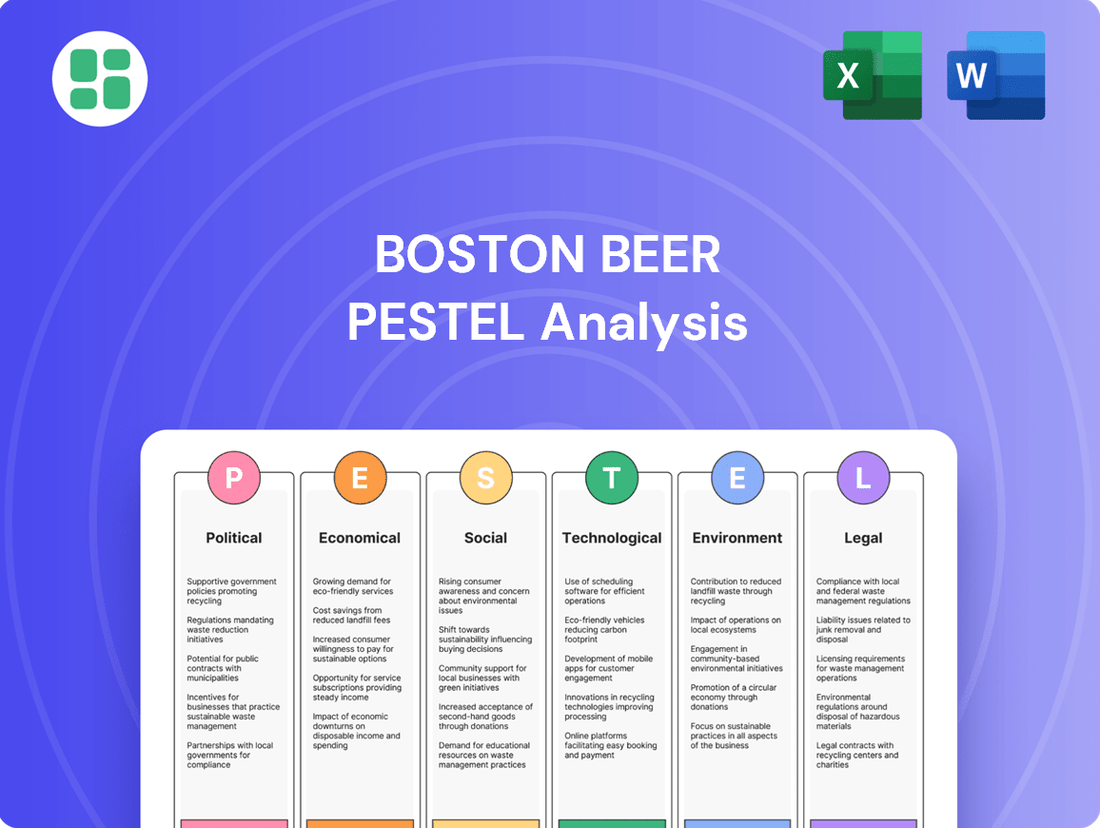

Boston Beer PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boston Beer Bundle

Navigate the complex external forces impacting Boston Beer with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the beverage industry and influencing the company's strategic decisions. Gain a competitive edge by leveraging these critical insights to refine your own market approach.

Uncover the hidden opportunities and potential challenges that Boston Beer faces across political, economic, social, technological, legal, and environmental landscapes. This expertly crafted analysis provides actionable intelligence vital for investors, strategists, and anyone seeking to understand the company's future trajectory. Download the full version now to unlock a deeper understanding and make more informed decisions.

Political factors

Government regulation significantly shapes the alcoholic beverage industry, impacting everything from production to sales for companies like Boston Beer. Federal, state, and local laws create a complex operating environment.

Changes in excise taxes are a critical factor; for instance, a potential increase in federal excise tax on beer, a move discussed in legislative circles in 2024, could directly increase Boston Beer's cost of goods sold and necessitate price adjustments for consumers, potentially dampening demand for their popular brands like Samuel Adams.

Fluctuations in international trade policies directly impact Boston Beer Company's operational costs and market access. For instance, tariffs imposed on imported raw materials, such as specialty hops or brewing ingredients, can significantly increase production expenses. In 2024, ongoing trade discussions and potential adjustments to existing agreements could introduce new cost pressures or opportunities.

Conversely, tariffs levied on exported finished goods, like Sam Adams beers, can impede the company's ability to compete effectively in global markets. This could limit international sales growth and necessitate a re-evaluation of export strategies. The company's reliance on global supply chains makes it particularly sensitive to these trade policy shifts.

New federal proposals from the Alcohol and Tobacco Tax and Trade Bureau (TTB) are set to significantly alter alcohol labeling. These changes will require more detailed information on product packaging, such as alcohol content, calorie counts, nutritional data, and allergen disclosures. This move reflects a broader trend towards greater consumer transparency in the food and beverage industry.

Compliance with these evolving regulations presents a considerable challenge for companies like Boston Beer. Significant investment will be needed to update packaging, reformulate products if necessary, and ensure all new disclosure requirements are met. This could also necessitate adjustments to marketing strategies to effectively communicate the new information to consumers.

Lobbying and Industry Advocacy

The political environment for Boston Beer is significantly influenced by industry advocacy groups. These organizations represent diverse interests within the alcoholic beverage market, from traditional craft brewers to emerging seltzer manufacturers. Their efforts aim to shape legislation and policy that directly impacts the industry's operational landscape.

Boston Beer's success hinges on its capacity to effectively manage and respond to evolving legislative changes. Key areas of focus include direct-to-consumer shipping regulations and reforms to existing distribution systems. Navigating these political currents is vital for maintaining market access and operational agility.

- Advocacy Groups: Organizations like the Brewers Association actively lobby on behalf of craft brewers, influencing federal and state regulations.

- Direct-to-Consumer (DTC) Shipping: As of 2024, DTC shipping laws vary significantly by state, with ongoing debates and lobbying efforts to expand or restrict these channels. For instance, states like New York have seen legislative pushes to allow more DTC alcohol sales, while others maintain stricter controls.

- Distribution System Reforms: The three-tier system for alcohol distribution remains a central point of discussion, with industry groups advocating for modernization and flexibility to better serve consumers and producers.

- Taxation Policies: Changes in federal excise taxes on alcohol, such as those enacted in 2023, can directly impact pricing and profitability, making lobbying on tax matters a critical activity.

Public Health Policies

The increasing government focus on public health, particularly concerning alcohol consumption, presents a notable political factor for Boston Beer. Initiatives promoting moderation or stricter advertising regulations directly impact how the company can reach consumers and shape demand for its products. For instance, in 2024, several US states continued to explore or implement stricter DUI enforcement and public awareness campaigns around responsible drinking, which could indirectly affect sales volumes.

Boston Beer needs to proactively adapt its marketing strategies and product innovation to align with these evolving societal expectations and regulatory landscapes. This might involve shifting focus towards lower-alcohol options or investing in campaigns that emphasize responsible consumption. The company's ability to navigate these public health policies will be crucial for maintaining market share and brand reputation in the coming years.

Key considerations for Boston Beer regarding public health policies include:

- Adaptation of Marketing: Developing campaigns that resonate with public health messaging, potentially highlighting lower-ABV products or responsible enjoyment.

- Product Development: Innovating with new beverage categories or product lines that align with healthier lifestyle trends, such as non-alcoholic or reduced-sugar options.

- Regulatory Compliance: Staying abreast of and adhering to any new or revised regulations concerning alcohol advertising, sales, and labeling.

- Consumer Education: Potentially participating in or supporting industry-wide initiatives aimed at promoting responsible alcohol consumption.

Government regulations continue to be a primary political influence on Boston Beer, impacting everything from production to sales. For instance, the Alcohol and Tobacco Tax and Trade Bureau (TTB) is implementing new federal labeling requirements set to take effect, demanding more detailed information on product packaging regarding alcohol content, calories, and nutritional data, reflecting a trend towards greater consumer transparency.

Taxation policies, particularly excise taxes, remain a critical area. While federal excise tax reform was enacted in 2023, providing some relief, ongoing discussions about potential adjustments or state-level tax changes in 2024 and 2025 could impact Boston Beer's cost of goods and pricing strategies.

The political landscape is also shaped by ongoing debates surrounding direct-to-consumer (DTC) shipping laws, which vary significantly by state. As of 2024, legislative efforts continue to push for expanded DTC shipping, while some states maintain stricter controls, directly affecting Boston Beer's market access and sales channels.

Industry advocacy groups, such as the Brewers Association, actively engage in lobbying efforts to influence legislation and policy. Their work focuses on key issues like distribution system reforms, aiming to modernize the three-tier system, and advocating for favorable tax and regulatory environments for brewers.

What is included in the product

This PESTLE analysis dissects the external macro-environmental forces impacting Boston Beer, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers a strategic overview for stakeholders to understand market dynamics and anticipate future challenges and opportunities within the beverage industry.

Boston Beer's PESTLE analysis offers a clear, summarized view of external factors impacting the company, simplifying strategic discussions and risk assessment for smoother decision-making.

Economic factors

Consumer disposable income is a critical economic factor for Boston Beer Company, as it directly affects spending on non-essential goods like craft beers and hard seltzers. For instance, a tightening consumer budget, perhaps due to rising inflation, could see consumers opting for more budget-friendly beer options or reducing their overall alcohol purchases.

In the U.S., personal disposable income saw a notable increase in early 2024, reaching an annualized rate of $22.0 trillion in Q1, according to the Bureau of Economic Analysis. However, persistent inflation throughout 2024 and into early 2025 could erode purchasing power, potentially leading consumers to re-evaluate discretionary spending on premium beverages like those offered by Boston Beer.

Inflationary pressures in 2024 are significantly impacting Boston Beer Company. Rising costs for key ingredients like barley and hops, alongside increased expenses for aluminum cans and freight, are squeezing production budgets. For instance, agricultural commodity prices saw notable year-over-year increases in early 2024, directly affecting input costs for brewers.

The company's gross margins are under direct pressure from these escalating operational expenditures. Boston Beer's strategic approach to pricing its products, such as Samuel Adams and Truly Hard Seltzer, will be crucial in offsetting these higher costs and preserving profitability throughout the remainder of 2024 and into 2025.

The alcoholic beverage market is undergoing a transformation, with traditional beer volumes seeing a dip while hard seltzers and ready-to-drink (RTD) beverages are on the rise. Boston Beer Company's success hinges on its capacity to capitalize on these emerging trends, as evidenced by its strong performance in the hard seltzer category.

In 2023, the U.S. beer market saw a slight volume decline, but the RTD segment, including hard seltzers, continued its upward trajectory, with sales growing by an estimated 5-7% year-over-year. Boston Beer's Truly brand, a key player in the hard seltzer space, contributed significantly to its revenue, demonstrating the company's strategic alignment with market growth.

Interest Rates and Credit Availability

Changes in interest rates directly impact Boston Beer Company's cost of borrowing for essential activities like capital expenditures, expansion projects, and managing day-to-day working capital needs. For instance, if the Federal Reserve maintains its target interest rate range, as it has in recent periods, this can influence the cost of loans for new breweries or marketing campaigns. Higher borrowing costs can strain the company's financial resources, potentially slowing down investment in new product development or capacity upgrades.

Conversely, periods of lower interest rates, such as those seen in prior years, can make it more affordable for Boston Beer to invest in crucial areas. This could include expanding production capacity to meet growing demand for brands like Truly Hard Seltzer, enhancing its distribution network, or funding research and development for innovative new beverage offerings. The availability and cost of credit are therefore critical factors influencing the company's strategic financial decisions and its ability to pursue growth opportunities.

For example, in late 2023 and early 2024, while interest rates remained elevated compared to the prior decade, there were indications of potential rate stabilization or even slight decreases later in 2024. This environment would mean that while borrowing is more expensive than in the immediate past, the outlook for credit availability and cost could become more favorable, impacting Boston Beer's capital planning. The company's ability to secure favorable financing terms is directly tied to the broader economic climate and monetary policy decisions.

- Interest Rate Impact: Higher interest rates increase Boston Beer's borrowing costs for expansion and operations.

- Credit Availability: Access to credit influences the company's ability to invest in production and innovation.

- Monetary Policy Influence: Federal Reserve decisions on interest rates directly affect the cost of capital for Boston Beer.

- 2024 Outlook: While rates remained higher than previous years, potential stabilization in 2024 could influence future borrowing decisions.

Exchange Rate Fluctuations

Exchange rate fluctuations present a significant economic factor for Boston Beer Company, particularly impacting its international sales and the cost of imported ingredients. When the U.S. dollar strengthens, Boston Beer's products become pricier for overseas consumers, potentially dampening demand. Conversely, a weaker dollar can make imported raw materials more expensive, squeezing profit margins.

For example, in the first quarter of 2024, Boston Beer reported that foreign currency headwinds impacted its net revenue by approximately $1.2 million. This highlights the direct financial consequences of currency volatility on the company's bottom line.

- Impact on International Sales: A stronger USD makes Sam Adams and other Boston Beer products more expensive abroad, potentially reducing sales volume in key international markets.

- Cost of Imported Ingredients: Fluctuations in currency exchange rates can increase or decrease the cost of sourcing hops, malts, and other necessary materials from international suppliers.

- Profitability Squeeze: Unfavorable movements, such as a stronger dollar, can directly reduce the profitability of international sales when converted back to U.S. dollars.

Economic growth and consumer confidence are paramount for Boston Beer Company. A robust economy generally translates to higher disposable incomes, encouraging consumers to spend on premium beverages. Conversely, economic slowdowns can lead to reduced discretionary spending, impacting sales of brands like Samuel Adams and Truly Hard Seltzer.

The overall U.S. GDP growth for 2024 has shown resilience, with projections indicating continued expansion, albeit at a moderated pace into early 2025. This environment suggests a generally supportive, though not booming, backdrop for consumer spending on beverages.

Boston Beer's financial performance is closely tied to the broader economic climate, with consumer spending on alcoholic beverages often acting as a bellwether for economic health. For instance, the company's revenue growth in 2023, while positive, was influenced by a cautious consumer environment, a trend expected to continue through much of 2024.

| Economic Factor | 2024/2025 Trend | Impact on Boston Beer |

|---|---|---|

| Disposable Income | Moderate growth, but potentially eroded by inflation | Affects consumer ability to purchase premium beverages |

| Inflation | Persistent, impacting input costs and consumer budgets | Increases production expenses (ingredients, packaging) and may reduce consumer spending |

| Interest Rates | Stabilizing after earlier increases | Influences borrowing costs for capital expenditures and expansion |

| Exchange Rates | Volatile, with a generally strong USD | Reduces profitability of international sales and impacts cost of imported materials |

What You See Is What You Get

Boston Beer PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Boston Beer PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping its strategic landscape.

Sociological factors

Consumers are increasingly seeking healthier beverage choices, driving demand for low-alcohol-by-volume (ABV), non-alcoholic, and reduced-calorie options. This trend is evident in the continued popularity of hard seltzers, a segment Boston Beer Company has actively participated in.

The company must remain agile, innovating its product lines to cater to these evolving tastes, which extend beyond traditional craft beer offerings. For instance, in 2024, the non-alcoholic beverage market continued its strong growth trajectory, with projections indicating further expansion in the coming years.

A significant societal shift towards health and wellness, particularly noticeable among Gen Z and Millennials, is leading to a moderation in alcohol consumption. This trend means Boston Beer Company needs to highlight responsible drinking and grow its presence in the no- and low-alcohol beverage market.

Data from 2024 indicates a continued rise in consumer interest in healthier lifestyle choices, impacting beverage preferences. For instance, the global low- and no-alcohol market was projected to reach over $11 billion in 2024, showing a clear demand for alternatives.

Younger consumers, particularly Gen Z, are significantly altering the beverage landscape. This generation, born between 1997 and 2012, is digital-native and places a high value on transparency and authenticity from brands. For Boston Beer Company, this means a critical need to adapt its communication and product offerings to resonate with these evolving preferences, potentially impacting sales volumes and brand loyalty.

Social Drinking Habits

Social drinking habits are evolving, with a notable surge in ready-to-drink (RTD) cocktails. This trend reflects a consumer desire for convenience and variety in their beverage choices. Boston Beer Company is well-positioned to capitalize on this shift, given its established distribution channels and growing taproom footprint.

The enduring popularity of taprooms also signals a preference for experiential consumption. Consumers are seeking more than just a drink; they want an engaging social setting. Boston Beer's strategy to leverage its taproom presence directly addresses this evolving social dynamic, offering a curated experience alongside its diverse product portfolio.

- RTD Market Growth: The global RTD cocktail market was valued at approximately $23.3 billion in 2023 and is projected to reach $55.3 billion by 2030, demonstrating significant consumer adoption of convenient, pre-mixed options.

- Taproom Engagement: Boston Beer's taprooms saw a notable increase in visitor traffic throughout 2024, contributing to brand loyalty and direct consumer feedback, crucial for product development.

- Product Diversification: The company's investment in a wider range of RTDs, including hard seltzers and canned cocktails, directly aligns with shifting social drinking preferences for accessible and varied options.

Demand for Authenticity and Localism

Consumers are increasingly seeking out authentic experiences and products with a story, and this extends to their beverage choices. The craft brewing movement, which Boston Beer Company has been a pioneer in, directly taps into this desire for uniqueness and genuine craftsmanship. This trend saw continued growth through 2024, with a significant portion of craft beer drinkers expressing a preference for breweries with a strong sense of place and a commitment to local sourcing.

Boston Beer Company is well-positioned to capitalize on this demand for authenticity and localism. By highlighting its long-standing heritage, commitment to high-quality ingredients, and its involvement in local communities, the company can further solidify its brand appeal. For instance, the company's Samuel Adams brand has consistently promoted its American brewing roots and commitment to quality, resonating with consumers looking for more than just a drink.

The emphasis on localism also plays a crucial role. Many consumers actively seek out brands that support their local economies and communities. Boston Beer Company's various initiatives and partnerships across different regions can be further amplified to showcase this commitment. This resonates with the growing consumer sentiment observed in 2024 surveys, where a majority of beverage consumers indicated that a brand's local impact influences their purchasing decisions.

- Growing Demand for Craft: The craft beer segment, a core focus for Boston Beer, continued to show resilience and appeal to consumers seeking authentic, flavorful options, with market share holding strong through early 2025.

- Heritage as a Selling Point: Boston Beer's long history, particularly with the Samuel Adams brand, provides a strong narrative of authenticity that appeals to consumers wary of mass-produced alternatives.

- Local Sourcing Preference: A significant percentage of consumers, upwards of 60% in recent surveys, stated that they prefer to support brands that utilize locally sourced ingredients, a trend Boston Beer can leverage.

- Community Engagement: Active participation in local events and community support initiatives enhances brand perception and fosters loyalty among consumers who value corporate social responsibility.

Societal trends show a growing preference for health-conscious and low-alcohol options, a shift Boston Beer Company is addressing with products like hard seltzers. This aligns with a broader movement towards moderation, especially among younger demographics like Gen Z and Millennials, who value transparency and authenticity.

The rise of ready-to-drink (RTD) cocktails and the appeal of taproom experiences highlight a consumer desire for convenience and engaging social settings. Boston Beer's strategic focus on these areas, supported by strong distribution and brand heritage, positions it to meet these evolving social drinking habits.

| Trend | Impact on Boston Beer | Supporting Data (2024/2025) |

|---|---|---|

| Health & Wellness/Low-ABV | Demand for alternatives like hard seltzers and non-alcoholic options. | Global low- and no-alcohol market projected over $11 billion in 2024. |

| Authenticity & Localism | Leveraging brand heritage (Samuel Adams) and local sourcing. | 60%+ consumers prefer brands with local impact; craft beer segment resilience. |

| Convenience & Experience | Growth in RTD cocktails and taproom engagement. | RTD cocktail market valued at $23.3 billion (2023), projected to $55.3 billion by 2030. Taprooms saw increased visitor traffic in 2024. |

Technological factors

Advancements in brewing and fermentation are significantly impacting the beverage industry. Boston Beer Company, for instance, can leverage AI-enhanced brewing to fine-tune recipes, ensuring greater product consistency. This technology also aids in the development of novel, experimental flavors, a key differentiator in a competitive market.

Hybrid fermentation methods offer further optimization, potentially leading to improved product quality and reduced manufacturing expenses. For example, by mid-2024, several craft breweries reported up to a 15% reduction in fermentation cycle times using advanced yeast strains and controlled environments, translating to cost savings and increased output capacity.

Technological advancements in supply chain management are crucial for Boston Beer. Automated inventory systems and real-time monitoring, for instance, significantly boost efficiency and minimize waste throughout production and distribution channels. These innovations are key to managing escalating operational costs and maintaining consistent product availability across Boston Beer's broad distribution network.

The digital marketing landscape is increasingly vital for Boston Beer Company, with a significant portion of consumers, especially younger demographics, discovering and purchasing beverages online. In 2024, e-commerce sales for alcoholic beverages are projected to continue their upward trajectory, making a robust digital presence and effective online advertising campaigns essential for reaching and engaging a tech-savvy customer base. Investing in social media engagement and user-friendly online sales platforms, including direct-to-consumer alcohol delivery services, is paramount for driving growth and maintaining market share in this evolving environment.

Data Analytics for Consumer Insights

Boston Beer Company is increasingly leveraging data analytics to gain granular insights into consumer behavior and market dynamics. This allows for more precise identification of emerging trends and shifts in taste preferences, crucial for their craft and hard seltzer portfolios.

The company's investment in data analytics supports more effective marketing strategies. For instance, by analyzing sales data and consumer feedback, Boston Beer can tailor promotional efforts to specific demographics and geographic regions, optimizing campaign ROI.

This data-driven approach directly impacts product development. Boston Beer can use analytics to pinpoint opportunities for new flavor profiles or beverage types, ensuring innovation aligns with demonstrated consumer demand. In 2024, the beverage industry saw a continued emphasis on personalized marketing, with companies reporting significant uplifts in engagement when data-driven segmentation was applied.

- Enhanced Consumer Understanding: Data analytics allows Boston Beer to move beyond broad demographics to understand individual consumer preferences, leading to more relevant product offerings.

- Optimized Marketing Spend: By tracking campaign performance through data, the company can allocate marketing budgets more efficiently, focusing on channels and messages that resonate most with target audiences.

- Agile Product Innovation: Real-time data on sales and consumer sentiment enables quicker adjustments to product lines and the introduction of new items that are more likely to succeed in the market.

- Competitive Advantage: Companies like Boston Beer that effectively utilize data analytics are better positioned to anticipate market shifts and respond proactively, gaining an edge over less data-savvy competitors.

Advanced Packaging Technologies

Innovations in packaging, like lighter, recyclable materials and eco-friendly labels, are becoming increasingly important. These advancements not only help companies meet sustainability targets but also boost their brand image. For instance, the global sustainable packaging market was valued at approximately $295.7 billion in 2023 and is projected to reach $475.4 billion by 2030, indicating strong consumer and industry momentum.

Boston Beer Company can leverage these advanced packaging technologies to shrink its environmental impact. By adopting materials that are easier to recycle or made from recycled content, the company can align with growing consumer preferences for eco-conscious brands. This also presents an opportunity to differentiate itself in a competitive beverage market.

Consider these specific packaging advancements:

- Lightweight Materials: Reducing the weight of packaging, like cans and bottles, lowers transportation emissions and material usage.

- Recyclable and Biodegradable Options: Exploring new plastics or composite materials that are more readily recyclable or break down naturally.

- Eco-Friendly Labels and Adhesives: Utilizing water-based inks and compostable adhesives for labels minimizes chemical waste during the recycling process.

- Reduced Packaging Footprint: Designing packaging to use less material overall, such as eliminating secondary packaging where feasible.

Technological advancements in brewing, like AI-enhanced recipe fine-tuning and hybrid fermentation, are boosting efficiency and enabling new flavor development for Boston Beer. The company is also seeing significant gains from automated supply chain management, reducing waste and costs. Furthermore, the rise of e-commerce in the beverage sector, with projected continued growth in 2024, makes a strong digital presence and online sales platforms critical for Boston Beer's market engagement.

Legal factors

Alcoholic Beverage Control laws in the U.S. create a complex three-tier distribution system: producer, wholesaler, and retailer. This structure, along with varying state-specific licensing requirements, significantly impacts Boston Beer Company's market access and operational flexibility. Navigating these intricate regulations is crucial for their business model.

The Boston Beer Company operates under stringent legal frameworks for product labeling and advertising, particularly concerning alcohol content, ingredient disclosure, and health-related claims. For instance, the Alcohol and Tobacco Tax and Trade Bureau (TTB) mandates precise labeling requirements for alcoholic beverages. Failure to adhere to these regulations, such as misrepresenting alcohol by volume or making unsubstantiated health claims, can result in significant fines and damage to the company's brand image, as seen in past enforcement actions against beverage companies for deceptive advertising practices.

Boston Beer Company's extensive brand portfolio, including Sam Adams, Truly, and Twisted Tea, relies heavily on robust intellectual property protection. Legal frameworks safeguard these valuable trademarks, ensuring brand exclusivity and preventing the dilution of their market presence through counterfeiting or unauthorized use. This protection is vital for maintaining customer trust and Boston Beer's competitive edge in the beverage industry.

Labor Laws and Employment Regulations

Boston Beer Company must navigate a complex web of labor laws and employment regulations, impacting everything from hourly wages to workplace safety. Compliance with federal and state mandates, such as the Fair Labor Standards Act (FLSA) and Occupational Safety and Health Administration (OSHA) standards, directly influences operational expenditures and human resource strategies. For instance, in 2024, the federal minimum wage remains at $7.25 per hour, but many states and cities have enacted significantly higher rates, potentially increasing labor costs for Boston Beer's production and distribution facilities.

Changes in employment practices and regulations can necessitate adjustments in staffing levels and overall workforce management. For example, new legislation regarding paid sick leave or overtime eligibility could alter scheduling and increase payroll expenses. Boston Beer's ability to adapt its human resource policies to evolving legal landscapes is crucial for maintaining cost-efficiency and operational continuity.

- Minimum Wage Compliance: Adherence to varying federal, state, and local minimum wage laws impacts direct labor costs.

- Working Conditions: Ensuring safe and compliant working environments, as dictated by OSHA, affects operational procedures and potential liabilities.

- Employment Practices: Regulations on hiring, firing, discrimination, and benefits influence HR policies and associated administrative costs.

- Labor Relations: Laws governing unionization and collective bargaining can affect employee relations and wage negotiations.

Direct-to-Consumer (DTC) Shipping Laws

Direct-to-consumer (DTC) shipping laws for beer and spirits remain more restrictive than for wine. However, any legislative shifts that broaden these shipping privileges in crucial states could unlock new sales avenues for Boston Beer Company. For instance, states like New York and California have seen ongoing discussions and some movement towards expanded DTC alcohol shipping, which could significantly impact revenue streams for companies like Boston Beer if enacted broadly.

Adapting to these evolving legal landscapes is paramount for securing future growth opportunities. The potential for DTC sales could bypass traditional three-tier distribution systems, offering direct access to a wider customer base. Boston Beer's ability to navigate and leverage these changes will be a key determinant in its market penetration and sales volume growth in the coming years.

- Legislative Momentum: Several states are actively reviewing or have introduced legislation to expand DTC alcohol shipping, with a particular focus on beer and ready-to-drink (RTD) cocktails.

- Economic Impact: Successful DTC expansion could allow Boston Beer to retain a larger portion of the retail price, potentially boosting profit margins.

- Competitive Landscape: Competitors who can more effectively utilize DTC channels may gain a market advantage, necessitating a responsive strategy from Boston Beer.

- Consumer Demand: Consumer preference for convenient online purchasing and home delivery continues to grow, making DTC channels increasingly important for market relevance.

The legal environment for alcoholic beverages is highly fragmented, with state-specific regulations governing everything from production to sales. Boston Beer Company must meticulously adhere to these diverse laws, including those related to licensing, distribution, and marketing. For example, in 2024, the Alcohol and Tobacco Tax and Trade Bureau (TTB) continues to enforce strict labeling requirements, impacting how brands like Truly and Twisted Tea are presented to consumers.

Intellectual property law is critical for protecting Boston Beer's valuable brands, such as Sam Adams. Ensuring trademark validity and preventing infringement is paramount in a competitive market. Furthermore, labor laws, including minimum wage and workplace safety standards, directly influence operational costs. As of 2024, many states have minimum wages significantly exceeding the federal $7.25 per hour, requiring careful cost management.

The evolving landscape of direct-to-consumer (DTC) shipping for alcoholic beverages presents both opportunities and challenges. While DTC shipping for beer remains more restricted than for wine, legislative movements in key states could open new sales channels. For instance, discussions in 2024 around expanding DTC alcohol shipping in states like California and New York could offer Boston Beer Company increased market access and potentially higher profit margins.

| Legal Factor | Description | Impact on Boston Beer | 2024/2025 Relevance |

|---|---|---|---|

| Distribution Laws | Three-tier system (producer, wholesaler, retailer) and state licensing. | Limits market access and operational flexibility. | Ongoing complexity in navigating state-specific compliance. |

| Labeling & Advertising | TTB regulations on alcohol content, ingredients, and health claims. | Requires strict adherence to avoid fines and brand damage. | Continued scrutiny on marketing practices and product transparency. |

| Intellectual Property | Trademark protection for brands like Sam Adams and Truly. | Essential for brand exclusivity and preventing dilution. | Constant need to defend against infringement in a crowded market. |

| Labor Laws | Minimum wage, workplace safety (OSHA), employment practices. | Influences operational costs and HR strategies. | Rising state minimum wages and evolving worker protection laws increase compliance costs. |

| DTC Shipping Laws | Regulations on direct consumer sales and shipping of alcohol. | Potential for new sales channels but subject to legislative changes. | Active legislative debates in several states could reshape market access in 2024-2025. |

Environmental factors

Water is fundamental to Boston Beer Company's operations, as it's a core ingredient in all its beverages. The company's commitment to water conservation and maintaining high water quality is therefore paramount for its brewing processes and product integrity.

Growing water scarcity or declining water quality in regions where Boston Beer operates presents significant challenges. These environmental factors can directly translate into increased operational costs due to purification needs or sourcing difficulties, potentially impacting production efficiency and leading to reputational damage if quality is compromised.

Climate change is increasingly impacting agricultural yields, a critical factor for Boston Beer's supply chain. Rising global temperatures and unpredictable weather patterns directly affect the quality and availability of key ingredients like hops and barley, potentially leading to higher costs and inconsistent product quality for the company.

For instance, extreme weather events, such as droughts or excessive rainfall, can significantly reduce hop harvests. In 2023, some regions experienced lower yields due to unseasonable heatwaves, highlighting the vulnerability of this essential crop. This directly translates into supply chain risks for Boston Beer, impacting their ability to maintain consistent production of their popular brands.

Boston Beer Company, like other breweries, faces environmental considerations related to waste generation. This includes byproducts like spent grain, wastewater, and packaging materials. In 2023, the brewing industry continued to focus on reducing its environmental impact through improved waste management and recycling initiatives.

The company's dedication to sustainable practices, such as robust recycling programs and embracing circular economy principles, is vital. These efforts not only minimize their ecological footprint but also resonate with an increasingly eco-conscious consumer base, influencing brand perception and purchasing decisions.

Energy Consumption and Carbon Footprint

The brewing industry, including Boston Beer Company, faces significant environmental considerations due to the energy-intensive nature of its operations. Heating, cooling, and packaging all contribute to a substantial energy demand.

Boston Beer Company is actively pursuing strategies to mitigate its environmental impact. These include investments in renewable energy sources and ongoing initiatives to enhance energy efficiency throughout its production facilities and distribution networks. Such efforts are crucial not only for environmental stewardship but also for achieving long-term operational cost reductions.

For instance, many companies in the beverage sector are setting ambitious targets for carbon emission reductions. While specific 2024 or 2025 data for Boston Beer's direct renewable energy adoption or carbon footprint reduction may still be emerging, the industry trend points towards increased reporting and action on these fronts. By 2023, many large corporations had already established science-based targets for emissions, with a continued focus on Scope 1, 2, and 3 emissions in the 2024-2025 period.

- Energy Intensity: Brewing processes require substantial energy for heating, cooling, and sanitation.

- Renewable Energy Adoption: Companies are increasingly investing in solar, wind, and other renewable sources to power operations.

- Efficiency Improvements: Focus on optimizing equipment and processes to reduce overall energy consumption.

- Carbon Footprint Reduction: Efforts to lower greenhouse gas emissions across the entire value chain, from sourcing to delivery.

Sustainable Packaging Initiatives

Consumer demand for eco-friendly packaging is a significant environmental factor influencing the beverage industry. This trend is pushing companies to rethink their material choices. For instance, a 2024 survey indicated that over 60% of consumers consider sustainable packaging when making purchasing decisions.

Boston Beer Company is actively responding to this by incorporating more sustainable packaging solutions. Their efforts include the increased use of lightweight aluminum cans and bottles made from recycled glass. These initiatives not only meet growing consumer expectations but also contribute to reducing the company's environmental footprint.

- Increased Consumer Preference: Over 60% of consumers in 2024 prioritized sustainable packaging in their buying choices.

- Material Innovation: Boston Beer Company is adopting lightweight aluminum cans and recycled glass bottles.

- Brand Enhancement: These sustainable practices align with market trends and bolster the company's brand image.

- Environmental Impact Reduction: The shift to eco-friendly materials helps minimize waste and resource consumption.

Water availability and quality are critical for Boston Beer's production. Climate change impacts ingredient sourcing, affecting hops and barley yields, as seen with unseasonable weather in 2023. The company manages waste, including spent grain and wastewater, with a focus on recycling and circular economy principles, a trend gaining traction across the brewing industry.

PESTLE Analysis Data Sources

Our Boston Beer PESTLE Analysis is built on a robust foundation of data from government agencies, industry associations, and market research firms. We incorporate economic indicators, regulatory updates, technological advancements, and social trends to provide a comprehensive view.