Boliden Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boliden Bundle

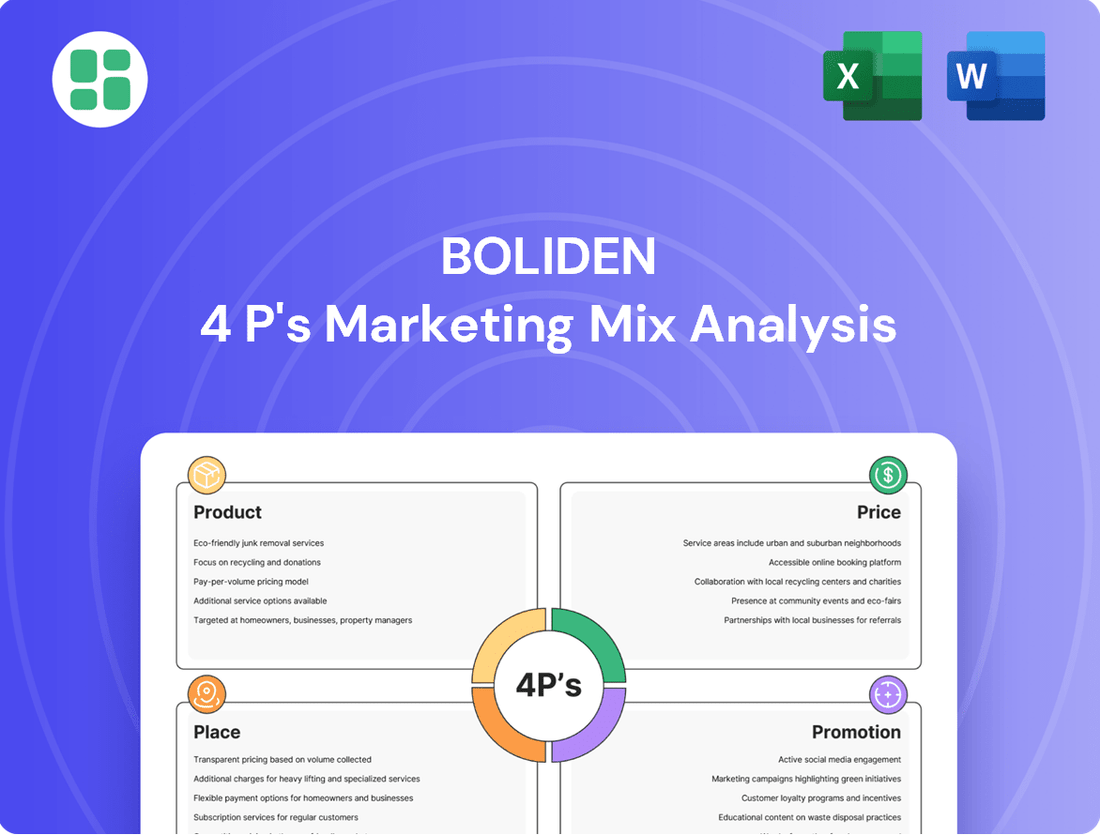

Dive into Boliden's strategic brilliance with our comprehensive 4Ps Marketing Mix Analysis. Understand how their innovative product development, competitive pricing, strategic distribution, and impactful promotional campaigns create a powerful market presence.

Unlock the full potential of Boliden's marketing strategy by accessing our in-depth analysis of Product, Price, Place, and Promotion. This ready-to-use report is perfect for business professionals, students, and consultants seeking actionable insights.

Go beyond the surface and gain a complete understanding of Boliden's marketing success. Our full 4Ps analysis provides editable, presentation-ready content, saving you valuable research time.

Product

Boliden's core product suite centers on high-purity base metals like zinc, copper, and lead, complemented by precious metals including gold and silver. This focus on quality is paramount, as these metals are essential components in sophisticated industrial applications, from electronics to renewable energy technologies.

The exceptional purity of Boliden's metals serves as a significant competitive advantage, guaranteeing consistent performance and meeting stringent customer requirements. For instance, Boliden's zinc, known for its high purity, is crucial for galvanizing steel, a process vital for infrastructure projects and automotive manufacturing, sectors that saw significant investment in 2024.

Boliden's sustainable metals are central to its product offering, emphasizing a commitment to being the world's most climate-friendly metal producer. This focus translates into tangible efforts to lower greenhouse gas emissions and maximize resource efficiency across their entire value chain, from mining to recycling.

For businesses prioritizing Environmental, Social, and Governance (ESG) criteria, Boliden's sustainably produced metals provide a significant competitive edge. In 2023, Boliden reported a 30% reduction in CO2 emissions from their own operations compared to 2019 levels, a key metric demonstrating their progress towards climate neutrality.

Boliden's metals are the bedrock for vital sectors like construction, electronics, and the booming electric vehicle market. These essential raw materials are in high demand due to global shifts towards urbanization, digitalization, and green energy solutions.

The ongoing green transition is a significant driver; for instance, the International Energy Agency projected in 2024 that global demand for critical minerals like copper, essential for EVs and renewable energy infrastructure, could increase by over 40% by 2030 compared to 2020 levels.

Recycled Metals and Circular Economy Contributions

Boliden is a significant player in metal recycling, actively contributing to the circular economy by processing a substantial volume of recycled metals. This commitment goes beyond their primary mining operations, allowing them to offer a diversified product stream of metals sourced from secondary materials. In 2023, Boliden's recycling operations processed approximately 226,000 tonnes of electronic scrap, recovering valuable metals and reducing the need for primary extraction.

Their recycling capabilities directly support environmental goals and enhance resource efficiency. By reprocessing materials, Boliden not only minimizes waste but also lowers the carbon footprint associated with metal production. This focus strengthens their sustainability profile, appealing to an increasingly environmentally conscious market.

- Circular Economy Contribution: Boliden processes significant volumes of electronic scrap, diverting waste from landfills and recovering valuable metals.

- Diversified Product Offering: The company provides metals derived from both primary mining and recycling, offering customers a broader choice.

- Sustainability Enhancement: Recycling operations bolster Boliden's environmental credentials and improve resource efficiency.

- 2023 Recycling Volume: Boliden processed around 226,000 tonnes of electronic scrap in 2023.

Tailored Solutions and Technical Support

Boliden's approach in the B2B space goes beyond simply supplying raw materials. They actively develop tailored metal solutions, recognizing that industrial clients often require specific grades and forms to optimize their manufacturing. This focus on customization is a key differentiator, ensuring customers receive products that precisely meet their operational needs.

Crucially, Boliden backs these solutions with comprehensive technical support. This includes ensuring a reliable and consistent supply chain, a critical factor for manufacturers. For instance, in 2024, Boliden continued its commitment to stable production at its key mines, contributing to a predictable supply for its B2B partners.

Their technical expertise assists clients in the seamless integration of Boliden's metals into their own production processes. This collaborative engagement fosters strong, long-term customer relationships built on trust and mutual benefit. Boliden's direct interaction allows them to understand and address evolving customer requirements effectively.

- Customized Metal Solutions: Boliden provides specific grades and forms of metals to meet precise industrial requirements.

- Robust Technical Support: Offering expertise to aid customers in integrating metals into their manufacturing.

- Consistent Supply Assurance: Boliden prioritizes reliability in its supply chain, crucial for B2B operations.

- Direct Customer Engagement: Fostering strong relationships through close collaboration and understanding of client needs.

Boliden's product strategy emphasizes high-purity base and precious metals, essential for advanced industries. Their commitment to sustainability, evidenced by a 30% reduction in CO2 emissions from their own operations by 2023 compared to 2019, appeals to ESG-focused clients.

The company's recycling efforts, processing 226,000 tonnes of electronic scrap in 2023, bolster their circular economy contribution and resource efficiency. Boliden also excels in offering customized metal solutions backed by robust technical support and a reliable supply chain, as seen in their continued stable production at key mines in 2024.

| Product Focus | Sustainability Metric | Recycling Volume (2023) | Key Market Driver |

|---|---|---|---|

| High-purity Zinc, Copper, Lead, Gold, Silver | 30% CO2 reduction (vs. 2019) | 226,000 tonnes electronic scrap | Green transition, EV demand |

| Sustainable & Recycled Metals | Resource efficiency | Contribution to circular economy | Urbanization, digitalization |

| Tailored Metal Solutions | Consistent supply chain | Reduced waste, lower carbon footprint | Industrial application needs |

What is included in the product

This analysis provides a comprehensive examination of Boliden's marketing mix, detailing their strategies across Product, Price, Place, and Promotion to understand their market positioning.

It offers a deep dive into Boliden's actual marketing practices and strategic implications, serving as a valuable resource for understanding their competitive approach.

Simplifies complex marketing strategies into actionable insights for Boliden's 4Ps, alleviating the pain of strategic ambiguity.

Provides a clear, concise overview of Boliden's marketing approach, relieving the burden of deciphering intricate plans.

Place

Boliden's mine and smelter locations are a cornerstone of their strategy, with operations concentrated in Sweden, Finland, Norway, and Ireland. This geographic placement offers proximity to major European industrial hubs, streamlining distribution and market access.

These strategically chosen sites enable efficient raw material extraction and processing, minimizing transportation costs and bolstering supply chain resilience. For instance, Boliden's Aitik mine in Sweden, one of Europe's largest copper mines, benefits from its location within a well-established mining region.

In 2023, Boliden reported strong operational performance from its mines, with production volumes such as 6.3 million tonnes of ore from Aitik, underscoring the effectiveness of these site selections in supporting their output and market reach.

Boliden's direct sales strategy is central to its industrial customer interactions, reflecting the specialized nature of its metal products. This B2B focus allows for direct engagement with manufacturers in key sectors such as automotive, construction, and electronics, where customized solutions and reliable supply chains are paramount.

This direct approach facilitates detailed negotiations on pricing, volume, and delivery schedules, ensuring Boliden meets the specific technical requirements of its industrial clients. Building these strong, long-term relationships is crucial for securing consistent demand for its zinc, copper, and lead products, with industrial customers representing a significant portion of Boliden's revenue base.

Boliden's robust logistics and supply chain management are critical for its success in delivering substantial volumes of metals to industrial customers worldwide. This intricate network manages the movement of materials from extraction sites through processing facilities and finally to end-users, ensuring efficiency and punctuality. For instance, in 2023, Boliden's total sales volume reached 514 thousand tonnes of copper, zinc, lead, and nickel, highlighting the scale of their distribution operations.

The company focuses on optimizing transportation routes and methods to minimize costs and adhere to tight industrial production timelines. This includes utilizing various modes of transport, such as rail, road, and sea, to reach diverse global markets. Boliden's commitment to reliable delivery underpins its reputation as a dependable supplier in the metals industry.

Global Market Reach from European Hubs

While Boliden's mining and smelting operations are primarily situated in the Nordic region and Ireland, their reach extends far beyond these geographical confines. The company's high-quality metals find their way to a diverse global customer base, facilitated by well-established international trade routes and robust logistics networks. This strategic positioning allows Boliden to serve industries across continents, solidifying its role as a key player in the global metals market.

Boliden's commitment to global distribution is evident in their sales figures. In 2023, Boliden reported total sales of SEK 83,520 million, with a significant portion of these sales originating from customers outside of Europe, underscoring their international market penetration. This broad market access ensures that their essential raw materials are readily available to manufacturers and industries worldwide, supporting global supply chains.

- Global Customer Base: Boliden's metals are supplied to customers across Europe, North America, and Asia, catering to diverse industrial needs.

- Established Trade Networks: The company leverages existing and efficient trade routes to ensure timely and reliable delivery of its products globally.

- Market Accessibility: Boliden's strategic distribution ensures that their essential metals are accessible to industries worldwide, reinforcing their international market presence.

- 2023 Sales Reach: With total sales of SEK 83,520 million in 2023, a substantial part of this revenue was generated from international markets, demonstrating significant global reach.

Inventory Management for Consistent Supply

Boliden's approach to inventory management is foundational to its place strategy, ensuring a consistent supply of essential metals like zinc, copper, and lead. By maintaining optimal stock levels, they effectively buffer against the volatility inherent in industrial demand and potential supply chain interruptions. This proactive stance is critical for their industrial clientele who rely on uninterrupted access to these vital raw materials.

Their strategic warehousing and sophisticated inventory control systems are designed to guarantee the continuous availability of their product portfolio, which also includes precious metals. This commitment to reliable supply underpins Boliden's reputation as a dependable partner in the global metals market. For instance, Boliden's zinc production capacity alone is significant, with their Skellefteå mine in Sweden being one of Europe's largest zinc mines, highlighting the scale of inventory they manage.

- Strategic Warehousing: Boliden utilizes strategically located facilities to minimize transit times and ensure product availability across key markets.

- Inventory Control: Advanced systems track and manage stock levels of various metals, from base metals like copper and zinc to precious metals, aligning with market demand forecasts.

- Supply Chain Resilience: Robust inventory management acts as a buffer against external shocks, ensuring Boliden can consistently meet customer orders even during periods of disruption.

- Product Availability: The focus on optimal inventory levels directly translates to high product availability for industrial buyers, reinforcing Boliden's market position.

Boliden's physical presence, encompassing mines and smelters in Sweden, Finland, Norway, and Ireland, is a core element of its market strategy. This geographic concentration allows for efficient resource extraction and processing, reducing logistical costs and enhancing supply chain reliability. The proximity to major European industrial centers facilitates streamlined distribution and market access for their essential metals.

The company's Aitik mine in Sweden, a significant copper producer, exemplifies the strategic advantage of these locations. In 2023, Aitik alone processed 6.3 million tonnes of ore, showcasing the operational scale enabled by its site selection. This strategic placement is crucial for meeting the demands of industrial customers who require consistent and timely access to raw materials.

Boliden's commitment to its physical locations also extends to its inventory management. By maintaining strategically located warehouses and employing sophisticated inventory control systems, they ensure the continuous availability of products like zinc and copper. This focus on product availability is vital for industrial clients, reinforcing Boliden's reputation as a dependable supplier.

| Location Type | Key Regions | Strategic Advantage | 2023 Operational Highlight |

|---|---|---|---|

| Mines & Smelters | Sweden, Finland, Norway, Ireland | Proximity to European markets, reduced logistics costs, supply chain resilience | Aitik mine processed 6.3 million tonnes of ore |

| Warehousing | Key European industrial hubs | Ensured product availability, minimized transit times | Supported consistent supply of zinc and copper |

| Logistics Network | Global | Efficient movement of materials, adherence to industrial timelines | Facilitated 514 thousand tonnes of total copper, zinc, lead, and nickel sales volume |

Same Document Delivered

Boliden 4P's Marketing Mix Analysis

The preview shown here is the actual Boliden 4P's Marketing Mix Analysis document you’ll receive instantly after purchase—no surprises. This comprehensive report details every aspect of their strategy, ready for your immediate review.

Promotion

Boliden's investor relations and financial reporting are crucial for building trust and attracting capital. Their consistent communication through quarterly reports, like the expected Q1 and Q2 2025 updates, and comprehensive annual documents, such as the 2024 Annual and Sustainability Report, are vital promotional channels. These reports detail operational performance, strategic direction, and their commitment to sustainability, directly influencing shareholder confidence and potential investment.

Boliden actively promotes its dedication to sustainable mining and metal production, a key differentiator in its marketing. Their 2024 Annual and Sustainability Report details significant progress in reducing emissions and enhancing social responsibility, resonating with environmentally conscious investors and consumers.

This focus on ESG (Environmental, Social, and Governance) engagement is a powerful promotional tool, attracting capital from funds specifically targeting sustainable investments. For instance, Boliden's commitment to responsible resource management and ethical labor practices is a core part of their brand narrative, influencing purchasing decisions for those prioritizing supply chain transparency.

Boliden actively participates in key industry conferences and trade associations, such as the European Association of Mining Industries, Metal Ores & Industrial Minerals (Euromines) and the International Lead Zinc Study Group. This engagement allows them to directly connect with industrial customers, highlighting their commitment to high-quality metals and sustainable mining practices. In 2024, Boliden's presence at events like the EIT RawMaterials Summit provided opportunities to showcase innovations and discuss industry challenges, reinforcing their role as a leading metal provider.

Direct Sales and Technical Expertise

Boliden's direct sales force is crucial for its B2B marketing, acting as a primary promotional channel. These teams engage directly with clients, delving into their unique requirements and providing specialized technical knowledge. This direct interaction fosters strong customer relationships and underscores the advantages of Boliden's advanced metal products.

This approach is particularly effective in the metals industry where tailored solutions and deep product understanding are paramount. Boliden's sales personnel act as consultants, not just vendors, building trust by demonstrating how their high-tech metals can solve specific customer challenges. This direct engagement is key to securing long-term partnerships and driving sales for specialized materials.

For instance, Boliden reported a significant portion of its sales, particularly in its key markets, are driven by these direct relationships. In 2023, the company continued to invest in its sales and technical support teams, recognizing their impact on customer retention and new business acquisition. Their technical expertise allows them to articulate the value proposition of Boliden's metals, such as their role in advanced electronics and electric vehicles, directly to decision-makers.

- Direct Engagement: Boliden's B2B model relies heavily on its direct sales force to connect with customers.

- Technical Expertise: Sales teams provide in-depth knowledge to address specific client needs.

- Partnership Building: This personalized strategy cultivates trust and long-term business relationships.

- Value Proposition: Emphasis is placed on the benefits of Boliden's high-tech metals through expert consultation.

Corporate Communications and Press Releases

Boliden's corporate communications and press releases are a cornerstone of their marketing mix, ensuring transparency and engagement with investors, employees, and the public. These communications highlight operational successes, strategic moves like acquisitions, and key financial achievements, keeping stakeholders informed and confident in the company's direction.

For instance, Boliden's proactive approach is evident in their timely dissemination of information regarding their Q2 2025 financial results, which are crucial for market assessment. Their recent announcements about strategic mine acquisitions further underscore their commitment to growth and operational expansion, providing tangible evidence of their forward-looking strategy.

- Q2 2025 Earnings: Boliden's Q2 2025 report is expected to detail production volumes and revenue figures, offering critical insights into their performance.

- Mine Acquisitions: Recent press releases have detailed the acquisition of new mining assets, aiming to bolster their resource base and production capacity.

- Investor Relations: Regular updates via press releases and corporate announcements are key to maintaining strong investor relations and market confidence.

- Sustainability Reporting: Communications also often touch upon sustainability initiatives, a vital aspect for stakeholders in the mining sector.

Boliden utilizes a multi-faceted promotional strategy, emphasizing its financial transparency and sustainability leadership. Investor relations, through regular reports like the anticipated Q1 and Q2 2025 updates and the 2024 Annual and Sustainability Report, build trust and attract capital by detailing operational successes and ESG commitments. This focus on responsible mining practices is a key differentiator, appealing to ethically-minded investors and consumers.

Price

Boliden's pricing for key products like zinc, copper, and lead is directly tied to global commodity markets, notably the London Metal Exchange (LME). For instance, LME zinc prices averaged around $2,500 per tonne in early 2024, a figure Boliden closely monitors.

These market prices are dynamic, reacting to global supply and demand, geopolitical tensions, and economic trends. Boliden actively manages this volatility through continuous market surveillance and employing hedging strategies to stabilize revenue streams.

Boliden frequently secures long-term supply contracts with its key industrial clients, often featuring fixed or indexed pricing structures. These agreements are crucial for stabilizing revenue streams and managing the impact of fluctuating market prices, benefiting both Boliden and its customers.

Boliden's value-based pricing strategy leverages its commitment to sustainability, allowing it to price above commodity benchmarks. For instance, their Low-Carbon Nickel, with a significantly reduced environmental footprint, commands a premium from environmentally conscious customers. This approach acknowledges that discerning buyers are willing to pay more for metals produced with lower emissions and greater responsibility.

Cost-Efficiency for Industrial Buyers

Boliden's pricing strategy emphasizes cost-efficiency for industrial buyers, recognizing that consistent supply, high purity, and reliable delivery are critical for their customers' operational success. By providing a dependable source of essential raw materials, Boliden enables clients to maintain uninterrupted production, thereby managing their own costs more effectively.

For instance, Boliden's commitment to high-purity metals, such as zinc and copper, directly impacts downstream manufacturing processes, reducing waste and rework for their industrial clients. This focus on quality contributes to a lower total cost of ownership, making Boliden a valuable partner in a competitive market.

- Consistent Supply: Boliden's robust production and logistics network ensures reliable availability of key metals, minimizing the risk of costly production stoppages for industrial buyers.

- High Purity: The company's dedication to producing high-purity metals like zinc (often exceeding 99.99%) reduces processing inefficiencies and material waste for its customers.

- Reliable Delivery: Boliden's efficient supply chain management guarantees on-time delivery, allowing industrial clients to optimize their inventory levels and production planning.

Investments and Capital Expenditure Impact on Pricing

Boliden's strategic capital expenditures significantly shape its pricing power. For instance, substantial investments in the Odda zinc smelter expansion, a project expected to boost capacity, directly affect the company's cost base and its ability to compete on price in the long run. These large-scale projects are designed to enhance efficiency and output, which are critical factors in determining future pricing strategies and overall profitability.

The company's approach to capital expenditure, including mine acquisitions and upgrades, directly influences its cost structure. Boliden's 2024 outlook highlighted ongoing investments in modernization and expansion, aiming for greater operational efficiency. These investments are crucial for maintaining a competitive edge and supporting its pricing strategies in the global metals market.

Boliden's investment decisions, such as those in the Odda expansion, are geared towards increasing production capacity and improving operational efficiency. By doing so, the company aims to achieve economies of scale, which can lead to more competitive pricing for its zinc and copper products. This strategic capital allocation is fundamental to its long-term market positioning and profitability.

- Capital Expenditure Focus: Boliden's investments in projects like the Odda smelter expansion are key drivers of its cost structure and future pricing capabilities.

- Efficiency Gains: These capital expenditures are designed to increase production capacity and operational efficiency, potentially leading to more competitive pricing.

- Long-Term Strategy: Investments in assets and expansions are integral to Boliden's strategy for sustained profitability and market competitiveness.

- 2024 Investment Snapshot: Boliden continued to invest in its core operations throughout 2024, focusing on modernization and expansion to bolster efficiency.

Boliden's pricing strategy for its metals is multifaceted, balancing global market dynamics with customer-centric value propositions. The company leverages its commitment to sustainability and operational efficiency to differentiate its offerings and influence pricing, particularly for its premium, low-carbon products.

Boliden's pricing is intrinsically linked to global commodity markets, with LME prices serving as a primary benchmark. For example, LME zinc prices fluctuated, averaging approximately $2,500 per tonne in early 2024. Boliden also employs long-term contracts with fixed or indexed pricing to provide stability for both itself and its clients.

The company's investment in operational efficiency, such as the Odda smelter expansion, directly impacts its cost structure and competitive pricing. These strategic capital expenditures, like the continued modernization investments throughout 2024, aim to enhance output and achieve economies of scale, supporting its long-term market positioning.

| Metal | Early 2024 LME Average (approx.) | Boliden Pricing Strategy Element | Customer Value Proposition |

|---|---|---|---|

| Zinc | $2,500/tonne | Market benchmark, long-term contracts | Consistent supply, high purity, reliable delivery |

| Copper | $8,500/tonne | Market benchmark, long-term contracts | Consistent supply, high purity, reliable delivery |

| Lead | $2,100/tonne | Market benchmark, long-term contracts | Consistent supply, high purity, reliable delivery |

| Low-Carbon Nickel | Premium over market | Value-based pricing (sustainability) | Reduced environmental footprint, responsible sourcing |

4P's Marketing Mix Analysis Data Sources

Our Boliden 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, industry publications, and market intelligence. We analyze product portfolios, pricing strategies, distribution networks, and promotional activities to provide a clear picture of their market approach.