Bidcorp Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidcorp Group Bundle

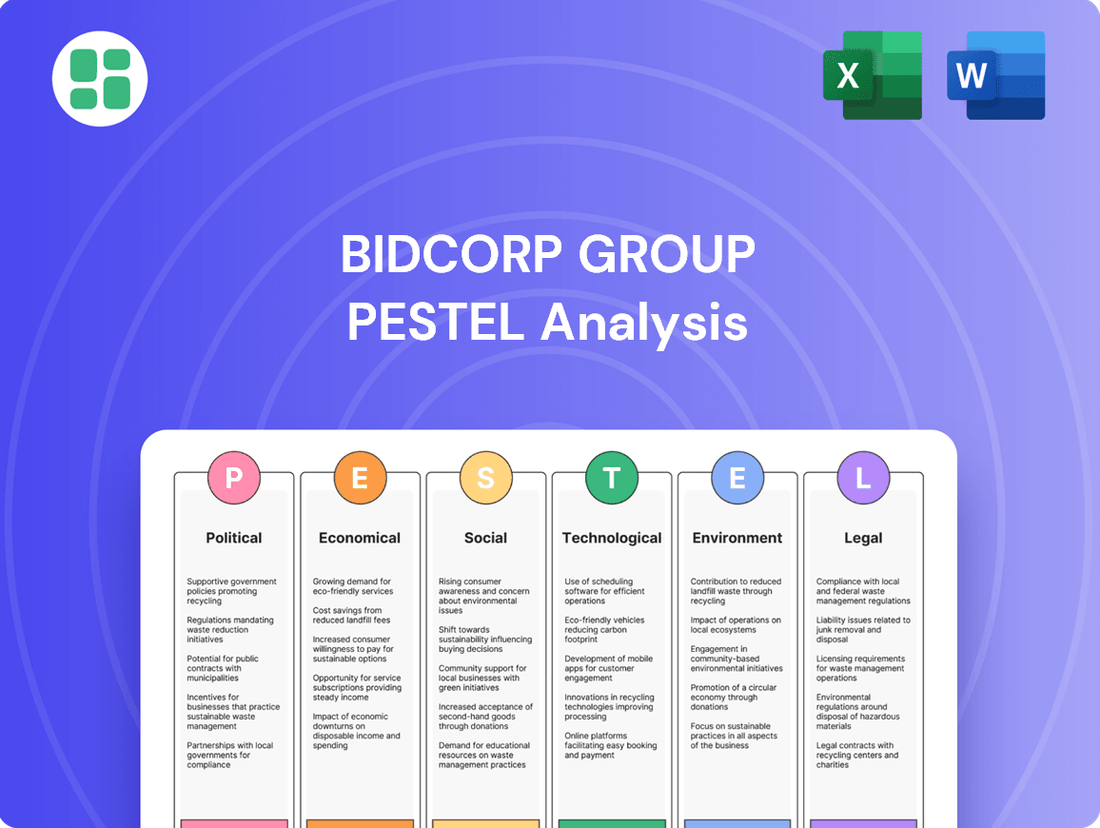

Navigating the complex global food service landscape requires a keen understanding of external forces. Our PESTLE analysis for Bidcorp Group meticulously dissects the political, economic, social, technological, legal, and environmental factors that are shaping its operations and future growth. Discover how regulatory shifts, economic volatility, and evolving consumer preferences present both challenges and opportunities.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis of Bidcorp Group. Understand the critical external trends impacting its supply chain, market access, and operational efficiency. Equip yourself with actionable intelligence to inform your investment decisions and strategic planning. Download the full report now and unlock Bidcorp Group's external landscape.

Political factors

Bidcorp's extensive global footprint means it's deeply influenced by political shifts and trade regulations across its many markets, from Africa to Europe. For instance, changes in import duties or the imposition of new trade barriers in key European markets could directly affect Bidcorp's supply chain costs and pricing strategies throughout 2024 and into 2025, impacting its profitability.

The company's decentralized structure allows its local operating companies to navigate these varying political environments effectively, adapting to specific national policies. This agility is crucial as governments worldwide continue to review and potentially alter trade agreements and local content requirements, a trend likely to persist through 2025.

The global food industry faces increasingly strict food safety regulations, exemplified by the U.S. FDA's Food Traceability Rule (FSMA 204) and parallel EU initiatives. These regulations emphasize enhanced preventive measures and robust traceability throughout the supply chain.

Bidcorp must diligently adhere to these complex legal frameworks across its vast operations to guarantee product integrity and uphold consumer confidence. Compliance necessitates substantial investment in advanced tracking technologies and comprehensive staff training.

Government fiscal policies, such as corporate tax rates and import duties, significantly shape Bidcorp's operational costs and strategic investment choices across its global footprint. Changes in these policies can alter the financial viability of markets, influencing decisions on expansion or divestment, as seen in Bidcorp's 2023 decision to exit its German operations due to scaling cost challenges.

Geopolitical Risks and Supply Chain Disruptions

Geopolitical events are a significant concern for Bidcorp. For instance, the ongoing Red Sea crisis, which intensified in late 2023 and continued into 2024, has severely disrupted global shipping. This has led to increased transit times and elevated freight costs for many businesses, including those in the food service sector that Bidcorp operates within. Such disruptions directly impact Bidcorp's logistics efficiency and the cost of sourcing and distributing its wide range of products.

These external political factors present ongoing challenges for Bidcorp's supply chain resilience and its ability to maintain competitive pricing in various markets. The company has already acknowledged experiencing impacts from such events, necessitating the development and implementation of adaptive strategies to mitigate these risks. For example, rerouting shipments or securing alternative suppliers are measures that become crucial in navigating these turbulent geopolitical landscapes.

- Red Sea Crisis Impact: Shipping costs on key East-West routes saw substantial increases in early 2024, with some reports indicating a doubling of rates compared to pre-crisis levels.

- Supply Chain Volatility: Geopolitical tensions contribute to increased uncertainty regarding product availability and lead times, affecting inventory management for food service distributors.

- Bidcorp's Adaptation: The group’s operational agility is tested as it navigates these disruptions, potentially impacting margins and service levels if not managed effectively.

Political Interventions in Local Markets

Government policies, such as incentives for local sourcing or import restrictions on specific food items, directly shape Bidcorp's supply chain and distribution networks. For instance, in 2024, several African nations implemented new regulations aimed at boosting domestic agriculture, potentially impacting Bidcorp's import volumes for certain commodities in those regions.

Bidcorp’s decentralized operational structure is a key advantage, enabling its local entities to adapt swiftly to these political shifts. This autonomy allows them to customize product assortments and procurement strategies to align with local market demands and evolving political landscapes, ensuring continued relevance and compliance.

- Government Support for Local Sourcing: Policies promoting local procurement can reduce reliance on imports and foster stronger relationships with regional suppliers.

- Product Restrictions: Bans or tariffs on specific food products necessitate strategic adjustments in sourcing and product offerings to maintain market presence.

- Decentralized Model Adaptation: Local management teams can effectively navigate and respond to country-specific political interventions and consumer preferences.

Political stability and government trade policies are critical for Bidcorp's international operations. For example, the company's significant presence in Europe means that shifts in EU trade agreements or national import/export regulations, particularly concerning food products, directly impact its cost of goods and market access throughout 2024 and into 2025.

Government fiscal policies, including corporate tax rates and import duties, continue to influence Bidcorp's profitability and investment decisions across its diverse markets. For instance, changes in tax regimes, like those observed in some African nations in 2023 and expected to continue into 2024, can significantly alter the attractiveness of operating in those regions.

Geopolitical events, such as the ongoing disruptions in global shipping routes observed in early 2024, directly affect Bidcorp's supply chain efficiency and costs. The company's ability to navigate these political volatilities, including potential trade sanctions or regional conflicts, remains paramount for maintaining operational continuity and competitive pricing.

Bidcorp's decentralized structure allows local management to adapt to country-specific political landscapes and regulatory changes effectively. This agility is essential as governments worldwide refine policies on food safety, local sourcing, and environmental standards, trends that are expected to intensify through 2025.

| Market Region | Key Political Factor (2024-2025) | Potential Impact on Bidcorp | Example (Illustrative) |

|---|---|---|---|

| Europe | EU Trade Policy & National Regulations | Supply chain costs, market access, compliance burden | Increased tariffs on imported dairy products in a key European market |

| Africa | Fiscal Policies & Local Sourcing Incentives | Profitability, investment decisions, supplier relations | Changes in corporate tax rates affecting net income; new regulations favoring local food producers |

| Global Shipping | Geopolitical Stability & Trade Route Security | Logistics costs, delivery times, inventory management | Continued impact of Red Sea disruptions leading to higher freight rates for imported goods |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Bidcorp Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to support strategic decision-making and identify opportunities within the global food service and distribution industry.

A concise PESTLE analysis for Bidcorp Group that simplifies complex external factors, enabling faster strategic decision-making and reducing the burden of extensive research.

This PESTLE analysis serves as a pain point reliever by offering a clear, actionable overview of the external landscape, allowing Bidcorp to proactively address challenges and capitalize on opportunities without getting lost in granular detail.

Economic factors

Bidcorp's financial performance is closely linked to the economic growth in the countries where it operates, as this directly impacts consumer spending power and the demand for food services. Even with economic headwinds in several key markets, Bidcorp demonstrated resilience by achieving revenue growth of 7.1% in constant currency for the first half of its 2025 fiscal year (ending December 31, 2024).

The global foodservice industry is expected to expand, fueled by trends such as the rise of online food delivery services and a growing consumer preference for healthier menu options. This positive market outlook provides a favorable backdrop for Bidcorp's continued expansion and revenue generation.

Persistent inflationary pressures, particularly on non-food costs like labor, continue to impact Bidcorp's operational expenses, even as food inflation moderates. The company has noted that cost inflation, driven by wage pressures from labor availability, especially in warehouse and driver categories, remains sticky.

This necessitates aggressive management of costs and refinement of sales mix to maintain gross profit margins. For instance, in the fiscal year ending June 2024, Bidcorp highlighted that wage inflation was a significant factor impacting its cost base, contributing to the need for strategic pricing and operational efficiencies.

Bidcorp's global operations mean it's constantly navigating the ups and downs of currency exchange rates. When the South African Rand weakens against other currencies where Bidcorp operates, its reported earnings in Rand can look stronger, and vice-versa. This volatility is a key economic factor that requires careful financial management.

For instance, in the first half of fiscal year 2024, Bidcorp reported headline earnings per share growth of 13.5%. This resilience, despite operating in numerous countries with varying currency strengths, underscores the effectiveness of their financial strategies, likely including hedging mechanisms to mitigate adverse currency movements.

Consumer Price Sensitivity and Competition

As economic conditions tighten globally, consumers and businesses alike are becoming more mindful of prices. This heightened price sensitivity directly fuels increased competition within the foodservice distribution sector. Bidcorp itself has acknowledged this dynamic, indicating instances where it has strategically lowered margins to secure sales volumes and expand its market share.

This environment necessitates a careful balancing act for Bidcorp. The company must offer competitive pricing to attract and retain customers, especially in markets experiencing economic headwinds. However, this must be achieved without unduly eroding profitability, which is crucial for sustained investment and growth. For instance, in the fiscal year ending June 2024, Bidcorp reported a slight increase in its gross profit margin to 23.5%, suggesting a successful navigation of these pressures, though ongoing vigilance is required.

- Increased Customer Price Sensitivity: Economic pressures are making customers more reluctant to pay premium prices, forcing distributors to compete more on cost.

- Aggressive Pricing Strategies: Bidcorp has been willing to accept lower profit margins in certain markets to protect or grow its market share, a common tactic in competitive environments.

- Margin vs. Volume Dilemma: The core challenge is finding the sweet spot between offering attractive prices to maintain sales volume and ensuring sufficient profit margins to remain financially healthy.

- Competitive Landscape: The foodservice distribution market is inherently competitive, and economic downturns often intensify this competition as players fight for a shrinking or slower-growing pie.

Interest Rates and Investment Climate

Rising interest rates globally present a significant challenge for businesses by increasing finance costs, which can dampen investment in working capital and expansion. Bidcorp has directly experienced this, reporting higher net finance charges due to both increased investment activities and a generally elevated interest rate environment. For instance, in the first half of fiscal year 2024, Bidcorp’s net finance costs rose notably compared to the prior year.

Despite these headwinds, Bidcorp remains committed to strategic growth. The company continues to allocate substantial capital towards expanding its distribution capacity and pursuing bolt-on acquisitions. These investments are crucial for Bidcorp to maintain its market position and drive future revenue growth in a competitive landscape.

- Higher Finance Costs: Global interest rate hikes directly translate to increased borrowing expenses for companies like Bidcorp.

- Impact on Investment: Elevated finance charges can make new projects and working capital investments less attractive.

- Bidcorp's Response: The group is navigating this by continuing significant investments in infrastructure and acquisitions.

- Fiscal Year 2024 Performance: Bidcorp’s interim results for FY24 highlighted an increase in net finance charges, reflecting the prevailing economic conditions.

Economic growth directly influences Bidcorp's revenue through consumer spending. Despite economic challenges in some markets, Bidcorp achieved 7.1% revenue growth in constant currency for H1 FY2025 (ending December 31, 2024).

Inflation, particularly wage inflation, impacts Bidcorp's costs. For FY2024, wage inflation was a significant factor, necessitating careful cost management and pricing strategies.

Currency fluctuations affect Bidcorp's reported earnings. For H1 FY2024, Bidcorp reported headline earnings per share growth of 13.5%, demonstrating resilience amidst currency volatility.

Rising interest rates increase Bidcorp's finance costs. In H1 FY2024, net finance costs rose, impacting investment decisions, though Bidcorp continues strategic capital allocation.

| Economic Factor | Impact on Bidcorp | Data Point (FY2024/2025) |

|---|---|---|

| Economic Growth | Drives consumer spending and demand for foodservice. | 7.1% revenue growth (constant currency) in H1 FY2025. |

| Inflation (Wage) | Increases operational expenses, particularly labor costs. | Wage inflation noted as a significant factor impacting costs in FY2024. |

| Currency Exchange Rates | Affects reported earnings in Rand. | 13.5% headline EPS growth in H1 FY2024 despite currency volatility. |

| Interest Rates | Increases finance costs, potentially impacting investment. | Net finance costs rose in H1 FY2024 due to higher rates and investments. |

What You See Is What You Get

Bidcorp Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Bidcorp Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the critical external forces shaping Bidcorp's future success.

Sociological factors

Consumers are increasingly focused on health, wellness, and sustainability, which directly impacts their food purchasing decisions. This means a growing demand for healthier, plant-based, and ethically sourced food products. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to reach over $160 billion by 2030, indicating a significant shift.

Bidcorp, operating as a major foodservice distributor, needs to adapt its product portfolio to meet these changing consumer preferences. The modern consumer archetype prioritizes taste, affordability, and nutrition, but increasingly also considers environmental impact and social responsibility when making choices.

This evolving landscape is prompting menu expansions that feature a wider array of plant-based proteins and diverse ethnic ingredients. For example, in 2024, many restaurant chains reported significant growth in their vegetarian and vegan offerings, with some seeing these categories contribute over 10% to their overall sales.

Busy lives are making convenience a top priority, leading to a surge in online food delivery and direct-to-consumer services within the foodservice sector. This shift means Bidcorp's clients, like restaurants and caterers, are increasingly turning to digital channels for their ordering and stock management needs.

This evolving consumer preference isn't just about large-scale events; it's also fueling a comeback for smaller, more intimate catering gatherings, further emphasizing the need for accessible and efficient ordering systems.

Consumer habits are evolving, with a noticeable trend towards less frequent traditional restaurant dining, especially during peak lunch hours, largely influenced by the rise of remote and hybrid work models. This shift directly impacts the demand for different foodservice segments, pushing distributors like Bidcorp to adapt by offering a broader range of solutions, including robust catering and convenient take-out options to meet these new demands.

Furthermore, there's a growing consumer appetite for more personalized and unique dining experiences, moving beyond simple meal consumption to seeking memorable occasions. This preference for experiential dining is reshaping menu development and service delivery expectations across the entire foodservice industry.

Cultural Preferences and Dietary Diversity

Cultural preferences are significantly shaping the food industry, driving a demand for greater diversity. As globalization continues, consumers are increasingly seeking out a wider array of cuisines and specialty food items, reflecting a more interconnected world. This trend is evident in the growing popularity of ethnic foods and the desire for customized dining experiences.

Bidcorp's operational structure, which emphasizes decentralization, is well-suited to capitalize on these evolving cultural preferences. By empowering its local businesses, Bidcorp can effectively adapt its product and service offerings to meet specific regional tastes and cultural demands. This localized approach allows for greater agility in responding to shifts in consumer behavior.

- Growing Demand for Ethnic Foods: In 2024, the global ethnic food market was valued at approximately $138.5 billion and is projected to grow, indicating a strong consumer interest in diverse culinary options.

- Customization in Dining: A 2025 survey revealed that over 60% of consumers are willing to pay more for food that caters to their specific dietary needs or cultural preferences, highlighting the importance of tailored menus.

- Bidcorp's Decentralized Advantage: Bidcorp's model allows its subsidiaries, such as catering companies and food distributors, to source and offer products that align with local cultural traditions and emerging food trends.

- Specialty Product Growth: The market for specialty food products, including organic, gluten-free, and plant-based options, continues to expand, driven by health consciousness and diverse lifestyle choices.

Ethical Consumption and Transparency

Consumers are increasingly scrutinizing how their food is produced and where it comes from, demanding greater transparency about sourcing, labor practices, and environmental footprints. This growing awareness fuels a demand for sustainably produced goods, compelling foodservice companies like Bidcorp to weave sustainability into their core brand messaging and operational practices.

Bidcorp addresses these concerns by adhering to a comprehensive supplier code of conduct. This code mandates suppliers to meet specific standards related to environmental protection, human rights, and ethical production methods, ensuring alignment with consumer expectations for responsible business practices.

- Consumer Demand for Transparency: In 2024, surveys indicated that over 70% of consumers consider a company's ethical practices when making purchasing decisions in the food sector.

- Sustainability Integration: Bidcorp's commitment to sustainability is reflected in its supplier audits, which in 2023 covered environmental impact and fair labor practices for 85% of its key suppliers.

- Ethical Sourcing: The group actively promotes ethical sourcing, with initiatives aimed at ensuring fair wages and safe working conditions throughout its supply chain, a trend that gained further traction throughout 2024.

Sociological factors significantly shape consumer food choices, with a strong emphasis on health, convenience, and ethical considerations. This translates into increased demand for plant-based options and transparency in sourcing, with the global plant-based food market projected to exceed $160 billion by 2030.

Cultural diversity is also a key driver, fueling a growing appetite for ethnic cuisines and customized dining experiences. Bidcorp's decentralized structure allows it to effectively cater to these varied regional tastes and emerging food trends.

Consumer habits are shifting towards convenience and personalized experiences, impacting traditional dining models and increasing reliance on digital ordering and delivery services.

Ethical practices and sustainability are paramount, with a majority of consumers considering a company's social responsibility in their purchasing decisions.

| Trend | Description | 2024/2025 Data/Projection |

|---|---|---|

| Health & Wellness | Demand for healthier, plant-based, and ethically sourced foods. | Global plant-based food market projected to reach over $160 billion by 2030. |

| Cultural Diversity | Growing interest in ethnic cuisines and personalized dining. | Global ethnic food market valued at approx. $138.5 billion in 2024. |

| Convenience | Rise of online food delivery and direct-to-consumer services. | Increased reliance on digital channels for food ordering and management. |

| Ethical Consumption | Consumer scrutiny of sourcing, labor practices, and environmental impact. | Over 70% of consumers consider ethical practices in food purchasing (2024 surveys). |

Technological factors

Digital transformation is rapidly reshaping the food distribution landscape, with companies increasingly leveraging digital solutions to optimize operations and secure a competitive advantage. This acceleration is evident as businesses integrate advanced technologies to enhance efficiency and customer engagement.

Bidcorp is actively participating in this trend, likely directing significant investment towards modernizing its foundational business systems. This includes upgrades to Enterprise Resource Planning (ERP), inventory management, and order processing platforms, aiming to create more streamlined workflows and foster better communication channels with both its customer base and its network of suppliers.

The surge in e-commerce is fundamentally altering food distribution, with foodservice operators increasingly adopting online platforms for ordering and inventory control. Bidcorp's capacity to deliver smooth digital ordering and real-time order tracking is now a customer expectation.

In 2024, Bidcorp's digital sales channels are projected to see continued growth, reflecting the broader industry trend where online ordering accounts for a significant portion of new customer acquisition. For instance, many food distributors are reporting that over 60% of their new business comes through digital channels.

Furthermore, Bidcorp is leveraging artificial intelligence to anticipate and shape customer behavior on its e-commerce sites, aiming to enhance user experience and drive sales. This proactive approach is crucial in a market where digital engagement directly correlates with market share.

Bidcorp is seeing significant adoption of automation and robotics across its foodservice operations. This includes everything from automated warehousing and logistics to advanced kitchen automation solutions. These technologies are vital for improving efficiency and managing the persistent challenge of sticky cost inflation and labor shortages.

The integration of robotics directly addresses the need to reduce labor costs, a key operational expense for large distributors. For instance, in 2024, the global robotics market in food and beverage processing was projected to reach over $7 billion, indicating substantial investment and growth in this area. This trend allows Bidcorp to maintain competitive pricing and operational stability.

Data Analytics for Efficiency and Forecasting

Data analytics is transforming how Bidcorp manages its supply chain. By analyzing vast datasets, the group can refine supplier interactions, streamline inventory, and shorten delivery times, leading to significant operational efficiencies. For instance, advanced analytics can predict demand fluctuations with greater accuracy, allowing Bidcorp to optimize stock levels and minimize waste.

AI-powered data analysis offers Bidcorp the capability to proactively influence market trends and customer behavior. This predictive power enables better strategic planning, from product assortment to promotional activities. In 2024, companies leveraging AI for demand forecasting saw an average improvement of 10-15% in forecast accuracy, directly impacting reduced stockouts and overstock situations.

Bidcorp's focus on data analytics is crucial for maintaining a competitive edge. Key benefits include:

- Enhanced Supplier Relationship Management: Data-driven insights facilitate more collaborative and efficient partnerships.

- Optimized Inventory Control: Predictive analytics minimize holding costs and prevent stockouts.

- Reduced Lead Times: Streamlined logistics and better forecasting contribute to faster order fulfillment.

- Improved Demand Forecasting: AI models enable more accurate predictions, supporting better resource allocation.

Food Safety and Traceability Technologies

Technology is increasingly vital for ensuring food safety and quality across the distribution chain, a trend amplified by stringent regulations and consumer desires for transparency. Bidcorp's commitment to these areas necessitates investment in sophisticated tools.

Key technological advancements include real-time temperature monitoring systems and data loggers, crucial for maintaining the cold chain integrity of perishable goods. For instance, the global cold chain logistics market was valued at approximately $175 billion in 2023 and is projected to grow substantially, highlighting the importance of these investments.

Furthermore, adopting blockchain technology can provide unparalleled supply chain visibility, allowing for the tracking of products from origin to consumer. This enhances trust and accountability. AI-powered predictive risk management offers another avenue for Bidcorp to proactively identify and mitigate potential food safety issues before they arise, bolstering compliance and brand reputation.

- Advanced Temperature Monitoring: Real-time tracking of product temperatures to prevent spoilage and ensure safety.

- Blockchain for Traceability: Creating an immutable record of product movement, enhancing transparency and recall efficiency.

- AI-Driven Risk Assessment: Utilizing artificial intelligence to predict and manage potential food safety hazards.

- Data Logging Solutions: Comprehensive digital records of handling conditions throughout the supply chain.

Technological advancements are fundamentally reshaping food distribution, with Bidcorp investing in digital transformation for operational efficiency and enhanced customer engagement. The group is upgrading core systems like ERP and inventory management, recognizing that digital ordering and real-time tracking are now customer expectations, with online channels driving significant new business in 2024.

Bidcorp is increasingly adopting automation and robotics, from warehousing to kitchen solutions, to combat cost inflation and labor shortages. The global robotics market in food and beverage processing, projected to exceed $7 billion in 2024, underscores the strategic importance of these investments for maintaining competitive pricing.

Data analytics, particularly AI-driven forecasting, is crucial for Bidcorp's supply chain optimization, improving demand prediction accuracy by 10-15% in 2024, thus reducing stockouts and waste.

Technology ensures food safety and quality, with real-time monitoring and blockchain for traceability becoming essential. The global cold chain logistics market, valued at approximately $175 billion in 2023, highlights the ongoing investment in maintaining product integrity.

Legal factors

The food industry, including Bidcorp, faces escalating food safety regulations. A prime example is the FDA's Food Traceability Final Rule (FSMA Section 204), which significantly enhances record-keeping and traceability requirements. This rule aims to improve the speed and effectiveness of recalls during contamination events.

Bidcorp must diligently ensure its operations and those of its supply chain partners adhere to these intricate mandates. Non-compliance can lead to significant penalties and reputational damage, underscoring the critical nature of robust food safety protocols.

Bidcorp's global operations mean it must navigate a complex web of labor laws, from minimum wage stipulations to working condition standards and labor availability rules in every country it operates in.

The company faces ongoing wage pressures, especially for essential roles like warehouse staff and drivers, which directly contribute to its persistent sticky cost inflation.

For instance, in 2024, many developed nations saw minimum wage increases, impacting Bidcorp's operational costs, while labor shortages in sectors like logistics continued to drive up wages, a trend projected to persist into 2025.

Bidcorp's significant acquisition activities, a key driver of its market share expansion, are closely scrutinized under competition laws across its operating regions. These regulations are designed to safeguard against monopolistic practices and ensure a level playing field for all market participants. For instance, during the fiscal year ending June 30, 2024, Bidcorp continued its strategy of bolt-on acquisitions, aiming to bolster its presence in existing and new markets. The company's ability to integrate these acquisitions while adhering to merger control thresholds and antitrust guidelines is paramount to its continued growth and market positioning.

Data Privacy and Protection Regulations

Bidcorp operates in a landscape increasingly shaped by data privacy and protection regulations, notably GDPR in Europe. As digitalization accelerates, the company's handling of customer data is under scrutiny. Failure to comply can lead to significant penalties, impacting both financial performance and reputation.

Ensuring the secure storage and processing of sensitive information is paramount for maintaining customer trust. This includes implementing robust cybersecurity measures and transparent data usage policies. For instance, the European Union's General Data Protection Regulation (GDPR) mandates strict rules for data handling, with fines reaching up to 4% of annual global turnover or €20 million, whichever is higher.

- GDPR Fines: Potential penalties for non-compliance can be substantial, reaching up to 4% of global annual revenue or €20 million.

- Customer Trust: Secure data handling is crucial for maintaining confidence among Bidcorp's diverse customer base.

- Digitalization Impact: Increased reliance on digital platforms necessitates stringent adherence to evolving privacy laws.

Environmental Compliance and Reporting Standards

Bidcorp operates within a complex web of environmental laws across its global footprint, covering areas like emissions control, responsible waste disposal, and efficient resource utilization. These regulations are constantly evolving, requiring continuous adaptation to maintain compliance. For instance, in 2024, many jurisdictions strengthened their reporting requirements for greenhouse gas emissions, impacting companies like Bidcorp that have extensive supply chains.

The company faces an increasing demand for transparent sustainability reporting, aligning with global frameworks such as the Global Reporting Initiative (GRI) or the Task Force on Climate-related Financial Disclosures (TCFD). This growing non-financial reporting burden necessitates robust data collection and verification processes to meet stakeholder expectations and regulatory scrutiny, with many investors now prioritizing ESG (Environmental, Social, and Governance) performance.

- Stricter Emission Standards: Many operating regions are implementing more stringent limits on industrial emissions, requiring investment in cleaner technologies.

- Waste Management Regulations: Enhanced rules on waste reduction, recycling, and disposal are impacting operational costs and logistics.

- Resource Consumption Monitoring: Growing emphasis on water and energy efficiency necessitates detailed tracking and reporting of usage.

- ESG Reporting Mandates: An increasing number of regulatory bodies are introducing mandatory ESG disclosure requirements, adding to compliance complexity.

Bidcorp's global expansion through acquisitions is subject to rigorous antitrust reviews and competition laws, aiming to prevent market monopolization. The company must navigate varying merger control thresholds and regulatory approvals across different jurisdictions, which can influence the timeline and feasibility of strategic deals. For example, during the fiscal year ending June 30, 2024, Bidcorp continued its strategy of bolt-on acquisitions, each requiring careful assessment against competition guidelines in its key markets.

Environmental factors

Climate change is a significant concern for Bidcorp, as extreme weather events, shifting temperatures, and altered precipitation patterns directly threaten food safety and supply chains. These changes can disrupt agricultural yields, impacting the availability and quality of products Bidcorp sources.

For instance, the World Meteorological Organization reported in early 2024 that 2023 was the warmest year on record, with global average temperatures 1.45°C above pre-industrial levels, underscoring the increasing volatility suppliers face. This poses risks to Bidcorp's product sourcing, especially for those relying on specific climatic conditions or operating in water-stressed regions, potentially leading to price volatility and supply shortages.

Sustainability is a major concern in the foodservice sector, with a growing demand for reduced food waste, greener operations, and sustainable packaging. Bidcorp is actively working towards its Net Zero 2050 goal, having pledged to cut its Scope 1 and 2 carbon emissions further.

In 2023, Bidcorp reported a 12% reduction in food waste intensity across its operations. The company also increased its use of recycled or sustainably sourced packaging materials by 15% compared to the previous year, demonstrating tangible progress in its environmental commitments.

Bidcorp is navigating an increasing demand for environmental reporting and sustainability data from both consumers and investors. This trend is accelerating the burden of compliance for the group.

The company has demonstrated proactive engagement with environmental targets, having already exceeded its initial carbon reduction goals. Bidcorp is now focused on establishing more ambitious objectives for the period beyond 2025.

To ensure transparency and credibility, Bidcorp has committed to obtaining external assurance for its emissions reporting, underscoring its dedication to accurate environmental accounting.

Resource Scarcity and Water Management

Bidcorp's extensive supply chain, particularly in agriculture, means that water scarcity is a significant environmental consideration. Many of its suppliers are directly impacted by the availability and quality of water resources. For instance, agricultural production, a key input for many food service businesses, is highly water-dependent.

The company must monitor water management practices throughout its value chain, especially in regions facing increasing water stress. This awareness is crucial to mitigate risks associated with potential resource scarcity that could affect supply availability and pricing.

- Global Water Stress: Over 2 billion people live in countries experiencing high water stress, according to the World Resources Institute. This directly impacts agricultural output, a core supplier segment for Bidcorp.

- Agricultural Water Use: Agriculture accounts for approximately 70% of global freshwater withdrawals, highlighting the sector's vulnerability to water scarcity and its importance in Bidcorp's supply chain risk assessment.

- Climate Change Impact: Projections suggest that by 2050, between 3.4 and 4.8 billion people could be living in areas facing water scarcity, a trend that will increasingly influence food production and distribution networks.

Consumer and Investor Pressure for ESG Performance

Consumers and investors are increasingly scrutinizing companies for their environmental, social, and governance (ESG) practices. This pressure is a significant environmental factor for businesses like Bidcorp. Bidcorp acknowledges this trend, actively showcasing its ESG commitments in its annual reports and investor communications, understanding that strong ESG performance is vital for sustained value.

Bidcorp's 2024 sustainability report, for instance, detailed a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2022 baseline. Furthermore, investor interest in ESG-linked funds has surged, with global sustainable fund assets projected to reach $50 trillion by 2025, underscoring the financial imperative for companies to demonstrate robust ESG credentials.

This heightened demand translates into tangible expectations for companies:

- Demonstrable ESG Metrics: Investors seek quantifiable data on environmental impact, social responsibility, and governance structures.

- Transparency in Reporting: Clear and accessible ESG reports are crucial for building trust with stakeholders.

- Integration into Strategy: ESG considerations are no longer peripheral but are being integrated into core business strategies for long-term resilience.

- Supply Chain Scrutiny: Pressure extends to supply chains, requiring companies to ensure their partners also adhere to ESG principles.

Bidcorp faces significant environmental challenges due to climate change, impacting food safety and supply chains through extreme weather events and altered precipitation. The company is actively pursuing sustainability goals, including a Net Zero 2050 target, and has reported a 12% reduction in food waste intensity in 2023.

Water scarcity is a critical concern, with agriculture, a key supplier segment, accounting for 70% of global freshwater withdrawals. Bidcorp must manage water usage throughout its value chain to mitigate risks associated with resource availability, especially as projections indicate widespread water scarcity by 2050.

Investor and consumer demand for robust ESG performance is intensifying, pushing companies like Bidcorp towards greater transparency and integration of sustainability into core strategies. Bidcorp's 2024 sustainability report highlighted a 10% reduction in Scope 1 and 2 greenhouse gas emissions compared to 2022, aligning with growing investor interest in sustainable funds projected to reach $50 trillion by 2025.

| Environmental Factor | Impact on Bidcorp | Key Data/Initiatives (2023-2025) |

| Climate Change & Extreme Weather | Disruption to food supply chains, price volatility | 2023 warmest year on record (WMO); Bidcorp aims for Net Zero 2050 |

| Food Waste Reduction | Operational efficiency, cost savings, brand reputation | 12% reduction in food waste intensity (2023) |

| Water Scarcity | Risk to agricultural sourcing, supply availability | Agriculture uses 70% of global freshwater; 2 billion people in high water-stress areas |

| ESG Scrutiny | Investor relations, access to capital, strategic alignment | 10% GHG emission reduction (Scope 1 & 2, 2024 report vs 2022); Sustainable fund assets projected to reach $50 trillion by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bidcorp Group is built upon a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in credible and current information.