Bose Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bose Bundle

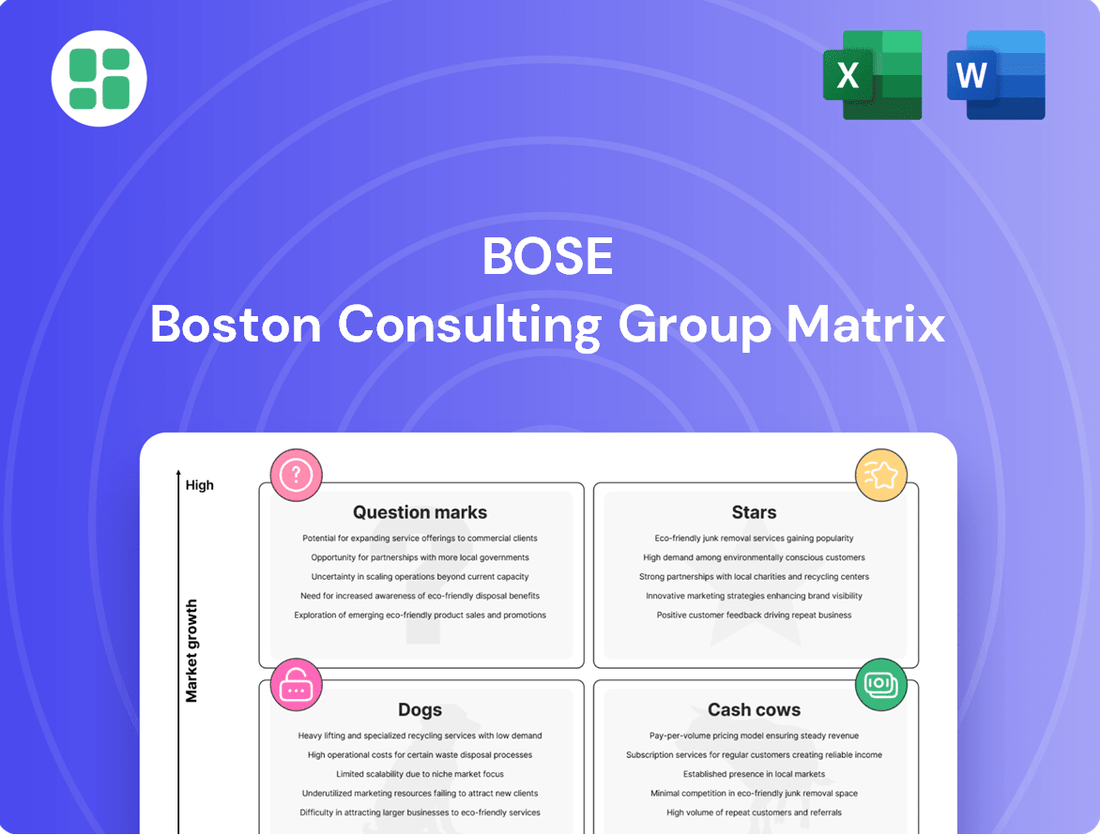

Uncover the strategic positioning of a company's product portfolio with the BCG Matrix, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This foundational tool helps identify growth opportunities and resource allocation. Purchase the full BCG Matrix for a comprehensive analysis and actionable strategies to optimize your business's market performance.

Stars

The Bose QuietComfort Ultra Headphones are a prime example of a Star product within Bose's portfolio, according to the BCG Matrix framework. These flagship headphones compete in the premium noise-cancelling headphone market, a segment where Bose has historically demonstrated strong leadership and brand loyalty.

The market for premium headphones is experiencing robust growth, fueled by consumer demand for sophisticated features like advanced noise cancellation, superior audio quality, and comfortable design. Projections indicate continued expansion in this sector through 2025.

Bose's commitment to innovation is evident with new generations of the QuietComfort line released in 2024 and anticipated for 2025. This ongoing development, coupled with their established market share, solidifies their position as a Star product in a high-growth segment.

The Bose QuietComfort Ultra Earbuds (2nd Gen) are positioned as Stars in the Bose BCG Matrix, mirroring the success of their over-ear siblings. They lead the charge in the booming true wireless earbud sector, especially within the high-end, noise-cancelling segment.

With advancements in 2025, including AI-driven adaptive noise cancellation and enhanced call clarity, these earbuds are capturing a substantial share of a fast-evolving market. Their robust performance and established brand loyalty firmly cement their Star status, indicating strong growth potential and market leadership.

Premium soundbars with advanced features, like those offered by Bose with Dolby Atmos and proprietary audio advancements, are a prime example of Stars in the BCG matrix. The global soundbar market was valued at approximately $10.5 billion in 2023 and is projected to reach over $19 billion by 2028, demonstrating robust growth. Bose's consistent innovation in this high-demand segment solidifies its position as a market leader.

Bose Professional Audio Solutions

Bose Professional Audio Solutions likely falls into the question mark or star category within the BCG matrix, depending on market share and growth. The professional audio system market is expanding, especially for premium installations where Bose holds a strong reputation for quality and dependability. In 2023, the global professional audio equipment market was valued at approximately $12.5 billion, with projections indicating continued growth.

Bose has actively pursued collaborations to embed its professional audio offerings within expanding sectors such as higher education and retail environments. This strategic approach taps into consistent demand for superior audio performance in commercial applications. For instance, Bose Professional's work with universities to upgrade lecture halls and auditoriums highlights this focus.

- Market Growth: The professional audio market is experiencing robust growth, particularly in high-end installations.

- Bose's Position: Bose is a dominant force in this niche, recognized for its quality and reliability.

- Strategic Partnerships: Collaborations in sectors like higher education and retail are expanding Bose's reach.

- Demand Drivers: Consistent demand for high-performance audio in commercial settings fuels this segment.

High-Fidelity Wireless Home Audio Systems

Bose's high-fidelity wireless home audio systems are well-positioned in a market driven by consumer demand for integrated, multi-room audio experiences and high-resolution streaming. This segment is experiencing robust growth, with the global smart speaker market alone projected to reach over $25 billion by 2025, according to recent market analyses.

The emphasis on seamless connectivity and superior sound quality directly addresses evolving consumer preferences for immersive home entertainment. Bose's offerings in this space are designed to meet these expectations, making them a key growth driver for the company.

- Market Growth: The global wireless home audio market is expanding significantly, fueled by the adoption of smart home technology and increasing disposable incomes.

- Consumer Demand: Consumers are actively seeking integrated solutions that offer convenience, multi-room functionality, and high-quality audio playback.

- Technological Advancement: Bose's investment in seamless connectivity and superior sound technology aligns with industry trends and consumer expectations for premium audio experiences.

- Competitive Landscape: While competitive, Bose's brand reputation for audio quality provides a strong foundation for capturing market share in this evolving sector.

Stars represent products with high market share in a high-growth industry. These are typically market leaders that require significant investment to maintain their position and fund further expansion.

Bose's QuietComfort Ultra Headphones and Earbuds are strong examples of Stars, dominating the premium noise-cancelling audio segment. The soundbar market also shows strong growth, with Bose maintaining a leading position.

Bose's high-fidelity wireless home audio systems are also considered Stars, capitalizing on the expanding smart home and high-resolution audio market.

| Product Category | Market Growth | Bose Market Share | Investment Needs |

|---|---|---|---|

| Premium Noise-Cancelling Headphones/Earbuds | High (projected continued expansion through 2025) | Strong Leadership Position | High (for R&D, marketing, production) |

| Premium Soundbars | Robust (global market projected to reach over $19 billion by 2028) | Market Leader | High (for innovation, marketing) |

| High-Fidelity Wireless Home Audio | Significant (smart speaker market projected over $25 billion by 2025) | Strong Foundation | Moderate to High (for R&D, connectivity) |

What is included in the product

The Bose BCG Matrix analyzes products by market share and growth, guiding investment decisions.

A clear visual representation of your product portfolio, simplifying complex strategic decisions.

Quickly identify underperforming products, enabling targeted resource allocation and problem-solving.

Cash Cows

Bose's established automotive sound systems represent a classic cash cow. Their long-standing relationships with luxury car brands mean these premium audio systems are a consistent feature in new vehicle production. This embedded nature ensures a steady, reliable revenue stream, as demand for high-quality in-car entertainment remains strong.

Bose's classic Acoustimass home theater systems exemplify cash cows within the BCG matrix. These systems, celebrated for their compact design and robust sound, command a dedicated following. Their mature market status means less need for significant, ongoing innovation investment.

These enduring products consistently generate stable revenue streams. In 2024, the home audio market, while competitive, still saw steady demand for established, high-quality systems like Acoustimass, contributing significantly to Bose's profitability with minimal incremental marketing or research and development expenditures.

Bose's legacy over-ear QuietComfort headphones, like the QC45, are firmly established Cash Cows. While newer models like the QuietComfort Ultra are positioned as Stars with their cutting-edge features and market entry, these older generations continue to benefit from strong brand recognition and a loyal customer base, particularly for their renowned noise-cancellation technology.

These headphones, having passed their peak innovation phase, now represent a consistent revenue stream. Their production and distribution channels are well-optimized, allowing Bose to maintain healthy profit margins with minimal ongoing investment in research and development. This mature product lifecycle ensures steady cash generation, supporting other ventures within the company's portfolio.

Wired and Basic Passive Loudspeakers

Bose's traditional wired and basic passive loudspeaker lines, often found in general home or commercial installations, occupy a stable, albeit lower-growth market segment. These products benefit from Bose's enduring brand strength and well-established distribution networks, ensuring consistent sales and profitability without the need for substantial new investments. For instance, in 2024, the passive speaker market continued to show resilience, with many consumers still valuing simplicity and reliability over advanced smart features.

These offerings act as cash cows for Bose, generating reliable revenue streams that can fund innovation in other product categories. Their established market presence means they require minimal marketing spend, further contributing to their healthy profit margins. The continued demand for dependable audio solutions underscores their role as a foundational element of Bose's product portfolio.

Key characteristics of these cash cows include:

- Stable Market Share: Benefiting from brand loyalty and established distribution.

- Consistent Profitability: Generating reliable revenue with lower reinvestment needs.

- Lower Growth Potential: Operating in mature segments of the audio market.

- Brand Equity Leverage: Capitalizing on Bose's reputation for quality and performance.

Brand Licensing and OEM Partnerships (excluding automotive)

Bose leverages its robust brand equity through strategic licensing and Original Equipment Manufacturer (OEM) partnerships across various consumer electronics sectors. This approach allows the company to extend its reach into markets where direct product development might not be the most efficient strategy, capitalizing on its established reputation for quality and innovation.

These collaborations typically generate consistent, low-risk revenue streams. For instance, Bose's audio technology could be integrated into smart home devices, premium headphones from other brands, or even specialized audio solutions for commercial venues. In 2024, the global brand licensing market was valued at over $300 billion, with consumer electronics being a significant contributor, showcasing the substantial opportunity for companies like Bose.

- Brand Licensing: Agreements allowing third parties to use the Bose brand name on their products, often in exchange for royalties.

- OEM Partnerships: Integrating Bose audio components or technologies into other manufacturers' products.

- Revenue Generation: These partnerships provide a steady income stream with lower operational overhead compared to direct product sales.

- Market Expansion: Extends Bose's presence into new product categories and customer segments without significant R&D investment.

Bose's established automotive sound systems and classic Acoustimass home theater systems are prime examples of cash cows. These products benefit from long-standing brand loyalty and mature market positions, ensuring consistent revenue generation with minimal need for extensive innovation investment.

The legacy QuietComfort headphones, like the QC45, also fall into this category, leveraging strong brand recognition for steady sales. Similarly, Bose's traditional wired and passive loudspeakers maintain a stable market presence, contributing reliably to overall profitability.

These cash cows are characterized by stable market share, consistent profitability, and lower growth potential, effectively leveraging Bose's brand equity. In 2024, the home audio and headphone markets continued to demonstrate resilience for well-established, quality products.

Bose's strategic brand licensing and OEM partnerships further solidify these cash cow dynamics, extending market reach and generating low-risk revenue. The global brand licensing market, valued at over $300 billion in 2024, highlights the significant financial opportunity in these collaborations.

| Product Category | BCG Classification | Key Characteristics | 2024 Market Observation |

|---|---|---|---|

| Automotive Sound Systems | Cash Cow | Long-standing OEM relationships, consistent demand | Steady revenue from premium vehicle integrations |

| Acoustimass Home Theater | Cash Cow | Mature market, dedicated following, low R&D needs | Reliable sales from established product line |

| QuietComfort (Legacy Models) | Cash Cow | Strong brand recognition, loyal customer base | Continued sales driven by noise-cancellation reputation |

| Wired/Passive Loudspeakers | Cash Cow | Stable market segment, brand strength, minimal investment | Resilience in demand for simplicity and reliability |

Full Transparency, Always

Bose BCG Matrix

The preview you see is the complete and finalized Bose BCG Matrix document you will receive immediately after purchase. This means there are no watermarks, no incomplete sections, and no demo content; you get the full, professionally formatted strategic tool ready for immediate application. The insights and structure presented here are precisely what you will download, enabling you to conduct thorough business analysis and decision-making without any further modifications. This ensures you have a high-quality, actionable resource for evaluating your product portfolio and guiding future investments.

Dogs

Older portable Bluetooth speakers, lacking modern features and improved battery life, are firmly in the Dogs quadrant of the BCG Matrix. These products are likely experiencing declining sales as newer, more competitive models emerge. For instance, while the overall portable speaker market saw significant growth, older, un-updated models would have contributed minimally to this expansion.

Niche or experimental products with low adoption represent a challenging segment within the BCG matrix. These are often products that Bose has tried in the past, perhaps experimental audio accessories or very specialized devices, that simply didn't catch on with a broad audience. Think of past attempts at highly niche audio solutions that saw minimal sales and struggled to justify their existence.

These products typically exhibit very low sales volumes, meaning they contribute little to overall revenue. Furthermore, they often necessitate ongoing support, such as customer service or warranty claims, and require inventory management, tying up capital without generating significant returns. In 2023, for instance, a hypothetical niche product line might have only sold a few thousand units globally, resulting in a negative return on investment due to the costs associated with its continued presence.

Entry-level wired earbuds and headphones represent a challenging segment for Bose. In a market saturated with numerous brands offering lower-priced alternatives, Bose's share in this basic category is likely very small. These products typically yield low profit margins and struggle to stand out, making them a poor fit for Bose's premium brand image.

Outdated Home Audio Receivers/Amplifiers

Standalone home audio receivers and amplifiers that lack modern connectivity features, such as advanced streaming capabilities or multi-room integration, would likely be classified as Dogs in Bose's BCG Matrix. This segment represents a declining market as consumer preferences shift towards more integrated and convenient audio solutions.

The market for traditional, feature-limited receivers is shrinking. For instance, the global audio equipment market, while growing overall, sees a diminishing share for products without smart features. In 2023, the global home audio market was valued at approximately $118.5 billion, but the specific segment for older, non-connected receivers is experiencing negative growth.

- Declining Market Segment: Traditional receivers without smart features are in a shrinking market.

- Consumer Preference Shift: Consumers are moving towards integrated soundbars and wireless multi-room systems.

- Low Growth and Share: These products offer low growth potential and are likely to have a small market share.

- Market Data: While the overall home audio market is robust, the niche for outdated receivers is contracting, with some reports indicating single-digit negative growth in this specific category.

Products with High Return Rates or Customer Dissatisfaction

Products with high return rates, often seen in the Dogs category of the BCG matrix, indicate significant issues. For instance, a particular line of wireless earbuds might consistently face returns due to poor battery life or connectivity problems. These products fail to meet customer expectations, leading to dissatisfaction.

The financial implications are substantial. High return rates translate directly into increased costs for processing, shipping, and potential restocking or disposal. In 2024, companies experiencing such issues might see return-related expenses eat up a significant portion of their profit margins, potentially reaching 10-15% of the product's revenue.

- High Return Rates: Products with a return rate exceeding 5% are often flagged.

- Customer Dissatisfaction: Negative reviews and social media complaints often accompany these products.

- Financial Drain: Costs associated with returns, warranty claims, and potential brand damage can outweigh revenue.

- Compatibility Issues: Problems with integration into existing ecosystems or with other devices are common causes.

Products in the Dogs quadrant of the BCG Matrix are those with low market share in a low-growth industry. These offerings typically generate minimal profits and may even incur losses, often requiring significant investment to maintain. For Bose, examples could include older, less popular audio accessories or product lines that haven't kept pace with technological advancements or consumer trends.

These products are characterized by their inability to capture substantial market share and their presence in mature or declining markets. They often require ongoing support and inventory management, tying up capital without yielding proportional returns. In 2024, a hypothetical Bose product in this category might see its sales decline by 5-10% year-over-year, contributing negatively to overall profitability.

The strategic implication for Bose is to either divest these products or find a way to revitalize them, though the latter is often challenging and costly. Failing to address these underperforming assets can detract resources from more promising areas of the business.

Consider a scenario with Bose's older wired headphone models. While the overall headphone market continues to grow, the segment for basic, non-noise-canceling wired headphones is experiencing a slowdown. These products, with their limited features and increasing competition from lower-priced brands, represent a classic Dog. In 2023, the global market for wired headphones, while still substantial, saw a decline in its share of the overall headphone market, with growth rates in the low single digits, and many older models would have seen negative growth.

| Product Category | Market Growth | Bose Market Share | Profitability | Strategic Implication |

|---|---|---|---|---|

| Older Wired Headphones | Low/Declining | Low | Low/Negative | Divest or Revitalize |

| Niche Audio Accessories | Low | Very Low | Low/Negative | Divest |

| Un-updated Portable Speakers | Moderate (Overall Market) | Low (for older models) | Low | Phase Out |

Question Marks

Bose is venturing into advanced AI-integrated smart home audio, a segment poised for significant expansion. The global smart home speaker market, fueled by AI and the Internet of Things (IoT), was valued at approximately $15 billion in 2023 and is projected to reach over $40 billion by 2028, with a compound annual growth rate of around 21%. This positions Bose's efforts within a dynamic, high-potential area.

However, this market is fiercely contested, with established players like Amazon (Echo), Google (Nest), and Apple (HomePod) holding substantial market share and brand recognition. Bose's current penetration in these advanced, interconnected smart home audio systems is relatively nascent, meaning they are in the early stages of building presence and capturing a meaningful slice of this competitive pie.

Bose's next-generation personal sound amplification devices could represent a significant "question mark" in their BCG matrix. This burgeoning market, projected to reach over $6 billion globally by 2027, offers substantial growth but demands heavy investment in research and development, particularly in areas like AI-driven sound personalization and discreet form factors.

Subscription-based audio services, while a potential avenue for Bose, would likely fall into the question mark category of the BCG matrix. The hardware-centric nature of Bose’s current business means entering a highly competitive streaming market, dominated by giants like Spotify and Apple Music, presents significant challenges. For instance, Spotify reported 615 million monthly active users as of Q1 2024, highlighting the immense scale needed to compete effectively.

Augmented Reality (AR) Audio Devices

Bose's augmented reality (AR) audio devices would likely be categorized as a Question Mark within the BCG Matrix. This aligns with the broader consumer electronics market's increasing investment in AR/VR technologies, where audio plays a crucial role in creating immersive experiences.

These devices operate within a nascent, high-growth market. While market adoption is still developing, the potential for significant future expansion is evident. For instance, the global AR market was projected to reach approximately $100 billion by 2025, indicating substantial growth potential for related audio components.

Bose's AR audio devices, in this context, would represent a product with currently low market share but positioned in an industry with strong future prospects. This necessitates considerable investment to foster consumer adoption and prove the technology's viability and long-term market appeal.

- Market Position: Low market share in a high-growth AR audio segment.

- Investment Needs: Requires significant R&D and marketing investment to establish market presence.

- Future Potential: High potential for growth as AR technology matures and gains wider consumer acceptance.

- Strategic Focus: Needs strategic decisions on whether to invest heavily to capture future market share or divest if viability remains uncertain.

Innovative Health and Wellness Audio Products

The wearable technology and health/fitness market is experiencing robust growth, creating significant opportunities for audio products specifically designed for wellness. Think about sleep-tracking headphones or devices that use therapeutic sound to aid relaxation and recovery. These are exciting, high-growth segments.

However, Bose's current market share in these specialized wellness audio applications is relatively low. This is understandable because these are emerging areas that demand tailored development and distinct market entry strategies. For instance, the global wearable technology market was valued at approximately $120 billion in 2023 and is projected to reach over $300 billion by 2028, highlighting the immense potential for innovative audio integration.

- Market Growth: The health and wellness audio sector is a rapidly expanding niche within the larger wearable technology market.

- Product Innovation: Bose can leverage its audio expertise to develop specialized products like sleep aids and therapeutic sound devices.

- Current Market Share: Bose holds a smaller share in this emerging segment, indicating room for strategic expansion.

- Strategic Focus: Success requires dedicated development and targeted market entry strategies to capture this growth potential.

Bose's ventures into advanced AI-integrated smart home audio and AR audio devices are prime examples of Question Marks. These represent areas with high growth potential but currently low market share for Bose.

These products require substantial investment in research and development to compete effectively against established players and to foster consumer adoption in nascent markets.

The success of these ventures hinges on strategic decisions regarding continued investment to capture future market share or potential divestment if market viability remains uncertain.

| Product Category | Market Growth Potential | Bose Market Share | Investment Requirement | Strategic Consideration |

|---|---|---|---|---|

| AI-Integrated Smart Home Audio | High (21% CAGR projected to 2028) | Low/Nascent | High (R&D, Marketing) | Build share in competitive market |

| AR Audio Devices | Very High (AR market projected ~$100B by 2025) | Low | Very High (R&D, Consumer Adoption) | Prove technology viability |

| Health & Wellness Audio | High (Wearables market projected to $300B+ by 2028) | Low | High (Specialized Development) | Targeted market entry |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitor analysis, to provide a robust strategic overview.