Bowman Consulting Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bowman Consulting Group Bundle

Bowman Consulting Group boasts strong technical expertise and a solid reputation, but faces challenges in market diversification and intense competition. Understanding these internal capabilities and external pressures is crucial for strategic growth.

Want the full story behind Bowman Consulting Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Bowman Consulting Group boasts a comprehensive service portfolio, encompassing planning, engineering, construction management, surveying, land procurement, and environmental consulting. This extensive range allows them to support clients from initial concept through to project completion, minimizing the need for external specialists and offering integrated solutions for intricate infrastructure needs.

Bowman Consulting Group's strength lies in its broad client base, serving both public and private sectors. This diversification across various regulated end markets significantly reduces the risk tied to downturns in any single industry. For instance, their work with federal agencies on infrastructure projects can offset slower periods in the private development market, providing a more stable revenue stream.

This balanced approach allows Bowman to capitalize on different economic cycles. While private development might be sensitive to interest rate changes, public infrastructure spending, often driven by multi-year government programs, offers a more predictable revenue source. Their client roster includes major national homebuilders and key federal government entities, showcasing this dual-sector reach.

Bowman Consulting Group actively pursues strategic acquisitions of smaller, specialized firms. This approach has demonstrably broadened their service portfolio, extended their geographic footprint, and enriched their talent base.

In 2024 alone, Bowman successfully integrated eight acquisitions, which collectively added roughly $60 million in run-rate net service billing. This momentum carried into 2025 with the acquisition of e3i Engineers, specifically to bolster their data center design expertise.

This consistent mergers and acquisitions strategy is a fundamental element fueling Bowman's expansion and strengthening its position within the market.

Strong Financial Performance and Backlog Growth

Bowman Consulting Group has showcased impressive financial momentum, with Q4 2024 and Q1 2025 reporting substantial growth in gross contract revenue and net service billing. The company achieved a net income of $3.0 million for the entirety of 2024, a significant turnaround from prior losses.

Furthermore, Bowman secured record new order bookings in Q1 2025, bolstering its gross backlog to $547.4 million as of March 31, 2025. This upward trend in backlog signals strong market demand and effective project pipeline management.

- Record Backlog Growth: Gross backlog reached $547.4 million by the end of Q1 2025.

- Profitability Turnaround: Achieved $3.0 million net income in 2024, reversing previous losses.

- Revenue Increases: Demonstrated significant growth in gross contract revenue and net service billing in recent quarters.

- Strong Order Bookings: Q1 2025 saw record new order bookings, indicating robust demand.

Expertise in High-Demand Sectors

Bowman Consulting Group's deep expertise is a significant strength, particularly its alignment with critical, high-demand infrastructure sectors. This includes areas like transportation, renewable energy, energy transmission, and the rapidly growing data center market. Their strategic focus on these growth engines positions them to benefit from substantial ongoing investment and development.

The company's specialization in these areas is not just theoretical; it's backed by tangible project wins. For instance, Bowman has secured notable contracts for aerial lidar services, a technology crucial for detailed infrastructure mapping and analysis, and for vital water system upgrades. These projects demonstrate their ability to translate expertise into real-world application and revenue generation.

This targeted approach enhances Bowman's competitive advantage. By concentrating on sectors with sustained demand and significant capital allocation, they are building a robust pipeline of future opportunities. This specialization is key to their long-term growth and market position.

Key areas of Bowman's expertise include:

- Transportation Infrastructure: Projects supporting road, bridge, and transit development.

- Renewable Energy: Services for solar, wind, and other clean energy installations.

- Energy Transmission: Expertise in power grid upgrades and new transmission lines.

- Data Centers: Providing engineering and consulting for critical digital infrastructure.

Bowman Consulting Group's comprehensive service offering is a significant strength, covering planning, engineering, construction management, surveying, land procurement, and environmental consulting. This end-to-end capability allows them to manage complex projects efficiently, reducing reliance on external vendors and providing integrated solutions for clients.

The company's diversified client base, spanning both public and private sectors, provides a stable revenue foundation. This broad market reach, including work with federal agencies and major homebuilders, mitigates risks associated with downturns in any single industry, ensuring more consistent financial performance.

Bowman's strategic focus on high-growth infrastructure sectors like transportation, renewable energy, and data centers positions them for sustained expansion. Their demonstrated expertise in these areas, evidenced by securing contracts for lidar services and water system upgrades, translates directly into revenue and market share gains.

| Metric | Q1 2025 (as of March 31, 2025) | Full Year 2024 |

|---|---|---|

| Gross Backlog | $547.4 million | N/A |

| Net Income | N/A | $3.0 million |

| Acquisitions Integrated | 1 (e3i Engineers) | 8 |

| Acquisition Revenue Impact | N/A | ~$60 million (run-rate net service billing) |

What is included in the product

Analyzes Bowman Consulting Group’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and leverage strengths, mitigating weaknesses and capitalizing on opportunities for strategic growth.

Weaknesses

Bowman Consulting Group's reliance on skilled professionals makes its business model inherently labor-intensive. This means that expanding services or taking on larger projects often requires a direct, proportional increase in headcount, which can limit rapid scalability. For instance, in the professional services sector, revenue per employee is a key metric, and while Bowman aims for efficiency, this dependency can cap growth potential without significant investment in human capital.

The firm's dependence on its workforce also exposes it to the risks of talent acquisition and retention. A shortage of qualified engineers, surveyors, and project managers, a persistent challenge in the industry, can directly impact project timelines and profitability. Furthermore, rising wage expectations, especially in competitive markets, can put pressure on Bowman's margins, as employee compensation is a significant operational cost.

Bowman Consulting Group, despite its diversified client base, faces a significant weakness in its exposure to economic cycles. A downturn in the construction and real estate development sectors, which are key for the firm, can directly impact its revenue streams.

For instance, while infrastructure projects might offer some stability, a general slowdown in construction spending, as anticipated for 2025, could lead to a reduced project pipeline. This sensitivity to macroeconomic conditions presents a persistent risk to the company's financial performance.

Bowman Consulting Group operates in a highly fragmented market, facing intense competition from both large, established engineering firms and nimble, specialized consultancies. This crowded field often leads to significant pricing pressure, as clients seek the most cost-effective solutions. For instance, the broader A/E/C (Architecture/Engineering/Construction) industry, which Bowman serves, experienced an average bid-to-award ratio that can fluctuate significantly based on project type and economic conditions, impacting Bowman's ability to secure lucrative contracts without compromising margins. This necessitates continuous investment in differentiating services, whether through advanced technology adoption or cultivating deep expertise in niche sectors, to stand out and maintain profitability.

Integration Challenges from Acquisitions

While Bowman Consulting Group's acquisition strategy fuels growth, integrating multiple new entities, including eight in 2024 and ongoing efforts into 2025, presents significant hurdles. These challenges stem from aligning diverse company cultures, realizing anticipated operational synergies, and retaining crucial talent post-acquisition. Failure to manage these integration complexities effectively could impede efficiency and impact profitability.

The successful assimilation of acquired businesses requires substantial management bandwidth. For instance, if integration timelines are extended or synergy targets are missed, it could lead to:

- Increased operational costs: Overlapping functions or inefficient processes can inflate expenses.

- Reduced employee morale: Uncertainty and cultural clashes can lead to key personnel departures.

- Slower realization of revenue growth: Disruption to sales and client relationships can delay expected benefits.

Dependency on Key Personnel and Talent Shortage

Bowman Consulting Group's reliance on its core engineering and project management talent is a significant vulnerability. The firm's project execution and client relationships are deeply intertwined with the skills and experience of these individuals.

The broader civil engineering and construction sectors are grappling with a pronounced talent deficit. This industry-wide challenge, exacerbated by an aging workforce, makes it difficult to recruit and retain the skilled professionals Bowman needs to maintain its project pipeline and pursue expansion opportunities.

This dependency on key personnel, coupled with the industry-wide talent shortage, poses a substantial risk to Bowman's operational capacity and its potential for organic growth. For instance, the U.S. Bureau of Labor Statistics projected a 5% growth in civil engineering jobs between 2022 and 2032, a rate slower than the average for all occupations, highlighting the competitive landscape for talent.

- Key Personnel Dependency: Success hinges on specialized expertise of engineers and project managers.

- Industry Talent Shortage: Difficulty in finding and retaining skilled workers across civil engineering and construction.

- Aging Workforce: A contributing factor to the scarcity of experienced professionals.

- Growth Constraint: The talent gap can limit Bowman's ability to staff new projects and expand services.

Bowman Consulting Group's heavy reliance on its skilled engineering and project management talent is a significant weakness. The firm's operational capacity and ability to secure new projects are directly tied to the availability of these specialized professionals. This dependency is amplified by a widespread talent shortage in the civil engineering and construction sectors, with an aging workforce contributing to the scarcity of experienced individuals. For example, the U.S. Bureau of Labor Statistics projected only a 5% growth in civil engineering jobs between 2022 and 2032, indicating a competitive market for talent that could constrain Bowman's growth.

The firm's exposure to economic cycles, particularly downturns in construction and real estate development, represents another key vulnerability. A slowdown in these sectors, which are critical revenue drivers for Bowman, can directly impact its project pipeline and financial performance. For instance, if the anticipated slowdown in construction spending for 2025 materializes, it could reduce the number of available projects, affecting Bowman's revenue streams despite potential stability from infrastructure work.

Bowman operates within a highly competitive and fragmented market, facing pressure from both large established firms and smaller, specialized consultancies. This intense competition often leads to pricing challenges, as clients prioritize cost-effectiveness. The broader A/E/C industry, which Bowman serves, can experience fluctuating bid-to-award ratios, making it difficult for Bowman to secure profitable contracts without compromising margins. This necessitates ongoing investment in service differentiation to maintain a competitive edge.

The company's growth-by-acquisition strategy, while beneficial, introduces integration challenges. Assimilating multiple new entities, such as the eight acquired in 2024, requires substantial management focus. Difficulties in aligning company cultures, realizing operational synergies, and retaining key talent post-acquisition can lead to increased costs, reduced employee morale, and slower revenue growth, potentially hindering overall efficiency and profitability.

| Weakness Category | Specific Challenge | Impact | Industry Context/Data Point (2024-2025) |

|---|---|---|---|

| Talent Dependency | Reliance on specialized engineers and project managers | Limits scalability, project execution capacity | U.S. civil engineering job growth projected at 5% (2022-2032); aging workforce |

| Economic Sensitivity | Exposure to construction and real estate cycles | Reduced project pipeline, revenue volatility | Anticipated slowdown in construction spending in 2025 |

| Market Competition | Intense competition and pricing pressure | Difficulty securing profitable contracts, margin erosion | Fluctuating bid-to-award ratios in A/E/C sector |

| Integration Challenges | Assimilation of acquired companies | Increased costs, cultural clashes, talent retention issues | Eight acquisitions completed in 2024, ongoing integration in 2025 |

What You See Is What You Get

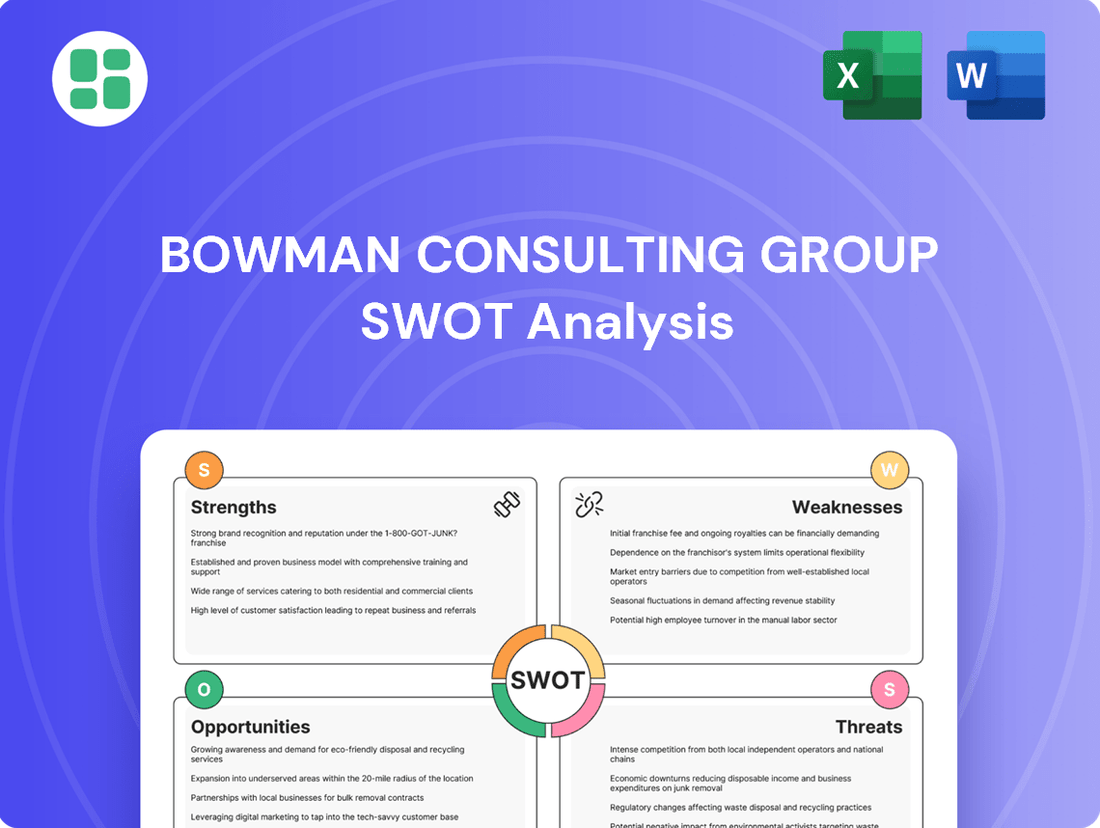

Bowman Consulting Group SWOT Analysis

This is the actual Bowman Consulting Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a clear overview of the company's Strengths, Weaknesses, Opportunities, and Threats. The preview you see is exactly what you'll download, ensuring you get the complete, detailed report.

Opportunities

Governments worldwide are channeling substantial funds into infrastructure development, a trend amplified by initiatives like the Bipartisan Infrastructure Investment and Jobs Act (IIJA) in the United States, which allocates billions to upgrade transportation networks and utilities. This global focus on modernization and economic stimulus creates a fertile ground for Bowman Consulting Group to expand its project pipeline.

Bowman is well-positioned to capitalize on this surge in infrastructure spending, particularly in sectors such as transportation, water management, and energy. The increasing demand for resilient and sustainable infrastructure solutions directly aligns with Bowman's expertise, promising significant revenue growth opportunities through new project acquisitions in 2024 and beyond.

The global push for sustainable and resilient infrastructure presents a significant opportunity for Bowman Consulting Group. With climate change concerns escalating, governments and private entities are prioritizing environmentally friendly projects. For instance, the U.S. government's Infrastructure Investment and Jobs Act, passed in 2021, allocated substantial funds towards climate-resilient infrastructure and clean energy initiatives, a trend expected to continue and expand through 2025.

Bowman's established environmental consulting services and planning expertise are well-positioned to leverage this demand. The company can offer specialized solutions in areas like green building design, renewable energy integration, and climate-adaptive infrastructure planning. This allows Bowman to tap into new and growing market segments focused on sustainability, potentially increasing project pipelines and revenue streams in the coming years.

Bowman Consulting Group can significantly boost efficiency and accuracy by adopting advanced technologies like Building Information Modeling (BIM), Geographic Information Systems (GIS), and AI in design. The firm's existing investments in technology tools and its innovation fund position it to capitalize on these advancements.

This technological edge allows Bowman to improve project outcomes and attract clients who prioritize forward-thinking solutions. For instance, the increasing adoption of digital twins in infrastructure projects by 2024 offers a tangible opportunity for Bowman to showcase its capabilities and secure new business.

Strategic Expansion into New Sectors/Geographies

Bowman Consulting Group can capitalize on growth by targeting new geographic markets with strong economic development or by entering rapidly expanding sectors. Focusing on areas like smart cities, digital infrastructure, and advanced manufacturing facilities presents significant opportunities for new revenue generation.

The acquisition of e3i Engineers, a firm with expertise in data centers, exemplifies Bowman's strategy to enter high-growth, technology-focused markets. This move positions them to benefit from the increasing demand for digital infrastructure. For instance, the global data center market was valued at approximately $200 billion in 2023 and is projected to grow substantially in the coming years, driven by cloud computing and AI advancements.

- Geographic Expansion: Identifying and penetrating emerging markets with robust infrastructure investment plans.

- Sector Diversification: Targeting high-growth sectors such as renewable energy, advanced manufacturing, and digital infrastructure.

- Acquisition Strategy: Continuing to acquire specialized firms like e3i Engineers to gain immediate market access and expertise in new areas.

- Smart City Integration: Leveraging existing capabilities to offer consulting services for smart city development projects, a market expected to see considerable investment in the next decade.

Outsourcing Trends in Engineering

The persistent shortage of skilled civil engineers, a challenge that intensified in 2024 and is projected to continue into 2025, is a significant driver for outsourcing. This scarcity compels many engineering firms to seek external expertise for specialized design tasks and project management assistance.

This shift creates a prime opportunity for companies like Bowman Consulting Group. By offering flexible, outsourced solutions, Bowman can provide crucial support to firms grappling with talent deficits, thereby enhancing their capacity to handle large-scale residential and commercial developments. This allows clients to improve project delivery timelines and manage costs more efficiently.

- Scalable Support: Bowman can provide on-demand engineering talent, allowing clients to scale their workforce without the long-term commitment of hiring.

- Improved Turnaround: Outsourcing specialized functions can significantly reduce project completion times, a critical factor in competitive markets.

- Cost-Effectiveness: Accessing specialized skills through outsourcing often proves more economical than building an in-house team for niche requirements.

- Focus on Core Competencies: By offloading non-core tasks, firms can concentrate their internal resources on strategic planning and client relationships.

The global infrastructure development boom, fueled by government spending and a focus on sustainability, presents a significant growth avenue for Bowman Consulting Group. The company is well-positioned to leverage its expertise in resilient and environmentally friendly solutions, aligning with initiatives like the U.S. Infrastructure Investment and Jobs Act, which continues to drive investment in transportation and utilities through 2025.

Bowman's strategic acquisitions, such as e3i Engineers, demonstrate a clear path to capitalize on burgeoning sectors like digital infrastructure and data centers, a market projected for substantial growth driven by AI and cloud computing. Furthermore, the ongoing shortage of skilled engineers globally creates a demand for outsourced expertise, allowing Bowman to offer scalable support and improve project turnaround times for clients.

| Opportunity Area | Description | Market Data/Projection (2024-2025) |

|---|---|---|

| Infrastructure Spending | Increased government investment in transportation, water, and energy projects. | U.S. Infrastructure Investment and Jobs Act (IIJA) continues to fund projects. Global infrastructure spending expected to rise. |

| Sustainable Solutions | Demand for green building, renewable energy integration, and climate-adaptive planning. | Growing emphasis on ESG factors in project selection. |

| Digital Infrastructure | Expansion in data centers, smart cities, and advanced manufacturing facilities. | Global data center market valued at ~$200 billion in 2023, with strong projected growth. |

| Outsourced Engineering Services | Addressing the shortage of skilled engineers by providing specialized design and project management. | Persistent engineer shortage in 2024-2025 driving demand for external expertise. |

Threats

Economic downturns pose a significant threat to Bowman Consulting Group. A substantial contraction in the economy or prolonged inflation could curb capital spending by public and private clients, directly diminishing demand for infrastructure projects. For instance, the U.S. Bureau of Economic Analysis reported a 1.4% decrease in real GDP in Q1 2024, signaling potential headwinds.

Market volatility further exacerbates these risks. While the engineering and construction sector often demonstrates resilience, forecasts suggest a slowdown in overall U.S. engineering and construction spending for 2025. This projected deceleration, as indicated by industry reports, could translate into fewer new contracts and increased project delays for Bowman Consulting Group.

The professional services sector is fiercely competitive, with established giants and specialized firms all chasing the same projects. This intense rivalry often forces companies like Bowman Consulting Group to lower their prices, which can squeeze profit margins, especially on routine services. For instance, a 2024 industry report indicated that average profit margins for mid-sized engineering consulting firms dipped by nearly 1.5% due to heightened bid competition.

This persistent pricing pressure makes it more challenging for Bowman to secure lucrative contracts and maintain healthy profitability. Winning bids, particularly for more standardized offerings, becomes an uphill battle where cost often outweighs perceived value, directly impacting Bowman's revenue growth potential.

Changes in environmental regulations, such as stricter carbon emission standards or new land use policies, could increase project development costs and lengthen approval timelines for Bowman Consulting Group. For instance, the U.S. Environmental Protection Agency (EPA) continues to refine regulations impacting stormwater management and wetland delineation, directly affecting the civil engineering projects Bowman undertakes.

New compliance requirements or shifts in permitting processes, particularly at state and local levels, pose a direct threat by potentially delaying or even halting projects. The increasing focus on sustainability and resilience in infrastructure planning, driven by climate change concerns, necessitates continuous adaptation and investment in new expertise for the firm to remain competitive.

Talent Shortage and Wage Inflation

Bowman Consulting Group faces a significant threat from a persistent shortage of skilled engineers, surveyors, and environmental consultants. This scarcity, combined with increasing wage demands, directly impacts operational costs and the ability to adequately staff projects. For instance, the U.S. Bureau of Labor Statistics projects a 4% growth in civil engineering jobs from 2022 to 2032, a rate that may not outpace demand in specialized areas. This talent gap can hinder project execution and potentially erode Bowman's competitive edge.

The rising cost of labor due to wage inflation presents a challenge to Bowman's profitability and project pricing strategies. Companies are increasingly competing for a limited pool of qualified professionals, driving up compensation expectations. This can strain project budgets and make it harder to secure profitable contracts if Bowman cannot effectively manage its talent acquisition and retention costs in a highly competitive market.

- Talent Scarcity: A critical lack of specialized engineering, surveying, and environmental expertise.

- Wage Inflation: Escalating salary expectations for in-demand professionals.

- Increased Operational Costs: Higher labor expenses impacting project profitability.

- Competitive Disadvantage: Difficulty attracting and retaining top talent compared to rivals.

Technological Disruption and Obsolescence

The consulting industry faces significant threats from rapid technological advancements, especially in artificial intelligence and automation. If Bowman Consulting Group doesn't effectively adopt these new technologies, their current service methods could become inefficient or even outdated.

A failure to consistently invest in and integrate cutting-edge tools puts the company at a competitive disadvantage. This could lead to a decline in demand for their traditional consulting services as clients seek more technologically advanced solutions.

- AI Integration: Companies like Accenture, a major competitor, are heavily investing in AI, with a stated goal of integrating AI into 80% of their client services by 2025. This highlights the pressure on firms like Bowman Consulting to keep pace.

- Automation Impact: Gartner predicted in 2023 that by 2025, 60% of IT service providers will be impacted by automation, potentially reducing the need for manual labor in certain consulting areas.

- Skills Gap: The rapid evolution of technology creates a skills gap. If Bowman Consulting cannot upskill its workforce or attract talent with expertise in AI, machine learning, and data analytics, its service offerings may become less relevant.

Intense competition and pricing pressure are significant threats, potentially squeezing Bowman's profit margins as firms may lower bids to secure projects. For instance, industry reports from 2024 indicated a nearly 1.5% dip in average profit margins for mid-sized engineering consulting firms due to heightened bid competition.

Stricter environmental regulations and evolving land use policies present another challenge, likely increasing project development costs and extending approval timelines for Bowman. The U.S. Environmental Protection Agency's ongoing refinement of stormwater management and wetland delineation rules directly impacts civil engineering projects.

A persistent shortage of skilled engineers and consultants, coupled with rising wage demands, directly impacts Bowman's operational costs and project staffing capabilities. The U.S. Bureau of Labor Statistics projects civil engineering job growth at 4% from 2022-2032, a rate that may not fully meet specialized demand, potentially hindering project execution.

Rapid technological advancements, particularly in AI and automation, pose a threat if Bowman fails to integrate them effectively, risking outdated service methods and a competitive disadvantage. Competitors like Accenture are heavily investing in AI, aiming to integrate it into 80% of client services by 2025, underscoring the need for Bowman to adapt.

SWOT Analysis Data Sources

This Bowman Consulting Group SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial reports, comprehensive market research, and insights from industry experts to ensure a thorough and actionable assessment.