Best Buy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Best Buy Bundle

Best Buy navigates a complex retail landscape, facing intense rivalry from online giants and brick-and-mortar competitors alike. Understanding the power of its suppliers and the evolving threat of substitutes is crucial for its continued success.

The complete report reveals the real forces shaping Best Buy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Best Buy's bargaining power of suppliers is influenced by supplier concentration, with a few major electronics manufacturers holding significant sway. In fiscal 2024, the top five suppliers, including giants like Apple, Samsung, HP, Sony, and LG, accounted for roughly 55% of Best Buy's merchandise purchases. This reliance on a limited number of key vendors grants them considerable leverage in negotiating pricing and contractual terms.

Best Buy faces significant switching costs when considering new suppliers. These costs stem from deeply integrated supply chains and the potential disruption to established relationships. For instance, the intricate logistics and inventory management systems are often tailored to specific suppliers, making a transition complex and expensive.

Furthermore, Best Buy actively cultivates vendor partnerships that go beyond simple product sourcing. These collaborations often involve co-branded in-store experiences and exclusive product lines. In 2024, Best Buy continued its strategy of deepening these partnerships, which further ties its operational success to the reliability and unique offerings of its current suppliers.

The loss of exclusive product access or unique merchandising collaborations can represent a substantial financial and competitive disadvantage. This reliance on specific, integrated supplier relationships significantly enhances the bargaining power of these suppliers, as Best Buy’s ability to quickly or easily replace them is limited.

Many of Best Buy's key suppliers offer highly differentiated and in-demand products, such as the latest smartphones and computers, which consumers actively seek. For example, in 2024, the global smartphone market continued its strong demand, with shipments reaching over 1.17 billion units, highlighting the importance of these specific product categories for retailers like Best Buy.

Best Buy's position as an authorized reseller for major brands like Apple, and its ability to carry exclusive product lines, strengthens its customer appeal but simultaneously increases its dependence on these powerful suppliers. This reliance means Best Buy must maintain favorable relationships to secure access to sought-after inventory.

The inherent technological innovation and strong brand equity of these suppliers mean Best Buy critically needs their products to attract and retain its customer base. Without access to these unique and desirable offerings, Best Buy's ability to compete effectively in the electronics retail space would be significantly diminished.

Threat of Forward Integration by Suppliers

While less common in electronics retail, large manufacturers could theoretically bypass retailers like Best Buy and sell directly to consumers, a trend already seen online. This direct-to-consumer (DTC) model, though often facing hurdles in scale and distribution, represents a potential long-term threat. For instance, in 2024, many electronics brands continued to invest in their own e-commerce platforms, aiming to capture a larger share of the online market.

However, Best Buy's significant advantage lies in its vast physical store network and value-added services, such as Geek Squad installations and repairs. These offerings provide a tangible benefit to suppliers by reaching customers who prefer in-person experiences or require immediate technical support. In 2023, Best Buy's services segment contributed significantly to its overall revenue, demonstrating the continued demand for these specialized offerings.

- DTC Growth: Manufacturers increasingly leverage online channels to reach consumers directly, bypassing traditional retail.

- Scale Challenges: While growing, DTC models often struggle to match the logistical and customer service reach of established retailers.

- Best Buy's Advantage: The company's extensive store footprint and services like Geek Squad offer a valuable distribution and support channel for suppliers.

- Service Revenue: In 2023, Best Buy's services revenue underscored the ongoing importance of its in-person customer support and technical expertise.

Supplier Investment in Best Buy's Operations

Suppliers are increasingly investing in Best Buy's operations, a trend that can shift the balance of power. This investment includes funding for promotions, in-store displays, dedicated staffing, and even fulfillment services. These contributions can help Best Buy manage its selling, general, and administrative expenses.

This vendor funding is a significant indicator of suppliers' commitment to Best Buy as a crucial distribution channel. For example, in the fourth quarter of fiscal year 2024, this funding amounted to approximately $20 million. Projections suggest this level of investment will continue into fiscal year 2025.

This mutual dependency, where suppliers invest in Best Buy's success, can actually moderate the bargaining power of these suppliers. It suggests a shared interest in the retail channel's performance.

- Supplier Investment: Suppliers are funding promotions, displays, special staffing, and fulfillment services for Best Buy.

- Financial Impact: This vendor funding helped offset Best Buy's SG&A expenses, reaching about $20 million in Q4 FY24.

- Future Outlook: Similar levels of supplier investment are expected to continue in FY25.

- Moderating Power: The mutual dependency created by these investments can reduce supplier bargaining power.

Best Buy's bargaining power with its suppliers is significantly challenged by supplier concentration and the high switching costs associated with established relationships. The top five suppliers, including major brands like Apple and Samsung, represented approximately 55% of Best Buy's merchandise purchases in fiscal 2024, granting them substantial leverage.

Key suppliers offer highly differentiated products, such as popular smartphones, which are essential for Best Buy's customer appeal. In 2024, global smartphone shipments exceeded 1.17 billion units, underscoring the critical need for Best Buy to stock these in-demand items.

While suppliers increasingly invest in Best Buy's operations, funding promotions and displays, this mutual dependency can moderate their bargaining power. For instance, vendor funding contributed around $20 million to Best Buy's SG&A in Q4 FY24, with similar levels anticipated for FY25.

| Supplier Characteristic | Impact on Best Buy | Supporting Data (FY24) |

|---|---|---|

| Supplier Concentration | Increases supplier bargaining power | Top 5 suppliers = ~55% of merchandise purchases |

| Product Differentiation | Enhances supplier leverage; critical for Best Buy's sales | Global smartphone shipments > 1.17 billion units |

| Supplier Investment in Retail Channel | Can moderate supplier bargaining power | Q4 FY24 vendor funding ≈ $20 million |

What is included in the product

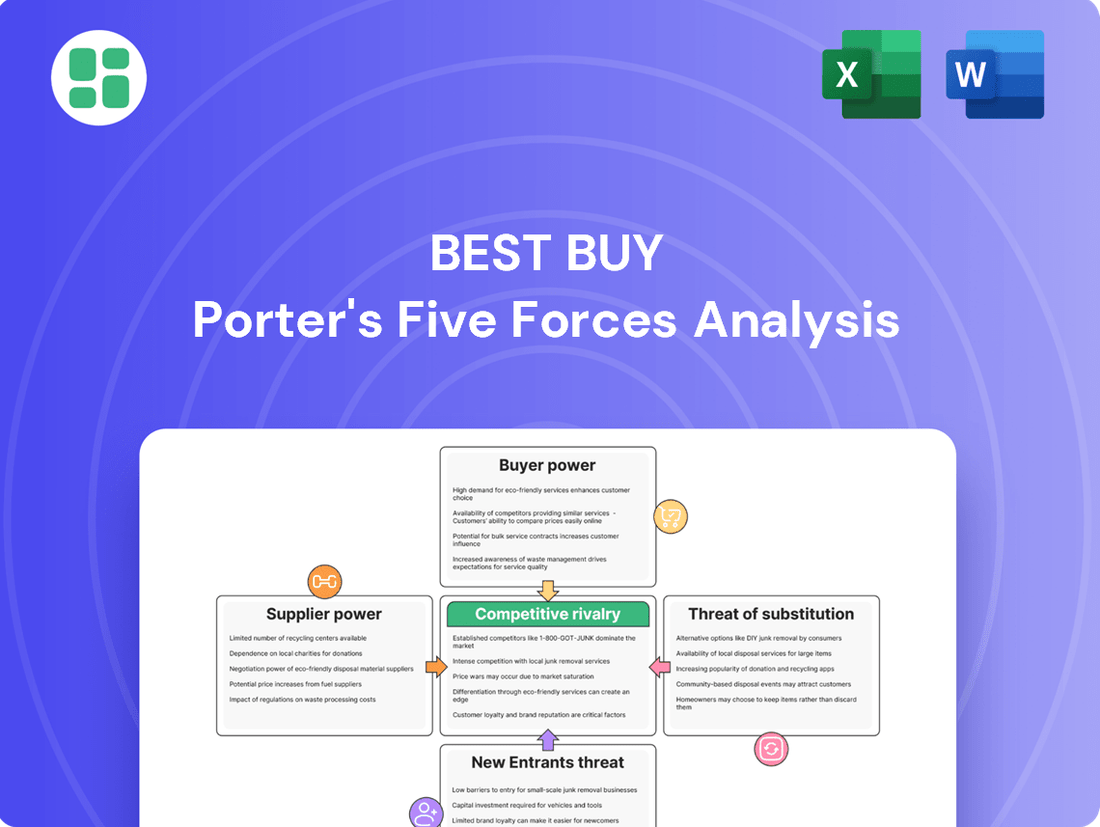

Tailored exclusively for Best Buy, analyzing its position within its competitive landscape by evaluating supplier and buyer power, threat of new entrants, substitutes, and rivalry.

Instantly visualize Best Buy's competitive landscape with a clear, interactive five forces model, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Best Buy customers are quite attuned to pricing, with many actively comparing prices across different stores before buying. In 2024, studies indicated that over 60% of electronics purchases involved some form of online price comparison.

The ease of accessing price information through platforms like Amazon, Walmart, and dedicated comparison websites significantly amplifies customer bargaining power. This readily available data forces Best Buy to remain competitive, directly impacting its pricing strategies and overall profitability.

For consumers, the decision to switch from Best Buy to another electronics retailer, be it online or a physical store, involves very little effort or expense. This low barrier to entry significantly strengthens their bargaining position.

The straightforward process of buying comparable products from numerous competitors, coupled with the widespread availability of online shopping platforms and diverse retail options, allows customers to easily shift their spending to alternative providers. In 2023, online retail sales in the US accounted for approximately 21.4% of total retail sales, highlighting the ease of digital switching.

The bargaining power of customers is significantly amplified by the sheer abundance of substitute products and purchasing channels available. For instance, consumers can readily find electronics not only at Best Buy but also through major online retailers like Amazon, which reported over $574 billion in net sales for 2023. Mass merchandisers such as Walmart and Target, alongside warehouse clubs like Costco, also offer competitive pricing and convenience, further fragmenting customer loyalty and increasing their leverage.

Customer Segmentation and Loyalty Programs

Best Buy actively works to lessen customer bargaining power by implementing loyalty programs such as My Best Buy Plus and My Best Buy Total. By the end of fiscal year 2025, these initiatives had attracted close to 8 million members, demonstrating a significant reach.

These programs are designed to foster customer retention and diminish price sensitivity by providing exclusive deals and enhanced services. The goal is to create a more committed customer base less inclined to switch for minor price differences.

- Customer Loyalty Programs: My Best Buy Plus and My Best Buy Total aim to reduce customer power through exclusive benefits.

- Membership Growth: Nearly 8 million members were part of these loyalty programs by the end of FY25.

- Customer Behavior: Despite loyalty efforts, customers remain 'deal-focused' and heavily influenced by seasonal sales, indicating ongoing price sensitivity.

Impact of Macroeconomic Conditions on Spending

Ongoing macroeconomic pressures, particularly inflation, have significantly impacted consumer spending habits. In 2024, many households faced tough choices with their budgets, leading to a shift away from discretionary electronics purchases. This trend often saw consumers prioritizing essential needs or spending on services and experiences over new gadgets.

This reduction in overall demand for big-ticket items, like high-end televisions or appliances, directly amplifies customer bargaining power. When consumers are more selective and value-focused due to economic constraints, they are more likely to seek out deals, compare prices extensively, and demand better terms from retailers like Best Buy.

- Consumer Price Index (CPI) Growth: In the US, the CPI saw significant increases in 2023 and early 2024, impacting discretionary spending. For instance, the CPI rose by 3.4% year-over-year in April 2024, indicating persistent inflationary pressures.

- Retail Sales Trends: While overall retail sales might show nominal growth, the composition often reveals a slowdown in durable goods, which includes electronics. This suggests consumers are indeed cutting back on larger, non-essential purchases.

- Discount Sensitivity: Studies in 2024 indicated a heightened consumer sensitivity to discounts and promotions, with a larger percentage of shoppers actively seeking sales events before making purchasing decisions.

Best Buy customers possess significant bargaining power due to the readily available price comparisons and low switching costs in the electronics market. The ease of comparing prices across numerous online and physical retailers, such as Amazon, which reported over $574 billion in net sales for 2023, forces Best Buy to maintain competitive pricing. Consumers can easily switch to alternative providers, especially given that online retail accounted for approximately 21.4% of total US retail sales in 2023.

| Factor | Impact on Best Buy | Supporting Data (2023-2024) |

|---|---|---|

| Price Transparency | High; customers easily compare prices. | Over 60% of electronics purchases involved online price comparison in 2024. |

| Switching Costs | Low; minimal effort to buy elsewhere. | Online retail sales reached 21.4% of total US retail sales in 2023. |

| Availability of Substitutes | High; numerous retailers offer similar products. | Amazon's 2023 net sales exceeded $574 billion. |

Preview Before You Purchase

Best Buy Porter's Five Forces Analysis

This comprehensive Best Buy Porter's Five Forces analysis is the exact document you will receive immediately after purchase, offering a detailed examination of the competitive landscape. You're previewing the final version, precisely the same document that will be available to you instantly after buying, allowing for immediate strategic insights. No mockups, no samples; the document you see here is exactly what you’ll be able to download and utilize to understand Best Buy's competitive environment.

Rivalry Among Competitors

Best Buy faces a crowded marketplace, with competitors ranging from online giants like Amazon, which captured an estimated 37.6% of the US e-commerce market in 2024, to traditional retailers such as Walmart and Target. This diversity means Best Buy must contend with different competitive strategies, from aggressive pricing by online sellers to broad product assortments from general merchandisers.

While the overall electronic product retailing market is expected to see a compound annual growth rate of 6.2% between 2024 and 2025, the consumer electronics sector itself has been grappling with shrinking profit margins and persistent price deflation. This dynamic suggests that despite market expansion, companies are intensely competing for a larger slice of a market that is becoming increasingly saturated.

Best Buy stands out by offering a broad selection of technology products coupled with robust in-store customer assistance. Its distinctive services, such as the Geek Squad for device setup and troubleshooting, create a significant differentiator.

The company is actively enhancing its personalized offerings and seamless omnichannel capabilities, allowing for online purchases with convenient in-store pickup and returns. These strategic moves are designed to present a value proposition that extends beyond mere price competition.

In fiscal year 2024, Best Buy reported approximately $40 billion in revenue, showcasing the scale of its operations and the effectiveness of its differentiated strategy in a competitive market.

Exit Barriers and Industry Consolidation

High capital investments in physical stores, inventory, and extensive supply chain networks represent substantial exit barriers for large retailers like Best Buy. These significant sunk costs make it economically challenging for companies to leave the market gracefully, thus intensifying competitive rivalry as firms are incentivized to remain and defend their positions.

While Best Buy has been strategically adjusting its store footprint, closing some larger locations and opening smaller ones, the overall financial commitment to its existing infrastructure remains considerable. This means that even with strategic shifts, the cost of a complete exit or a drastic reduction in operations is still a major deterrent.

- Exit Barriers: High capital tied up in physical retail, inventory, and logistics.

- Industry Consolidation: High exit barriers discourage companies from leaving, leading to sustained competition.

- Best Buy's Strategy: While optimizing store count, significant infrastructure costs remain.

Marketing and Pricing Strategies of Rivals

Rivals like Walmart capitalize on their immense scale, enabling aggressive low pricing. Amazon counters with an unparalleled selection and the convenience of its Prime membership, offering rapid delivery. Target competes through strategic pricing and promotional bundles, frequently including gift cards with electronics purchases.

Best Buy strategically deploys its own promotional tactics, particularly during peak sales periods like Black Friday. In 2023, Best Buy saw its online sales increase by 8.1%, demonstrating the effectiveness of its digital push, which includes significant investment in advertising and the development of a third-party marketplace to broaden its product assortment.

- Walmart's Scale Advantage: Leverages vast buying power for price competitiveness.

- Amazon's Prime Ecosystem: Offers extensive selection and expedited shipping.

- Target's Promotional Bundles: Utilizes gift card incentives and competitive pricing.

- Best Buy's Response: Focuses on targeted deals, digital marketing, and marketplace expansion.

Best Buy faces intense rivalry from diverse competitors, including e-commerce giants like Amazon, which held 37.6% of the US e-commerce market in 2024, and large brick-and-mortar retailers such as Walmart and Target. These rivals leverage different strengths, from Amazon's vast selection and rapid delivery to Walmart's aggressive pricing and Target's promotional bundles, creating a highly competitive landscape where price, selection, and convenience are paramount.

| Competitor | Key Strengths | 2024 Market Share/Data Point |

| Amazon | Vast selection, Prime ecosystem, rapid delivery | 37.6% of US e-commerce market |

| Walmart | Scale, aggressive pricing, broad assortment | Significant portion of general merchandise sales |

| Target | Strategic pricing, promotional bundles (e.g., gift cards) | Strong presence in consumer electronics promotions |

SSubstitutes Threaten

Many electronics manufacturers are increasingly selling directly to consumers via their own websites, offering an alternative to traditional retail channels. This trend directly impacts Best Buy by diminishing its role as the primary gateway for these products. For instance, in 2023, many major tech brands saw significant growth in their online DTC sales, providing consumers with a convenient purchasing option that bypasses retailers like Best Buy.

The threat of substitutes for Best Buy's specialized electronics retail model is substantial, primarily driven by the pervasive reach of online marketplaces. Giants like Amazon, eBay, and Alibaba offer an almost limitless selection of electronics alongside a vast array of other goods, often at highly competitive price points. This broad accessibility means consumers can easily find and purchase electronics without needing to visit a physical store or rely on a specialized retailer.

Furthermore, general merchandise retailers have increasingly become significant substitute channels for electronics. Companies such as Walmart and Target have aggressively expanded their electronics departments, leveraging their existing customer traffic and supply chains. In 2023, Walmart reported strong growth in its online electronics sales, demonstrating its ability to compete effectively with specialized retailers by offering convenience and frequently lower prices on popular electronic items.

The increasing prevalence of subscription-based services and digital media presents a significant threat of substitutes for Best Buy. Consumers are increasingly opting for streaming platforms like Netflix and Disney+ over physical media such as DVDs, a market Best Buy has largely exited. In 2023, the global digital media market was valued at over $2.5 trillion, highlighting the massive shift away from traditional product purchases.

Furthermore, the adoption of subscription models for software, gaming, and entertainment content means consumers may not need to buy individual physical products as often. For instance, gaming subscriptions offer access to vast libraries of titles, reducing the need to purchase individual game discs. This ongoing trend directly impacts Best Buy's traditional product sales, forcing the company to adapt its strategy to remain competitive in a rapidly evolving retail landscape.

DIY Solutions and Repair Alternatives

For some consumers facing less complex tech issues, the threat of substitutes is quite real. DIY troubleshooting guides and readily available online tutorials can often resolve minor problems, bypassing the need for professional assistance. This segment of the market might opt for these free or low-cost solutions instead of engaging Best Buy's Geek Squad.

Independent repair shops also present a significant substitute. These businesses, often specializing in specific brands or types of electronics, can provide competitive pricing for repairs. In 2024, the independent electronics repair market continued to grow, with many shops offering mail-in services or local pick-up options, further increasing convenience for consumers seeking alternatives to big-box retailers.

While these DIY and independent options cater to simpler needs, Best Buy's Geek Squad still holds an advantage for more intricate tasks. Complex installations, such as home theater setups or smart home integrations, often require specialized knowledge and tools that third-party providers may not possess. Best Buy's bundled service offerings and manufacturer partnerships can also be a draw for consumers seeking a more comprehensive and reliable solution for advanced technical needs.

- DIY Troubleshooting: Many consumers can fix minor issues using online guides and forums.

- Independent Repair Shops: Offer competitive pricing and specialized services for electronics.

- Online Tutorials: Provide accessible, often free, step-by-step instructions for common problems.

- Best Buy's Niche: Complex installations and integrated smart home solutions remain a key differentiator.

Changing Consumer Preferences and Product Lifecycles

Consumers are increasingly shifting their focus from owning physical products to valuing experiences, which can impact demand for big-ticket electronics. Economic headwinds in 2024, such as persistent inflation, have further encouraged consumers to delay discretionary spending on these items, opting instead for essential goods or services.

The relentless pace of technological advancement means products quickly become outdated, a trend amplified in 2024. This rapid obsolescence pressures consumers to either upgrade more frequently or seek out more cost-effective alternatives, thereby intensifying the threat of substitutes as new, more appealing technologies emerge.

For instance, the smartphone market, a key category for electronics retailers, saw global shipments grow by only 3.4% in the first quarter of 2024 compared to the previous year, according to IDC. This indicates a potential slowdown in upgrade cycles as consumers weigh the benefits of new models against their cost, making alternative spending more attractive.

- Shifting Consumer Priorities: Growing preference for experiences over tangible goods.

- Economic Headwinds: Consumers delaying non-essential electronic purchases due to inflation in 2024.

- Rapid Technological Obsolescence: Shorter product lifecycles encourage value-seeking or delayed upgrades.

- Market Data: Q1 2024 smartphone shipment growth of 3.4% suggests a more cautious consumer approach to upgrades.

The threat of substitutes for Best Buy is significant, with online marketplaces like Amazon and general merchandise retailers such as Walmart offering readily available electronics. The rise of direct-to-consumer sales by manufacturers and the increasing popularity of subscription services for media and software also present compelling alternatives. Even independent repair shops and DIY solutions for minor issues can divert customers from Best Buy's services.

| Substitute Channel | Key Characteristics | Impact on Best Buy |

|---|---|---|

| Online Marketplaces (e.g., Amazon) | Vast selection, competitive pricing, convenience | Direct competition for product sales, price pressure |

| General Merchandise Retailers (e.g., Walmart) | Existing customer base, convenience, often lower prices | Captures electronics sales from a broader consumer base |

| Direct-to-Consumer (DTC) Sales | Manufacturer control over pricing and customer experience | Bypasses traditional retail channels, erodes retailer margin |

| Subscription Services (Digital Media, Software) | Access over ownership, recurring revenue model | Reduces demand for physical media and software purchases |

| Independent Repair Shops | Specialized services, competitive pricing | Offers an alternative for product maintenance and repair |

Entrants Threaten

The threat of new entrants into the consumer electronics retail space is significantly tempered by the immense capital required. Establishing a retail footprint comparable to Best Buy's, which includes extensive inventory, prime real estate, sophisticated logistics, and robust e-commerce platforms, demands billions of dollars. For instance, a new entrant would need to invest heavily in supply chain infrastructure and technology to even approach the operational efficiencies that established players leverage.

Furthermore, achieving the economies of scale that allow incumbents like Best Buy to offer competitive pricing presents a formidable hurdle. New entrants struggle to match the purchasing power and operational efficiencies that come with vast sales volumes. In 2023, Best Buy's revenue was approximately $40.4 billion, illustrating the scale of operations that a newcomer must overcome to compete effectively on price and product availability.

Best Buy enjoys significant brand recognition and deep-rooted customer loyalty, bolstered by its popular loyalty programs and the highly regarded Geek Squad services. Newcomers would struggle to replicate this level of trust and affinity, particularly in a consumer landscape that increasingly prioritizes expert advice and reliable post-purchase support.

Best Buy's deeply entrenched relationships with key electronics manufacturers, like Samsung and Sony, grant it preferential access and favorable terms. For instance, in early 2024, Best Buy continued to be a primary retail partner for many premium product launches, a position built over years of consistent performance and volume. Newcomers face significant hurdles in replicating these supplier networks, often finding themselves at a disadvantage in securing competitive pricing and a diverse product inventory, let alone exclusive product lines.

Regulatory Hurdles and Compliance Costs

The threat of new entrants in the electronics retail sector is significantly impacted by regulatory hurdles and the associated compliance costs. New businesses must navigate a complex web of product safety standards, such as those mandated by the Consumer Product Safety Commission (CPSC) in the US, and environmental regulations like the Restriction of Hazardous Substances (RoHS) directive in Europe, which govern electronic waste disposal. These requirements add substantial operational expenses and can deter smaller players from entering the market.

For instance, ensuring compliance with evolving data privacy laws, like the California Consumer Privacy Act (CCPA), adds another layer of complexity and cost. These regulations necessitate investments in secure data management systems and legal counsel. The sheer effort and financial commitment required to meet these standards can create a considerable barrier, effectively limiting the number of new companies that can realistically challenge established retailers like Best Buy.

- Product Safety Standards: Compliance with CPSC regulations in the US and similar international standards raises initial product sourcing and testing costs.

- Environmental Regulations: Adhering to e-waste directives (e.g., WEEE in the EU) requires investment in recycling infrastructure or partnerships, increasing operational overhead.

- Consumer Protection Laws: Meeting stringent consumer rights legislation, including return policies and warranty provisions, demands robust customer service systems and clear legal frameworks.

- Data Privacy Compliance: Investments in cybersecurity and adherence to data protection laws (e.g., GDPR, CCPA) are critical and costly for new entrants.

Intellectual Property and Proprietary Technology

While Best Buy doesn't typically own the intellectual property of the products it sells, its significant investments in proprietary retail technology create a barrier for new entrants. These include advanced omnichannel capabilities, AI-driven customer service platforms, and sophisticated supply chain management systems. For instance, in fiscal year 2024, Best Buy continued to invest in its digital transformation, enhancing its website and app to provide a seamless customer experience across online and in-store channels.

These technological advancements are not easily or quickly replicated by potential competitors. They contribute directly to Best Buy's operational efficiency and its ability to offer a superior customer experience, making it challenging for newcomers to match its service levels and cost structures. The company's ongoing focus on leveraging data analytics and AI in its operations further solidifies this advantage.

- Proprietary Technology: Best Buy's investments in omnichannel retail, AI customer service, and supply chain are difficult for new entrants to replicate quickly.

- Operational Efficiency: These technological advantages enhance Best Buy's ability to operate efficiently.

- Customer Experience: Superior technology contributes to a better customer experience, a key differentiator.

The threat of new entrants for Best Buy is moderate, primarily due to high capital requirements and established brand loyalty. Newcomers face significant hurdles in matching Best Buy's scale, supplier relationships, and technological infrastructure, which are crucial for competitive pricing and product availability. For example, Best Buy's 2023 revenue of approximately $40.4 billion highlights the massive scale a new entrant would need to achieve.

Furthermore, regulatory compliance, including product safety and data privacy laws, adds substantial costs and complexity for potential new players. Best Buy's established customer trust, bolstered by services like Geek Squad, also presents a difficult barrier for new entrants to overcome.

| Barrier to Entry | Assessment | Supporting Fact/Reason |

| Capital Requirements | High | Establishing a retail footprint comparable to Best Buy requires billions in inventory, real estate, and logistics. |

| Economies of Scale | High | Best Buy's 2023 revenue of ~$40.4 billion allows for competitive pricing and product availability. |

| Brand Loyalty & Reputation | High | Established trust and services like Geek Squad are difficult for new entrants to replicate. |

| Supplier Relationships | High | Deep relationships with manufacturers provide preferential access and terms, a key advantage in early 2024. |

| Regulatory Hurdles | Moderate | Compliance with safety (CPSC) and environmental (RoHS) standards adds significant costs. |

| Proprietary Technology | Moderate | Investments in omnichannel and AI platforms create operational efficiencies difficult to match. |

Porter's Five Forces Analysis Data Sources

Our Best Buy Porter's Five Forces analysis is built upon a foundation of robust data, drawing from Best Buy's official investor relations website, SEC filings, and annual reports. We supplement this with insights from reputable industry research firms like Statista and IBISWorld, and macroeconomic data to provide a comprehensive view of the competitive landscape.