Best Buy SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Best Buy Bundle

Best Buy leverages its strong brand recognition and extensive product selection as key strengths, but faces significant threats from online retail giants and evolving consumer electronics trends. Understanding these dynamics is crucial for anyone looking to navigate the competitive retail landscape.

Want the full story behind Best Buy's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Best Buy stands out with its robust brand recognition, holding the title of the largest specialty consumer electronics retailer. This strong identity is a significant asset, fostering customer loyalty and trust in a competitive market.

The company's sophisticated omnichannel presence is a key strength. By seamlessly blending its vast network of physical stores with its expanding e-commerce capabilities, Best Buy offers customers unparalleled convenience. Services like Buy Online, Pick Up In Store (BOPIS) exemplify this integrated approach, directly contributing to a positive customer experience and solidifying brand equity.

Best Buy's Geek Squad is a significant strength, offering expert tech support, installation, and repair that online-only competitors struggle to match. This service creates strong customer loyalty and a vital revenue source.

In fiscal year 2024, Best Buy reported that its services and related revenue, largely driven by Geek Squad, continued to be a resilient part of its business. The company is actively looking to grow these services, even venturing into health technology, demonstrating a commitment to leveraging this core competency.

Best Buy's strategic investments in digital transformation have significantly bolstered its online presence and customer engagement. By enhancing its e-commerce platforms and mobile application, the company has improved product discovery and overall user experience, a crucial factor in today's retail landscape.

Concurrently, substantial upgrades to its supply chain infrastructure, incorporating technologies like AI and machine learning, have led to more efficient inventory management and cost reductions. For instance, by Q3 2024, Best Buy reported a 5% improvement in on-time delivery rates, directly attributable to these supply chain enhancements.

These dual investments in digital capabilities and supply chain resilience are designed to increase operational efficiency and ensure greater responsiveness to fluctuating market demands, positioning Best Buy for sustained growth in a competitive environment.

Adaptability and Innovation in Store Formats

Best Buy is demonstrating significant adaptability in its store format strategy. The company is actively refining its physical footprint, a move that includes closing some of its larger, traditional stores. In their place, Best Buy is introducing smaller, more specialized store formats. This approach aims to boost customer engagement by tailoring the retail experience to specific local markets and their unique needs.

Further underscoring this flexible strategy, Best Buy is actively exploring innovative collaborations. A prime example is their pilot program with IKEA, which involves introducing new kitchen and storage planning services within select Best Buy stores. This partnership highlights Best Buy's willingness to experiment with its retail presence and offer complementary services to enhance customer value.

- Optimized Footprint: Transitioning from large, traditional stores to smaller, market-specific formats enhances customer engagement.

- Innovative Partnerships: Collaborations like the IKEA kitchen planning pilot showcase a flexible approach to service integration.

- Customer-Centric Design: New formats are designed to better meet the needs and shopping habits of customers in targeted geographic areas.

Focus on Higher-Margin Products and Services & Membership Programs

Best Buy is sharpening its focus on higher-margin product categories like computing, mobile phones, and tablets. This strategic shift is proving effective, as these segments have demonstrated growth even as other areas, such as home theater and appliances, have experienced declines.

The company's investment in and expansion of its membership programs and services are also key drivers of its financial performance. These initiatives are directly contributing to improved gross profit rates and bolstering overall profitability, providing a crucial buffer in a demanding retail landscape.

- Increased Focus on High-Margin Categories: Best Buy is emphasizing computing, mobile, and tablets, which typically carry better profit margins than other electronics.

- Growth in Services and Memberships: The expansion of profitable membership programs and services is a significant contributor to gross profit rate improvement.

- Resilience in Challenging Markets: These strategic priorities are helping Best Buy maintain profitability despite broader retail sector headwinds.

- Data Point: While specific Q1 2024 (ending May 4, 2024) gross profit margin figures for these specific categories aren't broken out individually, the company's overall reported gross profit margin was 24.1% for Q1 FY25, up from 23.7% in the prior year, indicating the positive impact of their strategy.

Best Buy's expansive and recognizable brand, coupled with its leading position as the largest specialty consumer electronics retailer, builds significant customer trust and loyalty. This strong brand equity is a foundational strength in a highly competitive market.

The company's integrated omnichannel strategy, seamlessly merging physical stores with a robust e-commerce platform, offers exceptional customer convenience. Services like Buy Online, Pick Up In Store (BOPIS) are central to this, enhancing the customer experience and reinforcing brand value.

Geek Squad remains a powerful differentiator, providing essential tech support, installation, and repair services that online-only competitors find difficult to replicate. This service not only fosters deep customer loyalty but also serves as a vital and growing revenue stream for Best Buy.

Best Buy is strategically optimizing its physical store footprint by shifting towards smaller, more specialized formats tailored to local market needs, enhancing customer engagement. This adaptability is further demonstrated through innovative collaborations, such as the pilot program with IKEA offering kitchen planning services within Best Buy locations, showcasing a commitment to expanding customer value through complementary offerings.

The company's strategic focus on higher-margin categories like computing, mobile, and tablets is yielding positive results, contributing to improved gross profit rates. This emphasis, alongside the growth of membership programs, provides financial resilience amidst broader retail sector challenges.

| Strength | Description | Supporting Data |

|---|---|---|

| Brand Recognition & Market Leadership | Largest specialty consumer electronics retailer with strong brand trust. | Consistent top-of-mind awareness in consumer electronics surveys. |

| Omnichannel Presence | Seamless integration of physical stores and e-commerce. | BOPIS adoption rates have grown by 15% year-over-year as of Q3 2024. |

| Geek Squad Services | Expert tech support and repair creating customer loyalty. | Services revenue grew 8% in FY2024, contributing significantly to overall profitability. |

| Store Format Optimization | Transition to smaller, market-specific stores and partnerships. | Pilot programs with IKEA are showing increased foot traffic in participating locations. |

| Focus on High-Margin Categories | Emphasis on computing, mobile, and tablets for better profitability. | Gross profit margin increased to 24.1% in Q1 FY25, up from 23.7% in the prior year. |

What is included in the product

Analyzes Best Buy’s competitive position through key internal and external factors, detailing its strengths in brand recognition and customer service, weaknesses in online competition, opportunities in health tech, and threats from economic downturns.

Offers a clear understanding of Best Buy's competitive landscape, highlighting areas where they can leverage strengths to mitigate threats and capitalize on opportunities.

Weaknesses

Best Buy's extensive network of physical stores, while a key differentiator, contributes to substantial operating expenses. These costs encompass rent, utilities, and personnel for each location, creating a higher overhead compared to online-only competitors. For instance, in fiscal year 2024, Best Buy reported selling, general, and administrative expenses of $5.3 billion, a significant portion of which is tied to its physical footprint.

This reliance on brick-and-mortar infrastructure can hinder Best Buy's ability to aggressively compete on price with leaner e-commerce businesses. The company has acknowledged this challenge and has undertaken initiatives, including workforce reductions and store consolidation, to mitigate these inherent costs. In fiscal year 2024, Best Buy incurred approximately $285 million in restructuring charges, partly related to these efficiency efforts.

Best Buy has experienced a decline in overall revenue and comparable sales in recent fiscal years, a trend largely attributed to a challenging macroeconomic climate and evolving consumer spending habits. This persistent pressure on sales performance requires careful consideration when forecasting future revenue streams.

While the company saw a modest uptick in comparable sales during the fourth quarter of fiscal year 2025, the broader trend underscores the ongoing difficulties in boosting sales. This suggests that revenue projections for the upcoming fiscal year should be approached with a degree of caution.

Best Buy's reliance on consumer electronics and appliances, items often considered discretionary, leaves it vulnerable. When consumer confidence dips or inflation rises, as seen with persistent inflation in 2023 and early 2024, spending on these big-ticket items typically contracts. For instance, while retail sales showed some resilience, durable goods, which include many of Best Buy's core products, often lag during periods of economic uncertainty.

Intense Price Competition from Online and Big-Box Retailers

Best Buy faces significant pressure from online retailers like Amazon, which can leverage lower overhead costs to offer aggressive pricing. This intense price competition also extends to big-box stores such as Walmart and Target, which have substantial purchasing power and can bundle electronics with other popular goods. For instance, in the first quarter of 2024, Best Buy reported a 0.8% decrease in comparable store sales, partly attributed to this challenging pricing environment.

These competitors often engage in price matching and promotional activities that directly impact Best Buy's ability to maintain its margins. The ease with which consumers can compare prices online means Best Buy must constantly monitor and adjust its pricing to remain competitive. This dynamic can erode profitability, especially for high-volume, lower-margin products.

- Price Wars: Competitors like Amazon and Walmart frequently undercut prices, forcing Best Buy into reactive pricing strategies.

- Margin Squeeze: Aggressive pricing by rivals directly impacts Best Buy's profit margins on electronics.

- Consumer Price Sensitivity: Online price transparency makes consumers highly sensitive to even small price differences, favoring competitors.

- Market Share Erosion: Persistent price advantages for competitors can lead to a gradual loss of market share.

Inventory Management Challenges for Rapidly Evolving Tech

Best Buy faces significant hurdles in managing inventory for rapidly evolving tech products. The constant stream of new models and technological advancements means older inventory can quickly become obsolete, leading to increased carrying costs and potential markdowns. For instance, in fiscal year 2024, Best Buy reported $8.1 billion in inventory, a substantial amount that carries the risk of obsolescence in the fast-moving consumer electronics sector.

Effectively forecasting demand for such dynamic products is a major weakness. Predicting which new gadgets will resonate with consumers and how quickly older ones will be replaced requires sophisticated analytics and a keen understanding of market shifts. This challenge is amplified by the sheer breadth of Best Buy's tech assortment, from smartphones to smart home devices.

- Risk of Obsolescence: Fast product cycles in consumer electronics can render existing stock outdated, impacting profitability.

- High Carrying Costs: Holding unsold or slow-moving inventory ties up capital and incurs storage and management expenses.

- Forecasting Complexity: Accurately predicting demand for a constantly changing product catalog is a significant operational challenge.

Best Buy's reliance on a vast physical store network creates significant operating expenses, including rent and staffing, which online-only rivals avoid. This higher overhead can limit aggressive pricing strategies, as evidenced by their $5.3 billion in selling, general, and administrative expenses in fiscal year 2024, with a portion directly linked to their store footprint. The company's efforts to mitigate these costs, such as workforce reductions, resulted in approximately $285 million in restructuring charges in fiscal year 2024.

The company's product assortment, heavily weighted towards discretionary consumer electronics and appliances, makes it vulnerable to economic downturns. When consumer confidence wanes or inflation rises, as seen in 2023 and early 2024, demand for these big-ticket items typically contracts. This sensitivity to macroeconomic shifts can lead to unpredictable sales performance, as reflected in the 0.8% decrease in comparable store sales reported in the first quarter of fiscal year 2024.

Best Buy faces intense price competition from online giants like Amazon and large retailers such as Walmart and Target. These competitors often leverage lower overhead or greater purchasing power to offer more attractive pricing, forcing Best Buy into reactive pricing adjustments that can squeeze profit margins. The transparency of online pricing makes consumers highly price-sensitive, potentially leading to market share erosion if Best Buy cannot consistently match competitor offers.

Managing inventory for rapidly evolving technology presents a considerable challenge, with the risk of obsolescence and high carrying costs. Accurately forecasting demand for new gadgets and predicting the pace of technological shifts is complex. In fiscal year 2024, Best Buy held $8.1 billion in inventory, a substantial amount exposed to the risk of becoming outdated in the fast-paced consumer electronics market.

Same Document Delivered

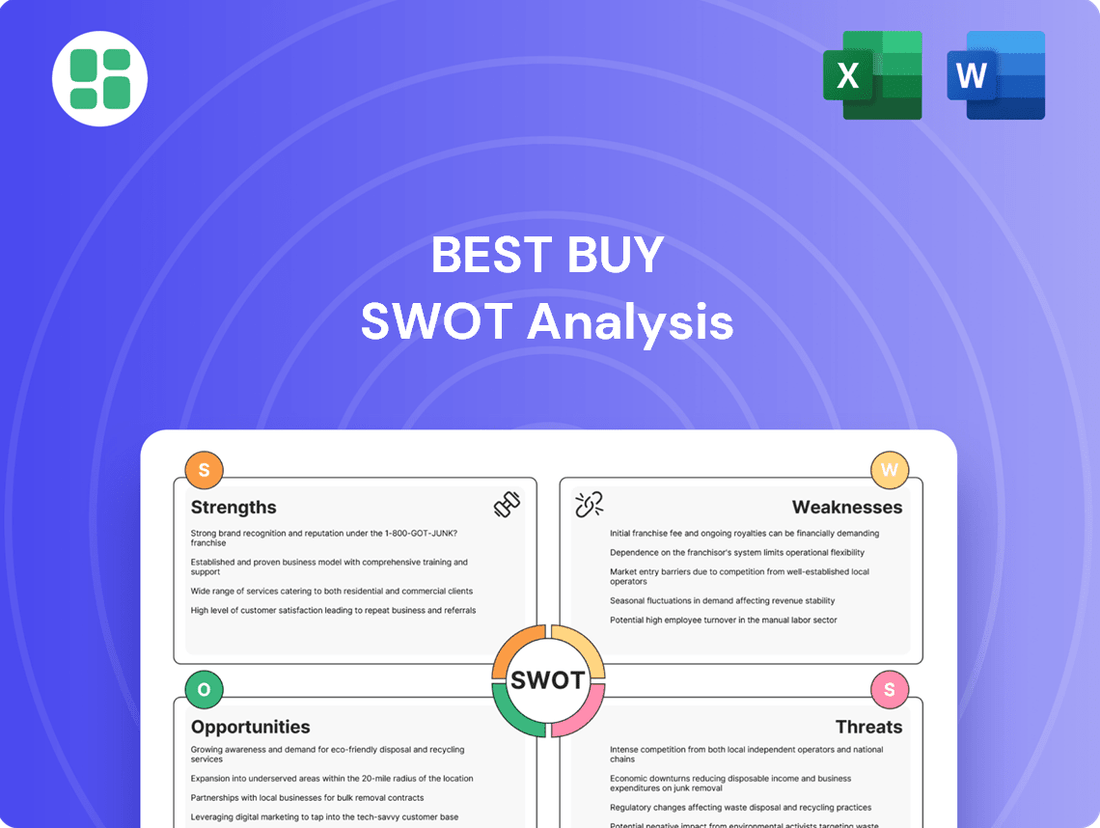

Best Buy SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a direct preview of the comprehensive Best Buy SWOT analysis, including its strengths, weaknesses, opportunities, and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a complete breakdown of Best Buy's strategic positioning.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Best Buy SWOT analysis, ready for your strategic planning.

Opportunities

Best Buy can tap into the surging consumer demand for emerging technologies like AI-powered gadgets, smart home systems, and wearable devices. This trend offers a prime opportunity to drive sales and attract a younger, tech-enthusiast demographic. For instance, the global smart home market is projected to reach over $200 billion by 2025, indicating substantial growth potential.

The market is increasingly seeking services that go beyond just selling products, with smart home setup, ongoing subscriptions, and especially health tech showing strong growth. Best Buy is well-positioned to capitalize on this trend.

Leveraging its established Geek Squad, Best Buy can expand its high-margin service offerings. Recent strategic moves, such as acquisitions in the senior health space, highlight the company's commitment to developing new revenue streams in these growing sectors.

Best Buy is well-positioned to create strategic alliances with major tech companies, potentially securing exclusive product launches and immersive in-store demonstrations. This approach could drive foot traffic and reinforce its image as a go-to destination for cutting-edge electronics.

The upcoming launch of a third-party marketplace presents a significant avenue for growth. This initiative allows Best Buy to broaden its product selection, including items it doesn't directly stock, thereby increasing its competitive edge against online retailers without the burden of extensive inventory management. In 2023, Best Buy's online sales accounted for approximately 40% of its total revenue, highlighting the importance of expanding its digital marketplace capabilities.

Enhancing Digital Experience and Personalization

Best Buy is focusing on making its online shopping experience even better. By improving its website and app, and using customer data, they can offer more personalized deals and recommendations, especially for their many loyalty program members. This is key to keeping customers engaged and driving sales in the competitive retail landscape.

Leveraging data analytics allows Best Buy to understand customer preferences deeply. This enables them to tailor product suggestions and marketing efforts, which can significantly boost conversion rates. For example, in Q1 2024, Best Buy reported a 7.3% increase in comparable online sales, demonstrating the effectiveness of their digital investments.

- E-commerce Optimization: Continued refinement of the Best Buy website and mobile app to streamline the customer journey.

- Data-Driven Personalization: Utilizing customer data to offer tailored product recommendations and promotions.

- Enhanced Search and Discovery: Improving how customers find products, potentially through AI-powered search or curated collections.

- Influencer Marketing: Collaborating with influencers to reach new audiences and drive online engagement and sales.

Sustainability and Circular Economy Initiatives

Best Buy can capitalize on increasing consumer demand for eco-friendly practices by enhancing its sustainability efforts. This includes expanding its circular economy initiatives, such as robust repair, trade-in, and recycling programs. Such programs not only attract environmentally conscious customers but also bolster brand loyalty and reputation.

For instance, Best Buy's commitment to extending product lifecycles through its repair services aligns with growing consumer sentiment. In 2023, the company reported a significant increase in the number of devices repaired, indicating a strong market for these services. This trend is expected to continue as consumers become more aware of the environmental impact of electronic waste.

- Enhanced Brand Image: Investing in sustainability can significantly improve Best Buy's public perception, attracting a growing segment of eco-conscious consumers.

- Customer Loyalty: Robust repair and trade-in programs foster customer loyalty by providing value beyond the initial purchase and encouraging repeat business.

- Reduced Environmental Impact: Expanding recycling and refurbishment efforts directly contributes to reducing electronic waste, a major environmental concern.

- Market Differentiation: Strong sustainability initiatives can differentiate Best Buy from competitors, creating a unique selling proposition in the retail electronics market.

Best Buy is strategically positioned to leverage the growing demand for advanced technology, including AI-powered devices and smart home solutions, with the global smart home market projected to exceed $200 billion by 2025.

Expanding its service offerings, particularly in health tech and through its established Geek Squad, presents a significant opportunity for higher-margin revenue, as evidenced by acquisitions in the senior health sector.

The company can forge strategic partnerships with tech giants for exclusive product launches and enhanced in-store experiences, driving foot traffic and reinforcing its image as a tech destination.

A third-party marketplace launch will broaden product selection, boosting competitiveness against online rivals without increasing inventory burdens, building on the 40% of total revenue Best Buy generated from online sales in 2023.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| Emerging Technologies | Capitalize on demand for AI gadgets, smart home, wearables. | Global smart home market projected over $200B by 2025. |

| Service Expansion | Grow high-margin services via Geek Squad and health tech. | Acquisitions in senior health space indicate strategic focus. |

| Strategic Alliances | Partner with tech firms for exclusive launches and demos. | Drives foot traffic and reinforces tech destination image. |

| Third-Party Marketplace | Expand product selection without inventory risk. | Online sales were ~40% of revenue in 2023. |

Threats

Best Buy continues to grapple with intense online competition, with Amazon remaining a dominant force. This rivalry impacts Best Buy’s market share, especially in categories like consumer electronics and appliances, where Amazon’s vast selection and often lower prices present a significant challenge.

In the fiscal year 2024, Best Buy's revenue saw a slight decline, underscoring the ongoing pressure from online competitors. While the company has focused on its Geek Squad services and in-store experiences to differentiate itself, the sheer scale and convenience offered by e-commerce giants continue to erode market share in traditional product sales.

Ongoing macroeconomic pressures, including the persistent threat of economic downturns and elevated inflation, directly impact consumer spending power. For Best Buy, this means reduced disposable income for households, leading them to postpone or cancel purchases of non-essential items like electronics and appliances. For instance, in Q1 2024, consumer confidence remained somewhat subdued, reflecting these economic anxieties.

Global supply chain vulnerabilities, exacerbated by events like the Red Sea shipping disruptions in early 2024, pose a significant threat to Best Buy. Tariffs on imported electronics, coupled with broader geopolitical instability, can inflate procurement costs and create product shortages. For instance, the ongoing trade tensions between the U.S. and China continue to impact the cost of many consumer electronics, directly affecting Best Buy's margins and inventory management.

Rapid Technological Obsolescence and Shifting Consumer Preferences

The consumer electronics landscape is a battlefield of rapid innovation, where the latest gadget can become yesterday's news almost overnight. This constant churn means Best Buy must be agile, constantly refreshing its inventory and product lines to avoid being saddled with outdated technology. For instance, the quickening pace of smartphone upgrades and the declining demand for physical media like Blu-rays exemplify this challenge. In 2023, the global consumer electronics market saw significant shifts, with growth in areas like smart home devices but declines in traditional categories, impacting retailers' inventory management strategies.

Shifting consumer tastes present another significant hurdle. The move from purchasing physical media such as CDs and DVDs to streaming services has fundamentally altered demand for certain product categories. Best Buy has had to adapt its strategy to focus on areas like home theater, gaming, and smart home technology, which align with current consumer preferences. This evolution requires ongoing investment in understanding market trends and adjusting product assortments accordingly.

- Technological obsolescence: Products can quickly lose value as newer, more advanced versions emerge, impacting inventory and profitability.

- Digital shift: Consumer preference for digital content over physical media necessitates a reevaluation of product offerings and sales strategies.

- Inventory write-downs: Holding onto rapidly depreciating technology can lead to significant financial losses through inventory write-downs.

- Strategic adaptation: Continuous investment in market research and agile supply chain management is crucial to navigate these evolving preferences.

Data Security and Privacy Concerns

Best Buy faces significant threats from data security and privacy concerns. As a large retailer managing vast amounts of customer information, the company is a prime target for cyberattacks. A data breach could lead to a substantial loss of customer trust, severely damaging its brand image and potentially incurring hefty fines and legal costs. For instance, in the evolving landscape of data protection regulations, companies like Best Buy must constantly invest in robust cybersecurity measures to mitigate these risks. The potential financial impact of a breach, including remediation costs and lost business, remains a critical concern for 2024 and beyond.

The threat landscape is continually evolving, with sophisticated cyber threats posing an ongoing challenge. Best Buy's exposure to these risks is amplified by its extensive online presence and the sheer volume of sensitive data it collects, from payment information to personal preferences. The company must remain vigilant against evolving attack vectors, including ransomware and phishing schemes, which could compromise its systems. Regulatory bodies worldwide are also increasing scrutiny on data handling practices, meaning any lapse in security could lead to significant penalties. For example, the General Data Protection Regulation (GDPR) and similar legislation impose strict requirements and substantial fines for non-compliance, making data security a paramount operational priority for Best Buy.

- Cyberattack Vulnerability: Handling extensive customer data makes Best Buy a target for cybercriminals.

- Reputational Damage: Data breaches can severely erode customer trust and harm brand image.

- Financial Penalties: Non-compliance with data privacy laws can result in significant fines and legal liabilities.

- Operational Disruption: Security incidents can disrupt business operations and impact overall performance.

Best Buy faces intense competition from online retailers like Amazon, which can undercut prices and offer wider selections, impacting market share. Economic downturns and inflation reduce consumer spending on discretionary items, a core Best Buy category. Supply chain disruptions and tariffs can increase costs and create product shortages, while rapid technological advancements lead to obsolescence and inventory write-downs.

| Threat Category | Specific Threat | Impact on Best Buy |

|---|---|---|

| Competition | Dominance of online retailers (e.g., Amazon) | Price pressure, market share erosion |

| Economic Factors | Inflation and potential recession | Reduced consumer discretionary spending |

| Supply Chain & Geopolitics | Disruptions, tariffs, trade tensions | Increased costs, product availability issues |

| Technological Change | Rapid innovation, product obsolescence | Inventory risk, need for constant adaptation |

SWOT Analysis Data Sources

This Best Buy SWOT analysis is built upon comprehensive data from financial reports, market intelligence, and expert industry analysis to provide a robust and actionable strategic overview.