Boliden Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Boliden Bundle

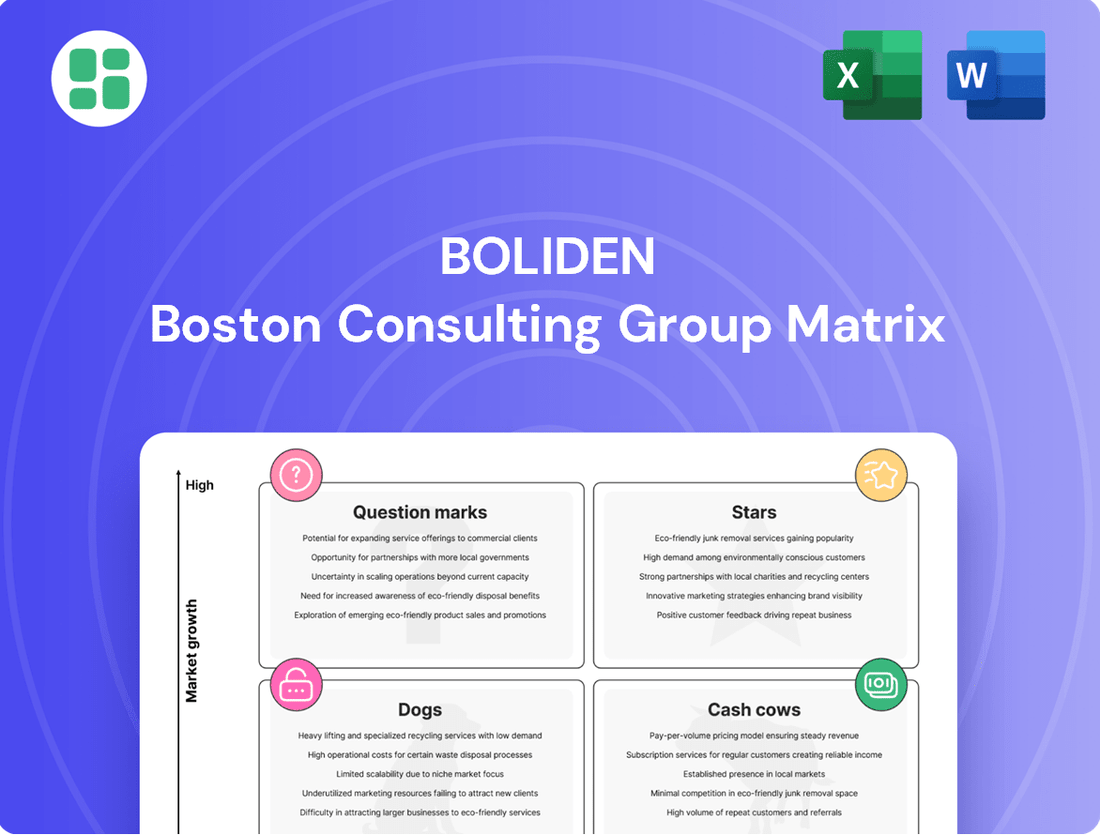

Unlock the strategic power of Boliden's product portfolio with our comprehensive BCG Matrix analysis. Understand which of their operations are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or potential future successes (Question Marks).

This isn't just a classification; it's your roadmap to optimized resource allocation and informed investment decisions. Gain the clarity needed to navigate the competitive landscape and drive sustainable growth.

Purchase the full BCG Matrix report today to access detailed quadrant placements, data-backed recommendations, and a clear strategy for Boliden's future success.

Stars

Boliden's copper production is a prime candidate for a Star in the BCG Matrix due to the booming demand from the electric vehicle (EV) sector. The global copper market within the EV industry is anticipated to expand at a compound annual growth rate of 15.9% between 2025 and 2034.

By 2030, the entire EV industry is projected to require more than 2.5 million tonnes of copper. Boliden is strategically positioning itself to meet this demand, evidenced by its SEK 4.8 billion investment in a new tank house at the Rönnskär copper smelter, which will boost copper cathode output and capitalize on this high-growth opportunity.

Boliden's vision to be the most climate-friendly and respected metal provider, emphasizing sustainable production and low-carbon products, firmly places Sustainable Metals Production in the Star category of the BCG Matrix. This strategic focus is attracting significant attention from ESG-focused investors, a growing segment of the market.

The company's proactive approach is evident in initiatives like the launch of Low-Carbon Nickel and ongoing pilot programs for a low-carbon cement substitute derived from metal production residue. These efforts directly align with global decarbonization trends, giving Boliden a distinct competitive edge.

In 2023, Boliden reported a 17% reduction in its Scope 1 and 2 emissions compared to 2018, demonstrating tangible progress towards its ambitious climate goals. This commitment to environmental responsibility is a key differentiator in today's market.

The Aitik mine, a cornerstone of Boliden's operations, continues to impress with its robust output. In the second quarter of 2025, it achieved a remarkable milestone, setting a new record for mine production, encompassing both waste rock and ore. This consistent performance underscores its importance to Boliden's overall success.

Significant infrastructure upgrades, such as the completion of the Aitik dam in December 2024, are crucial for maintaining these high production levels. These investments are not just about current output but are strategically designed to ensure the mine's long-term viability and efficiency, supporting sustained operations.

Aitik's high-volume, cost-efficient production model allows it to command a substantial share of the copper market. This is particularly noteworthy as copper demand is projected to grow, driven by global electrification initiatives, positioning Aitik as a key player in a burgeoning industry.

Acquisition of Somincor and Zinkgruvan

The acquisition of Somincor (Neves-Corvo) and Zinkgruvan mines, finalized in April 2025, represents a significant strategic move for Boliden. This expansion nearly doubled their zinc concentrate production, a key metric for their business. It also provided a substantial increase in copper production, immediately adding value and setting the stage for future growth.

These newly acquired, well-invested assets are poised to solidify Boliden's standing as a premier European base metals producer. The integration of these operations is expected to yield considerable synergies and operational efficiencies.

- Increased Production: Boliden's zinc concentrate output nearly doubled post-acquisition.

- Enhanced Copper Output: The deal significantly boosted Boliden's copper concentrate production.

- Strategic European Position: The acquisitions strengthen Boliden's role as a leading European base metals company.

- Foundation for Growth: The well-invested nature of the mines provides a strong base for long-term development.

Precious Metals (Gold & Silver) Production

Boliden's production of precious metals, especially gold and silver, is a significant revenue driver. In Q1 2025, prices for these metals experienced an upward trend, bolstering this segment's contribution. These metals are often sought after as a hedge against economic instability, maintaining a strong market presence in a sector known for its consistent, though sometimes fluctuating, valuations.

The ongoing investment in the Rönnskär smelter is designed not only to enhance copper processing but also to boost precious metals production capacity. This strategic initiative underscores Boliden's commitment to expanding its footprint in the precious metals market.

- Boliden's precious metals output is a key revenue stream.

- Gold and silver prices saw an increase in Q1 2025.

- The Rönnskär smelter upgrade will increase precious metals capacity.

- Precious metals serve as a hedge against economic uncertainty.

Boliden's copper operations, particularly those driven by the burgeoning electric vehicle market, are positioned as Stars. The demand for copper in EVs is projected to grow significantly, with the market expected to expand at a CAGR of 15.9% from 2025 to 2034. By 2030, the EV sector alone will require over 2.5 million tonnes of copper, a demand Boliden is actively addressing through strategic investments like the SEK 4.8 billion upgrade to its Rönnskär copper smelter, set to increase cathode output.

Boliden's commitment to sustainable, low-carbon metal production, exemplified by its vision to be the most climate-friendly provider, also firmly places this aspect in the Star category. This focus attracts ESG-conscious investors. Tangible progress is evident, with a 17% reduction in Scope 1 and 2 emissions by 2023 compared to 2018, demonstrating a clear competitive advantage in a decarbonizing world.

The Aitik mine is a consistent performer, setting production records in Q2 2025 for both waste rock and ore. Infrastructure improvements, such as the Aitik dam completion in December 2024, ensure its long-term efficiency and high-volume, cost-effective copper output, aligning with increasing global electrification needs.

Furthermore, the strategic acquisition of Somincor (Neves-Corvo) and Zinkgruvan mines in April 2025 nearly doubled Boliden's zinc concentrate production and significantly boosted copper output, solidifying its European base metals leadership and providing a strong foundation for future growth.

| Segment | BCG Category | Key Drivers | Recent Performance/Developments |

|---|---|---|---|

| Copper (EV Demand) | Star | Growing EV market, electrification initiatives | SEK 4.8bn Rönnskär smelter upgrade, 15.9% CAGR projected for EV copper market (2025-2034) |

| Sustainable Metals Production | Star | ESG investing trends, decarbonization | 17% Scope 1 & 2 emission reduction (vs. 2018), low-carbon product focus |

| Aitik Mine Operations | Star | High-volume, cost-efficient production | Record mine production (Q2 2025), Aitik dam completion (Dec 2024) |

| Acquired Zinc/Copper Assets (Somincor, Zinkgruvan) | Star | Market expansion, increased production capacity | Nearly doubled zinc concentrate output, significant copper output boost (April 2025 acquisition) |

What is included in the product

Strategic guidance on resource allocation by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs.

The Boliden BCG Matrix provides a clear, visual overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

Boliden's existing zinc production, notably the Kokkola smelter, positions it as a strong player in a mature market. Despite anticipated price softening by 2025 due to increased global supply, the demand for zinc, particularly for galvanization in construction and automotive sectors, continues to grow, albeit at a slower pace. This segment, characterized by high market share and consistent cash flow generation, requires minimal new investment for maintenance and promotion, aligning perfectly with the characteristics of a Cash Cow in the BCG matrix.

Boliden's lead production functions as a Cash Cow within its portfolio, contributing significantly to the smelters' revenue streams. This base metal segment benefits from a generally mature market characterized by stable demand, predominantly driven by the automotive battery sector and construction industries. In 2023, Boliden's lead production volume was approximately 140,000 tonnes, underscoring its established market presence.

Boliden's sulphuric acid and by-products are classic Cash Cows within its portfolio. These are generated as a natural outcome of its core smelting activities, meaning their production is inherently tied to existing operations without significant extra capital outlay. This integration allows Boliden to leverage its infrastructure efficiently.

The demand for sulphuric acid remains robust and steady across various industrial sectors, such as fertilizer production and chemical manufacturing. In 2024, the global sulphuric acid market is projected to continue its stable growth trajectory, underscoring the reliable revenue stream these by-products provide. Boliden benefits from this consistent industrial need in mature markets.

Because these by-products are already part of the smelting process, the need for substantial new investments to maintain their market position is minimal. This low reinvestment requirement translates directly into high cash flow generation, a defining characteristic of a Cash Cow. Boliden's operational efficiency in handling these materials further bolsters their profitability.

Mature Smelting Operations

Boliden's mature smelting operations in Sweden, Finland, and Norway, including facilities like Harjavalta and Kokkola, represent its Cash Cows. These established smelters benefit from significant installed capacity and decades of operational expertise, allowing them to refine metal concentrates and secondary materials efficiently. They contribute substantially to Boliden's revenue through stable treatment and refining charges, indicative of a low-growth, high-market-share position.

- Stable Revenue Streams: These operations generate consistent income from treatment and refining charges, underpinning Boliden's financial stability.

- High Market Share: Boliden holds a strong position in the European smelting market, leveraging its established infrastructure and expertise.

- Operational Efficiency: Long-standing facilities are optimized for high throughput and cost-effectiveness, maximizing profitability.

- Contribution to Profitability: In 2023, Boliden's smelting operations were a significant contributor to the company's overall financial performance, with refining charges forming a core part of their gross profit.

Garpenberg Mine (Existing Production)

The Garpenberg mine, Sweden's oldest continuously operating mine, stands as a prime example of a cash cow for Boliden. Its long history is matched by its consistent and significant production of key metals including zinc, lead, copper, silver, and gold. This established output, even with future expansion plans, solidifies its position as a high-market-share asset in a mature industry phase.

Garpenberg's role as a cash cow is evident in its reliable contribution to Boliden's financial performance. In 2023, Boliden reported that the Garpenberg mine produced approximately 2.3 million tonnes of ore. This consistent output generates substantial and predictable cash flow, a hallmark of a cash cow within the BCG matrix.

- Established Production: Garpenberg consistently produces zinc, lead, copper, silver, and gold.

- Market Share: It holds a significant market share in its product segments.

- Profitability: The mine is a stable and substantial contributor to Boliden's profits.

- Cash Flow Generation: Its mature operational phase ensures reliable and strong cash flow.

Boliden's established zinc and lead operations, particularly smelters like Kokkola and its lead production which reached approximately 140,000 tonnes in 2023, function as key cash cows. These segments benefit from mature markets with stable demand, primarily from construction and automotive sectors. The consistent cash flow generated requires minimal new investment, solidifying their position as reliable profit drivers.

| Asset | Primary Metals | Market Position | Cash Flow Characteristic |

| Kokkola Smelter | Zinc | High Market Share (Mature Market) | Consistent, Low Reinvestment |

| Lead Production | Lead | Stable Demand (Automotive, Construction) | Reliable Revenue Stream |

| Sulphuric Acid & By-products | N/A | Steady Industrial Demand | High Profitability, Low Capital Needs |

What You’re Viewing Is Included

Boliden BCG Matrix

The Boliden BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic decision-making, contains no watermarks or placeholder content, ensuring you get a professional and ready-to-use analysis of Boliden's business units.

Dogs

Forecasts for zinc prices point towards a downward trend leading up to 2025. This is largely attributed to demand growth that is not keeping pace with a surge in production.

For Boliden, a significant zinc producer, this sustained period of lower prices poses a challenge. It could potentially push some of its less efficient or higher-cost zinc operations into the question mark category of the BCG matrix.

In 2024, the global zinc market has been navigating these price pressures, with benchmark LME zinc prices fluctuating. For instance, LME zinc prices have seen periods below $2,500 per metric ton during the year, reflecting the supply-demand imbalance.

Underperforming smaller mines within Boliden's portfolio, characterized by high operational costs, diminishing ore grades, or significant geopolitical and environmental hurdles, represent potential 'Dogs' in the BCG Matrix. These units often struggle to achieve profitability, potentially consuming cash without offering substantial future growth prospects.

Boliden's Q2 2025 financial disclosures highlighted a mixed performance across its various mining operations. While specific details on individual mine profitability were not fully elaborated, the report indicated that certain facilities were experiencing operational challenges that could place them in this underperforming category.

Boliden has a history of divesting assets that no longer align with its strategic vision or profitability targets. A prime example is the divestiture of the Myra Falls mine. While these are historical examples, they illustrate the principle of shedding low-growth, low-market-share assets to prevent them from becoming financial burdens.

These divested assets, though not current offerings, serve as a benchmark for identifying operations that might be candidates for divestiture within Boliden's current portfolio. The company's approach is to proactively manage its asset base, ensuring resources are allocated to segments with higher growth potential and market share.

Operations with Persistent Negative Currency Effects

Boliden's Q2 2025 financial report highlighted a significant headwind, with operating profit negatively impacted by approximately SEK -600 million due to a weaker US dollar. This illustrates how operations heavily reliant on currencies that move unfavorably can suffer.

When certain business units within a company are disproportionately exposed to adverse currency movements, and lack robust hedging strategies or natural offsets, they can become persistent drains on profitability. This vulnerability can transform potentially sound operations into cash-consuming liabilities.

- Persistent Currency Erosion: Operations exposed to unfavorable currency shifts without adequate hedging can see their profitability consistently diminished, potentially turning profitable ventures into losses.

- Q2 2025 Impact: Boliden experienced a SEK -600 million hit to operating profit in Q2 2025, directly attributed to a weaker US dollar, underscoring the real-world impact of currency fluctuations.

- Strategic Vulnerability: Such operations represent a strategic vulnerability, as they require constant monitoring and management to mitigate the ongoing financial drag they impose on the overall business.

Less Efficient Legacy Technologies

Less efficient legacy technologies within Boliden’s operations, such as older smelting or mining equipment, can be categorized as Dogs in the BCG Matrix. These technologies often come with higher operating costs and a greater environmental impact when compared to contemporary, more sustainable alternatives. For instance, while specific 2024 figures for legacy tech inefficiencies aren't publicly detailed in isolation, Boliden's broader commitment to modernizing sites like Rönnskär, which received significant investment, indicates a strategic move to phase out less productive assets.

These older processes typically generate lower profit margins and demand substantial maintenance expenditure without offering a clear path for future expansion or growth. Boliden's strategic focus on sustainability and innovation inherently pushes these legacy systems towards obsolescence.

- Higher Operating Costs: Legacy technologies often consume more energy and require more manual intervention, driving up per-unit production costs.

- Environmental Footprint: Older equipment may not meet current environmental standards, leading to higher emissions or waste generation.

- Limited Growth Potential: These technologies are less adaptable to market changes or new product demands, hindering future expansion.

- Maintenance Burden: Older machinery requires more frequent repairs and spare parts, diverting resources from more productive investments.

Boliden's 'Dogs' are business units or assets that exhibit low market share and low growth potential, often characterized by high costs and declining profitability. These segments typically consume more resources than they generate, posing a drag on the company's overall performance.

In 2024, Boliden's less efficient mines, particularly those with higher operational costs or diminishing ore grades, represent prime candidates for the 'Dog' category. These operations struggle to compete in a market facing downward price pressures, as seen with LME zinc prices dipping below $2,500 per metric ton at times during the year.

Legacy technologies, such as older smelting equipment, also fall into this classification due to their higher operating expenses and limited adaptability compared to modern alternatives. Boliden's strategic investments in modernizing facilities like Rönnskär signal a move away from such underperforming assets.

The company's historical divestitures, like the Myra Falls mine, serve as examples of Boliden's proactive approach to shedding low-growth, low-market-share assets to avoid them becoming financial burdens.

Question Marks

Integrating newly acquired mines like Somincor and Zinkgruvan in Q2 2025 presented short-term financial headwinds for Boliden. These strategic growth assets, while promising for the future, demanded significant capital infusion during their initial integration and ramp-up periods. This resulted in a substantial negative impact on free cash flow, amounting to SEK -12,354 million.

The Odda smelter expansion project, a key initiative for Boliden, is currently categorized as a Question Mark. While it signifies a substantial investment aimed at boosting zinc production capacity, reflecting strong growth ambitions, it's experiencing significant hurdles.

The project has encountered delays and cost overruns, pushing the projected investment to EUR 950 million. Ramp-up is now anticipated in the latter half of 2025. These challenges, coupled with current low returns stemming from commissioning issues and increased costs, place it squarely in the Question Mark quadrant of the BCG Matrix.

Boliden's introduction of Low-Carbon Nickel exemplifies a "Question Mark" product. This innovative offering taps into burgeoning markets fueled by stringent environmental regulations and growing consumer preference for sustainable materials, indicating substantial future growth potential.

While the demand for low-carbon alternatives is on an upward trajectory, Boliden's Low-Carbon Nickel currently holds a modest market share, characteristic of a new entrant. This positioning necessitates significant strategic investment in marketing, research and development, and production scaling to capture a larger portion of this expanding market.

The company's pilot of a low-carbon cement substitute further reinforces this "Question Mark" classification. These emerging products require substantial capital outlay to transition from their current nascent stage to becoming market leaders, or "Stars," in the competitive landscape of sustainable materials.

Advanced Exploration Projects

Advanced exploration projects for Boliden, while not explicitly categorized within the standard BCG Matrix, can be viewed as strategic investments with high risk and high potential reward, akin to question marks. These projects are crucial for Boliden's long-term growth, aiming to discover and develop new mineral resources to sustain and expand its operations. For instance, Boliden's 2024 exploration activities are focused on identifying new deposits and extending the life of existing mines, with significant capital allocated to these future-oriented endeavors.

These advanced exploration projects represent a significant commitment to future production capacity. They are characterized by substantial upfront capital expenditure with no guarantee of immediate returns, mirroring the uncertainty associated with question mark investments. However, a successful outcome could lead to the development of new, high-volume mines, significantly boosting Boliden's market share in the commodities it extracts.

- Boliden's exploration budget for 2024 is a key indicator of investment in these advanced projects.

- These projects are in the pre-production or early development stages, requiring extensive geological assessment and feasibility studies.

- The potential upside of a successful discovery includes securing long-term, high-volume production assets.

- The risk lies in the inherent uncertainty of finding commercially viable ore bodies and the substantial capital required for development.

Tailings Recycling and Circular Economy Initiatives

Boliden's tailings recycling and circular economy initiatives, such as using tailings as backfill and transforming smelter slag into cement substitutes, position them in a high-growth market for sustainable solutions. These efforts are currently in early adoption or pilot phases, indicating low current market share but substantial future expansion and profitability potential, aligning with the characteristics of a Question Mark in the BCG matrix.

- Boliden's investment in tailings utilization as backfill addresses waste reduction and resource efficiency.

- The development of a smelter slag-based cement substitute targets a significant reduction in climate impact, estimated at up to 80% compared to traditional cement.

- These circular economy ventures operate in a rapidly expanding market for green building materials and sustainable mining practices, with global market size projections reaching hundreds of billions by the late 2020s.

- Despite their promising potential, these initiatives are in nascent stages, facing challenges in scaling up production and market penetration, characteristic of a Question Mark's high growth, low market share profile.

Boliden's Odda smelter expansion, Low-Carbon Nickel, and circular economy initiatives are all prime examples of Question Marks. These ventures are characterized by significant investment in high-growth potential markets, but currently hold low market share due to their early stages of development or operational challenges.

The company's exploration activities, while not formally BCG-categorized, also function as Question Marks, demanding substantial capital for uncertain future returns. These strategic bets are crucial for Boliden's long-term growth trajectory.

The success of these Question Marks hinges on Boliden's ability to navigate development hurdles, scale production, and capture market share in increasingly competitive and sustainability-focused landscapes.

| Initiative | Market Potential | Current Market Share | Investment/Risk Level | BCG Category |

|---|---|---|---|---|

| Odda Smelter Expansion | High (Zinc Production) | Low (Pre-ramp-up) | High (EUR 950M, delays) | Question Mark |

| Low-Carbon Nickel | High (Sustainable Materials) | Low (New Entrant) | High (R&D, scaling) | Question Mark |

| Circular Economy Initiatives | High (Green Building, Waste Reduction) | Low (Pilot/Early Adoption) | High (Scaling, Market Penetration) | Question Mark |

| Advanced Exploration Projects | High (Future Resource Security) | N/A (Pre-production) | High (Exploration Budget 2024) | Question Mark (Analogue) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.