Booz Allen Hamilton Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booz Allen Hamilton Holding Bundle

Booz Allen Hamilton Holding operates in a complex environment shaped by intense competition, significant buyer power, and the constant threat of new entrants and substitutes. Understanding these forces is crucial for navigating the consulting and technology services landscape.

The complete report reveals the real forces shaping Booz Allen Hamilton Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Booz Allen Hamilton's success hinges on its highly skilled workforce, especially in critical fields like artificial intelligence, cybersecurity, and data science. The demand for these specialized skills, particularly within the government sector, is immense.

The limited supply of professionals possessing both advanced technical expertise and the required security clearances gives these employees considerable leverage. This translates into demands for attractive compensation packages and comprehensive benefits.

In 2023, the U.S. Bureau of Labor Statistics reported a significant shortage in cybersecurity professionals, with projections indicating millions of unfilled positions globally. This scarcity directly impacts companies like Booz Allen Hamilton, necessitating substantial investment in talent acquisition and retention to maintain its competitive edge.

Booz Allen Hamilton's reliance on specialized technology and software providers like Amazon Web Services, Palantir, and NVIDIA grants these suppliers significant bargaining power. These partnerships are essential for Booz Allen to offer cutting-edge digital solutions and meet demanding government client needs. For instance, NVIDIA's dominance in AI hardware, a critical component for many of Booz Allen's advanced analytics projects, allows them to influence pricing and terms.

Booz Allen Hamilton's reliance on niche data and analytics providers is growing as the company deepens its expertise in AI and advanced analytics. These specialized suppliers can wield significant bargaining power because their unique datasets and analytical tools are often critical for Booz Allen to deliver innovative and effective client solutions. For instance, Booz Allen's provision of commercial geospatial intelligence data to agencies like the National Geospatial–Intelligence Agency highlights this dependency.

Infrastructure and Cloud Service Providers

The bargaining power of infrastructure and cloud service providers for Booz Allen Hamilton is significant, especially given the government's push for digital transformation. These providers are critical for Booz Allen's ability to offer secure and scalable IT solutions. Their capacity to meet rigorous government compliance standards directly impacts Booz Allen's service delivery. For instance, in 2023, the U.S. federal government's spending on cloud computing services was projected to reach over $20 billion, highlighting the essential nature of these suppliers and their leverage.

Booz Allen's reliance on major cloud platforms like Amazon Web Services (AWS) underscores the suppliers' influence. These partnerships are not just transactional; they are strategic enablers for Booz Allen's modernization efforts. The concentration of a few dominant cloud providers means they possess considerable pricing power and can dictate terms, which Booz Allen must navigate to maintain its competitive edge in delivering advanced IT capabilities to its government clients.

- Critical Dependence: Booz Allen's operations are heavily dependent on cloud infrastructure for delivering modern IT solutions to government clients.

- Regulatory Compliance Leverage: Cloud providers' ability to meet stringent government security and compliance mandates (e.g., FedRAMP) grants them significant bargaining power.

- Market Concentration: The dominance of a few major cloud providers (like AWS, Microsoft Azure, Google Cloud) limits Booz Allen's supplier options and strengthens provider leverage.

- Strategic Partnerships: Booz Allen's need for advanced, secure cloud services necessitates strong relationships with these key providers, further solidifying their position.

External Training and Certification Bodies

Booz Allen Hamilton relies on external training and certification bodies to keep its workforce skilled in areas like AI and cybersecurity, which are crucial for its competitive edge. These third-party providers are essential for delivering specialized knowledge. In 2024, the demand for cybersecurity professionals continued to surge, with a projected global shortage of 3.4 million by the end of the year, highlighting the importance of these training partners.

The quality and industry recognition of certifications offered by these external organizations directly impact Booz Allen's human capital. This gives these training providers a degree of bargaining power, influencing both the availability and cost of acquiring cutting-edge expertise. For instance, certifications in cloud security or advanced data analytics often command premium pricing due to their specialized nature and high demand among consulting firms.

- Specialized Skill Development: External bodies provide critical training in rapidly evolving fields like artificial intelligence and cybersecurity.

- Human Capital Impact: The quality of these certifications directly affects Booz Allen's workforce capabilities.

- Supplier Influence: Training providers hold influence over the cost and accessibility of essential, specialized knowledge.

- Market Demand: In 2024, the cybersecurity talent gap underscored the value and leverage of certified training providers.

Booz Allen Hamilton's reliance on specialized technology providers, particularly in areas like AI and cloud computing, grants these suppliers significant bargaining power. Companies such as NVIDIA for AI hardware and major cloud platforms like AWS exert influence due to their critical role in delivering advanced solutions to government clients. This dependence is amplified by the concentration within these markets, limiting Booz Allen's alternatives and strengthening supplier leverage.

The scarcity of specialized talent, especially those with government security clearances, empowers employees and, by extension, specialized training providers. In 2024, the persistent cybersecurity talent shortage, projected to reach 3.4 million unfilled positions globally, highlights the leverage held by those who can equip professionals with in-demand certifications. This dynamic influences compensation and the cost of acquiring crucial expertise.

| Supplier Category | Key Providers | Impact on Booz Allen | 2024 Data/Trend |

|---|---|---|---|

| AI Hardware | NVIDIA | Critical for advanced analytics projects; influences pricing. | Continued demand for AI acceleration hardware. |

| Cloud Computing | AWS, Microsoft Azure, Google Cloud | Essential for secure, scalable IT solutions; dictates terms due to market concentration. | U.S. federal cloud spending projected to exceed $25 billion in 2024. |

| Specialized Training | Various certification bodies | Affects cost and availability of critical skills; influences workforce capabilities. | Cybersecurity talent gap projected at 3.4 million globally by end of 2024. |

What is included in the product

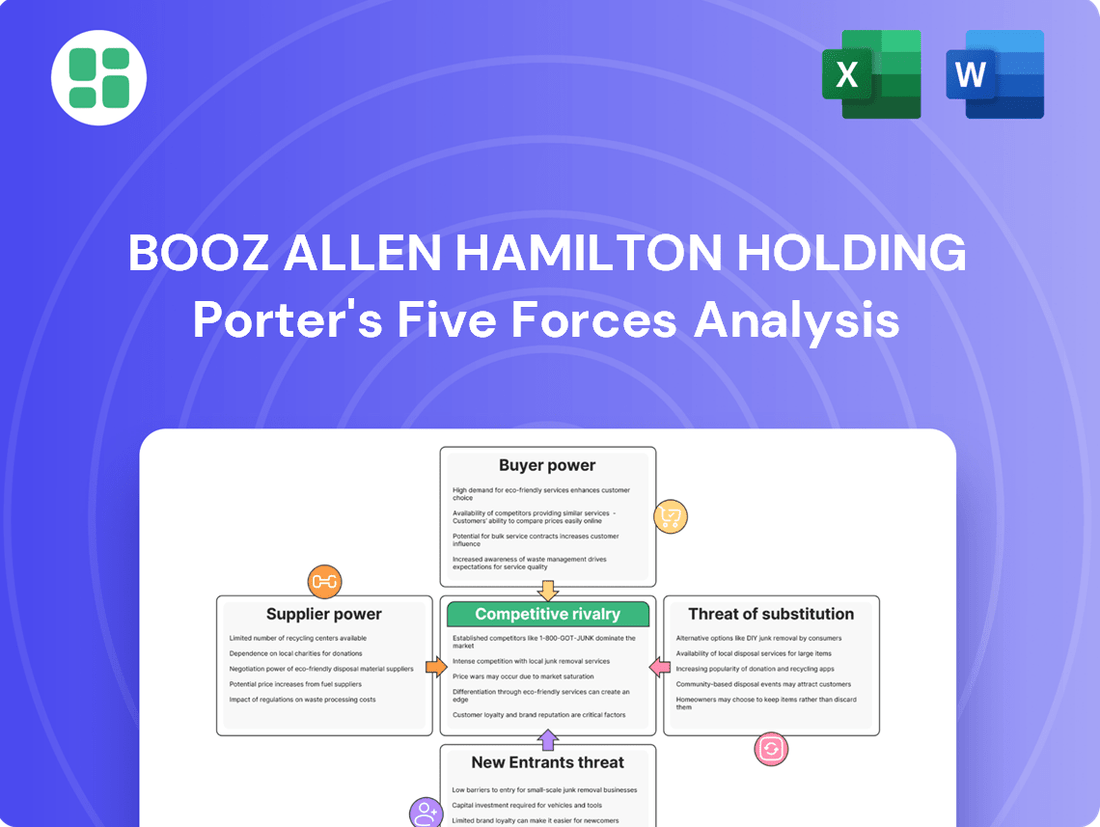

Analyzes the competitive landscape for Booz Allen Hamilton Holding, detailing the intensity of rivalry, the threat of new entrants, buyer and supplier power, and the availability of substitutes.

Instantly identify competitive pressures and strategic vulnerabilities within the consulting landscape, enabling proactive mitigation of threats.

Customers Bargaining Power

Booz Allen Hamilton's reliance on the U.S. federal government as its primary customer, with a substantial portion of revenue stemming from a few key agencies in Defense, Intelligence, and Civil sectors, grants these entities significant bargaining power. For instance, in fiscal year 2023, approximately 90% of Booz Allen's revenue came from the U.S. government, highlighting the concentrated nature of its client base.

This concentration means that major government departments, due to the sheer volume and strategic importance of their contracts, can exert considerable influence over pricing and contract terms. Any shifts in government spending priorities or policy changes directly and significantly impact Booz Allen's revenue streams, underscoring the customer's leverage.

Booz Allen Hamilton's customers, particularly government entities, often enter into large, multi-year contracts. For instance, the company secured a $506 million contract with the Army Aviation and a $1.2 billion CDM DEFEND contract in recent periods. These substantial commitments, spanning several years, inherently give clients significant bargaining power.

The sheer scale and extended duration of these contracts allow customers to negotiate terms that are highly advantageous to them. This leverage is felt not only during the initial bidding process but also throughout the ongoing management and renewal phases of these significant engagements.

Booz Allen Hamilton Holding's customers often rely on mission-critical services essential for national security, defense, and intelligence. These indispensable functions mean clients have limited flexibility in switching providers, especially for sensitive projects. In 2024, the company's deep integration and established trust in these sectors significantly mitigate customer bargaining power.

Competitive Procurement Processes

The U.S. government's procurement process is inherently competitive, forcing Booz Allen Hamilton to vie against numerous qualified firms for lucrative contracts. This structured bidding environment significantly enhances the bargaining power of government customers, enabling them to negotiate for competitive pricing, superior service delivery, and cutting-edge solutions. Booz Allen's demonstrated ability to consistently secure substantial government contracts, such as its significant wins in the defense and civilian sectors, underscores its effectiveness in this demanding marketplace.

Key aspects of this competitive procurement include:

- Rigorous Bidding Requirements: Government solicitations often involve detailed proposal submissions, technical evaluations, and price negotiations, giving customers leverage.

- Multiple Qualified Bidders: Booz Allen frequently faces competition from established players and emerging firms, driving down prices and increasing demands for value.

- Contract Re-competition: Existing contracts are often re-competed, providing customers opportunities to reassess performance and secure more favorable terms.

Pressure for Innovation and Cost Efficiency

Government clients, a core demographic for Booz Allen Hamilton, are increasingly demanding cutting-edge technological solutions, especially in areas like artificial intelligence and cybersecurity. This push for innovation is coupled with a strong emphasis on cost efficiency, as these clients are accountable for taxpayer money. In 2024, federal IT spending was projected to reach over $160 billion, with a significant portion allocated to modernization and advanced capabilities, highlighting this dual pressure.

This dynamic grants customers considerable leverage. They can effectively push for the development of sophisticated solutions while simultaneously demanding optimized pricing. Booz Allen Hamilton must therefore maintain a relentless focus on innovation, consistently demonstrating the clear, tangible value and return on investment their advanced services provide to meet these evolving client expectations.

- Demand for AI and Cybersecurity: Government agencies are prioritizing investments in AI and cybersecurity to address national security and operational efficiency.

- Cost Efficiency Mandate: Clients are scrutinizing budgets, requiring vendors to deliver high-value services at competitive price points.

- Innovation as a Differentiator: Booz Allen's ability to offer novel solutions that directly address these dual pressures is key to maintaining its competitive edge.

Booz Allen Hamilton's customer base, heavily concentrated in the U.S. federal government, grants these entities significant bargaining power. With approximately 90% of its revenue derived from government contracts in fiscal year 2023, the company's reliance on a few key agencies means clients can strongly influence pricing and terms. This concentration amplifies the leverage held by major government departments due to the sheer volume and strategic importance of their engagements.

The competitive nature of government procurement, where Booz Allen Hamilton must contend with numerous qualified firms, further enhances customer bargaining power. This environment necessitates rigorous bidding, multiple bidder engagement, and the potential for contract re-competition, all of which allow clients to negotiate for better pricing and service delivery. For example, the U.S. government's IT spending in 2024 was projected to exceed $160 billion, indicating a vast market where competition is fierce.

Clients' increasing demand for advanced solutions, such as AI and cybersecurity, coupled with a stringent focus on cost efficiency, also bolsters their leverage. Booz Allen Hamilton must continually innovate and demonstrate clear value to meet these dual pressures, ensuring their services provide a strong return on investment in a market where taxpayer accountability is paramount.

| Customer Segment | Revenue Dependence (FY23) | Key Leverage Factors |

|---|---|---|

| U.S. Federal Government | ~90% | Concentrated client base, large contract volumes, competitive bidding, demand for innovation & cost efficiency |

| Defense Sector | High | Mission-critical services, long-term contracts, stringent security requirements |

| Intelligence Sector | High | Highly specialized needs, deep integration, sensitive project requirements |

| Civil Sector | Moderate | Focus on modernization, efficiency mandates, diverse agency needs |

Full Version Awaits

Booz Allen Hamilton Holding Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for Booz Allen Hamilton Holding, detailing the competitive landscape and strategic implications within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or alterations. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a thorough understanding of the forces shaping Booz Allen Hamilton's market position.

Rivalry Among Competitors

Booz Allen Hamilton faces intense competition from a wide range of established players. Major consulting firms like Accenture Federal Services, alongside government contractors such as Leidos, SAIC, and CACI International, are significant rivals. This crowded field means competition for government contracts is fierce, with many firms possessing similar skill sets and bidding on the same projects.

Competitive rivalry within the consulting sector is intense, yet firms like Booz Allen Hamilton distinguish themselves through specialized expertise and incumbency. This differentiation is crucial as competitors aim to carve out unique niches or build superior capabilities in specific areas, leading to a multi-faceted rivalry rather than a simple price war.

Booz Allen’s competitive edge is significantly bolstered by its highly cleared technical workforce and deep domain expertise, particularly within the federal government space. Their incumbency in managing legacy systems and a leading position in federal artificial intelligence and cybersecurity initiatives are substantial advantages that competitors find difficult to replicate.

The government contracting landscape is defined by immense, multi-year deals that are the lifeblood of revenue and market standing. These substantial contracts naturally fuel intense competition, with companies vying fiercely for every strategic win.

In 2023, the U.S. federal government awarded over $700 billion in prime contracts, highlighting the sheer scale of these opportunities and the high stakes involved for contractors like Booz Allen Hamilton.

Securing these large contracts not only guarantees predictable income for years but also significantly bolsters a firm's credibility and competitive edge within the industry.

Industry Consolidation and Strategic Partnerships

The competitive rivalry in the consulting sector is intensifying due to significant industry consolidation. Larger players are actively acquiring smaller, specialized firms to broaden their service offerings and gain market share. For instance, Booz Allen Hamilton's acquisition of PAR Government Systems Corporation in 2023 aimed to bolster its capabilities in areas like artificial intelligence and data analytics.

Strategic partnerships are also a key driver of competitive intensity. Collaborations, like Booz Allen's alliance with Palantir, allow companies to combine expertise and deliver more comprehensive, innovative solutions to clients. These alliances can create formidable competitive forces, making it challenging for standalone firms to compete effectively against integrated offerings.

- Industry Consolidation: Booz Allen Hamilton's acquisition of PAR Government Systems Corporation in 2023 is an example of how firms are consolidating to enhance service portfolios.

- Strategic Partnerships: Collaborations like Booz Allen's with Palantir enable the delivery of integrated and innovative solutions.

- Competitive Impact: These strategic moves create powerful competitive forces, increasing pressure on isolated market participants.

Impact of Government Spending Cycles and Policy Shifts

The competitive rivalry within the government contracting sector, particularly for firms like Booz Allen Hamilton, is significantly shaped by the ebb and flow of government spending and evolving policy landscapes. When government budgets tighten, such as during periods of fiscal austerity, the demand for consulting and technology services can decrease, intensifying the competition for a smaller pie of available contracts. For instance, in fiscal year 2023, the U.S. federal government awarded approximately $713 billion in prime contract obligations, a figure that can fluctuate based on appropriations and national priorities.

Policy shifts, such as changes in defense spending priorities or a renewed focus on specific technological advancements, directly impact contract availability and the types of services in demand. Firms must remain agile, adapting their offerings to align with these evolving governmental needs to maintain their competitive edge. The ability to pivot and secure contracts in emerging areas, rather than relying on legacy programs, becomes crucial for sustained market presence.

- Government contract awards can fluctuate significantly year-over-year due to budget cycles.

- Policy changes can rapidly alter the demand for specific government services.

- Firms must demonstrate agility to adapt to shifts in government priorities and funding.

- Increased scrutiny on spending can lead to more competitive bidding processes.

Booz Allen Hamilton operates in a highly competitive environment, facing significant rivalry from established consulting firms and government contractors. The sheer volume of government contracts awarded, exceeding $700 billion in prime contracts in 2023, fuels this intense competition. Firms like Accenture Federal Services, Leidos, SAIC, and CACI International are direct competitors, often bidding on the same lucrative, multi-year deals.

Distinguishing factors like specialized expertise, incumbency, and a highly cleared workforce are crucial for Booz Allen to maintain its edge. Industry consolidation, exemplified by Booz Allen's 2023 acquisition of PAR Government Systems Corporation, and strategic partnerships, such as its alliance with Palantir, further intensify this rivalry by creating more integrated and formidable market players.

| Competitor Type | Key Players | Competitive Strategy Example |

|---|---|---|

| Major Consulting Firms | Accenture Federal Services | Broad service offerings, leveraging global resources. |

| Government Contractors | Leidos, SAIC, CACI International | Focus on specific government agency needs, deep domain expertise. |

| Specialized Tech Firms | (Acquired entities, e.g., PAR Government Systems Corporation) | Niche capabilities in AI, cybersecurity, data analytics. |

SSubstitutes Threaten

Government agencies are increasingly building in-house capabilities, potentially reducing reliance on external consultants like Booz Allen Hamilton. This trend is driven by a desire for greater control over sensitive data and long-term cost efficiencies. For instance, the U.S. federal government's IT spending has been steadily increasing, with a significant portion potentially allocated to developing internal digital services, impacting the market for outsourced IT consulting.

The growing availability of sophisticated off-the-shelf software and advanced AI tools poses a significant threat of substitution for some of Booz Allen Hamilton's consulting services. These technologies can now handle many data analysis, IT support, and process optimization tasks that previously required human consultants. For instance, the market for AI-powered business process automation software is projected to reach $60.1 billion by 2030, indicating a substantial shift towards automated solutions.

As government agencies and commercial clients increasingly adopt these automation platforms, the demand for consulting expertise in these specific areas may decline. This trend is evident as companies invest heavily in digital transformation, with global spending on AI software alone expected to exceed $200 billion in 2024. Such adoption directly reduces the reliance on external consultants for routine or easily automatable functions.

For less complex or highly niche requirements, government entities may turn to freelance consultants or smaller, specialized firms. These alternatives often provide more cost-effective solutions or very focused expertise, bypassing the higher overhead of larger consulting organizations. While Booz Allen Hamilton excels in large, intricate, and mission-critical projects, these smaller entities can represent a competitive challenge on the fringes of their market.

Direct Engagement with Technology Vendors

Government agencies are increasingly exploring direct engagement with technology vendors, bypassing traditional consulting intermediaries. This trend poses a significant threat of substitutes for firms like Booz Allen Hamilton, particularly in areas like technology implementation and integration. For instance, many agencies are building out their internal IT project management and systems integration capabilities, reducing their reliance on external expertise.

This shift means that instead of engaging a firm like Booz Allen to manage the integration of new software or cloud services, agencies might opt to work directly with providers such as Microsoft, Amazon Web Services, or Google Cloud. This direct approach can potentially reduce costs and streamline the procurement and implementation process. In 2024, federal IT spending on cloud services alone was projected to reach over $30 billion, indicating a substantial market where direct vendor relationships are becoming more common.

- Direct Vendor Partnerships: Agencies can procure and manage technology solutions directly from software, hardware, and cloud providers.

- Internal Capability Development: Government entities are investing in internal expertise for project management and technology integration.

- Cost Efficiency: Bypassing consulting firms can lead to direct cost savings for government technology projects.

- Market Trends: The growing federal cloud services market, exceeding $30 billion in 2024, highlights the potential for direct vendor engagement.

Evolution of Service Delivery Models

The increasing adoption of 'as-a-service' models, like Platform as a Service (PaaS) and Software as a Service (SaaS), along with outcome-based contracting, presents a significant threat of substitution for traditional consulting services. These new delivery methods fundamentally change how government agencies acquire solutions, shifting focus from hours billed to tangible results. For instance, the rise of cloud-based solutions, which Booz Allen Hamilton is actively integrating, allows agencies to access capabilities without the same reliance on bespoke, long-term consulting engagements that characterized earlier procurement methods.

Booz Allen Hamilton is proactively addressing this threat by pivoting towards outcome-based and fixed-price contracts. This strategic shift aims to align service delivery with the value generated for clients, directly countering the substitution risk posed by models that emphasize results over traditional time-and-materials consulting. The company reported that approximately 60% of its revenue in fiscal year 2023 was derived from performance-based contracts, indicating a strong move away from the very service models that are being substituted.

These evolving service delivery models substitute conventional consulting by redefining the nature of value. Instead of selling hours of expertise, firms are increasingly selling access to capabilities, guaranteed outcomes, or long-term partnerships tied to performance metrics. This puts pressure on traditional consulting firms to demonstrate a clear, quantifiable return on investment that goes beyond the delivery of advice or analysis.

- Shift to Outcome-Based Contracts: Government agencies are increasingly favoring contracts where payment is tied to achieving specific, measurable outcomes rather than the hours consultants work.

- Rise of 'As-a-Service' Models: Cloud-based solutions (SaaS, PaaS) offer alternative, often more flexible and cost-effective, ways for clients to access technological capabilities, reducing the need for traditional IT consulting.

- Booz Allen's Adaptation: Booz Allen Hamilton is responding by increasing its focus on performance-based and fixed-price contracts, aiming to align its revenue with client success.

- Impact on Traditional Consulting: These substitutions challenge the long-standing model of selling consulting hours, forcing a re-evaluation of value proposition and service delivery methods.

The rise of sophisticated, off-the-shelf software and advanced artificial intelligence tools presents a significant threat of substitution for certain Booz Allen Hamilton services. These technologies can now perform many data analysis, IT support, and process optimization tasks that previously required human consultants. The market for AI-powered business process automation software is projected to reach $60.1 billion by 2030, indicating a substantial shift toward automated solutions.

As government agencies and commercial clients increasingly adopt these automation platforms, the demand for consulting expertise in these specific areas may decline. Global spending on AI software alone was expected to exceed $200 billion in 2024, with such adoption directly reducing the reliance on external consultants for routine or easily automatable functions.

For less complex or highly niche requirements, government entities may turn to freelance consultants or smaller, specialized firms. These alternatives often provide more cost-effective solutions or very focused expertise, bypassing the higher overhead of larger consulting organizations. While Booz Allen Hamilton excels in large, intricate, and mission-critical projects, these smaller entities can represent a competitive challenge on the fringes of their market.

The increasing adoption of 'as-a-service' models, like Platform as a Service (PaaS) and Software as a Service (SaaS), along with outcome-based contracting, presents a significant threat of substitution for traditional consulting services. These new delivery methods fundamentally change how government agencies acquire solutions, shifting focus from hours billed to tangible results.

Entrants Threaten

The threat of new entrants into the government contracting arena, where Booz Allen Hamilton operates, is considerably low due to substantial barriers. These include the rigorous and time-consuming process of obtaining specialized security clearances for personnel and facilities, which can take months or even years and significant investment. For instance, obtaining a Top Secret clearance can cost upwards of $10,000 per individual, a substantial upfront cost for a new firm.

Furthermore, navigating the intricate web of federal regulations, compliance standards like the Federal Acquisition Regulation (FAR), and specific agency requirements presents another formidable challenge. New companies must invest heavily in legal and compliance expertise to ensure they meet these complex demands. The need for an established track record and proven performance in delivering sensitive government projects also acts as a significant deterrent, as agencies often prioritize experienced vendors.

Building trust and relationships with federal agencies is paramount, and this takes time and consistent, high-quality delivery. In 2024, the U.S. federal government awarded over $700 billion in contracts, but the majority of these went to established players with a history of successful engagement, making it difficult for newcomers to break in and secure a meaningful share of this market.

Becoming a major player in the consulting and technology services sector, akin to Booz Allen Hamilton, demands significant upfront capital. This includes substantial investments in attracting and retaining top-tier talent, particularly those with essential security clearances, which can be a lengthy and costly process. For instance, in fiscal year 2023, Booz Allen Hamilton reported approximately $9.7 billion in revenue, underscoring the scale of operations required to compete effectively.

Furthermore, developing and maintaining cutting-edge technological capabilities, such as advanced artificial intelligence platforms and robust cybersecurity infrastructure, requires continuous and considerable financial outlay. Booz Allen's commitment to innovation is evident in their ongoing investments in research and development, aiming to stay ahead in rapidly evolving fields. The need for a strong compliance framework also adds to these high fixed costs.

These substantial capital requirements and the necessity for ongoing investment create a significant barrier to entry. Potential new competitors face considerable hurdles in matching the scale, expertise, and technological prowess of established firms like Booz Allen Hamilton, thereby limiting the threat of new entrants.

Booz Allen Hamilton Holding benefits immensely from over a century of operation, cultivating a formidable reputation for deep expertise, particularly within national security and intricate government problem-solving. This long-standing trust and credibility are significant barriers for newcomers aiming to establish a similar foothold with federal clients.

The process for new entrants to replicate Booz Allen's brand recognition and the associated client confidence is both lengthy and exceptionally challenging. For instance, in fiscal year 2024, Booz Allen secured a substantial $16.7 billion in total backlog, underscoring the continued reliance of government agencies on their established capabilities.

Complex Regulatory Environment and Compliance

The government contracting landscape, particularly for a firm like Booz Allen Hamilton, is a significant barrier to entry due to its highly complex regulatory environment. New companies must contend with intricate procurement rules and demanding cybersecurity standards. For instance, in 2024, the U.S. government continued to emphasize stringent data protection measures, requiring contractors to adhere to evolving cybersecurity frameworks like the Cybersecurity Maturity Model Certification (CMMC) for many defense contracts.

Navigating this challenging regulatory terrain demands substantial legal and operational expertise, which new entrants often lack. The sheer weight of compliance obligations, from understanding Federal Acquisition Regulation (FAR) clauses to managing export control regulations, acts as a substantial deterrent. Firms without deep experience in this sector find the upfront investment in compliance infrastructure and personnel to be a formidable hurdle.

- Stringent Procurement Rules: New entrants must master complex bidding processes and contract administration requirements.

- Cybersecurity Mandates: Adherence to evolving standards like CMMC is critical for many government contracts.

- Compliance Expertise Required: Significant investment in legal and operational knowledge is necessary to meet obligations.

- High Cost of Non-Compliance: Penalties for failing to meet regulatory requirements can be severe, deterring less prepared firms.

Incumbency Advantage and Strategic Partnerships

Booz Allen Hamilton Holding benefits significantly from its established incumbency advantage. The firm possesses deep institutional knowledge and long-standing relationships with government agencies and commercial clients, making it challenging for new entrants to gain traction. For instance, in fiscal year 2023, Booz Allen reported a backlog of approximately $34 billion, underscoring the sticky nature of its existing contracts.

Strategic partnerships further erect barriers to entry. Collaborations with major technology providers, like their ongoing work with Palantir Technologies, allow Booz Allen to offer integrated, advanced solutions. These combined capabilities, often involving complex data analytics and cybersecurity, are difficult for smaller, specialized firms to match, effectively limiting the threat of new entrants who lack such established ecosystems.

- Incumbency Advantage: Booz Allen's deep institutional knowledge and long-standing government contracts create significant switching costs for clients.

- Strategic Partnerships: Alliances with technology leaders like Palantir offer integrated, hard-to-replicate solutions.

- Market Penetration: The complexity and scale of existing client systems and needs favor established players with proven track records.

- Fiscal Year 2023 Backlog: A backlog of ~$34 billion highlights the stability and depth of Booz Allen's existing client engagements.

The threat of new entrants for Booz Allen Hamilton is low due to high barriers like extensive security clearance requirements and complex federal regulations. For instance, obtaining a Top Secret clearance can cost over $10,000 per person, a significant initial investment. New firms also face the challenge of navigating intricate rules such as the Federal Acquisition Regulation (FAR) and demanding cybersecurity standards like CMMC, which were heavily emphasized by the U.S. government in 2024.

Significant capital investment is also a major deterrent, requiring substantial funds for talent acquisition, especially for cleared personnel, and for developing advanced technological capabilities. In fiscal year 2023, Booz Allen Hamilton’s revenue of approximately $9.7 billion illustrates the scale needed to compete. Furthermore, Booz Allen's century-long reputation and established client trust, evidenced by a fiscal year 2024 backlog of $16.7 billion, make it difficult for newcomers to gain market share.

The incumbency advantage, coupled with strategic partnerships, further solidifies Booz Allen's position. Their fiscal year 2023 backlog of $34 billion highlights the sticky nature of existing contracts. Collaborations, such as those with Palantir Technologies, allow Booz Allen to offer integrated solutions that are challenging for new entrants to replicate, effectively limiting competitive pressure from new market participants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Booz Allen Hamilton Holding is built upon a foundation of robust data, including company annual reports, investor presentations, and SEC filings. We also leverage industry-specific market research reports and data from reputable financial information providers.