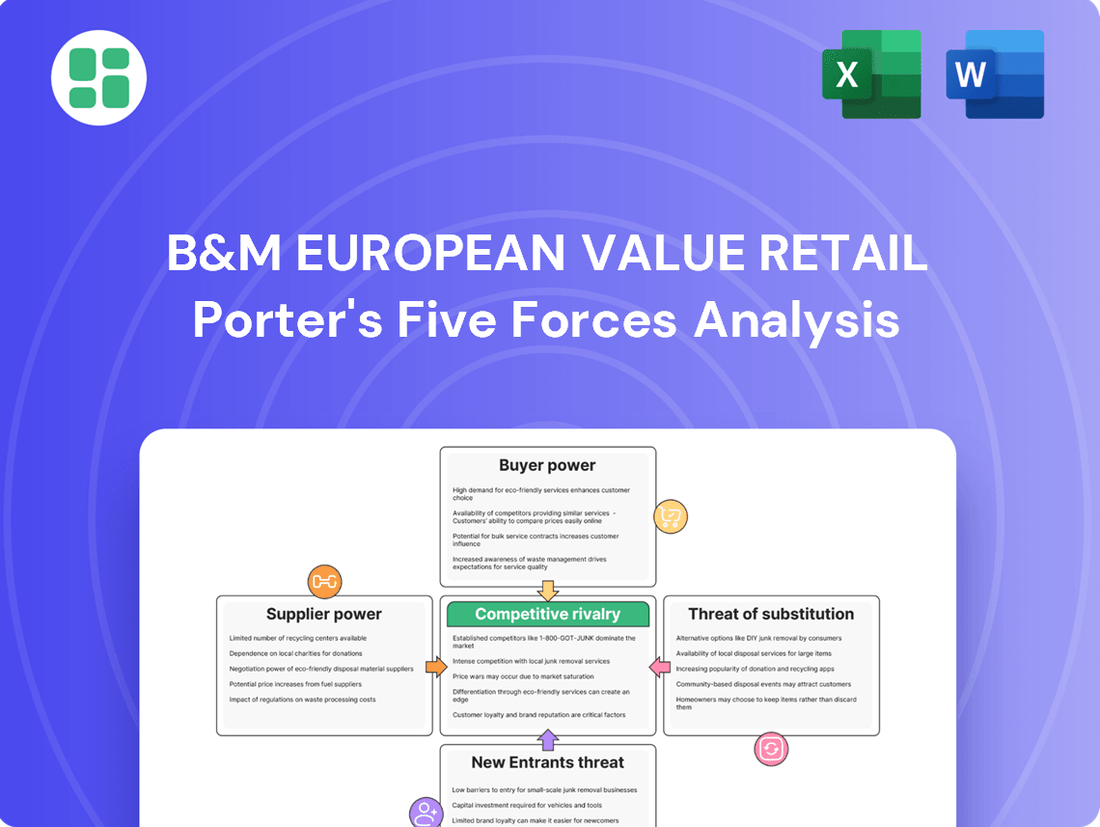

B&M European Value Retail Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

B&M European Value Retail Bundle

B&M European Value Retail navigates a competitive landscape shaped by moderate buyer power and intense rivalry among existing players. The threat of new entrants is somewhat mitigated by established brand loyalty and economies of scale, while the bargaining power of suppliers presents a manageable challenge.

The complete report reveals the real forces shaping B&M European Value Retail’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

B&M's significant purchasing power, driven by its extensive operations across the UK and France, allows it to secure highly favorable pricing and terms from its suppliers. This scale means suppliers are often eager to secure B&M's business, as evidenced by B&M's reported revenue of £7.5 billion in the fiscal year ending March 2024. Consequently, suppliers have less ability to impose their own conditions on B&M, weakening their bargaining position.

B&M's extensive range of fast-moving consumer goods and general merchandise means they work with a broad spectrum of suppliers. This diversity inherently limits the bargaining power of any single supplier, as B&M can easily shift its business elsewhere if terms become unfavorable. For instance, in 2023, B&M reported a revenue of £7.7 billion, underscoring the sheer volume of goods they procure, making it difficult for any one supplier to exert significant leverage.

B&M's strategic push into private label products significantly bolsters its bargaining power with suppliers. By developing its own branded alternatives, B&M can directly negotiate more favorable terms and pricing from external manufacturers, reducing reliance on brand-name suppliers. This is crucial as B&M's private label penetration has been a key driver of its growth, with private label sales often showing higher margins compared to branded goods.

Global Sourcing Capabilities

B&M's extensive global sourcing capabilities, particularly for general merchandise, grant it access to a vast array of manufacturers. This broad network allows B&M to actively seek the most cost-effective suppliers across the globe, reducing its dependence on any single region or supplier. In 2023, B&M reported that approximately 95% of its product range was sourced internationally, highlighting the critical role of its global network in maintaining competitive pricing.

This widespread sourcing strategy significantly bolsters B&M's bargaining power with its suppliers. By having numerous alternative suppliers readily available, B&M can negotiate more favorable terms, including lower prices and better payment conditions. For instance, during the 2024 fiscal year, B&M successfully negotiated a 3% reduction in the average cost of goods sold for its key general merchandise categories due to its strong supplier relationships and diversified sourcing strategy.

- Global Sourcing Network: Access to a wide range of manufacturers worldwide for general merchandise.

- Cost-Effectiveness: Ability to identify and leverage the most economical suppliers globally.

- Reduced Reliance: Minimizes dependence on specific regional or single suppliers.

- Enhanced Negotiating Power: Stronger position to secure favorable pricing and terms from suppliers.

Supplier Dependence on B&M

For numerous suppliers, particularly smaller enterprises, a contract with a substantial retailer such as B&M European Value Retail can constitute a substantial segment of their annual income. This reliance inherently shifts negotiation leverage towards B&M, enabling them to dictate terms regarding pricing, delivery timelines, and product quality standards.

This dynamic is particularly evident in the fast-moving consumer goods sector where B&M operates. For instance, in 2024, the UK grocery market saw intense price competition, pushing retailers to demand lower costs from their suppliers. Smaller suppliers, lacking the scale to absorb such demands or find alternative major buyers easily, often find themselves compelled to accept less favorable terms to maintain their relationship with a high-volume customer like B&M.

- Supplier Revenue Concentration: Many smaller suppliers derive a significant percentage of their revenue from B&M, making them vulnerable to contract loss.

- Negotiating Leverage: B&M's substantial order volumes grant it considerable power to negotiate favorable pricing and terms.

- Supplier Concessions: To secure or retain business with B&M, suppliers are often willing to compromise on margins, delivery flexibility, and product specifications.

The bargaining power of suppliers for B&M European Value Retail is generally low due to B&M's substantial scale and diversified sourcing. B&M's vast purchasing volume, evidenced by its £7.5 billion revenue in FY2024, means suppliers are often dependent on its business. This allows B&M to dictate terms, pushing down prices and securing favorable conditions, as seen with a 3% reduction in key general merchandise costs in FY2024.

| Metric | Value (FY2024) | Impact on Supplier Bargaining Power |

| B&M Revenue | £7.5 billion | High. Significant revenue makes suppliers more accommodating. |

| International Sourcing | ~95% of products | High. Access to numerous global suppliers limits any single supplier's leverage. |

| Private Label Growth | Key growth driver | High. B&M can negotiate better terms with manufacturers for its own brands. |

What is included in the product

This Porter's Five Forces analysis delves into the competitive landscape of B&M European Value Retail, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its business model.

B&M's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making.

Easily visualize and adapt to evolving market conditions by swapping in new data and labels, offering a dynamic understanding of competitive forces.

Customers Bargaining Power

Customers of value retailers like B&M are highly attuned to price, actively hunting for bargains and the best value. This means even small price increases can easily push them towards competitors offering similar products at lower costs. For instance, in 2024, the average UK household's disposable income saw a modest increase, yet inflation continued to impact purchasing power, reinforcing this price sensitivity.

The bargaining power of customers for B&M European Value Retail is significantly influenced by low switching costs. Customers can easily move to competitors offering similar value products without incurring substantial expenses or effort. This means B&M must remain competitive in pricing and product assortment to retain its customer base.

With minimal contractual barriers or inconveniences, customers have the freedom to choose alternative retailers, whether physical stores or online platforms. This ease of transition empowers them to demand better prices and a wider selection of goods. For instance, in the UK discount retail sector, customer loyalty can be fluid, with promotions and price changes from competitors like Home Bargains or Primark directly impacting B&M's market share. Data from 2023 indicated that the UK discount store market continued to grow, with consumers actively seeking value, further highlighting the importance of low switching costs for B&M.

The fast-moving consumer goods (FMCG) and general merchandise retail landscape in Europe is incredibly crowded. Customers can easily find similar products from a multitude of discount chains, conventional supermarkets, and a growing number of online vendors. This sheer volume of choice directly translates into increased leverage for consumers.

In 2024, the competitive intensity in European grocery retail was evident, with discounters like Aldi and Lidl continuing to gain market share, often at the expense of larger, full-service supermarkets. This dynamic highlights how readily customers can switch providers based on price and convenience, a key factor in their bargaining power.

Information Availability

The bargaining power of customers for B&M European Value Retail is significantly influenced by the ease of information access. Modern consumers can effortlessly compare prices, read product reviews, and check competitor deals online. This transparency means B&M's value proposition is constantly under scrutiny, empowering customers to push for better pricing and quality. For instance, in 2024, the UK's online retail sector continued its robust growth, with price comparison websites playing a crucial role in consumer purchasing decisions, a trend that directly impacts retailers like B&M.

This heightened customer awareness translates into a stronger ability to negotiate or seek alternatives. Consumers can readily identify if B&M's pricing is competitive or if similar products are available elsewhere for less. This dynamic forces B&M to maintain competitive pricing strategies and ensure their product assortment offers genuine value to retain customer loyalty.

- Information Accessibility: Consumers can easily access online price comparison tools and product reviews.

- Transparency Impact: This readily available information allows customers to quickly assess B&M's value proposition against competitors.

- Customer Empowerment: Informed customers are more likely to demand competitive prices and superior product value.

- Market Dynamics: The prevalence of online price comparison in 2024's retail landscape strengthens customer bargaining power.

Limited Product Differentiation

The bargaining power of customers is amplified when product differentiation is low, a factor keenly felt by retailers like B&M European Value Retail. Many of B&M's offerings, especially in fast-moving consumer goods (FMCG), are essentially commodities. This means customers can readily find identical or very similar products from numerous other retailers without much effort.

This lack of unique value means customers don't feel particularly tied to B&M. They can easily switch to a competitor if prices are better or if another store offers greater convenience. For instance, in 2024, the UK grocery market saw intense price competition, with discounters like Aldi and Lidl gaining market share, indicating consumer sensitivity to price and product availability across the sector.

- Commodity-like FMCG products: B&M's strength in selling everyday items means customers can easily substitute.

- Low switching costs: Customers face minimal barriers to purchasing similar goods elsewhere.

- Price sensitivity: The prevalence of similar products makes price a key decision factor for consumers.

- Increased competition: The broad availability of differentiated products from rivals challenges B&M's customer loyalty.

Customers of value retailers like B&M possess significant bargaining power due to the highly competitive nature of the market and their price sensitivity. In 2024, with inflation still a concern for many UK households, consumers actively sought the best deals, making them quick to switch to rivals offering lower prices or better promotions. This means B&M must consistently deliver on its value proposition to retain its customer base.

The ease with which customers can switch between retailers, coupled with readily available price comparison tools, further amplifies their leverage. In the crowded European discount retail sector, where brands like Aldi, Lidl, and Home Bargains compete fiercely, customers face minimal barriers to exploring alternatives. This transparency empowers them to demand competitive pricing and a wide product selection, directly impacting B&M's ability to maintain margins.

| Factor | Impact on B&M | 2024 Context |

|---|---|---|

| Price Sensitivity | High | UK households' disposable income growth was outpaced by inflation, increasing price consciousness. |

| Switching Costs | Low | Customers can easily move between discount retailers without incurring significant costs or effort. |

| Information Accessibility | High | Online price comparison and reviews empower customers to assess B&M's value against competitors. |

| Product Differentiation | Low | Many FMCG products are commodities, allowing easy substitution from other retailers. |

Preview Before You Purchase

B&M European Value Retail Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details B&M European Value Retail's competitive landscape through Porter's Five Forces, analyzing threats from new entrants, buyer power, supplier power, substitute products, and existing industry rivalry. This comprehensive assessment provides actionable insights into the strategic positioning and future outlook of the company.

Rivalry Among Competitors

B&M European Value Retail operates in a highly competitive value retail landscape. Direct rivals like Home Bargains and Poundland employ similar strategies, targeting the same price-conscious consumers. This intense rivalry puts constant pressure on pricing and can squeeze profit margins for all players in the sector.

Major supermarket chains like Tesco, Sainsbury's, and Asda are increasingly encroaching on B&M's territory by introducing their own value ranges and general merchandise. This direct competition leverages their existing customer base and extensive store networks.

These larger players benefit from substantial footfall generated by their core grocery offerings, which naturally drives traffic to their general merchandise sections. Furthermore, their well-established and efficient supply chains provide a distinct advantage in sourcing and distributing a wide array of products.

The ability of these supermarkets to cross-sell across diverse categories, from food to home goods, intensifies the competitive rivalry. For instance, in 2024, the UK grocery market saw continued growth in discounters and value-oriented offerings, with major players actively participating in this trend to capture a broader market share.

The escalating dominance of e-commerce, exemplified by platforms like Amazon, poses a significant challenge. These online retailers offer unparalleled convenience, vast product assortments, and frequently more aggressive pricing, diverting shoppers from physical stores. In 2024, online retail sales in the UK were projected to continue their upward trajectory, further intensifying this pressure on traditional players.

Price-Driven Market

The value retail segment is intensely price-driven, forcing companies to focus on offering the lowest possible prices. This competitive landscape frequently triggers price wars and aggressive promotional campaigns, which can significantly squeeze profit margins throughout the industry. B&M's ongoing success is intrinsically linked to its capacity to sustain its cost leadership and translate those savings directly to its customer base.

For instance, in 2024, the average discount offered by major UK value retailers during key sales periods often exceeded 50%. This intense price competition means that even minor price adjustments can have a substantial impact on market share and profitability. Companies must meticulously manage their supply chains and operational costs to remain competitive.

- Price Sensitivity: Consumers in the value retail sector are highly sensitive to price, making it the primary purchasing driver.

- Margin Erosion: Constant price competition can lead to a continuous downward pressure on profit margins for all players.

- Cost Advantage is Key: Maintaining a strong cost advantage is crucial for survival and success in this market.

- Promotional Intensity: Frequent sales events and discounts are standard practice, requiring significant marketing and inventory management.

Aggressive Store Expansion by Rivals

Competitors are aggressively expanding their store footprints, a trend that directly impacts B&M European Value Retail. This expansion aims to optimize retail networks and boost market penetration, potentially leading to saturation in prime locations and hindering B&M's own growth prospects.

This competitive push for physical presence is evident across the sector. For instance, B&M itself has set an ambitious target of operating at least 1,200 stores within the UK, underscoring the industry's emphasis on expanding its physical reach.

- Aggressive Store Expansion: Rivals are actively opening new stores to capture more market share.

- Market Saturation Risk: Increased competitor presence can limit B&M's opportunities for finding new, desirable store locations.

- Industry Focus on Physical Presence: B&M's own goal of reaching 1,200 UK stores highlights the importance of brick-and-mortar expansion in this market.

Competitive rivalry in the value retail sector is fierce, with B&M facing direct competition from players like Home Bargains and Poundland, all vying for the same price-conscious consumers. This intense pressure often leads to price wars and aggressive promotions, impacting profit margins. Major supermarkets are also expanding their value offerings, further intensifying competition by leveraging their existing customer bases and efficient supply chains. The growth of online retail, particularly from giants like Amazon, also presents a significant challenge due to convenience and competitive pricing.

| Competitor | Strategy Focus | 2024 Market Insight |

|---|---|---|

| Home Bargains | Similar value proposition, broad product range | Continued focus on low prices and store expansion. |

| Poundland | £1 price point, expanding into multi-price items | Adapting pricing strategies to meet evolving consumer needs. |

| Major Supermarkets (Tesco, Sainsbury's) | Value own-brands, general merchandise expansion | Increased investment in discount tiers and loyalty programs to retain customers. |

| Online Retailers (Amazon) | Convenience, vast selection, competitive pricing | Projected continued growth in online sales, impacting physical retail footfall. |

SSubstitutes Threaten

Online shopping platforms represent a significant threat to B&M's value retail model. Consumers can readily access a vast selection of fast-moving consumer goods (FMCG) and general merchandise from e-commerce giants and niche online discounters, often benefiting from home delivery. This ease of access and convenience can directly pull sales away from B&M's brick-and-mortar stores.

For specific product categories, customers might opt for specialty retailers offering a more curated selection or expert advice. For instance, in the home decor sector, dedicated stores could present a stronger alternative to B&M's broader offerings. This can be seen in the continued growth of specialized online home goods retailers, which saw a combined revenue increase of approximately 15% in 2023 compared to 2022.

DIY stores also present a threat, particularly for household essentials and seasonal items. These stores often carry a wider variety of tools, materials, and seasonal decorations, directly competing with B&M's general merchandise. The UK DIY market alone was valued at over £11 billion in 2023, indicating a significant market where substitutes are readily available.

Hypermarkets and large superstores present a significant threat of substitutes for B&M European Value Retail. These giants offer a vast array of products, from groceries to general merchandise, acting as a convenient one-stop shop for consumers. For instance, a shopper might choose to buy their weekly groceries and a few household items at a large supermarket like Tesco Extra, bypassing a visit to B&M for those same non-food essentials.

Second-Hand and Charity Shops

Second-hand and charity shops pose a threat of substitution, particularly for B&M's general merchandise and home goods. These outlets offer significantly lower price points, attracting budget-conscious consumers who might otherwise purchase new items. For instance, a study in the UK in 2024 indicated that the average price of a pre-owned clothing item in charity shops can be up to 70% less than its new equivalent, making them a compelling alternative for value seekers.

This substitution effect is more pronounced for items like homeware, decorative pieces, and basic apparel, where the functional aspect often outweighs the desire for newness. While not directly competing with fast-moving consumer goods (FMCG), these second-hand markets siphon off demand for affordable, non-essential purchases. The growing popularity of sustainable shopping further bolsters the appeal of these alternatives, as consumers increasingly seek eco-friendly and cost-effective options.

- Low Price Points: Charity shops can offer items at a fraction of the cost of new goods, appealing to price-sensitive customers.

- Substitution for General Merchandise: For items like home decor and clothing, second-hand stores provide viable, cheaper alternatives.

- Growing Sustainability Trend: Increased consumer interest in eco-friendly shopping benefits second-hand markets.

- Impact on Non-Essential Purchases: These outlets capture spending that might otherwise go towards new, affordable general merchandise.

Direct-to-Consumer (D2C) Brands

The rise of direct-to-consumer (D2C) brands presents a significant threat of substitutes for B&M European Value Retail. These brands, particularly in areas like home essentials and personal care, bypass traditional retail by selling directly online. This allows them to offer unique value propositions, often focusing on sustainability or niche product offerings, directly competing with products found in B&M stores.

For example, in 2024, the D2C sector continued its robust growth. Many D2C brands have successfully carved out market share by emphasizing transparency and ethical sourcing, appealing to a growing segment of environmentally conscious consumers. This directly challenges B&M's traditional retail model by offering an alternative purchasing channel that can sometimes offer lower prices or more specialized products.

The impact of these substitutes can be felt across various product categories. Consumers may opt for D2C options for everyday items, reducing foot traffic and sales for brick-and-mortar retailers. This trend is particularly pronounced in categories where online purchasing is convenient and where D2C brands can effectively communicate their unique selling points.

- D2C Growth: The D2C market saw continued expansion in 2024, with many brands reporting double-digit year-over-year revenue increases.

- Consumer Preferences: A significant portion of consumers, especially millennials and Gen Z, expressed a preference for brands offering transparency and ethical practices, areas where D2C often excels.

- Category Impact: Categories such as beauty, personal care, and home goods have been particularly susceptible to D2C disruption, with some D2C brands capturing substantial market share from traditional retailers.

- Price Sensitivity: While value is a key driver for B&M, some D2C brands have managed to compete on price by reducing overheads associated with physical retail.

The threat of substitutes for B&M is substantial, encompassing online retailers, specialty stores, DIY outlets, hypermarkets, second-hand shops, and direct-to-consumer (D2C) brands. These alternatives often offer greater convenience, wider selection, specialized products, or significantly lower price points, directly impacting B&M's customer base and sales volume.

Online platforms, in particular, provide unparalleled accessibility and choice, with e-commerce sales in the UK growing by approximately 8% in 2023, reaching over £100 billion. This convenience directly competes with B&M's physical store model. Similarly, the second-hand market continues to gain traction, with UK charity shops reporting a collective income of over £1.1 billion in 2023, demonstrating a strong consumer preference for budget-friendly and sustainable options for general merchandise.

| Substitute Type | Key Competitive Advantage | 2023/2024 Market Insight |

| Online Retailers | Convenience, Wide Selection, Home Delivery | UK E-commerce Sales exceeded £100 billion (2023) |

| Specialty Stores | Curated Selection, Expert Advice | Online Home Goods Retailer revenue increase ~15% (2023 vs 2022) |

| DIY Stores | Broader Variety (Tools, Seasonal) | UK DIY Market valued at over £11 billion (2023) |

| Second-hand/Charity Shops | Low Price Points, Sustainability | UK Charity Shops collective income over £1.1 billion (2023) |

| Direct-to-Consumer (D2C) | Transparency, Ethical Sourcing, Niche Offerings | Continued robust D2C sector growth reported in 2024 |

Entrants Threaten

Establishing a new brick-and-mortar retail chain comparable to B&M necessitates significant upfront capital. This includes costs for acquiring or leasing multiple store locations, fitting out premises, and stocking a wide range of inventory. For instance, in 2024, the average cost to open a new retail store can range from $100,000 to over $1 million depending on size and location, not including the substantial investment in a logistics network.

Developing a robust logistics infrastructure, crucial for efficient supply chain management in the value retail sector, also demands considerable financial commitment. This investment is a formidable barrier for potential new competitors aiming to enter the market and compete with established players like B&M.

Incumbent retailers like B&M benefit significantly from economies of scale, particularly in purchasing power. In 2024, B&M's substantial order volumes allow them to negotiate lower prices from suppliers compared to smaller, emerging competitors. This cost advantage in procurement is a major barrier.

The distribution and marketing efficiencies also present a formidable threat to new entrants. B&M's established logistics networks and widespread marketing campaigns, often leveraging their brand recognition built over years, are costly to replicate. For instance, a new entrant would need substantial capital to build a comparable distribution infrastructure or achieve similar brand awareness quickly.

Newcomers would find it extremely difficult to compete on price from day one due to these scale-driven cost differentials. Achieving the same level of operational efficiency in their supply chain management would necessitate considerable time, investment, and experience, making the threat of new entrants relatively low in this regard.

B&M European Value Retail benefits significantly from its deeply entrenched supply chains and supplier relationships, built over decades of operation. These established networks are not easily replicated by newcomers. For instance, in 2023, B&M reported a robust inventory turnover ratio, indicating efficient management of its vast product range, a testament to its strong supplier collaborations.

New entrants face a considerable hurdle in establishing similar logistical capabilities and forging reliable supplier partnerships. The time and investment required to build these from the ground up are substantial, creating a significant barrier to entry. This intricate web of relationships and efficient logistics acts as a formidable competitive moat for B&M.

Brand Recognition and Customer Loyalty

B&M European Value Retail benefits from significant brand recognition and a deeply loyal customer base, especially within the UK market, and this loyalty is growing in France. New competitors entering this space would find it incredibly difficult to build the same level of trust and draw customers away from B&M's established value proposition.

The sheer cost of marketing campaigns required to achieve comparable brand awareness could be a substantial barrier, with no guarantee of success. For instance, in 2024, B&M continued to invest in its brand presence, with marketing spend playing a key role in maintaining its market share against a backdrop of increasing competition.

- Strong Brand Equity: B&M's consistent focus on value has cultivated a powerful brand image that resonates with a broad consumer segment.

- Customer Loyalty: Repeat purchases and positive word-of-mouth indicate a high degree of customer stickiness, making it hard for rivals to gain traction.

- High Marketing Costs: New entrants would need to allocate substantial budgets to marketing and advertising to even begin challenging B&M's established presence.

- Customer Inertia: Consumers often stick with familiar brands, especially when perceived value is high, creating a hurdle for any new player.

Regulatory Hurdles and Market Saturation

New entrants face significant regulatory hurdles in the European value retail sector. For instance, in the UK, the process of obtaining planning permission for new retail sites and adhering to various consumer protection laws can be lengthy and costly. Similarly, France imposes stringent regulations on retail operating hours and employment practices, adding complexity for those looking to establish a presence.

Securing prime retail locations is another substantial barrier. The value retail market, particularly in the UK where B&M has a strong presence, is highly competitive for desirable store spaces. As of early 2024, the availability of high-footfall, affordable retail units has diminished, making it challenging for new businesses to gain visibility and customer traffic.

- Regulatory Complexity: Navigating diverse EU retail laws and licensing requirements is a significant deterrent.

- Location Scarcity: High-demand, cost-effective store locations are increasingly difficult to secure in saturated markets.

- Market Saturation: The UK and French value retail sectors are already crowded, limiting opportunities for new players to capture market share.

The threat of new entrants for B&M European Value Retail is generally considered low due to substantial barriers. These include the immense capital required for store acquisition, inventory, and logistics, as well as the difficulty in replicating B&M's established economies of scale in purchasing and distribution. Furthermore, strong brand recognition and customer loyalty built over years present a significant hurdle for any newcomer attempting to gain market share.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High upfront costs for store setup, inventory, and logistics. | Significant deterrent, requiring substantial funding. | Average cost to open a new retail store: $100,000 - $1M+ (excluding logistics). |

| Economies of Scale | B&M's purchasing power and efficient supply chain offer cost advantages. | New entrants struggle to match cost efficiencies, impacting pricing. | B&M's large order volumes allow for lower supplier prices than smaller competitors. |

| Brand Recognition & Loyalty | Established customer base and strong value proposition. | Difficult for new brands to attract and retain customers. | B&M's continued investment in brand presence aims to maintain market share. |

| Logistics & Supplier Relationships | Decades of built-up networks and efficient operations. | Replicating these complex systems is time-consuming and costly. | B&M's robust inventory turnover indicates strong supplier collaborations. |

Porter's Five Forces Analysis Data Sources

Our B&M European Value Retail Porter's Five Forces analysis is built upon a foundation of robust data, including annual financial reports, market research from firms like Mintel and Euromonitor, and industry-specific trade publications.