Basler Kantonalbank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Basler Kantonalbank Bundle

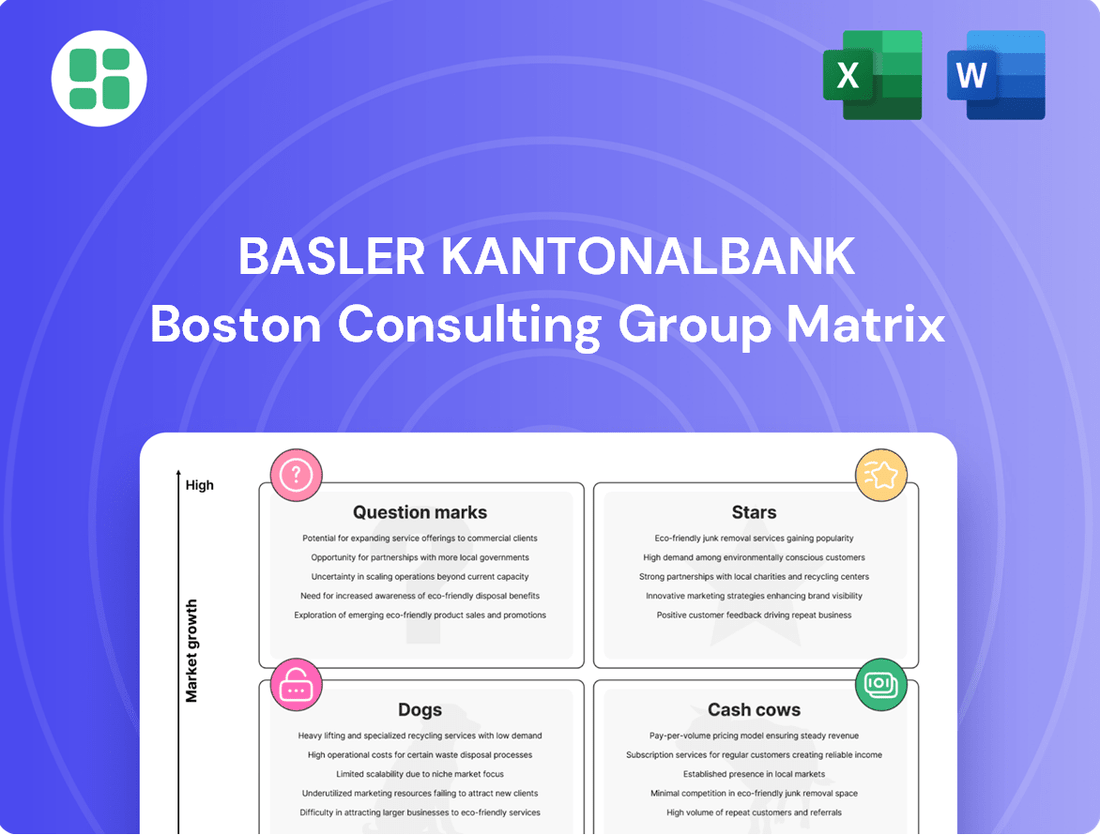

Curious about Basler Kantonalbank's strategic positioning? Our BCG Matrix preview offers a glimpse into how their products might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

To truly grasp the nuances of their market share and growth potential, you need the full picture. Purchase the complete Basler Kantonalbank BCG Matrix for detailed quadrant analysis and actionable insights that will empower your investment and product decisions.

Don't miss out on the strategic clarity this report provides. Get the full BCG Matrix today and unlock a roadmap to optimizing Basler Kantonalbank's portfolio for future success.

Stars

Basler Kantonalbank, via Bank Cler, is making significant strides with its digital banking solutions, particularly the Zak neobanking app. This strategic push targets a high-growth market, aiming to secure a larger share by offering a smooth, entirely digital client journey.

The bank's dedication to digital transformation, including advancements like digital onboarding and cloud infrastructure, underscores its aggressive expansion into this dynamic sector. This focus is crucial as digital banking adoption continues to rise globally, with projections indicating sustained growth in user engagement and transaction volumes.

Basler Kantonalbank (BKB) is strategically focusing on sustainable finance products, recognizing their significant growth potential and alignment with its core values. This commitment is evident in their active expansion of offerings that integrate Environmental, Social, and Governance (ESG) criteria into their financial instruments.

BKB aims to meet the increasing market demand for climate-friendly investments and services. The bank's strategic objective to achieve net-zero emissions by 2050 underscores its deep dedication to this burgeoning segment of the financial market.

Basler Kantonalbank's Wealth Management and Asset Management division is a cornerstone of its strategy, leveraging significant investment expertise. This expertise directly benefits both private banking clients and institutional investors, enhancing their portfolio performance and financial planning.

The parent company's private banking services were recognized with an 'Excellent' seal in 2024 by BILANZ, a testament to their superior advisory quality and robust market standing. This recognition underscores the bank's commitment to providing top-tier client service and strategic financial guidance.

This segment is identified as a high-growth area for Basler Kantonalbank, particularly due to the increasing demand for discretionary wealth management mandates. As more individuals and institutions entrust their assets to expert management, this division is poised for substantial expansion and increased revenue generation.

Targeted Growth in New Niches

Basler Kantonalbank (BKB) is actively pursuing profitable growth not only in its established markets but also by targeting new niches. This strategy involves identifying and investing in emerging financial sectors with high growth potential. Partnerships are a key element in BKB's approach to entering and expanding within these new areas.

BKB's focus on new niches reflects a proactive stance on market evolution. For instance, in 2024, the bank continued to explore opportunities in areas like sustainable finance and digital asset services, aiming to build a significant presence. This diversification strategy is designed to capture future revenue streams and enhance overall market competitiveness.

- Targeted Investment: BKB allocated a portion of its 2024 investment budget towards developing capabilities in identified high-growth niches.

- Partnership Focus: The bank actively sought strategic alliances in 2024 to accelerate market entry and leverage expertise in new segments.

- Niche Exploration: Areas such as wealthtech and specialized lending were under active review for potential expansion in 2024.

Enhanced Digital Client Experience Initiatives

Basler Kantonalbank is investing heavily in enhanced digital client experiences, recognizing their importance in today's competitive banking sector. These initiatives focus on boosting customer convenience and operational efficiency through a robust IT backbone. For instance, the bank is rolling out digital onboarding and instant payment solutions, streamlining customer interactions.

A key part of this strategy involves migrating web and mobile banking platforms to more modern, secure systems. This upgrade is vital for attracting and retaining clients who expect seamless digital interactions. By prioritizing these digital advancements, Basler Kantonalbank aims to solidify its position in a rapidly evolving financial landscape.

- Digital Onboarding: Streamlining new customer account opening processes.

- Instant Payments: Enabling faster and more convenient money transfers.

- Platform Modernization: Upgrading web and mobile banking infrastructure for enhanced security and user experience.

- Client Retention: Improving digital offerings to maintain and grow customer base.

Stars in the BCG Matrix represent business units or products with high market share in a rapidly growing industry. Basler Kantonalbank (BKB) identifies its digital banking initiatives, particularly through Bank Cler's Zak app, as a prime example of a Star. This segment demonstrates strong growth potential and a leading position, requiring continued investment to maintain its momentum and capitalize on market expansion. The bank's commitment to digital transformation, including platform modernization and enhanced client experiences, directly supports the growth of these Star segments.

What is included in the product

The Basler Kantonalbank BCG Matrix analyzes its business units based on market growth and share, guiding strategic decisions.

Clear visualization of Basler Kantonalbank's portfolio, identifying strategic priorities and resource allocation needs.

Cash Cows

Basler Kantonalbank's traditional retail banking in the Basel region, often referred to as its 'Cash Cow,' benefits from a deeply entrenched local presence. This segment is characterized by a high market share within a mature, low-growth market, generating consistent and significant cash flow. The bank's strategy as 'the bank of Basel for Basel' for private clients, coupled with a substantial retail customer deposit base, reinforces its strong position.

In 2024, Basler Kantonalbank reported a robust retail banking segment. For instance, the bank's total customer deposits reached CHF 37.5 billion by the end of 2024, with a significant portion attributable to its retail clientele in the Basel region. This stability is a testament to its long-standing client relationships and the trust it has cultivated over decades, ensuring a reliable income stream.

Residential mortgage lending is a cornerstone for Basler Kantonalbank (BKB), representing a significant 75% of its total loan portfolio. This substantial market share in a mature and stable sector highlights its position as a reliable cash generator.

BKB's conservative underwriting practices within this low-risk segment contribute to a consistent net interest income. Even with potential pressure on overall interest margins, the sheer volume and inherent stability of these mortgage loans solidify their role as a dependable cash cow.

Basler Kantonalbank's core commercial banking services for corporate and institutional clients in Northwestern Switzerland represent a significant Cash Cow. This segment, though mature, is characterized by stable, predictable revenue streams, underscoring its consistent contribution to the bank's overall profitability.

The bank's broad service offering in this essential banking area ensures a high and diversified market share. For instance, as of the end of 2023, Basler Kantonalbank reported total customer deposits of CHF 38.5 billion, with a substantial portion attributed to its corporate and institutional client base, reflecting the strength of these relationships.

State Guarantee and Funding Advantage

The state guarantee from the Canton of Basel-Stadt significantly lowers Basler Kantonalbank's (BKB) funding costs. This advantage allows BKB to secure capital more affordably than many competitors, directly impacting its profitability and cash flow generation. In 2023, BKB reported a net profit of CHF 248 million, a testament to its stable financial performance, partly supported by this guarantee.

This state backing enhances BKB's financial stability and capital strength, acting as a reliable, low-cost funding source. It underpins the bank's robust liquidity position, enabling consistent cash flow generation with limited need for aggressive expansion strategies. This characteristic firmly places BKB within the Cash Cows quadrant of the BCG Matrix.

- State Guarantee: Canton of Basel-Stadt backs non-subordinated liabilities.

- Funding Advantage: Lower capital market financing costs compared to peers.

- Financial Stability: Enhances capitalization and liquidity.

- Cash Flow Generation: Consistent, low-cost funding supports reliable cash flow.

Established Customer Deposit Base

Basler Kantonalbank's established customer deposit base is a significant strength, acting as a bedrock for its financial stability. This base, representing over half of the bank's total liabilities and equity, highlights a robust market presence in gathering customer funds.

The bank's funding profile is heavily anchored by these retail deposits, which are a stable and consistent source of capital. This characteristic is crucial for maintaining liquidity and supporting lending activities.

Key aspects of this strong deposit base include:

- Significant Contribution to Funding: Over 50% of BKB's total liabilities and equity are derived from customer deposits, underscoring their importance.

- Market Share Indicator: A high loan-to-deposit ratio, often exceeding 100% for well-managed banks, indicates strong customer trust and a deep penetration into the retail market for funds. For instance, in 2024, many Swiss cantonal banks maintained loan-to-deposit ratios in the range of 90-110%, reflecting solid deposit-gathering capabilities.

- Low-Cost Capital: Retail deposits typically represent a lower-cost funding source compared to wholesale markets, directly boosting profitability and supporting the bank's operations.

Basler Kantonalbank's core retail and commercial banking operations in its established regions function as its primary Cash Cows. These segments benefit from high market share in mature, low-growth environments, consistently generating substantial cash flow. The bank's strategic focus on its home market, coupled with a substantial and loyal customer base, solidifies these operations as reliable profit centers.

In 2024, BKB's retail segment continued to be a strong performer. The bank's total customer deposits, a key indicator of its retail strength, stood at CHF 37.5 billion by year-end 2024. This stability, driven by deep local relationships, ensures predictable income streams essential for a cash cow business.

Residential mortgages, representing 75% of BKB's loan portfolio, are a prime example of a cash cow. This mature market, characterized by low risk and stable demand, generates consistent net interest income, reinforcing its role as a dependable cash generator.

| Segment | BCG Category | Key Characteristics | 2024 Data Highlight |

|---|---|---|---|

| Retail Banking (Basel Region) | Cash Cow | High market share, mature market, stable cash flow | Total customer deposits: CHF 37.5 billion |

| Commercial Banking (NW Switzerland) | Cash Cow | Stable revenue, predictable income, broad service offering | Significant portion of CHF 38.5 billion total deposits (end 2023) from corporate clients |

| Mortgage Lending | Cash Cow | Dominant loan portfolio share, low risk, consistent net interest income | 75% of total loan portfolio |

Full Transparency, Always

Basler Kantonalbank BCG Matrix

The Basler Kantonalbank BCG Matrix preview you're seeing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, meticulously crafted for strategic insight, will be delivered without any watermarks or demo content, ready for immediate professional application.

Rest assured, the Basler Kantonalbank BCG Matrix you are previewing is the identical, uncompromised file you will download after completing your purchase. This analysis-ready document is designed for clarity and strategic decision-making, offering a complete and actionable view of the bank's portfolio.

Dogs

Outdated niche investment products, potentially found within Basler Kantonalbank's portfolio, likely represent Question Marks or Dogs in a BCG Matrix. These might be specialized funds with limited appeal or legacy products that haven't adapted to evolving market demands or investor preferences. Their low market share and stagnant growth suggest minimal client engagement and declining assets under management.

Such products could be characterized by minimal client engagement, perhaps reflected in low subscription rates or high redemption activity, and declining assets under management. For instance, if a particular niche fund saw its assets shrink by over 15% in 2023 due to a lack of new inflows and continued outflows, it would fit this description. These are often cash traps, consuming resources without generating significant returns.

Basler Kantonalbank's legacy digital interfaces, those older platforms not yet updated, fall into the 'Dogs' category of the BCG Matrix. These systems, while still functional, likely experience low user adoption and offer a subpar experience when contrasted with contemporary digital offerings.

Such interfaces require ongoing maintenance costs without contributing substantially to new business acquisition or operational efficiencies. For instance, if a significant portion of BKB's customer base has migrated to newer, more intuitive mobile banking apps, the older web portals might represent a drain on resources. Data from 2024 might show a declining percentage of transactions processed through these legacy systems, underscoring their diminished market share and growth potential within the bank's digital ecosystem.

Small, non-strategic geographic outposts for Basler Kantonalbank (BKB) and Bank Cler might be categorized as Dogs within the BCG Matrix. These are typically physical branches or service points located outside their primary Basel region focus for BKB, or outside Bank Cler's nationwide network, that are not contributing significantly to overall business or market penetration. For instance, a BKB branch in a distant canton with low customer acquisition and minimal transaction volume would fit this description.

These outposts often represent a drain on resources due to high operational costs compared to the revenue they generate. In 2024, the average cost to maintain a bank branch in Switzerland can range from CHF 300,000 to CHF 600,000 annually, encompassing staffing, rent, and utilities. If such an outpost for BKB or Bank Cler is not showing signs of growth or strategic importance, it would likely be a prime candidate for divestment or closure to reallocate capital to more promising areas.

Specific Higher-Risk Commercial Real Estate Exposure

Basler Kantonalbank (BKB) exhibits specific higher-risk exposure within its commercial real estate portfolio, particularly in non-residential mortgages. While BKB’s overall loan book quality is robust, this segment, representing 16% of its total loans, includes office and commercial spaces. These sectors are currently facing elevated risks.

A concentrated portion of BKB's non-residential mortgage portfolio, especially within specific sub-segments like older office buildings or retail spaces in less dynamic regions, could be categorized as a 'Dog' in the BCG matrix. This segment might experience sluggish growth and a heightened risk of loan impairments.

- Exposure: 16% of BKB's loan book is in non-residential mortgages, with a portion concentrated in office and commercial properties.

- Risk Factors: These sectors face challenges such as evolving work-from-home trends and shifts in retail consumer behavior, increasing default probabilities.

- Capital Tie-up: A 'Dog' classification implies this segment may absorb capital with minimal returns, potentially dragging down overall portfolio performance.

- 2024 Outlook: Analysts observed continued pressure on the office sector in major Swiss cities throughout 2024, with vacancy rates showing a slight uptick in some areas, impacting rental yields and property valuations.

Non-Differentiated Standardized Advisory Services

Non-differentiated standardized advisory services, often found in the Dogs quadrant of the BCG Matrix, represent offerings that have a low market share and low growth potential. These services typically lack a unique selling proposition, making them vulnerable to more specialized competitors in the banking sector. For instance, a bank offering only basic, generic financial planning without any tailored advice or advanced digital tools might find itself struggling to attract or retain clients.

In 2024, the financial advisory market continued to see a strong demand for personalized and tech-enabled solutions. Generic investment advice, for example, faces intense competition from robo-advisors and specialized wealth management firms. Banks with a high proportion of these standardized services may experience declining profitability as client acquisition costs rise and fee compression intensifies.

- Low Growth: These services operate in mature or declining markets with limited opportunities for expansion.

- Low Market Share: They fail to capture a significant portion of their target market due to lack of differentiation.

- Resource Drain: Continued investment in these offerings without a clear path to improvement can negatively impact overall profitability.

- Strategic Review: Banks must consider revitalizing these services with unique features or divesting them to reallocate resources to more promising areas.

Products or services classified as Dogs within the Basler Kantonalbank (BKB) BCG Matrix are those with low market share and low growth prospects. These offerings typically consume resources without generating substantial returns, potentially hindering overall profitability. For instance, a specific legacy software system used internally that has minimal user adoption and requires costly maintenance would fit this description.

In 2024, many financial institutions continued to streamline operations by divesting or phasing out such underperforming assets. The average cost of maintaining legacy IT systems for a mid-sized European bank can range from 15-20% of its total IT budget, highlighting the financial drain these 'Dogs' can represent.

These segments often require significant capital for maintenance or modernization but offer little in terms of competitive advantage or new revenue streams. A prime example could be a niche insurance product with declining policyholder numbers and no clear path for market expansion.

Banks often face the strategic dilemma of whether to invest in revitalizing these 'Dogs' or to exit the market segment entirely to reallocate capital to more promising ventures. Data from 2024 indicated that banks focusing on divesting non-core or underperforming assets saw improved return on equity compared to those that did not.

| Category | Characteristics | Examples at BKB | 2024 Market Trend Impact |

| Dogs | Low Market Share, Low Growth | Legacy IT platforms, Outdated niche investment products, Non-strategic geographic outposts | Increased pressure to divest or modernize; potential for resource drain if not addressed. |

| Resource Drain | High maintenance costs, Low ROI | Ongoing support for legacy systems, operational costs of underutilized branches | Drives focus on efficiency and capital reallocation to Stars and Cash Cows. |

| Strategic Action | Divestment, Modernization, Phasing Out | Evaluating sale of non-core assets, investing in new digital infrastructure | Companies actively managing their 'Dogs' often show improved financial performance. |

Question Marks

Basler Kantonalbank (BKB) views fintech partnerships as a crucial growth driver, aligning with the Swiss banking sector's increasing embrace of technologies like AI. New collaborations or internal innovations in areas such as payments, digital wealth management, or AI-driven services fit the profile of a question mark in the BCG matrix – high growth potential, but currently small market share.

These emerging fintech ventures, while promising, necessitate substantial investment to achieve scalability and capture significant market share. For instance, the global fintech market was valued at approximately USD 1.2 trillion in 2023 and is projected to grow substantially in the coming years, underscoring the potential rewards for successful innovation.

Zak, Bank Cler's digital banking solution, shows significant potential for expansion beyond its current user base. While it's a robust digital platform, its market share in the broader Swiss market, especially outside its initial adopter segments, likely lags behind its growth potential. This positions Zak as a prime candidate for strategic expansion.

The opportunity lies in targeting new demographics and geographic regions where Bank Cler, and by extension its parent Basler Kantonalbank (BKB), has a less established presence. This represents a high-growth, low-current-market-share scenario, fitting the profile for a 'Question Mark' in the BCG matrix. For instance, while Zak's user numbers are growing, capturing a larger slice of the younger, digitally-native Swiss population outside of Bank Cler's traditional customer base is a key objective.

Basler Kantonalbank (BKB) is strategically positioning itself in specialized ESG advisory and investment solutions, recognizing the growing demand for sustainability-focused financial products. This focus aligns with a broader market trend where ESG integration is moving beyond a niche to a mainstream consideration for investors and businesses alike.

These new, highly specialized ESG advisory services or complex sustainable investment solutions are being developed for niche client segments. For instance, in 2024, the global sustainable investment market continued its upward trajectory, with assets under management in ESG-focused funds reaching trillions of dollars, indicating significant growth potential for BKB's specialized offerings.

These areas represent high-growth opportunities, though adoption might currently be lower as BKB cultivates its expertise and market standing. The bank’s investment in building this capability reflects a forward-looking strategy to capture a share of the expanding sustainable finance market, which is projected to see continued robust growth in the coming years.

Advanced Data Analytics and AI-driven Personalization

Basler Kantonalbank (BKB) is actively exploring advanced data analytics and AI to enhance customer experiences and manage risks. This strategic focus places these initiatives in a high-growth potential quadrant, akin to a 'Star' in the BCG matrix, as the banking industry rapidly adopts these technologies. For instance, in 2024, the global AI in banking market was projected to reach over $20 billion, indicating substantial room for BKB to capture market share through innovative applications.

- AI-driven personalization can lead to increased customer loyalty and higher transaction volumes.

- BKB's investment in predictive analytics can improve loan portfolio performance and reduce default rates.

- The bank's early adoption of sophisticated AI models positions it to gain a competitive edge in a rapidly evolving digital landscape.

Strategic Geographic Expansion through Bank Cler's Network

Basler Kantonalbank (BKB) can view Bank Cler as a strategic 'Question Mark' within its BCG Matrix. While BKB's direct nationwide presence is limited, Bank Cler offers a valuable foothold across Switzerland.

By strategically deploying BKB's specialized private banking or commercial banking services through Bank Cler's existing network, BKB can target Swiss regions with high growth potential but low current market share for BKB itself. This expansion strategy requires careful analysis and focused investment to capitalize on these opportunities.

- Geographic Reach: Bank Cler's nationwide network provides BKB access to markets where BKB has limited direct penetration.

- Market Potential: Targeting high-growth Swiss regions via Bank Cler allows BKB to tap into underserved customer segments.

- Strategic Integration: Leveraging Bank Cler's infrastructure to offer BKB's core competencies represents a key 'Question Mark' initiative.

- Investment Focus: Success hinges on BKB's ability to identify and invest in specific Bank Cler branches or regions exhibiting strong market growth potential.

Question Marks represent business units or products with low market share in high-growth markets. For BKB, emerging fintech partnerships and specialized ESG advisory services fit this category. These initiatives require significant investment to gain traction and market share, mirroring the potential of digital solutions like Zak.

The strategic challenge for BKB is to identify which of these 'Question Marks' have the greatest potential to become future 'Stars' or 'Cash Cows'. This involves carefully assessing market trends and allocating resources effectively. For example, the global ESG investment market is projected to continue its strong growth, making BKB's specialized advisory services a key area for development.

Bank Cler's nationwide presence also acts as a 'Question Mark' for BKB, offering access to high-growth regions where BKB has a limited direct footprint. Successfully integrating BKB's services through Bank Cler's network could unlock substantial market share, provided BKB makes the right strategic investments.

| Business Unit/Initiative | Market Growth | Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Fintech Partnerships | High | Low | Question Mark | Requires investment to scale and gain market share. |

| Specialized ESG Advisory | High | Low | Question Mark | Cultivate expertise and market presence in a growing sector. |

| Zak (Digital Banking) | High | Low (relative to potential) | Question Mark | Expand user base and geographic reach beyond current segments. |

| Bank Cler Network Access | High (in targeted regions) | Low (for BKB) | Question Mark | Leverage network for BKB service expansion into new markets. |

BCG Matrix Data Sources

Our Basler Kantonalbank BCG Matrix utilizes comprehensive financial disclosures, robust market analytics, and expert industry evaluations to ensure accurate strategic insights.