Bright Horizons SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bright Horizons Bundle

Bright Horizons excels in its strong brand reputation and extensive network of childcare centers, positioning it as a leader in the early childhood education sector. However, understanding the nuances of its operational challenges and competitive landscape is crucial for informed decision-making.

Want the full story behind Bright Horizons' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bright Horizons holds a commanding position as a market leader in the early education and child care industry, a status cemented by its robust brand reputation for delivering exceptional quality. This established leadership and the trust its brand inspires serve as significant differentiators, setting it apart from competitors and fostering consistent growth alongside a dedicated customer following.

Bright Horizons boasts a diversified service portfolio, encompassing full-service center-based childcare, essential back-up dependent care, and valuable educational advisory services. This broad range of solutions addresses the varied requirements of both working families and their employers, establishing multiple avenues for revenue generation and fostering cross-selling potential.

Bright Horizons boasts robust employer partnerships, working with over 1,450 prominent companies worldwide. This deep integration into corporate benefits structures fosters exceptional client loyalty, with retention rates frequently surpassing 95%. Such strong relationships create a stable and predictable revenue base, underscoring its value as a key employee benefit for businesses.

Consistent Financial Performance and Growth

Bright Horizons has shown impressive financial stability and expansion. The company has achieved consistent increases in both its revenue and earnings, even when the market presented challenges. This resilience highlights a strong operational foundation.

For instance, the company’s Q1 and Q2 2025 financial reports indicate a continuation of this positive trend. Revenue and adjusted earnings per share (EPS) both saw upward movement. This growth is largely attributed to more children enrolling, strategic tuition adjustments, and higher usage of their services, especially in the Back-Up Care sector.

Key financial highlights from recent periods include:

- Revenue growth driven by enrollment and pricing strategies.

- Increased utilization of services, particularly in Back-Up Care.

- Consistent expansion in adjusted earnings per share (EPS).

- Demonstrated ability to perform well in a complex market landscape.

Operational Efficiency and Pricing Power

Bright Horizons has demonstrated a notable enhancement in its operational efficiency, evidenced by expanding operating margins. This improvement contributes directly to the company's robust free cash flow generation, a key indicator of financial health and operational strength.

The company possesses significant pricing power, successfully implementing tuition increases even amidst considerable inflationary pressures. This ability to pass on costs without substantially impacting demand underscores its strong market position and the perceived value of its services.

- Expanding Operating Margins: Bright Horizons has seen its operating margins grow, indicating better cost management and revenue generation efficiency.

- Strong Free Cash Flow: The company consistently generates substantial free cash flow, providing financial flexibility for investments and shareholder returns.

- Tuition Price Increases: The ability to raise tuition prices effectively protects profitability against rising operational costs.

Bright Horizons' market leadership is a significant strength, built on a widely recognized brand synonymous with high-quality early education and childcare. This strong reputation translates into customer loyalty and a competitive edge. The company's diversified service offerings, including full-service centers, back-up care, and educational consulting, cater to a broad client base, creating multiple revenue streams and opportunities for cross-selling.

The company's extensive network of over 1,450 corporate partnerships provides a stable and predictable revenue base, with client retention rates often exceeding 95%. This deep integration into employer benefit packages highlights the essential nature of its services. Financially, Bright Horizons has demonstrated resilience, consistently growing revenue and earnings even in challenging economic conditions. For example, Q1 and Q2 2025 saw continued growth in revenue and adjusted EPS, driven by increased enrollments and service utilization.

| Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Revenue Growth | Positive | Positive |

| Adjusted EPS Growth | Positive | Positive |

| Client Retention | >95% | >95% |

| Corporate Partnerships | 1,450+ | 1,450+ |

What is included in the product

Delivers a strategic overview of Bright Horizons’s internal and external business factors, highlighting its strengths in brand reputation and market leadership, weaknesses in staffing challenges, opportunities in corporate partnerships, and threats from increased competition and regulatory changes.

Offers a clear, actionable framework to identify and leverage strengths, mitigate weaknesses, capitalize on opportunities, and defend against threats.

Weaknesses

Bright Horizons' premium pricing, while reflecting high-quality care and comprehensive programs, does present a significant weakness. For instance, in 2024, the average weekly tuition for full-time infant care at Bright Horizons centers could range from $400 to $600 or more, placing it at the higher end of the market. This cost structure may deter families with more constrained financial resources, potentially limiting the company's reach and market share among a broader demographic.

Bright Horizons' substantial reliance on employer-sponsored contracts, which form a significant portion of its revenue, presents a notable weakness. This dependence means that the company's financial performance is closely tied to corporate discretionary spending on employee benefits. For instance, in fiscal year 2023, employer-sponsored services represented a core segment of their business, highlighting this concentration.

This reliance creates vulnerability, as corporate budgets for employee benefits can be significantly impacted by economic downturns. During periods of economic contraction, companies may reduce spending on such benefits to cut costs, directly affecting Bright Horizons' revenue streams. This sensitivity to economic cycles is a key risk factor for the company.

Bright Horizons, while financially robust, grapples with operational hurdles due to escalating costs and a scarcity of available workers. The need to comply with new wage mandates, potentially impacting profit margins, coupled with the ongoing challenge of securing and keeping skilled educators in a competitive landscape, presents a significant operational weakness.

Slower Full Service Center Enrollment Growth

While Bright Horizons' Back-Up Care segment has demonstrated robust growth, its Full Service Center (FSC) segment has encountered softer enrollment increases in recent times. This deceleration in a key revenue-generating area poses a potential challenge to the company's overall revenue trajectory and operational efficiency, particularly if it leads to underutilized facilities.

For example, during the first quarter of 2024, Bright Horizons reported that while their back-up care services saw a significant uptick, the enrollment in their full-service centers experienced a more subdued expansion. This disparity highlights a critical area for strategic focus.

- Slower FSC Enrollment: The Full Service Center segment is not growing as quickly as other areas of the business.

- Revenue Impact: This slower growth could affect the company's total revenue.

- Operational Efficiency: Underutilization of FSC facilities is a potential concern.

- Strategic Focus Needed: Addressing the reasons for softer FSC enrollment is crucial for balanced growth.

Sensitivity to Macroeconomic Uncertainties

Bright Horizons' reliance on corporate clients makes it vulnerable to shifts in the broader economy. For instance, during periods of high inflation or potential recession, companies may reduce discretionary spending, including employee benefits like childcare and education programs, directly impacting Bright Horizons' revenue streams. This sensitivity was underscored in late 2023 and early 2024 as many businesses recalibrated their budgets amidst persistent inflation concerns.

The company's performance is closely tied to consumer confidence and disposable income, which are often dampened during economic downturns. A slowdown in consumer spending can lead to decreased demand for backup care and other family support services, as individuals prioritize essential expenses. This was a notable factor in the childcare sector's recovery post-pandemic, with economic anxieties lingering through 2024.

- Economic Sensitivity: Vulnerability to corporate budget cuts and reduced consumer spending due to inflation and recessionary fears.

- Impact on Demand: Macroeconomic uncertainties can directly lower the demand for employee benefits and family support services.

- 2024 Economic Climate: Persistent inflation and recessionary concerns in 2024 presented ongoing challenges for discretionary spending on services like those offered by Bright Horizons.

Bright Horizons faces challenges in attracting and retaining qualified staff, a persistent issue in the early childhood education sector. The company's ability to maintain high service quality is directly impacted by labor shortages and rising wage expectations, especially as new wage mandates emerge. This scarcity of educators, coupled with increased operational costs, can compress profit margins and hinder expansion efforts.

What You See Is What You Get

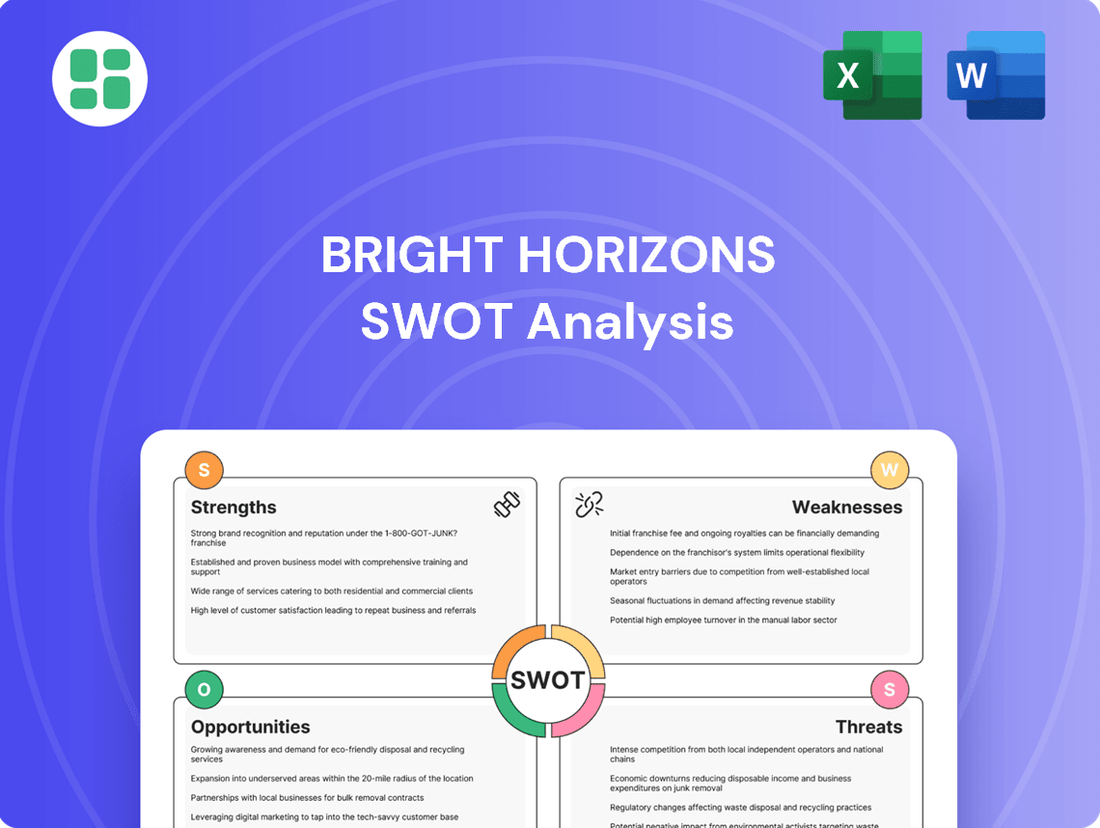

Bright Horizons SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout, offering the same professional structure and insights.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It's the exact same Bright Horizons SWOT analysis you'll download.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. No hidden content, just the complete, actionable report.

Opportunities

The shift towards dual-income households and the continued prevalence of hybrid work arrangements are significantly boosting the need for flexible and reliable childcare. This evolving family dynamic directly translates into a larger market for services like those offered by Bright Horizons.

Bright Horizons is well-positioned to capitalize on this trend. For instance, in 2023, the company reported a 9% increase in revenue, partly driven by the growing demand for their employer-sponsored benefits, which often include childcare solutions.

This growing demand for work-life balance and childcare support presents a clear opportunity for Bright Horizons to expand its service offerings and secure new corporate partnerships, further solidifying its market presence.

Policy tailwinds present a significant opportunity for Bright Horizons. For instance, the potential for increased federal tax credits for childcare expenses, building on measures seen in prior years, could make employer-sponsored childcare more attractive. This could directly translate to a larger corporate client base seeking Bright Horizons’ services.

Bright Horizons is strategically expanding beyond its core childcare services into workforce education and upskilling, specifically targeting early childhood educators. This move directly addresses the critical talent shortage within the sector, aiming to improve educator retention rates.

This new focus represents a significant growth opportunity, creating fresh recurring revenue streams for the company by offering valuable training and development programs. For instance, in 2023, the early childhood education sector faced a persistent shortage, with reports indicating thousands of open positions nationwide, highlighting the demand for such upskilling initiatives.

Leveraging Technology for Enhanced Service Delivery

Bright Horizons can significantly boost its service delivery by embracing technological advancements. The integration of sophisticated childcare management software, for instance, offers a pathway to streamline administrative tasks and enhance parent communication. This can lead to greater operational efficiency and a more seamless experience for families.

Data-driven enrollment systems present a compelling opportunity to optimize resource allocation and understand market demand more effectively. By leveraging analytics, Bright Horizons can refine its outreach strategies and ensure its services are aligned with community needs, potentially reducing costs associated with underutilized capacity.

These technological integrations are not merely about efficiency; they provide a distinct competitive advantage. In 2024, the early childhood education sector is increasingly recognizing the value of digital tools in attracting and retaining families. Bright Horizons' adoption of such technologies can solidify its position as a leader in quality, accessible childcare.

- Enhanced Efficiency: Implementing childcare management software can automate tasks like billing, scheduling, and attendance tracking, freeing up staff time.

- Data-Driven Decisions: Utilizing enrollment data allows for better forecasting, targeted marketing, and resource planning.

- Improved Parent Engagement: Digital platforms can facilitate easier communication, provide real-time updates, and offer access to child progress reports.

- Cost Reduction: Streamlining operations through technology can lead to lower administrative overhead and optimized staffing.

Strategic Acquisitions and Market Expansion

Bright Horizons' robust financial health, evidenced by its consistent revenue growth and healthy cash flow, positions it advantageously for strategic acquisitions. This financial strength allows the company to actively seek out and integrate businesses that complement its existing service portfolio, thereby accelerating market share gains and enhancing its competitive edge. For example, in late 2023, Bright Horizons completed several smaller acquisitions, bolstering its presence in specific childcare niches.

Expansion into new geographic markets presents a significant opportunity, particularly in regions where demand for high-quality early childhood education and employer-sponsored benefits outstrips current supply. Leveraging its established brand reputation for reliability and its comprehensive suite of services, Bright Horizons can tap into these underserved markets. As of early 2024, the company has been exploring expansion opportunities in several suburban areas across the Midwest and Southeast United States, regions showing strong demographic trends for young families.

- Financial Strength for M&A: Bright Horizons' solid balance sheet supports strategic acquisitions to drive growth and diversification.

- Geographic Market Expansion: Potential exists to enter new, underserved geographic markets leveraging brand reliability and comprehensive offerings.

- Targeted Expansion Focus: Exploration of suburban markets in the Midwest and Southeast indicates a strategic approach to expansion in early 2024.

The increasing demand for flexible childcare, driven by dual-income households and hybrid work, creates a substantial market opportunity for Bright Horizons. The company's revenue growth, up 9% in 2023, highlights its ability to meet this demand, particularly through employer-sponsored benefits.

Policy shifts, such as potential increases in childcare tax credits, could further incentivize employers to offer childcare solutions, expanding Bright Horizons' corporate client base.

Bright Horizons' strategic expansion into workforce education, specifically upskilling early childhood educators, addresses a critical sector talent shortage. This move in 2023, amidst thousands of open positions nationwide, promises new recurring revenue streams and improved service quality.

Leveraging technology, like childcare management software and data-driven enrollment systems, offers significant operational efficiencies and a competitive edge. In 2024, digital tools are becoming key differentiators in attracting and retaining families in the early childhood education sector.

Bright Horizons' strong financial health, demonstrated by consistent revenue growth and healthy cash flow, supports strategic acquisitions. The company's expansion into new geographic markets, particularly in underserved suburban areas in the Midwest and Southeast as of early 2024, further capitalizes on market demand.

Threats

Economic downturns, marked by rising inflation and potential recessionary pressures, present a significant threat to Bright Horizons. During such periods, companies often cut back on discretionary spending, which can include employee benefits like childcare services. This directly impacts Bright Horizons' client base and revenue streams.

Historically, the company has seen its revenue dip during economic contractions. For instance, in the immediate aftermath of the 2008 financial crisis, many businesses scaled back on benefits, affecting service providers like Bright Horizons. While specific 2024-2025 data is still emerging, the pattern suggests a continued vulnerability to these macroeconomic shifts.

Bright Horizons operates in a highly competitive environment, facing pressure from national childcare chains, numerous local independent centers, and even corporate-sponsored facilities. The rise of in-home care services also presents an alternative for parents. This crowded market can indeed impact pricing strategies and the ability to grow market share.

The early education sector faces a constant challenge from evolving regulations. For instance, the Child Care and Development Fund (CCDF) rules, while aiming to improve quality, have not always been accompanied by sufficient federal funding increases, creating potential funding gaps for providers.

These funding gaps can directly impact providers like Bright Horizons, potentially forcing them to absorb increased costs or pass them on to families. This could lead to higher tuition fees, making quality childcare less accessible and potentially dampening demand for services, especially if economic conditions are already tight.

Labor Market Pressures and Wage Mandates

Bright Horizons faces ongoing labor market pressures, including persistent staffing shortages and increasing wage mandates. These factors directly impact operating costs and profitability. For instance, the U.S. Bureau of Labor Statistics reported a median hourly wage for childcare workers of $15.14 in May 2023, a figure that is likely to continue rising due to demand and legislative changes.

The company's ability to effectively pass these escalating labor expenses onto its corporate clients will be a critical determinant in maintaining healthy profit margins. A significant portion of Bright Horizons' revenue comes from employer-sponsored childcare programs, making client relationships and contract negotiations paramount in absorbing these cost increases.

- Staffing Shortages: Difficulty in recruiting and retaining qualified early childhood educators remains a significant operational challenge.

- Wage Inflation: Rising minimum wage laws and competitive market pressures are driving up compensation costs for employees.

- Client Cost Absorption: The capacity to transfer increased labor expenses to corporate clients through pricing adjustments is vital for margin protection.

Political Volatility Affecting Childcare Policies

Political volatility presents a significant threat, as potential shifts in administration could lead to the reversal or delay of current pro-childcare policies and tax credits. These incentives, which often support employer-sponsored childcare programs like those offered by Bright Horizons, are crucial for maintaining demand and a favorable market environment.

For instance, changes in federal or state administrations could impact the continuation of the Child and Dependent Care Credit, a vital tax benefit for many families utilizing employer-subsidized childcare. In 2023, this credit allowed families to deduct a significant portion of childcare expenses, a benefit that could be altered by new legislative priorities.

The uncertainty stemming from election cycles and potential policy changes can create a less predictable operating landscape for companies like Bright Horizons. This instability might affect long-term investment decisions and the overall growth trajectory of the employer-sponsored childcare sector.

- Policy Reversal Risk: Future administrations may reduce or eliminate tax credits and subsidies that currently bolster employer-sponsored childcare, directly impacting Bright Horizons' service demand.

- Market Uncertainty: Political instability can create an unpredictable market, potentially deterring businesses from investing in or expanding childcare benefits for their employees.

- Regulatory Changes: Shifts in political power can lead to new regulations affecting childcare providers, potentially increasing compliance costs or altering operational standards for Bright Horizons.

Intensifying competition from various childcare providers, including national chains and local centers, poses a threat to Bright Horizons' market share and pricing power. Additionally, evolving government regulations, while intended to improve quality, can create funding gaps and increase operational costs for providers, potentially impacting affordability for families.

Labor market challenges, such as persistent staffing shortages and rising wage mandates, directly affect operating costs and profitability. For instance, the U.S. Bureau of Labor Statistics reported that the median hourly wage for childcare workers was $15.14 in May 2023, a figure likely to increase further due to demand and potential legislative changes in 2024-2025.

| Threat Category | Specific Challenge | Impact on Bright Horizons | Supporting Data/Trend |

|---|---|---|---|

| Competition | Increased competition from national chains and local centers | Pressure on pricing, potential loss of market share | Growth in the number of licensed childcare facilities nationwide. |

| Regulatory Environment | Evolving regulations and potential funding gaps | Increased compliance costs, potential impact on service fees | Changes in state-specific childcare licensing requirements and subsidy programs. |

| Labor Market | Staffing shortages and wage inflation | Higher operating costs, challenges in service delivery | Projected increase in demand for early childhood educators, with wage growth expectations. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a comprehensive review of Bright Horizons' financial reports, industry-specific market research, and insights from educational sector experts. These sources provide a robust foundation for understanding the company's internal capabilities and external market positioning.