Booz Allen Hamilton Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Booz Allen Hamilton Holding Bundle

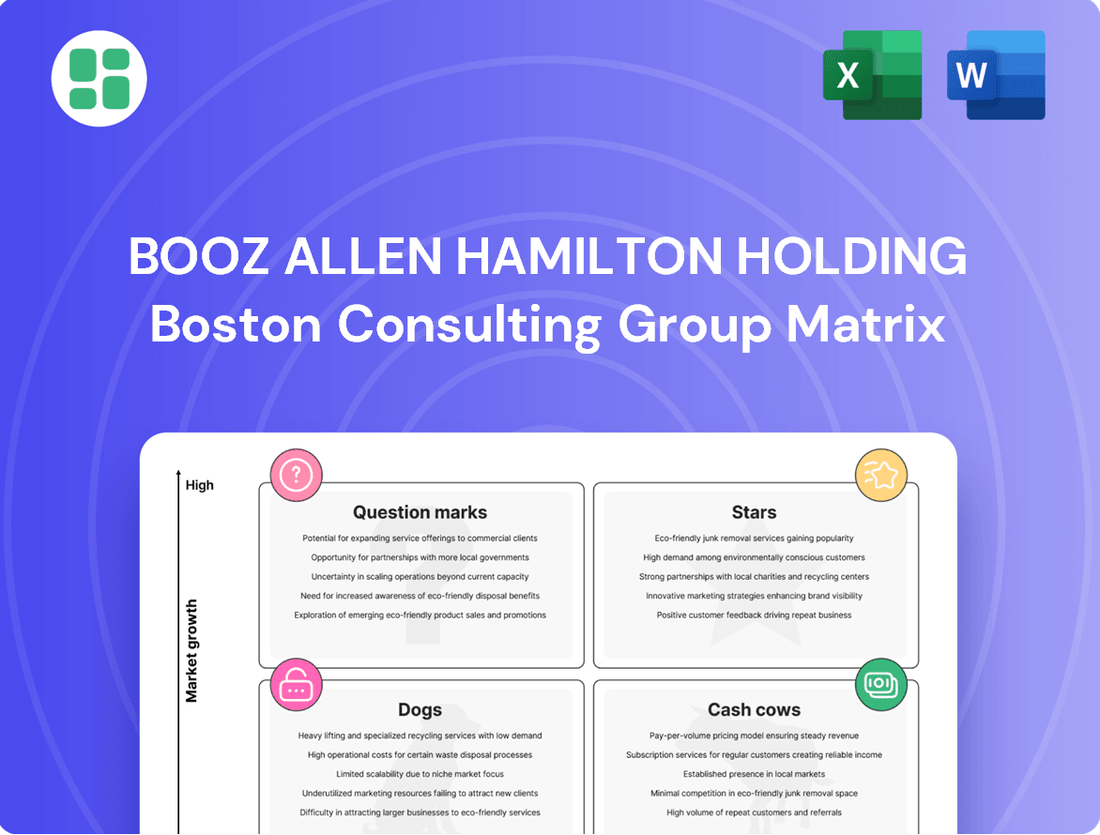

Explore the strategic positioning of Booz Allen Hamilton Holding's product portfolio with our insightful BCG Matrix preview. Understand which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially underperforming (Dogs).

This glimpse into Booz Allen Hamilton Holding's market standing is just the beginning. Purchase the full BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investment and product development strategies.

Gain a competitive edge by understanding exactly where Booz Allen Hamilton Holding stands in today's dynamic market. The complete BCG Matrix provides quadrant-by-quadrant insights and actionable strategic takeaways, offering you a direct path to market clarity and informed decision-making.

Stars

Booz Allen Hamilton is a powerhouse in AI and analytics for the U.S. government, bringing in about $600 million in AI revenue for fiscal year 2024. They aim to more than double this, reaching over $1 billion soon.

Demand for AI and machine learning in federal agencies is soaring as they look to boost critical missions. Booz Allen is well-positioned to capture this growth.

The company is making significant investments in AI talent and cutting-edge solutions, including generative AI and computer vision, solidifying its leading role in this fast-growing sector.

Cybersecurity Dominance represents a strong star for Booz Allen Hamilton, with its federal cyber revenue projected between $2.5 billion and $2.8 billion by fiscal year 2025. This segment is expected to account for almost a quarter of the company's total revenue, highlighting its significant growth and market leadership.

This robust performance is fueled by escalating digital threats and the government's critical need to fortify its systems. Initiatives like zero trust architectures and AI-powered cyber defenses are major drivers, positioning Booz Allen as a key player in securing national digital infrastructure.

With over 8,000 dedicated cyber professionals and a comprehensive service portfolio, Booz Allen Hamilton maintains a commanding market share in this essential and rapidly expanding sector.

Booz Allen Hamilton is heavily involved in the government's digital modernization, particularly with cloud solutions, which are crucial for enhancing agency efficiency and security. Their expertise in cloud migration and digital engineering supports federal agencies in updating their IT infrastructure.

The demand for these services is robust, driven by the federal government's continuous push for greater agility and modernized systems. Booz Allen's data analytics capabilities are also integral to these large-scale transformation projects, making them a key player in this space.

Defense and National Security Technology

The Defense and National Security Technology segment of Booz Allen Hamilton Holding Corp. is a significant growth engine, reflecting strong market demand and the company's strategic positioning. This sector experienced a substantial 20% revenue increase year-over-year in fiscal year 2024, with most of its business lines showing double-digit growth.

Booz Allen's established presence and deep expertise within national security and defense, coupled with a strategic emphasis on cutting-edge technologies, fuel considerable demand in this critical area. The company's involvement in major initiatives underscores this strength.

- Defense and National Security Technology Segment Growth: Revenue increased by 20% year-over-year in fiscal year 2024, with broad double-digit growth across its portfolio.

- Key Growth Drivers: Deep incumbency, extensive expertise in national security and defense, and a focus on advanced technologies are driving significant demand.

- Notable Contracts and Initiatives: Booz Allen is actively involved in high-priority projects such as the $1.86 billion Thunderdome contract, which focuses on zero trust implementation and artificial intelligence applications for defense.

- Market Position: The company leverages its established relationships and technological capabilities to secure and execute complex, high-impact programs within the defense sector.

Strategic Emerging Technologies for Government

Booz Allen Hamilton is strategically focusing on emerging technologies beyond AI and cybersecurity to bolster defense and national security capabilities. This includes significant investment in post-quantum cryptography, autonomous swarms, and advanced sensing technologies.

These areas are identified as crucial future growth vectors, with Booz Allen aiming to secure early market leadership. The company leverages its Tech Scouting team and venture capital arm to identify and invest in these high-potential fields.

- Post-Quantum Cryptography: Protecting sensitive data from future quantum computing threats.

- Autonomous Swarms: Developing coordinated, multi-agent systems for defense applications.

- Advanced Sensing Technologies: Enhancing situational awareness and intelligence gathering.

Booz Allen Hamilton's AI and analytics capabilities are a significant star, with AI revenue projected to exceed $1 billion soon, up from around $600 million in fiscal year 2024. This growth is driven by high demand from federal agencies seeking to enhance their critical missions through AI and machine learning.

The company's cybersecurity segment shines brightly, with federal cyber revenue anticipated to reach $2.5 billion to $2.8 billion by fiscal year 2025, representing nearly a quarter of total revenue. This expansion is fueled by the increasing need for robust digital defenses and the adoption of advanced solutions like zero trust architectures.

Defense and National Security Technology is another star performer, achieving a 20% year-over-year revenue increase in fiscal year 2024. This segment's strength is bolstered by deep incumbency, extensive expertise, and strategic investments in advanced technologies, exemplified by participation in the $1.86 billion Thunderdome contract.

| Strategic Area | FY24 Revenue (Approx.) | Projected FY25 Revenue | Key Growth Drivers |

|---|---|---|---|

| AI & Analytics | $600 million | >$1 billion | Federal agency demand for mission enhancement |

| Cybersecurity | N/A (Segment focus) | $2.5 - $2.8 billion | Digital threat escalation, zero trust adoption |

| Defense & National Security Tech | 20% YoY Growth | Continued strong growth | Incumbency, expertise, advanced tech investment |

What is included in the product

This BCG Matrix overview provides strategic insights into Booz Allen Hamilton's portfolio, highlighting units for investment, divestment, or divestment.

A clear BCG Matrix visualizes business unit performance, relieving the pain of strategic uncertainty.

This tool offers a quick, actionable overview, simplifying complex portfolio decisions.

Cash Cows

Booz Allen Hamilton's core federal government consulting acts as a robust cash cow. The company consistently generates over 96-98% of its revenue from the U.S. federal government, highlighting the stability of its long-standing relationships with defense, intelligence, and civil agencies.

These engagements, though not typically high-growth, offer predictable revenue and healthy profit margins, bolstered by established contracts and extensive domain knowledge. Booz Allen Hamilton's total revenue hit $10.7 billion in fiscal year 2024, underscoring its substantial presence in this mature market.

Booz Allen Hamilton's established analytics and data science services for government clients are a classic cash cow. Their deep-rooted expertise in data engineering, visualization, and analysis has secured a high market share in a mature, reliable sector. These foundational capabilities continue to be critical for government decision-making, generating consistent revenue without the need for heavy reinvestment.

This segment, which has been a core offering for years, predates the current AI boom but remains indispensable. In 2023, Booz Allen reported that its consulting business, which includes these analytics services, saw significant growth, highlighting the enduring demand for their core competencies. This stability provides a strong financial bedrock, allowing the company to invest in and scale its more cutting-edge initiatives.

Booz Allen Hamilton Holding's legacy systems integration and support services function as a cash cow within their BCG matrix. The company has a deep-rooted expertise in helping federal agencies manage and update their often older IT infrastructures.

Despite the push for modernization, the continued necessity for skilled maintenance and operational continuity for these vital systems guarantees a consistent demand for Booz Allen's support. This steady revenue stream is bolstered by their established client relationships and existing operational capabilities, proving to be a reliable income generator.

Defense and Intelligence Operations Support

Booz Allen Hamilton's Defense and Intelligence Operations Support segment functions as a robust cash cow, underpinned by long-term, large-scale contracts. These agreements are crucial for the daily operations and mission-critical functions within the Department of Defense and the Intelligence Community, ensuring a stable and predictable revenue flow.

The services offered, such as operational analytics, systems engineering, and strategic advisory, are deeply integrated into government processes. This deep integration, coupled with the firm's established presence, creates significant barriers to entry and fosters recurring revenue streams, making this segment a reliable generator of cash for the company.

- Defense and Intelligence Operations Support generated approximately $4.7 billion in revenue for Booz Allen Hamilton in fiscal year 2023.

- This segment represents over 40% of Booz Allen Hamilton's total revenue.

- The company has secured multiple multi-year contracts with the U.S. Department of Defense, some extending beyond 2028.

- Booz Allen Hamilton's backlog in defense and intelligence services was reported at over $30 billion as of early 2024.

Human Capital and Organizational Strategy Consulting

Booz Allen Hamilton's Human Capital and Organizational Strategy Consulting services are a strong Cash Cow within their BCG portfolio. These offerings are vital for government clients, addressing critical areas like workforce planning, talent management, and organizational restructuring. This segment benefits from Booz Allen's established reputation and deep understanding of public sector needs.

The market for these services is mature, meaning growth is steady rather than explosive. However, Booz Allen commands a significant market share, allowing them to generate consistent and predictable revenue streams. In 2024, Booz Allen reported significant revenue from their consulting services, with human capital and organizational strategy forming a substantial portion of this, demonstrating their ability to leverage their expertise for reliable financial returns.

- Mature Market Segment: Focus on established government needs for workforce optimization and change management.

- High Market Share: Booz Allen's strong relationships and expertise ensure a dominant position.

- Consistent Revenue: Predictable income generation with relatively low reinvestment needs.

- Profitability Driver: Contributes significantly to overall firm profitability due to its stable nature.

Booz Allen Hamilton's core federal government consulting, particularly in Defense and Intelligence Operations Support, acts as a strong cash cow. This segment, which generated approximately $4.7 billion in revenue in fiscal year 2023, representing over 40% of the company's total revenue, benefits from long-term, large-scale contracts with predictable revenue flows and healthy profit margins.

The company's established analytics and data science services, along with human capital and organizational strategy consulting, also function as reliable cash cows. These mature market segments, where Booz Allen holds a high market share, provide consistent income with relatively low reinvestment needs, contributing significantly to the firm's overall profitability and financial bedrock.

| Segment | FY23 Revenue (Approx.) | % of Total Revenue (Approx.) | Key Characteristics |

|---|---|---|---|

| Defense & Intelligence Operations Support | $4.7 billion | 40%+ | Long-term contracts, mission-critical services, stable revenue |

| Analytics & Data Science | N/A (Integrated into Consulting) | N/A | Mature market, high market share, consistent demand |

| Human Capital & Org Strategy | N/A (Integrated into Consulting) | N/A | Mature market, predictable revenue, profitability driver |

What You See Is What You Get

Booz Allen Hamilton Holding BCG Matrix

The Booz Allen Hamilton Holding BCG Matrix preview you are viewing is the exact, final document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered without any watermarks or demo content, ensuring you get a ready-to-use report. You can confidently use this preview as a direct representation of the professional-grade BCG Matrix analysis that will be yours to download and implement immediately. It's a fully formatted, analysis-ready file, perfect for integrating into your business planning and presentations.

Dogs

Booz Allen Hamilton's global commercial business segment represents a small fraction of its overall revenue, contributing just 2% in fiscal year 2024. This segment also faced a substantial 25% decrease in revenue compared to the previous year.

The company has strategically divested parts of this business and experienced softness in the market, leading to the discontinuation of separate reporting for this segment due to its minimal size. This positions it within the 'Dog' category of the BCG matrix, signifying a low market share in a market that is either not growing or is contracting.

Outdated or commoditized basic IT services, while not explicitly labeled as such for Booz Allen Hamilton, would fall into the Dogs quadrant of the BCG matrix. These are services that offer low growth and low market share, often characterized by basic IT support or maintaining legacy systems without a clear path to modernization. For instance, if a significant portion of a company's IT budget is still allocated to maintaining older hardware or providing routine help desk functions that could be automated or outsourced more cheaply, these are likely "Dogs."

As government clients, a key demographic for Booz Allen, push for digital transformation and advanced capabilities like AI and cloud migration, services that fail to evolve risk losing relevance. By 2024, the demand for cutting-edge solutions has surged, meaning basic IT support without an upgrade path may see declining market share and minimal profit margins, potentially even operating at a loss if not managed strategically. This is particularly true as competitors offering more advanced, integrated solutions gain traction.

Non-strategic niche consulting areas for Booz Allen Hamilton, when viewed through a BCG matrix lens, would likely reside in the "Dogs" quadrant. These are segments characterized by low growth and low relative market share. For instance, a highly specialized cybersecurity offering with limited demand from federal agencies or a niche analytics service for a shrinking industry might fit here.

In 2024, Booz Allen reported that its commercial revenue grew by 15%, reaching $2.2 billion, indicating a strategic shift towards more lucrative sectors. Conversely, areas that remain "Dogs" might represent consulting services with minimal federal contracts, perhaps in areas where government funding has been significantly reduced or where Booz Allen's competitive advantage is not pronounced.

These "Dog" segments could be consulting practices where the firm has a small market share, and the overall market for that specific service is either not expanding or is too small to justify substantial investment. Such areas might only cover their costs or even drain resources without generating significant profits, making them candidates for divestiture or careful management to minimize losses.

Services Dependent on Divested Assets

Following Booz Allen Hamilton's strategic divestitures, particularly of its commercial business in 2020, service lines that were heavily dependent on these divested assets would fall into the 'Dogs' category of the BCG Matrix. These areas would have lost their strategic backing and market presence.

These 'Dog' segments would be characterized by low market share and limited growth prospects within Booz Allen's refocused portfolio, which now primarily serves the federal government. For instance, consulting services specifically tailored to commercial industries that were part of the divested segment would now be a poor fit for the company's core strategy.

The divestiture of the commercial business, completed in 2020, meant that any remaining capabilities or services that were intrinsically linked to that market would struggle. This strategic shift aimed to concentrate resources on the more lucrative and stable federal sector.

- Low Market Share: Services tied to divested commercial assets would have a minimal presence in the current market.

- Limited Growth Prospects: Without the strategic focus and investment, these areas are unlikely to expand.

- Resource Drain: Maintaining these underperforming segments can divert resources from more promising federal contracts.

- Strategic Misalignment: They no longer fit with Booz Allen's core mission of serving the federal government.

Non-Core, Low-Margin Project Work

Non-core, low-margin project work within Booz Allen Hamilton Holding's BCG Matrix, often categorized as Dogs, represents engagements taken primarily to utilize existing resources or maintain client relationships rather than to drive significant profit or strategic growth. These projects can sometimes account for a portion of revenue but are characterized by thin profit margins, potentially hindering overall profitability. For instance, in 2023, Booz Allen Hamilton reported revenue of $9.3 billion, but the focus on higher-margin strategic consulting and digital transformation initiatives means that lower-margin, non-core work, while present, is carefully managed to avoid resource drain.

These types of projects, while potentially filling capacity, often offer limited long-term strategic value and can divert attention and capital from more lucrative and growth-oriented opportunities. In the consulting industry, a focus on high-value, differentiated services is key to maximizing profitability and market share. While specific figures for "non-core, low-margin project work" are not publicly itemized by Booz Allen Hamilton, the company's strategic emphasis on areas like artificial intelligence, cybersecurity, and digital modernization highlights their prioritization of high-margin, high-growth segments.

- Low Profitability: These projects typically yield profit margins below the company's average, impacting overall financial performance.

- Resource Diversion: Engagement in these areas can pull skilled personnel and financial resources away from more strategic, higher-return initiatives.

- Limited Strategic Impact: They do not significantly contribute to Booz Allen Hamilton's market position in high-growth, innovative sectors.

Booz Allen Hamilton's "Dogs" in the BCG matrix represent business areas with low market share in slow-growing or declining markets. These segments, often characterized by basic IT services or non-strategic niche consulting, struggle to generate significant profits and may even drain resources. The company's strategic focus on high-growth areas like AI and digital transformation means these "Dog" segments are candidates for divestiture or careful cost management to minimize losses.

| BCG Category | Booz Allen Hamilton Holding Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Divested commercial business remnants; outdated IT services; non-core, low-margin projects | Low or Declining | Low | Divest, harvest, or minimize investment |

Question Marks

Booz Allen Hamilton's venture arm is actively investing in quantum computing, signaling a belief in its substantial future growth potential. While the technology is nascent, meaning market share for specific quantum solutions is currently minimal, these strategic investments align with Booz Allen's mission to leverage advanced commercial technologies for government applications.

These early-stage quantum computing ventures are characterized by significant cash requirements for research, development, and the crucial process of market adoption. For instance, Booz Allen Ventures participated in a $20 million funding round for a quantum computing startup in late 2023, underscoring the capital-intensive nature of this emerging field.

Booz Allen Hamilton is strategically increasing its venture investments in advanced manufacturing and the reindustrialization of America. These sectors are poised for significant growth, fueled by both national security imperatives and broader economic objectives. For instance, the U.S. Department of Defense has been actively promoting domestic manufacturing capabilities, with initiatives aimed at strengthening the defense industrial base, potentially injecting billions into these areas through 2024 and beyond.

While the growth potential is substantial, Booz Allen's current market share within these specialized sub-segments of advanced manufacturing and reindustrialization is likely still developing. These are considered high-risk, high-reward ventures. Success in these areas demands considerable upfront capital and a long-term commitment to building a strong competitive position, making them prime candidates for a Stars or Question Marks classification within a BCG matrix, depending on market penetration and growth rate.

Booz Allen's Tech Scouting team actively identifies hyper-specialized dual-use technologies, such as advanced AI for autonomous systems or novel materials for energy storage. These innovations hold significant promise for defense and national security applications, but their early-stage development means government adoption is still nascent.

For instance, Booz Allen might identify a breakthrough in quantum sensing, a technology with potential for both secure communications and advanced navigation. However, the market for such highly specific applications is currently very small, and the company's penetration within these nascent niches is consequently limited, placing them in the 'Question Mark' category of the BCG matrix.

New Geographic or Client Market Penetration

New geographic or client market penetration for Booz Allen Hamilton, while historically U.S. government-centric, would initially be classified as a question mark in the BCG matrix. This reflects ventures into entirely new international government arenas or substantial expansion into novel, high-growth commercial sectors, demanding significant investment to establish a foothold.

These strategic moves, such as targeting emerging defense markets in Southeast Asia or developing advanced cybersecurity solutions for the burgeoning fintech industry, represent high-potential, high-risk opportunities. Booz Allen's 2024 revenue from its commercial segment, though growing, still represented a smaller portion compared to its government business, highlighting the nascent stage of such diversified market entries.

- High Growth Potential: Entering new international government markets or expanding into rapidly growing commercial sectors offers significant upside.

- Low Market Share: Initially, Booz Allen would possess a minimal share in these new markets, requiring substantial effort to build presence.

- Investment Intensive: Gaining traction necessitates considerable financial and resource allocation for market research, business development, and tailored service offerings.

- Strategic Importance: These ventures are crucial for long-term diversification and mitigating reliance on a single client base, particularly as global defense spending patterns evolve.

AI-Enabled Malware Analysis and Threat Detection Products (e.g., Vellox Reverser)

Booz Allen Hamilton's AI-enabled malware analysis and threat detection products, such as Vellox Reverser, are positioned as potential 'Stars' in the BCG matrix. These advanced solutions, like Vellox Reverser, offer automated malware analysis and are considered high-growth products with a currently limited market share.

The development and market introduction of these innovative cybersecurity tools demand substantial cash investment. However, their cutting-edge AI capabilities present a significant opportunity for widespread adoption within the federal government and potentially broader markets, which could propel them to 'Star' status.

- High Growth Potential: AI-driven malware analysis offers a significant leap in threat detection speed and accuracy compared to traditional methods.

- Cash Intensive Development: Significant R&D and marketing resources are required to bring these sophisticated AI products to market.

- Market Penetration Strategy: Focus on securing early adoption within key federal agencies is crucial for establishing a strong market foothold.

- Future 'Star' Status: Successful integration and widespread use could lead to market leadership and substantial revenue growth.

Question Marks represent ventures with high growth potential but low market share, requiring significant investment to gain traction. Booz Allen's investments in quantum computing and advanced manufacturing exemplify this, as these nascent fields demand substantial capital for R&D and market penetration. These are strategic bets on future growth, aiming to capture emerging opportunities in critical technological areas.

For instance, Booz Allen's venture into quantum computing startups, with participation in a $20 million funding round in late 2023, highlights the capital intensity. Similarly, their focus on advanced manufacturing aligns with national security imperatives, with the U.S. Department of Defense potentially injecting billions into these sectors through 2024. These ventures are crucial for diversification but carry inherent risks due to their early stage and limited current market penetration.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, and competitive landscape analysis, to accurately position each business unit.