B&M European Value Retail PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&M European Value Retail Bundle

Uncover the intricate web of external forces shaping B&M European Value Retail's trajectory with our comprehensive PESTLE analysis. From evolving political landscapes to shifting consumer behaviors, understand the critical factors influencing their success. Download the full report to gain actionable intelligence and refine your own market strategy.

Political factors

Government retail policies and taxation significantly influence B&M's operational landscape. For example, upcoming changes in the UK's business rates and corporate tax structure, coupled with rising national insurance contributions and minimum wage increases in 2025, are expected to elevate operational costs. These factors can directly impact B&M's profitability and its capacity to maintain its value-driven pricing strategy.

Furthermore, potential adjustments to corporate taxation in France could also affect B&M's cost base and investment decisions within that market. The company must navigate these evolving fiscal policies, as they can influence the feasibility of expansion plans and the overall competitive positioning of its product offerings.

The UK's ongoing trade relationship with the EU, shaped by Brexit, directly impacts B&M's supply chain. For 2024, the continued complexities of customs procedures and potential regulatory divergence between the UK and EU could still add friction to importing goods for B&M's operations, including its nascent French presence. This could translate to increased logistics costs and potential delays, affecting product availability and pricing strategies.

Rising minimum wage regulations in key markets like the UK and France directly impact B&M's employment expenses. For instance, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, a significant jump that will affect B&M's payroll. Similarly, France's SMIC (minimum wage) is subject to annual adjustments based on inflation and economic performance, adding further pressure on labor costs.

These legislative changes can necessitate adjustments to staffing models and may influence operational efficiency as businesses adapt to higher wage bills. Retailers like B&M might face increased operating costs due to these mandated wage hikes, potentially impacting profit margins if not offset by productivity gains or price adjustments.

Political Stability and Elections

Political stability in key markets like the UK and France significantly impacts consumer confidence and retail sentiment. Upcoming elections in these nations, such as a potential UK general election in late 2024 or early 2025, can create uncertainty, leading consumers to curb discretionary spending, which directly affects retailers like B&M.

Changes in government following elections could usher in new economic policies. For instance, a new administration might alter tax structures, introduce different employment regulations, or adjust trade agreements, all of which could influence B&M's operational costs and strategic investment decisions across its European footprint.

- UK General Election: While the exact date is unconfirmed, speculation points to a potential election in late 2024 or early 2025, creating a period of political flux.

- French Political Landscape: France has a presidential election scheduled for 2027, but local and regional elections can also signal shifts in political sentiment and policy direction.

- Consumer Confidence Indices: Fluctuations in consumer confidence, often linked to political events, directly correlate with retail sales performance. For example, GfK's Consumer Confidence Barometer in the UK has shown volatility tied to political developments.

Consumer Protection and Retail Regulations

New consumer protection laws, like the UK's Digital Markets, Competition and Consumers Act 2024, significantly impact retailers like B&M. These regulations target unfair terms, online choice architecture, drip pricing, and fake reviews, demanding strict adherence to avoid hefty fines. For instance, the Competition and Markets Authority (CMA) actively investigates misleading pricing practices, which could affect B&M's promotional strategies.

Compliance with these evolving consumer protection frameworks is crucial for maintaining customer trust and operational integrity. B&M must ensure its online and in-store practices align with the latest directives on transparency and fair dealing. This includes scrutinizing pricing displays and product descriptions for any potential misrepresentation.

- Digital Markets, Competition and Consumers Act 2024 (UK): Focuses on preventing unfair commercial practices and enhancing consumer rights in digital markets.

- Online Choice Architecture: Regulations aim to prevent manipulative design features that steer consumers towards certain choices.

- Drip Pricing: Prohibits the practice of adding hidden fees or charges late in the purchasing process.

- Fake Reviews: Legislation seeks to combat the spread of inauthentic customer feedback to ensure genuine consumer insights.

Political stability and upcoming elections in the UK and France directly influence consumer confidence, a critical factor for retailers like B&M. A UK general election, potentially in late 2024 or early 2025, could introduce policy shifts affecting B&M's operational costs and investment strategies. These shifts might alter tax structures or employment regulations, impacting the company's financial planning and market positioning.

Government retail policies, including business rates and corporate taxation, are key political considerations. For 2025, expected increases in UK national insurance and minimum wage rates, such as the National Living Wage rising to £11.44 per hour for those 21+ from April 2024, will elevate B&M's operational expenses. Navigating these evolving fiscal and labor policies is essential for maintaining B&M's competitive value pricing.

New consumer protection laws, such as the UK's Digital Markets, Competition and Consumers Act 2024, impose stricter compliance requirements. This act targets issues like drip pricing and fake reviews, necessitating careful review of B&M's promotional and pricing strategies to avoid penalties from bodies like the CMA.

| Factor | Impact on B&M | Relevant Data/Policy |

|---|---|---|

| Political Stability/Elections | Affects consumer confidence and spending. | Potential UK General Election (late 2024/early 2025). |

| Taxation & Business Rates | Increases operational costs, impacts pricing. | UK business rates reform discussions; potential corporate tax adjustments in France. |

| Labor Regulations | Raises employment expenses. | UK National Living Wage £11.44/hr (21+ from April 2024); French SMIC adjustments. |

| Consumer Protection Laws | Requires compliance in pricing and marketing. | UK Digital Markets, Competition and Consumers Act 2024; CMA scrutiny of pricing. |

What is included in the product

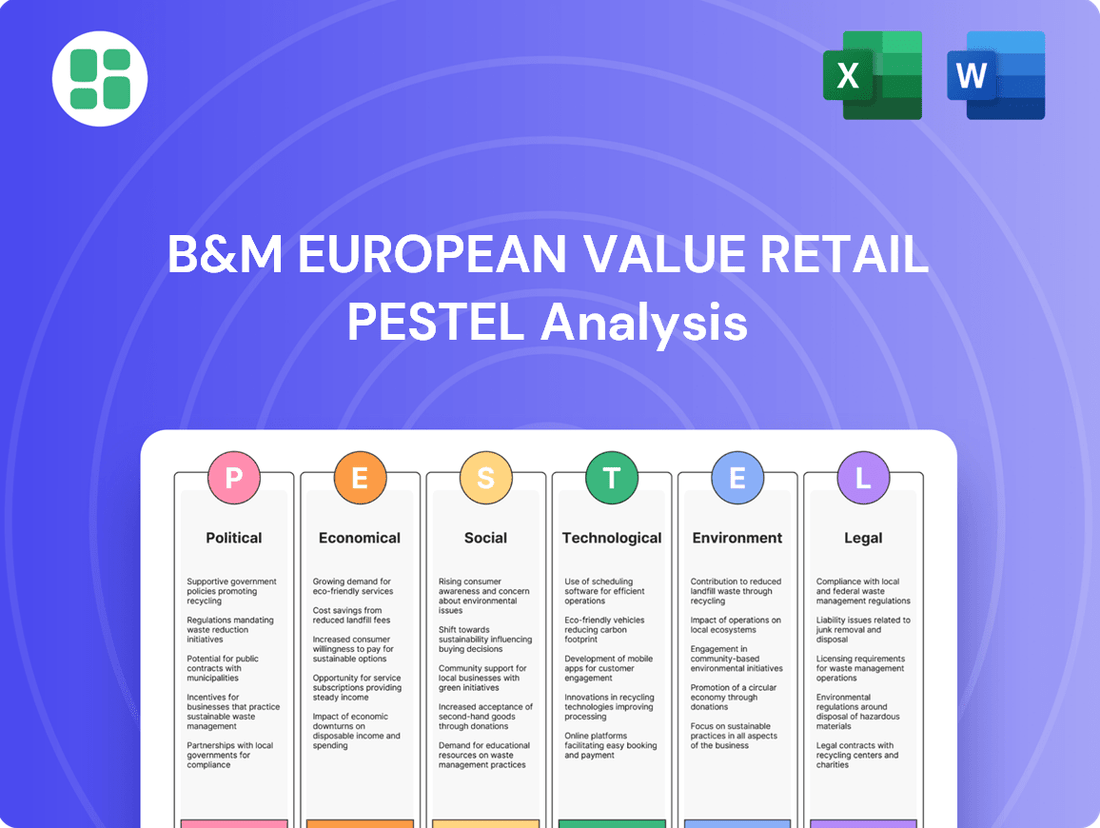

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting B&M European Value Retail, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying opportunities and threats within the dynamic retail landscape.

This PESTLE analysis for B&M European Value Retail offers a clear, summarized version for easy referencing during meetings, effectively relieving the pain point of sifting through extensive data.

It provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying the process of integrating external factors into strategic discussions.

Economic factors

The persistent inflation and cost of living crisis in key markets like the UK and France significantly squeeze consumer disposable income. This economic pressure drives shoppers towards more affordable options, directly benefiting discount retailers like B&M. For instance, UK inflation remained elevated throughout 2023 and into early 2024, impacting household budgets and increasing demand for value-driven purchases.

Consumers are actively seeking out products that offer the best value for money, which plays directly into B&M's core business model. This trend is evident in the UK, where the proportion of spending on essential goods versus discretionary items has shifted, with consumers prioritizing essential needs and seeking savings on non-essentials.

Consequently, B&M's sales volumes and product mix are positively influenced by this environment, as its appeal as a value retailer strengthens. The company's ability to offer a wide range of discounted goods positions it favorably to capture market share from competitors as consumers become more price-sensitive.

Central bank policies, like those from the Bank of England and European Central Bank, directly impact B&M's borrowing expenses. Higher interest rates make it more expensive for B&M to finance new store openings, upgrade existing ones, and manage day-to-day operations. This increased cost of capital can squeeze profit margins.

In fiscal year 2025, B&M experienced this firsthand, reporting that higher interest and finance costs notably affected its profit before tax. This demonstrates how shifts in interest rate environments can directly influence the company's financial leverage and overall profitability, making debt management a critical consideration.

Exchange rate fluctuations, particularly between the British Pound (GBP) and the Euro (EUR), significantly impact B&M's operations. Volatility can increase procurement costs for imported goods, as a weaker GBP makes sourcing from the Eurozone more expensive. For instance, in early 2024, the GBP experienced periods of weakness against the EUR, potentially affecting B&M's import margins.

Cross-border sales in Euros are also affected; a stronger Pound reduces the sterling value of revenue earned in the Eurozone. Furthermore, B&M's French operations' financial results must be translated back into GBP for reporting, introducing translation risk. The company likely employs hedging strategies to mitigate these currency risks, aiming to stabilize its cost of goods and reported profits.

Disposable Income and Consumer Spending Patterns

Changes in household disposable income significantly influence B&M's performance. As consumers face economic pressures, there's a pronounced shift towards value-seeking and more cautious spending habits across both the UK and France. This trend directly benefits discount retailers like B&M, as shoppers prioritize affordability and essential purchases.

The market share and sales performance of B&M are directly impacted by these evolving consumer patterns. While overall consumer spending might appear flat, the preference for private-label brands and discount goods is a clear indicator of a market ripe for B&M's offerings. This is particularly evident in the UK market.

- UK Disposable Income: In Q1 2024, UK households experienced a slight increase in real disposable income, but inflation continued to erode purchasing power, leading to continued cautious spending.

- French Consumer Confidence: French consumer confidence in early 2024 remained subdued, reflecting ongoing concerns about inflation and economic stability, further encouraging value-driven purchasing decisions.

- Discount Retail Growth: The discount retail sector in Europe, including B&M's operating regions, saw continued growth in 2023 and early 2024, outperforming many other retail segments due to its price-sensitive appeal.

Retail Market Growth and Competition

The UK retail market, particularly for value and general merchandise, has shown resilience. In 2024, the British Retail Consortium reported a 4.1% increase in retail sales volume year-on-year for April, indicating continued consumer spending, though inflation remains a factor. France's retail sector also experienced growth, with the value segment often outperforming more specialized areas.

B&M European Value Retail operates in a highly competitive environment. It faces pressure from other discounters like Home Bargains and Wilko, as well as the expanding value offerings from major supermarkets such as Tesco and Sainsbury's. The modest growth observed in specialized retail segments means B&M's broad appeal in general merchandise is a key differentiator.

- UK retail sales volume grew by 4.1% year-on-year in April 2024.

- Value retail segments often demonstrate stronger performance than specialized retail.

- Major grocers are increasingly competing in the value general merchandise space.

- B&M's strategy focuses on a wide range of affordable products to capture market share.

The economic landscape in 2024 and early 2025 continues to favor value-oriented retailers like B&M. Persistent inflation, while showing signs of easing in some areas, still impacts consumer spending, pushing shoppers towards more affordable options. This trend is a significant tailwind for B&M's business model, as consumers prioritize price and value in their purchasing decisions across key markets like the UK and France.

Interest rate policies by central banks remain a crucial economic factor. While rates may stabilize or slightly decrease in 2025, the cost of borrowing will still influence B&M's investment in expansion and operational upgrades. Exchange rate volatility, particularly between GBP and EUR, will continue to affect procurement costs and the translation of overseas earnings, requiring careful financial management.

The overall resilience of the UK retail sector, with sales volumes showing growth in early 2024, suggests underlying consumer demand. However, this demand is increasingly channeled towards discount and value segments. B&M's ability to offer a broad assortment of low-priced goods positions it to capture a larger share of this evolving consumer spending, especially as competitors face challenges or shift focus.

| Economic Factor | 2023/2024 Trend | 2024/2025 Outlook | Impact on B&M |

|---|---|---|---|

| Inflation | Elevated, impacting disposable income | Moderating but still a concern, driving value seeking | Positive for B&M's sales volumes and market share |

| Interest Rates | Increased, raising borrowing costs | Stabilizing or slightly decreasing, but costs remain | Increased finance costs impacting profitability; careful debt management needed |

| Disposable Income | Squeezed by inflation, leading to cautious spending | Slight recovery possible, but value focus persists | Continued demand for B&M's affordable product range |

| Exchange Rates (GBP/EUR) | Volatile, affecting import costs and overseas profits | Continued volatility expected | Potential impact on procurement costs and reported earnings; hedging strategies crucial |

| Retail Sales Volume (UK) | Showed growth in early 2024 (e.g., +4.1% in April) | Expected to remain broadly stable with potential for modest growth | Supports B&M's sales growth, especially in value segments |

Preview the Actual Deliverable

B&M European Value Retail PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive B&M European Value Retail PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into the external forces shaping B&M's European value retail landscape. You'll gain actionable insights into market trends and potential challenges.

Sociological factors

Consumers are increasingly prioritizing value and affordability due to ongoing economic pressures, a trend that directly bolsters B&M's discount retail model. This societal shift means shoppers are actively looking for deals and budget-friendly options across a wide range of goods.

B&M's success hinges on its ability to cater to this value-seeking demographic. By consistently offering low prices and a diverse product selection, the company resonates with consumers looking to stretch their budgets further, especially as inflation continues to impact household spending power. For instance, in the first half of fiscal year 2024, B&M reported a 10.1% increase in revenue, demonstrating the strong consumer appetite for their offering.

Consumers are increasingly blending online and in-store shopping experiences. In 2024, the UK saw a continued shift towards omnichannel retail, with a significant portion of shoppers using click-and-collect services. This trend means B&M needs to ensure a seamless experience across its physical stores and any digital platforms it utilizes, catering to shoppers who might browse online before visiting a store, or vice versa.

Basket sizes and visit frequency are also evolving, influenced by economic factors and a desire for value. Shoppers are often looking for quick, efficient trips to pick up specific items rather than extended browsing sessions. B&M's focus on value and its often more compact store layouts can align well with this, but adapting to the growing demand for online convenience and rapid delivery remains a key challenge and opportunity.

Demographic shifts, like the aging population in the UK and Germany, mean B&M needs to consider product ranges that appeal to older consumers, alongside its value-focused offerings. Urbanization trends, particularly in France where B&M operates a 'land-and-expand' strategy, necessitate adaptable store formats that can serve densely populated areas efficiently, ensuring accessibility for a wider range of communities.

Lifestyle and Home-Centric Trends

Shifting lifestyles, with a greater emphasis on home-centric activities like DIY, gardening, and leisure, directly boost demand for B&M's diverse general merchandise. This trend was particularly evident in 2024, with strong sales reported in categories like outdoor living and home improvement, aligning with consumer desires to enhance their living spaces.

B&M effectively capitalizes on these lifestyle shifts by curating its product assortment and seasonal promotions to reflect evolving consumer preferences. For instance, their well-stocked garden centers and seasonal toy ranges often see significant upticks in sales during periods of increased home-based leisure, demonstrating a keen ability to adapt their offerings.

- Increased spending on home improvement and gardening: In 2024, the UK home improvement market saw continued growth, with consumers investing in their living spaces.

- Popularity of leisure and hobby activities: B&M's strong performance in DIY and toy categories in 2024 reflects a sustained interest in home-based hobbies and family entertainment.

- Seasonal promotions driving sales: The retailer's strategic use of seasonal campaigns, such as those for gardening in spring and toys during holiday periods, effectively captures consumer spending driven by lifestyle trends.

Ethical Consumerism and Social Responsibility

Ethical consumerism is a significant force, with shoppers increasingly scrutinizing brands for their social and environmental impact. This trend is particularly relevant for B&M, a value retailer, as consumers expect even budget-friendly options to align with responsible practices. A 2024 survey indicated that over 60% of UK consumers consider sustainability when making purchasing decisions, a figure likely to rise.

B&M is responding to these evolving expectations by focusing on its supply chain and operational efficiency. Initiatives to reduce its carbon footprint, such as optimizing logistics and exploring more sustainable packaging solutions, are crucial for maintaining consumer trust. While specific public commitments to extensive ethical sourcing might be less pronounced compared to premium brands, B&M's value proposition often inherently aligns with reducing waste through efficient product turnover.

- Growing Consumer Demand: Over 60% of UK consumers consider sustainability in purchasing decisions as of 2024.

- Supply Chain Scrutiny: Consumers expect ethical sourcing and responsible practices even from value retailers.

- Carbon Footprint Reduction: B&M's efforts in logistics and packaging aim to address environmental concerns.

- Brand Image: Demonstrating social responsibility is key to maintaining consumer loyalty and trust in the current market.

Societal trends heavily favor B&M's discount model, with consumers prioritizing value due to persistent economic pressures. This has led to increased demand for affordability across product categories. For instance, B&M's revenue saw a significant 10.1% increase in the first half of fiscal year 2024, underscoring this consumer preference.

Shifting lifestyles, including a rise in home-centric activities like DIY and gardening, directly benefit B&M's diverse general merchandise. The retailer's strong performance in DIY and toy categories in 2024 reflects this sustained interest in home-based hobbies and family entertainment.

Ethical consumerism is growing, with over 60% of UK consumers considering sustainability in 2024. B&M is addressing this by focusing on supply chain efficiency and reducing its carbon footprint through optimized logistics and packaging solutions.

| Sociological Factor | Impact on B&M | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Value Consciousness | Drives demand for discount retail | B&M revenue up 10.1% (H1 FY24) |

| Home-Centric Lifestyles | Boosts sales in DIY, gardening, home goods | Strong performance in DIY/toy categories |

| Ethical Consumerism | Requires focus on sustainability and supply chain | >60% of UK consumers consider sustainability (2024) |

Technological factors

B&M European Value Retail is actively investing in its digital transformation, aiming to bolster its e-commerce capabilities and overall online presence. This strategic move acknowledges the persistent consumer shift towards online shopping, a trend that accelerated significantly in recent years. For instance, in the fiscal year ending March 2024, B&M reported a notable increase in online sales, though specific figures remain under review as the company refines its digital strategy.

The primary challenge for B&M lies in effectively integrating its robust physical store network with its developing digital channels. This requires a delicate balance to ensure a seamless customer experience, particularly for a value retailer where price point is a key differentiator. Opportunities abound in leveraging digital platforms for customer engagement, data collection, and potentially expanding reach beyond its current geographical footprint.

B&M's investment in supply chain technology is a significant driver of efficiency. The company is adopting automation in warehousing and advanced logistics software to streamline operations. For instance, their new UK import centre, operational since late 2023, is designed to handle increased volumes and improve inbound flow.

The expansion of their distribution centre in Gennevilliers, France, further bolsters logistical capabilities. These technological advancements directly contribute to better cost control by reducing manual handling and optimizing stock levels through data analytics, ensuring improved product availability for customers across their network.

B&M European Value Retail is exploring technology to streamline operations and boost customer engagement. Initiatives like self-checkout kiosks and digital displays are being tested to improve efficiency and provide dynamic product information. The company is carefully balancing these tech investments with its core low-cost strategy, ensuring that upgrades enhance value without significantly increasing overhead.

Data Analytics and Business Intelligence

Data analytics is crucial for B&M European Value Retail to understand its customers. By analyzing purchasing behavior, B&M can optimize its product assortment, ensuring it offers what shoppers want at the right price. This data-driven approach helps them stay competitive in the value retail sector.

B&M leverages data to refine its strategy, focusing on its core strengths of product and price. This allows for more personalized marketing efforts, reaching the right customers with relevant offers. The insights gained from data analytics inform strategic decisions, from inventory management to store layout, ultimately enhancing their market position.

- Consumer Insight: B&M utilizes data analytics to dissect customer purchasing habits, enabling a deep understanding of preferences and buying patterns.

- Product Optimization: Insights from data help B&M fine-tune its product assortment, ensuring it aligns with consumer demand and maximizes sales potential.

- Personalized Marketing: The company employs data to craft targeted marketing campaigns, enhancing customer engagement and driving loyalty.

- Strategic Decision-Making: Data analytics underpins B&M's strategic choices, reinforcing its competitive edge in the value retail market by focusing on product and price efficiency.

Cybersecurity and Data Protection

B&M European Value Retail must prioritize robust cybersecurity and compliance with data protection regulations like GDPR to protect sensitive customer and company information. Data breaches pose significant risks, impacting trust and potentially incurring substantial fines. For instance, in 2023, the average cost of a data breach globally rose to $4.45 million, according to IBM's Cost of a Data Breach Report.

Continuous investment in IT security is crucial for B&M to mitigate these threats. This includes regular system updates, employee training on data handling, and implementing advanced threat detection systems. The retail sector, with its high volume of customer transactions, is a prime target for cyberattacks, making proactive security measures essential for operational continuity and brand reputation.

- GDPR Fines: Non-compliance with GDPR can result in fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- Customer Trust: A data breach can severely erode customer trust, leading to lost sales and long-term damage to brand loyalty.

- Ransomware Attacks: Retailers are increasingly targeted by ransomware, locking down systems and demanding payment for data recovery.

- Evolving Threats: The cybersecurity landscape is constantly evolving, requiring ongoing vigilance and adaptation of security protocols by B&M.

B&M is enhancing its digital capabilities, focusing on e-commerce to meet evolving consumer preferences. The company is also investing in supply chain technology, including automation in warehouses and advanced logistics software, to improve efficiency and cost control. For instance, the new UK import centre, operational since late 2023, aims to boost inbound flow.

Technological advancements are key to B&M's strategy for streamlining operations and improving customer engagement. Initiatives like self-checkout kiosks and digital displays are being piloted to enhance efficiency and provide dynamic product information. Data analytics plays a crucial role, enabling B&M to understand customer behaviour for optimized product assortments and targeted marketing.

B&M's commitment to technology extends to robust cybersecurity measures to protect customer data, a critical aspect given the rising costs of data breaches, which averaged $4.45 million globally in 2023. Proactive security is vital for maintaining customer trust and operational continuity in the retail sector.

| Technology Area | B&M Initiatives | Impact |

|---|---|---|

| E-commerce | Digital transformation, online presence enhancement | Meeting consumer shift to online shopping |

| Supply Chain | Warehouse automation, advanced logistics software | Streamlined operations, better cost control, improved product availability |

| In-Store Technology | Self-checkout kiosks, digital displays | Improved efficiency, enhanced customer engagement |

| Data Analytics | Customer purchasing behavior analysis | Optimized product assortment, personalized marketing, strategic decision-making |

| Cybersecurity | IT security investment, GDPR compliance | Protection of customer data, maintenance of customer trust |

Legal factors

B&M operates within stringent consumer protection frameworks in both the UK and France, which are increasingly focused on digital commerce. The UK's Digital Markets, Competition and Consumers Act 2024, for instance, introduces robust measures against unfair practices such as drip pricing and fake online reviews, directly impacting how B&M advertises and conducts sales online. Failure to comply can lead to significant penalties and damage brand trust.

To navigate these legal complexities, B&M likely implements rigorous internal compliance protocols. This includes thorough vetting of all advertising content to ensure transparency and accuracy, particularly concerning pricing and product claims. Proactive adherence to regulations helps B&M avoid costly fines, which can be substantial; for example, the UK's Competition and Markets Authority (CMA) has the power to impose fines of up to 10% of a company's global annual turnover for breaches of consumer law.

B&M European Value Retail must adhere to stringent product safety and quality regulations across its diverse product range, from fast-moving consumer goods (FMCG) to general merchandise. This includes compliance with UK and EU standards such as the General Product Safety Regulations 2005 and specific directives for electrical goods or toys, ensuring products are safe for consumers and correctly labelled to prevent misuse. For instance, in 2023, the UK's Office for Product Safety and Standards (OPSS) continued to enforce product safety laws, with significant fines issued for non-compliance in the retail sector.

Ensuring compliance across B&M's extensive product portfolio and complex international supply chains presents a significant challenge. The company sources a vast array of products from numerous suppliers globally, requiring robust quality control measures and due diligence to verify adherence to varying national and international safety and quality standards. Failure to meet these legal requirements can result in product recalls, reputational damage, and substantial financial penalties, as demonstrated by various recalls in the UK FMCG market throughout 2024 due to undeclared allergens or safety concerns.

B&M's operations in the UK and France are subject to distinct employment and labor laws. In the UK, the National Living Wage, set at £11.44 per hour for those 21 and over as of April 2024, directly influences wage costs. Similarly, France has a statutory minimum wage, the SMIC, which was last adjusted in January 2024 to €11.65 per hour gross.

Compliance with regulations on working hours, paid leave, and employee benefits, such as statutory sick pay and pension contributions, adds to B&M's operational expenses. The potential for unionization and collective bargaining agreements in both countries also necessitates careful human resources management to mitigate risks and maintain stable employee relations.

Upcoming increases in minimum wages, like the projected rise in the UK's National Living Wage for 2025, will continue to exert upward pressure on B&M's labor costs. This requires strategic planning in workforce management and pricing to absorb or offset these increased expenses while remaining competitive.

Competition Law and Anti-Trust Regulations

Competition law and anti-trust regulations are highly relevant for B&M European Value Retail, especially as it continues to grow and potentially acquire other businesses. These rules are designed to ensure a level playing field, preventing any single company from dominating the market unfairly. For B&M, this means careful consideration of how its pricing and expansion strategies might impact competitors and consumer choice.

These regulations can significantly shape B&M's operational decisions. For instance, anti-trust bodies might scrutinize pricing strategies to prevent predatory pricing or collusion. Similarly, any proposed mergers or acquisitions would undergo rigorous review to ensure they do not create a monopoly or substantially lessen competition. In 2024, the UK's Competition and Markets Authority (CMA) continued its active enforcement, reviewing numerous retail sector deals.

- Market Dominance Scrutiny: As B&M's market share increases, particularly in the discount retail segment, it faces greater scrutiny from regulators like the CMA regarding potential anti-competitive practices.

- Merger Control: Any future acquisitions by B&M will be subject to competition reviews, assessing whether they would harm consumers through higher prices or reduced choice. For example, the CMA blocked a significant retail merger in early 2024.

- Pricing Strategy Oversight: Regulators monitor pricing to prevent abuse of dominant positions, ensuring B&M's pricing remains competitive and doesn't disadvantage smaller rivals or consumers.

- Consumer Welfare Focus: The overarching goal of competition law is to protect consumer welfare, meaning B&M's growth and strategies must ultimately benefit the end consumer through fair prices and product availability.

Property and Planning Laws for Store Expansion

B&M's expansion strategy, targeting 50 new UK stores by 2025 and a further 45 annually in the subsequent two financial years, is significantly influenced by property and planning laws. Navigating the complexities of property acquisition and leasing agreements across the UK and France requires meticulous attention to local regulations and zoning ordinances. These legal frameworks can dictate the speed and viability of new store openings.

The pace of B&M's ambitious store rollout is directly tied to securing suitable retail spaces and obtaining necessary planning permissions. Local planning authorities in both the UK and France have specific rules regarding land use, building regulations, and the impact of new commercial developments on existing communities. Failure to comply with these can lead to delays or even prevent store openings.

- Property Acquisition & Leasing: B&M must adhere to diverse legal requirements for acquiring or leasing commercial properties, including contract law, landlord-tenant legislation, and property registration processes in both the UK and France.

- Planning Permissions: Obtaining planning permission is a critical legal hurdle, involving compliance with national and local zoning laws, environmental impact assessments, and public consultation processes.

- Regulatory Compliance: B&M's expansion necessitates adherence to a range of property-related regulations, such as health and safety standards, accessibility requirements, and potentially heritage protection laws if sites are in conservation areas.

- Impact on Expansion Pace: The stringency and efficiency of these legal processes can directly affect B&M's ability to meet its aggressive store opening targets, potentially slowing down the rollout if permissions are difficult or time-consuming to secure.

B&M's legal landscape is shaped by evolving consumer protection laws, particularly concerning online sales. The UK's Digital Markets, Competition and Consumers Act 2024 targets practices like drip pricing and fake reviews, necessitating strict adherence to advertising standards to avoid penalties. Product safety regulations, such as the UK's General Product Safety Regulations 2005, mandate rigorous quality control across B&M's diverse product range, with non-compliance potentially leading to significant fines and recalls, as seen with various FMCG recalls in 2024.

Employment law significantly impacts B&M's operational costs. The UK's National Living Wage, £11.44 per hour for those 21+ as of April 2024, and France's SMIC (€11.65 per hour gross as of January 2024) set baseline wage expenses. Compliance with working hour regulations, leave entitlements, and benefits adds to overheads, with projected minimum wage increases for 2025 likely to further influence labor costs.

Competition law and property planning regulations are critical for B&M's growth. Anti-trust scrutiny from bodies like the UK's CMA in 2024 impacts pricing and merger strategies, aiming to prevent market dominance and ensure consumer benefit. Securing planning permissions for its ambitious store rollout, targeting 50 new UK stores by 2025, involves navigating complex local zoning and building regulations in both the UK and France.

| Legal Area | Key Regulations/Factors | Impact on B&M | 2024/2025 Data Point |

|---|---|---|---|

| Consumer Protection | Digital Markets, Competition and Consumers Act 2024 (UK) | Requires transparent online advertising and sales practices. | CMA can impose fines up to 10% of global annual turnover. |

| Product Safety | General Product Safety Regulations 2005 (UK) | Mandates adherence to safety and quality standards for all products. | OPSS enforced product safety laws in 2023, with fines for non-compliance. |

| Employment Law | National Living Wage (UK), SMIC (France) | Directly influences wage costs for B&M employees. | UK NLW £11.44/hr (21+ as of April 2024); French SMIC €11.65/hr gross (as of Jan 2024). |

| Competition Law | Anti-trust regulations (UK/EU) | Scrutinizes pricing and expansion strategies for anti-competitive practices. | CMA reviewed numerous retail sector deals in 2024. |

| Property & Planning | Zoning laws, planning permissions (UK/France) | Affects the pace and feasibility of new store openings. | B&M targets 50 new UK stores by 2025. |

Environmental factors

B&M European Value Retail is increasingly focusing on sustainability, with initiatives aimed at reducing waste and promoting recycling across its operations. The company is exploring ways to implement circular economy principles within its supply chain, though specific targets for waste reduction and recycling rates for 2024/2025 are still being formalized as part of broader ESG strategies.

While B&M has publicly committed to reducing its carbon footprint, detailed progress reports specifically for waste reduction and circularity initiatives for the 2024-2025 period are not yet widely available. The company's approach is likely to involve optimizing packaging, improving in-store waste management, and working with suppliers to enhance their own environmental practices.

B&M European Value Retail is actively working to shrink its environmental impact. A key goal is a 25% cut in its direct and indirect emissions (Scope 1 and 2) by 2030 compared to a 2022 baseline. This ambitious target necessitates significant operational shifts across the company.

Achieving these reduction targets will require substantial changes in B&M's logistics, focusing on more efficient transportation methods and route optimization to lower fuel consumption. Furthermore, the company is looking at reducing energy use in its stores and distribution centers through upgrades to lighting, heating, and cooling systems, alongside exploring renewable energy sources. B&M is also engaging its supply chain, aiming to have 67% of its suppliers commit to science-based emissions reduction targets by fiscal year 2027, a crucial step in addressing its wider environmental footprint.

Evolving packaging regulations, especially those targeting plastic reduction and encouraging recyclable materials, will significantly impact B&M's product packaging and supply chain. The UK's increased plastic packaging tax, set to rise from October 2025, will add a direct cost to B&M's operations if they continue to use substantial amounts of virgin plastic.

Adopting more sustainable packaging solutions presents both cost challenges and strategic opportunities for B&M. While initial investments in new materials or redesigns might be higher, it can also lead to cost savings in the long run through reduced tax liabilities and potentially attract environmentally conscious consumers, a growing market segment.

Supply Chain Environmental Impact and Sourcing

B&M's extensive global supply chain presents significant environmental challenges, particularly concerning the sourcing of its diverse product range. The company must navigate the environmental impact of raw material extraction, manufacturing processes, and the transportation of goods across vast distances. Ensuring ethical sourcing and minimizing the carbon footprint associated with logistics are critical for responsible operations.

The company's efforts to mitigate its supply chain's environmental impact are ongoing. This includes scrutinizing supplier environmental performance and implementing practices to reduce emissions from transportation. B&M is increasingly focused on responsible sourcing to align with growing consumer and regulatory expectations regarding sustainability.

- Transportation Emissions: B&M's reliance on global shipping and road freight contributes to its carbon footprint. For instance, the shipping industry alone accounted for approximately 2.89% of global greenhouse gas emissions in 2023, a figure that directly impacts retailers with extensive international supply chains.

- Ethical Sourcing: Ensuring raw materials like cotton, wood, and plastics are sourced sustainably and ethically is paramount. The textile industry, a significant supplier for B&M, faces scrutiny over water usage and chemical pollution, with initiatives like the Better Cotton Initiative aiming to improve practices.

- Supplier Environmental Performance: B&M likely engages with suppliers to encourage adherence to environmental standards. This can involve audits and collaborations to improve energy efficiency and waste management within manufacturing facilities.

- Waste Reduction: Minimizing packaging waste throughout the supply chain, from production to point of sale, is another key environmental consideration. Efforts to use recycled or recyclable materials are becoming increasingly important.

Climate Change Adaptation and Resilience

Climate change poses significant risks to B&M European Value Retail, particularly through extreme weather events that could disrupt its extensive supply chain and impact store operations. For instance, severe flooding or heatwaves could affect product availability and increase operational costs. B&M's resilience strategies likely involve diversifying sourcing locations and investing in more robust infrastructure to mitigate these physical risks.

The company's approach to climate-related financial disclosures, as mandated by evolving regulations, is crucial for managing investor expectations and demonstrating proactive risk management. By detailing its adaptation plans and the financial implications of climate change, B&M can build trust and ensure long-term sustainability. This includes assessing the physical and transition risks associated with climate change, such as potential carbon pricing mechanisms or shifts in consumer preferences towards more sustainable products.

- Supply Chain Disruption: Extreme weather events in key sourcing regions could lead to stock shortages and increased logistics costs for B&M.

- Operational Impacts: Retail locations may face direct impacts from severe weather, affecting foot traffic and potentially requiring costly repairs or temporary closures.

- Regulatory Scrutiny: Increased focus on climate disclosures means B&M must transparently report on its climate risks and adaptation strategies.

- Reputational Risk: Failure to adequately address climate change impacts could damage B&M's brand image among environmentally conscious consumers and investors.

B&M is actively working to reduce its environmental impact, setting a target to cut its direct and indirect emissions (Scope 1 and 2) by 25% by 2030 from a 2022 baseline. This involves optimizing logistics for lower fuel consumption and improving energy efficiency in stores and distribution centers. Furthermore, B&M aims for 67% of its suppliers to commit to science-based emissions reduction targets by fiscal year 2027.

Evolving packaging regulations, particularly in the UK, will impact B&M. The plastic packaging tax is set to increase from October 2025, adding costs if the company continues to use significant amounts of virgin plastic. This presents both a cost challenge and a strategic opportunity for B&M to adopt more sustainable packaging solutions.

Climate change poses risks through extreme weather events that could disrupt B&M's supply chain and operations. For instance, severe weather could affect product availability and increase logistics costs. B&M's resilience strategies likely include diversifying sourcing and investing in robust infrastructure to mitigate these physical risks.

| Environmental Factor | B&M European Value Retail Initiatives/Impact | Relevant Data/Targets (2024/2025 Focus) |

|---|---|---|

| Emissions Reduction | Target: 25% cut in Scope 1 & 2 emissions by 2030 (vs. 2022 baseline) | Focus on logistics efficiency and energy use in stores/DCs. |

| Supplier Emissions | Aim: 67% of suppliers commit to science-based targets by FY27 | Engaging supply chain for broader environmental performance. |

| Packaging Regulations | Impact of UK plastic packaging tax (rising from Oct 2025) | Potential cost increase for virgin plastic use; opportunity for sustainable alternatives. |

| Climate Change Risks | Supply chain disruption from extreme weather | Mitigation through diversified sourcing and infrastructure investment. |

PESTLE Analysis Data Sources

Our PESTLE analysis for the B&M European Value Retail sector is constructed using data from official government statistics agencies, reputable market research firms specializing in retail and consumer behavior, and reports from leading economic institutions like Eurostat and the European Central Bank. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the market.