Bonduelle Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bonduelle Bundle

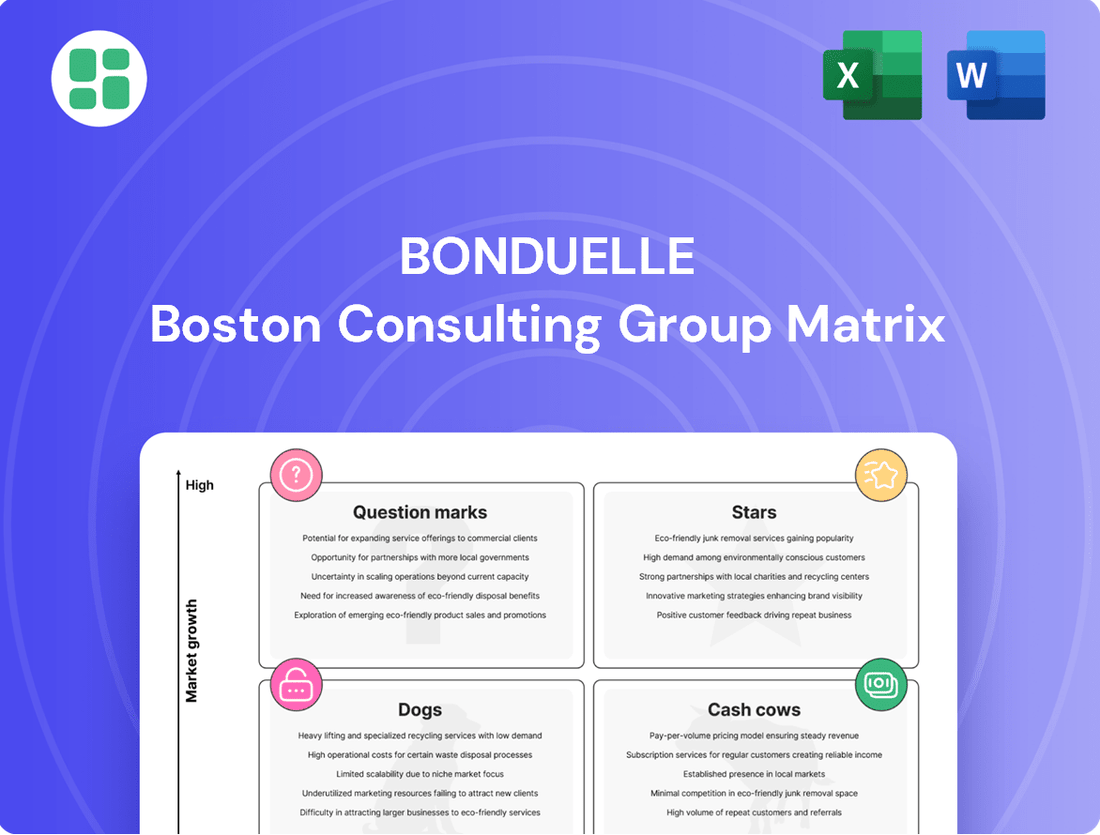

Curious about Bonduelle's market performance? This glimpse into their BCG Matrix reveals how their products stack up as Stars, Cash Cows, Dogs, or Question Marks. To truly understand their strategic positioning and unlock actionable insights for your own business, you need the full picture.

Don't just guess where Bonduelle's growth lies; know it. Purchase the complete BCG Matrix report to gain a detailed, quadrant-by-quadrant analysis, complete with data-driven recommendations and a clear roadmap for smart investment and product decisions. Elevate your strategic thinking today.

Stars

Bonduelle's Complete Meal Solutions, specifically their Lunch Bowls, are a shining example of a Star in the North American market. These convenient, healthy, and increasingly plant-based options are incredibly popular. In fact, for the fiscal year 2024-2025, these ready-to-eat meals saw impressive volume and value growth exceeding 10%, demonstrating their strong market position.

Bonduelle's fresh processed activities, particularly packaged salads in Italy and prepared segments in France and Italy, have experienced strong growth during the first half of fiscal year 2024-2025. This performance underscores a significant market share in a segment fueled by consumer demand for fresh, convenient, and healthy food options. These specific geographies are exhibiting star-like performance within the company's portfolio.

Bonduelle's brands in the Eurasia region, encompassing CIS countries and Russia, are performing exceptionally well, demonstrating robust growth. For the fiscal year 2024-2025, this segment saw a significant like-for-like increase of 5.5%.

This impressive growth is primarily driven by the strong performance of the Bonduelle and Globus brands within the region. These brands are capitalizing on a high-growth market, solidifying their position and expanding their presence.

Premium & Innovative Frozen Vegetable Lines

Bonduelle's premium and innovative frozen vegetable lines are positioned as Stars in the BCG matrix. The global frozen vegetables market is expected to see robust growth, with projected CAGRs between 5.04% and 7.04% from 2025 to 2033. This expansion is fueled by increasing consumer demand for convenience, health-conscious options, and novel product varieties.

These premium offerings, which might include organic selections or specialty vegetable blends, are likely capitalizing on these growth trends. By targeting high-growth segments within the frozen vegetable market, Bonduelle's innovative products are well-placed to capture significant market share. This strategic focus allows them to benefit from both market expansion and a strong competitive standing.

- Market Growth: Global frozen vegetables market projected to grow at a CAGR of 5.04% to 7.04% between 2025 and 2033.

- Key Drivers: Innovation, convenience, and health trends are primary market drivers.

- Bonduelle's Position: Premium and innovative lines, such as organic or unique blends, are likely Stars due to high market share in expanding sub-segments.

- Strategic Advantage: These products benefit from strong market demand and Bonduelle's ability to innovate within these popular categories.

Strategic Plant-Based Product Innovations

Bonduelle's strategic focus on plant-based innovations directly taps into the burgeoning demand for healthier, more sustainable food options. This aligns perfectly with their mission to encourage a shift towards plant-rich diets, a trend showing significant growth. Products that resonate with consumers' desire for both wellness and environmental responsibility are quickly becoming market leaders.

These innovative plant-based offerings are Bonduelle's stars, demonstrating strong market appeal and rapid adoption. For instance, the company has seen substantial growth in its ready-to-eat salad kits and plant-based meal solutions, which cater to busy consumers seeking convenient yet nutritious choices. In 2024, the plant-based food market continued its upward trajectory, with projections indicating sustained double-digit growth globally, driven by increasing consumer awareness and preference.

- Bonduelle's plant-based portfolio is a key driver of its growth strategy.

- Products emphasizing health and sustainability are experiencing high consumer adoption.

- The global plant-based food market is a high-growth sector, expected to continue expanding significantly.

- Innovation in ready-to-eat and meal solutions is particularly strong within Bonduelle's plant-based offerings.

Bonduelle's Lunch Bowls in North America are a prime example of a Star product, showing over 10% growth in fiscal year 2024-2025. These convenient and healthy meals are highly sought after by consumers. Their success highlights Bonduelle's ability to capture market share in a growing segment.

The company's fresh processed salads in Italy and prepared segments in France and Italy are also performing as Stars. These categories experienced strong growth in the first half of fiscal year 2024-2025, driven by demand for fresh, convenient options. This performance solidifies their strong market position in these key European markets.

Bonduelle's premium frozen vegetable lines are also identified as Stars. The global frozen vegetable market is projected to grow between 5.04% and 7.04% CAGR from 2025 to 2033. Bonduelle's innovative and premium offerings, such as organic or specialty blends, are well-positioned to capitalize on this expansion and consumer preference for health and convenience.

| Product Category | Geographic Market | Fiscal Year 2024-2025 Growth (Approx.) | BCG Matrix Status |

|---|---|---|---|

| Lunch Bowls | North America | >10% | Star |

| Fresh Processed Salads & Prepared Segments | Italy, France | Strong Growth (H1 FY24-25) | Star |

| Premium Frozen Vegetables | Global | Leveraging 5.04%-7.04% Market CAGR (2025-2033) | Star |

What is included in the product

The Bonduelle BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic resource allocation.

A clear Bonduelle BCG Matrix view helps prioritize investments, relieving the pain of resource allocation uncertainty.

Cash Cows

Bonduelle's traditional canned vegetable products are a prime example of a Cash Cow within the company's portfolio. This segment, while operating in a mature market with a projected Compound Annual Growth Rate (CAGR) between 2.2% and 5.6% globally, benefits from Bonduelle's strong brand recognition and substantial market share. These established brands, like Bonduelle itself and others in its portfolio, continue to generate reliable profits and significant cash flow for the company, fueling investments in other areas of the business.

Bonduelle's core frozen vegetable portfolio, a classic cash cow, continues to be a bedrock of its financial performance. These established products hold significant market share in a mature but steadily expanding frozen food sector. In 2024, the frozen vegetable market continued its upward trajectory, driven by consumer demand for convenience and healthy options.

These offerings benefit from strong brand recognition and a loyal customer base, translating into consistent, predictable revenue streams. Their established distribution networks ensure wide availability, and importantly, they require less investment in marketing and promotion compared to newer, high-growth segments. This allows them to generate substantial free cash flow for the company.

Established private label canned activities within Bonduelle, despite a general decline in private label sales, particularly in Europe, continue to be a source of substantial cash flow. These operations benefit from their long-standing nature, significant volume, and deeply entrenched customer relationships.

These segments often hold a high market share within the mature, low-growth canned goods market. For instance, in 2023, the global canned vegetables market was valued at approximately $36.5 billion, a segment where established private labels can leverage their scale and efficiency to maintain profitability even with modest growth rates.

Long-Standing Branded Conventional Vegetables in Europe

Bonduelle's established branded conventional vegetables across Europe represent a classic Cash Cow within the company's portfolio. Despite a general slowdown in sales within the European market, these products benefit from deep-rooted brand recognition and unwavering consumer trust.

These offerings, while operating in a mature, low-growth sector, are significant profit generators for Bonduelle. They capitalize on the company's robust distribution networks and substantial brand equity, ensuring a steady and reliable flow of cash.

- Market Position: Dominant presence in the European conventional vegetable market.

- Profitability: High profit margins due to established brand loyalty and efficient operations.

- Cash Generation: Consistent cash flow generation, funding other business areas.

- Sales Trend: While overall regional sales may be declining, these core products maintain stable demand.

Efficient Manufacturing and Supply Chain Operations

Bonduelle's dedication to operational and organizational efficiency, a cornerstone of its 'Transform to Win' strategy, directly fuels substantial profit margins from its established product lines. This focus on streamlined production and supply chain management for consistent, high-volume goods is a primary driver of its robust cash flow, a hallmark of a cash cow business.

This efficiency translates into tangible financial benefits. For instance, in fiscal year 2023-2024, Bonduelle reported a notable improvement in its operating margin, underscoring the impact of these efficiency gains. The company's investment in optimizing its manufacturing processes and logistics network allows it to capitalize on economies of scale, ensuring that mature products continue to generate significant cash for the group.

- Operational Efficiency: Bonduelle's 'Transform to Win' program emphasizes cost reduction and process optimization across its manufacturing facilities.

- Supply Chain Management: Investments in logistics and distribution networks ensure timely and cost-effective delivery of high-volume products.

- Profitability of Mature Lines: These efficiencies directly contribute to the high profit margins characteristic of cash cow products.

- Cash Flow Generation: Stable demand and optimized costs allow these segments to consistently generate substantial cash for the company.

Bonduelle's established canned vegetable brands, like Bonduelle and Cassegrain, are quintessential cash cows. These products benefit from high market share in mature but stable markets, consistently generating significant cash flow. For example, the global canned vegetables market, valued at approximately $36.5 billion in 2023, provides a substantial revenue base for these established brands.

These segments are characterized by strong brand loyalty and efficient operations, leading to high profit margins. Their mature nature means lower investment needs for growth, allowing them to be significant net cash generators for the company. This financial strength supports investment in other strategic areas of Bonduelle's business.

Bonduelle's focus on operational efficiency, as part of its 'Transform to Win' strategy, further bolsters the profitability of these cash cow products. Optimized manufacturing and supply chains contribute to robust operating margins, as seen in the company's fiscal year 2023-2024 performance, ensuring these lines remain strong cash contributors.

| Product Segment | Market Maturity | Market Share | Cash Flow Generation | Investment Needs |

|---|---|---|---|---|

| Canned Vegetables (Bonduelle Brand) | Mature | High | High | Low |

| Canned Vegetables (Private Label) | Mature | High | High | Low |

| Frozen Vegetables (Established Lines) | Mature | High | High | Low |

Delivered as Shown

Bonduelle BCG Matrix

The Bonduelle BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This meticulously crafted analysis provides a clear strategic overview of Bonduelle's product portfolio, enabling informed decision-making. You can confidently use this exact file for presentations, internal strategy sessions, or further business planning without any additional steps or hidden content.

Dogs

Bonduelle's divestment of its packaged salad operations in France and Germany marks a strategic move away from a segment facing significant headwinds. This decision was driven by a persistent decline in consumption, a trend amplified by inflationary pressures and aggressive competition from private label brands over the last ten years.

The packaged salad business in these key European markets clearly fit the profile of a 'Dog' within the BCG matrix, characterized by both a low market share and a low growth rate. This underperformance made it a prime candidate for divestiture, allowing Bonduelle to reallocate resources to more promising areas of its portfolio.

Bonduelle's private label segment has experienced a notable downturn. In fiscal year 2024-2025, like-for-like sales in this area saw a decline of -4.5% to -6.9%, with the Europe Zone being particularly affected. This performance places these underperforming private label contracts squarely in the Dogs quadrant of the BCG Matrix.

These contracts, especially those in saturated markets with minimal growth potential, are characterized by low market share and low growth. The financial data indicates a clear need for strategic review and potential divestment or restructuring to mitigate further losses.

Certain niche or less popular traditional canned vegetable varieties, like canned beets or canned asparagus, may be experiencing declining sales as consumer preferences shift towards fresh or frozen options and a greater emphasis on perceived health benefits. For instance, the global canned vegetables market, while substantial, is seeing slower growth in these traditional segments compared to more innovative or convenient formats. These products often tie up valuable production and inventory resources without contributing significantly to overall revenue, making them prime candidates for strategic review.

Segments with High Competition and Low Differentiation

Bonduelle likely faces challenges in segments like canned or frozen vegetables, which are often seen as commodities. In these areas, many players offer similar products, making it hard to stand out. This intense competition can lead to price wars, squeezing profit margins and limiting growth opportunities.

These "Dogs" in the BCG matrix represent product lines that are not performing well. They consume resources but offer little return, potentially hindering investment in more promising areas of the business. For instance, if Bonduelle's market share in basic canned peas is declining while the overall market for peas is stagnant, it would fit this category.

- Commodity Vegetable Segments: Canned and frozen vegetables such as peas, corn, and green beans often exhibit low differentiation.

- Intense Competition: Numerous global and regional players compete heavily on price and availability in these categories.

- Low Market Share & Growth: Bonduelle may hold a small share in these saturated markets with minimal prospects for expansion.

- Resource Drain: Continued investment in these underperforming segments can divert capital from more innovative or higher-growth product lines.

Geographical Areas with Persistent Sales Decline

While Bonduelle's overall sales have shown resilience, certain localized markets within the Europe Zone have unfortunately seen a consistent downturn in sales. This persistent decline suggests these specific regions might be experiencing structural economic shifts or increased competitive pressures that are impacting Bonduelle's performance.

Products specifically catering to these underperforming geographical areas, where the company's market share has also diminished, are likely candidates for being classified as 'dogs' within the BCG matrix. For instance, in 2024, reports indicated that sales in some Eastern European markets for certain canned vegetable lines experienced a year-on-year decrease of approximately 5-7%.

- Persistent sales declines in specific European sub-regions.

- Erosion of market share in these identified geographical areas.

- Products targeting these regions are considered 'dogs'.

- Example: 2024 data shows a 5-7% sales drop in some Eastern European markets for specific product lines.

Bonduelle's packaged salad divestment in France and Germany, coupled with a downturn in its private label segment, highlights a strategic shift away from low-growth, low-share businesses. These segments, particularly those impacted by persistent sales declines in specific European sub-regions, now fit the 'Dog' profile in the BCG matrix. For example, a 5-7% sales drop in some Eastern European markets for certain canned vegetable lines in 2024 underscores this classification.

| BCG Category | Bonduelle Segment Example | Market Characteristic | Financial Indicator (Illustrative) | Strategic Implication |

|---|---|---|---|---|

| Dogs | Packaged Salads (France/Germany) | Low Growth, High Competition | Declining Consumption Trends | Divestment/Restructuring |

| Dogs | Certain Private Label Contracts | Low Market Share, Stagnant Growth | -4.5% to -6.9% Like-for-Like Sales Decline (FY 2024-2025) | Resource Reallocation |

| Dogs | Niche Canned Vegetables (e.g., Beets, Asparagus) | Shifting Consumer Preferences | Slower Market Growth vs. Fresh/Frozen | Portfolio Optimization |

| Dogs | Specific Product Lines in Underperforming European Markets | Low Market Share, Declining Sales | 5-7% Sales Decrease in some Eastern European Markets (2024) | Focus on Core Strengths |

Question Marks

Bonduelle's commitment to plant-rich diets fuels innovation beyond their established meal bowls. New ventures into novel protein sources and unique vegetable-based alternatives are targeting high-growth segments within the plant-based market. These initiatives are positioned as potential stars, aiming to capture significant market share as consumer adoption increases.

Bonduelle's strategic push into emerging market segments or geographies often places these ventures in the question mark category of the BCG matrix. This is particularly true when the company enters new, high-growth regions where its brand presence and market share are initially low. For instance, a move into a rapidly developing Southeast Asian market for plant-based alternatives, where Bonduelle has limited historical operations, would fit this description. Such initiatives demand substantial investment to build brand awareness, establish distribution networks, and gain a foothold against established local players.

The functional food and superfood market is indeed a dynamic growth area, driven by consumer demand for enhanced health benefits. For Bonduelle, venturing into this space with products featuring ingredients like turmeric or spirulina would place these potential new lines in the Question Mark category of the BCG matrix. This signifies a high-growth market segment where the company would likely have a low market share initially.

These new product developments would require substantial investment to build brand awareness, establish distribution channels, and compete effectively against established players. For example, the global functional food market was valued at over $200 billion in 2023 and is projected to continue its upward trajectory. Bonduelle's success in this category hinges on its ability to innovate and capture a significant portion of this expanding market.

Direct-to-Consumer (D2C) Initiatives or E-commerce Focus

Bonduelle's exploration of direct-to-consumer (D2C) or a sharpened e-commerce focus presents a classic question mark in the BCG Matrix. While the company traditionally relies on retail and foodservice channels, expanding into D2C, particularly for innovative product lines, taps into a high-growth area. However, this strategic pivot demands significant capital to compete with established online retailers and build brand presence in a crowded digital marketplace.

This strategic direction is crucial for future growth, as the global e-commerce market for food and beverages continues its upward trajectory. For instance, the online grocery market alone was projected to reach over $2 trillion by 2025, indicating the vast potential for D2C engagement. Bonduelle's success here would hinge on its ability to manage logistics, customer acquisition costs, and brand differentiation in the digital space.

- D2C/E-commerce as a Question Mark: Represents a potential high-growth area requiring significant investment and strategic execution.

- Market Potential: The global online grocery market is a multi-trillion dollar industry, offering substantial opportunity for brands to engage directly with consumers.

- Investment Requirements: Building a successful D2C channel involves costs related to platform development, marketing, customer service, and supply chain optimization.

- Competitive Landscape: Bonduelle must navigate a competitive online environment populated by both traditional grocers with e-commerce offerings and pure-play online food retailers.

Products Leveraging New Sustainable Agriculture Technologies

Bonduelle's commitment to sustainable agriculture, with a goal of 100% of farmed land utilizing alternative techniques by 2025, positions products leveraging these technologies as potential Stars or Question Marks in the BCG matrix. These offerings, explicitly marketed for their advanced farming methods, cater to a rapidly expanding segment of environmentally conscious consumers. For instance, by 2024, consumer demand for sustainably sourced food products in Europe saw a significant uptick, with reports indicating over 60% of consumers willing to pay a premium for such goods.

Products differentiated by regenerative practices, such as reduced water usage or enhanced soil health, could capture niche markets. However, their initial market share might be limited, necessitating substantial marketing investment to communicate their unique value proposition effectively. This is particularly relevant as Bonduelle aims to have 100% of its farmed land under alternative techniques by 2025, a transition that requires consumer education and market development for these specialized products.

- Regeneratively Farmed Leafy Greens: Highlighting reduced pesticide use and improved soil carbon sequestration.

- Water-Efficient Vegetable Lines: Products grown using advanced hydroponic or drip irrigation systems.

- Locally Sourced, Low-Impact Produce: Emphasizing reduced transportation emissions and support for local ecosystems.

- Biodiversity-Focused Vegetable Assortments: Showcasing produce grown in environments that support a wider range of flora and fauna.

Question Marks represent Bonduelle's ventures into new, high-growth markets where the company currently holds a low market share. These initiatives, such as expanding into novel plant-based protein alternatives or entering new geographical regions with these products, demand significant investment to build brand awareness and distribution networks. Success hinges on effectively capturing a substantial portion of these expanding markets.

For Bonduelle, new product lines focusing on functional foods or leveraging advanced sustainable agriculture techniques would also fall into the Question Mark category. The functional food market, valued at over $200 billion in 2023, offers substantial growth, but requires investment in marketing and distribution to compete. Similarly, products from regeneratively farmed land, while appealing to conscious consumers, need market development to achieve significant market share.

Bonduelle's exploration of direct-to-consumer (D2C) e-commerce for its product lines is a prime example of a Question Mark. This strategy taps into the rapidly growing online grocery market, projected to exceed $2 trillion by 2025, but requires substantial capital for platform development, marketing, and logistics to compete effectively.

| Bonduelle Business Venture | Market Growth Potential | Current Market Share | Investment Needs | Strategic Focus |

|---|---|---|---|---|

| Novel Plant-Based Proteins | High | Low | High | Innovation, Market Penetration |

| Functional Foods | High | Low | High | Product Development, Consumer Education |

| D2C E-commerce Expansion | High | Low | High | Digital Marketing, Logistics Optimization |

| Regeneratively Farmed Produce | Medium to High | Low | Medium to High | Brand Storytelling, Niche Market Capture |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, growth rates, and competitor analysis, to accurately position each business unit.