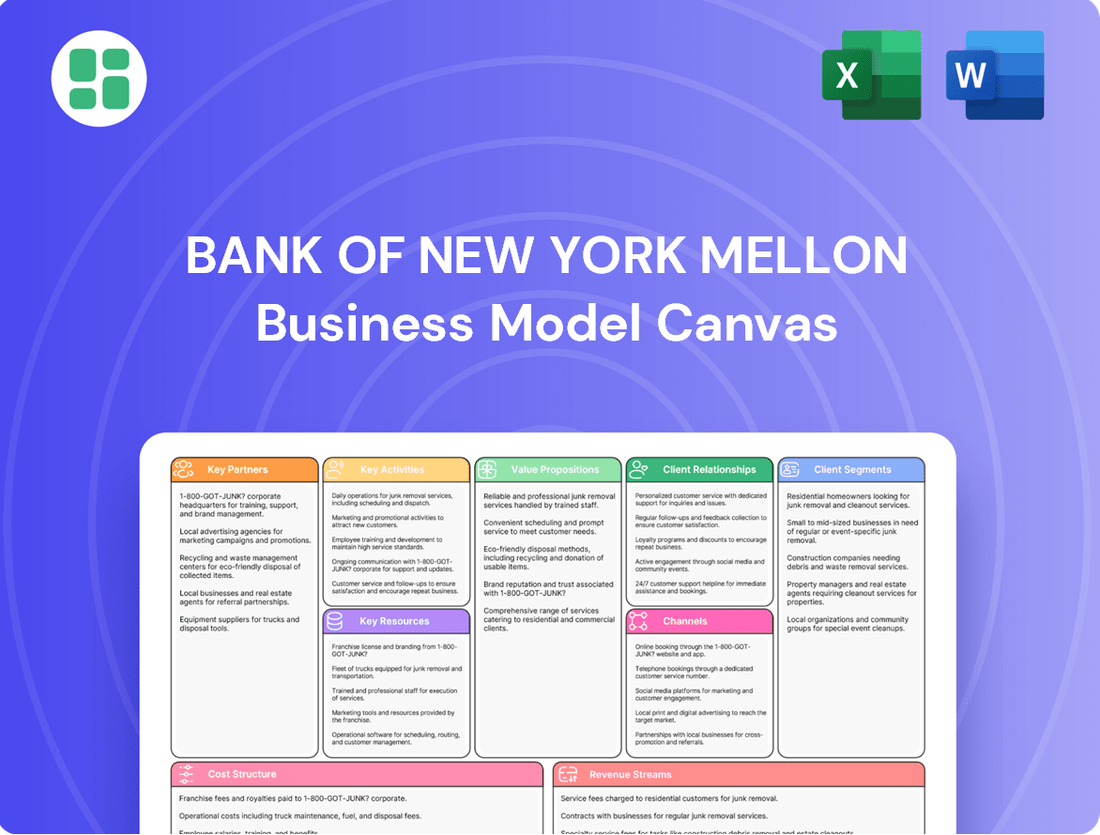

Bank of New York Mellon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bank of New York Mellon Bundle

Discover the strategic engine behind Bank of New York Mellon's enduring success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for understanding their market dominance.

Ready to dissect the inner workings of a financial giant? Our full Business Model Canvas for Bank of New York Mellon provides an in-depth look at their value propositions and cost structures. Download it now to gain a competitive edge.

Partnerships

BNY Mellon actively collaborates with technology and FinTech companies to boost its digital offerings. This includes developing cutting-edge AI solutions and leveraging blockchain technology. These partnerships are crucial for staying competitive in the evolving financial landscape.

A significant move in late 2024 was BNY Mellon's acquisition of Archer, a firm specializing in digital asset custody. This acquisition directly strengthens their capabilities in managing and securing digital assets, a rapidly growing area in finance. Such strategic integrations are key to their digital transformation.

Further enhancing its data management and analytics, BNY Mellon has partnered with Accenture. This collaboration focuses on implementing advanced data solutions, enabling more sophisticated insights and operational efficiencies. These partnerships underscore BNY Mellon's commitment to data-driven decision-making and technological advancement.

BNY Mellon's collaborations with other financial institutions are vital for broadening its service portfolio and extending its market presence. These partnerships allow BNY Mellon to offer more comprehensive solutions to its clients.

A prime example is the 2024 collaboration with Goldman Sachs to introduce tokenized money market fund solutions, signaling a move into digital asset services. Additionally, BNY Mellon expanded its alliance with alternative credit specialists, such as CIFC, to enhance the global distribution of diverse investment strategies.

BNY Mellon strategically partners with premier data and analytics firms to drive innovation in capital markets. These alliances are crucial for developing sophisticated solutions that cater to both buy-side and sell-side clients, enhancing data management and analytical capabilities.

A prime example is BNY Mellon's collaboration with Microsoft, announced in 2023, to build next-generation data management platforms. This partnership aims to leverage advanced cloud technologies and AI to provide clients with more efficient and insightful data processing, a key component in navigating the increasingly complex financial landscape.

Regulatory Bodies and Industry Consortia

BNY Mellon actively participates in industry consortia and engages with regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). This collaboration is crucial for navigating the complex and ever-changing regulatory landscape, ensuring BNY Mellon's operations remain compliant and secure. For instance, in 2024, BNY Mellon continued its engagement in discussions surrounding digital asset regulation, aiming to contribute to frameworks that promote innovation while safeguarding market integrity.

These partnerships are vital for shaping industry standards and fostering a stable global financial ecosystem. BNY Mellon's input helps influence the development of new rules and best practices, ultimately benefiting its clients and the broader market. Their involvement in groups like the Securities Industry and Financial Markets Association (SIFMA) allows them to stay ahead of regulatory shifts and contribute to solutions that enhance operational efficiency and risk management.

BNY Mellon's commitment to these engagements underscores its role as a responsible financial institution. By actively participating in shaping financial market standards, BNY Mellon not only ensures its own compliance but also contributes to the overall health and resilience of the financial system. This proactive approach is essential for maintaining trust and facilitating secure, efficient transactions for its diverse client base.

Key engagements include:

- Participation in Global Regulatory Forums: Contributing to discussions on capital requirements, market conduct, and systemic risk management.

- Industry Standard Setting: Collaborating with consortia to develop and implement best practices for areas like cybersecurity and data privacy.

- Advocacy for Market Efficiency: Engaging with regulators to promote policies that support innovation and reduce friction in financial markets.

- Compliance Framework Development: Working with industry peers to interpret and implement new regulations effectively.

Academic and Research Institutions

Bank of New York Mellon (BNY Mellon) actively partners with academic and research institutions, especially in areas like artificial intelligence. These collaborations are crucial for fostering innovation and developing a skilled workforce. For instance, BNY Mellon's engagement with Pittsburgh's thriving AI ecosystem, which includes prominent institutions like Carnegie Mellon University, exemplifies this strategy. The goal is to translate advanced research into tangible financial solutions.

These partnerships allow BNY Mellon to stay at the forefront of technological advancements. By tapping into the expertise of leading universities, the company can explore novel applications of AI and machine learning for areas such as fraud detection, risk management, and customer service. This proactive approach ensures BNY Mellon remains competitive in a rapidly evolving financial landscape.

- AI Talent Development: Collaborations with universities help BNY Mellon identify and recruit top AI talent.

- Cutting-Edge Research: Access to academic research provides insights into emerging AI methodologies applicable to finance.

- Innovation Hubs: Partnerships contribute to the growth of innovation ecosystems, like Pittsburgh's AI sector.

- Practical Application: The aim is to bridge the gap between theoretical research and real-world financial services.

BNY Mellon cultivates strategic alliances with technology providers and FinTech innovators to enhance its digital capabilities, particularly in areas like AI and blockchain. Furthermore, its 2024 acquisition of Archer, a digital asset custody specialist, directly bolsters its presence in this burgeoning market. Collaborations with firms like Accenture are also key for advancing data management and analytics, driving operational efficiencies.

What is included in the product

A comprehensive, pre-written business model tailored to the company’s strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

The Bank of New York Mellon's Business Model Canvas streamlines complex financial operations, relieving pain points associated with fragmented data and inefficient processes.

It provides a clear, actionable framework that simplifies the management of diverse financial services, addressing the pain of operational complexity.

Activities

BNY Mellon's core activity revolves around safeguarding and managing trillions of dollars in assets for clients worldwide. This includes global custody, where they hold securities for institutional investors, and securities lending, which generates revenue by lending out those assets.

In 2023, BNY Mellon's Assets Under Custody and Administration (AUC/A) reached an impressive $45.4 trillion, highlighting their massive scale in this critical area. This vast network of services, including fund administration and transfer agency, underpins their role as a vital financial infrastructure provider.

BNY Mellon's Investment Management segment offers a vast array of strategies, covering equities, fixed income, and alternative investments. This comprehensive approach caters to diverse client needs, from institutional investors to individual savers.

The company employs both active and passive management styles, aiming to meet specific client objectives and risk tolerances. As of the first quarter of 2024, BNY Mellon reported approximately $1.9 trillion in assets under management, showcasing the scale of its investment management operations.

BNY Mellon's Corporate Trust and Treasury Services are foundational to global commerce, offering critical support for efficient transaction processing and robust cash flow management. These services are essential for businesses operating on an international scale.

In 2024, BNY Mellon continued to be a leader in providing these vital services. Their treasury solutions, including payments and trade finance, help clients optimize liquidity and manage financial risks effectively. For instance, the company processed trillions of dollars in payments, highlighting the sheer volume and importance of these operations.

Furthermore, the clearance of securities is a core activity within this segment, ensuring the smooth and secure transfer of ownership for a vast array of financial instruments. This operational efficiency underpins the stability and functioning of capital markets worldwide, with BNY Mellon handling a significant portion of global securities settlement.

Technology and Platform Development

BNY Mellon's commitment to technology is evident in its substantial and continuous investment in developing proprietary platforms. This focus is crucial for maintaining a competitive edge and driving future growth.

Key initiatives include the enhancement of platforms like Pershing X, aimed at streamlining operations and client interactions, and the advancement of the Eliza AI platform. These developments are designed to boost efficiency and foster innovation.

- Pershing X: Continual upgrades to this platform focus on enhancing wealth management capabilities and advisor experience.

- Eliza AI: Further development of this AI solution aims to improve client service through advanced analytics and personalized engagement.

- Digital Transformation: Ongoing efforts to digitize core processes and client interfaces underscore BNY Mellon's strategic direction.

Risk Management and Compliance

BNY Mellon places paramount importance on risk management and compliance, navigating a constantly evolving global regulatory environment. This commitment is demonstrated through significant investments in technology and talent to ensure adherence to all applicable laws and standards.

The company actively monitors and adapts to new regulations, employing advanced solutions like AI-powered risk assessment tools to bolster operational resilience and mitigate potential threats. For instance, in 2024, BNY Mellon continued to enhance its cybersecurity frameworks, a critical component of managing operational risk in the digital age.

- Regulatory Adaptation: Continuous monitoring and integration of new global financial regulations, ensuring BNY Mellon's operations remain compliant.

- Technology Investment: Substantial allocation of resources towards advanced technological solutions, including AI, to strengthen risk identification and management processes.

- Operational Resilience: Focus on building robust systems and protocols to withstand and recover from disruptions, safeguarding client assets and business continuity.

- Compliance Culture: Fostering an internal culture that prioritizes ethical conduct and adherence to all compliance requirements across all business units.

BNY Mellon's key activities center on providing essential financial infrastructure services. This includes safeguarding trillions in assets through global custody and lending, managing investments across diverse strategies, and facilitating global commerce via corporate trust and treasury services.

The company's investment in technology, particularly platforms like Pershing X and AI solutions like Eliza, is crucial for operational efficiency and client engagement. Furthermore, robust risk management and compliance, bolstered by technology investments, are fundamental to maintaining trust and stability.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Global Custody & Securities Lending | Safeguarding and managing client assets, generating revenue through lending. | AUC/A reached $45.4 trillion in 2023. |

| Investment Management | Offering diverse investment strategies across asset classes. | Approximately $1.9 trillion in assets under management as of Q1 2024. |

| Corporate Trust & Treasury Services | Supporting global commerce through payments, trade finance, and securities clearance. | Processed trillions of dollars in payments in 2024. |

| Technology Development | Investing in proprietary platforms for efficiency and innovation. | Enhancements to Pershing X and Eliza AI platforms ongoing. |

| Risk Management & Compliance | Ensuring adherence to regulations and mitigating operational risks. | Continued enhancement of cybersecurity frameworks in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Bank of New York Mellon you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this insightful analysis, ready for immediate use and application.

Resources

BNY Mellon's extensive financial capital is a cornerstone of its business model, evidenced by its strong capital ratios and significant liquidity. As of the first quarter of 2024, BNY Mellon reported a Common Equity Tier 1 (CET1) ratio of 12.4%, well above regulatory minimums, underscoring its robust financial health.

This substantial financial backing allows BNY Mellon to effectively manage large-scale global operations, facilitate complex transactions, and absorb potential market shocks, ensuring stability for its clients and stakeholders. It also fuels strategic investments in technology and innovation, crucial for maintaining a competitive edge in the evolving financial landscape.

BNY Mellon's global network and infrastructure are paramount, enabling operations across more than 80 markets. This extensive reach is a core asset, facilitating the delivery of its financial services to a worldwide client base.

In 2023, BNY Mellon reported total assets under custody and administration of $45.4 trillion, underscoring the scale of its global operational capabilities. This vast infrastructure supports its role as a key player in the international financial system.

Bank of New York Mellon's proprietary technology platforms are critical key resources. These include advanced digital solutions like Pershing X, designed to streamline wealth management, and LiquidityDirect, which optimizes cash management for clients. The bank also leverages its Eliza AI platform to enhance client service and operational efficiency.

The sheer volume of financial data BNY Mellon manages and processes is another fundamental asset. This data underpins its ability to offer sophisticated analytics and insights, forming the bedrock of its competitive advantage in the financial services industry.

Human Capital and Expertise

BNY Mellon's global workforce, exceeding 50,000 employees as of early 2024, is a cornerstone of its business model. This vast team brings deep specialized knowledge across critical areas like investment management, cutting-edge technology development, and stringent regulatory compliance.

The company's commitment to continuous learning is evident through its significant investments in employee training programs. These initiatives are designed to keep its workforce at the forefront of industry advancements, particularly with the integration of artificial intelligence tools to enhance operational efficiency and client service.

- Global Workforce: Over 50,000 employees worldwide.

- Core Expertise: Investment management, asset servicing, technology, and compliance.

- Strategic Investment: Ongoing training and development, including AI adoption.

- Competitive Edge: Maintaining leadership through enhanced employee capabilities.

Brand Reputation and Trust

BNY Mellon's brand reputation, honed over more than 240 years, is a cornerstone of its business model. This long history translates into a deep-seated trust and reliability that institutional clients and high-net-worth individuals value immensely. The company's established security protocols and extensive expertise in financial services further bolster this reputation, making it a preferred partner in the global financial landscape.

This strong brand recognition directly impacts client acquisition and retention. In 2024, BNY Mellon continued to leverage this trust to maintain its position as a leading custodian and asset servicer. For instance, its Assets Under Custody/Administration reached approximately $47.6 trillion as of the first quarter of 2024, a testament to the confidence clients place in the institution.

- Longevity: Over 240 years of operational history.

- Client Trust: High retention rates among institutional and high-net-worth clients.

- Market Position: Significant market share in custody and asset servicing, evidenced by $47.6 trillion in Assets Under Custody/Administration (Q1 2024).

- Expertise: Deep and proven expertise in complex financial services.

BNY Mellon's key resources are built upon its substantial financial capital, a vast global infrastructure, proprietary technology, extensive data management capabilities, a skilled workforce, and a powerful brand reputation. These elements collectively enable the company to offer a comprehensive suite of financial services to a diverse global clientele.

| Resource Category | Specific Asset/Capability | Supporting Data/Example |

|---|---|---|

| Financial Capital | Strong Capital Ratios, Liquidity | CET1 Ratio of 12.4% (Q1 2024) |

| Global Infrastructure | Operations in 80+ Markets | $45.4 trillion in Assets Under Custody/Administration (2023) |

| Proprietary Technology | Digital Platforms, AI Tools | Pershing X, LiquidityDirect, Eliza AI |

| Data Management | Vast Data Processing | Underpins analytics and insights |

| Human Capital | Skilled Global Workforce | Over 50,000 employees (early 2024); AI training |

| Brand Reputation | Trust and Longevity | 240+ years; $47.6 trillion in AUC/A (Q1 2024) |

Value Propositions

BNY Mellon's core value proposition is the exceptional safety and security it provides for trillions of dollars in client assets. This is crucial for institutional and individual investors who entrust their wealth to the bank.

As a premier global custodian, BNY Mellon ensures peace of mind through its advanced safeguarding protocols and rigorous risk management frameworks. This commitment to security is fundamental to its client relationships.

In 2023, BNY Mellon reported $45.7 trillion in assets under custody and administration, underscoring the immense scale of trust placed in its security measures by clients worldwide.

Clients gain substantial advantages from BNY Mellon's focus on operational efficiency and its enormous scale. The firm's integrated platforms and advanced automation, increasingly powered by AI, significantly streamline workflows and minimize manual tasks, leading to more efficient service delivery.

This operational prowess translates directly into cost savings and faster processing times for clients. For instance, in 2024, BNY Mellon continued to invest heavily in technology to enhance these efficiencies, aiming to process trillions of dollars in transactions daily with exceptional accuracy and speed.

Bank of New York Mellon (BNY Mellon) provides clients with an extensive global network, facilitating access to a broad spectrum of integrated financial services. This global footprint allows for efficient management and servicing of financial assets across numerous markets and product categories.

The company's integrated solutions enable clients to seamlessly invest and manage their financial assets, offering a comprehensive approach to complex financial requirements. This holistic service model is crucial for navigating diverse international markets and product lines.

As of the first quarter of 2024, BNY Mellon reported total assets under custody and administration of $47.8 trillion, underscoring its significant global reach and the scale of its integrated service offerings. This figure highlights the trust placed in BNY Mellon by a vast international client base.

Specialized Expertise and Insights

BNY Mellon leverages its deep industry knowledge and a vast network of specialists to offer clients unparalleled, data-driven insights. This specialized expertise is crucial for navigating the intricacies of investment management, asset servicing, and treasury services, providing a distinct advantage in complex financial markets.

Clients benefit from access to cutting-edge advice and tailored strategies, directly contributing to their ability to optimize portfolios and manage financial operations effectively. For instance, BNY Mellon's asset servicing division reported $45.5 trillion in assets under custody and administration as of the first quarter of 2024, underscoring the scale of their operational expertise.

- Deep Industry Knowledge: BNY Mellon’s experts possess extensive understanding across various financial sectors.

- Specialized Investment Strategies: Access to unique, data-informed approaches to investment management.

- Data-Driven Insights: Utilization of sophisticated analytics for informed decision-making.

- Leading-Edge Advice: Guidance in investment management, asset servicing, and treasury services.

Regulatory Compliance Support

BNY Mellon offers crucial support for clients facing intricate and ever-changing global regulations. This robust assistance helps clients manage their compliance duties more effectively and lower the risks associated with non-compliance.

Their comprehensive compliance frameworks and specialized solutions are designed to significantly lighten the regulatory load for their clients. This proactive approach helps BNY Mellon's clients avoid potential penalties and operational disruptions.

- Regulatory Expertise: BNY Mellon provides deep knowledge of global financial regulations, including those impacting capital markets and asset management.

- Risk Mitigation: The firm's solutions are built to identify and address potential compliance risks, safeguarding clients from regulatory breaches.

- Efficiency Gains: By handling complex compliance processes, BNY Mellon enables clients to focus on their core business activities, improving operational efficiency.

BNY Mellon's value proposition centers on providing unparalleled security for client assets, fostering trust through advanced risk management and safeguarding protocols.

The firm enhances client operations via significant investments in technology and automation, leading to streamlined workflows and cost efficiencies, as evidenced by their continued technological advancements in 2024.

BNY Mellon offers clients an expansive global network and integrated financial services, enabling seamless asset management across diverse international markets.

Clients benefit from BNY Mellon's deep industry expertise and data-driven insights, receiving tailored advice to optimize portfolios and navigate complex financial landscapes.

| Value Proposition Aspect | Key Offering | Client Benefit | 2024 Data Point (Illustrative) |

|---|---|---|---|

| Asset Security & Trust | Global Custody & Safeguarding | Peace of Mind, Wealth Protection | Assets Under Custody/Admin: $47.8 Trillion (Q1 2024) |

| Operational Efficiency | Integrated Platforms & Automation | Cost Savings, Faster Processing | Continued Investment in AI-driven efficiencies |

| Global Network & Integration | Cross-Market Servicing | Seamless International Asset Management | Extensive Global reach supporting diverse markets |

| Expertise & Insights | Data-Driven Advice & Strategies | Portfolio Optimization, Informed Decisions | $45.5 Trillion in Assets Under Custody (Asset Servicing, Q1 2024) |

Customer Relationships

BNY Mellon cultivates deep relationships with its institutional and high-net-worth clients through dedicated service teams. These teams, along with specialized relationship managers, focus on building enduring partnerships by offering personalized attention to significant accounts. This high-touch approach is crucial for retaining and growing business within its core client segments.

BNY Mellon goes beyond basic banking, actively engaging clients with an advisory and consultative approach. They offer strategic guidance and customized solutions, partnering with clients to understand their distinct financial aims and support their achievement.

This client-centric strategy is crucial for retaining high-value relationships. For instance, in 2023, BNY Mellon's assets under custody and administration reached $45.4 trillion, demonstrating the scale of trust placed in their advisory capabilities.

BNY Mellon prioritizes client convenience through robust digital self-service options and dedicated client portals. These platforms, such as LiquidityDirect and Pershing X, empower clients to manage their accounts, access real-time information, and conduct transactions independently, streamlining operations and enhancing efficiency.

Long-term Strategic Partnerships

BNY Mellon focuses on cultivating long-term strategic partnerships by consistently enhancing its services and embedding them within clients' core operations. This deep integration, often seen through their cross-selling efforts, underscores a dedication to fostering clients' enduring growth and prosperity.

For instance, BNY Mellon's investment in technology and digital solutions aims to streamline client processes and provide value-added services that solidify these partnerships. In 2024, the company continued to invest heavily in its digital transformation, with a significant portion of its operating expenses allocated to technology and development, directly supporting this client-centric strategy.

- Deep Integration: BNY Mellon embeds its services into client workflows to become an indispensable partner.

- Cross-Selling Initiatives: Proactively offering a wider range of services to meet evolving client needs, fostering deeper engagement.

- Commitment to Growth: Aligning BNY Mellon's success with the sustained growth and operational efficiency of its clients.

Community and Industry Engagement

BNY Mellon actively participates in key financial industry conferences, fostering dialogue and sharing expertise. This direct engagement with peers and stakeholders helps solidify its reputation and influence within the sector.

The company's commitment to thought leadership, including publications and research, further enhances its relationships and trust. For instance, BNY Mellon's 2024 outlook reports often highlight emerging trends, demonstrating proactive engagement with market development.

- Industry Conferences: BNY Mellon's presence at major events like Sibos and the World Economic Forum provides platforms for networking and partnership building.

- Thought Leadership: Publications and research papers from BNY Mellon analysts in 2024 offer insights into global financial markets and investment strategies, attracting a wide audience.

- Market Development: Contributions to industry working groups and initiatives aimed at improving market infrastructure underscore BNY Mellon's role in shaping the future of finance.

BNY Mellon fosters strong client bonds through dedicated relationship managers and advisory services, aiming for deep integration and long-term partnerships. Their digital platforms enhance client experience, while industry engagement and thought leadership solidify trust and market presence.

| Relationship Aspect | BNY Mellon Approach | Impact/Data Point |

|---|---|---|

| Client Engagement | Dedicated service teams and relationship managers | Assets under custody and administration reached $45.4 trillion in 2023. |

| Advisory Services | Consultative approach, customized solutions | Continued investment in digital transformation in 2024 to enhance client value. |

| Client Convenience | Digital self-service portals (LiquidityDirect, Pershing X) | Streamlining operations and improving efficiency for clients. |

| Industry Presence | Participation in conferences, thought leadership | Publishing 2024 outlook reports and contributing to market development initiatives. |

Channels

BNY Mellon leverages a dedicated direct sales force and experienced client relationship teams to engage its diverse customer base. These professionals are crucial for identifying new opportunities, nurturing client partnerships, and delivering tailored support across the globe.

In 2024, BNY Mellon reported significant growth in its asset servicing business, a segment heavily reliant on these client-facing teams. Their efforts in managing and expanding relationships with institutional investors, corporations, and governments directly contribute to the firm's overall revenue and market position.

BNY Mellon leverages proprietary digital platforms like Pershing X and LiquidityDirect as key channels for delivering its services. These platforms are designed to offer clients efficient access to a wide range of financial solutions and data.

Integration through Application Programming Interfaces (APIs) is a critical aspect of these platforms, allowing for smooth data flow and operational links between BNY Mellon and its clients. This connectivity is vital for clients managing complex portfolios and requiring real-time information.

In 2024, BNY Mellon continued to invest in enhancing these digital capabilities, recognizing their importance in a competitive landscape. For instance, advancements in APIs facilitate direct integration with client systems, streamlining workflows and improving data accuracy for institutions utilizing their services.

BNY Mellon actively cultivates strategic partnerships with other financial institutions, technology innovators, and niche service providers. These collaborations are crucial for expanding their market presence and offering a more comprehensive suite of services.

Through these alliances, BNY Mellon can deliver integrated solutions that cater to a wider and more varied client demographic. For instance, their 2024 partnerships with fintech firms aim to enhance digital asset services, thereby reaching a new segment of investors.

Industry Events and Conferences

BNY Mellon actively participates in and hosts key industry events, such as Sibos and various asset management forums. These gatherings are crucial for demonstrating thought leadership and engaging with a global client base. In 2023, BNY Mellon continued its presence at these vital platforms, highlighting advancements in digital assets and sustainable finance solutions.

These conferences serve as a direct channel to showcase BNY Mellon's evolving capabilities and connect with potential and existing clients. For instance, their presence at major financial technology events allows them to present innovations in areas like data analytics and AI-driven client services. The company also leverages these events for strategic partnerships and client acquisition.

- Thought Leadership: BNY Mellon executives frequently speak at major financial conferences, sharing insights on market trends and future financial landscapes.

- Client Engagement: Events offer a direct avenue for networking, fostering stronger relationships with existing clients and attracting new business.

- Solution Showcase: Conferences provide a platform to unveil and demonstrate BNY Mellon's latest technological solutions and service offerings.

- Industry Influence: Active participation helps shape industry discussions and positions BNY Mellon as a key player in financial innovation.

Direct Marketing and Investor Relations

BNY Mellon leverages direct marketing through personalized outreach and email campaigns to connect with specific client segments, aiming to deepen relationships and offer tailored solutions. This approach is crucial for acquiring new business and retaining existing clients in a competitive financial landscape.

Its investor relations function is a cornerstone of its communication strategy, ensuring transparency and building trust with shareholders and the broader financial community. In 2024, BNY Mellon continued to prioritize clear and consistent communication regarding its financial performance and strategic initiatives.

- Direct Marketing: Targeted campaigns focus on client segmentation for personalized financial product and service offerings.

- Investor Relations: Distribution of quarterly earnings reports, annual reports, and press releases to maintain open communication with stakeholders.

- Engagement: Hosting investor calls and webcasts to discuss financial results and strategic direction, fostering transparency.

- Data-Driven Approach: Utilizing client data analytics to refine marketing messages and improve engagement effectiveness.

BNY Mellon utilizes a multi-faceted channel strategy, blending direct client engagement with sophisticated digital platforms and strategic partnerships. This approach ensures broad market reach and tailored service delivery.

The firm's direct sales force and client relationship teams are pivotal, fostering deep connections with institutional clients, a strategy that proved vital in 2024 as asset servicing revenues grew. Digital platforms like Pershing X and LiquidityDirect, enhanced by API integrations, provide efficient access to services, with continued investment in these areas throughout 2024. Strategic alliances with fintech firms, particularly in digital assets, expanded their reach in 2024, demonstrating a commitment to innovation and market expansion.

| Channel | Description | 2024 Focus/Activity |

|---|---|---|

| Direct Sales & Client Relations | Personalized engagement by dedicated teams. | Driving growth in asset servicing; nurturing institutional partnerships. |

| Digital Platforms (Pershing X, LiquidityDirect) | Proprietary platforms for service delivery and data access. | Continued investment in enhancements and API integration for seamless client workflows. |

| Strategic Partnerships | Collaborations with financial institutions and innovators. | Expanding into digital assets via fintech alliances; broadening service offerings. |

| Industry Events & Thought Leadership | Participation in conferences (e.g., Sibos) and hosting forums. | Showcasing technological advancements and engaging with global clients; highlighting digital assets and sustainable finance. |

| Direct Marketing & Investor Relations | Targeted outreach, email campaigns, and transparent stakeholder communication. | Acquiring new business, retaining clients, and maintaining trust through clear financial reporting and investor calls. |

Customer Segments

Institutional investors, including major pension funds, endowments, and sovereign wealth funds, represent BNY Mellon's most significant customer base. These entities entrust BNY Mellon with trillions in assets for critical services like custody, fund administration, and investment management. For instance, as of the first quarter of 2024, BNY Mellon reported servicing $47.1 trillion in assets under custody and administration, a substantial portion of which comes from these large institutional clients.

Large corporations are a cornerstone customer segment for BNY Mellon, relying on its robust corporate trust services to manage complex financial arrangements, including debt issuance and bondholder relations. In 2024, BNY Mellon continued to be a leading provider in this space, facilitating trillions of dollars in corporate debt issuances globally.

These entities also leverage BNY Mellon for sophisticated treasury solutions and advanced cash management services. This includes optimizing liquidity, managing foreign exchange exposure, and streamlining payment processes, critical functions for their extensive global operations. BNY Mellon's 2024 performance highlighted its strength in supporting these vital corporate financial needs.

BNY Mellon actively serves high-net-worth individuals and family offices through specialized wealth management and private banking divisions. This segment requires tailored investment approaches, holistic wealth planning, and sophisticated financial guidance to preserve and expand significant wealth. As of 2024, BNY Mellon Wealth Management reported managing approximately $470 billion in assets for these clients, highlighting their commitment to this discerning customer base.

Asset Managers and Investment Firms

Other asset managers and investment firms, a critical customer segment for BNY Mellon, rely heavily on its comprehensive suite of services. These include mutual funds, exchange-traded funds (ETFs), and sophisticated hedge funds, all of whom utilize BNY Mellon for essential functions like fund administration, global custody, and middle-office support. This segment represents a significant portion of BNY Mellon's revenue, with its Pershing subsidiary being a key enabler of these relationships.

BNY Mellon's ability to provide integrated solutions for these diverse investment entities is a core strength. For instance, in 2024, BNY Mellon continued to see strong demand for its custody services, safeguarding trillions of dollars in assets for these clients. The firm's expertise in navigating complex regulatory environments and providing efficient operational support is paramount for asset managers seeking to scale their operations and focus on investment performance.

- Fund Administration: BNY Mellon offers end-to-end administration for various fund structures, including NAV calculation and investor services.

- Global Custody: Providing safekeeping of assets, settlement of trades, and corporate action processing across multiple markets.

- Middle-Office Solutions: Services like trade support, reconciliation, and performance measurement to streamline investment operations.

- Pershing Subsidiary: A key platform for delivering brokerage, custody, and technology solutions to investment firms.

Governments and Public Sector Entities

BNY Mellon partners with a wide array of governmental and public sector bodies, from national central banks to municipal governments. These entities rely on BNY Mellon for sophisticated management of public finances, crucial for economic stability and development.

The bank's services are instrumental in supporting large-scale infrastructure development, ensuring that public investments are managed efficiently and securely. This includes facilitating financing and managing the associated financial flows for projects vital to national progress.

Furthermore, BNY Mellon acts as a custodian and manager for national reserves and sovereign wealth funds, safeguarding the long-term financial health and strategic interests of nations. For instance, in 2023, BNY Mellon reported significant growth in its custody and administration services for institutional clients, which includes many public sector entities.

- Central Bank Services: Providing liquidity management, foreign exchange operations, and safekeeping of reserves for central banks globally.

- Public Fund Management: Offering tailored solutions for local and regional authorities to manage tax revenues, pension funds, and other public assets.

- Infrastructure Financing Support: Facilitating the financial infrastructure for major public works and development projects.

- Sovereign Investment Management: Safeguarding and growing national investments and sovereign wealth funds.

BNY Mellon's customer segments are diverse, ranging from massive institutional investors like pension funds and endowments to large corporations needing robust corporate trust and treasury solutions. They also cater to high-net-worth individuals and family offices with specialized wealth management, alongside other asset managers and investment firms requiring fund administration and global custody. Governmental and public sector bodies also form a key segment, utilizing BNY Mellon for public finance management and national reserve safekeeping.

| Customer Segment | Key Services Provided | 2024 Data/Relevance |

|---|---|---|

| Institutional Investors | Custody, Fund Administration, Investment Management | Serviced $47.1 trillion in assets under custody and administration (Q1 2024) |

| Large Corporations | Corporate Trust, Treasury Solutions, Cash Management | Facilitated trillions in global corporate debt issuances |

| High-Net-Worth Individuals & Family Offices | Wealth Management, Private Banking | Managed approx. $470 billion in assets (2024) |

| Other Asset Managers & Investment Firms | Fund Administration, Global Custody, Middle-Office Support (via Pershing) | Significant revenue driver, essential for ETFs and hedge funds |

| Governmental & Public Sector Bodies | Public Finance Management, National Reserve Safekeeping | Growth in custody and administration services for institutional clients (2023) |

Cost Structure

BNY Mellon's cost structure heavily relies on substantial and continuous investment in its global technology infrastructure. This includes the development, maintenance, and enhancement of core operational systems, crucial for its banking and investment services.

Significant expenditure is allocated to integrating advanced technologies like Artificial Intelligence (AI) and building capabilities for digital assets. For instance, in 2023, BNY Mellon continued to invest in its digital transformation, with technology and development costs remaining a key operational expense, reflecting the industry-wide push for innovation and efficiency.

Personnel costs are a significant driver for BNY Mellon, encompassing salaries, benefits, and ongoing training for its vast global workforce, which numbered over 50,000 employees as of the end of 2023. This substantial investment supports a diverse range of roles, from highly specialized financial experts and client relationship managers to essential operational staff across all business segments.

BNY Mellon faces substantial costs to navigate the intricate global financial regulatory landscape. These expenses cover compliance with diverse and often changing rules, implementing sophisticated risk management frameworks, and upholding rigorous data security and privacy standards.

In 2024, the financial services industry continued to see significant investment in compliance technology and personnel. For instance, global spending on RegTech solutions, which BNY Mellon utilizes, was projected to reach over $100 billion by 2025, highlighting the scale of these operational necessities.

Global Operations and Real Estate

Bank of New York Mellon's global operations and real estate represent a substantial cost center. Maintaining its extensive network of offices, data centers, and critical infrastructure across numerous countries incurs significant expenses. These costs are driven by factors such as lease agreements, property taxes, utilities, and ongoing facility management services necessary to support its worldwide operations.

In 2024, financial institutions like BNY Mellon continue to invest heavily in their physical and digital infrastructure. While specific figures for BNY Mellon's real estate and operations costs are not publicly itemized in this manner, industry benchmarks indicate that such expenses are a major component of overall operating expenditures for large global banks.

Key cost drivers within this category include:

- Real Estate Leases and Ownership: Costs associated with renting or owning prime office space and operational facilities in major financial hubs worldwide.

- Data Center Operations: Significant expenditure on maintaining and upgrading secure, high-availability data centers, including power, cooling, and hardware.

- Facility Management and Utilities: Ongoing expenses for maintenance, repairs, security, cleaning, and utility consumption across its global footprint.

Marketing and Sales Expenses

Marketing and sales expenses are a significant component of BNY Mellon's cost structure, directly supporting client acquisition and retention. These expenditures cover a broad range of activities aimed at building and maintaining brand visibility and client loyalty. In 2023, BNY Mellon reported total operating expenses of $14.9 billion, with a substantial portion allocated to these revenue-generating activities.

- Client Acquisition Costs: Investment in sales teams, lead generation, and direct outreach to secure new institutional and retail clients.

- Brand Building and Advertising: Spending on advertising campaigns, sponsorships, and public relations to enhance BNY Mellon's market presence and reputation.

- Relationship Management: Costs associated with dedicated client service teams and maintaining strong relationships with existing customers.

- Industry Engagement: Participation in and sponsorship of key financial industry conferences and events to network and showcase services.

BNY Mellon's cost structure is dominated by technology and personnel, reflecting its service-intensive nature. In 2023, total operating expenses were $14.9 billion, with significant portions dedicated to innovation and its global workforce of over 50,000 employees. Regulatory compliance and global infrastructure also represent substantial, ongoing investments essential for its operations.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Technology Investment | Infrastructure, AI, Digital Assets | Ongoing development and maintenance of core systems and advanced capabilities. |

| Personnel Costs | Salaries, Benefits, Training | Supporting a global workforce of over 50,000 employees across diverse roles. |

| Regulatory Compliance | Risk Management, Data Security | Navigating complex global financial regulations and implementing robust frameworks. |

| Global Operations & Real Estate | Office Space, Data Centers | Maintaining a worldwide network of facilities and critical infrastructure. |

| Marketing & Sales | Client Acquisition, Brand Building | Driving revenue through client outreach, advertising, and relationship management. |

Revenue Streams

Asset servicing fees are a cornerstone of BNY Mellon's revenue. These fees are primarily generated from the vast sums of assets the company holds in custody and administers on behalf of its institutional clients. The more assets BNY Mellon safeguards and manages, the higher the fee income.

In the first quarter of 2024, BNY Mellon reported total revenue of $4.4 billion. A significant portion of this revenue is directly attributable to asset servicing, reflecting the company's critical role in the financial infrastructure for global institutions.

Bank of New York Mellon's investment management fees are a significant revenue driver, primarily generated from assets under management (AUM). These fees can include advisory charges and, in some cases, performance-based incentives for the investment strategies they manage.

This revenue stream is directly tied to market performance and client asset flows. For instance, in the first quarter of 2024, BNY Mellon reported total revenue of $4.4 billion, with investment management and wealth management contributing significantly to this figure, reflecting the impact of market valuations on their fee income.

BNY Mellon generates substantial income by processing a wide array of financial transactions and offering specialized services. These revenue streams include fees from treasury services, such as payment processing and cash management, as well as corporate trust services, clearance operations, and foreign exchange transactions.

Net Interest Income (NII)

While fee-based revenue is a significant driver for Bank of New York Mellon (BNY Mellon), Net Interest Income (NII) remains a crucial component of its overall earnings. NII represents the profit a bank makes from its lending and borrowing activities. For BNY Mellon, this involves earning interest on assets like securities and loans while paying interest on liabilities such as customer deposits and borrowings.

In 2024, BNY Mellon's NII demonstrated its importance, even as fee income typically dominates. This income stream is directly influenced by the spread between the interest rates BNY Mellon earns on its assets and the rates it pays on its liabilities, as well as the volume of those interest-earning assets and interest-bearing liabilities.

- Net Interest Income (NII) Contribution: NII is a material contributor to BNY Mellon's earnings, complementing its substantial fee-based revenue.

- Core Calculation: NII is derived from the difference between interest earned on assets (loans, investments) and interest paid on liabilities (deposits, borrowings).

- Market Influence: Interest rate environments significantly impact NII, affecting the profitability of BNY Mellon's core banking operations.

- 2024 Performance Indicator: BNY Mellon's NII figures for 2024 highlight its ongoing role in the bank's financial health and profitability.

Interchange and Other Banking Services

Interchange fees represent a significant revenue stream, generated from transactions processed by Bank of New York Mellon (BNY Mellon) for its clients, particularly in its payment services. These fees are earned when BNY Mellon facilitates transactions between merchants and cardholders. In 2023, BNY Mellon's total revenue from fees and commissions reached $10.5 billion, demonstrating the importance of these service-based earnings.

Beyond interchange, BNY Mellon diversifies its revenue through securities financing and other specialized financial products. These offerings cater to sophisticated institutional clients, providing solutions for collateral management, securities lending, and repurchase agreements. Such services are crucial for clients managing large portfolios and seeking to optimize their assets.

- Interchange Fees: Revenue generated from processing payment transactions for clients.

- Securities Financing: Income derived from lending securities and facilitating repurchase agreements.

- Specialized Financial Products: Earnings from tailored solutions like collateral management and other bespoke financial services.

- 2023 Performance: BNY Mellon reported $10.5 billion in fees and commissions revenue, highlighting the contribution of these diverse banking services.

BNY Mellon's revenue streams are diverse, with asset servicing and investment management forming the bedrock. These fee-based services, driven by assets under custody and management, are critical. In Q1 2024, the company reported $4.4 billion in total revenue, underscoring the significance of these core operations.

Net Interest Income (NII) also plays a vital role, representing profit from lending and borrowing activities. The interest rate environment directly impacts this income. In 2024, BNY Mellon's NII performance highlighted its contribution to the bank's overall financial health, complementing its substantial fee-based earnings.

Additional revenue is generated through transaction processing, treasury services, corporate trust, and clearance operations. Securities financing and specialized financial products, like collateral management and securities lending, further diversify BNY Mellon's income, catering to institutional clients. In 2023, fees and commissions totaled $10.5 billion, showcasing the breadth of these service-based revenues.

| Revenue Stream | Primary Driver | 2023/2024 Relevance |

|---|---|---|

| Asset Servicing Fees | Assets under custody and administration | Core revenue driver; significant portion of Q1 2024 $4.4B total revenue |

| Investment Management Fees | Assets under management (AUM) | Significant contributor to Q1 2024 total revenue; market-dependent |

| Net Interest Income (NII) | Interest spread on assets and liabilities | Material contributor to earnings; influenced by interest rates |

| Transaction & Other Services | Payment processing, treasury, corporate trust, clearance | Diversifies income; part of $10.5B fees and commissions in 2023 |

| Securities Financing & Specialized Products | Securities lending, collateral management, repurchase agreements | Caters to institutional clients; part of 2023 fees and commissions |

Business Model Canvas Data Sources

The Bank of New York Mellon's Business Model Canvas is informed by a blend of internal financial disclosures, extensive market research, and strategic analyses of the global financial services landscape. These diverse data sources ensure a comprehensive and accurate representation of the company's operations and strategic direction.