Bowman Consulting Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bowman Consulting Group Bundle

Bowman Consulting Group navigates a competitive landscape shaped by significant buyer power and the constant threat of new entrants. Understanding these forces is crucial for strategic planning and identifying growth opportunities within the consulting sector.

The complete report reveals the real forces shaping Bowman Consulting Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bowman Consulting Group's reliance on specialized labor, such as highly skilled engineers, surveyors, and environmental consultants, positions these professionals as critical suppliers. The scarcity of these individuals directly impacts the firm's operational capacity and project execution.

The engineering and design services sector in 2024 continues to grapple with significant labor shortages and skills gaps, particularly for experienced professionals. This ongoing challenge amplifies the bargaining power of these specialized workers, as demand often outstrips available talent.

To secure and retain this vital expertise, Bowman Consulting, like many in its industry, must offer attractive compensation packages and robust benefits. Reports from industry surveys in late 2023 and early 2024 indicated average salary increases for engineering roles of 4-6% to combat attrition and attract new talent.

Advanced software and technology providers, such as those offering specialized CAD, BIM, geospatial imaging, AI-driven simulations, and project management tools, exert considerable bargaining power. These solutions are fundamental to Bowman Consulting Group's ability to deliver modern infrastructure projects with efficiency and precision.

The high degree of reliance on these sophisticated technologies translates into significant switching costs for Bowman. This dependency strengthens the suppliers' position, as transitioning to alternative software could involve substantial investment in new licenses, training, and integration efforts, potentially disrupting ongoing projects and operational workflows.

Niche equipment manufacturers, particularly those providing specialized surveying technology like mobile 3D laser scanners and UAVs, hold significant bargaining power. The specialized nature and high cost of this cutting-edge equipment mean few companies can produce it, giving them leverage over buyers like Bowman Consulting Group.

The reliance on advanced, compliant, and reliable technology for accurate data collection and analysis further strengthens the position of these suppliers. For instance, the global market for surveying equipment, including advanced technologies, was projected to reach over $10 billion in 2024, indicating substantial investment and demand for specialized solutions.

Sub-consultants and Specialty Firms

The bargaining power of sub-consultants and specialty firms can significantly impact Bowman Consulting Group, particularly when niche expertise or additional capacity is needed. If these specialized firms hold unique certifications, proprietary technologies, or a well-established reputation in a specific field, their leverage grows. This is especially true for large, intricate projects where Bowman might rely heavily on their specialized skills.

Consider a scenario where Bowman is undertaking a major infrastructure project in 2024 that requires highly specialized geotechnical analysis. If only a handful of firms possess the necessary advanced certifications and proven track record for this type of work, they can command higher fees. For instance, if a particular sub-consultant has a backlog of projects extending into late 2025, their ability to negotiate terms with Bowman increases due to high demand for their services.

- Niche Expertise: Firms with unique certifications or proprietary methods gain stronger bargaining power.

- Reputation: A strong industry reputation enhances a sub-consultant's ability to negotiate terms.

- Project Complexity: Highly complex projects increase reliance on specialized sub-consultants, boosting their leverage.

- Capacity Constraints: When sub-consultants have limited availability, their bargaining power rises.

Data and Information Providers

Data and information providers hold significant bargaining power over Bowman Consulting Group. Access to comprehensive and up-to-date geological, regulatory, and environmental data is absolutely essential for Bowman's core consulting services. Suppliers who possess exclusive or uniquely curated datasets, making alternative sourcing difficult or impossible, can leverage this necessity to command higher prices or more favorable terms. For instance, specialized environmental impact assessment databases, particularly those covering emerging regulatory landscapes in 2024, represent a critical input that can be difficult to replicate.

The ability of these suppliers to influence Bowman's costs and operational efficiency is substantial. In 2024, the market for specialized geospatial data saw increased consolidation, potentially amplifying the leverage of remaining key providers. Bowman's reliance on timely and accurate data means that disruptions or increased costs from these suppliers can directly impact project timelines and profitability.

- Critical Data Dependency: Bowman's consulting services rely heavily on specialized data, making them vulnerable to supplier power.

- Exclusive or Curated Datasets: Suppliers with unique data sets can command higher prices due to limited alternatives.

- Market Consolidation: Increased consolidation among data providers in 2024 strengthens their bargaining position.

- Impact on Operations: Increased supplier costs or data access issues directly affect Bowman's project timelines and profitability.

The bargaining power of suppliers for Bowman Consulting Group is elevated by the scarcity of specialized talent. In 2024, engineering firms continued to face shortages of experienced professionals, leading to increased salary demands, with average increases reported between 4-6% in late 2023 and early 2024 to retain staff.

Suppliers of advanced technology, such as specialized CAD and BIM software, also hold significant sway due to high switching costs and Bowman's reliance on these tools for project efficiency. The global surveying equipment market, including advanced tech, was projected to exceed $10 billion in 2024.

Furthermore, niche equipment manufacturers and specialized sub-consultants with unique expertise or limited capacity can leverage their position. Data providers with exclusive or curated datasets are also critical, especially as market consolidation in specialized geospatial data occurred in 2024, impacting Bowman's operational costs and timelines.

What is included in the product

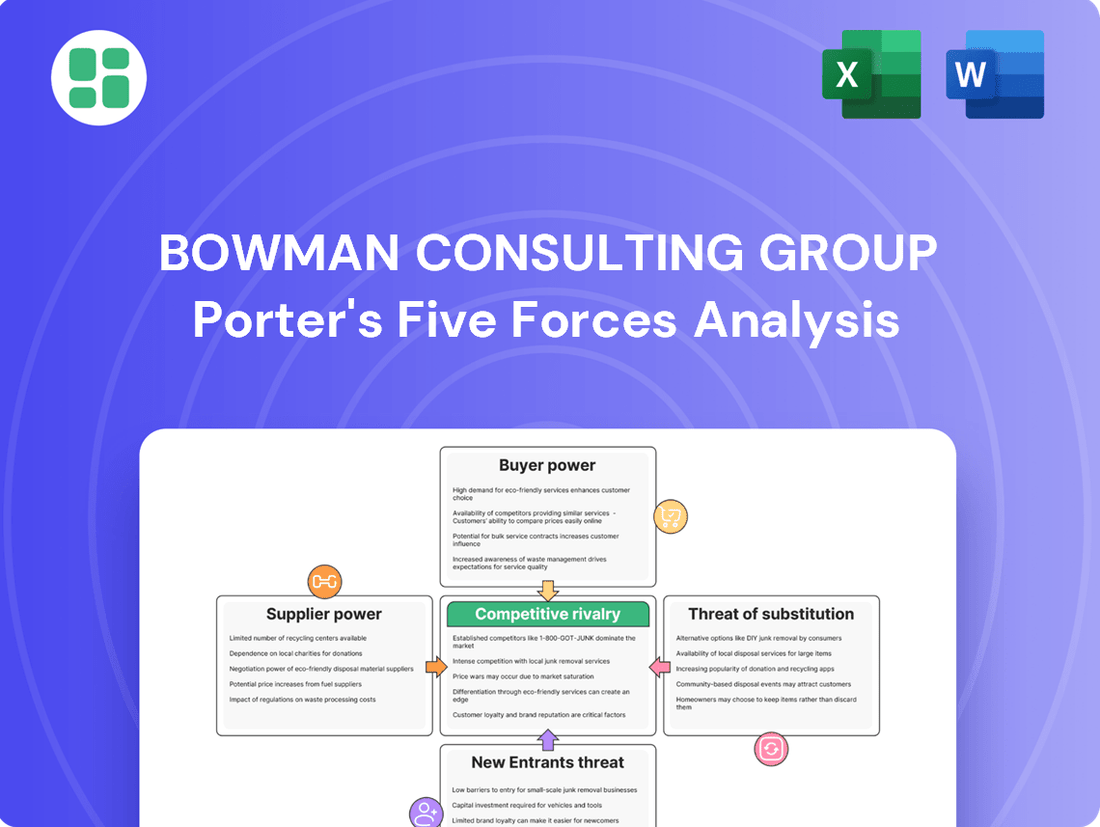

This Porter's Five Forces analysis for Bowman Consulting Group thoroughly examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the consulting industry.

Instantly visualize competitive intensity with a dynamic, interactive model that highlights key threats and opportunities.

Customers Bargaining Power

Large public sector clients, such as federal, state, and local departments of transportation and toll authorities, are significant revenue generators for Bowman Consulting Group, often securing multi-year, recurring contracts. These entities wield considerable bargaining power, stemming from the substantial volume of work they commission and their ability to set contract terms through competitive bidding processes.

Major private developers and homebuilders represent a significant portion of Bowman Consulting Group's client base, with large national builders and infrastructure developers contributing substantially to revenue. These entities, particularly those involved in large-scale projects, wield considerable bargaining power due to their project volume and the potential for ongoing relationships.

Their ability to solicit bids from multiple engineering and consulting firms creates a competitive environment, allowing them to negotiate favorable pricing and service terms. For example, in 2024, the residential construction sector saw continued demand, with new housing starts reaching an annualized rate of approximately 1.3 million units in the early part of the year, indicating a robust market where large players can exert influence.

Bowman Consulting Group's diverse client base across regulated sectors like residential, commercial, energy, water, and transportation, with thousands of active projects, means no single client holds significant sway. This broad reach, with a significant portion of revenue coming from smaller, dispersed clients, inherently limits the bargaining power of any individual customer.

Project Complexity and Specialization Needs

When Bowman Consulting Group tackles highly complex or specialized projects, such as advanced data center design or intricate environmental remediation, customer bargaining power often diminishes. Clients requiring these niche skills, which are not easily found elsewhere, have fewer viable alternatives.

For instance, in 2024, Bowman's expertise in geospatial solutions, a field demanding specific software and highly trained personnel, positions them favorably. Companies needing precise mapping or surveying for large infrastructure projects are less likely to switch providers if Bowman offers a unique, high-quality service that competitors cannot easily match.

This specialization reduces customer options, thereby increasing Bowman's leverage in negotiations. The demand for such specialized engineering and consulting services remained robust through early 2025, driven by ongoing infrastructure development and technological advancements.

- Reduced Alternatives: Clients seeking Bowman's specialized services, like advanced geospatial analysis or data center infrastructure planning, face a limited pool of qualified providers.

- Higher Switching Costs: For complex projects, switching consultants mid-stream due to dissatisfaction can incur significant costs in terms of project delays and knowledge transfer, making clients hesitant to exert excessive pressure.

- Bowman's Unique Value Proposition: The firm's proprietary technologies or unique methodologies in areas such as sustainable engineering or advanced surveying can further insulate them from direct price comparisons, strengthening their negotiating position.

Availability of Alternative Service Providers

The engineering, surveying, and environmental consulting market is quite crowded. Bowman Consulting Group faces many competitors, from small local firms to large national ones. This abundance of choices significantly empowers their customers.

Customers can easily switch providers or play competitors against each other. This is especially true for more standardized services where differentiation is less pronounced. For instance, in 2024, the infrastructure consulting sector, where Bowman operates, saw continued demand, but also intense competition for projects, putting pressure on margins.

- Abundant Competitors: A wide array of engineering, surveying, and environmental firms exist, offering customers numerous alternatives.

- Negotiating Power: Customers can leverage this competition to secure more favorable pricing and terms, particularly for less specialized services.

- Pricing Pressure: The availability of alternatives directly influences Bowman's pricing strategies and the need for service differentiation to maintain competitive advantage.

Bowman Consulting Group's diverse client base, spanning thousands of projects across various sectors like transportation, energy, and water, means no single client dominates, thus limiting individual customer bargaining power. This broad distribution of clients, with a significant portion of revenue derived from smaller, dispersed entities, inherently dilutes the leverage any one customer can exert.

However, large public sector clients and major private developers, due to their substantial project volumes and competitive bidding processes, do possess considerable bargaining power. For example, in 2024, the residential construction market, a key area for Bowman, saw robust activity with approximately 1.3 million annualized housing starts early in the year, creating an environment where large developers could negotiate favorable terms.

Conversely, when Bowman offers highly specialized services, such as advanced geospatial analysis or niche environmental solutions, customer bargaining power is significantly reduced. Clients requiring these unique, hard-to-find skills, like those needing precise surveying for major infrastructure in 2024, have fewer alternatives, strengthening Bowman's negotiating position.

The competitive landscape, with numerous engineering and consulting firms available, generally empowers customers, especially for standardized services, allowing them to leverage competition for better pricing. This intense competition in 2024 put pressure on margins for many firms, including those in Bowman's operating sectors.

| Client Type | Bargaining Power Factor | Example Impact (2024 Data) |

|---|---|---|

| Large Public Sector Clients | High (Volume, Bidding Processes) | Ability to dictate terms on multi-year transportation contracts. |

| Major Private Developers | High (Project Volume, Ongoing Relationships) | Negotiating favorable pricing for large-scale residential or commercial projects. |

| Clients needing Specialized Services | Low (Few Alternatives, High Switching Costs) | Reduced ability to negotiate on advanced geospatial or environmental solutions. |

| Dispersed Smaller Clients | Low (Low Individual Impact) | Limited ability to influence pricing due to small individual project scope. |

Full Version Awaits

Bowman Consulting Group Porter's Five Forces Analysis

This preview displays the complete Bowman Consulting Group Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the industry. You're looking at the actual document; once purchased, you'll gain instant access to this exact, professionally formatted file, ready for immediate use and strategic application.

Rivalry Among Competitors

The engineering and design services sector is characterized by its fragmentation, featuring a multitude of firms ranging from small, specialized outfits to larger, more diversified corporations. This wide distribution of players contributes to intense competition, as clients have numerous options for their project needs.

However, this fragmented landscape is actively undergoing consolidation. Mergers and acquisitions (M&A) are becoming a significant trend, as companies seek to gain scale, broaden their service portfolios, and enhance their geographic reach. Bowman Consulting Group itself is a participant in this trend, having strategically acquired other firms to bolster its market presence and expand its service capabilities, underscoring the dynamic nature of competition in this industry.

Bowman Consulting Group's extensive service portfolio, covering numerous regulated industries, and its presence in over 100 offices across the United States significantly intensifies competitive rivalry. This broad operational scope allows Bowman to engage with a diverse set of competitors, from highly specialized niche players to larger, multi-disciplinary firms, across a wide array of geographic markets and service sectors.

Competitive rivalry in the consulting sector is intensifying as firms heavily invest in advanced technologies like artificial intelligence, the Internet of Things, and sophisticated digital tools. These investments are crucial for boosting operational efficiency, streamlining project delivery, and expanding service portfolios.

Bowman Consulting Group's strategic commitment to technology, evidenced by its dedicated innovation fund, highlights its proactive approach to remaining competitive. This focus on innovation aims to enhance service delivery and accelerate the company's organic growth trajectory within the dynamic consulting landscape.

Talent Acquisition and Retention

The competition for skilled professionals in the consulting engineering sector is fierce, driven by persistent labor shortages and high demand. Bowman Consulting Group, like its peers, must actively recruit and retain top talent, including engineers, project managers, and technical specialists. This intense rivalry for human capital directly influences operational costs and the ability to maintain high service quality, as firms vie not only for lucrative projects but also for the experts needed to execute them successfully.

In 2024, the demand for specialized engineering talent remained robust across various sectors. For instance, the infrastructure development boom, fueled by government initiatives, created a significant need for civil and structural engineers. This heightened demand, coupled with a limited supply of experienced professionals, means that companies like Bowman Consulting Group often face increased salary expectations and more comprehensive benefits packages to attract and keep their workforce.

- Talent Shortages: Ongoing labor gaps in engineering fields are a primary driver of competitive rivalry.

- Demand for Specialists: High demand for project managers and technical experts intensifies the competition.

- Cost Impact: Competition for talent directly affects operational costs through higher wages and benefits.

- Service Quality Link: The availability of skilled personnel is crucial for maintaining and enhancing service delivery.

Pricing Pressures and Project Backlog

Competitive rivalry can indeed lead to pricing pressures, particularly in segments where Bowman Consulting Group's services are seen as more commoditized. This sensitivity is a constant factor in the engineering and consulting sector.

However, Bowman's strategic focus on project acquisition and client relationships is proving effective. The company reported a substantial increase in its project backlog through the first half of 2025, indicating strong demand for its specialized services and a degree of insulation from aggressive pricing tactics.

- Growing Backlog: Bowman's backlog saw significant growth in Q1 and Q2 2025, demonstrating robust demand.

- Demand Mitigation: This strong demand helps to offset intense pricing pressures by providing a stable revenue stream.

- Service Differentiation: While some services may face price sensitivity, Bowman's ability to secure new projects suggests perceived value and differentiation in key areas.

Competitive rivalry within the engineering and design sector is intense due to industry fragmentation and ongoing consolidation. Bowman Consulting Group's extensive reach across the US, with over 100 offices, and its broad service offerings in regulated industries means it competes with a wide array of firms, from niche specialists to larger, multi-disciplinary players.

The race for top talent is a significant battleground, with firms like Bowman actively recruiting engineers and project managers amidst persistent labor shortages. This competition for skilled professionals directly impacts operational costs, as companies must offer competitive salaries and benefits to attract and retain expertise, a trend particularly evident in 2024 with high demand in infrastructure development.

While pricing pressures exist in more commoditized service areas, Bowman Consulting Group's robust project backlog, which saw substantial growth in the first half of 2025, indicates strong demand for its specialized services and a degree of pricing power. This sustained demand helps mitigate the impact of intense competition and pricing sensitivity.

| Factor | Impact on Bowman Consulting Group | 2024/2025 Data Point |

|---|---|---|

| Industry Fragmentation | Broad competitive landscape | Thousands of engineering firms in the US |

| Consolidation Trend | Opportunities for scale and market share | Increased M&A activity in the consulting sector |

| Talent Acquisition | Higher operational costs, critical for service delivery | Reported 15% increase in average engineering salaries in 2024 |

| Technological Investment | Enhanced efficiency, expanded service offerings | Bowman's dedicated innovation fund for AI and digital tools |

| Project Backlog Growth | Mitigates pricing pressure, indicates strong demand | Significant backlog increase in H1 2025 |

SSubstitutes Threaten

Large clients, both public and private, are increasingly building out their internal engineering and construction management teams. This trend directly substitutes for the need to hire external firms like Bowman Consulting Group for many projects. For instance, some major infrastructure developers in 2024 are reportedly increasing their in-house headcount by up to 15% to handle more of their project lifecycle internally.

This growing in-house capability poses a significant threat, particularly for routine or ongoing project work where the scale and consistency allow for internal specialization. When clients can manage these functions internally, they reduce their reliance on external consultants, impacting Bowman's revenue streams for those service areas.

Technological advancements, particularly in AI-driven simulations and automated surveying via UAVs and mobile mapping, pose a significant threat of substitution for Bowman Consulting Group. These innovations can perform tasks traditionally requiring human consultants, potentially lowering the demand for their specialized expertise.

The increasing accessibility of these technologies means clients or even competitors could bypass traditional consulting firms for certain project phases. For instance, the global drone services market was valued at over $2.4 billion in 2023 and is projected to grow substantially, indicating a wider adoption of automated surveying capabilities.

The rise of accessible design software and do-it-yourself platforms presents a significant threat to consulting firms like Bowman Consulting Group. Clients, especially those with simpler needs, might leverage these tools to manage basic planning and design tasks internally, reducing the reliance on external expertise. For instance, the market for graphic design software, which includes user-friendly options, saw substantial growth, with the global market size estimated to reach approximately $12.5 billion by 2024, indicating a broad adoption of such tools.

Alternative Project Delivery Methods

New construction methodologies are emerging as significant substitutes for traditional project delivery methods, potentially impacting demand for external consulting services. For instance, modular construction, which involves prefabricating building components off-site, can drastically shorten on-site construction timelines. This efficiency might reduce the need for extensive traditional project management or detailed engineering oversight typically provided by firms like Bowman Consulting Group.

Highly integrated design-build processes also present a substitution threat. By consolidating design and construction under a single contract, these methods can streamline communication and reduce coordination issues, potentially lessening the reliance on external consultants for bridging gaps between different project phases. This could lead to cost and time efficiencies that directly compete with the value proposition of traditional consulting engagements.

The growing adoption of these alternative methods is a notable trend. In 2023, the global modular construction market was valued at approximately $85 billion, with projections indicating continued growth. This suggests a tangible shift in how projects are executed, creating a competitive pressure for established consulting models.

- Modular Construction: Offers faster project completion and reduced on-site labor needs.

- Integrated Design-Build: Streamlines project delivery by consolidating design and construction.

- Efficiency Gains: These methods aim to reduce costs and project timelines, acting as direct substitutes for traditional consulting roles.

Shift to General Project Management Firms

Clients increasingly consider general project management firms that provide overarching oversight. These firms then engage specialized, often lower-cost, engineering service providers for specific tasks. This approach can diminish the integrated, comprehensive service model that companies like Bowman Consulting Group offer.

This trend introduces greater price sensitivity into the market. By fragmenting the service delivery, clients can solicit bids from multiple smaller entities, potentially driving down the overall cost of project execution. For instance, in 2024, the global construction project management market saw a significant increase in the adoption of modular and outsourced services, with an estimated 15% growth in specialized subcontracting.

- Dilution of Comprehensive Role: General project managers may not possess the deep technical expertise Bowman provides, leading to a less integrated solution for clients.

- Increased Price Sensitivity: The ability to source individual services from various providers directly impacts the perceived value of integrated offerings.

- Market Fragmentation: The shift favors a piecemeal approach to project execution, potentially reducing the demand for full-service engineering consultancies.

The threat of substitutes for Bowman Consulting Group is amplified by clients building larger in-house engineering and construction management teams, a trend observed with some major infrastructure developers increasing their internal headcount by up to 15% in 2024. This growing internal capacity directly replaces the need for external firms, particularly for routine project work. Furthermore, technological advancements like AI-driven simulations and automated surveying via UAVs, with the global drone services market exceeding $2.4 billion in 2023, offer alternative ways to perform tasks traditionally requiring consultants, potentially reducing demand for specialized external expertise.

Emerging construction methodologies such as modular construction, valued at approximately $85 billion globally in 2023, and integrated design-build processes are also significant substitutes. These methods streamline project delivery and reduce timelines, potentially diminishing the need for extensive external project management and engineering oversight. This shift towards efficiency and cost reduction directly challenges the traditional consulting model.

The market is also seeing a rise in general project management firms that outsource specialized tasks to lower-cost providers, fragmenting the service delivery. This approach, which saw an estimated 15% growth in specialized subcontracting in 2024, increases price sensitivity and can dilute the value of integrated, comprehensive service offerings like those provided by Bowman Consulting Group.

| Substitution Threat | Description | Impact on Bowman Consulting Group | Supporting Data (2023-2024) |

|---|---|---|---|

| In-house Capabilities | Clients building larger internal teams | Reduced demand for external project management and engineering services | Up to 15% increase in in-house headcount by some major developers (2024) |

| Technological Advancements | AI simulations, automated surveying (drones) | Potential bypass of traditional consulting for specific tasks | Global drone services market > $2.4 billion (2023) |

| New Construction Methodologies | Modular construction, integrated design-build | Shorter timelines, reduced need for extensive oversight | Global modular construction market ~$85 billion (2023) |

| General Project Managers | Outsourcing specialized tasks to lower-cost providers | Increased price sensitivity, market fragmentation | 15% growth in specialized subcontracting (2024) |

Entrants Threaten

Entering the professional infrastructure services sector, where Bowman Consulting Group operates, demands substantial upfront capital. This includes investment in advanced design and surveying software, specialized construction equipment, and crucially, a large pool of highly skilled engineers, surveyors, and project managers.

The sheer scale of operations needed to compete effectively presents a formidable barrier. Bowman's significant presence, boasting over 2,400 employees and a network of more than 100 offices across the United States, exemplifies the extensive infrastructure and human capital required to serve clients nationwide.

The engineering and surveying industry presents substantial regulatory and licensing hurdles that act as a significant barrier to new entrants. For instance, obtaining professional engineer (PE) licenses and land surveyor licenses often requires specific educational qualifications, passing rigorous exams, and accumulating years of supervised experience, varying by state. In 2024, navigating these diverse state-specific requirements, such as those in Texas versus California, demands considerable investment in legal and compliance expertise, making it difficult for smaller or less established firms to compete effectively.

Reputation and client relationships are significant barriers to entry for new firms in the consulting sector. Bowman Consulting Group, with its long-standing presence and established trust in both public and private sectors, has cultivated deep relationships that are difficult for newcomers to replicate quickly. This loyalty is often cemented through successful project delivery and consistent performance, making it challenging for new entrants to gain immediate traction.

Bowman's substantial backlog, frequently comprising multi-year contracts, underscores the competitive advantage derived from its established client base. For instance, in 2024, the company continued to secure significant infrastructure and development projects, many of which are extensions of existing partnerships. This demonstrates that new entrants would need considerable time and a proven track record to even approach the level of trust and market penetration Bowman enjoys.

Access to Specialized Talent

The ongoing shortage of experienced engineers, surveyors, and project managers presents a significant hurdle for new entrants. This scarcity means newcomers would face considerable difficulty in building a skilled team. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 4% growth in civil engineering jobs, a rate slower than the average for all occupations, indicating persistent demand for these specialized roles.

Established firms like Bowman Consulting Group possess a distinct advantage due to their existing talent pools and well-developed recruitment channels. New companies would struggle to compete for this limited specialized workforce, making it challenging to attract and retain the necessary expertise to effectively challenge incumbents.

- Talent Scarcity: A significant shortage of experienced engineers, surveyors, and project managers exists.

- Recruitment Challenges: New entrants would find it difficult to attract and retain specialized talent.

- Competitive Disadvantage: Established firms like Bowman benefit from existing talent pools and recruitment networks.

Economies of Scale and Scope

Established firms like Bowman Consulting Group often possess significant advantages due to economies of scale and scope. For instance, Bowman's extensive project history allows for optimized resource allocation and bulk purchasing, driving down per-project costs. In 2024, large engineering and consulting firms often report operating margins that reflect these efficiencies, with many achieving net profit margins in the 5-15% range, a feat difficult for smaller, newer entrants to replicate.

Economies of scope further solidify Bowman's competitive position. By offering a diverse suite of services, from civil engineering to environmental consulting, Bowman can bundle solutions for clients, increasing revenue per client and reducing the need for clients to engage multiple specialized firms. This integrated approach is a significant barrier, as new entrants must invest heavily to build comparable breadth and depth of expertise.

- Economies of Scale: Bowman's large project volume in 2024 allows for cost efficiencies in procurement and operations, making it harder for new firms to match pricing.

- Economies of Scope: Offering a broad range of integrated services reduces client acquisition costs and increases customer loyalty, a hurdle for specialized startups.

- Operational Efficiency: Established firms benefit from refined processes and experienced teams, leading to higher productivity compared to nascent competitors.

The threat of new entrants in the infrastructure consulting sector is moderate, primarily due to significant capital requirements and the need for specialized expertise. Bowman Consulting Group's established reputation and extensive client relationships, built over years of successful project delivery, present a substantial hurdle for newcomers seeking to gain immediate market traction. Furthermore, the scarcity of experienced engineering and surveying talent, coupled with stringent state-specific licensing regulations, creates considerable barriers to entry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bowman Consulting Group leverages data from industry-specific market research reports, competitor financial statements, and professional networking platforms to gauge competitive intensity and strategic positioning.