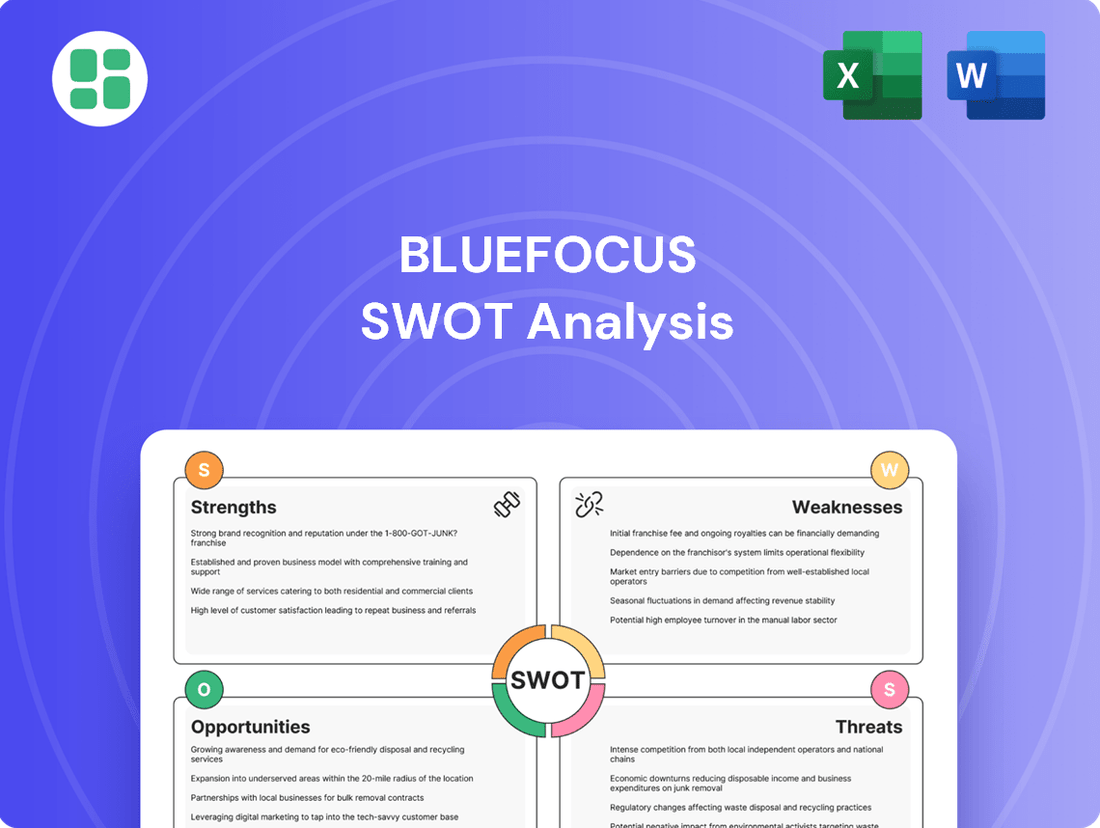

BlueFocus SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BlueFocus Bundle

BlueFocus boasts a strong brand reputation and extensive industry experience, positioning it well in the competitive PR landscape. However, understanding the nuances of its market position, potential threats, and untapped opportunities requires a deeper dive.

Want the full story behind BlueFocus's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BlueFocus Communication Group's market leadership is undeniable, evidenced by its impressive RMB 60.797 billion revenue in 2024. This achievement not only marks a significant milestone as the first Chinese marketing firm to exceed RMB 60 billion but also highlights its substantial market share and dominant industry position.

Further solidifying its strength, BlueFocus is recognized among the top ten global marketing and communications groups. This global standing underscores its extensive operational scale and widespread influence across international markets.

BlueFocus has aggressively pursued an AI-first strategy since 2023, developing its proprietary BlueAI model. This strategic shift has seen BlueAI integrated into over 95% of the company's operational workflows, dramatically enhancing efficiency and productivity.

The success of this AI integration is evident in the company's 2024 financial performance, where AI-driven revenue experienced a tenfold increase, reaching RMB 1.2 billion. This substantial growth underscores BlueFocus's effective commercialization of its advanced AI capabilities.

BlueFocus's extensive global footprint is a significant strength, fueled by its Globalization 2.0 strategy. This has led to impressive overseas growth, with international advertising revenue hitting RMB 48.333 billion in 2024, representing almost 80% of the company's total income.

The company's strategic establishment of local offices in nine countries, coupled with key partnerships with global giants like Meta, Google, and TikTok for Business, underscores its commitment to international markets. This widespread international presence not only diversifies revenue streams but also effectively reduces exposure to risks tied to any single region.

Comprehensive Integrated Services

BlueFocus boasts a robust suite of integrated communication services, covering everything from digital marketing and public relations to advertising and brand management. This broad offering allows them to serve a wide range of clients across various industries, including IT, automotive, consumer goods, and finance, on a global scale.

Their ability to deliver end-to-end marketing strategies is a significant advantage. For instance, in 2023, BlueFocus reported total revenue of approximately RMB 7.6 billion (around USD 1.05 billion), indicating strong market demand for their comprehensive solutions.

- Integrated Service Portfolio: Covers digital marketing, PR, advertising, media buying, and brand management.

- Global Reach: Caters to diverse client needs across IT, automotive, consumer goods, and finance sectors worldwide.

- Client Retention & Acquisition: Holistic strategies enhance client loyalty and attract new business opportunities.

Strong Vision for Future Growth

BlueFocus, under CEO Fei Pan, is charting an ambitious course towards RMB 100 billion in scale. This growth is fundamentally tied to the deep integration of AI and technology, signaling a strategic pivot towards becoming a premier AI-powered Marketing Technology Company.

This clear vision provides a vital roadmap for BlueFocus, guiding its innovation efforts and ensuring sustained expansion. The company is positioning itself to lead in the rapidly evolving global marketing landscape by embracing technological advancements.

- Ambitious Scale Target: Aiming for RMB 100 billion in scale.

- AI and Technology Integration: Core strategy for growth and transformation.

- Strategic Vision: Becoming a leading AI-powered Marketing Technology Company.

BlueFocus's market dominance is underscored by its RMB 60.797 billion revenue in 2024, a first for a Chinese marketing firm. Its AI-first strategy, with BlueAI in over 95% of workflows, drove a tenfold increase in AI-driven revenue to RMB 1.2 billion in 2024. This global player, with 80% of its 2024 income from international markets (RMB 48.333 billion), strategically operates in nine countries and partners with tech giants like Meta and Google.

| Metric | 2024 Value (RMB) | Significance |

|---|---|---|

| Total Revenue | 60.797 billion | Market leadership, first Chinese firm over 60 billion |

| AI-Driven Revenue | 1.2 billion | Tenfold increase, effective AI commercialization |

| International Revenue | 48.333 billion | Almost 80% of total income, strong global presence |

What is included in the product

Analyzes BlueFocus’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address competitive weaknesses, turning strategic challenges into opportunities.

Weaknesses

BlueFocus Intelligent Communications Group has faced challenges with its return on capital employed (ROCE), which has trended downwards over the last five years. This suggests that the company may not be effectively utilizing its capital to generate profits. For instance, as of September 2023, BlueFocus reported a ROCE of 0.7%, significantly lower than the typical performance seen in the broader media industry.

While the company's forward-looking 'All in AI' strategy is designed to boost profitability, this historical underperformance in capital efficiency highlights a critical area requiring ongoing attention and strategic adjustments to ensure better returns on invested capital.

BlueFocus's substantial reliance on overseas advertising, which accounted for approximately 80% of its revenue in 2024, presents a significant weakness. This concentration in international markets, heavily influenced by major advertising platforms, makes the company vulnerable to global economic downturns, geopolitical instability, and shifts in platform regulations.

BlueFocus operates in a digital marketing arena that is incredibly crowded, both worldwide and specifically in China. With tens of thousands of companies vying for attention, the industry is highly fragmented. This intense competition directly impacts pricing power and necessitates constant innovation to stay relevant.

The sheer number of competitors means BlueFocus must continually invest in new technologies and creative strategies to differentiate itself. Failure to do so risks losing market share to more agile or aggressive players. For instance, in 2023, the global digital advertising market was estimated to be worth over $600 billion, a figure that underscores the vastness and the number of entities seeking a piece of that pie.

Challenges in Talent Acquisition and Retention

BlueFocus faces significant hurdles in attracting and retaining the specialized talent needed for its aggressive 'AI-First' transformation. The rapid pace of technological change demands a fundamental shift in how the company approaches its workforce, creating a competitive disadvantage in securing AI and advanced tech professionals.

While embedding AI into recruitment and compensation is a forward-thinking move, the intense competition for skilled individuals in the AI sector presents a persistent operational challenge. This talent war is a critical factor impacting the company's ability to execute its strategic vision effectively.

- Talent Gap: The demand for AI specialists often outstrips supply, a trend expected to continue through 2025, making recruitment difficult.

- Retention Costs: High demand for tech talent drives up salaries and benefits, increasing operational costs for retention efforts.

- Skill Obsolescence: The rapid evolution of AI means continuous upskilling is required, posing a challenge for both employees and the company's training budget.

Exposure to Geopolitical and Regulatory Risks

BlueFocus's significant operations in China and its global reach expose it to the volatile landscape of geopolitical and trade tensions. For instance, the ongoing US-China trade friction and potential sanctions could disrupt supply chains and market access, impacting revenue streams. In 2023, the company's reliance on the Chinese market, which accounts for a substantial portion of its revenue, makes it particularly vulnerable to these cross-border economic shifts.

Furthermore, the company faces increasing regulatory complexities, especially concerning data privacy and cybersecurity. China's evolving legal framework, such as the Personal Information Protection Law (PIPL) and the Cybersecurity Law, imposes stringent requirements on data handling and cross-border data transfer. Non-compliance can lead to significant fines and reputational damage, as seen with other tech firms operating in the region.

Adapting to these unpredictable policy changes and ensuring robust compliance necessitates continuous investment in legal, IT, and operational infrastructure. This can directly impact operational flexibility and increase overall costs, potentially affecting profitability. For example, the need to localize data storage and processing for different markets adds complexity and expense to BlueFocus's global operations.

- Geopolitical Sensitivity: BlueFocus's extensive presence in China makes it susceptible to international trade disputes and political instability, potentially affecting its access to global markets and talent.

- Regulatory Hurdles: Navigating China's increasingly stringent data privacy and cybersecurity regulations, such as PIPL, requires significant compliance efforts and investments, posing a risk of penalties for non-adherence.

- Operational Costs: The need to adapt to evolving global and regional regulations and geopolitical shifts can lead to increased operational expenses and reduced agility in business strategy.

BlueFocus's financial performance is hampered by its declining return on capital employed (ROCE), which stood at a mere 0.7% as of September 2023. This indicates inefficient use of capital, a concern given the industry average. The company's heavy reliance on overseas advertising, making up about 80% of its 2024 revenue, also presents a weakness. This concentration leaves BlueFocus exposed to global economic volatility and platform policy changes.

What You See Is What You Get

BlueFocus SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The marketing landscape is being reshaped by AI, creating a massive opportunity estimated in the trillions of RMB for companies like BlueFocus. This technological shift allows for unprecedented efficiency in campaign execution and content generation.

BlueFocus's commitment to an 'All in AI' strategy, supported by its proprietary BlueAI model, is designed to capture this burgeoning market. The company anticipates AI-driven revenue to hit between RMB 3 to 5 billion by 2025, a testament to the transformative power of AI in marketing.

This AI integration enables highly personalized content creation and provides real-time insights, allowing for dynamic campaign adjustments and improved customer engagement.

BlueFocus's Globalization 2.0 strategy is a significant opportunity, targeting high-growth emerging markets like Southeast Asia, Europe, and Latin America. This diversification aims to boost its global market share and revenue streams by tapping into new customer bases. The company plans to establish more branches in these regions to solidify its presence and reach.

BlueFocus is actively integrating generative AI, VR, and blockchain to drive the commercialization of xR+AI across various industries. This strategic focus positions the company to capitalize on emerging markets and deliver innovative marketing solutions.

The company's dedicated metaverse division and BLUEBOX xR Studios are expected to achieve significant advancements in areas like cultural tourism, virtual production, and digital infrastructure development. These developments are key to unlocking new revenue streams and enhancing BlueFocus's competitive edge.

By leveraging these advanced technologies, BlueFocus is set to tap into the rapidly growing metaverse market, which is projected to reach $1.6 trillion by 2030 according to Bloomberg Intelligence. This expansion into virtual and augmented reality experiences, powered by AI, offers substantial opportunities for growth and diversification.

Increasing Demand for Hyper-Personalized Marketing

The market's increasing demand for hyper-personalized marketing presents a significant opportunity for BlueFocus. As consumer expectations shift towards tailored experiences, companies that can effectively deliver individualized messages stand to gain a competitive edge. BlueFocus’s existing strengths in data analytics and artificial intelligence are crucial assets in capitalizing on this trend, enabling the creation of highly relevant campaigns.

Leveraging this demand can translate directly into improved business outcomes. By providing marketing that resonates deeply with individual consumers, BlueFocus can help its clients achieve:

- Enhanced Engagement: Personalized content typically sees higher interaction rates compared to generic advertising.

- Improved Conversion Rates: Tailored messaging speaks directly to consumer needs and preferences, increasing the likelihood of purchase.

- Greater Customer Loyalty: Consumers feel more valued when brands understand and cater to their specific requirements, fostering long-term relationships.

- Data-Driven Optimization: The ongoing collection and analysis of consumer data allow for continuous refinement of marketing strategies, maximizing ROI.

Strategic Acquisitions and Partnerships

BlueFocus has a proven track record of growth through strategic mergers and acquisitions, a strategy it actively pursues. For instance, in 2023, the company continued to forge alliances with key technology players, including Adobe and KLING AI, to bolster its digital marketing and AI capabilities. These collaborations are crucial for expanding its service portfolio and solidifying its market standing.

These strategic partnerships are instrumental in accelerating BlueFocus's evolution into an AI-driven marketing technology leader. By integrating advanced AI solutions and expanding its service offerings, the company is better positioned to achieve its ambitious revenue target of RMB 100 billion. The synergy from these alliances directly supports its long-term vision and competitive advantage in the rapidly evolving marketing landscape.

- Strategic Acquisitions: BlueFocus has a history of successful M&A activity, which it intends to continue.

- Technology Alliances: Partnerships with firms like Adobe and KLING AI in 2023 enhance technological capabilities.

- Service Expansion: These collaborations broaden the company's service offerings in the digital marketing space.

- Revenue Growth: Strategic moves are designed to support the company's goal of reaching RMB 100 billion in revenue.

The significant market opportunity driven by AI in marketing, estimated in the trillions of RMB, allows BlueFocus to leverage its 'All in AI' strategy and proprietary BlueAI model. The company projects AI-driven revenue to reach RMB 3 to 5 billion by 2025, highlighting the transformative impact of AI on campaign efficiency and content creation.

BlueFocus's Globalization 2.0 strategy targets emerging markets like Southeast Asia, Europe, and Latin America, aiming to increase global market share and revenue. The company is also integrating generative AI, VR, and blockchain for xR+AI commercialization, with its metaverse division and BLUEBOX xR Studios poised to advance cultural tourism and virtual production.

The increasing demand for hyper-personalized marketing presents a key opportunity, with BlueFocus's data analytics and AI strengths enabling tailored campaigns that boost engagement, conversion rates, and customer loyalty.

Strategic mergers, acquisitions, and technology alliances, such as those with Adobe and KLING AI in 2023, are crucial for expanding BlueFocus's service portfolio and solidifying its market position. These collaborations are vital for achieving the company's ambitious revenue target of RMB 100 billion.

Threats

The digital marketing landscape is incredibly crowded, with thousands of agencies vying for attention. BlueFocus contends with over 97,000 active global competitors, a mix of established giants and nimble startups. This sheer volume of competition puts constant pressure on pricing strategies and demands ongoing investment in new services to stay relevant.

This intense rivalry directly impacts BlueFocus’s ability to secure and retain clients. With so many options available, clients can be more selective, forcing agencies to differentiate themselves through specialized expertise or superior results. The need to constantly innovate and adapt to evolving digital trends is paramount to avoid losing market share.

BlueFocus faces significant threats from the evolving regulatory environment, especially concerning data privacy and cybersecurity. Operating in China and globally means navigating a complex web of rules, including China's strict data localization mandates and the Great Firewall, which can impact international operations and data flow.

Non-compliance with these increasingly stringent regulations, such as China's Personal Information Protection Law (PIPL) which came into full effect in late 2021, can lead to substantial fines and operational disruptions. For instance, a data breach or violation could result in penalties equivalent to up to 5% of annual revenue or RMB 50 million, whichever is higher, as stipulated by PIPL.

The continuous adaptation to these rapidly changing laws and the implementation of robust, ethical data handling practices represent an ongoing challenge and a considerable cost for BlueFocus. This necessitates significant investment in compliance infrastructure and legal expertise to mitigate risks.

The relentless march of technological change, particularly in AI and MarTech, presents a significant threat to BlueFocus. The company must maintain a robust commitment to R&D and talent acquisition to keep pace with rapid advancements and emerging competitors. For instance, while BlueFocus reported a 10.5% revenue growth in Q3 2023, this growth could be jeopardized if they fail to integrate cutting-edge AI tools as effectively as newer, more agile players.

Failure to adapt swiftly to these disruptive innovations could lead to a significant erosion of BlueFocus's competitive edge. Existing service offerings might quickly become outdated, impacting their market position and client retention. Staying ahead requires proactive investment in retraining staff and adopting new platforms, a challenge given the estimated $150 billion global AI market growth projected by 2027.

Economic Slowdown and Reduced Marketing Budgets

Global economic uncertainties and a projected deceleration in China's GDP growth, potentially impacting consumer spending and business investment, could lead to reduced marketing and advertising expenditures by clients. For instance, China's GDP growth forecast for 2024 has been revised downwards by several institutions, reflecting these headwinds.

Economic downturns or market volatility can directly impact BlueFocus's revenue and profitability as businesses, particularly those in discretionary spending sectors, tend to cut marketing budgets first. This necessitates the company to remain agile and continuously demonstrate a clear return on investment (ROI) for its services to retain and attract clients during challenging economic periods.

- Projected Slowdown: Analysts anticipate a moderation in global economic growth for 2024-2025, with particular concern for regions heavily reliant on export or domestic consumption.

- Client Budget Cuts: Historically, during economic contractions, marketing and advertising budgets are among the first to face reductions, directly impacting agencies like BlueFocus.

- Demonstrating Value: The imperative for BlueFocus is to quantify and communicate the tangible business outcomes of its marketing strategies, proving essential value rather than a discretionary expense.

Client Decision Fatigue and Shift in Consumer Behavior

Chinese consumers are increasingly overwhelmed by the sheer volume of online advertising, leading to 'decision fatigue.' This phenomenon means that simply bombarding potential clients with more messages is less effective. In 2024, studies indicated that over 60% of consumers felt inundated by digital ads, making it harder for brands to capture attention.

There's a clear and growing preference for authentic, user-generated content (UGC) over polished corporate branding. This trend is particularly strong among younger demographics, who trust peer recommendations and reviews more than traditional advertising. For instance, platforms that heavily feature UGC often see higher engagement rates, with some reports showing UGC driving conversion rates up to 7x higher than traditional ads.

This shift requires companies like BlueFocus to constantly adapt their marketing strategies. Relying solely on conventional advertising models may prove less impactful. The challenge lies in creating campaigns that feel genuine and provide value, rather than just pushing products. This necessitates a strategic pivot towards influencer marketing, community building, and content that genuinely resonates with consumer needs and preferences.

- Decision Fatigue: Over 60% of consumers report feeling overwhelmed by online ads in 2024.

- UGC Preference: User-generated content can boost conversion rates by up to 7x compared to traditional ads.

- Strategy Shift: Marketing must prioritize authenticity and value to combat consumer saturation.

BlueFocus faces intense competition, with over 97,000 global rivals, demanding constant innovation and competitive pricing. Evolving data privacy regulations, like China's PIPL, pose compliance risks and potential fines, necessitating significant investment in legal and technical safeguards.

Rapid technological advancements, particularly in AI, threaten to make existing services obsolete if BlueFocus fails to adapt quickly. Economic slowdowns and reduced client spending, especially in China, could directly impact revenue, requiring a strong demonstration of ROI.

Consumers are experiencing ad fatigue, with over 60% feeling overwhelmed in 2024, and show a growing preference for authentic user-generated content, which can boost conversions up to seven times higher than traditional ads.

SWOT Analysis Data Sources

This SWOT analysis for BlueFocus is built upon a foundation of robust data, including their official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded view of BlueFocus's competitive landscape and internal capabilities.