Bellsystem24 Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bellsystem24 Bundle

Bellsystem24 operates in a dynamic market, facing significant pressures from buyer power and the threat of substitutes. Understanding these forces is crucial for any stakeholder looking to navigate its competitive landscape.

The complete report reveals the real forces shaping Bellsystem24’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of technology and software providers for BPO and contact center services is on the rise. This is largely driven by the increasing demand for advanced AI, machine learning, and automation tools. Bellsystem24, to maintain its competitive edge in customer service, data analytics, and operational efficiency, must secure access to these sophisticated solutions.

Suppliers of specialized talent, especially those skilled in AI, data analytics, and omnichannel support, wield considerable power. The Business Process Outsourcing (BPO) sector is increasingly focused on sophisticated, knowledge-driven services, making adept human capital a crucial resource.

This is particularly true in Japan, where a declining working-age population intensifies the demand for highly specialized BPO professionals. Bellsystem24's reliance on such talent means suppliers can command higher wages and more favorable contract terms, impacting the company's cost structure.

Telecommunications and cloud infrastructure providers hold significant sway over Bellsystem24's operations. Their services are fundamental to the contact center solutions Bellsystem24 offers, making reliable and advanced communication channels a necessity. As of 2024, the global cloud contact center market was valued at approximately $15.5 billion, a figure projected to grow substantially, underscoring the critical role these suppliers play.

Supplier Power 4

Suppliers of physical real estate and facilities for contact centers, while still relevant, are seeing their bargaining power potentially tempered by the increasing adoption of remote and hybrid work models within the BPO industry. This shift can reduce reliance on large, centralized physical locations. For example, in 2024, many BPO firms continued to optimize their real estate footprints, with some reporting a reduction in office space utilization by as much as 30% compared to pre-pandemic levels, directly impacting the leverage of traditional facility suppliers.

However, suppliers in key operational hubs or those offering specialized, high-demand services for physical centers can still command significant influence. The overall trend suggests a gradual erosion of supplier power in this segment as the BPO landscape evolves.

- Real Estate and Facilities: While physical contact centers remain, the rise of remote work lessens their critical importance.

- Remote Work Impact: The BPO sector's move towards remote and hybrid models is gradually diminishing the bargaining power of traditional facility suppliers.

- Key Hubs: Suppliers in strategically important locations or offering niche services may retain stronger leverage.

Supplier Power 5

The bargaining power of suppliers for data security and compliance solutions is escalating for Bellsystem24. As data privacy becomes a critical concern and regulations tighten within the Business Process Outsourcing (BPO) sector, specialized vendors in this area are seeing their influence grow. Bellsystem24's need to meet stringent global data protection standards directly translates to increased reliance on and leverage for these essential service providers.

Bellsystem24's reliance on these specialized suppliers is amplified by evolving regulatory landscapes. For instance, the General Data Protection Regulation (GDPR) in Europe and similar frameworks worldwide necessitate robust data handling and security protocols. Failure to comply can result in significant penalties, driving Bellsystem24 to secure reliable and compliant solutions, thereby strengthening the suppliers' position.

- Increasing Regulatory Demands: Bellsystem24 must navigate a complex web of data protection laws globally, enhancing the leverage of compliance solution providers.

- Specialized Expertise Required: The niche nature of data security and compliance means fewer suppliers possess the necessary advanced capabilities, concentrating power.

- High Switching Costs: Integrating and validating new security systems can be time-consuming and costly, making Bellsystem24 less likely to switch providers readily.

- Growing Market for Data Protection: The global data security market was projected to reach over $230 billion in 2024, indicating strong demand and supplier confidence.

The bargaining power of technology and software providers for BPO and contact center services is on the rise, driven by the increasing demand for AI, machine learning, and automation tools. Bellsystem24 needs these advanced solutions to stay competitive.

Suppliers of specialized talent, particularly those skilled in AI and data analytics, hold significant power as the BPO sector increasingly focuses on knowledge-driven services. This is especially true in Japan, where a shrinking workforce amplifies the demand for skilled BPO professionals, allowing suppliers to negotiate higher wages and favorable terms.

Telecommunications and cloud infrastructure providers are crucial to Bellsystem24's operations, as reliable communication channels are fundamental to their contact center solutions. The global cloud contact center market's substantial growth, valued at approximately $15.5 billion in 2024, highlights the critical role and leverage of these suppliers.

Data security and compliance solution providers are gaining influence due to escalating data privacy concerns and stricter regulations. Bellsystem24's need to adhere to global data protection standards, like GDPR, increases its reliance on these specialized vendors, strengthening their position.

| Supplier Type | Impact on Bellsystem24 | Key Drivers | 2024 Data Point |

| Technology & Software (AI/Automation) | Increased Costs, Need for Integration | Demand for advanced AI/ML | Global AI market expected to exceed $200 billion |

| Specialized Talent (AI/Data Analytics) | Higher Labor Costs, Talent Shortages | Focus on knowledge-driven services, demographic shifts | Japan's working-age population decline |

| Telecom & Cloud Infrastructure | Essential for Operations, Potential Price Increases | Need for reliable communication, market growth | Cloud contact center market valued at ~$15.5 billion |

| Data Security & Compliance | Increased Spending, Vendor Lock-in Potential | Stricter regulations, data privacy concerns | Global data security market projected over $230 billion |

What is included in the product

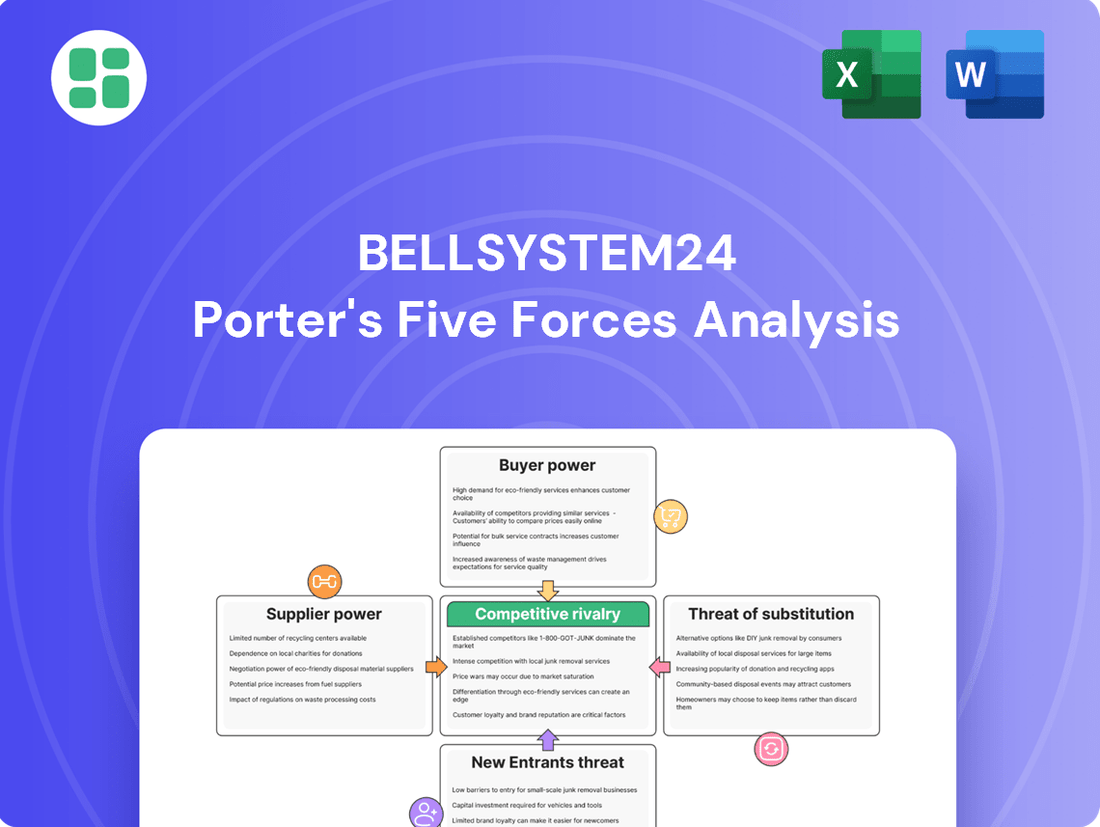

This analysis unpacks the competitive forces impacting Bellsystem24, examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within the business process outsourcing industry.

Instantly visualize competitive pressures and identify strategic opportunities with a dynamic, interactive Porter's Five Forces model.

Customers Bargaining Power

Bellsystem24's corporate clients, particularly large enterprises, wield considerable bargaining power. This strength stems from the highly competitive business process outsourcing (BPO) market, where numerous providers vie for contracts. These major clients can leverage this competition to negotiate favorable pricing, demand tailored service packages, and insist on superior service quality, impacting Bellsystem24's margins and operational flexibility.

Bellsystem24's customers hold significant bargaining power, especially when procuring standardized business process outsourcing (BPO) services. The relative ease with which clients can switch between BPO providers for these routine tasks directly influences their leverage.

While some switching costs are present for deeply integrated or customized solutions, the persistent drive for cost reduction and enhanced operational efficiency frequently prompts clients to investigate alternative vendors. In 2024, the BPO market continued to see competitive pricing pressures, with many clients actively seeking providers offering better value propositions, further amplifying buyer power.

Clients increasingly demand sophisticated digital transformation and AI-driven services from BPO providers. This shift empowers them to negotiate for better terms, pushing companies like Bellsystem24 to demonstrate advanced technological capabilities to remain competitive.

In 2024, the BPO market saw a significant rise in clients seeking AI-powered customer service solutions, with many expecting providers to offer predictive analytics and personalized customer journeys. Bellsystem24's ability to integrate these advanced technologies directly impacts its bargaining power with clients seeking to enhance their own customer experiences.

Buyer Power 4

Clients' ability to bring business processes in-house or automate them significantly strengthens their negotiating position with outsourcing providers like Bellsystem24. This is particularly true as advancements in AI and automation make it increasingly feasible for companies to handle customer interactions internally, thereby lessening their dependence on external Business Process Outsourcing (BPO) firms.

For instance, in 2024, the global BPO market was valued at approximately $269.9 billion, with a significant portion driven by customer care services. However, the increasing sophistication of AI-powered chatbots and virtual assistants, capable of handling a growing range of customer queries, directly empowers buyers. Companies can leverage these technologies to reduce their outsourcing spend, putting pressure on BPO providers to offer more competitive pricing and enhanced service levels.

- Increased Automation Adoption: Businesses are increasingly investing in AI and automation for customer service, with global spending on AI in customer service projected to reach tens of billions of dollars by 2025.

- In-sourcing as a Strategy: The ability to perform functions like data entry, customer support, and IT services internally provides a credible alternative to outsourcing, limiting the pricing power of BPO providers.

- Demand for Cost Efficiency: In a competitive economic climate, clients are more inclined to explore in-house solutions if they offer a better cost-benefit analysis compared to outsourcing.

- Technological Advancements: The continuous improvement of self-service portals and AI-driven solutions allows clients to manage customer interactions more effectively without relying on third-party BPO services.

Buyer Power 5

The business process outsourcing (BPO) market, including services like those offered by Bellsystem24, is characterized by significant price transparency. This transparency, fueled by industry reports and competitive bidding, allows customers to easily compare service providers and their pricing structures. For instance, a 2024 report by Grand View Research indicated the global BPO market was valued at $273.3 billion, with a significant portion driven by cost-conscious decision-making.

This ease of comparison directly impacts Bellsystem24's bargaining power. Customers can readily identify providers offering similar services at lower price points, putting pressure on Bellsystem24 to justify any premium pricing. Without clear, demonstrable differentiation in service quality or specialized capabilities, customers are likely to opt for the most cost-effective solution.

- Price Transparency: BPO market pricing is widely available through industry analysis and direct vendor comparisons.

- Competitive Bidding: Many large contracts are awarded through competitive tender processes, highlighting price as a key factor.

- Customer Comparison: Clients can easily benchmark Bellsystem24's offerings against numerous other BPO providers.

- Limited Pricing Power: Without strong unique selling propositions, Bellsystem24 faces challenges in maintaining high margins due to customer price sensitivity.

Bellsystem24's customers, particularly large enterprises, possess substantial bargaining power due to the highly competitive nature of the BPO market. This allows them to negotiate favorable pricing and demand tailored, high-quality services, directly influencing Bellsystem24's profitability and operational flexibility.

The ease with which clients can switch providers for standardized BPO services, coupled with a persistent demand for cost reduction, amplifies buyer power. In 2024, this competitive pricing pressure was evident, with clients actively seeking better value propositions, further empowering them in negotiations.

Clients' increasing demand for digital transformation and AI-driven solutions also strengthens their negotiating position. Bellsystem24 must demonstrate advanced technological capabilities to retain these clients, who are keen on enhancing their own customer experiences through AI-powered services.

The ability for clients to bring processes in-house or automate them, especially with advancements in AI, significantly reduces their reliance on external BPO providers. This capability directly translates into stronger negotiating leverage for clients, pushing BPO firms to offer more competitive terms.

| Factor | Impact on Bellsystem24 | 2024 Market Context |

|---|---|---|

| Market Competition | High buyer power due to numerous BPO providers | Intense competition for contracts |

| Switching Costs | Low for standardized services, enabling easier client movement | Clients actively seeking cost-effective alternatives |

| Technological Advancements | Clients leverage AI/automation for in-sourcing, reducing dependence | Growing adoption of AI in customer service solutions |

| Price Transparency | Facilitates easy comparison, limiting Bellsystem24's pricing power | Global BPO market valued around $273.3 billion in 2024, with price sensitivity |

What You See Is What You Get

Bellsystem24 Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Bellsystem24 Porter's Five Forces Analysis meticulously details the competitive landscape, including the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for Bellsystem24's strategic decision-making and for identifying opportunities and challenges within its industry.

Rivalry Among Competitors

Bellsystem24 operates in the BPO and customer experience outsourcing sector, a market characterized by intense competition from a multitude of global and regional players. These competitors, ranging from massive multinational BPO corporations to agile, specialized local firms, vie for the same client base, driving down prices and demanding service differentiation.

Bellsystem24 operates in an industry where technological shifts are constant and rapid. The increasing integration of Artificial Intelligence, automation, and cloud solutions means companies must perpetually invest in these areas to stay relevant. For Bellsystem24, this translates to a need for ongoing capital expenditure and a focus on agile development to keep pace with competitors who are also embracing these innovations.

While the BPO market, particularly in customer experience, shows robust growth, Bellsystem24 faces intense rivalry. This is exacerbated by Japan's demographic challenges, such as a declining working-age population, which tightens the labor market. In 2023, Japan's working-age population (15-64 years) continued its downward trend, creating a significant hurdle for service providers reliant on human capital.

This scarcity of skilled labor intensifies competition for talent among BPO providers, driving up recruitment and training costs. Bellsystem24 must navigate this environment where securing and retaining qualified personnel is a constant battle, directly impacting service quality and operational efficiency.

Competitive Rivalry 4

Competitive rivalry within the Business Process Outsourcing (BPO) sector, especially for companies like Bellsystem24, is intense. Providers differentiate themselves through specialized industry knowledge, cutting-edge technology like AI for analytics and omnichannel customer service, and a proven ability to boost efficiency and customer happiness. This constant push for unique offerings means companies are always looking for ways to stand out.

Bellsystem24 operates in a market where differentiation is key. For instance, in 2024, the global BPO market was projected to reach over $300 billion, highlighting the sheer scale and competition. Companies are investing heavily in technology to gain an edge.

- Specialized Expertise: Providers focus on niche industries like healthcare, finance, or technology to offer tailored solutions.

- Technological Advancement: Adoption of AI, machine learning, and advanced analytics is crucial for improving service delivery and insights.

- Customer Centricity: A strong emphasis on customer satisfaction and loyalty programs is a major differentiator.

- Scalability and Flexibility: The ability to quickly scale operations up or down based on client needs is highly valued.

Competitive Rivalry 5

Competitive rivalry within the Business Process Outsourcing (BPO) sector, particularly impacting firms like Bellsystem24, is characterized by intense pricing pressure. Clients consistently aim for cost optimization, which fuels aggressive pricing tactics among service providers. This dynamic directly squeezes profit margins across the industry.

Bellsystem24 operates in a market where differentiation often hinges on service quality and technological innovation, but price remains a primary decision driver for many clients. For instance, in 2024, the global BPO market was valued at approximately $273.5 billion, with significant competition driving down average contract values in certain segments.

- Intense Price Competition: Clients frequently prioritize cost savings, leading to a constant downward pressure on pricing for BPO services.

- Margin Erosion: Aggressive pricing strategies by competitors can diminish profitability for all players, including Bellsystem24.

- Service vs. Price: While service quality is important, price often dictates client choices in the BPO landscape.

- Market Dynamics: The large and competitive nature of the BPO market, estimated to grow further in the coming years, exacerbates rivalry.

Bellsystem24 faces fierce competition in the BPO sector, where numerous global and local players vie for market share. This intense rivalry is driven by a constant need for service differentiation, technological innovation, and cost-effectiveness. In 2024, the global BPO market was valued at approximately $273.5 billion, illustrating the high stakes and crowded competitive landscape.

| Competitor Type | Key Differentiators | Impact on Bellsystem24 |

| Global BPO Giants | Scale, broad service offerings, established client relationships | Price pressure, need for extensive service portfolios |

| Specialized Niche Players | Deep industry expertise, tailored solutions | Competition for specific vertical markets, need for specialized talent |

| Technology-Focused Firms | AI, automation, advanced analytics integration | Requirement for continuous R&D investment, agility in tech adoption |

SSubstitutes Threaten

Internal or in-house customer service departments pose a significant threat of substitution for Bellsystem24. Companies can opt to manage their contact center operations internally, especially those with ample resources or specific needs. For instance, a large financial institution might find it more cost-effective and secure to build its own customer service infrastructure rather than outsourcing.

The threat of substitutes for Bellsystem24's services is escalating, primarily driven by advancements in AI. Intelligent chatbots and sophisticated knowledge bases are increasingly capable of handling customer inquiries, offering a cost-effective alternative to human-powered business process outsourcing (BPO). This trend is particularly evident as companies look to optimize operational expenses.

For instance, in 2024, the global AI market, which fuels these self-service solutions, was projected to reach hundreds of billions of dollars. Companies are investing heavily in AI to automate customer support, directly impacting the demand for traditional BPO services. This shift means customers can often find immediate answers or resolve issues without needing to interact with a Bellsystem24 agent.

The threat of substitutes for Bellsystem24's services is significant, particularly from Robotic Process Automation (RPA) and hyperautomation tools. These technologies can automate many of the back-office and customer service functions that BPO providers like Bellsystem24 traditionally manage, allowing companies to achieve internal efficiencies without outsourcing. For instance, in 2024, the global RPA market was projected to reach over $13.7 billion, indicating a strong adoption trend and a clear substitute for human-driven BPO tasks.

4

The threat of substitutes for Bellsystem24's services is significant, primarily stemming from the increasing sophistication and accessibility of cloud-based contact center software and Customer Relationship Management (CRM) systems. These technologies empower companies to build and manage their own advanced customer interaction platforms, thereby reducing their reliance on full Business Process Outsourcing (BPO) engagements like those offered by Bellsystem24. For instance, by mid-2024, many businesses were actively exploring or implementing self-service portals and AI-powered chatbots, which can handle a substantial volume of customer inquiries previously managed by human agents.

This trend directly impacts Bellsystem24 by offering alternative solutions that can be more cost-effective and customizable for clients. Companies can leverage platforms like Salesforce Service Cloud or Zendesk to automate routine tasks, manage customer data, and provide omnichannel support without outsourcing the entire operation. The growing capabilities in areas like natural language processing and machine learning further enhance the effectiveness of these in-house solutions, presenting a compelling substitute for traditional BPO services.

Consider these key aspects of the substitute threat:

- Technological Advancements: Sophisticated cloud-based contact center software and CRM systems enable in-house management of customer interactions.

- Cost-Effectiveness: Companies can potentially reduce operational costs by adopting self-service and automated solutions over full BPO outsourcing.

- Customization and Control: In-house platforms offer greater control and customization to align with specific business needs and brand identity.

- Market Adoption: By 2024, there was a noticeable increase in businesses adopting these technologies, indicating a growing acceptance of substitutes.

5

The threat of substitutes for Bellsystem24's services is moderate. Businesses are increasingly adopting direct digital communication channels like social media, in-app messaging, and internal email management. This shift can reduce their reliance on traditional voice-based contact center services, a core offering of Business Process Outsourcing (BPO) firms. For example, a significant portion of customer service interactions are now handled through self-service portals or chatbots, diverting volume from human agents.

Bellsystem24, like other BPO providers, faces pressure from these evolving customer engagement strategies. While voice remains important, the growth in digital channels means clients may opt for integrated solutions that minimize outbound calling or complex inbound routing. The ability to manage customer relationships across multiple touchpoints, often with lower per-interaction costs for digital methods, presents a viable alternative to traditional call center outsourcing.

The increasing self-sufficiency of customers, empowered by readily available online information and FAQs, further contributes to this threat. Companies can invest in robust knowledge bases and AI-powered chatbots to address a substantial volume of inquiries without external BPO support. This trend is evident across various industries, where digital-first customer service models are becoming the norm, impacting the demand for traditional contact center services.

- Digital Channels: Social media, in-app messaging, and email are growing substitutes for voice-based support.

- Self-Service: Online FAQs and AI chatbots reduce the need for human agent intervention.

- Cost Efficiency: Digital and self-service options often offer lower per-interaction costs for businesses.

- Customer Preference: A growing segment of customers prefers digital self-service over voice communication.

The threat of substitutes for Bellsystem24 is significant, driven by advancements in AI, Robotic Process Automation (RPA), and sophisticated cloud-based contact center software. These technologies allow companies to build in-house customer service solutions, manage interactions through digital channels like social media and chatbots, and leverage self-service portals, all of which can be more cost-effective and customizable than traditional BPO. For instance, the global RPA market was projected to exceed $13.7 billion in 2024, highlighting a strong adoption trend for automation that directly substitutes human-driven BPO tasks.

| Substitute Type | Key Characteristics | Impact on Bellsystem24 | 2024 Market Data/Trend |

|---|---|---|---|

| In-house Customer Service | Cost-effective, secure, tailored to specific needs | Reduced outsourcing demand for core BPO functions | Large enterprises increasingly exploring internal solutions |

| AI Chatbots & Knowledge Bases | 24/7 availability, instant responses, cost savings | Handles high volume of routine inquiries, reducing need for human agents | Global AI market projected in hundreds of billions USD |

| RPA & Hyperautomation | Automates back-office and customer service tasks | Replaces manual processes traditionally handled by BPO | RPA market projected over $13.7 billion in 2024 |

| Cloud Contact Center Software & CRM | Enables in-house platform management, customization | Reduces reliance on full BPO, offers alternative to outsourcing entire operations | Increased adoption of self-service portals and AI chatbots by mid-2024 |

Entrants Threaten

The capital investment needed to launch a large-scale contact center, covering everything from office space and advanced technology to recruiting and training staff, presents a substantial hurdle for potential new competitors. For instance, setting up a modern contact center in 2024 can easily cost millions of dollars in initial outlay.

However, the increasing prevalence of remote work arrangements is beginning to chip away at this barrier. Companies can now leverage distributed workforces, potentially reducing the need for massive physical infrastructure investments, which could make entry more feasible for smaller, agile players in the contact center market.

Bellsystem24's long-standing reputation, built on years of accumulating client trust and deep industry-specific expertise, creates a significant hurdle for potential new entrants. Clients typically gravitate towards established providers with a proven history of success, making it difficult for newcomers to gain traction.

The threat of new entrants in the Business Process Outsourcing (BPO) sector, particularly for companies like Bellsystem24, is moderate. A significant barrier is the need for a skilled and scalable workforce. New players may find it challenging to attract and retain talent, especially in specialized fields such as AI-driven customer service or advanced data analytics, which are increasingly in demand. For instance, in 2024, the global BPO market continued to face talent acquisition challenges, with many regions experiencing labor shortages that inflate hiring costs and slow down expansion for newcomers.

4

The threat of new entrants for Bellsystem24 is moderate, largely due to significant hurdles in regulatory compliance and data security. Meeting stringent standards like ISO certifications and various data protection laws, such as GDPR or local equivalents, requires substantial investment and expertise. For instance, obtaining and maintaining ISO 27001 certification, a common benchmark for information security management, can cost tens of thousands of dollars annually for audits and ongoing compliance efforts. This financial and operational burden deters many smaller or less capitalized firms from entering the market.

Furthermore, the established reputation and existing client relationships of companies like Bellsystem24 act as a formidable barrier. New entrants would need to demonstrate a comparable level of trust and reliability, particularly when handling sensitive customer data. The upfront costs associated with building brand recognition and securing initial contracts can be prohibitive. In 2024, the competitive landscape continues to emphasize trust and proven security protocols, making it challenging for newcomers to gain a foothold without a significant initial investment in these areas.

- High initial investment in regulatory compliance and data security.

- Existing customer trust and brand loyalty favor incumbents.

- Complex and evolving legal frameworks for data handling.

- Need for specialized technical infrastructure and expertise.

5

The threat of new entrants for Bellsystem24 is moderate, influenced heavily by the capital and technological requirements. The business process outsourcing (BPO) sector, particularly in customer service and IT support, has seen a surge in demand for AI and automation integration. New players must therefore demonstrate substantial investment in advanced technologies to even enter the market, let alone compete. For instance, the global AI in customer service market was valued at approximately $3.5 billion in 2023 and is projected to grow significantly, indicating a high bar for entry for those without robust tech capabilities.

New entrants face challenges in building brand reputation and securing client trust, which are critical in the BPO industry where reliability and data security are paramount. Bellsystem24, with its established track record and existing client relationships, benefits from significant brand loyalty. Furthermore, the need for specialized talent in areas like data analytics and AI implementation creates another barrier. Companies entering this space must not only invest in technology but also in attracting and retaining skilled personnel, a costly endeavor. In 2024, the demand for AI specialists in customer service roles continues to outpace supply, driving up recruitment costs.

The industry's regulatory landscape, particularly concerning data privacy and compliance, also poses a hurdle for newcomers. Adhering to stringent regulations like GDPR or CCPA requires significant legal and operational resources. Bellsystem24, having navigated these complexities for years, has established compliance frameworks. New entrants must build these from scratch, adding to their initial investment and time-to-market. The cost of compliance can be a substantial deterrent, especially for smaller, less-resourced organizations looking to enter the BPO market.

- Technological Sophistication: New entrants must possess advanced AI and automation capabilities to meet evolving client demands in the BPO sector.

- Capital Investment: Significant upfront investment is required for technology, skilled talent acquisition, and regulatory compliance.

- Brand Reputation & Trust: Established players like Bellsystem24 benefit from existing client relationships and a proven track record, making it difficult for new entrants to gain market share.

- Regulatory Compliance: Navigating data privacy laws and industry-specific regulations adds complexity and cost for potential new market participants.

The threat of new entrants for Bellsystem24 is assessed as moderate. Significant capital is required for advanced technology, particularly in AI and automation, which are now essential for competitive BPO services. For instance, implementing sophisticated AI-powered customer service solutions in 2024 can involve initial investments of hundreds of thousands to millions of dollars.

Established trust and brand reputation are crucial in the BPO sector, creating a barrier for newcomers. Bellsystem24's long-standing client relationships and proven track record provide a distinct advantage. Furthermore, the need for specialized talent, such as AI engineers and data scientists, drives up recruitment costs, with demand often exceeding supply in 2024, leading to higher compensation packages for these roles.

Navigating complex regulatory environments, especially concerning data privacy and security, presents another substantial hurdle. Compliance with standards like GDPR or industry-specific certifications requires significant ongoing investment and expertise. For example, maintaining ISO 27001 certification can cost upwards of $20,000 annually in audit and compliance fees, deterring less capitalized entrants.

| Barrier Type | Description | Estimated 2024 Cost/Impact |

|---|---|---|

| Capital Investment (Technology) | Implementing advanced AI and automation solutions. | $100,000 - $2,000,000+ |

| Talent Acquisition | Hiring specialized AI engineers and data scientists. | Salaries up 15-25% year-over-year in high-demand roles. |

| Regulatory Compliance | Achieving and maintaining data security certifications (e.g., ISO 27001). | $20,000 - $50,000+ annually. |

| Brand Reputation & Trust | Building client confidence in data handling and service reliability. | Prohibitive for new entrants without proven history. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bellsystem24 is built upon a foundation of verified data, including Bellsystem24's annual reports, investor relations disclosures, and industry-specific market research from reputable firms. We also incorporate data from government filings and economic indicators to provide a comprehensive understanding of the competitive landscape.