Bonduelle Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

Bonduelle faces a dynamic competitive landscape shaped by intense rivalry and significant buyer power within the processed food sector. Understanding the threat of new entrants and the bargaining power of suppliers is crucial for navigating this market.

The complete report reveals the real forces shaping Bonduelle’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bonduelle's reliance on agricultural raw materials means its suppliers, primarily farmers, hold significant bargaining power. This power is amplified when specific vegetable varieties are unique or difficult to source. For instance, if Bonduelle requires a particular heritage tomato variety for a premium product, suppliers of that specific crop would have greater leverage.

The concentration of suppliers also plays a crucial role. If only a few farms can produce the necessary inputs, their collective bargaining power increases substantially. This is particularly true in regions where climate or soil conditions are highly specific to certain crops that Bonduelle processes.

Bonduelle's strategy to counter this involves building strong, long-term relationships. By partnering with over 2,000 growers and emphasizing commitments to sustainable and regenerative agriculture, Bonduelle aims to foster loyalty and create a more stable supply chain, thereby reducing supplier-induced price pressures.

Bonduelle faces considerable switching costs when changing suppliers, particularly for niche or sustainably sourced produce. Building new relationships, verifying quality, and reconfiguring logistics are resource-intensive endeavors, thereby bolstering the bargaining power of current, dependable suppliers who align with Bonduelle's sustainability goals.

The threat of individual farmers integrating forward into processing and distribution is minimal for a company like Bonduelle. These farmers typically lack the substantial capital, sophisticated processing technology, and established global distribution channels necessary to challenge a major player. For instance, while the global agricultural sector is vast, the specialized processing of vegetables for international markets requires significant investment in facilities and logistics that individual farms rarely possess.

However, larger agricultural entities or well-organized farmer cooperatives might pose a more credible, albeit still limited, threat of forward integration. These groups could potentially pool resources to develop processing capabilities. Nevertheless, Bonduelle's extensive and efficient processing infrastructure, coupled with its robust supply chain and brand recognition, presents a formidable barrier to entry for any such integrated supplier.

Importance of Bonduelle to Suppliers

Bonduelle's significant purchasing volume makes it a crucial client for many agricultural suppliers, offering them consistent demand and often securing long-term agreements. This substantial reliance on Bonduelle can diminish the bargaining leverage of individual suppliers, as the loss of such a major customer would significantly disrupt their business. For instance, in 2023, Bonduelle's procurement of vegetables and fruits from its network of partner farms represented a substantial portion of their output.

The company's commitment to fostering sustainable and collaborative relationships with its growers further solidifies these connections. This approach positions Bonduelle as an attractive and reliable buyer, often preferred by many agricultural producers over less stable market opportunities. This strategic focus means suppliers are often incentivized to maintain favorable terms with Bonduelle.

- Major Customer Status: Bonduelle's large-scale operations mean it accounts for a significant percentage of sales for many of its agricultural partners.

- Stable Demand & Long-Term Contracts: The company's purchasing patterns provide predictability, reducing supplier risk and their need to exert strong price demands.

- Sustainable Partnerships: Bonduelle's emphasis on ethical and enduring relationships makes it a preferred and stable outlet for growers.

- Reduced Supplier Leverage: The dependence of suppliers on Bonduelle's consistent orders limits their ability to negotiate significantly higher prices or less favorable terms.

Availability of Substitute Inputs

The availability of substitute inputs for Bonduelle can influence supplier bargaining power. While Bonduelle's broad product range, encompassing canned, frozen, fresh-cut, and ready-to-eat vegetables, offers some flexibility in sourcing, the reliance on specific vegetable varieties for certain products means substitute options might be limited. This is especially true when particular growing conditions or intrinsic qualities are critical for product integrity.

For instance, if a specific type of pea is crucial for a signature frozen product, and its supply is constrained, Bonduelle may face higher prices from its existing suppliers. In 2023, the global vegetable market saw price fluctuations due to weather events and increased demand, highlighting the importance of input availability. For example, adverse weather in key growing regions in Europe impacted the supply of certain root vegetables, potentially increasing the bargaining power of suppliers for those specific inputs.

- Limited Substitutes: For niche or highly specific vegetable requirements within Bonduelle's product lines, the availability of cost-effective and quality-equivalent substitutes can be scarce, thereby strengthening supplier leverage.

- Specialized Inputs: When particular growing conditions or unique varietal characteristics are non-negotiable for product quality, suppliers of these specialized inputs gain more power.

- Market Dynamics: Global agricultural market trends, such as those observed in 2023 with weather-related supply disruptions, can further concentrate supplier power for essential, non-substitutable inputs.

Bonduelle's suppliers, primarily farmers, possess considerable bargaining power due to the specialized nature of agricultural inputs and the company's reliance on specific crop varieties. This power is amplified when only a limited number of farms can meet Bonduelle's stringent quality and sustainability standards, as seen with heritage tomato varieties or specific regional produce. For example, in 2023, adverse weather conditions in key European growing regions impacted the supply of certain root vegetables, increasing the leverage of those suppliers who could still provide consistent quality.

Bonduelle actively mitigates this by cultivating long-term relationships with over 2,000 growers, emphasizing commitments to sustainable practices. This strategy fosters supplier loyalty and creates a more stable supply chain, reducing the impact of price pressures. The company's substantial purchasing volume also makes it a critical client for many agricultural partners, offering predictable demand and limiting individual suppliers' ability to negotiate significantly higher prices.

Switching suppliers for niche or sustainably sourced produce involves considerable costs for Bonduelle, including relationship building, quality verification, and logistical adjustments. This strengthens the bargaining position of existing, dependable suppliers who align with Bonduelle's operational and ethical requirements. While the threat of forward integration by individual farmers is minimal, larger cooperatives could potentially pose a challenge, though Bonduelle's established infrastructure and market presence act as significant barriers.

| Factor | Impact on Bonduelle | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | High | Limited farms meeting specific quality/sustainability standards for niche crops. |

| Switching Costs | High | Resource-intensive to build new relationships, verify quality, and reconfigure logistics. |

| Supplier Dependence on Bonduelle | Low | Bonduelle represents a significant portion of sales for many agricultural partners, providing stable demand. |

| Availability of Substitutes | Varies (Low for niche inputs) | Limited cost-effective and quality-equivalent substitutes for specific vegetable varieties crucial to product integrity. |

What is included in the product

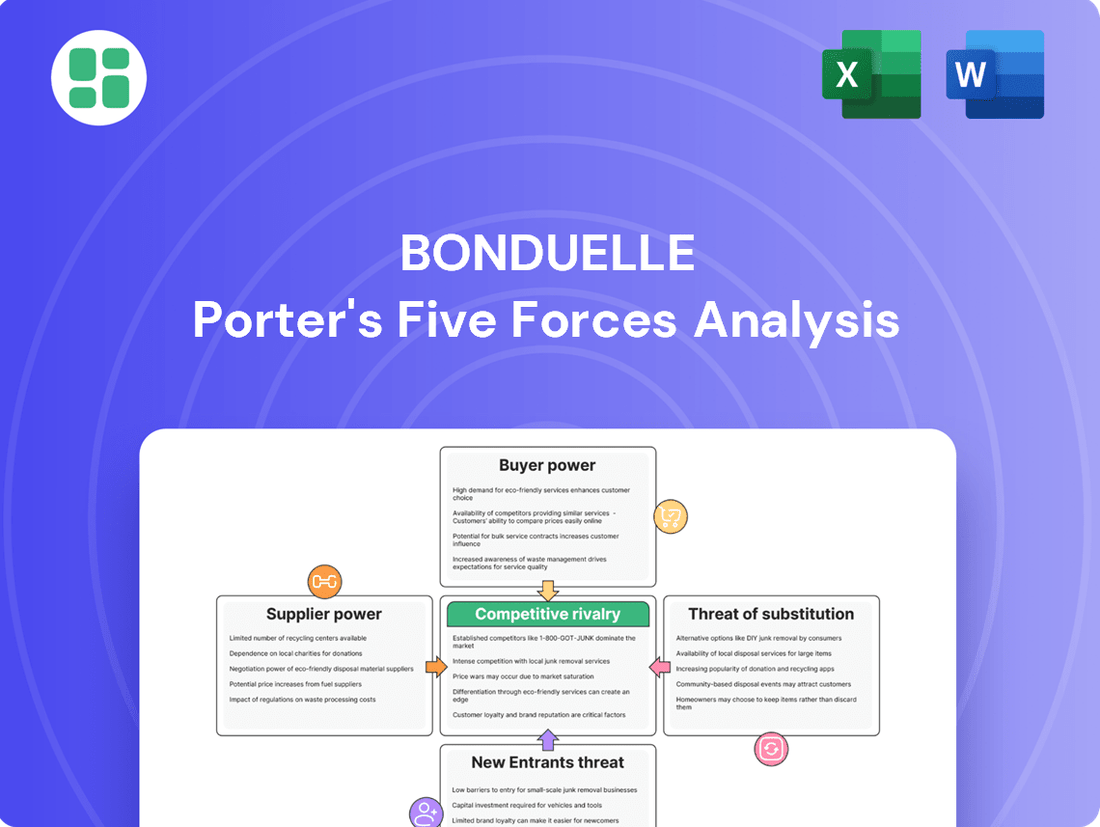

Bonduelle's Porter's Five Forces Analysis details the competitive intensity within the vegetable processing industry, assessing supplier and buyer power, threat of new entrants and substitutes, and the rivalry among existing players.

Bonduelle's Porter's Five Forces Analysis provides a clear, one-sheet summary of competitive pressures—perfect for quickly identifying and addressing market challenges.

Customers Bargaining Power

Bonduelle's customer base is spread across various channels like retail and foodservice globally. However, significant buying power resides with large retail chains and foodservice distributors who purchase in substantial volumes and can influence contract terms.

The company's performance in the first half of fiscal year 2024-2025 highlights a shift. Branded product sales grew by 1.9%, while private label sales dropped by 6.9%. This suggests customers are increasingly valuing brands, potentially reducing the bargaining power of those focused solely on private label volume.

Bonduelle's customers, particularly major retail chains, wield significant power due to their access to comprehensive market data. This includes insights into pricing trends, competitor product ranges, and evolving consumer tastes, all of which they leverage to negotiate better terms and put pressure on Bonduelle's profitability. For instance, in 2024, the increasing dominance of large supermarket chains in many of Bonduelle's key markets means these buyers can consolidate their purchasing power, demanding lower wholesale prices.

Consumer price sensitivity is another critical factor influencing Bonduelle's bargaining power. In 2024, with ongoing economic pressures and concerns about disposable income, consumers are actively seeking value. This trend favors private label brands, which often offer lower price points, thereby increasing the bargaining power of retailers who stock them. Bonduelle's strategy to counter this involves investing in brand differentiation and product innovation to justify premium pricing and maintain customer loyalty.

For retail and foodservice customers, the ease of switching between processed vegetable brands means Bonduelle faces low switching costs. Consumers can readily opt for competitor products or private labels, often with little to no disruption to their purchasing habits.

While Bonduelle benefits from strong brand recognition across its portfolio, including brands like Bonduelle, Cassegrain, and Globus, this alone doesn't create insurmountable barriers to switching in the processed vegetable sector. The core nature of these products allows for straightforward substitution.

Threat of Backward Integration by Customers

Large retail chains, especially those with robust private label offerings, present a moderate risk of backward integration. By establishing their own processed vegetable operations or securing direct sourcing agreements with growers, these retailers gain greater control over their supply chain, quality standards, and overall costs. This enhanced control naturally amplifies their bargaining power when negotiating with external suppliers like Bonduelle.

This strategic capability allows retailers to exert significant leverage, potentially dictating terms and pricing to suppliers. The threat is amplified by the increasing consolidation within the retail sector, where fewer, larger players command a greater share of the market.

Bonduelle's strategic decision to divest its packaged salad business in France and Germany reflects an adaptation to these evolving market dynamics, including the heightened bargaining power of its customer base. This move likely aims to streamline operations and focus on areas where its competitive advantage is stronger, mitigating the direct impact of potential backward integration by major retail partners.

- Retailer Private Label Growth: In 2023, private label sales in the U.S. grocery market reached approximately $200 billion, highlighting the significant scale and influence of these programs.

- Consolidation Trend: The top 10 U.S. grocery retailers controlled over 60% of the market in 2023, concentrating purchasing power.

- Direct Sourcing Initiatives: Major retailers are increasingly investing in direct sourcing models to ensure supply chain transparency and cost efficiency.

Product Differentiation and Brand Loyalty

Bonduelle's strategic emphasis on product differentiation through brand development, sustainable agriculture, and healthy food options is a key factor in managing customer bargaining power. By cultivating strong brand loyalty, Bonduelle aims to reduce price sensitivity among consumers.

Brands like Bonduelle, Cassegrain, and Globus have shown consistent performance, with stable sales in markets like the United States, underscoring their resilience and consumer appeal. This established brand equity allows Bonduelle to command a degree of pricing power.

- Brand Strength: Bonduelle's portfolio includes well-recognized brands, fostering consumer trust and reducing reliance on price alone.

- Consumer Pull: Strong brand loyalty creates consumer demand that can counterbalance the negotiating leverage of large retail buyers.

- Reduced Switching: Differentiated products and loyal customer bases make consumers less inclined to switch to private label or generic alternatives, even when offered at lower prices.

Bonduelle's customers, particularly large retailers and foodservice distributors, possess considerable bargaining power. This stems from their substantial purchasing volumes, access to market data, and the increasing prevalence of private label brands, which can erode Bonduelle's pricing leverage.

The trend of retailer consolidation, with top players controlling significant market share, further concentrates this power. For instance, in 2023, the top 10 U.S. grocery retailers commanded over 60% of the market, enabling them to negotiate more aggressively on price and terms with suppliers like Bonduelle.

Additionally, the relatively low switching costs for consumers in the processed vegetable market mean that retailers can easily substitute Bonduelle's products with private label alternatives, increasing pressure on Bonduelle's margins.

| Customer Segment | Bargaining Power Factors | Impact on Bonduelle |

|---|---|---|

| Major Retail Chains | High volume purchases, Private label development, Market data access, Retailer consolidation | Increased price pressure, Demands for favorable terms, Reduced brand loyalty reliance |

| Foodservice Distributors | Bulk purchasing, Influence on menu selections, Potential for direct sourcing | Negotiation leverage on wholesale pricing, Demand for product customization |

| End Consumers | Price sensitivity, Brand preference, Low switching costs | Vulnerability to price competition, Demand for value-driven offerings |

What You See Is What You Get

Bonduelle Porter's Five Forces Analysis

This preview displays the complete Bonduelle Porter's Five Forces Analysis, offering a thorough examination of industry competitiveness and profitability. The document you see here is precisely what you will receive instantly after purchase, ensuring no discrepancies or missing information. You can trust that the detailed insights into buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry are all included and ready for your immediate use.

Rivalry Among Competitors

The processed vegetable market is a crowded space, featuring a multitude of global giants, regional specialists, and local producers, alongside the ever-present private labels. This fragmentation means Bonduelle is up against a broad spectrum of competitors, from massive multinational food corporations to niche companies focusing on specific vegetable types or preparation methods like canning, freezing, or fresh-cutting.

The global processed vegetable market is set for robust expansion, with an anticipated compound annual growth rate exceeding 11.04% between 2024 and 2028. This significant growth, coupled with the broader processed fruit and vegetable market valued at USD 77 billion in 2025 and projected to reach USD 111.6 billion by 2035, signals a dynamic and attractive industry.

However, this burgeoning market also acts as a magnet for new entrants and intensifies competition among established companies. As the pie grows larger, so does the desire of each player to capture a greater share, leading to increased rivalry and strategic maneuvering within the sector.

Bonduelle stands out in the competitive landscape through its extensive product portfolio, commitment to sustainable farming practices, and a robust brand identity. The company's strategic initiative, 'Transform to win,' specifically targets strengthening its brands and highlighting its positive societal impact, a vital move given the increasing competition from private label brands.

In 2024, Bonduelle's focus on brand development is particularly important as it aims to secure its market position. The company's pursuit of B Corp certification by 2025 underscores its dedication to ethical and sustainable operations, further differentiating it in the eyes of increasingly conscious consumers.

Exit Barriers

High fixed costs in the processed vegetable sector, driven by substantial investments in processing plants, specialized machinery, and intricate supply chains, create significant hurdles for companies looking to exit. These substantial sunk costs can trap less profitable firms, forcing them to continue operations to recoup their investments, thereby sustaining competitive intensity.

Bonduelle, with its extensive global operational presence, exemplifies these high exit barriers. Their established infrastructure and distribution networks, while advantageous for market penetration, also represent significant assets that are difficult and costly to divest, further solidifying the commitment required to remain in the industry.

- High Fixed Costs: Capital expenditures for processing facilities and specialized equipment represent a major barrier.

- Supply Chain Investment: Established and efficient supply chains are costly to build and maintain, making them difficult to abandon.

- Forced Continuation: Companies may be compelled to operate at a loss to cover fixed costs rather than incur further losses through exit.

- Bonduelle's Global Footprint: The scale of Bonduelle's operations amplifies these exit barriers due to the widespread nature of its assets.

Intensity of Price Competition

Price competition is a significant factor in the processed vegetable sector, especially for private label products. Bonduelle experienced a notable downturn in this segment during the first half of fiscal year 2024-2025, highlighting the intense pressure.

Consumers' heightened price sensitivity, particularly during economic headwinds, compels businesses to adopt stringent cost management and competitive pricing. This environment necessitates constant vigilance on operational expenses.

- Price-driven market: The processed vegetable industry, especially private labels, sees intense price competition.

- Consumer sensitivity: Economic challenges amplify consumer focus on price, impacting sales.

- Bonduelle's response: The company's cost control initiatives and efficiency drives are crucial for navigating this competitive landscape.

The competitive rivalry within the processed vegetable market is fierce, driven by a fragmented industry structure and significant growth potential. Bonduelle faces intense competition from global players, regional specialists, and private labels, all vying for market share in a sector projected to grow substantially. This dynamic necessitates strategic differentiation and cost management, as evidenced by Bonduelle's focus on brand strengthening and operational efficiency to counter price pressures, particularly in the private label segment.

| Competitor Type | Market Share Impact | Bonduelle's Strategy |

|---|---|---|

| Global Food Corporations | Significant market presence, broad product lines | Brand differentiation, sustainability focus |

| Regional Specialists | Niche market dominance, tailored offerings | Portfolio expansion, targeted marketing |

| Private Labels | Price-driven competition, high volume potential | Cost control, value proposition emphasis |

SSubstitutes Threaten

Direct substitutes for Bonduelle's processed vegetables, such as canned or frozen options, include fresh, unprocessed produce. Consumers often perceive fresh vegetables as healthier and of higher quality, making them a strong alternative. The widespread availability of fresh produce in supermarkets and local markets ensures easy access for shoppers.

Furthermore, other food categories can act as substitutes for vegetables within a meal. Grains, legumes, and various protein sources can fulfill similar dietary roles, offering consumers a broader range of choices for their meals. This broadens the competitive landscape beyond just processed versus fresh vegetables.

The threat of substitutes for Bonduelle's fresh vegetable offerings is moderate. While processed vegetables like canned and frozen options offer convenience and can be more budget-friendly, particularly outside of peak seasons, consumer preferences are shifting. For instance, a 2024 survey indicated that 65% of consumers actively seek out fresh produce for perceived health benefits, a trend that directly counters the convenience appeal of substitutes.

Switching from processed vegetables to fresh alternatives generally presents low switching costs for consumers. The primary considerations are often related to preparation time and proper storage, rather than significant financial outlays or complex learning curves. This ease of transition means consumers can readily explore and adopt fresh options without substantial barriers.

For foodservice businesses, the costs associated with shifting from processed to fresh vegetables are typically manageable. These might include minor adjustments to menu planning, kitchen workflows, and potentially sourcing new suppliers. However, these are usually not prohibitive, allowing for flexibility in adopting fresher produce.

The low switching costs for both individual consumers and foodservice clients significantly amplify the threat of substitutes. When it is easy and inexpensive to move from processed to fresh vegetables, consumers and businesses are more likely to explore and embrace these alternatives, impacting the market position of processed vegetable providers.

Consumer Propensity to Substitute

Consumer propensity to substitute is notably high, fueled by shifting dietary habits, increased health awareness, and a growing preference for natural, minimally processed foods. This trend is strongly influenced by the rise of plant-based diets and the demand for clean-label products, encouraging consumers to explore fresh or simply prepared alternatives.

Bonduelle's strategic pivot to expand its fresh delicatessen offerings and emphasize healthy choices directly addresses this elevated consumer propensity to substitute. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow significantly, indicating a strong consumer shift that Bonduelle is actively engaging with.

- Consumer Preference Shift: Consumers are increasingly opting for plant-based and minimally processed foods.

- Market Growth: The global plant-based food market's substantial valuation and growth projections underscore this trend.

- Bonduelle's Response: Strategic focus on fresh delicatessens and healthy options counters substitution threats.

Innovation in Substitute Products

The threat of substitutes for Bonduelle is heightened by continuous innovation in the food sector. New fresh-cut and ready-to-eat meal solutions are constantly emerging, offering consumers more convenient and appealing alternatives to traditional fresh produce. For instance, the demand for plant-based alternatives, which can substitute for some vegetable consumption, has seen significant growth. By 2024, the global plant-based food market was projected to reach over $74 billion, indicating a substantial shift in consumer preferences that directly impacts traditional vegetable sales.

Furthermore, the proliferation of meal kits and subscription services, coupled with advancements in fresh produce logistics, makes these substitute options increasingly attractive. These services simplify meal preparation and delivery, directly competing with the need to purchase and prepare raw vegetables. The subscription box market, for example, has seen consistent expansion, with many services focusing on healthy and convenient meal solutions.

Bonduelle itself recognizes this evolving landscape and is actively innovating in complete meal solutions and fresh-cut segments. This strategy aims to capture consumer demand for convenience and new taste experiences, directly addressing the growing threat posed by substitutes. Their investment in ready-to-eat salads and plant-based protein options reflects a proactive approach to maintaining market share in a dynamic food industry.

- Innovation in convenience foods: New ready-to-eat and fresh-cut options present direct substitutes for raw vegetables.

- Growth of meal kits and subscriptions: These services offer convenient alternatives, reducing reliance on traditional grocery shopping for produce.

- Plant-based alternatives: The increasing popularity of plant-based diets creates substitutes for traditional vegetable consumption.

- Bonduelle's strategic response: The company is investing in its own convenient meal solutions to counter these substitute threats.

The threat of substitutes for Bonduelle is significant, driven by consumer shifts towards plant-based and minimally processed foods. The convenience of ready-to-eat meals and meal kits further intensifies this, as these offerings directly compete with traditional vegetable consumption. Bonduelle's strategic focus on fresh delicatessens and healthy options is a direct response to these evolving consumer preferences.

Innovations in the food sector continuously introduce new convenient alternatives to raw vegetables, such as fresh-cut produce and ready-to-eat salads. The burgeoning plant-based food market, projected to exceed $74 billion globally by 2024, highlights a substantial consumer pivot that directly impacts the demand for conventional vegetables.

The ease of switching to substitutes, with low costs for consumers and foodservice businesses, amplifies the threat. This allows for quick adoption of alternatives like meal kits and subscription services, which simplify meal preparation and delivery, thereby reducing reliance on purchasing raw produce.

| Substitute Category | Key Characteristics | Consumer Trend Impact | Bonduelle's Strategic Response |

|---|---|---|---|

| Fresh, Unprocessed Produce | Perceived health benefits, higher quality | Growing preference for natural foods | Expansion of fresh delicatessen offerings |

| Convenience Foods (Ready-to-eat, Fresh-cut) | Time-saving, easy preparation | Increasing demand for convenience | Investment in complete meal solutions |

| Meal Kits & Subscription Services | Simplified meal planning and delivery | Growth in online food ordering | Focus on healthy and convenient options |

| Plant-Based Alternatives | Dietary trends, perceived health benefits | Significant market growth | Development of plant-based protein options |

Entrants Threaten

The processed vegetable industry demands significant upfront capital for land, advanced farming machinery, sophisticated processing facilities, extensive cold storage solutions, and robust distribution logistics. Bonduelle's expansive global footprint, encompassing 58 production companies, exemplifies the scale of investment needed to compete effectively.

Bonduelle, like many established food companies, benefits from substantial economies of scale. This means their per-unit costs decrease as their production volume increases, giving them a significant cost advantage. For example, in 2023, Bonduelle reported consolidated revenue of €2.2 billion, indicating a large operational footprint that likely translates into better purchasing power for raw materials and more efficient manufacturing processes.

New companies entering the vegetable market would find it incredibly challenging to match these cost efficiencies. Sourcing large quantities of produce, running extensive processing plants, and managing widespread distribution networks all require massive upfront investment and ongoing operational costs. Without achieving similar scale, new entrants would likely face higher production costs, making it difficult to compete on price, particularly in high-volume, lower-margin segments like canned or frozen vegetables.

Bonduelle's global presence further amplifies its scale advantages. Their international operations allow for optimized sourcing across different regions and more efficient logistics networks. This global reach, evident in their operations across Europe, North America, and other markets, enables them to spread fixed costs over a larger output and negotiate better terms with suppliers and distributors worldwide, presenting a formidable barrier for any nascent competitor.

Bonduelle benefits from significant brand loyalty, cultivated through established names like Bonduelle, Cassegrain, and Globus. This deep consumer trust, further enhanced by its B Corp certification underscoring sustainability, presents a formidable barrier.

Newcomers face the daunting task of matching Bonduelle's decades of brand-building and differentiation. Substantial marketing expenditure and a considerable time investment would be necessary for any new entrant to carve out a comparable market presence and consumer affinity in the competitive processed vegetable sector.

Access to Distribution Channels

New entrants often struggle to secure shelf space in established retail outlets and gain access to efficient foodservice distribution networks. Bonduelle benefits from decades of cultivating strong relationships with major global retailers and food service companies. This established network makes it difficult for newcomers to get their products in front of consumers without significant investment or a truly disruptive offering.

For instance, in 2024, the grocery retail sector continued to consolidate, with the top 10 retailers in many developed markets controlling over 70% of sales. This concentration means that securing placement on the shelves of these dominant players is a significant barrier. New entrants must either offer substantial promotional support or innovative products that retailers are eager to stock to overcome this hurdle.

Consider these points regarding access to distribution channels:

- Established Relationships: Bonduelle's long-standing partnerships with key distributors and retailers provide preferential access and terms.

- Shelf Space Competition: New entrants face intense competition for limited shelf space, often requiring substantial marketing budgets or unique value propositions.

- Logistical Hurdles: Building a robust and cost-effective distribution network from scratch is a major capital and operational challenge.

- Volume Requirements: Major distributors often require minimum order volumes that can be difficult for nascent companies to meet.

Government Policy and Regulations

Government policy and regulations significantly raise the barrier to entry in the food processing sector. For instance, in 2024, the European Union continued to enforce strict food safety standards like HACCP and specific labeling requirements, demanding substantial upfront investment from newcomers. These regulatory hurdles, encompassing everything from product traceability to environmental impact assessments, can deter potential competitors by increasing operational costs and complexity, thereby protecting established players like Bonduelle.

Compliance with these evolving regulations is a critical factor. New entrants must allocate considerable resources to obtain necessary certifications, implement robust quality control measures, and secure legal counsel to navigate the intricate web of food safety, hygiene, and environmental protection laws. Bonduelle's long-standing experience and established compliance infrastructure provide a distinct advantage, allowing them to operate more efficiently and with greater certainty than a new entrant facing these initial challenges.

- Food Safety Regulations: Compliance with standards like HACCP (Hazard Analysis and Critical Control Points) is mandatory, requiring significant investment in process control and documentation.

- Environmental Standards: Adherence to regulations concerning waste management, water usage, and emissions in food processing plants adds to the operational cost for new businesses.

- Labeling and Traceability: Strict rules on ingredient disclosure and product origin tracking necessitate sophisticated supply chain management systems.

The threat of new entrants in the processed vegetable market is generally low due to substantial capital requirements for land, machinery, and processing facilities. Bonduelle's global operations, with 58 production companies, highlight the significant investment needed to compete effectively. Newcomers face immense challenges in matching Bonduelle's economies of scale, which in 2023 generated €2.2 billion in revenue, enabling cost advantages in sourcing and manufacturing.

Brand loyalty and established distribution networks also present significant barriers. Bonduelle's strong brand portfolio and decades of relationships with major retailers make it difficult for new players to gain market access and consumer trust. For instance, in 2024, retail consolidation meant the top 10 retailers controlled over 70% of sales in many developed markets, intensifying the competition for shelf space.

Furthermore, stringent government regulations, including food safety standards like HACCP and environmental compliance, increase operational costs and complexity for new entrants. Navigating these evolving rules requires substantial investment in certifications and quality control, areas where Bonduelle's established infrastructure offers a distinct advantage.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High investment in land, machinery, processing, and logistics. | Deters new entrants due to substantial upfront costs. |

| Economies of Scale | Bonduelle's €2.2 billion revenue in 2023 enables lower per-unit costs. | Newcomers struggle to match cost efficiencies and pricing. |

| Brand Loyalty & Distribution | Established brands and strong retailer relationships. | Difficult for new entrants to secure shelf space and consumer trust. |

| Regulatory Compliance | Strict food safety and environmental standards. | Increases operational costs and complexity for new businesses. |

Porter's Five Forces Analysis Data Sources

Our Bonduelle Porter's Five Forces analysis is built upon a foundation of robust data, including Bonduelle's annual reports, industry-specific market research from firms like Euromonitor, and publicly available competitor financial filings.