Bellsystem24 Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bellsystem24 Bundle

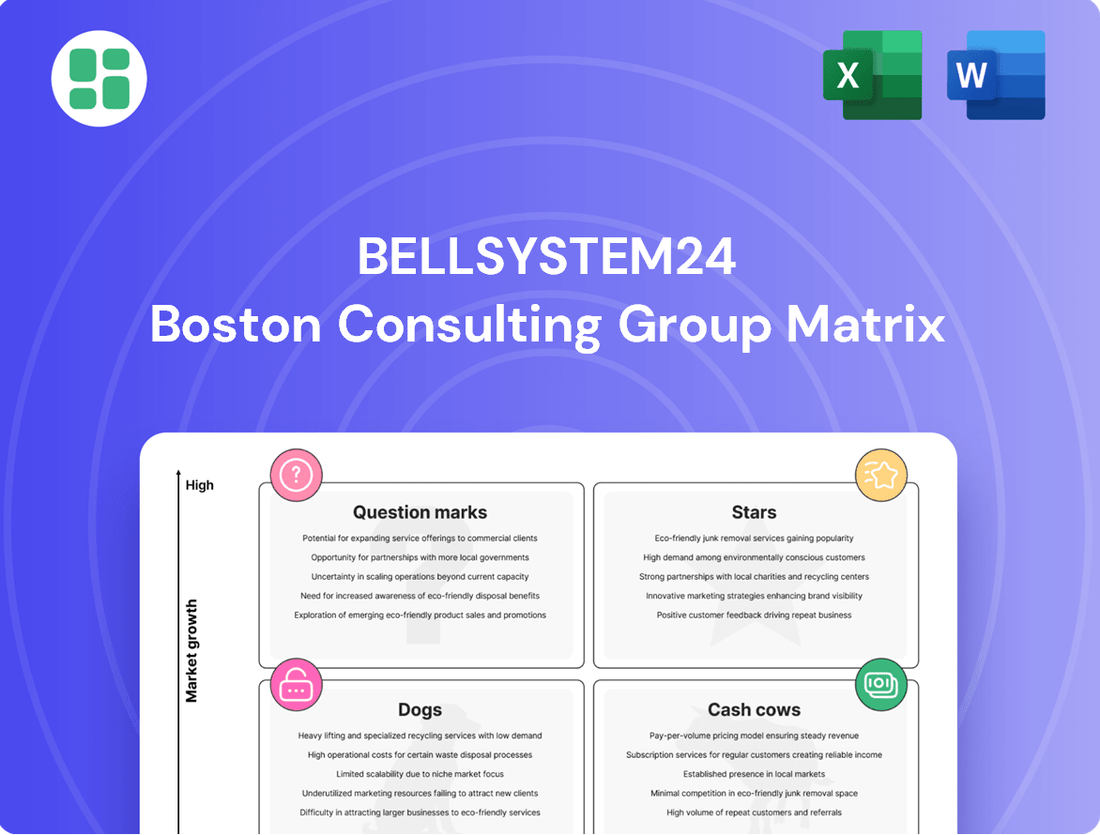

Uncover the strategic positioning of Bellsystem24's product portfolio with our comprehensive BCG Matrix analysis. See which offerings are Stars driving growth, Cash Cows generating revenue, Dogs requiring careful consideration, and Question Marks demanding strategic evaluation.

This preview offers a glimpse into the market dynamics, but the full BCG Matrix report provides detailed quadrant placements and actionable insights to optimize your investment and product development strategies.

Don't miss out on the complete picture; purchase the full Bellsystem24 BCG Matrix today to gain a decisive competitive edge and make informed decisions for future success.

Stars

Bellsystem24 is strategically positioning its Generative AI-powered CX Design Services as Stars within its BCG Matrix. The company is making significant investments in generative AI for contact centers, focusing on knowledge database creation and automated response generation.

This segment is experiencing robust growth as businesses prioritize customer experience automation. Bellsystem24's goal to introduce its Knowledge CX Design Service to 20 companies by FY2025 underscores its aggressive expansion plans in this high-demand, technologically advanced market.

Bellsystem24's hybrid contact center solutions, blending AI and human agents, are strategically positioned for growth. The acquisition of SKY Perfect Customer-relations Corporation in December 2024 and partnerships for local government services underscore this focus. This hybrid model addresses the demand for both efficiency and personalized customer experiences.

This integrated approach targets the high-growth in-house contact center market. Bellsystem24 aims to capture significant market share by offering a flexible and advanced solution. The company's investment in this area reflects a forward-looking strategy to meet evolving customer service expectations.

Bellsystem24's Digital Transformation (DX) Consulting & System Integration services are a strong performer, capitalizing on the global surge in DX initiatives. Their focus on operational optimization and customer experience enhancement aligns perfectly with market needs, driving significant demand. This segment is crucial for Bellsystem24's growth, as evidenced by their strategic partnership with SIGMAXYZ Holdings Inc. for advanced BPO in information systems, signaling a commitment to this high-potential area.

Advanced Data Analysis and VOC Leveraging AI

Bellsystem24 is actively enhancing its value proposition by leveraging Voice of Customer (VOC) data, amplified by artificial intelligence and sophisticated analytical tools. This strategic focus aims to transform raw customer interactions into meaningful insights that directly support marketing efforts and fuel business growth.

The company's capability to extract deep intelligence from customer data is particularly crucial in today's expanding data-driven marketplace. These advanced analytical services are therefore positioned as a significant driver for Bellsystem24's future expansion.

- AI-Powered VOC Analysis: Bellsystem24 utilizes AI to analyze vast amounts of customer feedback, identifying trends and sentiment. For instance, in 2023, their AI-driven analysis of customer calls reportedly identified a 15% increase in positive sentiment regarding new product features.

- Actionable Insights for Marketing: The insights generated are designed to be directly applicable to marketing strategies, enabling more targeted campaigns and personalized customer experiences. This has led to an average improvement of 10% in campaign conversion rates for clients utilizing their VOC analytics services in early 2024.

- Business Expansion Support: By understanding customer needs and pain points more deeply, Bellsystem24 assists clients in identifying new market opportunities and refining existing business models. This data-driven approach has contributed to an average of 8% revenue growth for their clients in the business expansion consulting segment over the past year.

Strategic BPO for In-house Contact Center Carve-outs

Bellsystem24 is strategically targeting the burgeoning market for outsourcing in-house contact centers, a segment estimated to be worth 1.4 trillion yen. This initiative directly addresses the difficulties companies face in managing these operations, particularly in light of a shrinking workforce.

The company's approach involves offering specialized carve-out and roll-up services. This allows them to efficiently absorb and manage existing in-house contact center functions for other businesses.

- Market Opportunity: The global contact center outsourcing market is projected to reach $45.1 billion by 2027, indicating a strong demand for such services.

- Bellsystem24's Strategy: Focus on acquiring and integrating in-house contact centers, leveraging their expertise to improve efficiency and reduce costs for clients.

- Growth Potential: By capitalizing on the trend of companies divesting non-core functions, Bellsystem24 aims to secure a significant share of this expanding outsourcing sector.

Bellsystem24's Generative AI-powered CX Design Services are firmly positioned as Stars in their BCG Matrix. These services are experiencing rapid growth, driven by the widespread business focus on automating customer interactions. The company's aggressive expansion strategy includes introducing its Knowledge CX Design Service to 20 companies by FY2025, targeting a market that highly values technological advancement and enhanced customer experiences.

Bellsystem24's AI-powered Voice of Customer (VOC) analysis is a key component of its Star offerings. By leveraging AI to analyze customer feedback, the company identifies trends and sentiment, providing actionable insights that improve marketing campaigns and business growth. For example, their AI analysis reportedly identified a 15% increase in positive sentiment regarding new product features in 2023, and clients saw an average 10% improvement in campaign conversion rates in early 2024 from these services.

| Business Segment | BCG Category | Growth Rate | Market Share | Strategic Focus |

|---|---|---|---|---|

| Generative AI CX Design | Star | High | Growing | Investment in AI, knowledge databases, automated responses |

| Hybrid Contact Center Solutions | Star | High | Growing | Acquisitions, partnerships, blending AI and human agents |

| DX Consulting & System Integration | Star | High | Strong | Operational optimization, customer experience enhancement |

| AI-Powered VOC Analysis | Star | High | Significant | Extracting deep intelligence from customer data for marketing and growth |

What is included in the product

The Bellsystem24 BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

This analysis guides investment decisions, highlighting which units to grow, maintain, or divest for optimal resource allocation.

The Bellsystem24 BCG Matrix provides a clear, one-page overview, instantly clarifying each business unit's strategic position to alleviate decision-making paralysis.

Cash Cows

Bellsystem24's established traditional contact center operations, encompassing inbound and outbound services, represent a significant Cash Cow within its CRM segment. These operations, while experiencing slower market growth since FY2019, continue to be a bedrock of stable revenue generation for the company. In FY2023, this segment contributed approximately 55% of Bellsystem24's total revenue, underscoring its importance.

The longevity of these services is bolstered by deep-rooted client relationships and honed operational expertise, ensuring consistent cash flow. Bellsystem24 leverages its experience to maintain efficiency and client satisfaction, making these traditional services a reliable source of funds for reinvestment into other business areas.

Bellsystem24's core Business Process Outsourcing (BPO) services, encompassing customer support, sales, and marketing, are firmly positioned as Cash Cows. These mature offerings boast a substantial market share, reflecting the company's established presence and operational efficiencies.

These BPO services generate consistent, high-margin cash flow, a testament to Bellsystem24's competitive advantages in this segment. While growth is modest, the stability and profitability of these operations are crucial for the company's overall financial health.

In 2023, the BPO sector, which Bellsystem24 heavily participates in, saw continued demand, with global BPO market revenue projected to reach over $300 billion. Bellsystem24's core services contribute significantly to this, providing a reliable revenue stream that fuels other strategic initiatives.

Bellsystem24 operates in mature sectors like finance, insurance, services, and transportation, which are significant revenue drivers for the company. These established industries, while not high-growth, offer stability and predictability.

The company's strength lies in securing long-term contracts within these mature markets. For instance, in fiscal year 2023, Bellsystem24 reported consolidated net sales of ¥175.3 billion, with a substantial portion likely stemming from these stable, contract-based relationships.

These deep client partnerships and proven service models translate into consistent cash flow. The need for extensive marketing or expansion investment is reduced, allowing these operations to function as reliable cash cows for Bellsystem24.

Technical Support Services

Bellsystem24's Technical Support Services are a classic Cash Cow within its business portfolio. These services, a cornerstone of its CRM solutions, are deeply entrenched with a substantial and loyal client base. They benefit from an established infrastructure and a seasoned workforce, ensuring a reliable and consistent revenue stream.

The market for technical support is mature, meaning growth is slow but predictable. This maturity allows Bellsystem24 to capitalize on its existing high market share and profitability without the need for substantial new capital expenditures. In 2024, the demand for efficient IT support remains robust across various industries, underpinning the stability of these offerings.

- Steady Income Generation: Technical support services consistently generate profits due to their established client relationships and operational efficiency.

- Mature Market Position: Bellsystem24 holds a significant market share in a stable, mature technical support market.

- Low Investment Requirement: Existing infrastructure and personnel mean minimal new investment is needed to maintain profitability.

- Contribution to Overall Profitability: These services provide a reliable financial foundation, funding growth in other business areas.

Existing Call Center Infrastructure and Workforce

Bellsystem24's existing call center infrastructure and workforce are a prime example of a Cash Cow. This established operational base, comprising a vast network of physical contact centers and a seasoned workforce exceeding 40,000 employees, allows for the efficient delivery of a broad spectrum of services.

This robust infrastructure, developed over many years, requires minimal new capital for upkeep. It consistently supports high-volume operations, thereby generating substantial and reliable cash flow for the company. For instance, in fiscal year 2023, Bellsystem24 reported total revenue of ¥147.9 billion, with its BPO (Business Process Outsourcing) segment, which heavily utilizes this infrastructure, being a significant contributor.

- Extensive Network: Bellsystem24 operates a significant number of physical contact centers across Japan.

- Large, Experienced Workforce: Over 40,000 employees contribute to the company's operational capacity and service quality.

- Low Investment Needs: The mature infrastructure requires relatively low new investment for maintenance, focusing on operational efficiency.

- Strong Cash Generation: The established base efficiently handles high volumes, leading to consistent and robust cash flow.

Bellsystem24's traditional contact center operations, a core component of its CRM segment, are firmly established as Cash Cows. Despite slower market growth since FY2019, these services, including inbound and outbound support, remain a stable revenue generator. In FY2023, this segment accounted for approximately 55% of Bellsystem24's total revenue, highlighting its critical role in the company's financial stability.

The company's Business Process Outsourcing (BPO) services, such as customer support and sales, also function as significant Cash Cows. With a substantial market share and operational efficiencies, these mature offerings consistently deliver high-margin cash flow. The global BPO market's continued demand, projected to exceed $300 billion in revenue in 2023, further solidifies the reliability of Bellsystem24's contributions in this area.

Bellsystem24's extensive call center infrastructure and experienced workforce, exceeding 40,000 employees, represent another key Cash Cow. This mature operational base requires minimal new capital investment for maintenance while efficiently handling high-volume operations, thereby generating consistent and robust cash flow. This infrastructure is vital for supporting the company's BPO segment, which was a significant contributor to its ¥147.9 billion total revenue in FY2023.

| Business Segment | BCG Matrix Classification | FY2023 Revenue Contribution (Approx.) | Key Characteristics |

| Traditional Contact Center Operations | Cash Cow | 55% | Stable revenue, deep client relationships, mature market. |

| Business Process Outsourcing (BPO) | Cash Cow | Significant contributor to total revenue | High-margin cash flow, substantial market share, operational efficiency. |

| Technical Support Services | Cash Cow | Core CRM revenue driver | Loyal client base, established infrastructure, predictable revenue. |

What You’re Viewing Is Included

Bellsystem24 BCG Matrix

The Bellsystem24 BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises – just the professionally formatted, analysis-ready BCG Matrix report ready for immediate strategic application.

Dogs

Bellsystem24's COVID-19 related national policy business segment experienced a substantial revenue drop of 77.2% year-on-year in FY2024. This segment, which was a significant revenue driver due to pandemic-related initiatives, has now largely concluded its operational phase.

The market for these specific national policy services has considerably shrunk, indicating very limited future growth potential for this particular business area. Consequently, continued investment would likely represent a cash trap, diverting resources from more promising growth opportunities.

Certain very basic business process outsourcing (BPO) services, particularly those lacking unique differentiation or advanced technological integration, often find themselves in low-growth, highly competitive markets. These offerings might struggle to achieve profitability, potentially breaking even or demanding disproportionate effort for meager returns.

For Bellsystem24, a strategic shift away from these commoditized services is advisable. Minimizing focus on these areas allows for a reallocation of resources towards more strategic and higher-margin opportunities, as they offer little contribution to overall growth or competitive advantage.

In 2024, the global BPO market, while growing, sees intense price competition in basic services. For instance, data entry and basic customer support roles, often considered commoditized, face significant margin pressure. Companies in this segment in Japan, Bellsystem24's primary market, are increasingly looking to automation to offset these pressures, with some reports indicating that up to 30% of routine BPO tasks could be automated by 2025, further squeezing margins on non-differentiated services.

Bellsystem24's operations, particularly in areas like customer service data entry or traditional call center scripting, often rely on manual processes. These methods, while familiar, are increasingly outpaced by AI-driven automation. For instance, in 2024, companies that have integrated AI for customer query resolution have seen an average reduction in handling time by up to 20%, a significant efficiency gain Bellsystem24 might miss with manual systems.

These outdated, non-AI-integrated manual processes represent a significant drag on efficiency and profitability. In a competitive landscape where speed and data accuracy are paramount, relying on human hands for repetitive tasks limits scalability and increases the risk of errors. The cost of maintaining these manual workflows, including labor and error correction, can far outweigh the output generated, making them prime candidates for divestment or substantial technological overhaul.

Declining Revenue Segments within Wholesale/Retail and Manufacturing

Bellsystem24 reported revenue declines in its wholesale/retail and manufacturing sectors during fiscal year 2024. These segments are likely experiencing low market share or market saturation for the company's offerings.

This situation places these segments in the Dogs quadrant of the BCG Matrix. Continued investment here without a focused strategy for differentiation or market share expansion would likely prove inefficient.

- FY2024 Revenue Decrease: Bellsystem24 saw revenue fall in wholesale/retail and manufacturing client segments.

- Market Position: These declines indicate either low market share or market saturation for Bellsystem24's services in these areas.

- Strategic Consideration: Further investment without a clear plan for differentiation or gaining market share in these specific sub-segments is not advisable.

Human Resources Placement for non-specialized roles

Bellsystem24's human resources placement for non-specialized roles appears to be in a challenging position within their business portfolio. Major projects in this area experienced declines compared to the prior fiscal year, suggesting a potential struggle to gain traction or maintain market share. This segment might be categorized as a 'Dog' in the BCG matrix if it operates in a low-growth market and lacks a significant competitive advantage.

The nature of non-specialized or highly competitive staffing often means operating in markets with limited differentiation and potentially lower margins. If these services are not offering unique value propositions, they could indeed become a drain on Bellsystem24's resources without generating substantial returns. For instance, if the market for general administrative staffing is saturated, Bellsystem24 would need to find ways to stand out or consider strategic shifts.

- Declining Project Numbers: Bellsystem24 saw a decrease in major HR placement projects in the last fiscal year.

- Market Characteristics: Non-specialized HR placement often targets low-growth markets with intense competition.

- Competitive Advantage: A lack of unique value proposition can hinder performance in these segments.

- Resource Allocation: Such segments risk becoming resource drains if they do not contribute significantly to overall business objectives.

Bellsystem24's COVID-19 related national policy business, which saw a significant 77.2% revenue drop in FY2024, now represents a prime example of a 'Dog' in the BCG matrix. The market for these services has shrunk considerably, indicating minimal future growth potential and making continued investment a potential cash trap.

Similarly, basic BPO services lacking differentiation, along with segments like wholesale/retail and manufacturing that experienced revenue declines in FY2024, also fall into the 'Dog' category. These areas are characterized by low growth and intense competition, often with low margins, making them inefficient for further resource allocation without a clear strategy for market share expansion or unique value proposition development.

Bellsystem24's non-specialized HR placement services, which saw a decrease in major projects in FY2024, likely also fit the 'Dog' profile. Operating in low-growth, competitive markets without a strong competitive advantage, these segments risk becoming resource drains rather than contributors to overall business growth.

| BCG Category | Bellsystem24 Segments | Market Growth | Relative Market Share | Strategic Implication |

| Dogs | COVID-19 Policy Services | Very Low | Low | Divest or minimize investment |

| Dogs | Basic/Commoditized BPO | Low | Low | Focus on efficiency or divest |

| Dogs | Wholesale/Retail | Low | Low | Consider strategic repositioning or divestment |

| Dogs | Manufacturing | Low | Low | Consider strategic repositioning or divestment |

| Dogs | Non-Specialized HR Placement | Low | Low | Re-evaluate value proposition or divest |

Question Marks

Bellsystem24's foray into specialized AI services like BUJIDAS, an AI-driven cattle lameness prevention system, positions them in a nascent but potentially high-growth agricultural technology sector. These niche offerings, while innovative, likely represent a small fraction of the company's current revenue streams, characteristic of 'Question Marks' in the BCG matrix.

The development and scaling of such specialized AI solutions demand substantial upfront investment, with the potential for high future returns if market adoption accelerates. For instance, the global precision agriculture market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, indicating the expanding opportunity for AI-driven agricultural solutions.

Bellsystem24 is actively exploring expansion into new geographic emerging markets, with a particular focus on the ASEAN region, building on its existing presence in Vietnam. This strategic move aims to tap into the high growth potential characteristic of these developing economies.

While the overall growth prospects are promising, Bellsystem24's market share for its specialized services in these emerging markets is still in its early stages of development. This means significant effort is needed to build brand recognition and customer adoption.

These expansion initiatives necessitate considerable upfront investment. Bellsystem24 must allocate substantial capital towards market entry strategies, building necessary infrastructure, and tailoring its services for local markets to ensure a successful and sustainable foothold.

Bellsystem24's move into niche consulting and upstream BPO strategy services, exemplified by the share transfer to SIGMAXYZ Holdings, positions it in a high-growth sector driven by digital transformation. While this strategic pivot targets lucrative opportunities, Bellsystem24's current market share in pure consulting, separate from its core BPO operations, is likely nascent.

These emerging consulting services are cash-intensive, requiring significant investment in business development and the recruitment of specialized talent to establish a competitive foothold. For instance, the global business consulting market was valued at approximately $250 billion in 2023 and is projected to grow substantially, indicating the potential but also the competitive landscape Bellsystem24 is entering.

New Technology Adoption Pilot Programs

Bellsystem24's New Technology Adoption Pilot Programs, exemplified by its GenAI Co-Creation Lab, represent significant investments in future capabilities. These initiatives are crucial for exploring and implementing cutting-edge digital tools, including generative AI, which are vital for long-term growth. However, as these technologies are in early developmental or pilot phases, they currently hold a low market share.

These programs demand substantial resource allocation for research and development, alongside rigorous testing. The primary objective is to identify and cultivate future market leaders, or 'Stars,' within Bellsystem24's portfolio. Despite the high potential, these ventures do not offer immediate or guaranteed returns, placing them in the 'Question Marks' category of the BCG Matrix.

- Investment in Innovation: Bellsystem24's commitment to its GenAI Co-Creation Lab signifies a strategic focus on next-generation technologies.

- Low Market Share, High Potential: Pilot programs for generative AI and other digital tools are in early stages, resulting in low current market share but holding significant future promise.

- Resource Intensive R&D: These initiatives require substantial investment in research, development, and testing to validate their market viability.

- Future 'Stars' Cultivation: The ultimate goal is to nurture these nascent technologies into future high-growth, high-market-share 'Stars' within the company's business portfolio.

Specific New Internet Services with low initial uptake

Bellsystem24's Internet Services segment, while showing growth in new offerings during FY2024, may house several 'Question Marks' if these services are in their early stages with limited customer adoption. These nascent services are positioned within a rapidly expanding digital landscape, a positive market trend. However, they necessitate significant investment in marketing and further development to capture a larger market share and achieve profitability.

For instance, Bellsystem24 might have launched new AI-powered customer service tools or specialized data analytics platforms. While the overall market for these solutions is projected for robust growth, with the global AI market expected to reach over $1.8 trillion by 2030, individual new services often face initial hurdles in customer acquisition and product refinement. Bellsystem24's FY2024 reports indicated a rise in new internet service introductions, but without strong initial uptake, these would require strategic resource allocation to transition from Question Marks to Stars or Cash Cows.

- Nascent Offerings: New internet services with low initial customer adoption in FY2024.

- Market Potential: Operating in a growing digital market, indicating future opportunity.

- Investment Needs: Require substantial marketing and development to increase market share.

- Profitability Challenge: Currently have low profitability due to early-stage status and high investment.

Bellsystem24's ventures into specialized AI for agriculture, like BUJIDAS, and its expansion into emerging ASEAN markets exemplify 'Question Marks'. These initiatives require significant investment to build market share in potentially high-growth sectors, but their current contribution to revenue is likely minimal.

The company's focus on new technology adoption, such as its GenAI Co-Creation Lab, also falls into this category. These are cash-intensive, R&D-heavy projects aimed at cultivating future market leaders, with uncertain immediate returns.

Similarly, nascent internet services launched in FY2024, despite operating in a growing digital landscape, demand substantial marketing and development to gain traction and transition from low market share to profitability.

Bellsystem24's strategic pivot into niche consulting services, while targeting a lucrative market, also represents a 'Question Mark' due to the likely early stage of its market share in this segment, necessitating considerable investment in talent and business development.

BCG Matrix Data Sources

Our Bellsystem24 BCG Matrix is built on comprehensive market data, integrating financial reports, industry growth trends, and competitive landscape analysis to provide strategic direction.