Bidcorp Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bidcorp Group Bundle

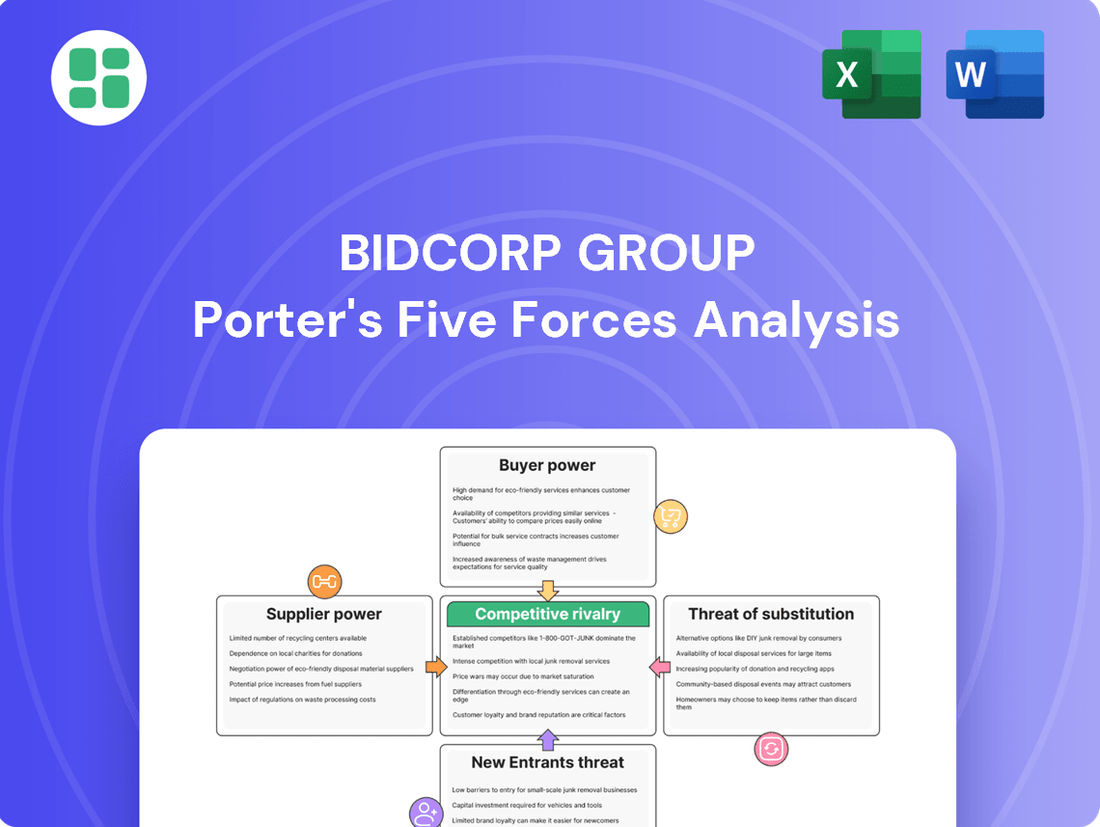

Bidcorp Group navigates a competitive landscape shaped by moderate buyer power and intense rivalry within the food service distribution sector. While supplier power is generally low due to fragmented supply chains, the threat of substitutes and new entrants demands constant strategic adaptation.

The complete report reveals the real forces shaping Bidcorp Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bidcorp's extensive global sourcing for a wide variety of food and non-food items typically weakens individual supplier power due to the often fragmented nature of food production markets. However, for highly specialized or niche products, a limited supplier pool can significantly increase their bargaining leverage.

The group's decentralized operational structure enables its local businesses to cultivate strong, long-term relationships with regional suppliers. This can effectively balance the power dynamics between Bidcorp and its suppliers, ensuring more favorable terms.

Switching suppliers for Bidcorp, a major food service distributor, can involve moderate costs. These include the time and resources needed to vet new suppliers, reconfigure procurement systems, and rigorously test for product consistency and quality assurance. For instance, in 2024, Bidcorp's extensive product portfolio means that for specialized ingredients or proprietary non-food items, the costs associated with finding and onboarding replacements could be significant, impacting operational efficiency.

While Bidcorp handles many commodity items where switching suppliers might be relatively straightforward, the complexity increases with customized product lines or items requiring specific certifications. The company's strategic emphasis on building strong, long-term relationships with its existing supplier base is a key strategy to manage and potentially reduce these switching costs, ensuring a reliable supply chain and minimizing disruptions to its diverse customer base.

The threat of suppliers moving into foodservice distribution themselves is typically low for Bidcorp. This is because it demands substantial investment in things like delivery trucks, storage facilities, and reaching a wide range of customers, which most food producers don't have. For instance, Bidcorp's extensive network across various geographies and product categories is a significant barrier to entry.

While Bidcorp operates globally, with significant operations in Europe and Africa, the capital required for a supplier to replicate its distribution capabilities is immense. Consider that in 2024, Bidcorp managed a vast fleet and warehousing network serving hundreds of thousands of customers, a scale few individual food manufacturers can match. This high cost of entry effectively limits the risk of suppliers integrating forward.

Importance of Bidcorp's Volume to Suppliers

Bidcorp's immense purchasing volume as a global foodservice distributor grants it substantial leverage over its suppliers. This scale means Bidcorp is a critical, high-volume customer for many, enabling the company to negotiate highly favorable pricing, payment terms, and delivery arrangements. For instance, in its 2023 fiscal year, Bidcorp reported revenue of over €16 billion, underscoring the sheer scale of its procurement activities.

The consistent, large-scale orders placed by Bidcorp translate into significant efficiency benefits for its suppliers. These benefits can include reduced production costs per unit, optimized logistics, and more predictable revenue streams. This symbiotic relationship, where Bidcorp's volume drives supplier efficiency, further solidifies Bidcorp's bargaining position.

- Substantial Purchasing Power: Bidcorp's global reach and significant market share translate into considerable buying power.

- Negotiating Advantage: This power allows Bidcorp to secure better pricing, terms, and delivery schedules from its suppliers.

- Supplier Efficiency Gains: Suppliers benefit from the consistent, large-volume orders, leading to operational efficiencies.

- 2023 Revenue Benchmark: Bidcorp's €16+ billion in revenue for fiscal year 2023 highlights the magnitude of its procurement impact.

Availability of Substitute Inputs

Bidcorp's access to a wide array of standard food and non-food items means that no single supplier typically holds significant sway. This broad availability of substitute inputs significantly dampens the bargaining power of most suppliers, as Bidcorp can readily switch to alternatives if prices become unfavorable. For instance, in 2024, Bidcorp's extensive supplier network for general produce and cleaning supplies allowed for competitive pricing across multiple vendors.

However, the landscape shifts for unique or branded products. When Bidcorp requires specialized ingredients or proprietary items, the availability of substitutes diminishes, granting those specific suppliers greater leverage. This is particularly relevant in niche markets where product differentiation is high, potentially leading to higher input costs for those specialized items.

The increasing emphasis on local and sustainable sourcing in 2024 also presents a dynamic. While this can foster new relationships, it may also introduce smaller, specialized suppliers who, due to their unique offerings or limited scale, could wield higher individual bargaining power within their specific product categories. This trend requires careful supplier relationship management to balance cost and strategic sourcing objectives.

- Broad Supplier Base: Bidcorp's ability to source many standard items from multiple vendors limits individual supplier power.

- Niche Product Vulnerability: Unique or branded products with fewer substitutes empower their suppliers.

- Emerging Supplier Dynamics: The rise of local and sustainable sourcing may increase the bargaining power of smaller, specialized suppliers.

Bidcorp's substantial purchasing volume, evidenced by its over €16 billion in revenue for fiscal year 2023, grants it significant leverage over suppliers. This scale allows for negotiation of favorable pricing and terms, while suppliers benefit from consistent, large orders that drive their own operational efficiencies.

While a broad supplier base for standard items limits individual supplier power, Bidcorp faces increased supplier leverage for niche or branded products with fewer substitutes. The growing trend towards local and sustainable sourcing in 2024 may also empower smaller, specialized suppliers within their specific categories.

The bargaining power of Bidcorp's suppliers is generally moderate to low due to the group's immense purchasing scale and the availability of alternative suppliers for many products. However, for highly specialized or proprietary items, or in cases where a supplier holds a unique market position, their bargaining power can increase significantly.

Switching costs for Bidcorp are moderate, involving vetting, system reconfiguration, and quality assurance for new suppliers. The threat of suppliers integrating forward into foodservice distribution is low due to the high capital investment required to match Bidcorp's extensive network and customer reach.

| Factor | Impact on Bidcorp | Supporting Data/Reasoning |

|---|---|---|

| Purchasing Volume | Low Supplier Power | Over €16 billion revenue (FY2023) indicates massive procurement scale. |

| Supplier Base Breadth | Low Supplier Power | Wide availability of substitutes for standard items in 2024. |

| Product Specialization | High Supplier Power | Niche or proprietary products with limited substitutes increase supplier leverage. |

| Switching Costs | Moderate Barrier | Costs for vetting, system changes, and quality assurance for new suppliers. |

| Forward Integration Threat | Low Threat | High capital requirements for suppliers to replicate Bidcorp's distribution network. |

What is included in the product

This analysis provides a comprehensive overview of the competitive forces shaping Bidcorp Group's operating environment, detailing threats from rivals, buyers, suppliers, new entrants, and substitutes.

Bidcorp's Five Forces analysis provides a clear, one-sheet summary of competitive pressures—perfect for quick, strategic decision-making in the food service distribution sector.

Customers Bargaining Power

Bidcorp's customer base is quite varied, ranging from small, independent restaurants and hotels to larger catering firms and healthcare facilities. This broad distribution across many different types of clients generally limits the bargaining power of any single customer. In 2024, Bidcorp's diverse portfolio, serving thousands of these smaller, independent entities, means that no single customer group dictates terms.

While some larger, national chains might possess significant purchasing power due to their volume, Bidcorp strategically balances its client relationships. The company often prioritizes working with independent businesses that appreciate its extensive service offerings and are less price-sensitive, thereby mitigating the impact of large-volume buyers.

For Bidcorp's diverse customer base, the effort and expense involved in switching food service distributors can be significant. These costs often include the time and resources needed to reconfigure ordering systems, train employees on new product assortments, and manage the potential for temporary disruptions in the supply chain. In 2024, these factors contribute to a moderate to high barrier for customers considering a change.

Bidcorp actively works to make it less appealing for customers to switch by focusing on building strong relationships and providing a superior overall experience. This includes offering valuable extras like menu planning assistance, efficient and adaptable delivery schedules, and a carefully curated product selection that meets specific client needs. Such a dedication to exceptional service fosters loyalty and makes customers less inclined to look elsewhere.

Customer price sensitivity is a significant factor for Bidcorp, especially among independent foodservice operators who often grapple with thin profit margins. In 2024, persistent cost pressures and evolving consumer spending habits mean that while Bidcorp offers value-added services, price remains a crucial element in purchasing decisions for many of its clients.

Threat of Backward Integration by Customers

The threat of customers, particularly large restaurant chains, integrating backward into food distribution is generally low for Bidcorp. This is primarily due to the significant capital investment required for warehousing, sophisticated logistics networks, and extensive procurement infrastructure. For instance, establishing a nationwide distribution network comparable to Bidcorp's would likely necessitate hundreds of millions, if not billions, in upfront capital expenditure.

While major chains may engage in some direct sourcing for specific high-volume items, the sheer complexity and capital intensity of managing a broadline food distribution business make full backward integration an impractical endeavor for the vast majority of customers. Bidcorp's established, efficient supply chain and its ability to offer a wide, diverse product range present a far more cost-effective and less risky alternative for these businesses.

- Capital Intensity: Full backward integration requires substantial investment in warehousing, cold chain logistics, and fleet management, often exceeding $100 million for a national operation.

- Operational Complexity: Managing a diverse product portfolio, fluctuating demand, and regulatory compliance in food distribution is highly complex.

- Economies of Scale: Bidcorp benefits from significant economies of scale in procurement and distribution, making its services more competitive than most individual customers could achieve.

- Focus on Core Competencies: Customers can focus on their core business of food preparation and service, outsourcing the complexities of distribution to specialists like Bidcorp.

Availability of Substitute Products/Services for Customers

Customers have a wide array of choices when sourcing food and beverages. These alternatives range from other broadline distributors and specialized suppliers to cash-and-carry wholesalers and local markets, all of which can fulfill similar needs.

The digital landscape further expands these options, with e-commerce platforms and direct-to-consumer models emerging as significant alternative sourcing channels for businesses.

Bidcorp Group differentiates itself by offering a comprehensive product range, tailoring its services to local market demands, and providing value-added services that set it apart from these numerous substitutes.

- Broadline Distributors: Competitors offering a similar wide range of products.

- Specialized Suppliers: Niche providers focusing on specific product categories.

- Cash-and-Carry Wholesalers: Outlets allowing customers to purchase goods directly and immediately.

- Local Markets: Traditional sourcing points offering fresh produce and local specialties.

- E-commerce & DTC: Online platforms and direct sales models providing alternative purchasing avenues.

Bidcorp's customer bargaining power is generally moderate, influenced by the diverse nature of its client base and the costs associated with switching distributors. While large chains can exert pressure due to volume, Bidcorp's strategy of serving many smaller, independent businesses helps to diffuse this power. In 2024, the company's focus on value-added services and strong relationships further solidifies its position.

The financial impact of customer bargaining power on Bidcorp is managed through its diversified customer portfolio and strategic service offerings. While price sensitivity remains a factor, particularly for smaller operators, the significant capital and operational hurdles for customers to switch distributors, estimated to be in the hundreds of millions for a national network, mitigate the risk of widespread defection.

Bidcorp's ability to retain customers is bolstered by its comprehensive product range and tailored services, differentiating it from numerous competitors including other broadline distributors, specialized suppliers, and emerging e-commerce platforms. The company's investment in logistics and customer relationships, evident in its operational efficiency, ensures it remains a preferred partner.

| Factor | Impact on Bidcorp | 2024 Relevance |

|---|---|---|

| Customer Concentration | Low due to diverse client base | Thousands of independent clients limit individual customer leverage. |

| Switching Costs | Moderate to High | Significant investment in new systems and training deters switching. |

| Price Sensitivity | Moderate | Affects smaller clients; offset by value-added services. |

| Threat of Backward Integration | Low | Prohibitive capital expenditure for customers to replicate Bidcorp's network. |

| Availability of Substitutes | Moderate | Numerous alternatives exist, but Bidcorp's breadth and service offer differentiation. |

Same Document Delivered

Bidcorp Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for the Bidcorp Group, detailing the competitive landscape and strategic positioning within the food service and distribution industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

The global foodservice distribution arena features a diverse competitive landscape. Bidcorp, a major international entity, contends with other large global players, alongside a multitude of regional and local distributors, each carving out their own market share.

Competitive intensity isn't uniform across all regions where Bidcorp operates. For instance, while some markets might be dominated by a few large entities, others are considerably more fragmented, presenting different strategic challenges and opportunities.

In 2024, the foodservice distribution sector continued to see consolidation, though many localized, niche operators remained significant. Bidcorp's extensive reach across Europe, Africa, and Asia means it navigates a complex web of rivals, from established multinational corporations to smaller, agile businesses deeply embedded in specific territories.

The global foodservice industry is poised for continued expansion. Projections suggest a compound annual growth rate (CAGR) ranging from 2.4% to 7.8% between 2025 and 2035, varying by specific market segments. This generally healthy growth environment tends to temper intense rivalry, as companies can increase sales through market expansion rather than solely fighting for existing market share.

However, this growth dynamic isn't without its challenges. Economic uncertainties and a moderation in food price inflation can intensify competition for sales volume. For instance, if consumer spending tightens, foodservice providers might engage in more aggressive pricing or promotional activities to capture a larger slice of a slower-growing demand pool, thereby increasing competitive pressure.

Bidcorp faces intense competition in foodservice distribution where many products are essentially commodities, making differentiation a key battleground. The group distinguishes itself by offering an exceptionally broad product assortment, complemented by value-added services. These services include light manufacturing capabilities, adaptable delivery schedules, and the cultivation of robust local connections, all facilitated by its decentralized operational structure.

The company's commitment to technological advancement is a significant differentiator. Investments in e-commerce platforms streamline customer interactions, while AI-driven analytics provide deeper market insights and operational efficiencies. This focus on technology helps Bidcorp maintain a competitive edge by enhancing customer experience and optimizing its supply chain, thereby solidifying its market position.

Exit Barriers

High capital investment in warehouses, sophisticated logistics networks, and specialized refrigeration equipment presents substantial exit barriers for foodservice distributors. These significant sunk costs make it economically challenging for companies to divest or cease operations, fostering sustained competitive intensity even when market conditions are unfavorable. For instance, establishing a modern distribution center can easily run into tens of millions of dollars, a figure that is difficult to recoup upon exit.

Bidcorp's global footprint, encompassing extensive infrastructure across numerous continents, further solidifies these exit barriers. The sheer scale of their operations, including a vast fleet of refrigerated vehicles and strategically located depots, represents an immense investment that discourages smaller players from entering or larger ones from easily withdrawing.

- High Capital Investment: Foodservice distribution requires substantial upfront capital for facilities and equipment.

- Sunk Costs: Warehouses, logistics, and specialized vehicles represent unrecoverable expenses, deterring market exit.

- Global Infrastructure: Bidcorp's extensive international network amplifies these barriers for all participants.

Strategic Objectives and Aggressiveness of Competitors

Competitors such as Sysco and Performance Food Group in North America, alongside numerous regional players worldwide, are aggressively pursuing growth through acquisitions, technological advancements, and the expansion of their service portfolios. For instance, Sysco's acquisition of Coastal Pacific Food Distributors in late 2023 bolstered its West Coast presence, demonstrating a clear strategy of market consolidation.

This heightened competitive intensity means Bidcorp must consistently innovate and enhance operational efficiency to defend its market share and drive organic growth. The ongoing pursuit of market leadership by rivals necessitates a proactive approach to service differentiation and cost management.

- Sysco's 2023 revenue reached $72.8 billion, highlighting its significant scale and market influence.

- Performance Food Group reported $18.1 billion in fiscal year 2023 net sales, showcasing its substantial footprint.

- These figures underscore the substantial resources and strategic ambition of Bidcorp's key competitors.

The competitive rivalry within the foodservice distribution sector is intense, driven by the commodity nature of many products and the need for differentiation through services and technology. Bidcorp faces significant pressure from large global players like Sysco, which reported $72.8 billion in revenue in 2023, and Performance Food Group, with $18.1 billion in net sales for fiscal year 2023. These companies, along with numerous regional competitors, are actively pursuing growth through acquisitions and service expansion, forcing Bidcorp to continuously innovate and optimize its operations to maintain its market position.

| Competitor | 2023 Revenue/Sales | Key Strategies |

|---|---|---|

| Sysco | $72.8 billion | Acquisitions, technological advancements, service portfolio expansion |

| Performance Food Group | $18.1 billion (FY23) | Market consolidation, service expansion |

| Bidcorp | €16.1 billion (FY23) | Broad product assortment, value-added services, decentralized operations, technology investment |

SSubstitutes Threaten

Restaurants and foodservice operators can bypass distributors like Bidcorp by sourcing directly from manufacturers or local farms. This is a significant threat, especially for large chains that possess the purchasing power and logistical infrastructure to manage direct procurement effectively.

For instance, some major quick-service restaurant chains have explored direct relationships with food producers to gain better control over their supply chain and potentially reduce costs. This direct sourcing trend is driven by a desire for greater transparency and cost efficiencies.

However, the convenience, extensive product variety, and consolidated delivery services provided by broadline distributors like Bidcorp remain a strong counter-argument for most independent and smaller foodservice businesses. These operators often lack the scale and resources to replicate the benefits of a comprehensive distribution network.

Cash-and-carry wholesalers present a viable substitute for Bidcorp's customers, particularly smaller businesses or those with immediate ingredient needs. These wholesalers often compete on price, potentially offering lower unit costs. However, they typically require customers to manage their own logistics and inventory, a stark contrast to Bidcorp's integrated service model.

For instance, while Bidcorp focuses on supplying a wide range of food service businesses with a full suite of services, cash-and-carry options like Makro or Metro in various European markets allow businesses to pick up goods directly. This can be attractive for businesses with flexible staffing for collection and storage, allowing them to bypass delivery fees and potentially secure lower upfront costs on certain items.

While Bidcorp operates as a broadline distributor, a significant threat comes from specialty or niche distributors. These focused players cater to specific product categories like fresh produce, seafood, or baked goods, offering specialized expertise and unique selections that can attract certain customer segments away from Bidcorp's broader offerings.

For instance, a restaurant prioritizing premium organic produce might opt for a specialized supplier, even if Bidcorp offers a wider range of general food items. This partial substitution can impact Bidcorp's market share in specific, high-value niches within the food service industry.

Technological Advancements enabling Alternative Supply Models

Technological advancements are significantly increasing the threat of substitutes in the foodservice supply chain. The proliferation of e-commerce platforms, the rise of ghost kitchens, and the expansion of direct-to-consumer food delivery services are fundamentally altering how food reaches end-users and businesses.

These digital innovations allow food producers and aggregators to bypass traditional distribution channels, creating more direct relationships with restaurants and consumers. For example, the global online food delivery market was valued at approximately $150 billion in 2023 and is projected to grow substantially, indicating a significant shift in consumer behavior and supplier engagement.

- E-commerce Growth: Online grocery and food sales continue to surge, offering alternatives to traditional wholesale purchasing.

- Ghost Kitchens: These delivery-only kitchens reduce the need for traditional restaurant infrastructure and associated supply chains.

- Direct-to-Consumer (DTC): Brands increasingly leverage DTC models, potentially shortening supply chains and reducing reliance on intermediaries.

- Data Analytics: Improved data analytics enable more efficient, localized sourcing and delivery, challenging established distribution networks.

In-house Food Preparation and Manufacturing

The threat of substitutes for Bidcorp Group, specifically concerning in-house food preparation by large customers, presents a nuanced challenge. Major hotel chains or large institutional caterers possess the scale to consider preparing more food items themselves or even establishing light manufacturing for certain products. This move directly bypasses the need for Bidcorp’s prepared or semi-prepared offerings, thereby reducing their reliance on distributors.

However, the practicalities often temper this threat. The significant capital investment, operational complexity, and specialized labor required for in-house food manufacturing typically make it an economically unviable or inefficient option for most customers. For instance, while a large hotel might experiment with making some sauces or desserts internally, the cost-benefit analysis for a full range of prepared meals usually favors outsourcing to specialists like Bidcorp.

- Customer Scale: Larger clients, such as major hotel groups, have the potential to insource some food preparation.

- Cost & Complexity Barrier: The high costs and operational demands of in-house manufacturing limit its widespread adoption as a substitute.

- Bidcorp's Value Proposition: Bidcorp's expertise in sourcing, processing, and distributing a wide variety of food products remains a significant advantage over customers attempting self-sufficiency.

The threat of substitutes for Bidcorp is multifaceted, encompassing direct sourcing by large customers, the rise of cash-and-carry wholesalers, specialized distributors, and evolving digital platforms. While these substitutes can offer cost advantages or cater to niche needs, Bidcorp's broad product range, integrated services, and logistical expertise often present a more compelling value proposition for the majority of its customer base.

The increasing prevalence of online marketplaces and direct-to-consumer models, evident in the global online food delivery market's projected growth, signifies a shift. For instance, the online food delivery market was valued at approximately $150 billion in 2023, highlighting a growing alternative to traditional distribution channels.

Furthermore, while large clients might explore in-house preparation, the significant capital and operational hurdles typically make this an impractical substitute for most. Bidcorp's ability to manage complex supply chains and offer a diverse product portfolio remains a key differentiator against these potential disruptions.

| Substitute Type | Key Characteristics | Impact on Bidcorp | Example |

|---|---|---|---|

| Direct Sourcing | Cost control, supply chain transparency | Potential loss of volume from large accounts | Major restaurant chains sourcing directly from farms |

| Cash-and-Carry | Lower unit prices, immediate availability | Competition for smaller businesses, requires customer logistics | Makro or Metro stores |

| Specialty Distributors | Niche product expertise, unique selections | Market share erosion in specific high-value segments | Premium organic produce suppliers |

| E-commerce/Digital Platforms | Convenience, wider reach, bypassing intermediaries | Disruption of traditional distribution models | Online food delivery services, DTC brands |

Entrants Threaten

Entering the global foodservice distribution sector demands immense capital. Companies need to invest heavily in warehouses, sophisticated cold storage, a vast fleet of delivery trucks, and cutting-edge inventory tech. For instance, establishing a new, fully operational distribution center can easily cost tens of millions of dollars, making it a formidable hurdle.

Bidcorp's established global network of facilities and vehicles, built over years, acts as a significant deterrent. This existing infrastructure represents a massive upfront cost that new entrants must overcome. In 2024, the average cost to build a modern, large-scale distribution center with advanced refrigeration systems was estimated to be upwards of $50 million, a sum many aspiring competitors cannot readily access.

Established players like Bidcorp leverage substantial economies of scale, particularly in their extensive procurement networks and sophisticated logistics. This allows them to secure more favorable pricing from suppliers, a crucial advantage in the food service distribution sector. For instance, Bidcorp's vast purchasing power in 2024 likely enabled cost savings that new entrants would find difficult to match without significant upfront investment and market share.

New companies entering the market face a considerable hurdle in replicating Bidcorp's operational efficiencies. Achieving comparable cost advantages in areas like warehousing, transportation, and administrative overhead requires substantial volume. Without this scale, new entrants would operate at a cost disadvantage, making it challenging to compete on price and profitability against a deeply entrenched player like Bidcorp.

Bidcorp's formidable brand loyalty, cultivated through decades of consistent service and tailored solutions, presents a significant barrier to new entrants. These deep-rooted customer relationships, often built on trust and reliability in the food service sector, are not easily replicated. For instance, Bidcorp's commitment to understanding local market nuances and providing specialized support means that new players must invest heavily in building similar levels of rapport and demonstrating superior value to even gain a foothold.

Regulatory Hurdles and Food Safety Standards

The foodservice distribution industry is heavily regulated, with strict food safety, hygiene, and transportation rules varying by country. For instance, in the European Union, regulations like HACCP (Hazard Analysis and Critical Control Points) are mandatory, requiring robust operational procedures.

Meeting these complex and ever-changing standards necessitates substantial investment in compliance infrastructure, advanced traceability systems, and rigorous quality control measures. This financial and operational burden acts as a significant deterrent for potential new companies looking to enter the market, especially those without established capital or expertise.

Bidcorp, for example, operates in markets with diverse regulatory landscapes, from the stringent food safety laws in the UK and Europe to specific requirements in African nations. The company's ability to navigate these varied regulations, often through dedicated compliance teams and significant investment in its supply chain, highlights the barrier to entry for newcomers.

- Stringent Food Safety Laws: Compliance with regulations like HACCP across different jurisdictions requires significant upfront investment in infrastructure and processes.

- Traceability Systems: Implementing and maintaining sophisticated traceability technology to track products from source to customer is a costly necessity.

- Quality Control Investment: Ensuring consistent quality and hygiene standards demands ongoing expenditure on training, audits, and specialized equipment.

- Evolving Standards: The need to adapt to constantly updating regulations adds a layer of complexity and continuous cost for new entrants.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in replicating Bidcorp's established distribution channels and supply chain infrastructure. Building a robust cold chain logistics network and efficient last-mile delivery across diverse geographies is a capital-intensive and time-consuming endeavor. For instance, Bidcorp’s extensive network allows it to serve over 150,000 customers globally, a scale that new players would find difficult to match quickly.

- High Capital Investment: Replicating Bidcorp's extensive fleet, warehousing, and technology infrastructure requires substantial upfront capital.

- Established Supplier Relationships: Bidcorp benefits from long-standing relationships with a vast array of food and non-food manufacturers, securing favorable terms and product availability.

- Geographic Reach: Bidcorp's presence in over 40 countries means new entrants must navigate complex regulatory environments and build local market expertise from scratch.

- Operational Expertise: Managing a global supply chain with diverse product requirements and customer needs demands specialized knowledge and experience that is hard to acquire rapidly.

The threat of new entrants into the global foodservice distribution market, where Bidcorp operates, is significantly mitigated by the substantial capital requirements for infrastructure like warehouses and delivery fleets. For example, establishing a new, large-scale distribution center in 2024 could cost upwards of $50 million, a substantial barrier for aspiring competitors.

Bidcorp's established economies of scale in procurement and logistics provide a cost advantage that new firms struggle to match. Their vast purchasing power in 2024 likely secured better supplier pricing, a benefit new entrants would find difficult to achieve without significant market penetration.

Furthermore, Bidcorp's deep-rooted customer loyalty and operational expertise, honed over years, create a high barrier. Replicating their efficient supply chains and navigating diverse regulatory landscapes, such as stringent food safety laws in the EU, demands considerable investment and time, making rapid market entry challenging.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bidcorp Group leverages a comprehensive suite of data sources, including Bidcorp's annual reports, investor presentations, and financial statements. We also incorporate industry-specific market research from firms like Euromonitor and IBISWorld, alongside macroeconomic data from sources such as Statista and the World Bank.