Bank of New York Mellon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of New York Mellon Bundle

Navigate the complex external forces shaping Bank of New York Mellon's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this financial giant. Equip yourself with critical intelligence to inform your investment decisions and strategic planning.

Gain a decisive advantage by unlocking the full PESTLE analysis for Bank of New York Mellon. Our expert-crafted report provides actionable insights into the macro-environmental trends impacting its operations and market position. Download now to access the complete breakdown and make more informed strategic moves.

Political factors

Global political stability and international trade agreements significantly influence cross-border investment flows and client confidence, which are crucial for BNY Mellon's asset servicing and management operations. For instance, the ongoing geopolitical shifts in Eastern Europe and the Middle East, coupled with evolving trade relationships between major economies in 2024, create an environment of heightened uncertainty for international capital.

Changes in trade policies, such as tariffs or protectionist measures, or increased geopolitical tensions can directly lead to market volatility. This volatility can affect the value of assets under management and, consequently, the demand for BNY Mellon's services. The World Bank's projections for global GDP growth in 2024, revised down to 2.4% in early 2024 due to persistent inflation and geopolitical risks, underscore this sensitivity.

BNY Mellon must diligently monitor these dynamics to effectively navigate potential disruptions and identify emerging opportunities. Their ability to adapt to shifts in trade regulations and geopolitical landscapes will be key to maintaining operational resilience and client trust throughout 2024 and into 2025.

Government fiscal policies, including spending and taxation, along with monetary policy decisions by central banks like the Federal Reserve, directly shape economic conditions. For instance, in early 2024, the US government continued to manage significant fiscal outlays while the Federal Reserve maintained a cautious stance on interest rates, aiming to curb inflation without triggering a recession. This environment directly impacts BNY Mellon's operations by influencing asset valuations and the cost of capital for its clients.

These policy levers are critical determinants of investment returns and capital market stability. Higher government spending can stimulate economic activity but may also lead to increased national debt and potential inflationary pressures. Conversely, tighter monetary policy, such as higher interest rates, can cool down an overheating economy but might also slow down investment and growth. BNY Mellon must navigate these dynamics to effectively manage client assets and maintain its profitability.

The Bank of New York Mellon's strategic planning hinges on its ability to anticipate and adapt to these evolving fiscal and monetary landscapes. Changes in tax laws or interest rate trajectories can significantly alter the investment climate, affecting everything from bond yields to equity valuations. For example, a shift towards more expansionary fiscal policy in late 2024 or early 2025 could see increased infrastructure spending, potentially boosting certain sectors and influencing BNY Mellon's investment strategies.

The Bank of New York Mellon (BNY Mellon) navigates a complex landscape of international regulatory harmonization and divergence. While efforts towards global standards, such as those from the Basel Committee on Banking Supervision, aim to simplify operations, significant jurisdictional differences persist. For instance, varying capital adequacy requirements or data privacy laws across the EU, UK, and Asia necessitate tailored compliance strategies, increasing operational costs and complexity for BNY Mellon's cross-border services.

Sanctions and Trade Restrictions

Sanctions and trade restrictions significantly impact BNY Mellon's global operations. The evolving geopolitical landscape in 2024 and 2025 means that new sanctions can be imposed, or existing ones lifted, directly affecting the company's ability to conduct business in specific markets. For instance, the ongoing sanctions related to Russia's invasion of Ukraine continue to necessitate stringent compliance measures.

BNY Mellon's commitment to adhering to these complex regulations is crucial to prevent substantial legal fines and protect its reputation. The firm must continuously invest in and refine its screening and monitoring technologies to identify and manage transactions involving sanctioned parties. In 2023, financial institutions globally faced significant penalties for sanctions violations, underscoring the critical nature of robust compliance programs.

- Sanctions Compliance Costs: Financial institutions like BNY Mellon allocate significant resources annually to sanctions compliance, often running into hundreds of millions of dollars globally.

- Impact on Cross-Border Transactions: Trade restrictions can directly limit the volume and value of cross-border transactions BNY Mellon facilitates, affecting fee income.

- Regulatory Scrutiny: Increased geopolitical tensions in 2024 and 2025 have led to heightened regulatory scrutiny of financial institutions' compliance frameworks.

Political Stability of Key Markets

The political stability of key markets where Bank of New York Mellon (BNYM) operates is paramount for maintaining business operations and safeguarding client assets. For instance, geopolitical tensions in regions like Eastern Europe, particularly concerning the ongoing conflict in Ukraine, can create volatility in global financial markets, impacting BNYM's custodial and asset servicing businesses. The company's extensive global presence means it is exposed to varying degrees of political risk across continents.

Policy uncertainty in major economies also presents a significant challenge. Changes in trade policies, regulatory frameworks, or fiscal strategies in countries like the United States or the United Kingdom can directly influence investment flows and the overall health of the financial sector. BNY Mellon's 2024 outlook, like many in the industry, is closely watching for shifts in economic and trade policies that could affect cross-border capital movements and investment strategies.

Sudden regime changes or significant political unrest in countries where BNYM has substantial client holdings or operational interests could lead to market disruptions and asset value fluctuations. For example, political instability in emerging markets, while potentially offering growth opportunities, also carries inherent risks that require careful monitoring and mitigation strategies. The company’s risk management frameworks are designed to assess and adapt to these dynamic political landscapes.

- Geopolitical Risk Exposure: BNY Mellon's operations are indirectly affected by global geopolitical events, with the IMF forecasting a slowdown in global growth in 2024 due to these factors.

- Policy Uncertainty Impact: Regulatory shifts in financial services, such as those discussed in the US and EU in 2024, can alter operational costs and market access for BNYM.

- Emerging Market Volatility: Political instability in key emerging markets can lead to capital flight, impacting the value of assets BNYM custodies and manages.

- Operational Continuity: Maintaining business continuity during periods of political upheaval is a core focus, requiring robust contingency planning across BNYM's global network.

Global political stability and international trade agreements significantly influence cross-border investment flows and client confidence, crucial for BNY Mellon's operations. For instance, evolving trade relationships and geopolitical shifts in 2024 create an environment of heightened uncertainty for international capital, as highlighted by the World Bank's revised global GDP growth forecast of 2.4% for 2024 due to these risks.

Government fiscal and monetary policies directly shape economic conditions, impacting asset valuations and the cost of capital for BNY Mellon's clients. The US Federal Reserve's cautious stance on interest rates in early 2024, aimed at curbing inflation, directly affects investment returns and capital market stability.

BNY Mellon must diligently monitor evolving fiscal and monetary landscapes, as shifts in tax laws or interest rate trajectories can significantly alter the investment climate, influencing everything from bond yields to equity valuations through late 2024 and into 2025.

Sanctions and trade restrictions significantly impact BNY Mellon's global operations, with ongoing sanctions related to geopolitical events necessitating stringent compliance measures. Financial institutions globally faced significant penalties for sanctions violations in 2023, underscoring the critical nature of robust compliance programs.

| Factor | Impact on BNY Mellon | 2024/2025 Data/Outlook |

| Geopolitical Instability | Market volatility, affects asset values | IMF forecasts global growth slowdown in 2024 due to geopolitical risks. |

| Trade Policy Changes | Impacts cross-border transactions, fee income | Ongoing trade tensions between major economies create policy uncertainty. |

| Fiscal & Monetary Policy | Influences cost of capital, investment returns | Federal Reserve's cautious rate stance in early 2024 aims to manage inflation. |

| Sanctions & Restrictions | Operational limitations, compliance costs | Heightened regulatory scrutiny on financial institutions' compliance frameworks. |

What is included in the product

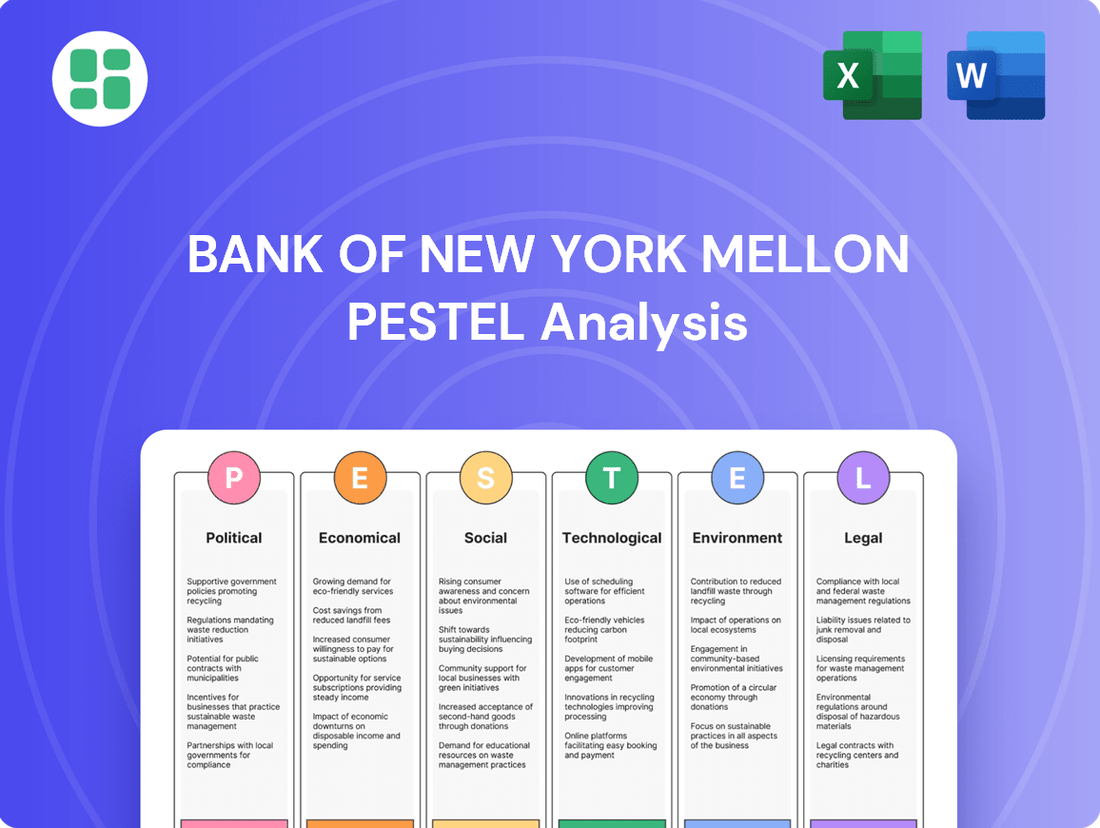

This PESTLE analysis of The Bank of New York Mellon examines the Political, Economic, Social, Technological, Environmental, and Legal forces shaping its operating landscape, offering a comprehensive view of external influences.

It provides actionable insights into how these macro-environmental factors present both challenges and strategic opportunities for BNY Mellon's global operations and future planning.

The Bank of New York Mellon's PESTLE analysis offers a clear, summarized version of the full analysis, acting as a pain point reliever by providing easy referencing during meetings or presentations, ensuring all stakeholders are aligned on external factors.

Economic factors

Global interest rates are a significant factor for Bank of New York Mellon (BNY Mellon). Fluctuations, largely dictated by central bank policies, directly influence the company's net interest income from its banking operations. For instance, the US Federal Reserve kept its benchmark interest rate in the 5.25%-5.50% range through early 2024, a period of elevated rates impacting borrowing costs and investment decisions across the financial sector.

A rising rate environment, like that experienced in 2022 and 2023, can boost certain revenue streams for BNY Mellon, such as those tied to lending. However, it also increases the cost of borrowing for the company itself and can alter client investment behavior, potentially shifting assets away from fixed-income instruments that BNY Mellon services or manages. Adapting to these dynamic shifts is crucial for maintaining optimal financial performance.

High inflation, like the 3.4% annual rate seen in the U.S. as of April 2024, directly impacts BNY Mellon by diminishing the real value of assets and clients' purchasing power. This can lead to a recalibration of investment strategies and a potential slowdown in demand for certain financial services as clients become more risk-averse.

Conversely, strong economic growth, with the U.S. GDP expanding at a 1.3% annualized rate in Q1 2024, generally fuels corporate profitability and improves market sentiment. This environment typically translates to higher assets under management for BNY Mellon and increased demand for its core investment and asset servicing solutions.

BNY Mellon's financial performance is intrinsically linked to these macroeconomic trends; robust growth supports higher fee income and transaction volumes, while inflationary pressures necessitate careful management of investment portfolios and client advisory services.

Periods of heightened financial market volatility, such as the sharp equity market declines seen in early 2024 due to inflation concerns, can significantly depress asset valuations and introduce operational risks for custodians like BNY Mellon. Reduced liquidity in certain asset classes, as experienced during the March 2023 regional banking stress, can further complicate asset servicing and impact client confidence.

BNY Mellon's robust risk management, demonstrated by its strong capital ratios exceeding regulatory requirements, is crucial for navigating these turbulent conditions. Maintaining operational resilience, including advanced technological infrastructure and business continuity plans, directly supports its ability to safeguard client assets and ensure uninterrupted market functioning, thereby reinforcing its service reliability.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant factor for BNY Mellon, given its extensive global operations and cross-border asset management. Changes in exchange rates directly impact the reported value of assets held in foreign currencies, influencing investment strategies and potentially altering the profitability of international transactions. For instance, a strengthening US dollar against other major currencies could decrease the dollar-denominated value of BNY Mellon's foreign investments and revenues.

These currency movements can also affect BNY Mellon's consolidated financial results. When foreign earnings are translated back into US dollars, adverse exchange rate movements can lead to lower reported profits, even if the underlying business performance remains strong. Conversely, favorable movements can boost reported figures. Managing this volatility through sophisticated hedging strategies and maintaining a diversified operational footprint across various currency zones is crucial for mitigating financial risks.

Looking at recent trends, the US Dollar Index (DXY), which measures the dollar's strength against a basket of major currencies, has experienced notable volatility. For example, throughout 2023 and into early 2024, the DXY saw periods of both appreciation and depreciation, reflecting shifting global economic conditions and monetary policy expectations. This ongoing fluctuation underscores the importance of BNY Mellon's risk management practices.

- Impact on Assets: Fluctuations in currency exchange rates directly alter the reported value of BNY Mellon's foreign-denominated assets, affecting its balance sheet and investment performance metrics.

- International Investment Decisions: Exchange rate volatility influences BNY Mellon's strategic decisions regarding foreign market entry, investment allocation, and the repatriation of profits from international subsidiaries.

- Financial Reporting: The translation of foreign currency earnings and assets into US dollars for consolidated financial reporting is significantly impacted by exchange rate movements, potentially distorting reported profitability.

- Risk Management: BNY Mellon employs hedging strategies, such as currency forwards and options, to mitigate the adverse effects of adverse currency movements on its financial results and asset values.

Global Recession Risks and Capital Flows

The specter of a global recession looms large, potentially curtailing investment and asset values, thereby influencing BNY Mellon's operations. Such a downturn could shrink assets under management and transaction volumes, directly affecting revenue streams.

Shifts in global capital flows, often exacerbated by recessionary fears, can alter the demand for BNY Mellon's crucial custodial and treasury services. For instance, as of early 2024, many emerging markets experienced net capital outflows as investors sought safer havens, impacting the scale of assets BNY Mellon custodies.

BNY Mellon's capacity to weather these economic storms hinges on its strategic positioning and operational flexibility. The firm's diversified business model, encompassing asset servicing, investment management, and clearing services, provides some insulation against sector-specific downturns.

- Reduced Investment Activity: A global recessionary environment typically sees a contraction in new investments and a decline in overall market liquidity.

- Asset Value Depreciation: Falling asset values directly impact assets under management (AUM) for firms like BNY Mellon, reducing fee-based revenues.

- Capital Flow Volatility: Increased risk aversion during downturns can lead to significant capital flight from riskier assets and regions, affecting custodial and treasury service demand.

- Impact on Transaction Volumes: Lower economic activity translates to fewer securities trades and other financial transactions, decreasing BNY Mellon's transaction-related income.

The economic landscape significantly shapes BNY Mellon's performance. Elevated interest rates, like the US Federal Reserve's 5.25%-5.50% range through early 2024, influence net interest income and client investment behavior. High inflation, evidenced by the 3.4% US annual rate in April 2024, erodes asset values and necessitates strategic portfolio adjustments.

Strong economic growth, such as the 1.3% annualized US GDP expansion in Q1 2024, generally boosts assets under management and transaction volumes for BNY Mellon. Conversely, market volatility, like equity declines in early 2024, can depress asset valuations and increase operational risks, highlighting the importance of BNY Mellon's robust risk management and strong capital ratios.

| Economic Factor | BNY Mellon Impact | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Affects net interest income, borrowing costs, and investment decisions. | US Fed rate held at 5.25%-5.50% through early 2024; potential for future adjustments based on inflation data. |

| Inflation | Diminishes real asset value, impacts client purchasing power and investment strategies. | US inflation at 3.4% (April 2024); ongoing concern for real returns. |

| Economic Growth | Drives AUM, transaction volumes, and demand for services. | US GDP grew 1.3% (Q1 2024); outlook for 2024/2025 remains a key indicator. |

| Market Volatility | Impacts asset valuations, liquidity, and operational risks. | Periods of equity decline and liquidity concerns observed in early 2024. |

Preview the Actual Deliverable

Bank of New York Mellon PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of The Bank of New York Mellon covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the institution. You'll gain valuable insights into the strategic landscape BNY Mellon operates within.

Sociological factors

Developed nations are experiencing aging populations, with the median age in the US reaching 38.9 years in 2023, a trend that will continue. This demographic shift is coupled with a significant intergenerational wealth transfer, projected to move trillions of dollars over the coming decades. For BNY Mellon, this means a growing demand for sophisticated wealth management, estate planning, and tailored retirement solutions to serve an increasingly affluent and older client base.

Adapting BNY Mellon's product suite is crucial to capture these evolving market needs. Offering specialized services in trusts, legacy planning, and philanthropic advisory will resonate with clients managing substantial inherited wealth. By proactively addressing the financial complexities associated with aging and wealth succession, BNY Mellon can foster deeper, long-term client relationships and tap into new revenue streams.

Clients, from large institutions to individual high-net-worth investors, now demand digital experiences that are as smooth and easy to use as their favorite consumer apps. They expect to manage their money, access services, and get support through intuitive, secure online and mobile platforms. A 2024 survey indicated 85% of financial services clients prioritize digital self-service options.

To keep pace, BNY Mellon must consistently upgrade its digital offerings, focusing on user-friendly interfaces, robust mobile capabilities, and personalized digital tools. Failing to do so risks losing clients to competitors who provide superior digital engagement. This investment is crucial for client satisfaction and long-term retention in a rapidly evolving financial landscape.

Societal expectations are increasingly pushing for Environmental, Social, and Governance (ESG) principles to be central to investment decisions and how companies operate. Investors, both individual and institutional, are actively seeking out opportunities that align with their values, driving significant capital towards sustainable options. This trend is reshaping the financial landscape, demanding greater transparency and accountability from corporations.

BNY Mellon, like its peers, is responding to this demand by integrating ESG factors into its investment management frameworks and expanding its offerings of sustainable financial products. The firm's ability to provide robust ESG data and reporting services is becoming a key differentiator, attracting clients who prioritize responsible stewardship. For instance, by mid-2025, it's projected that global sustainable investment assets could reach $50 trillion, underscoring the immense growth potential and client interest in this area.

Trust and Reputation in Financial Institutions

Public trust in financial institutions is a cornerstone for BNY Mellon's operations, particularly after economic downturns. A recent survey in late 2024 indicated that while overall trust in the financial sector saw a slight uptick, concerns about data security and transparency persist, directly impacting client retention for services like custody and asset management.

BNY Mellon's reputation hinges on its perceived security, reliability, and ethical framework. In 2024, the company emphasized its commitment to robust cybersecurity measures and transparent reporting, aiming to solidify client confidence. The firm's ability to maintain integrity across its diverse financial services is crucial for attracting and keeping high-value clients.

- Reputation Management: BNY Mellon's ongoing investment in ethical governance and transparent communication is vital for fostering client loyalty in a competitive landscape.

- Client Confidence: Maintaining a strong track record in security and reliability is paramount, especially as digital asset custody becomes more prevalent.

- Ethical Culture: Demonstrating a commitment to integrity reassures stakeholders and underpins the long-term sustainability of its trust and asset management divisions.

Workforce Diversity and Inclusion

Societal emphasis on diversity, equity, and inclusion (DEI) is a significant force shaping BNY Mellon's operations. This focus directly impacts its ability to attract and retain skilled employees, foster a culture of innovation, and genuinely connect with its increasingly diverse clientele. Companies that actively champion DEI are often viewed as more responsible and are better positioned for long-term success.

BNY Mellon's commitment to DEI initiatives is not just about corporate social responsibility; it's increasingly recognized as a driver of improved business performance. By building a workforce that mirrors the broader society, the company can tap into a wider range of perspectives, leading to more creative problem-solving and a deeper understanding of market needs.

A strong DEI strategy enhances BNY Mellon's human capital and bolsters its brand image. For instance, in 2023, BNY Mellon reported that 55% of its U.S. workforce identified as women or underrepresented ethnic minorities, reflecting a growing, though still evolving, commitment to diversity.

- Talent Acquisition and Retention: A diverse and inclusive environment is crucial for attracting top talent in a competitive market.

- Innovation and Problem-Solving: Diverse teams bring varied perspectives, leading to more robust solutions and innovative approaches.

- Client Relationships: Reflecting the diversity of its client base strengthens BNY Mellon's ability to understand and serve their needs effectively.

- Brand Reputation: Strong DEI practices enhance the company's image as a socially responsible and forward-thinking organization.

Societal shifts toward greater financial literacy and demand for personalized wealth management are critical for BNY Mellon. As individuals increasingly seek tailored advice for retirement planning and intergenerational wealth transfer, the company must adapt its offerings. The growing emphasis on digital accessibility, with an estimated 85% of clients prioritizing self-service options in 2024, necessitates continuous investment in user-friendly online platforms.

Technological factors

The increasing complexity of cyber threats presents a substantial risk to BNY Mellon's extensive digital systems, confidential client information, and overall operational stability. Protecting these assets necessitates advanced cybersecurity protocols, ongoing monitoring of emerging threats, and diligent defensive actions to maintain client confidence and adhere to strict data privacy laws.

In 2023, financial institutions globally reported an average of 162 cyberattacks per week, a significant increase from previous years, highlighting the critical need for robust defenses. BNY Mellon's commitment to cybersecurity is paramount, with substantial investments in advanced threat detection and data encryption technologies to safeguard its worldwide operations and the sensitive data entrusted to it.

The Bank of New York Mellon (BNY Mellon) is significantly investing in artificial intelligence (AI) and machine learning (ML) to transform its operations. These technologies are key to enhancing data analytics capabilities, automating intricate processes, and bolstering risk management frameworks.

By integrating AI/ML, BNY Mellon aims to deliver more personalized client services and drive innovation in product development. This strategic adoption is expected to boost operational efficiency and sharpen decision-making, thereby securing a competitive edge in the data-driven financial services sector.

BNY Mellon’s commitment is evident in its ongoing investments. For instance, in 2023, the company continued to expand its AI and data science teams, signaling a strong focus on leveraging these advanced technologies for future growth and service enhancement.

Blockchain and Distributed Ledger Technology (DLT) offer BNY Mellon significant avenues to boost efficiency, transparency, and security across its asset servicing, payments, and trade finance functions. These advancements hold the potential to simplify reconciliation processes, accelerate settlement cycles, and facilitate the creation of novel financial instruments. For instance, by mid-2024, the global DLT market was projected to reach over $10 billion, indicating substantial investment and ongoing development in this transformative area.

Cloud Computing Adoption and Infrastructure Modernization

BNY Mellon's strategic migration to cloud computing platforms is a significant technological factor, promising enhanced scalability, flexibility, and cost efficiencies for its vast financial operations. This modernization is crucial for handling demanding workloads and fostering innovation.

The company's investment in cloud infrastructure is geared towards accelerating innovation and ensuring robust business continuity, vital for a global financial institution operating in a dynamic market. Secure and compliant cloud strategies remain paramount.

- Cloud Spending Growth: Global spending on cloud services is projected to reach over $679 billion in 2024, indicating a strong industry trend that BNY Mellon is leveraging.

- Digital Transformation Investment: BNY Mellon has been actively investing in its technology infrastructure, with a significant portion of its capital expenditure allocated to digital transformation initiatives, including cloud adoption.

- Data Processing Enhancement: Cloud adoption allows for more efficient processing of the immense volumes of financial data BNY Mellon handles daily, improving analytics and client service delivery.

Fintech Innovation and Competition

Fintech innovation is rapidly reshaping the financial services landscape, presenting both challenges and opportunities for established institutions like Bank of New York Mellon (BNY Mellon). Agile fintech firms are carving out market share with specialized offerings in digital payments, robo-advisory services, and blockchain technology. For BNY Mellon, this means a constant need to adapt, either by developing its own innovative solutions or by forging strategic partnerships to integrate cutting-edge technologies. Staying ahead of these trends is paramount for maintaining market relevance and competitiveness.

The competitive pressure from fintechs is significant, as these startups often operate with lower overheads and a focus on user experience. For instance, the global fintech market was projected to reach over $300 billion in 2024, indicating substantial growth and investment. BNY Mellon must actively monitor these developments to identify potential threats and opportunities for collaboration. This could involve acquiring promising fintechs or integrating their platforms to enhance BNY Mellon's service offerings.

- Digital Payments: Fintechs are streamlining payment processes, impacting traditional transaction volumes.

- Automated Investing: Robo-advisors offer cost-effective portfolio management, challenging traditional wealth management models.

- Blockchain Solutions: Distributed ledger technology offers potential for increased efficiency and transparency in areas like asset servicing and trade finance.

- Partnership Opportunities: BNY Mellon can leverage fintech innovation through strategic alliances to enhance its digital capabilities and reach new customer segments.

BNY Mellon's technological strategy is heavily influenced by the rapid advancements in AI and machine learning, which are being implemented to enhance data analytics, automate processes, and strengthen risk management. The company's significant investments in these areas, evident in its expanding AI and data science teams throughout 2023, underscore its commitment to leveraging these tools for operational efficiency and client service innovation.

The firm is also embracing cloud computing for scalability and cost-efficiency, a trend mirrored by global cloud spending projected to exceed $679 billion in 2024. This strategic shift supports BNY Mellon's digital transformation, enabling more efficient data processing and robust business continuity.

Furthermore, BNY Mellon is exploring the potential of blockchain and DLT to improve efficiency and transparency in areas like asset servicing and payments, with the global DLT market anticipated to surpass $10 billion by mid-2024.

The competitive landscape is being reshaped by fintech innovation, with BNY Mellon needing to adapt through its own solutions or strategic partnerships to remain competitive in digital payments and automated investing, as the fintech market itself was projected to exceed $300 billion in 2024.

| Technology Area | BNY Mellon's Focus/Investment | Market Context (2024 Projections) | Impact on BNY Mellon |

|---|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Enhancing data analytics, automation, risk management; expanding AI/data science teams (2023) | Integral to financial services innovation | Improved operational efficiency, personalized client services |

| Cloud Computing | Migration for scalability, flexibility, cost-efficiency; digital transformation | Global cloud spending > $679 billion | Accelerated innovation, robust business continuity |

| Blockchain & Distributed Ledger Technology (DLT) | Improving efficiency, transparency, security in asset servicing, payments | DLT market > $10 billion | Simplified reconciliation, faster settlement |

| Fintech Innovation | Adapting to digital payments, robo-advisory; potential partnerships/acquisitions | Global fintech market > $300 billion | Maintaining market relevance, competitive edge |

Legal factors

BNY Mellon navigates a complex web of global financial regulations, including Basel III, which dictates capital adequacy ratios, and elements of the Dodd-Frank Act, aimed at mitigating systemic risk. For instance, as of the close of Q1 2024, BNY Mellon reported a Common Equity Tier 1 (CET1) ratio well above regulatory minimums, demonstrating its commitment to capital strength under these frameworks. Failure to comply with these evolving rules, which vary significantly by jurisdiction, can result in substantial fines and operational restrictions.

Maintaining robust compliance programs is therefore a critical operational imperative for BNY Mellon. The company invests heavily in technology and personnel to ensure adherence to these stringent requirements. This proactive approach is essential not only for avoiding penalties but also for safeguarding its reputation and maintaining the trust of its clients and the broader financial system.

Global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly impact BNY Mellon's operations. These laws mandate strict protocols for data collection, storage, processing, and protection, affecting how BNY Mellon handles sensitive client information across its global footprint.

Non-compliance with these evolving privacy laws can lead to severe financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. This necessitates robust data governance frameworks and advanced security measures to ensure adherence and maintain client trust, a critical asset in the financial services sector.

BNY Mellon operates under stringent Anti-Money Laundering (AML) and counter-terrorist financing (CTF) regulations, alongside a complex web of international sanctions. The firm must continuously invest in advanced technology for transaction monitoring and robust client verification processes to identify and report illicit financial activities, as failing to do so can result in substantial penalties. For instance, in 2023, global financial institutions faced billions in AML-related fines, underscoring the critical nature of compliance for entities like BNY Mellon.

Consumer Protection and Investor Rights Legislation

Legislation designed to safeguard consumers and investors, encompassing rules on transparency, equitable dealings, and avenues for recourse, directly influences how BNY Mellon engages with its clientele. For instance, the Securities and Exchange Commission's (SEC) Regulation Best Interest, effective since June 30, 2020, mandates that financial professionals act in the best interest of their retail customers when making recommendations. This framework, alongside similar global regulations, necessitates rigorous compliance in product development, service delivery, and client communications to foster trust and mitigate legal challenges.

BNY Mellon's commitment to upholding these consumer and investor protection laws is paramount for maintaining client confidence and avoiding costly litigation. The company must ensure all its offerings, from wealth management services to custody solutions, align with these stringent regulatory standards. Failure to do so could result in significant penalties; for example, in 2023, financial institutions faced billions in fines for various compliance breaches, underscoring the financial risks associated with non-adherence.

- Disclosure Requirements: BNY Mellon must provide clear and comprehensive information about its products, fees, and risks, adhering to regulations like the EU's MiFID II (Markets in Financial Instruments Directive II).

- Fair Practices: Adherence to rules preventing predatory or deceptive practices is essential, with regulators like the Consumer Financial Protection Bureau (CFPB) in the US actively enforcing such standards.

- Investor Redress Mechanisms: Establishing and promoting accessible channels for clients to raise grievances and seek resolutions is a key component of investor rights legislation.

- Data Privacy and Security: Compliance with data protection laws, such as GDPR and CCPA, is critical given the sensitive financial information BNY Mellon handles.

Cross-Border Legal and Jurisdictional Challenges

BNY Mellon, as a global financial institution, must navigate a labyrinth of differing legal frameworks across its operating jurisdictions. These variations impact everything from how contracts are upheld to how disputes are settled and how regulatory bodies exert their authority. This necessitates a deep understanding of international law and the ability to adapt to diverse legal landscapes.

The complexities are substantial, especially when dealing with cross-border transactions and managing international client relationships. BNY Mellon's legal teams must possess specialized expertise to mitigate risks inherent in these global operations. For instance, differing data privacy laws, such as GDPR in Europe versus other national regulations, require careful compliance to avoid penalties and maintain client trust.

Key legal and jurisdictional challenges include:

- Contract Enforcement Variances: Legal systems differ in their approach to enforcing contractual obligations across borders, potentially impacting the certainty of agreements.

- Dispute Resolution Mechanisms: The availability and effectiveness of arbitration, mediation, and litigation vary significantly by country, influencing how BNY Mellon resolves international disagreements.

- Regulatory Oversight Discrepancies: Financial regulations, capital requirements, and consumer protection laws are not uniform globally, demanding constant vigilance and adaptation to comply with each jurisdiction's rules.

- Cross-Border Data Flow Regulations: Restrictions on the movement of financial data across national borders can complicate operations and require sophisticated compliance strategies.

BNY Mellon's operations are heavily shaped by evolving legal and regulatory landscapes worldwide, demanding constant adaptation to ensure compliance. Key areas include capital adequacy rules like Basel III, investor protection mandates such as the SEC's Regulation Best Interest, and stringent data privacy laws like GDPR and CCPA. Failure to adhere to these complex requirements can lead to significant financial penalties and reputational damage, underscoring the critical need for robust legal and compliance frameworks.

Environmental factors

Climate change presents significant physical risks to Bank of New York Mellon (BNY Mellon), potentially impacting its global operational infrastructure through extreme weather events. Such disruptions could impede business continuity and service delivery.

Indirectly, climate-related impacts on client sectors and investment geographies can lead to asset devaluation and instability within BNY Mellon's extensive investment portfolios. For instance, in 2024, the increasing frequency of severe weather events globally, such as intensified hurricane seasons and prolonged droughts, directly threatened physical assets and supply chains across various industries where BNY Mellon holds significant investments.

BNY Mellon's proactive approach to risk management now increasingly incorporates the assessment and mitigation of these climate-related threats. This involves scenario analysis and stress testing to understand potential financial exposures arising from physical climate impacts, a critical component of its 2025 strategic planning.

BNY Mellon's investment management and asset servicing are significantly shaped by the increasing global focus on sustainability and the surge in ESG investing. Clients are actively seeking out investment products that align with environmental, social, and governance principles, pressuring financial institutions to demonstrate robust environmental responsibility.

By the end of 2023, global sustainable investment assets under management reached an estimated $37.2 trillion, highlighting the significant market demand that BNY Mellon must address. This trend necessitates the integration of sustainability into BNY Mellon's core operations and product development to attract and retain a growing base of environmentally conscious clients.

BNY Mellon, as a major global financial institution, faces increasing pressure to address its carbon footprint and operational emissions. Stakeholders, including regulators and investors, expect the company to actively measure, report, and reduce its environmental impact. This involves implementing strategies like enhancing energy efficiency across its facilities and increasing the use of renewable energy sources. The company's commitment to sustainability is crucial for maintaining a positive reputation and meeting evolving stakeholder expectations in the financial sector.

Regulatory and Policy Changes on Climate

Governments worldwide are intensifying efforts to combat climate change, leading to a surge in new regulations. For BNY Mellon, this means navigating a complex landscape of carbon pricing mechanisms, stringent emissions targets, and mandatory climate-related financial disclosures. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in by 2026, will impact industries and financial flows, requiring careful consideration for BNY Mellon's clients and its own operations.

These evolving environmental policies directly influence BNY Mellon's operational costs and reporting obligations. The firm must adapt its systems to accurately track and report on carbon footprints and climate-related risks, potentially increasing compliance expenses. Furthermore, the types of investments BNY Mellon can facilitate or service are being reshaped, with a growing emphasis on sustainable finance and a potential divestment from high-carbon industries.

Staying ahead of these regulatory shifts is crucial for maintaining competitiveness and managing risk. BNY Mellon's proactive engagement with these changes, including adapting its investment strategies and client advisory services to align with global climate goals, will be key. For example, the increasing demand for green bonds, which reached an estimated $1 trillion globally in 2024, highlights a significant market opportunity driven by regulatory pushes and investor preferences.

- Carbon Pricing: The expansion of carbon taxes and emissions trading systems globally, with over 70 jurisdictions implementing such measures by early 2025, directly impacts the cost of doing business for many of BNY Mellon's clients.

- Emissions Targets: National Determined Contributions (NDCs) under the Paris Agreement are becoming more ambitious, pushing companies and financial institutions towards net-zero commitments, influencing investment portfolios and risk assessments.

- Climate Disclosures: The adoption of frameworks like the ISSB Standards, which are being integrated into regulatory requirements in key markets like the UK and Singapore by 2025, necessitates enhanced data collection and reporting capabilities for BNY Mellon.

Resource Scarcity and Supply Chain Resilience

Potential resource scarcity, particularly concerning water and energy, could impact BNY Mellon's operational costs and the stability of its supply chain. For instance, the global energy market experienced significant volatility in early 2024, with Brent crude oil prices fluctuating around $80-$90 per barrel, directly affecting energy expenses for data centers and physical infrastructure. This highlights the need for BNY Mellon to monitor and mitigate these rising operational costs.

Ensuring resilience in its operations and supply chain against environmental shocks, including resource availability, is important for business continuity. A 2024 report by the World Economic Forum identified climate change and extreme weather events as top global risks, underscoring the potential for disruptions. BNY Mellon's commitment to operational continuity necessitates a proactive approach to these environmental challenges.

This includes assessing the environmental risks within its vendor network and operational footprint. By 2025, an estimated 60% of companies are expected to have integrated climate-related risks into their enterprise risk management frameworks, according to industry analyses. BNY Mellon's due diligence on its third-party providers and its own facilities is crucial for identifying and addressing vulnerabilities related to resource availability and environmental impact.

- Operational Cost Impact: Fluctuations in energy prices, such as the 2024 volatility in crude oil, directly influence BNY Mellon's utility expenses.

- Supply Chain Vulnerability: Global climate risks, identified as top concerns by the World Economic Forum in 2024, pose threats to the stability of BNY Mellon's operational supply chains.

- Vendor Risk Assessment: The increasing trend of integrating climate risks into enterprise risk management by 2025 necessitates thorough environmental due diligence on BNY Mellon's vendors.

- Business Continuity: Proactive management of resource scarcity and environmental shocks is essential for maintaining BNY Mellon's operational continuity and service delivery.

The intensifying focus on environmental, social, and governance (ESG) principles is reshaping BNY Mellon's investment strategies, driven by a surge in client demand for sustainable options. By late 2023, global sustainable investment assets hit $37.2 trillion, a figure BNY Mellon must actively address to retain and attract environmentally conscious clients.

BNY Mellon faces growing regulatory pressure to manage its carbon footprint, with governments worldwide implementing stricter emissions targets and carbon pricing mechanisms. The EU's Carbon Border Adjustment Mechanism, fully operational by 2026, exemplifies the evolving compliance landscape that will impact financial flows and necessitate robust reporting for BNY Mellon and its clients.

Resource scarcity, particularly in energy and water, poses a direct threat to BNY Mellon's operational costs and supply chain stability. The volatility in crude oil prices, hovering around $80-$90 per barrel in early 2024, highlights the rising expenses for energy-intensive operations like data centers.

BNY Mellon's commitment to operational continuity requires proactive management of environmental risks, including climate-related disruptions and resource availability. By 2025, an estimated 60% of companies are expected to integrate climate risks into their enterprise risk management, a trend BNY Mellon must mirror in its vendor assessments and internal operations.

| Environmental Factor | Impact on BNY Mellon | Key Data/Trend (2024-2025) |

|---|---|---|

| Climate Change Risks | Physical risks to infrastructure, asset devaluation in portfolios | Increased frequency of extreme weather events globally in 2024. |

| ESG Investing Trend | Client demand for sustainable products, need for integration | Global sustainable investment assets reached $37.2 trillion by end of 2023. |

| Regulatory Landscape | Carbon pricing, emissions targets, disclosure mandates | Over 70 jurisdictions implementing carbon pricing by early 2025; ISSB Standards integration by 2025. |

| Resource Scarcity | Increased operational costs, supply chain vulnerability | Brent crude oil prices fluctuated $80-$90/barrel in early 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bank of New York Mellon draws from a robust mix of official government publications, reputable financial news outlets, and reports from leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the financial services sector.