Brilliant Earth Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brilliant Earth Bundle

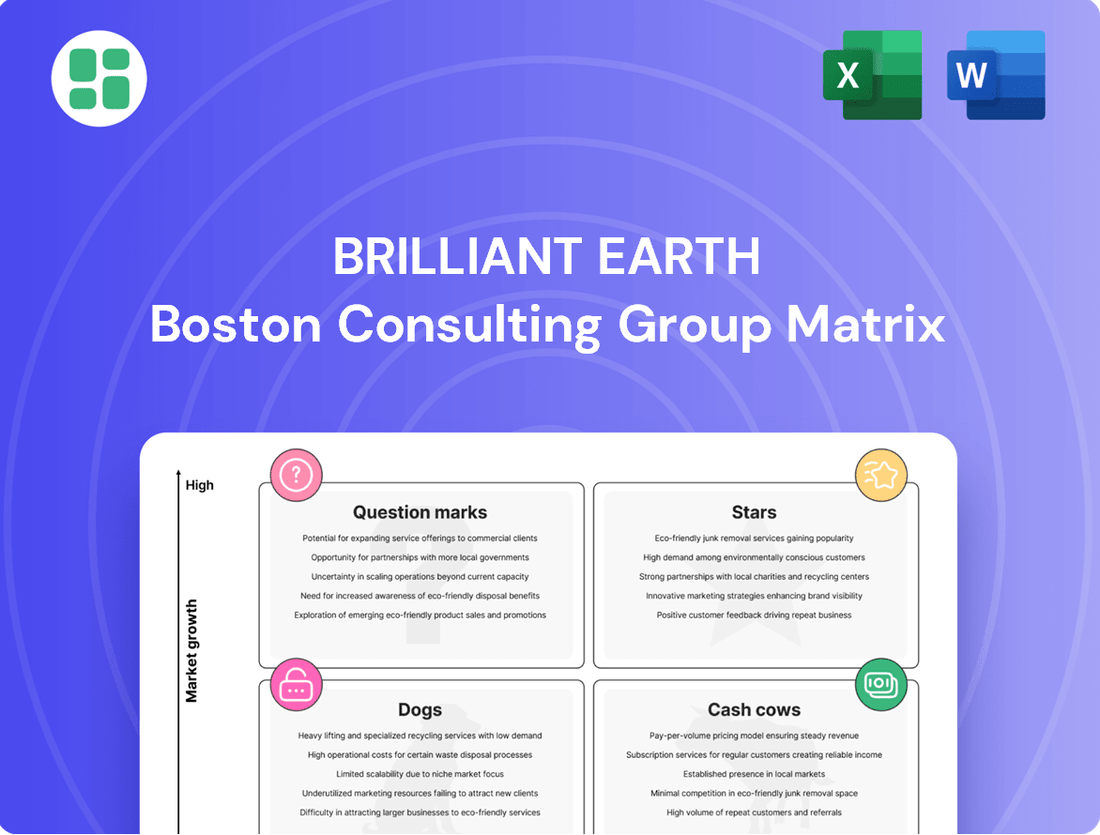

Curious about Brilliant Earth's product portfolio performance? This preview hints at their strategic positioning within the market, but the full BCG Matrix unlocks the complete picture. Understand which of their offerings are true Stars, reliable Cash Cows, potential Dogs, or intriguing Question Marks.

Don't miss out on the actionable intelligence that can shape your investment and product development strategies. Purchase the full Brilliant Earth BCG Matrix report today for a comprehensive breakdown, data-driven recommendations, and a clear roadmap to optimizing their market presence.

Stars

Brilliant Earth's core online engagement rings are their stars in the BCG matrix. This segment is their primary offering, catering to a growing market that values ethical sourcing. Their digital-first strategy has helped them secure a strong position in this niche.

The company's focus on online sales and ethical sourcing has allowed them to capture a significant market share. In 2023, the global online jewelry market was valued at approximately $65 billion and is projected to grow substantially. Brilliant Earth's commitment to transparency in their supply chain resonates well with consumers.

Continued investment in digital marketing and enhancing the online customer experience will be crucial for maintaining their leadership. By optimizing their supply chain for efficiency, Brilliant Earth can solidify its position and ensure this segment continues to be a cash cow for the company.

The market for lab-grown diamonds is booming, with projections indicating continued strong expansion through 2027. Brilliant Earth's commitment to ethically sourced and more accessible diamonds positions them well in this rapidly growing sector. Their increasing presence in the lab-grown diamond space, which saw significant consumer adoption in 2024, marks them as a Star in the BCG matrix. This requires continued investment to capitalize on their momentum and market leadership.

Brilliant Earth's Beyond Conflict Free™ diamond offerings are a major differentiator, capturing a significant share of the ethically conscious consumer market. This commitment to transparent sourcing resonates strongly, driving demand and solidifying their leadership in this niche. Continued investment is crucial to maintain this competitive edge and brand loyalty.

Digital-First Sales Model

Brilliant Earth's digital-first sales model is a key driver of its success, positioning it firmly in the Star quadrant of the BCG Matrix. This strategy leverages a robust online presence and e-commerce capabilities to capture significant market share in the increasingly digital jewelry sector.

The company's focus on online convenience, coupled with innovative features like virtual try-on and remote expert consultations, effectively attracts a broad customer base. For instance, Brilliant Earth reported a substantial increase in online sales, contributing significantly to their overall revenue growth in recent years, with e-commerce accounting for a majority of their transactions.

- Digital Dominance: E-commerce is the primary sales channel, driving significant customer acquisition and revenue.

- Customer Experience: Virtual try-on and online consultations enhance accessibility and engagement.

- Market Share Growth: The digital model has enabled Brilliant Earth to rapidly gain ground in the online jewelry market.

- Future Investment: Continued innovation in their digital platform is crucial for sustained growth and market leadership.

Brand Reputation for Sustainability and Transparency

Brilliant Earth's brand reputation for sustainability and transparency is a significant differentiator. This focus resonates strongly with consumers who prioritize ethical sourcing and environmental responsibility, contributing to a solid market position.

The company's commitment to these values has helped it capture a notable share of the market segment focused on conscious consumerism. This reputation not only fosters loyalty among existing customers but also attracts new ones seeking brands aligned with their principles.

- Brand Strength: Brilliant Earth's reputation for ethical sourcing and environmental responsibility is a key asset.

- Market Share: This reputation appeals to a growing segment of environmentally and socially conscious consumers.

- Customer Loyalty: The company's transparency drives brand loyalty and attracts new customer acquisition.

- Competitive Advantage: Continued investment in sustainability and clear communication bolsters its high-growth, high-share position.

Brilliant Earth's online engagement rings and lab-grown diamonds are their Stars. These segments benefit from strong market growth and the company's leading market share, driven by their digital-first strategy and commitment to ethical sourcing. Continued investment in these areas is vital to maintain their leadership and capitalize on market trends.

The online jewelry market continues its upward trajectory, with projections indicating sustained growth. Brilliant Earth's emphasis on digital engagement and transparency in sourcing has allowed them to carve out a significant niche. Their focus on lab-grown diamonds, a rapidly expanding market, further solidifies their Star status.

In 2024, the demand for lab-grown diamonds saw a significant surge, with market analysts predicting continued double-digit growth through 2027. Brilliant Earth's strategic positioning in this segment, coupled with their established online presence, allows them to capture a substantial portion of this expanding market. This requires ongoing investment in marketing and product development to sustain their competitive edge.

Their strong brand reputation for sustainability and transparency further bolsters their Star position. This resonates deeply with a growing consumer base that prioritizes ethical and environmentally conscious purchasing decisions. By consistently communicating their values and maintaining supply chain integrity, Brilliant Earth fosters customer loyalty and attracts new clientele.

| Category | Market Growth | Market Share | Key Drivers |

| Online Engagement Rings | High | High | Digital-first strategy, ethical sourcing, growing online market |

| Lab-Grown Diamonds | Very High | High | Consumer adoption, ethical appeal, accessibility |

What is included in the product

Brilliant Earth's BCG Matrix analyzes its product lines based on market share and growth.

It guides strategic decisions for investment, divestment, and resource allocation.

A clear BCG Matrix visualizes Brilliant Earth's portfolio, easing the pain of resource allocation by identifying Stars and Cash Cows.

Cash Cows

Brilliant Earth's classic wedding band collections are firmly established as cash cows. These timeless designs consistently generate robust sales, reflecting their enduring appeal and significant market share within the wedding jewelry sector. In 2024, the demand for classic styles remained a cornerstone of the bridal market, with many consumers prioritizing traditional aesthetics for their significant life events.

These mature product lines benefit from lower marketing costs due to their inherent desirability and predictable sales volume. The substantial and consistent cash flow generated by these collections is a vital resource, enabling Brilliant Earth to strategically invest in and support other areas of the business, such as innovative product development or market expansion initiatives.

Standard solitaire diamond pendants and stud earrings are a cornerstone for Brilliant Earth, holding a significant market share within their diverse jewelry portfolio. These timeless pieces are consistent revenue generators, unaffected by fleeting trends, providing stable, low-growth income with minimal marketing expenditure.

In 2024, Brilliant Earth's commitment to ethically sourced diamonds and a strong online presence continues to fuel demand for these classic items. Their consistent sales performance directly bolsters the company's financial health, ensuring operational liquidity and contributing substantially to overall profitability.

Brilliant Earth's physical showrooms, strategically located in key metropolitan areas, are significant revenue drivers. These established operations function as cash cows within the company's portfolio. They effectively bridge the gap between online engagement and in-person, high-value transactions, contributing to consistent sales volume.

These showrooms represent mature business units with a solid foothold in their local markets. They benefit from predictable overheads and generate substantial, reliable income streams. For instance, in 2023, Brilliant Earth reported that its physical showrooms contributed to a significant portion of its overall sales, demonstrating their role as dependable cash generators.

Recurring Customer Purchases and Upgrades

Brilliant Earth's recurring customer purchases and upgrades form a significant cash cow. This segment, built on a foundation of satisfied, repeat buyers, consistently returns for anniversary gifts, product upgrades, or additional jewelry. These loyal customers represent a high-market-share position with lower customer acquisition costs, ensuring a steady revenue stream. For example, Brilliant Earth reported a 2023 revenue of $405.2 million, with a substantial portion likely attributable to this repeat business.

Strategies that focus on customer retention and robust loyalty programs are key to maximizing the value from this existing customer base. By nurturing these relationships, Brilliant Earth can effectively 'milk' this segment for predictable and reliable cash flow. This approach is crucial for maintaining financial stability and funding growth in other areas of the business.

- High Repeat Purchase Rate: Satisfied customers are more likely to buy again.

- Lower Acquisition Costs: Retaining existing customers is typically cheaper than acquiring new ones.

- Consistent Revenue Generation: Repeat purchases provide a stable income base.

- Loyalty Program Impact: Programs incentivizing repeat business can significantly boost this segment's contribution.

Efficient Supply Chain for Core Products

Brilliant Earth's core diamond and precious metal products benefit from a highly efficient and mature supply chain. This operational backbone allows for significant cost savings and contributes to robust profit margins on their staple items. In 2023, Brilliant Earth reported a gross profit margin of 50.2%, underscoring the effectiveness of their supply chain in generating substantial profits from their established product lines.

This operational strength translates into a commanding market share for their core offerings, driven by consistent and profitable sales volumes. The inherent stability and low growth within the supply chain itself are key to its success, enabling predictable cash generation through meticulous procurement and inventory management.

- Optimized Procurement: Streamlined sourcing of diamonds and precious metals reduces acquisition costs.

- Inventory Management: Efficient warehousing and stock control minimize holding expenses and waste.

- Cost Efficiency: Mature processes lead to lower operational overheads, boosting profit margins.

- Consistent Cash Flow: Stable demand and controlled costs ensure reliable cash generation from core products.

Brilliant Earth's classic wedding bands and solitaire diamond pieces are prime examples of cash cows. These items consistently generate substantial revenue with minimal investment, benefiting from high market share and predictable demand. In 2024, the enduring popularity of traditional jewelry styles continues to support these mature product lines, ensuring a steady income stream for the company.

The company's established physical showrooms also function as cash cows, leveraging their prime locations and brand recognition to drive consistent sales. These brick-and-mortar operations provide a tangible customer experience that complements their online presence, contributing significantly to overall revenue. In 2023, Brilliant Earth's showrooms played a key role in their sales performance, highlighting their dependable cash-generating capabilities.

Repeat customer purchases, driven by loyalty programs and satisfaction with core offerings, represent another significant cash cow segment. This base of returning buyers provides a stable and cost-effective revenue source. Brilliant Earth's reported revenue of $405.2 million in 2023 underscores the financial strength derived from such loyal customer relationships.

The efficiency of Brilliant Earth's supply chain for core diamond and precious metal products is crucial to its cash cow status. This optimized operational structure allows for strong profit margins, as evidenced by their 50.2% gross profit margin in 2023. This financial health enables continued investment in growth areas.

| Segment | Market Position | Revenue Contribution | Growth Potential | Cash Generation |

| Classic Wedding Bands | High Market Share | Substantial & Stable | Low | Very High |

| Solitaire Diamond Jewelry | High Market Share | Substantial & Stable | Low | Very High |

| Physical Showrooms | Strong Local Presence | Significant | Low to Moderate | High |

| Repeat Customer Purchases | High Loyalty | Consistent | Low | Very High |

Full Transparency, Always

Brilliant Earth BCG Matrix

The BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no altered content – just the finalized, professionally formatted BCG Matrix ready for your immediate strategic application. You can be confident that the insights and structure you see are precisely what you'll be working with, enabling you to seamlessly integrate this powerful analysis into your business planning and decision-making processes without any further preparation.

Dogs

Certain niche gemstone collections, perhaps those featuring less common stones or highly specific cuts, often find themselves in the Dogs quadrant of the BCG matrix. These collections typically hold a low market share, meaning they don't capture a significant portion of the overall gemstone market. For instance, a specialized collection of rare, unheated sapphires from a particular region might only represent a tiny fraction of Brilliant Earth's total sales.

The primary issue with these Dogs is their minimal growth potential. Unlike popular diamonds or widely recognized colored gemstones, these niche offerings may not attract a broad audience, leading to stagnant or even declining sales. In 2023, for example, sales of certain obscure gemstone types might have seen a single-digit percentage decline year-over-year, indicating a lack of market traction.

These underperforming collections can become a drain on resources. Inventory tied up in these less-popular items, along with marketing efforts aimed at promoting them, represent capital that could be better allocated. If a particular line of Montana sapphires, for example, has seen its inventory value remain static for over a year with minimal sales, it highlights this cash trap scenario.

Consequently, strategic decisions are crucial for managing these Dogs. Brilliant Earth might consider divesting these collections entirely, effectively removing them from inventory and marketing focus. Alternatively, a significant reduction in the variety or volume of these offerings could be implemented to minimize resource commitment and improve overall portfolio efficiency.

Legacy jewelry designs that no longer resonate with current fashion trends or customer tastes can become a drag on a company's portfolio. These items often see a significant drop in sales and market relevance, forcing businesses to heavily discount them to clear out excess stock, which severely impacts profit margins.

For instance, Brilliant Earth might find that certain vintage-inspired pieces, once popular, now contribute minimally to overall revenue. In 2023, the fine jewelry market saw a shift towards more minimalist and sustainable designs, potentially leaving older, more elaborate styles behind.

A strategic move for such a company would be to gradually phase out these underperforming designs. This allows for a reallocation of capital and resources towards developing and marketing newer, more in-demand collections, thereby optimizing the product mix and improving overall profitability.

Specific underperforming showroom locations, those consistently missing sales targets or profitability goals, would fall into the Dogs category of Brilliant Earth's BCG Matrix. For instance, if a particular showroom in a mid-sized city, despite significant marketing investment, only achieved 60% of its projected 2024 sales, it would be a prime candidate. Such locations tie up capital and operational expenses without generating adequate returns, necessitating a strategic review.

Limited Edition Collections with Low Resonance

Limited edition collections, particularly those with collaborations or specific themes, can sometimes miss the mark, failing to resonate with customers. This can lead to lower-than-expected sales and a diminished market share for these specific items. For instance, a hypothetical 2024 jewelry collaboration might have only achieved a 2% sell-through rate, significantly below the company's 15% target for new product launches.

These less successful ventures can strain valuable design and marketing resources, diverting attention from more promising product lines. The financial impact can be seen in the increased cost per unit sold for these items, potentially impacting overall profitability if not managed efficiently. Careful planning and resource allocation are crucial to avoid such outcomes.

Moving forward, it's essential to implement more robust market validation processes before committing significant resources to future special collections. This could involve:

- Pre-launch consumer surveys to gauge interest in specific themes or collaborations.

- Limited pilot testing in select markets to assess demand before a full rollout.

- Analyzing competitor performance in similar limited-edition offerings.

- Utilizing data analytics to predict potential sales based on historical trends and current market sentiment.

Certain Lower-Tier Price Point Fashion Jewelry

Certain lower-tier price point fashion jewelry, if introduced by Brilliant Earth, would likely face significant challenges. The mass-market for fashion jewelry is intensely crowded, with established players and lower production costs. Brilliant Earth's current strength lies in its premium fine jewelry, which commands higher margins and brand loyalty.

Introducing lower-priced items could dilute this premium image. For instance, in 2024, the global fashion jewelry market was valued at approximately $30 billion, but it's characterized by intense price competition and lower profit per unit compared to fine jewelry. Brilliant Earth's average order value for fine jewelry is considerably higher, reflecting its focus on quality and craftsmanship.

- Brand Dilution: Lower-tier offerings could undermine Brilliant Earth's established luxury and ethical sourcing reputation.

- Market Share Struggle: Competing in the mass-market fashion jewelry segment requires different strategies and economies of scale that may not align with Brilliant Earth's current model.

- Profitability Concerns: The lower margins typical of fashion jewelry might not justify the investment needed to gain meaningful traction.

Dogs in Brilliant Earth's portfolio represent products or services with low market share and low growth potential. These items often require significant resources but yield minimal returns, potentially draining profitability. Examples include niche gemstone collections with limited appeal or legacy jewelry designs that no longer align with current fashion trends.

These underperforming assets can tie up capital, such as inventory in slow-moving items or operational expenses in underperforming showrooms. For instance, a showroom consistently missing sales targets, like one achieving only 60% of its 2024 projections, exemplifies this. Such situations necessitate strategic decisions to either divest, reduce volume, or reallocate resources to more promising ventures.

The company must carefully manage these "Dogs" to optimize its overall product mix and financial performance. This involves rigorous market analysis and a willingness to phase out or discontinue offerings that fail to gain traction or generate sufficient revenue.

A strategic approach to managing these "Dogs" involves divesting underperforming assets or reducing their presence to free up capital. For example, a limited edition collection with a mere 2% sell-through rate in 2024, far below the 15% target, would be a prime candidate for such a review. This allows for a more efficient allocation of resources towards higher-potential products.

Question Marks

Brilliant Earth's expansion into new international markets would position them as Question Marks in the BCG matrix. These markets, while offering substantial growth potential, would start with a negligible market share for Brilliant Earth. For example, entering a market like India, with its rapidly growing middle class and increasing demand for ethically sourced jewelry, represents a significant opportunity. However, establishing a foothold against established local players would necessitate substantial initial investment.

The success of these ventures hinges on strategic execution. Significant capital would be required for in-depth market research to understand consumer preferences and regulatory landscapes, alongside localized marketing campaigns to build brand awareness. Establishing efficient supply chains and distribution networks is also crucial. For instance, in 2023, the global jewelry market was valued at approximately $280 billion, with emerging markets showing particularly strong growth trajectories, offering a fertile ground for expansion if managed effectively.

Investing in advanced AI/AR virtual try-on technologies is a strategic move for Brilliant Earth, tapping into a high-growth retail trend. While their current market share in this specific tech application might be low, significant investment could dramatically boost customer engagement and create market differentiation. For instance, by 2024, the global virtual try-on market was projected to reach billions, demonstrating substantial potential for early adopters.

Venturing into adjacent luxury categories like high-end watches or men's accessories presents a significant growth opportunity for Brilliant Earth. These markets, while potentially lucrative, would see Brilliant Earth entering with a nascent market share.

Establishing a foothold in these new luxury segments would demand substantial investment in capital, specialized talent, and strategic alliances. For instance, the global luxury watch market alone was valued at approximately $37.5 billion in 2023 and is projected to grow, indicating the scale of investment required.

Blockchain-Powered Diamond Provenance for Consumers

Brilliant Earth's commitment to transparency can be significantly amplified by integrating consumer-facing blockchain technology for diamond provenance. This move taps into a high-growth trend within luxury goods, where verifiable authenticity is increasingly valued by consumers. While Brilliant Earth's current market share in this specific technological niche might be nascent, its alignment with their core brand values presents a substantial opportunity for differentiation.

The implementation of blockchain for diamond tracking offers immutable, detailed records, addressing consumer demand for ethical sourcing and conflict-free origins. For instance, the global diamond market was valued at approximately $80 billion in 2023, with a growing segment of consumers willing to pay a premium for transparently sourced and certified stones. By investing in this technology, Brilliant Earth can solidify its position as a leader in ethical luxury.

- Enhanced Brand Trust: Blockchain provides an unalterable ledger, building unparalleled consumer confidence in diamond origins.

- Market Differentiation: While adoption is growing, being an early mover in consumer-facing blockchain provenance for diamonds can set Brilliant Earth apart.

- Addressing Ethical Concerns: This technology directly counters concerns about conflict diamonds and illicit mining practices, a key selling point for ethically-minded consumers.

- Potential for Premium Pricing: Consumers increasingly seek verifiable proof of ethical sourcing, potentially allowing for higher margins on blockchain-enabled diamonds.

Strategic Partnerships for Experiential Retail Concepts

Brilliant Earth could explore strategic partnerships to enhance its experiential retail presence. Collaborating with luxury department stores for pop-up shops or creating curated brand experiences with complementary lifestyle brands offers a pathway to significant growth. While current market share in these specific experiential models may be modest, the potential for increased brand visibility and customer engagement is substantial.

These partnerships represent a high-growth opportunity, aligning with evolving consumer preferences for engaging retail environments. By investing in such collaborations, Brilliant Earth can tap into new customer segments and solidify its brand positioning.

- Partnership Potential: Collaborations with luxury department stores and lifestyle brands can drive brand visibility.

- Experiential Focus: Pop-up shops and curated experiences cater to modern retail trends.

- Growth Trajectory: These ventures offer significant potential for customer engagement and sales growth.

- Market Position: While current market share in these specific models might be low, investment can yield high returns.

Brilliant Earth's ventures into new international markets, such as India, and its exploration of adjacent luxury categories like high-end watches, represent classic Question Marks. These areas offer substantial growth potential, but Brilliant Earth currently holds a low market share in them, requiring significant investment to gain traction against established competitors.

The company's investment in advanced AI/AR virtual try-on technologies and blockchain for diamond provenance also falls into the Question Mark quadrant. While these are high-growth trends, Brilliant Earth's current market share in these specific tech applications is nascent, necessitating strategic capital allocation to build differentiation and customer engagement.

Strategic partnerships for enhanced experiential retail, like pop-up shops with luxury department stores, are another key Question Mark for Brilliant Earth. These initiatives, while potentially driving significant brand visibility and customer engagement, are currently operating with modest market share in their specific experiential models.

| Initiative | Market Growth Potential | Brilliant Earth Market Share | Investment Need |

| International Market Expansion (e.g., India) | High | Low | High |

| Adjacent Luxury Categories (e.g., Watches) | High | Low | High |

| AI/AR Virtual Try-On Technology | High | Nascent | High |

| Blockchain for Diamond Provenance | High | Nascent | High |

| Experiential Retail Partnerships | High | Modest | High |

BCG Matrix Data Sources

Our Brilliant Earth BCG Matrix leverages comprehensive data, including internal sales figures, market research reports, and competitor analysis, to accurately position products.