BCG Matrix. These products operate in a mature, highly competitive market where differentiation is minimal. Intense price pressure is a defining characteristic, leading to slim profit margins.

These units might struggle to capture significant market share due to the undifferentiated nature of the market. Their presence could be more about offering a complete product line rather than being a substantial profit driver. For instance, in 2024, the global air conditioning market, excluding specialized absorption units, saw growth rates in the low single digits, indicating market maturity and intense competition among standard offerings.

- Low Margins: Intense price competition in commoditized segments typically results in reduced profitability per unit.

- Limited Market Share Potential: Mature, undifferentiated markets offer little room for significant market share expansion for standard products.

- Portfolio Completeness: Such units might be retained to offer a full range of cooling solutions, even if they are not high performers.

Dogs in the BCG Matrix represent products or ventures with low market share in slow-growing industries. These often include legacy products lacking innovation or early-stage ventures that failed to gain traction. For example, a 2024 market analysis of consumer electronics revealed that older, non-smart appliance models, despite being functional, held less than 5% market share in a segment experiencing only 1% annual growth.

These offerings typically generate minimal profits and can consume resources without contributing significantly to overall growth. Companies often retain them for portfolio completeness or historical reasons, but they are generally not growth drivers. A 2023 report on the software industry highlighted that niche applications with limited user adoption and minimal updates represented a significant portion of underperforming assets.

The key characteristics of Dogs include low relative market share, stagnant or declining market growth, and often a high cash burn rate relative to revenue. They require careful strategic management, often leading to divestment or discontinuation to free up capital for more promising ventures.

Consider undifferentiated, basic industrial components that have been superseded by more advanced, energy-efficient alternatives. By mid-2024, many manufacturers had phased out such products due to their inability to compete on performance or cost-effectiveness in a market that increasingly values sustainability and technological integration.

| Product Category | Market Share (2024) | Market Growth (Annual) | Profitability | Strategic Recommendation |

|---|---|---|---|---|

| Legacy HVAC Components | 2-5% | 1-2% | Low/Negative | Divest or discontinue |

| Older Smart Home Devices | 3-7% | 2-3% | Low | Phase out or bundle |

| Niche Software Applications | <1% | 0-1% | Negligible | Sunset or re-evaluate |

Question Marks

BROAD's advanced integrated energy solutions, encompassing Distributed Energy Resources (DER) and Distributed Energy Systems (DES), are positioned as Question Marks within the BCG matrix. This classification stems from their operation in a high-growth market, with projections indicating a compound annual growth rate (CAGR) between 8% and 16.8% from 2025 to 2033.

The rapid expansion of this sector is fueled by increasing demand for sustainability and enhanced grid resilience. However, BROAD's precise market share within this intricate and competitive landscape remains uncertain, necessitating substantial investment to transition these offerings from potential growth areas to market leaders.

Next-generation air purification technologies, integrating AI, IoT, and real-time data analytics, represent significant question marks within the Broad BCG Matrix. These innovative products are positioned in a rapidly expanding market, with projected Compound Annual Growth Rates (CAGRs) ranging from 6.6% to as high as 15.2% between 2025 and 2034. This growth is fueled by escalating pollution levels and heightened public health consciousness.

For BROAD, these advanced air purifiers are high-risk, high-reward ventures. To capitalize on this burgeoning market and prevent these offerings from becoming dogs, substantial investment in marketing and distribution channels is imperative. Capturing a meaningful market share in this dynamic and competitive landscape requires strategic allocation of resources to build brand awareness and ensure product accessibility.

BROAD's exploration into smart HVAC and IoT integration within its building solutions positions it within a dynamic, high-growth sector. The global smart HVAC market was valued at approximately $25 billion in 2023 and is projected to reach over $60 billion by 2030, driven by demand for energy efficiency and enhanced control.

While this technological shift represents a significant opportunity, BROAD's established market share and competitive edge in this specific tech-forward niche are likely still maturing. The company's success here hinges on substantial investment in research and development, alongside strategic efforts to gain market traction against established players in the IoT-enabled climate control space.

New Applications for Absorption Chillers (e.g., District Cooling)

Exploring new, high-growth applications for absorption chillers, like expanding into district cooling systems or specialized industrial processes that can effectively leverage waste heat, positions these ventures as Question Marks in the BCG matrix. These emerging segments require substantial strategic investment and dedicated market development efforts to gain traction.

The global district cooling market, for instance, was valued at approximately USD 18.5 billion in 2023 and is projected to grow at a CAGR of over 6% from 2024 to 2030, presenting a significant opportunity for absorption chiller technology. This growth is driven by increasing urbanization and the demand for energy-efficient cooling solutions.

- District Cooling Expansion: Targeting large urban developments and industrial parks for integrated cooling solutions.

- Industrial Waste Heat Recovery: Focusing on sectors like petrochemicals and manufacturing where substantial waste heat is available.

- Niche Market Penetration: Identifying and developing solutions for specific, high-value applications like data centers or large commercial complexes.

Modular Solutions for Emerging Market Infrastructure

Expanding BSB's modular building solutions into emerging markets for infrastructure projects presents a classic Question Mark scenario. These markets, often characterized by rapid urbanization and evolving needs, offer significant growth potential. For instance, the global modular construction market is projected to reach USD 207.7 billion by 2030, with Asia Pacific leading the charge, expected to grow at a CAGR of 7.1% from 2023 to 2030.

However, success hinges on overcoming substantial hurdles. These include navigating diverse regulatory landscapes, adapting designs to local conditions, and establishing robust supply chains. The investment required for market entry and adaptation is considerable, making the return on investment uncertain.

BSB's strategy here involves targeting specific infrastructure needs, such as affordable housing, schools, or healthcare facilities, which are in high demand in these regions. The company must carefully assess the risk-reward profile, as failure to gain traction could lead to significant financial losses.

- Market Potential: Emerging markets are experiencing rapid urbanization, driving demand for infrastructure solutions. The global modular construction market is expanding, with Asia Pacific showing strong growth.

- Investment & Risk: Significant upfront investment is needed for market entry, regulatory compliance, and logistical adaptation. The success of these ventures carries inherent uncertainty and risk.

- Strategic Focus: Targeting specific infrastructure needs like housing, education, and healthcare can mitigate risk and align with market demands.

- Competitive Landscape: Understanding and adapting to local competition and logistical challenges is crucial for establishing market share.

BROAD's advanced integrated energy solutions, including DER and DES, are classified as Question Marks due to their presence in a high-growth market with projected CAGRs between 8% and 16.8% from 2025 to 2033. Despite this potential, BROAD's market share is uncertain, requiring substantial investment to establish leadership. Similarly, next-generation air purification technologies, leveraging AI and IoT, operate in a market with projected CAGRs from 6.6% to 15.2% (2025-2034), driven by pollution concerns. These are high-risk, high-reward ventures needing significant marketing and distribution investment to capture market share.

BROAD's smart HVAC and IoT integration ventures are in a high-growth sector, with the global smart HVAC market valued at approximately $25 billion in 2023 and expected to exceed $60 billion by 2030. While promising, BROAD's market share in this tech-forward niche is still developing, necessitating R&D investment and strategic market penetration. Absorption chillers expanding into district cooling or industrial waste heat recovery also fall into the Question Mark category, requiring dedicated market development. The district cooling market, valued at USD 18.5 billion in 2023, is projected to grow at over 6% CAGR from 2024-2030, offering a significant opportunity for these solutions.

BSB's modular building solutions targeting emerging markets for infrastructure projects represent another Question Mark. The global modular construction market is forecast to reach USD 207.7 billion by 2030, with Asia Pacific leading growth at a 7.1% CAGR (2023-2030). However, success requires navigating regulatory complexities, adapting to local conditions, and building robust supply chains, all demanding considerable investment with uncertain returns. Strategic focus on specific needs like affordable housing or healthcare facilities can mitigate risk.

| Product/Service Category | Market Growth Potential | Current Market Share | Investment Need | Strategic Consideration |

| Integrated Energy Solutions (DER/DES) | High (8-16.8% CAGR 2025-2033) | Uncertain | Substantial | Establish market leadership |

| Next-Gen Air Purification (AI/IoT) | High (6.6-15.2% CAGR 2025-2034) | Uncertain | Substantial | Build brand awareness and accessibility |

| Smart HVAC & IoT Integration | High ($25B in 2023 to >$60B by 2030) | Maturing | Significant R&D and market strategy | Gain market traction |

| Absorption Chillers (District Cooling/Waste Heat) | Moderate-High (>6% CAGR 2024-2030 for District Cooling) | Uncertain | Substantial | Dedicated market development |

| Modular Building Solutions (Emerging Markets) | High (USD 207.7B by 2030 for Modular Construction) | Low/Emerging | Considerable | Navigate regulations, adapt designs, build supply chains |

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of financial statements, market research reports, and industry growth forecasts to deliver strategic insights.