Bose Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bose Bundle

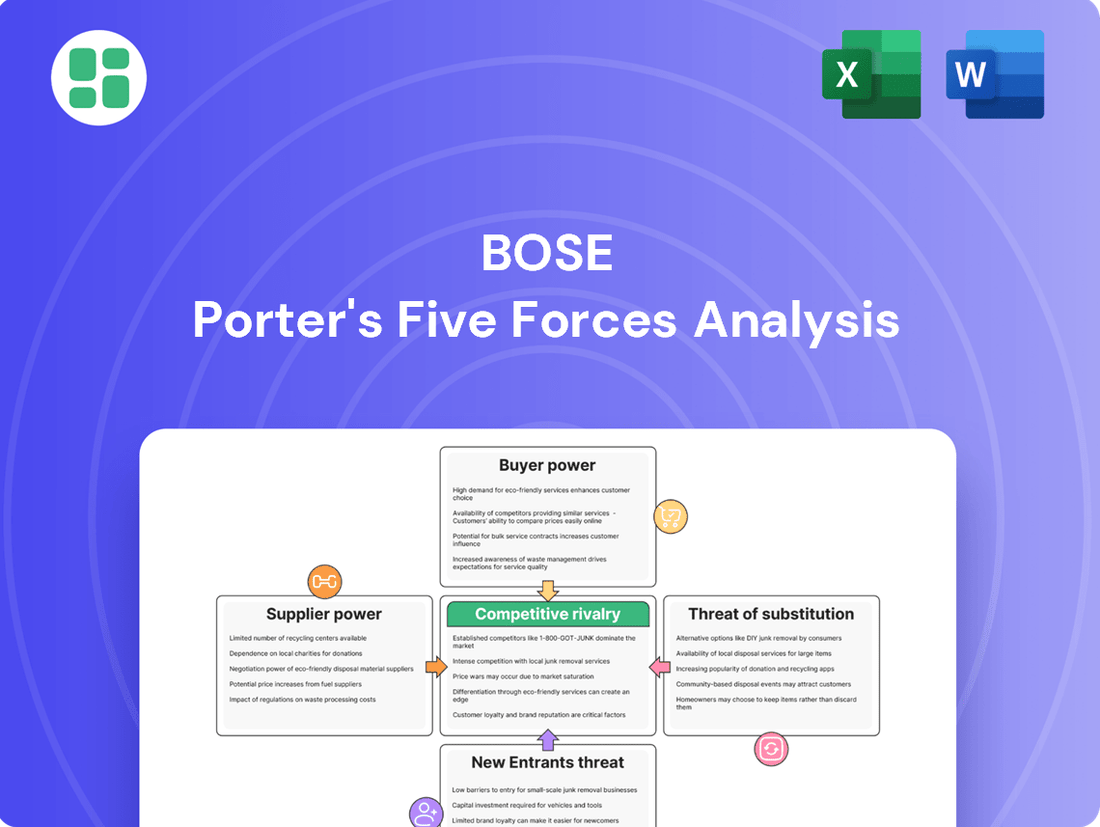

Porter's Five Forces provides a powerful lens to examine Bose's competitive landscape, revealing the intensity of rivalry, the power of buyers and suppliers, and the threats of substitutes and new entrants. Understanding these forces is crucial for navigating Bose's market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bose’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Bose's reliance on highly specialized components, such as advanced semiconductors and unique acoustic materials, grants significant bargaining power to its suppliers. The scarcity of these critical inputs, as evidenced by global semiconductor shortages in 2021-2022 which saw lead times extend by up to 50% for certain advanced chips, directly impacts Bose's production costs and delivery schedules.

The global electronics supply chain, a critical area for companies like Bose, continues to be a hotbed of volatility. Geopolitical tensions, ongoing trade disputes, and the ever-present threat of natural disasters can significantly impact the availability and cost of essential raw materials and manufactured components. This instability directly translates to increased bargaining power for suppliers who can guarantee a steady flow of these vital inputs, often at a premium.

When suppliers possess proprietary technology or patents for critical audio components, Bose's choices shrink, significantly boosting the supplier's bargaining power. This exclusivity means Bose might not have readily available alternatives, forcing them to accept the supplier's terms.

If a supplier provides unique, highly integrated solutions that are difficult for competitors to replicate, Bose could face substantial switching costs. This lack of easy substitution weakens Bose's negotiation leverage, potentially leading to higher input prices.

Bose's Volume and Strategic Partnerships

Bose's significant market presence and its reputation for premium audio products allow it to exert considerable bargaining power over its suppliers. By placing large volume orders, Bose can negotiate more favorable terms, potentially securing lower prices for components and materials. Furthermore, fostering long-term strategic partnerships can create mutual dependencies, strengthening Bose's position.

Bose's focus on sustainable procurement practices and its exploration of localized manufacturing strategies can also influence its relationships with suppliers. These initiatives may lead to more collaborative partnerships, where suppliers are incentivized to meet Bose's ethical and operational standards, thereby mitigating potential supply chain risks and enhancing leverage.

- Large Volume Orders: Bose's substantial sales volumes enable it to negotiate bulk discounts from suppliers.

- Strategic Partnerships: Long-term collaborations with key suppliers can ensure preferential treatment and pricing.

- Brand Reputation: Bose's premium brand image can attract suppliers eager to associate with a respected name, increasing Bose's leverage.

- Sustainability Initiatives: Commitment to ethical sourcing can be a bargaining chip, favoring suppliers who align with these values.

Supplier Concentration

When a few large suppliers control critical audio components, their ability to dictate terms, including pricing and delivery schedules, significantly enhances their bargaining power over Bose. This concentration means Bose has fewer alternatives for these essential inputs, making it more susceptible to supplier demands. For instance, in 2024, the global semiconductor market, crucial for advanced audio processing, remained highly concentrated, with a few key players accounting for a substantial portion of production capacity, potentially impacting component costs for companies like Bose.

Conversely, if Bose sources less specialized parts, such as standard casings or packaging materials, from a broad and competitive supplier base, the individual supplier's influence is considerably diluted. A fragmented supplier landscape for these less critical items allows Bose to switch suppliers more easily, negotiate better prices, and mitigate the risk of supply disruptions. This diversification in sourcing for non-core components strengthens Bose's overall negotiating position.

- Supplier Concentration: A market dominated by a few key suppliers for essential audio components grants them greater leverage over Bose.

- Impact on Bose: High supplier concentration can lead to increased costs and reduced flexibility for Bose in sourcing critical inputs.

- Diversified Sourcing: A wide array of suppliers for less specialized parts diminishes individual supplier influence and improves Bose's negotiating power.

- Market Dynamics: The semiconductor industry, vital for audio technology, has shown persistent concentration in 2024, highlighting potential supplier power in key areas.

Bose's bargaining power with suppliers is influenced by the concentration of suppliers for critical components. When few suppliers dominate, like in the semiconductor market where a handful of companies control significant production capacity, their leverage increases, potentially driving up costs for Bose. Conversely, a fragmented supplier base for less specialized items allows Bose to negotiate better terms and switch providers easily, enhancing its overall negotiating strength.

| Factor | Impact on Bose | Example (2024) |

|---|---|---|

| Supplier Concentration (Key Components) | High leverage for suppliers, potential cost increases | Semiconductor industry concentration impacting audio chip availability and pricing. |

| Supplier Fragmentation (Standard Components) | Low leverage for suppliers, improved negotiation for Bose | Broad competition for packaging materials allows for easier price negotiation. |

| Bose's Order Volume | Stronger negotiation position for Bose | Large orders for acoustic drivers can secure volume discounts. |

| Supplier Switching Costs | Weakens Bose's position if high | Proprietary technology from a single supplier can lock Bose into their terms. |

What is included in the product

This analysis examines the five competitive forces shaping Bose's industry: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitutes, and rivalry among existing competitors.

Quickly identify and neutralize competitive threats by visualizing the intensity of each of Porter's Five Forces.

Customers Bargaining Power

Bose's premium pricing strategy, centered on superior sound and innovation, cultivates a loyal customer base. However, this also means customers expect significant value for their investment. Any perceived gap between the high price and the delivered quality or innovation can heighten customer sensitivity and, consequently, their bargaining power.

The audio equipment market is incredibly crowded, with major players like Sony, Apple, Sennheiser, and JBL offering a vast array of products. This abundance of choice means consumers have significant leverage, easily switching to a competitor if Bose's products don't align with their needs or budget. For instance, in 2024, the global audio equipment market was valued at over $100 billion, highlighting the intense competition and the power consumers wield due to readily available alternatives.

The rise of information transparency, fueled by online reviews and comparison websites, significantly bolsters customer bargaining power. In 2024, platforms like Trustpilot and Google Reviews allow consumers to easily access detailed product information, feature comparisons, and pricing across numerous brands. This readily available data empowers customers, enabling them to negotiate better terms or switch to competitors if offerings are not satisfactory.

Diverse Customer Segments

Bose navigates a landscape with varied customer bases, each exerting different levels of influence. The consumer electronics segment, encompassing headphones and home audio, faces a crowded market. This high degree of product availability means consumers can readily switch brands, giving them significant bargaining power. For instance, the global headphone market alone was valued at approximately $25.4 billion in 2023, with numerous competitors vying for market share, amplifying consumer choice.

Conversely, Bose's professional audio and automotive sound system clients often represent a different dynamic. These customers, particularly in the automotive sector, engage in long-term contracts and require highly specialized, integrated solutions. This reduces their ability to easily switch suppliers, thereby lowering their bargaining power. In 2024, the automotive audio market is projected to continue its growth, driven by demand for premium sound experiences, solidifying the strategic importance of these B2B relationships for Bose.

- Consumer Electronics: High bargaining power due to numerous alternatives and product availability.

- Professional Audio: Moderate to high power depending on the scale and customization of the project.

- Automotive Sound Systems: Lower bargaining power due to specialized integration and long-term supplier relationships.

- Market Data: The global headphone market was valued at $25.4 billion in 2023, indicating intense competition and consumer choice.

Brand Loyalty and Customer Experience

Bose has built significant brand loyalty by consistently prioritizing innovation and delivering a superior customer experience, especially with its acclaimed noise-cancellation technology. This dedication means some customers are willing to pay more for the Bose brand, thereby reducing their power to negotiate lower prices.

- Brand Loyalty: Bose's commitment to R&D, exemplified by its continuous advancements in audio technology, fosters a loyal customer base.

- Customer Experience: The emphasis on a premium user experience, from product design to after-sales support, reinforces this loyalty.

- Price Sensitivity: While price-sensitive customers exist, a segment of Bose's market prioritizes performance and brand reputation over cost, limiting their bargaining power.

Customers' bargaining power is influenced by the availability of substitutes and the cost of switching. In the consumer electronics sector, Bose faces intense competition, with numerous brands offering comparable products. This ease of switching, amplified by readily available online information in 2024, grants consumers significant leverage. For instance, the global audio equipment market, exceeding $100 billion in 2024, underscores the vast array of choices available to consumers.

| Customer Segment | Bargaining Power Level | Key Factors |

|---|---|---|

| Consumer Electronics (e.g., Headphones) | High | Numerous competitors, low switching costs, price transparency |

| Professional Audio | Moderate to High | Project scale, customization needs, availability of specialized solutions |

| Automotive Sound Systems | Low | Long-term contracts, high integration costs, specialized requirements |

Full Version Awaits

Bose Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Bose Porter's Five Forces Analysis provides a detailed examination of the competitive landscape, including an in-depth look at the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. You'll gain actionable insights to inform your strategic decision-making.

Rivalry Among Competitors

The audio equipment and consumer electronics sectors are incredibly crowded, featuring a vast array of well-known brands alongside emerging players all competing fiercely for consumer attention and wallet share. This intense rivalry fuels a constant drive for new product development and puts significant pressure on pricing across the board, impacting everything from premium headphones to sophisticated home entertainment setups.

In 2024, the global consumer electronics market was valued at over $1 trillion, underscoring the sheer scale of competition. For instance, the headphone segment alone saw shipments of over 400 million units in 2023, with numerous brands, including Apple, Samsung, Sony, and JBL, constantly introducing new models and features, leading to frequent price adjustments and promotional activities.

Bose navigates a highly competitive landscape, directly challenged by powerhouses like Sony, Apple (with its Beats brand), Sennheiser, Harman International Industries, and JBL. These rivals boast robust brand equity, diverse product offerings, and substantial marketing investments, fueling intense competition.

The electronics market is characterized by rapid innovation, with these direct competitors consistently launching new products and cutting-edge technologies. For instance, in 2024, the premium headphone market saw significant activity, with Sony's WH-1000XM5 series continuing to be a benchmark, while Apple's AirPods Pro 2nd Generation maintained strong sales, demonstrating the ongoing product cycle and technological advancements that intensify rivalry.

Competition in the audio industry is intensely driven by innovation, compelling companies to pour significant resources into research and development. This focus on R&D is essential for introducing groundbreaking technologies, such as enhanced noise cancellation, immersive spatial audio, and integrated smart functionalities. Bose's long-standing commitment to R&D is a cornerstone of its ability to stay ahead in this fast-paced market.

For instance, in 2023, major players in the audio sector, including Bose's rivals, reported substantial R&D expenditures. Sony, a key competitor, allocated over $5 billion to R&D across its diverse business segments, with a notable portion directed towards audio technologies. Similarly, Apple's significant investments in product development, including its AirPods and audio features within its ecosystem, underscore the industry's innovation imperative. Bose itself has consistently reinvested a significant percentage of its revenue into R&D to maintain its technological leadership.

Pricing Strategies and Market Positioning

Bose typically employs a premium pricing strategy, which can be challenged by competitors offering a broader spectrum of price points. For instance, while Bose products often sit at the higher end, brands like Sony and Samsung offer comparable audio quality in mid-range segments, and brands like Anker or JLab provide very affordable alternatives.

The competitive landscape is dynamic, with rivals frequently introducing disruptive technologies at aggressive price points. This makes it difficult for Bose to maintain its premium positioning solely on brand reputation when feature parity is achieved at lower costs. In 2024, the consumer electronics market saw continued price competition, with many brands leveraging economies of scale to undercut premium pricing.

- Premium Pricing Challenge: Bose's premium pricing strategy faces pressure from competitors offering a wide range of price points, from budget to ultra-luxury.

- Feature-Price Competitiveness: Competitors can offer similar features at lower prices, challenging Bose's market position.

- Disruptive Technology Pricing: The introduction of new technologies at competitive rates by rivals further intensifies this challenge.

- 2024 Market Dynamics: In 2024, price competition remained a significant factor, with many brands leveraging scale to offer competitive pricing against premium brands.

Product Diversification and Ecosystems

Competitive rivalry in the audio industry is intensified by product diversification and the creation of integrated ecosystems. Tech giants such as Apple and Sony leverage their extensive product portfolios, offering seamless integration across smartphones, smartwatches, and other devices. This creates significant customer lock-in and raises switching costs for consumers, making it challenging for specialized audio companies like Bose to compete solely on product features.

Bose, with its core focus on audio solutions, faces intense pressure to innovate continuously and forge strategic partnerships. For instance, Apple's AirPods Pro, launched in 2019 and updated in 2022, have become a dominant force, with sales contributing significantly to Apple's Services revenue. Bose must therefore not only excel in audio quality but also explore ways to integrate its products into broader tech ecosystems or offer unique value propositions that differentiate it from these diversified competitors. In 2024, the market for true wireless earbuds alone is projected to exceed 400 million units shipped, highlighting the sheer volume of competition and the importance of ecosystem play.

- Ecosystem Integration: Competitors like Apple and Sony offer integrated ecosystems that enhance customer loyalty and increase switching costs.

- Bose's Challenge: Bose must innovate and partner strategically to remain competitive against broader technology offerings.

- Market Landscape: The audio market, particularly true wireless earbuds, is highly competitive, with millions of units shipped annually, underscoring the need for differentiation.

Competitive rivalry in the audio sector is extremely high, with numerous established brands and new entrants vying for market share. This intense competition forces companies to continually innovate and often leads to aggressive pricing strategies, impacting profitability and market positioning.

In 2024, the global audio equipment market continued its robust growth, with projections indicating a value exceeding $200 billion. Key players like Sony, Apple, Samsung, and Sennheiser are locked in a constant battle, introducing new models and technologies to capture consumer interest. For instance, the true wireless stereo (TWS) earbuds segment, a significant part of the market, saw shipments of over 450 million units in 2023, with major brands frequently updating their offerings.

| Competitor | 2023 Revenue (Audio Segment - Estimated) | Key Product Areas | Competitive Strategy |

| Sony | $10 billion+ | Headphones, Speakers, Home Audio | Technological innovation, broad product range, ecosystem integration |

| Apple (Beats) | $8 billion+ | Headphones, Earbuds | Brand loyalty, ecosystem integration, premium design |

| Samsung | $5 billion+ | Soundbars, Speakers, Earbuds | Value pricing, integration with mobile devices, broad electronics portfolio |

| Sennheiser | $1 billion+ | High-fidelity Headphones, Microphones | Audiophile quality, professional audio heritage, premium positioning |

SSubstitutes Threaten

The increasing sophistication of devices like smartphones, smart TVs, and laptops presents a significant threat of substitutes for Bose's audio products. These everyday electronics often come with integrated speakers and basic audio functionalities that are adequate for a large segment of consumers' listening needs.

For instance, in 2024, smartphone penetration globally exceeded 6.8 billion users, with many of these devices offering improved audio output compared to previous generations. This widespread adoption means a substantial portion of the potential market already possesses a functional audio solution, diminishing the perceived necessity for a dedicated Bose speaker or headphone for casual use.

This trend is further amplified by the growing capabilities of smart home ecosystems, where devices like smart assistants with built-in speakers can handle basic music playback and audio streaming. The convenience and cost-effectiveness of these multi-functional devices directly compete with the value proposition of specialized audio equipment, forcing Bose to continually innovate and differentiate its offerings.

The market is indeed saturated with numerous lower-cost, generic, or less premium brands offering audio products that fulfill basic listening needs, particularly in segments like headphones and portable speakers. These alternatives, while not replicating Bose's renowned audio fidelity or advanced features, present a significant threat due to their accessibility and attractive price points for budget-conscious consumers.

The threat of substitutes for Bose's traditional audio products is significant, particularly from alternative entertainment formats. Podcasts, audiobooks, and streaming video services offer compelling content that can divert consumer attention and spending away from dedicated music listening. For instance, the global podcasting market was valued at approximately $20 billion in 2023 and is projected to grow substantially, indicating a strong shift in how people consume audio content.

Do-It-Yourself (DIY) Audio Solutions

For some audiophiles and tech-savvy consumers, the DIY audio solutions market presents a viable substitute for purchasing pre-built, high-end equipment from companies like Bose. This segment, though niche, thrives on customization and cost-effectiveness, allowing individuals to assemble their own speaker systems or utilize open-source audio software.

While precise market share figures for DIY audio are difficult to isolate, the growth in online communities and component sales for custom builds indicates a persistent interest. For instance, the global market for audio components, which fuels DIY projects, was projected to reach over $100 billion by 2027, showing a significant underlying demand for individual parts. This trend highlights a threat where consumers bypass established brands for personalized, often more affordable, audio experiences.

- Niche Market Appeal: DIY audio caters to a specific segment valuing customization and hands-on assembly over convenience.

- Cost-Effectiveness: Building custom systems can often be cheaper than buying equivalent high-end commercial products.

- Technological Accessibility: Open-source software and readily available audio components lower the barrier to entry for DIY enthusiasts.

- Growing Online Communities: Platforms dedicated to DIY audio foster knowledge sharing and component sourcing, strengthening the substitute threat.

Changing Consumer Habits

Changing consumer habits significantly impact the threat of substitutes. The increasing demand for convenience and portability means consumers are readily adopting new technologies that integrate seamlessly into their daily lives. For instance, the rise of smart home ecosystems is a prime example of this shift.

Products such as smart speakers and wireless earbuds, even those from rival companies, are increasingly becoming the go-to audio solutions. These devices can effectively substitute traditional home audio systems or even wired headphones by offering a more integrated and effortless user experience. By 2024, the global market for truly wireless earbuds alone was projected to exceed 400 million units, highlighting the rapid adoption of these convenient alternatives.

- Smart Speaker Dominance: Smart speakers, offering voice control and multi-room audio, are increasingly replacing dedicated home stereo systems.

- Wireless Earbud Popularity: The convenience and freedom offered by wireless earbuds have led to a significant decline in the sales of wired headphones.

- Ecosystem Integration: Consumers favor audio solutions that integrate with their existing smart home devices, creating a more cohesive experience.

- Shifting Usage Patterns: Audio consumption is moving from dedicated listening sessions to background audio integrated into daily activities, favoring portable and voice-activated devices.

The threat of substitutes for Bose is substantial, stemming from a wide array of alternative audio solutions and entertainment formats. Everyday electronics like smartphones and smart TVs offer adequate audio for many, while smart home devices provide convenient, integrated sound experiences. The growing popularity of podcasts and audiobooks also diverts consumer attention from traditional music listening.

The DIY audio market, though niche, presents a cost-effective and customizable alternative for enthusiasts. Furthermore, the pervasive adoption of wireless earbuds and smart speakers highlights a consumer shift towards convenience and ecosystem integration, directly challenging Bose's premium, specialized audio products.

| Substitute Category | Key Characteristics | Impact on Bose | 2024 Data Point |

|---|---|---|---|

| Everyday Electronics (Smartphones, Smart TVs) | Integrated audio, convenience, multi-functionality | Adequate for casual listening, reduces need for dedicated devices | Global smartphone penetration exceeded 6.8 billion users in 2024. |

| Smart Home Devices (Smart Speakers) | Voice control, multi-room audio, ecosystem integration | Replaces dedicated home audio systems, offers convenience | The smart speaker market is projected to grow significantly, with major tech companies heavily investing in their ecosystems. |

| Alternative Content (Podcasts, Audiobooks) | Diverts attention and spending from music listening | Reduces time spent with music, impacting demand for high-fidelity audio | The global podcasting market was valued at approximately $20 billion in 2023 and continues to expand. |

| DIY Audio Solutions | Customization, cost-effectiveness, hands-on assembly | Appeals to a segment seeking personalized, often cheaper, audio experiences | The global market for audio components, supporting DIY, was projected to exceed $100 billion by 2027. |

| Wireless Earbuds | Portability, convenience, freedom of movement | Rapidly replacing wired headphones and impacting the portable audio market | The global market for truly wireless earbuds was projected to exceed 400 million units in 2024. |

Entrants Threaten

Entering the premium audio equipment market, like the one Bose operates in, demands a significant upfront investment. This isn't just about setting up a basic factory; it involves substantial capital for cutting-edge research and development (R&D) to innovate in areas like acoustic engineering and noise cancellation. For instance, developing advanced audio technologies can cost millions, making it a daunting prospect for newcomers.

Furthermore, establishing state-of-the-art manufacturing facilities capable of producing high-fidelity audio equipment requires immense financial backing. Bose has invested heavily over decades to build its production capabilities and sophisticated supply chains. This established infrastructure and the associated costs present a formidable barrier, as new entrants would need to replicate these extensive investments to compete effectively on quality and scale.

Bose's formidable brand reputation, cultivated over decades through consistent delivery of quality, innovation, and superior sound, creates a significant barrier for new entrants. This deep-seated customer loyalty, particularly in a market where brand perception is paramount, means newcomers face an uphill battle to establish the same level of trust and recognition. For instance, in 2023, Bose continued to command premium pricing, a testament to its brand equity, with its noise-cancelling headphones frequently ranking among the top choices in consumer reports, indicating strong ongoing customer preference.

Bose's robust portfolio of proprietary acoustic technologies and an extensive patent library, especially in noise cancellation, presents a significant hurdle for potential new entrants. Replicating or legally navigating these innovations is both technically challenging and financially prohibitive, effectively shielding Bose's market position.

Access to Distribution Channels

New entrants face significant hurdles in securing access to established distribution channels, a critical factor for reaching customers. Bose's extensive global retail network, encompassing both its own stores and partnerships with major electronics retailers, provides a substantial advantage. For instance, Bose's direct-to-consumer sales, bolstered by its own e-commerce platform and physical showrooms, allow for controlled brand experience and direct customer engagement. This existing infrastructure makes it difficult for newcomers to gain comparable visibility and shelf space.

The threat is amplified by the cost and effort required to replicate Bose's distribution capabilities. Building a comparable network of retail partnerships and online sales platforms demands considerable investment and time. In 2024, the average cost for a new consumer electronics brand to secure prime placement in a major retail chain could range from tens of thousands to hundreds of thousands of dollars in slotting fees and marketing support. This financial barrier significantly limits the ability of new entrants to compete effectively on distribution.

- Bose's Global Retail Footprint: Operates hundreds of retail stores worldwide, offering direct customer interaction and brand control.

- Established Dealer Relationships: Strong, long-standing partnerships with authorized dealers and premium electronics retailers provide broad market reach.

- Online Sales Dominance: A robust e-commerce platform and presence on major online marketplaces ensure widespread accessibility.

- High Barrier to Entry: Replicating Bose's distribution network requires substantial capital investment and established market presence, deterring many potential new competitors.

Market Saturation and Intense Competition

The audio equipment market is already a crowded space, making it tough for new companies to break in. Established brands have strong customer loyalty and deep pockets for marketing. For instance, in 2024, the global audio equipment market was valued at approximately $120 billion, with major players like Sony, Bose, and Apple holding significant market share.

New entrants would need to invest heavily in product innovation and aggressive marketing to even get noticed. They would likely face pressure to lower prices to compete, which can be unsustainable for a new business. This intense competition from incumbents means that the threat of new entrants is moderate to high, depending on the specific niche within the audio market.

- Market Saturation: The audio equipment sector is already densely populated with numerous domestic and international brands.

- Incumbent Strength: Existing players possess established brand recognition, distribution networks, and significant marketing budgets.

- Barriers to Entry: High capital requirements for manufacturing, research and development, and marketing create substantial hurdles for newcomers.

- Competitive Response: New entrants must anticipate aggressive pricing and promotional activities from established competitors.

The threat of new entrants for Bose is tempered by substantial capital requirements for R&D and manufacturing, alongside the need to build a strong brand reputation. Navigating Bose's extensive patent portfolio and established distribution channels also presents significant challenges.

New entrants must contend with market saturation and the aggressive competitive responses of established players, including potential price wars. In 2024, the global audio equipment market, valued around $120 billion, is dominated by strong incumbents, making market penetration difficult.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for R&D, advanced manufacturing, and marketing. | Significant financial hurdle; deters many potential entrants. |

| Brand Loyalty & Reputation | Decades of building trust and perceived quality. | New entrants struggle to gain customer recognition and preference. |

| Intellectual Property | Extensive patents, particularly in noise cancellation technology. | Technical and legal challenges in replicating or circumventing innovations. |

| Distribution Channels | Established global retail presence and online sales infrastructure. | Difficult for newcomers to secure comparable market access and visibility. |

| Market Saturation | Crowded market with strong existing brands. | Intense competition requires substantial differentiation and investment. |

Porter's Five Forces Analysis Data Sources

Our analysis leverages a comprehensive mix of data, including industry-specific market research reports, company financial statements, and expert interviews. This ensures a robust understanding of competitive dynamics, supplier power, and buyer influence.