Brilliant Earth SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brilliant Earth Bundle

Brilliant Earth shines with its strong ethical sourcing and unique designs, but faces intense competition and potential supply chain disruptions. Understanding these dynamics is key to navigating the competitive jewelry market.

Want the full story behind Brilliant Earth's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Brilliant Earth stands out as a pioneer in ethically sourced fine jewelry, driven by a mission to foster transparency, sustainability, compassion, and inclusivity within the industry. This core ethical commitment strongly appeals to younger consumers, particularly Millennials and Gen Z, who actively seek out brands that align with their personal values. For example, by Q2 2024, Brilliant Earth reported continued growth in its customer base, with a significant portion attributed to these demographics.

The company's commitment is further solidified by its proprietary 'Beyond Conflict Free™' diamond sourcing and its predominant use of recycled precious metals. These practices not only differentiate Brilliant Earth from competitors but also directly address growing consumer concerns about the environmental and social impact of jewelry production. This focus on responsible sourcing is a key competitive advantage, especially as more consumers become aware of the provenance of their purchases.

Brilliant Earth's omnichannel strategy, blending a robust online presence with 42 physical showrooms in the US, allows it to reach a broad customer base. This hybrid model, serving customers in over 50 countries, caters to diverse preferences, from digital-first shoppers to those seeking in-person experiences.

The company's asset-light, data-driven approach is a significant strength, enabling agility in responding to market shifts and optimizing inventory. This operational efficiency is crucial in the fast-paced jewelry sector, allowing them to adapt quickly to consumer trends and manage stock effectively.

Brilliant Earth boasts a strong history of profitability, achieving positive Adjusted EBITDA for 15 consecutive quarters since its 2021 IPO. This consistent performance underscores the company's ability to manage operations effectively, even amidst fluctuating revenues.

The company's financial resilience is further supported by a robust gross margin, which reached 58.6% in the first quarter of 2025. This healthy margin indicates strong pricing power and efficient cost management, providing a solid base for future investments and expansion.

Diversified Product Offerings and Innovation

Brilliant Earth's strength lies in its significantly diversified product range, extending well beyond its traditional bridal offerings. This expansion into broader fine jewelry categories is proving highly successful, with recent reports indicating strong double-digit growth in these segments. This strategic move broadens their appeal and lessens dependence on the bridal market.

Innovation is a key driver for Brilliant Earth, evident in offerings like their custom design services and unique collections. The Jane Goodall Collection, for instance, highlights their commitment to meaningful collaborations. Furthermore, their pioneering work with CO2-captured lab diamonds positions them at the forefront of sustainable luxury, attracting a growing segment of ethically conscious consumers.

The company's commitment to ethical sourcing and a wide array of lab-grown diamonds provides customers with extensive customization choices. This focus on transparency and choice is a significant differentiator in the competitive jewelry market, allowing consumers to align their purchases with their values. For example, in Q1 2024, lab-grown diamond sales represented a substantial portion of their overall revenue, demonstrating market acceptance and demand for these ethically produced stones.

- Diversified Product Lines: Growth in fine jewelry categories beyond bridal is a key strength.

- Innovative Collections: Partnerships like the Jane Goodall Collection and new materials like CO2-captured diamonds drive appeal.

- Ethical Sourcing and Customization: A broad selection of ethically sourced and lab-grown diamonds caters to conscious consumers.

- Market Responsiveness: Strong performance in lab-grown diamond sales in early 2024 underscores their ability to meet evolving consumer preferences.

High Customer Engagement and Retention

Brilliant Earth excels in fostering deep customer connections, evident in its impressive repeat order growth. This trend, which saw a significant year-over-year increase, underscores a strong brand loyalty and a customer base that values the company's offerings.

The sustained growth in total orders, even with a fluctuating average order value, highlights the company's ability to attract and maintain consumer interest. This ongoing engagement is a testament to their focus on delivering a customer experience that is both enjoyable and personalized.

Key metrics supporting this strength include:

- Significant year-over-year growth in repeat orders, indicating high customer satisfaction and loyalty.

- Consistent increase in total orders, demonstrating sustained market appeal and customer acquisition.

- A customer experience strategy that prioritizes joy, education, and personalization to build lasting relationships.

Brilliant Earth's diversified product lines, expanding beyond traditional bridal, show strong performance. Their innovative collections, like the Jane Goodall partnership and CO2-captured diamonds, attract ethically conscious consumers. The company's commitment to ethical sourcing and a wide array of lab-grown diamonds offers significant customization, resonating with modern buyers. This focus on ethical practices and product variety, particularly in lab-grown diamonds which saw substantial revenue contribution in early 2024, positions them well in a competitive market.

What is included in the product

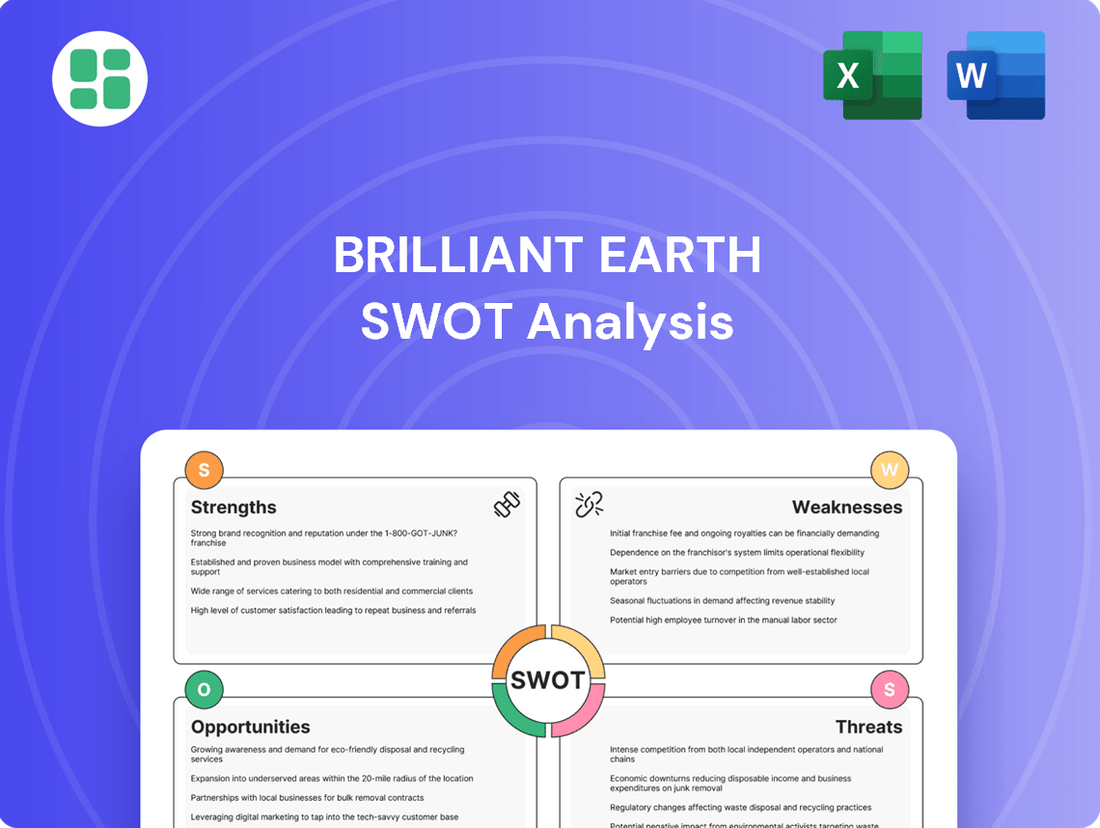

Analyzes Brilliant Earth’s competitive position through key internal and external factors, highlighting its strengths in ethical sourcing and brand appeal against market threats and operational weaknesses.

Offers a clear breakdown of Brilliant Earth's competitive landscape, highlighting areas for strategic advantage and potential threats.

Weaknesses

Brilliant Earth has seen a concerning trend with its average order value (AOV) dipping in both the fourth quarter of 2024 and the first quarter of 2025. This isn't due to fewer customers, but rather a conscious strategy shift.

The company has been actively promoting more budget-friendly engagement rings, specifically those priced under $5,000. Alongside this, lower-priced fine jewelry pieces are making up a larger portion of their sales bookings.

While this strategy might broaden their customer base, it directly impacts the revenue generated per transaction. This means that even with more units sold, overall revenue growth could be constrained.

Brilliant Earth experienced a notable downturn in its financial performance during the first quarter of 2025. The company reported a net loss, a stark contrast to the net income recorded in the same period of 2024, indicating a significant deterioration in profitability.

Further compounding these challenges, net sales for Q1 2025 saw a year-over-year decrease, failing to meet market expectations. While the company managed to maintain positive Adjusted EBITDA, the declining net income and net sales highlight a difficult financial environment.

Brilliant Earth experienced a notable dip in its gross margin during the first quarter of 2025. This downturn was primarily driven by escalating costs associated with gold, a key component in their jewelry, and increased expenses related to order fulfillment.

Furthermore, the company's marketing expenditures grew, representing a larger portion of its net sales. While Brilliant Earth has set ambitious targets for improving its Adjusted EBITDA margins throughout 2025, these upward cost pressures present a significant hurdle to achieving and sustaining enhanced profitability.

Sensitivity to Economic Conditions

Brilliant Earth, as a seller of luxury jewelry, faces a significant weakness in its sensitivity to economic downturns. When the economy tightens, consumers tend to cut back on discretionary purchases, and high-value items like engagement rings are often among the first to be affected. This makes the company's revenue stream vulnerable to shifts in consumer confidence and disposable income levels.

For instance, the company's 2025 outlook explicitly states an assumption of a 'normalized bridal market' and stable economic conditions. This highlights a key vulnerability: if economic conditions deteriorate, or if consumer spending on luxury goods falters, Brilliant Earth's performance could be significantly impacted. Such a scenario would directly challenge their revenue projections and profitability.

- Economic Sensitivity: Luxury goods are highly susceptible to consumer discretionary spending, which declines during economic slowdowns.

- 2025 Outlook Assumption: The company's reliance on a stable economic environment for its 2025 projections indicates a potential risk if conditions worsen.

- Consumer Sentiment: Negative shifts in consumer confidence can lead to reduced demand for high-ticket items like jewelry.

Supply Chain Dependence and Potential Tariff Impacts

Brilliant Earth's reliance on specific sourcing regions, particularly India for lab-grown diamonds, presents a notable weakness. This concentration makes the company vulnerable to supply chain disruptions stemming from geopolitical tensions or trade policy shifts. For instance, a significant percentage of the United States' lab-grown diamond imports originate from India, directly impacting companies like Brilliant Earth that prioritize ethical and sustainable sourcing.

The potential for tariffs on imported lab-grown diamonds from India could significantly increase operational costs for Brilliant Earth. As of early 2024, discussions and considerations around import duties for lab-grown diamonds have been ongoing, creating an uncertain environment. Such tariffs could compress profit margins or necessitate price adjustments, potentially affecting consumer demand.

- Supply Chain Concentration: Heavy dependence on India for lab-grown diamonds.

- Geopolitical Risk: Vulnerability to trade disputes and policy changes affecting imports.

- Tariff Exposure: Potential for increased costs due to import duties on diamonds.

Brilliant Earth's strategy to attract a broader customer base by promoting lower-priced jewelry, particularly engagement rings under $5,000, has led to a decrease in its average order value. This shift, evident in Q4 2024 and Q1 2025, means that even with potentially higher sales volumes, the revenue generated per customer transaction is declining.

The company's Q1 2025 financial results underscore this challenge, showing a net loss and a year-over-year decrease in net sales, missing market expectations. While Adjusted EBITDA remained positive, the declining net income and sales highlight a struggle to translate increased customer engagement into robust top-line growth and profitability.

Escalating costs for key materials like gold, coupled with increased fulfillment expenses, have also put pressure on Brilliant Earth's gross margins, as seen in Q1 2025. Furthermore, rising marketing expenditures are consuming a larger share of net sales, creating a significant hurdle for the company's stated goals of improving Adjusted EBITDA margins throughout 2025.

Preview the Actual Deliverable

Brilliant Earth SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you're getting the complete, professionally crafted report without any surprises.

You're viewing a live preview of the actual SWOT analysis file for Brilliant Earth. The complete version, offering in-depth insights, becomes available immediately after checkout, so you can start strategizing right away.

This is the same SWOT analysis document included in your download. The full content, detailing Brilliant Earth's strengths, weaknesses, opportunities, and threats, is unlocked after payment, providing you with a comprehensive strategic tool.

Opportunities

The jewelry sector is seeing a major change, with younger consumers, particularly Millennials and Gen Z, placing a higher value on ethically sourced materials, environmental responsibility, and supply chain transparency. This consumer preference is a significant tailwind for companies that can authentically demonstrate these commitments.

Brilliant Earth is exceptionally well-positioned to capitalize on this trend. Its foundational mission and the 'Beyond Conflict Free™' brand promise directly address the growing consumer demand for ethical and sustainable jewelry, setting it apart from many legacy competitors. This alignment serves as a powerful competitive differentiator.

This increasing consumer consciousness represents a substantial opportunity for Brilliant Earth to capture greater market share. For instance, a 2024 report indicated that over 70% of Gen Z consumers consider sustainability when making purchasing decisions, a figure that is expected to grow.

The market for lab-grown diamonds is experiencing significant growth, fueled by increasing consumer demand for more affordable and ethically sourced alternatives. Advancements in technology are also making these diamonds more accessible and appealing.

Brilliant Earth's early commitment to lab-grown diamonds positions them well to capitalize on this trend. Their innovative collections, such as those utilizing CO2 capture and renewable energy, further enhance their appeal to environmentally conscious buyers, representing a key opportunity for expansion.

This burgeoning market segment is particularly attractive to younger demographics and those prioritizing sustainability, offering a substantial avenue for Brilliant Earth to increase market share and revenue in the coming years.

Brilliant Earth is actively growing its physical presence, aiming for 50 showrooms by the end of 2025, up from its current 42 locations. This strategic expansion directly supports an omnichannel approach, allowing customers to experience products firsthand and receive personalized consultations, which is crucial for high-value purchases like jewelry.

The increased showroom count is designed to boost brand awareness and capture a larger share of the market by catering to consumer preferences for in-person shopping experiences. This physical expansion is a key strategy to deepen customer engagement and drive sales growth in the coming year.

Diversification Beyond Bridal Jewelry

Brilliant Earth is strategically broadening its product lines beyond its core bridal jewelry. This expansion includes categories like cocktail rings, men's jewelry, and designer collaborations, tapping into new customer segments.

This diversification into non-bridal fine jewelry presents a significant opportunity. While these items typically have lower average price points than bridal pieces, their high growth potential allows Brilliant Earth to expand its total addressable market.

By offering a wider range of products, the company can foster repeat purchases from existing customers and enhance overall customer lifetime value. For instance, in 2023, the company saw continued growth in its fashion jewelry segment, contributing to a more balanced revenue stream.

- Expansion into Men's Jewelry: Growing demand for stylish men's accessories offers a new revenue stream.

- Cocktail & Fashion Rings: These items cater to a broader consumer base seeking everyday luxury.

- Collaborations: Partnerships with designers can introduce unique collections and attract new clientele.

- Increased Customer Lifetime Value: Diversified offerings encourage repeat business beyond initial bridal purchases.

Leveraging Technology for Customer Experience

Brilliant Earth's digitally native roots and commitment to technology empower continuous enhancement of the customer experience. This allows for agile adaptation and innovation in how customers interact with their products.

Further investment in technologies such as augmented reality for virtual try-on experiences or artificial intelligence for personalized product recommendations can significantly deepen customer engagement. These advancements also streamline the online shopping journey, directly appealing to a tech-savvy consumer base.

- Augmented Reality (AR) Virtual Try-On: Enhances online visualization and reduces purchase uncertainty.

- Artificial Intelligence (AI) Personalization: Offers tailored product suggestions based on customer preferences and browsing history.

- Data Analytics for CX Improvement: Leverages customer data to identify pain points and optimize the digital journey.

Brilliant Earth is well-positioned to benefit from the increasing consumer preference for ethically sourced and sustainable jewelry, a trend particularly strong among younger demographics. The company's core mission and branding directly align with this demand, offering a significant competitive advantage.

The rapidly expanding market for lab-grown diamonds presents a substantial growth opportunity, and Brilliant Earth's early adoption and innovative approaches to their sourcing and presentation appeal to environmentally conscious consumers.

The company's strategic physical showroom expansion, aiming for 50 locations by the end of 2025, supports an omnichannel strategy that enhances brand visibility and customer engagement, crucial for high-value purchases.

Diversifying its product offerings beyond bridal jewelry into categories like men's accessories and fashion rings allows Brilliant Earth to tap into new customer segments and increase overall customer lifetime value, as evidenced by continued growth in its fashion jewelry segment in 2023.

Threats

The jewelry sector is a crowded space, featuring established luxury names like Tiffany & Co. and Signet Jewelers alongside newer, ethically focused companies. Brilliant Earth faces this intense competition, where market share is constantly contested.

While Brilliant Earth has carved out a niche, traditional competitors are not standing still. Many are integrating sustainable sourcing and ethical practices into their own offerings, a move that could diminish Brilliant Earth's unique selling proposition.

For instance, in 2023, the global jewelry market was valued at approximately $270 billion, with significant portions held by these larger, traditional players who are increasingly emphasizing their own ethical initiatives.

Economic volatility poses a significant threat to Brilliant Earth, as luxury goods like fine jewelry are particularly vulnerable to shifts in consumer confidence and inflation. A prolonged period of economic uncertainty, potentially marked by rising interest rates or a recession, could directly curtail discretionary spending on high-value items. For instance, in early 2024, consumer sentiment surveys indicated a cautious approach to non-essential purchases amidst persistent inflation, a trend that could directly impact sales for companies like Brilliant Earth.

Brilliant Earth's core brand promise revolves around ethical sourcing and sustainability, making reputational risk a significant threat. Any hint of compromise in their supply chain, such as issues with conflict minerals or labor practices, could severely damage consumer trust.

In 2023, consumer surveys indicated that over 70% of jewelry buyers consider ethical sourcing important, highlighting the direct impact of any perceived lapse. Such damage could lead to a sharp decline in sales and erode the brand loyalty that Brilliant Earth has cultivated.

Shifting Consumer Preferences and Trends

While ethical sourcing remains a significant driver, consumer tastes in jewelry are notoriously fickle. A rapid shift in popular styles, preferred metals, or even a renewed emphasis on affordability could challenge Brilliant Earth's current positioning. For instance, a surge in demand for lab-grown diamonds, which often carry a lower price point than natural diamonds, could impact sales if not adequately addressed. The company needs to stay agile, constantly refreshing its product lines and marketing strategies to resonate with these evolving preferences.

The jewelry market is particularly susceptible to broader economic sentiment. If economic uncertainty rises, consumers might prioritize value and durability over ethical considerations, potentially impacting demand for premium-priced, ethically sourced items. Brilliant Earth's reliance on a discerning customer base means it must be prepared for potential shifts where price sensitivity increases.

Key considerations for Brilliant Earth include:

- Monitoring Style Evolution: Tracking emerging jewelry trends and adapting product designs to align with current fashion.

- Material Innovation: Exploring and promoting a wider range of materials that appeal to diverse consumer preferences and price points.

- Economic Sensitivity: Developing strategies to maintain appeal and accessibility during periods of economic downturn.

Supply Chain Disruptions and Geopolitical Risks

Brilliant Earth's reliance on global supply chains for diamonds, gemstones, and precious metals presents significant threats. Geopolitical instability, trade disputes, and natural disasters can disrupt the flow of these essential materials, impacting operations and product availability.

For example, potential tariffs on goods from key sourcing countries, such as India which is a major hub for lab-grown diamonds, could directly increase Brilliant Earth's costs. This could lead to higher product prices for consumers and squeeze profit margins for the company.

- Supply Chain Vulnerability: Dependence on international suppliers for raw materials creates exposure to global economic and political fluctuations.

- Tariff Impact: Future trade policies, like potential tariffs on ethically sourced diamonds or gemstones from India, could raise costs by an estimated 5-10% for components.

- Logistical Hurdles: Disruptions can cause delays in receiving materials, affecting production schedules and the ability to meet customer demand promptly.

Intense competition from established and emerging jewelers, many of whom are adopting ethical sourcing, poses a significant threat, potentially diluting Brilliant Earth's unique market position. The global jewelry market, valued at approximately $270 billion in 2023, is highly contested, with larger players increasingly highlighting their own sustainability efforts.

Economic downturns and inflation can curb discretionary spending on luxury items like fine jewelry, directly impacting sales. Consumer sentiment in early 2024 showed caution towards non-essential purchases, a trend that could disproportionately affect companies like Brilliant Earth that cater to a premium market.

Shifting consumer preferences in styles, materials, and price points present a challenge, as does the potential impact of supply chain disruptions due to geopolitical instability or trade policies, which could increase costs by an estimated 5-10% for certain components.

SWOT Analysis Data Sources

This analysis is built on a foundation of credible data, including Brilliant Earth's financial filings, comprehensive market research reports, and expert industry commentary to ensure a robust and insightful SWOT assessment.