Bright Horizons Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bright Horizons Bundle

Bright Horizons faces moderate rivalry from other childcare providers, with differentiation playing a key role in their competitive landscape.

The threat of new entrants is somewhat limited by capital requirements and brand reputation, but the industry's attractiveness could draw new players.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bright Horizons’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The market for qualified early childhood educators is becoming increasingly concentrated, giving labor suppliers significant bargaining power. This scarcity means providers like Bright Horizons face intense competition for skilled staff. In 2024, reports indicated a national shortage of childcare workers, with some states experiencing over 20% vacancy rates for open positions, a trend expected to persist into 2025.

This tight labor market allows educators to demand higher wages and improved benefits, directly increasing Bright Horizons' operational expenses. The ability to attract and retain experienced professionals is a critical challenge, as higher labor costs can impact the company's profitability and its ability to maintain service quality.

Suppliers of specialized real estate and facility equipment for childcare centers, particularly in desirable urban and suburban areas, can exert considerable bargaining power. This is due to the high costs associated with acquiring or leasing properties that adhere to strict safety and educational regulations, as well as the significant investment required for facility development.

For instance, in 2024, the average cost to build a new childcare center could range from $500,000 to over $1 million, depending on location and size. This substantial capital outlay for specialized facilities means that landlords or equipment providers can command higher prices, directly impacting Bright Horizons' expansion plans and overall operating expenditures.

Bright Horizons leverages its internal curriculum development, but also partners with external educational content and curriculum providers. If these partners offer highly specialized or in-demand programs that are difficult to replicate, they could have some leverage. For instance, a provider of a unique early literacy program might command better terms.

However, the presence of numerous alternative providers in the educational sector, coupled with Bright Horizons' robust in-house curriculum design capabilities, significantly dilutes this supplier power. The company's ability to develop its own content means it is not overly reliant on any single external provider, thereby maintaining a strong negotiating position.

Food and General Supply Vendors

The bargaining power of food and general supply vendors for Bright Horizons is generally low. This is primarily because the markets for these essential goods are quite fragmented, meaning there are many suppliers available. Bright Horizons, as a large operator, can significantly leverage its substantial purchasing volume to negotiate more favorable pricing and terms with these vendors.

Bright Horizons' considerable scale in procurement allows for the realization of economies of scale. This means the company can reduce its per-unit costs for items like food, cleaning supplies, and other operational materials. For example, in 2024, large childcare providers like Bright Horizons were able to secure bulk discounts on essential supplies, with some reports indicating potential savings of 5-10% on recurring operational expenditures compared to smaller, independent centers.

- Fragmented Supplier Market: Numerous vendors offer food, cleaning supplies, and general operational materials, limiting individual supplier leverage.

- Purchasing Volume Advantage: Bright Horizons' large-scale operations enable significant negotiation power due to high order volumes.

- Economies of Scale: Bulk purchasing translates to lower per-unit costs, enhancing cost efficiency for the company.

- Favorable Terms: The company's size allows it to dictate terms and secure advantageous agreements with suppliers.

Technology and Software Providers

The bargaining power of technology and software providers for childcare management and digital learning is generally moderate for companies like Bright Horizons. The increasing availability of diverse solutions means that no single provider holds excessive sway. Bright Horizons' own integration of these tools also indicates that switching costs, while present, are manageable for a large enterprise, preventing suppliers from dictating terms too aggressively.

For instance, the global market for childcare management software was estimated to be around $2.5 billion in 2023 and is projected to grow significantly. This expansion fuels competition among providers, diluting the individual power of any single supplier. Bright Horizons, as a major player, can leverage this competitive landscape to negotiate favorable terms.

- Moderate Supplier Power: The growing number of childcare technology vendors limits the leverage of any single provider.

- Manageable Switching Costs: For large organizations like Bright Horizons, the effort and expense to change software providers are not prohibitive.

- Market Growth Fuels Competition: The expanding market for childcare software encourages new entrants and innovation, benefiting buyers.

- Strategic Adoption: Bright Horizons' proactive integration of technology further strengthens its position in negotiating with software suppliers.

The bargaining power of suppliers for Bright Horizons is a mixed bag, with labor being the most significant factor. The scarcity of qualified early childhood educators in 2024, with some states reporting over 20% vacancy rates, grants these professionals considerable leverage, driving up wage demands and impacting operational costs. While specialized real estate and curriculum providers can also exert influence, Bright Horizons' scale and in-house capabilities mitigate much of this power, particularly for general supplies where fragmented markets and bulk purchasing discounts are key advantages.

| Supplier Type | Bargaining Power | Key Factors | 2024/2025 Data Points |

|---|---|---|---|

| Labor (Educators) | High | Scarcity of qualified staff, high demand | National childcare worker shortage; 20%+ vacancy rates in some states |

| Real Estate/Facilities | Moderate to High | High capital costs for specialized centers, location desirability | New center construction costs: $500K - $1M+ |

| Curriculum Providers | Low to Moderate | Availability of alternatives, in-house development capabilities | N/A (dependent on specific program uniqueness) |

| Food & General Supplies | Low | Fragmented market, high purchasing volume | Bulk discounts of 5-10% on operational expenditures |

| Technology & Software | Moderate | Growing market competition, manageable switching costs | Global childcare management software market: ~$2.5B (2023) |

What is included in the product

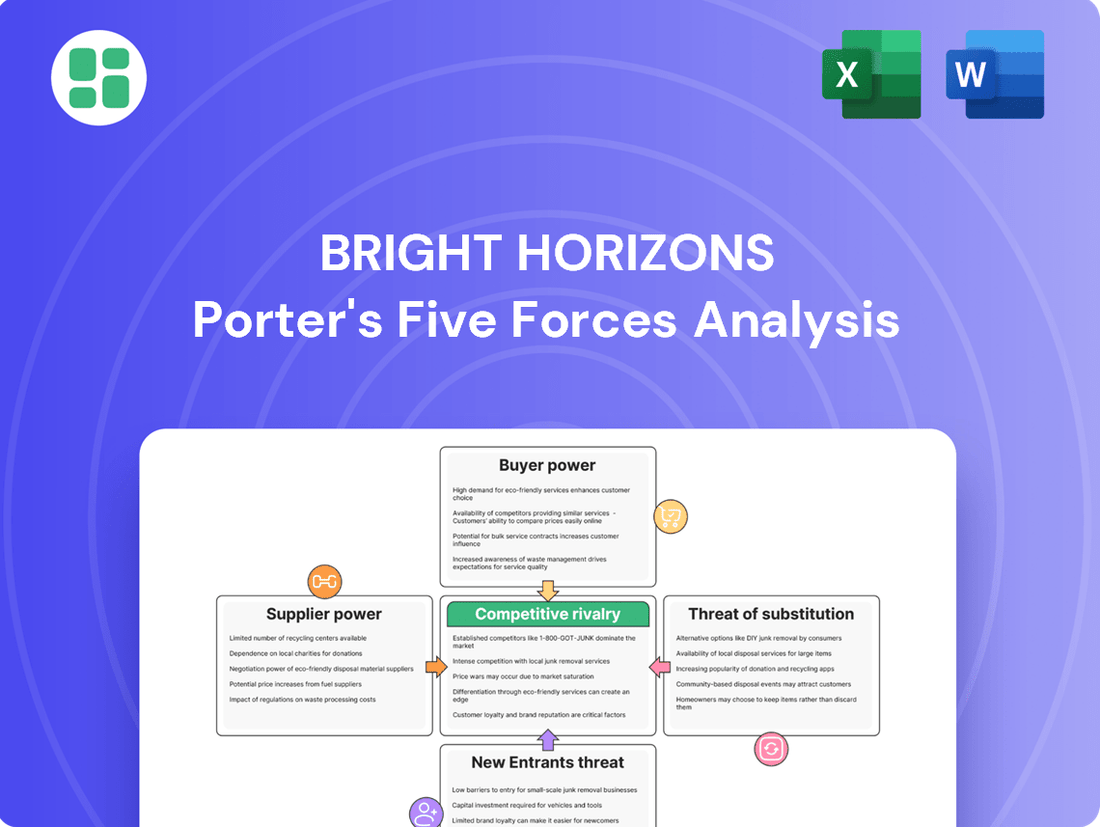

This analysis dissects the competitive landscape for Bright Horizons by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the risk of substitute products.

Instantly identify and mitigate competitive threats with a clear, visual breakdown of Porter's Five Forces, empowering strategic action.

Customers Bargaining Power

Bright Horizons' core clientele consists of large corporations that contract for its childcare and family support services. These significant clients wield substantial bargaining power due to the critical role these services play in their employee retention, recruitment, and overall productivity strategies.

These employers often view Bright Horizons' offerings as a strategic investment, seeking a demonstrable return on investment. The sheer volume of their contracts enables them to negotiate favorable terms, pricing structures, and specific service level agreements, directly impacting Bright Horizons' profitability.

Bright Horizons’ customer base is remarkably spread out, meaning no single client holds significant sway. In 2023, for instance, not one customer contributed more than 1% to the company's revenue. This wide distribution significantly dilutes the bargaining power of individual customers.

Furthermore, the top ten clients combined accounted for a mere 8% of Bright Horizons' total revenue in 2023. This low concentration among even its largest clients underscores the limited ability of any one customer to demand preferential terms or pricing, thereby strengthening Bright Horizons' position.

This customer diversification isn't just about numbers; it spans various industries. This broad reach across different sectors adds a layer of resilience, making the business less vulnerable to downturns in any single industry, a key factor in managing customer power.

For employer clients, the cost and complexity of switching from a provider like Bright Horizons, particularly for on-site or near-site childcare centers, are substantial. This involves not just finding a new vendor but also managing the physical relocation or transition of existing facilities and staff, often requiring significant upfront investment and operational disruption.

The deep integration of Bright Horizons' services into employee benefits packages also acts as a significant barrier to switching. Employers have already invested in establishing these programs, making a change a complex undertaking that impacts employee satisfaction and retention efforts. This integration makes customers very "sticky."

In 2024, the demand for comprehensive employee benefits, including childcare solutions, remained high as companies competed for talent. Companies that had already partnered with established providers like Bright Horizons would likely face considerable financial penalties or operational hurdles to exit these agreements, reinforcing the high switching costs.

Indirect Influence of Families/Employees

While employers are the primary customers for Bright Horizons' childcare services, the satisfaction and needs of the families and employees using these services exert significant indirect influence. The demand for high-quality, reliable childcare from parents directly impacts employer decisions on which benefits to offer. For instance, in 2024, the ongoing challenge of high childcare costs for many families means employers are increasingly pressured to provide competitive childcare benefits to attract and retain talent.

This indirect pressure means that Bright Horizons' ability to meet the expectations of both parents and employees is crucial for maintaining its relationships with corporate clients. The perceived value of Bright Horizons' services allows them to implement tuition increases, as evidenced by their consistent revenue growth. For example, Bright Horizons reported a 10% increase in revenue for the first quarter of 2024, partly attributable to their strong market position and the value proposition they offer to families.

- Indirect Influence: Families and employees are key stakeholders whose satisfaction impacts employer choices regarding childcare benefits.

- Cost Sensitivity: High childcare costs for families can translate into employer pressure for better benefits packages.

- Value Perception: Bright Horizons' ability to implement tuition increases suggests a strong perceived value among its end-users.

- Revenue Impact: In Q1 2024, Bright Horizons saw a 10% revenue increase, reflecting the demand for their services and their pricing power.

Limited Threat of Backward Integration by Customers

The threat of customers integrating backward to provide their own childcare services is minimal for Bright Horizons. While large corporations possess the financial capacity, the intricate operational demands, stringent licensing requirements, and the need for specialized pedagogical expertise create significant barriers to entry.

For instance, establishing and managing a high-quality early childhood education center involves navigating complex state and federal regulations, recruiting and retaining qualified educators, and developing age-appropriate curricula – tasks that are far removed from a typical company's core competencies.

Bright Horizons' established infrastructure, proven methodologies, and dedicated focus on child development offer a level of efficiency and quality that most organizations would find challenging and costly to replicate internally.

Consider that in 2024, the average cost for a company to establish and operate an on-site childcare facility can run into millions of dollars annually, encompassing real estate, staffing, curriculum development, and ongoing compliance, making outsourcing a more practical and cost-effective solution.

Bright Horizons' customer bargaining power is significantly mitigated by its highly diversified client base. In 2023, no single customer accounted for more than 1% of revenue, and the top ten clients represented only 8% of total revenue. This broad distribution across various industries limits any individual client's ability to dictate terms, as switching costs are substantial due to service integration and the complexity of managing childcare operations internally.

While corporate clients are the direct purchasers, the satisfaction of end-users—employees and their families—indirectly influences their decisions. The persistent demand for quality childcare in 2024, coupled with high family childcare costs, pressures employers to retain effective benefit providers. Bright Horizons' ability to implement tuition increases, reflected in a 10% revenue jump in Q1 2024, demonstrates strong perceived value, further diminishing customer leverage.

| Metric | 2023 Data | 2024 (Q1) Data |

|---|---|---|

| Largest Customer Revenue Share | < 1% | < 1% |

| Top 10 Customers Revenue Share | 8% | N/A (Trend continues) |

| Revenue Growth | N/A | 10% |

Preview the Actual Deliverable

Bright Horizons Porter's Five Forces Analysis

This preview showcases the complete Bright Horizons Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape within the early childhood education sector. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The center-based childcare market is quite fragmented, with a mix of small, local operations and larger, established companies. This means Bright Horizons, while a major player, constantly contends with a wide array of competitors, from neighborhood centers to national brands.

Bright Horizons distinguishes itself by focusing on employer-sponsored childcare, a segment where it holds a dominant position. However, it still faces significant competition from other large providers such as KinderCare Education LLC and Learning Care Group, which also operate numerous centers across the country.

In 2023, the US childcare market was valued at approximately $60 billion, highlighting the substantial size of the industry. Bright Horizons, as the largest provider in the employer-sponsored niche, likely captured a significant portion of this market, but the sheer number of other providers underscores the intense rivalry.

Competitive rivalry within the early childhood education and care sector is fierce, particularly concerning quality, safety, and educational outcomes. These factors are non-negotiable for both corporate partners seeking reliable employee benefits and parents entrusting their children's development.

Bright Horizons leverages its established brand reputation and unwavering dedication to high-quality care and innovative educational programs as a key differentiator. This focus on excellence allows them to command a premium and build strong loyalty in a crowded market.

In 2024, the demand for high-quality childcare solutions remained robust, with many employers recognizing its impact on employee retention and productivity. Bright Horizons' continued investment in its curriculum and staff development, evidenced by their ongoing professional training initiatives, reinforces their position as a trusted provider.

Bright Horizons stands out by offering a broad range of services, not just childcare. They also provide crucial back-up care and educational consulting, creating a diversified portfolio that lessens direct competition on price for their core childcare offerings.

This strategy allows them to leverage their existing client relationships. By cross-selling these varied services, Bright Horizons builds stronger client loyalty and reduces the intense pressure of competing solely on the cost of childcare.

Growth in Employer-Sponsored Benefits

The growing employer focus on childcare as a vital employee benefit is significantly boosting demand throughout the sector. This trend can actually ease competitive rivalry by expanding the total market size, making it less of a zero-sum game. For established providers like Bright Horizons, this translates into more opportunities for expansion and capturing new clients.

This shift in employer priorities is a key driver for the industry. For instance, in 2024, a significant percentage of companies are actively reviewing or enhancing their family-friendly benefits packages, with childcare support frequently at the top of the list. This widespread adoption means that while competition exists, the overall pie is getting larger, benefiting those who can effectively meet this demand.

- Increased Employer Investment: Many companies are allocating larger budgets to childcare benefits in 2024, recognizing its impact on employee retention and productivity.

- Market Expansion: The rising demand for employer-sponsored childcare services is creating a more expansive market, potentially diluting the intensity of direct competition among providers.

- Growth Opportunities: Established players like Bright Horizons are well-positioned to capitalize on this trend, as employers increasingly seek reliable and high-quality childcare solutions.

Labor Market Challenges

The competition for skilled educators and caregivers is a significant factor impacting the early childhood education and care sector. This industry-wide challenge of recruiting and retaining qualified staff intensifies rivalry as companies vie for a limited talent pool, driving up labor costs and impacting service quality.

Bright Horizons actively addresses this by investing in robust workforce development and retention programs. This strategic focus on its employees serves as a key differentiator, helping to mitigate the intense competitive pressure stemming from labor market shortages.

- Talent Scarcity: The U.S. Bureau of Labor Statistics projected a 6.7% growth for childcare workers from 2022 to 2032, indicating a continued demand that outpaces supply.

- Retention Efforts: Bright Horizons' commitment to competitive compensation, benefits, and professional development opportunities is crucial for retaining its workforce, a common challenge across the industry.

- Competitive Edge: By prioritizing employee well-being and career advancement, Bright Horizons aims to build a more stable and experienced team, setting it apart from competitors struggling with high turnover.

Competitive rivalry in the childcare sector is intense due to market fragmentation and the critical importance of quality and safety. Bright Horizons, despite its leadership in employer-sponsored care, faces strong competition from national players like KinderCare and Learning Care Group. The overall US childcare market was valued at approximately $60 billion in 2023, indicating a large but highly contested space.

Bright Horizons differentiates itself through its focus on employer partnerships, offering a broader suite of services beyond basic childcare, such as backup care and educational consulting. This diversified approach helps mitigate direct price competition. Furthermore, the growing recognition of childcare as a key employee benefit in 2024, with many companies enhancing their family-friendly packages, is expanding the market and creating growth opportunities for established providers.

The competition for qualified educators is a significant challenge, intensifying rivalry as companies vie for a limited talent pool, impacting labor costs and service quality. Bright Horizons addresses this by investing in workforce development and retention programs, aiming to build a stable and experienced team, which is a critical differentiator in a sector facing talent scarcity.

| Competitor | Market Segment Focus | Key Differentiators |

|---|---|---|

| Bright Horizons | Employer-sponsored childcare, backup care, educational consulting | High-quality care, innovation, employer partnerships, diversified services |

| KinderCare Education LLC | Center-based childcare, early education | National presence, established brand, curriculum programs |

| Learning Care Group | Center-based childcare, early education | Multiple brands (e.g., La Petite Academy, Primrose Schools), broad geographic reach |

SSubstitutes Threaten

Families often consider in-home care, like nannies or au pairs, as alternatives to traditional childcare centers. These arrangements can provide a highly personalized experience and greater flexibility, appealing to parents seeking tailored attention for their children. For instance, a 2024 survey indicated that approximately 25% of parents considered nannies as a primary childcare option.

While in-home care offers individualized attention, it typically lacks the structured educational programs and social development opportunities found in professional childcare settings. This makes it a less direct substitute for parents prioritizing early childhood education and peer interaction, as observed in the continued growth of the early education sector.

Numerous independent, non-corporate daycare centers operate within local communities, presenting a direct substitute for Bright Horizons' offerings. These smaller centers often compete by providing more accessible price points or fostering strong local community connections.

While these local alternatives may appeal to budget-conscious families, they frequently fall short in offering the extensive scale, established corporate partnerships, and holistic work-life balance solutions that are hallmarks of Bright Horizons' integrated model.

For instance, while a local independent center might charge $1,500 per month in a given area, Bright Horizons' comprehensive package, including employer subsidies and additional family support services, could represent a different value proposition for working parents, even at a potentially higher direct cost.

Employers offering direct financial assistance, such as childcare stipends or lifestyle spending accounts, present a significant substitute threat to full-service providers like Bright Horizons. This approach grants employees more autonomy in selecting care arrangements, bypassing the need for a contracted service. For instance, a 2024 survey indicated that 45% of companies were either considering or actively implementing such flexible benefit programs to enhance employee well-being.

Flexible Work Arrangements

The rise of flexible work arrangements, particularly remote and hybrid models, presents a significant threat of substitutes for center-based childcare services like Bright Horizons. As more parents work from home, even part-time, they can often cover childcare needs themselves, reducing the demand for full-day or regular part-day care. This shift fundamentally alters the traditional need for external childcare solutions.

In 2024, the adoption of flexible work continues to be a dominant trend. A significant percentage of the workforce now operates under hybrid or fully remote structures. For instance, surveys indicate that a substantial portion of companies plan to maintain hybrid models long-term, meaning parents have increased opportunities for self-managed childcare during the week.

- Increased Parental Availability: Flexible schedules allow parents to directly supervise their children for portions of the day, lessening reliance on external care providers.

- Cost Savings for Parents: Opting for self-care instead of full-time daycare translates to direct cost savings for families, making it an attractive alternative.

- Shifting Demand Patterns: The demand for full-time, five-day-a-week childcare may decrease, while demand for more flexible, on-demand, or part-time care options could potentially rise.

- Technological Enablement: Advancements in communication and collaboration tools further support remote work, solidifying the viability of flexible arrangements for a larger segment of the workforce.

School-Age Programs and Camps

For school-age children, a variety of programs and services can substitute for Bright Horizons' offerings. These include traditional after-school care, specialized summer camps, and academic tutoring. For instance, in 2024, the market for supplemental education services, which encompasses tutoring, was projected to reach over $140 billion globally, indicating a significant competitive landscape.

Bright Horizons actively addresses this threat by expanding its own portfolio. The company's acquisition of Sittercity, a platform connecting families with caregivers and sitters, directly competes with independent childcare providers. Furthermore, Bright Horizons offers its own school-age camps and tutoring services, aiming to retain families within its ecosystem and capture demand that might otherwise be met by external substitutes.

- After-school programs provide structured activities and supervision for children after school hours.

- Summer camps offer enrichment and recreational opportunities during school breaks.

- Tutoring services focus on academic support and skill development.

- Bright Horizons' acquisition of Sittercity in 2021 for $200 million aimed to strengthen its position against these substitutes.

The threat of substitutes for Bright Horizons stems from various alternatives parents consider for childcare and early education. These range from in-home care providers like nannies and au pairs to independent, local daycare centers, and even employer-provided flexible benefits. The rise of remote work further amplifies this threat, as parents may be able to manage childcare themselves.

In-home care, while offering personalization, often lacks the structured educational component of centers, making it a less direct substitute for education-focused parents. Local centers compete on price and community ties, but may not match Bright Horizons' scale or corporate partnerships. Employer stipends and flexible work arrangements are growing substitutes, with 45% of companies considering or implementing flexible benefits in 2024, and hybrid work becoming a norm.

For school-age children, after-school programs, summer camps, and tutoring services are key substitutes. The supplemental education market was projected to exceed $140 billion globally in 2024. Bright Horizons counters this by acquiring Sittercity and expanding its own supplementary services.

| Substitute Type | Key Features | Bright Horizons' Counter-Strategy | Market Data Point (2024) |

|---|---|---|---|

| In-Home Care (Nannies/Au Pairs) | Personalized attention, flexibility | Acquisition of Sittercity | 25% of parents considered nannies a primary option. |

| Independent Daycares | Lower price points, local focus | Focus on scale, corporate partnerships, holistic model | Varies by local market pricing (e.g., $1,500/month average). |

| Employer Benefits (Stipends) | Parental autonomy in choice | Integrated corporate partnerships | 45% of companies considering/implementing flexible benefits. |

| Flexible Work Arrangements | Parental self-care during work hours | N/A (market shift) | High adoption of hybrid/remote work models. |

| School-Age Programs (Camps, Tutoring) | Enrichment, academic support | Expansion of own programs, Sittercity | Supplemental education market projected over $140 billion globally. |

Entrants Threaten

Establishing and operating high-quality childcare centers, particularly employer-sponsored ones, demands significant upfront capital. This includes substantial investments in suitable facilities, age-appropriate equipment, and qualified, well-compensated staff. For instance, building a new, state-of-the-art childcare center can easily cost millions of dollars, with ongoing fixed costs for rent, utilities, and maintenance adding to the financial burden.

These considerable financial barriers act as a potent deterrent for many potential new entrants looking to enter the childcare market and compete directly with established providers like Bright Horizons. The sheer scale of the initial investment and the ongoing operational expenses make it difficult for smaller, less-capitalized businesses to gain a foothold.

The childcare sector faces substantial barriers to entry due to a complex web of regulations. These requirements, spanning local, state, and federal levels, dictate everything from staff-to-child ratios to facility safety standards. For instance, in 2024, many states continued to update their licensing criteria, often increasing the educational prerequisites for childcare providers, making it harder for new businesses to comply without significant investment in qualified personnel and infrastructure.

The childcare industry, and specifically companies like Bright Horizons, thrives on an established brand reputation built on trust and perceived quality. Families entrust their children to these centers, making safety, educational programs, and staff reliability paramount. Building this level of confidence is a long-term endeavor, often taking years of consistent, high-quality service delivery.

Bright Horizons, for instance, has cultivated a strong brand identity over decades, recognized by employers and parents alike for its commitment to excellence. This deep-seated trust acts as a significant barrier to entry for newcomers. New entrants find it challenging to quickly replicate the years of positive experiences and word-of-mouth referrals that solidify an established brand's position.

In 2024, the demand for high-quality childcare remained robust, with many markets experiencing shortages. This environment favors established players like Bright Horizons, whose reputation allows them to command premium pricing and maintain strong occupancy rates. New entrants would face the uphill battle of not only offering competitive services but also convincing parents and corporate clients to switch from trusted, proven providers.

Challenges in Securing Corporate Partnerships

The threat of new entrants in the corporate childcare sector, specifically concerning Bright Horizons, is significantly mitigated by the inherent difficulty in replicating its established network of corporate partnerships. These relationships are not easily formed; they require a proven track record of reliability, extensive service offerings, and often, multi-year commitments. For instance, Bright Horizons' business model thrives on long-standing contracts with major employers, many of whom are Fortune 500 companies. A new player would struggle to gain access to these key accounts, as trust and established service delivery are paramount.

Securing these critical corporate partnerships presents a substantial barrier. New entrants must demonstrate not only competitive pricing but also a capacity to meet the complex needs and high standards of large organizations. This often translates to significant upfront investment in infrastructure, staffing, and compliance, making the initial scaling of operations particularly challenging. The loyalty built over years of dependable service makes it difficult for newcomers to displace incumbent providers like Bright Horizons.

Consider the following factors that underscore this challenge:

- High Switching Costs for Employers: Employers often incur significant costs and disruptions when changing childcare providers, including administrative overhead, employee communication, and potential impacts on employee morale.

- Reputational Hurdles: New entrants must build a strong reputation for quality, safety, and reliability, which takes considerable time and consistent performance in a sector where trust is paramount.

- Scale and Geographic Presence: Bright Horizons operates a vast network of centers, enabling it to offer comprehensive solutions to national employers. New entrants often begin with a more limited geographic footprint, making it harder to compete for large, multi-location contracts.

- Regulatory and Compliance Expertise: Navigating the intricate web of childcare regulations and compliance requirements across different jurisdictions demands specialized knowledge and resources that new entrants may lack initially.

Economies of Scale and Operational Expertise

Bright Horizons leverages significant economies of scale, operating over 1,000 centers worldwide and offering a broad range of services. This extensive network translates into operational efficiencies and cost advantages that new competitors find challenging to match.

The company's established operational expertise, honed over years of managing a large, complex organization, creates a high barrier to entry. This expertise allows for optimized resource allocation and service delivery, further solidifying its competitive moat.

- Economies of Scale: Over 1,000 centers globally.

- Diversified Services: Broad range of childcare and education offerings.

- Operational Efficiencies: Cost advantages from large-scale operations.

- Expertise Barrier: Deep knowledge in managing childcare operations.

The threat of new entrants for Bright Horizons is considerably low due to substantial capital requirements for establishing high-quality childcare facilities and the complex regulatory landscape. Significant upfront investments in infrastructure, equipment, and qualified staff, coupled with stringent licensing and compliance demands that evolve annually, create formidable barriers. For instance, in 2024, many states continued to raise educational prerequisites for childcare providers, increasing the cost for newcomers to meet these standards.

Bright Horizons' established brand reputation, built on years of trust and consistent quality, further deters new entrants. Families and employers prioritize safety and reliability, making it difficult for new businesses to quickly gain the necessary confidence and referrals. This deep-seated trust, cultivated over decades, is a significant hurdle for any competitor attempting to displace incumbent providers.

The difficulty in replicating Bright Horizons' extensive network of corporate partnerships also acts as a major deterrent. These relationships are built on proven track records and multi-year commitments, which new entrants struggle to secure. High switching costs for employers and the need to build a strong reputation for quality and safety over time make it challenging for new players to gain market share.

Bright Horizons benefits from significant economies of scale, operating over 1,000 centers globally and offering diversified services. This scale leads to operational efficiencies and cost advantages that are difficult for new entrants to match, further solidifying its competitive position.

| Barrier Type | Description | Impact on New Entrants | Relevance to Bright Horizons |

|---|---|---|---|

| Capital Requirements | High upfront costs for facilities, equipment, and staff. | Significant financial hurdle, limiting the number of potential entrants. | Bright Horizons has already made these investments, creating a cost advantage. |

| Regulation & Compliance | Complex, evolving local, state, and federal requirements. | Demands specialized knowledge and resources, increasing operational complexity. | Bright Horizons possesses established expertise in navigating these regulations. |

| Brand Reputation & Trust | Long-term cultivation of confidence in quality and safety. | New entrants face challenges in quickly building credibility. | Bright Horizons enjoys strong brand loyalty from parents and employers. |

| Corporate Partnerships | Established relationships with major employers. | Difficult for new entrants to access key corporate accounts. | Bright Horizons' long-standing contracts provide a stable revenue base. |

| Economies of Scale | Operational efficiencies from a large network of centers. | New entrants struggle to achieve comparable cost advantages. | Bright Horizons' global presence enables significant cost savings. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bright Horizons leverages data from their annual reports, investor presentations, and competitor financial statements. We also incorporate insights from industry-specific market research reports and publications focused on the early childhood education and care sector.