Beiersdorf Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Beiersdorf Bundle

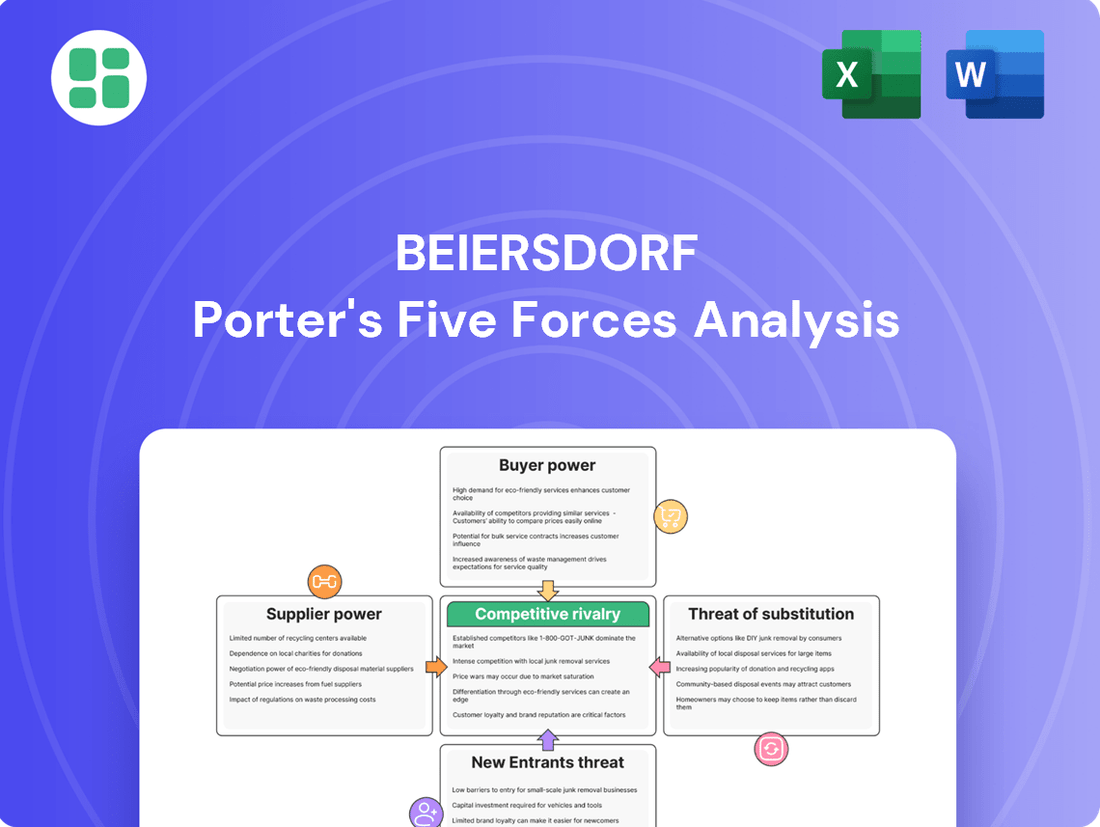

Beiersdorf navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the constant threat of substitutes, according to our Porter's Five Forces analysis. Understanding these forces is crucial for any stakeholder looking to grasp Beiersdorf's strategic positioning.

The complete report reveals the real forces shaping Beiersdorf’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Beiersdorf's reliance on a broad spectrum of raw materials, from specialty chemicals to packaging, means that disruptions or price hikes from any single supplier group can have a ripple effect. For instance, fluctuations in the price of key oils or emulsifiers, which are fundamental to many skincare formulations, can directly impact Beiersdorf's cost of goods sold. In 2023, the global chemical industry experienced continued price volatility due to energy costs and supply chain pressures, a trend that likely persisted into early 2024, directly affecting Beiersdorf's input expenses.

For premium brands like La Prairie or specialized dermatological lines such as Eucerin, Beiersdorf often relies on highly specialized or patented ingredients. These unique inputs, sourced from a limited number of suppliers, can give those suppliers significant bargaining power. The exclusivity and the high cost associated with reformulating or finding alternatives for these critical components mean Beiersdorf has less leverage.

The tesa segment, in particular, depends on niche chemical suppliers for its advanced adhesive technologies. These suppliers often possess proprietary knowledge and processes, making them indispensable. In 2024, the specialty chemicals market continued to see consolidation, further concentrating supply and potentially increasing supplier leverage for essential raw materials used in tesa's high-performance tapes and adhesives.

Beiersdorf, as a global player, relies significantly on logistics and distribution services to move its products across the world. The bargaining power of these suppliers can shift based on market dynamics, affecting Beiersdorf's operational efficiency and cost structure.

Consolidation within the logistics sector or rising fuel prices, which directly impact transportation costs, can enhance the leverage of logistics providers. For instance, a significant increase in global shipping rates, potentially driven by geopolitical events or supply chain disruptions, could force Beiersdorf to absorb higher costs or pass them on to consumers.

In 2024, the global logistics market experienced continued volatility. According to industry reports, ocean freight rates, while having stabilized from earlier peaks, remained a significant cost factor for many companies, including those in the fast-moving consumer goods sector like Beiersdorf. The ability of logistics firms to command these rates directly translates to their bargaining power.

Labor Market Dynamics

The availability of skilled labor significantly impacts Beiersdorf's operational costs. For instance, a shortage of specialized R&D personnel or experienced manufacturing technicians can drive up wages, increasing the company's cost structure. This is particularly true for highly specialized scientific talent crucial for product innovation.

Wage inflation and labor shortages in key operational regions directly enhance the bargaining power of Beiersdorf's workforce. In 2024, several European countries, where Beiersdorf has a strong presence, experienced notable wage growth in manufacturing sectors, putting upward pressure on labor expenses.

- Skilled Labor Availability: Beiersdorf relies on a pool of skilled workers in R&D, manufacturing, and marketing.

- Wage Pressures: In 2024, regions like Germany saw average wage increases in manufacturing, impacting Beiersdorf's labor costs.

- Specialized Talent: The demand for scientific expertise in cosmetics and skincare development remains high, giving specialized talent greater leverage.

- Impact on Costs: Labor dynamics can directly influence Beiersdorf's cost of goods sold and overall profitability.

Intellectual Property and Licensing

Intellectual property and licensing can significantly influence the bargaining power of suppliers for companies like Beiersdorf. If Beiersdorf relies on patented formulations or unique technologies licensed from external entities, those licensors gain considerable leverage. Their terms, including royalty rates and renewal conditions, directly impact Beiersdorf's cost structure and operational continuity.

For instance, a specialized active ingredient crucial for a premium skincare line might be exclusively licensed. The supplier of this ingredient, controlling the patent, can dictate pricing and terms, knowing Beiersdorf has few alternatives. This dependency grants the supplier substantial bargaining power, potentially affecting Beiersdorf's profit margins and its ability to maintain competitive product pricing.

- Supplier Leverage: Dependence on licensed IP grants suppliers significant control over pricing and terms.

- Cost Impact: Royalty payments and renewal fees directly affect Beiersdorf's operational costs.

- Competitive Risk: Exclusive licensing can limit Beiersdorf's product innovation and market competitiveness.

Beiersdorf's bargaining power with its suppliers is influenced by the concentration of suppliers for its diverse raw materials, ranging from common chemicals to specialized ingredients. While Beiersdorf's scale offers some leverage, reliance on niche suppliers for premium or patented components, particularly in its skincare lines and the tesa segment, can shift power to those providers. This dynamic is amplified when suppliers possess proprietary knowledge or face limited competition, as seen in the specialty chemicals market in 2024.

The logistics sector also presents a variable level of supplier bargaining power for Beiersdorf. Fluctuations in global shipping rates, as observed in 2024 with ocean freight remaining a significant cost factor, empower logistics providers. Furthermore, the availability of skilled labor, especially specialized R&D talent, can increase wage pressures, enhancing the bargaining position of employees and their representatives, a trend noted in European manufacturing in 2024.

Intellectual property licensing represents another area where supplier bargaining power can be substantial. When Beiersdorf depends on patented formulations or exclusive technologies, licensors can dictate terms, impacting Beiersdorf's costs and competitive flexibility. This is particularly relevant for unique active ingredients in high-end skincare, where finding alternatives is costly and time-consuming.

What is included in the product

This analysis delves into the competitive forces impacting Beiersdorf, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes within the skincare and personal care market.

Visualize competitive intensity with a dynamic force field analysis, instantly highlighting areas of strategic vulnerability and opportunity.

Customers Bargaining Power

Beiersdorf faces substantial bargaining power from its customers, particularly large retail chains and dominant e-commerce platforms. These powerful entities, by virtue of their sheer purchasing volume, can significantly influence pricing, demand promotional support, and dictate payment terms. For instance, in 2024, major European grocery retailers like Schwarz Group (Lidl, Kaufland) and Tesco in the UK, which are key channels for Beiersdorf's Nivea and Eucerin brands, often leverage their market share to negotiate better margins.

This customer power translates into intense pressure on Beiersdorf to offer competitive pricing and invest in cooperative advertising or in-store promotions to secure prominent shelf space and visibility. The need to satisfy these large buyers can also impact Beiersdorf's product development and marketing strategies, as retailers may demand specific product variations or promotional campaigns tailored to their customer base.

In the mass-market skincare and personal care sectors, where Beiersdorf's Nivea brand is a major player, customers often pay close attention to prices. This is particularly true for everyday items. For instance, in 2023, the global skincare market saw significant growth, but price remained a key factor for consumers, especially in emerging economies.

With so many brands available and simple ways to compare prices, Beiersdorf faces a challenge in increasing its prices. Doing so could easily lead to fewer sales or a loss of market share. This dynamic is amplified during economic slowdowns, as consumers become even more cautious with their spending.

Beiersdorf enjoys robust brand loyalty for its iconic brands like Nivea, a significant factor in mitigating customer power. However, the personal care market is flooded with alternatives, from direct competitors to readily available private label options, which naturally strengthens the bargaining power of customers.

The ease with which consumers can switch between brands, especially in the personal care segment where switching costs are typically low, means they can readily explore other options if they find a better price or perceive greater value elsewhere. This constant availability of choices empowers consumers to demand more.

For instance, in 2024, the global skincare market, a key area for Beiersdorf, saw continued growth, with an increasing number of brands, including those offering more affordable alternatives, vying for consumer attention. This competitive landscape directly translates to customers having more leverage.

Information Accessibility and Online Reviews

The widespread availability of product information through online reviews and social media significantly boosts customer bargaining power. Consumers can easily compare Beiersdorf's product efficacy, ingredient lists, and pricing against competitors, leading to more informed choices and a greater ability to negotiate or switch brands if dissatisfied. For instance, a 2024 report indicated that over 85% of consumers consult online reviews before making a purchase in the beauty and personal care sector, directly impacting brand loyalty and pricing sensitivity.

This enhanced transparency forces companies like Beiersdorf to be more competitive on price and quality. Consumers can readily access detailed insights into product performance and user experiences, creating a more level playing field. This accessibility directly translates into increased customer leverage, as they are less reliant on brand marketing alone and more on collective consumer intelligence.

- Information Accessibility: Consumers have unprecedented access to product details and competitor comparisons online.

- Online Reviews and Social Media: Platforms like Reddit, Instagram, and dedicated review sites are crucial for consumer decision-making.

- Impact on Bargaining Power: Increased transparency empowers consumers to demand better value, influencing pricing and product development.

- 2024 Consumer Behavior: Over 85% of consumers use online reviews, highlighting the direct influence on purchasing decisions and brand loyalty.

Growth of Private Labels and Discount Retailers

The growing sophistication and market penetration of private label brands, often positioned as direct alternatives to established names but at lower prices, significantly bolster customer bargaining power. This trend is particularly evident in the beauty and personal care sector, where retailers are increasingly developing their own high-quality, value-driven offerings.

The proliferation of discount retailers and online marketplaces further amplifies this effect. These channels provide consumers with readily accessible, more affordable options, forcing companies like Beiersdorf to carefully consider their pricing strategies. For instance, in 2024, the global discount retail market continued its robust growth, with many players expanding their private label assortments. This competitive landscape means customers have more choices than ever, directly impacting Beiersdorf's ability to command premium pricing.

- Increased Private Label Penetration: Retailers are investing more in developing and marketing their own brands, often achieving significant market share in key categories.

- Price Sensitivity: Consumers are increasingly seeking value, making them more responsive to lower-priced alternatives, including private labels.

- Online Retailer Influence: E-commerce platforms facilitate price comparisons and the discovery of discount brands, intensifying pressure on established players.

- Impact on Beiersdorf: Beiersdorf must balance brand equity with competitive pricing to retain market share against these growing customer-centric forces.

The bargaining power of customers for Beiersdorf is considerable, driven by market concentration among large retailers and the increasing transparency available to consumers. These powerful buyers can exert significant pressure on pricing and promotional terms. For example, in 2024, major European retailers like Rewe Group and Carrefour, key distribution partners for Beiersdorf, often utilize their scale to negotiate favorable terms, impacting Beiersdorf's margins.

The ease of price comparison online and the proliferation of private label brands further empower consumers. In 2024, the global beauty market continued to see a rise in private label penetration, with many retailers expanding their offerings to compete directly with established brands like Nivea. This trend, coupled with consumer reliance on online reviews—over 85% in 2024 consult them before beauty purchases—means Beiersdorf must remain highly competitive on both price and perceived value to maintain its market position.

| Factor | Impact on Beiersdorf | 2024 Data/Trend |

|---|---|---|

| Retailer Concentration | Increased negotiation power for large chains | Major European retailers (e.g., Schwarz Group, Rewe) leverage scale |

| Price Transparency | Consumers easily compare prices online | Widespread use of online price comparison tools |

| Private Labels | Direct competition with lower-priced alternatives | Growing market share for retailer-owned brands in beauty |

| Consumer Information Access | Empowered consumers rely on reviews and social media | Over 85% of consumers use online reviews before purchase |

Full Version Awaits

Beiersdorf Porter's Five Forces Analysis

This preview showcases the comprehensive Beiersdorf Porter's Five Forces Analysis, detailing the competitive landscape of the skincare and cosmetics industry. The document you see is precisely what you will receive immediately after purchase, offering an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, all professionally formatted and ready for your strategic use.

Rivalry Among Competitors

Beiersdorf faces formidable competition from global powerhouses like L'Oréal, Unilever, Procter & Gamble, and Estée Lauder. These giants command substantial financial muscle, diverse product lines, and established worldwide distribution, fueling a constant battle for consumer attention and market share across all product categories.

The skincare and personal care market, especially in developed nations, is notably mature and saturated, featuring a dense field of well-established companies. This intense competition often fuels aggressive marketing efforts, a constant drive for product innovation, and sometimes price wars as companies vie for market share. In this landscape, differentiation is absolutely crucial for survival and growth.

Competitors in the skincare and personal care market, including Beiersdorf's rivals, are locked in a fierce race for differentiation. They pour substantial resources into research and development, aiming to launch innovative formulations, novel active ingredients, and enhanced product benefits. For instance, L'Oréal, a major competitor, reported a significant investment in R&D, with its research and innovation expenditure reaching €1.1 billion in 2023, underscoring the industry's commitment to product advancement.

Beiersdorf's success hinges on its capacity for continuous innovation and its skill in articulating the distinct advantages of its brands. This is particularly vital in a sector highly susceptible to evolving consumer preferences and demands for efficacy. The company's ability to stay ahead of these trends through R&D is a cornerstone of its competitive edge, necessitating substantial and sustained investment in this area.

Marketing and Advertising Intensity

Beiersdorf's competitive rivalry is significantly influenced by marketing and advertising intensity. Building and maintaining strong brand recognition and consumer loyalty, especially for iconic brands like Nivea, necessitates substantial and continuous investment in marketing and advertising. Competitors with deeper pockets can escalate rivalry by outspending rivals, making it harder for Beiersdorf to capture consumer attention and maintain brand visibility.

Effective campaigns are crucial for differentiation in a crowded market. For instance, in 2023, Beiersdorf reported a significant portion of its revenue dedicated to marketing and sales efforts to support its diverse brand portfolio. This high level of expenditure is a direct response to the intense competitive landscape where brand perception and consumer engagement are paramount.

- Brand Strength: Iconic brands like Nivea require sustained, high-volume marketing to maintain their market position.

- Competitive Spending: Competitors with larger marketing budgets can create an uneven playing field, impacting market share.

- Campaign Effectiveness: The success of marketing initiatives directly influences Beiersdorf's ability to attract and retain customers.

- Market Share Impact: Intense advertising battles can lead to price wars or reduced profit margins if not managed strategically.

Strategic Acquisitions and Portfolio Expansion

The competitive rivalry within the skincare and personal care industry is intensified by strategic acquisitions and portfolio expansions. Major players frequently engage in mergers and acquisitions to broaden their product portfolios, penetrate new geographical markets, or secure niche brands, thereby enhancing their competitive standing. This constant strategic maneuvering demands that Beiersdorf maintain agility and a proactive approach to competitor activities.

In 2024, the consumer goods sector, which includes personal care, saw significant M&A activity. For instance, Procter & Gamble continued its portfolio optimization, while Unilever also pursued strategic divestitures and acquisitions to sharpen its focus. These moves directly impact Beiersdorf by altering the competitive landscape and potentially introducing new threats or opportunities.

- Strategic Acquisitions: Companies like L'Oréal and Estée Lauder are consistently active in acquiring smaller, innovative brands to bolster their market presence and access new consumer segments.

- Portfolio Expansion: Expanding product lines into adjacent categories or acquiring complementary brands allows competitors to offer a more comprehensive range of solutions to consumers.

- Market Dynamics: These actions create a dynamic environment where Beiersdorf must continuously assess competitor strategies, such as the reported significant investment by a major competitor into a new sustainable product line in early 2025, to maintain its competitive edge.

The competitive rivalry in the skincare and personal care market is exceptionally fierce, driven by global giants like L'Oréal and Unilever who possess vast financial resources and extensive global reach. This intense competition necessitates continuous innovation and significant marketing investment from Beiersdorf to maintain brand visibility and consumer loyalty.

Beiersdorf's ability to differentiate its products and effectively communicate brand value is paramount in this saturated market. For example, L'Oréal's substantial R&D expenditure of €1.1 billion in 2023 highlights the industry's commitment to product advancement, a trend Beiersdorf must actively participate in to remain competitive.

The intensity is further amplified by aggressive marketing campaigns and strategic acquisitions. Beiersdorf itself allocated a significant portion of its revenue to marketing and sales in 2023 to support its brands, a direct response to competitors who can outspend rivals on advertising. Strategic M&A activity, like Procter & Gamble's portfolio optimization in 2024, continuously reshapes the competitive landscape.

| Competitor | 2023 R&D Spend (Approx.) | Key Strategy |

|---|---|---|

| L'Oréal | €1.1 billion | Innovation, Acquisitions |

| Unilever | N/A (Part of broader FMCG) | Portfolio Optimization |

| Procter & Gamble | N/A (Part of broader FMCG) | Portfolio Optimization |

| Estée Lauder | N/A (Focus on premium brands) | Acquisitions, Brand Development |

SSubstitutes Threaten

The increasing demand for natural, organic, and 'clean beauty' products poses a considerable threat of substitution for Beiersdorf's traditional skincare offerings. Consumers are actively seeking formulations with fewer synthetic ingredients and more sustainable sourcing, a trend amplified by heightened awareness of ingredient transparency.

Numerous nimble smaller brands and emerging startups are capitalizing on this shift, offering specialized alternatives that directly compete with Beiersdorf's established product lines. For instance, the global clean beauty market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating a substantial and expanding consumer base prioritizing these attributes.

For basic skincare needs, some consumers turn to do-it-yourself (DIY) or homemade remedies using common household ingredients like oils, herbs, or fruits. This segment, though smaller, acts as a low-cost substitute for certain cosmetic products, appealing to environmentally conscious or budget-minded individuals. For instance, a 2023 survey indicated that roughly 15% of consumers in the beauty sector had experimented with DIY skincare solutions at least once in the past year.

For certain skin conditions and aesthetic goals, consumers may opt for medical treatments, dermatological procedures like laser therapy or injectables, or prescription drugs instead of over-the-counter skincare. This poses a threat, especially to Beiersdorf's Eucerin brand, as individuals with severe issues might bypass topical solutions for clinical interventions.

The global medical aesthetics market, a key area of substitution, was valued at approximately USD 15.2 billion in 2023 and is projected to grow significantly. For instance, the demand for non-invasive cosmetic procedures, which directly substitute for some skincare product benefits, saw a substantial increase in 2024, with millions of procedures performed worldwide.

Generic and Private Label Brands

The increasing availability of generic and private label brands presents a significant threat of substitutes for Beiersdorf. These offerings, particularly prevalent in personal care, often mirror the functional benefits of established brands but at a considerably lower cost. This price advantage allows them to attract consumers, especially in segments where brand loyalty is less pronounced or price sensitivity is high, thereby eroding market share from Beiersdorf's portfolio.

For instance, in the European market, private label penetration in the beauty and personal care sector has seen steady growth. By the end of 2023, private labels accounted for approximately 20% of sales in the German drugstore channel, a key market for Beiersdorf. This trend is expected to continue into 2024, driven by ongoing inflation and consumer focus on value.

- Private Label Growth: Retailers are expanding their private label ranges, offering direct competition to brands like Nivea and Eucerin.

- Price Sensitivity: Lower price points of substitutes appeal to a growing segment of consumers seeking value, especially for everyday personal care items.

- Market Share Erosion: In 2024, it's estimated that private labels could capture an additional 1-2% of market share in certain European personal care categories, directly impacting established players.

- Functional Equivalence: Many substitute products provide comparable functional benefits, making the choice between a premium brand and a private label less about performance and more about cost.

Lifestyle Changes and Holistic Wellness

The increasing consumer focus on holistic wellness presents a significant threat of substitutes for traditional skincare brands like Beiersdorf. This shift prioritizes internal health factors such as diet, exercise, and stress management as the primary determinants of skin health. Consequently, consumers may perceive less need for topical skincare products, impacting demand.

This broader substitute threat is evident in the growing market for wellness services and products that support internal health. For instance, the global wellness market was valued at approximately $5.6 trillion in 2023 and is projected to grow, indicating a significant allocation of consumer spending towards these alternative approaches to health and beauty.

- Holistic Wellness Trend: Consumers increasingly view diet, exercise, and stress management as key to skin health, reducing reliance on topical products.

- Market Shift: The global wellness market's substantial growth, reaching trillions of dollars, signifies a diversion of consumer spending away from traditional product categories.

- Reduced Perceived Need: This mindset shift can diminish the perceived necessity of specific skincare products, impacting Beiersdorf's market share.

The threat of substitutes for Beiersdorf is multifaceted, encompassing everything from DIY solutions to advanced medical treatments and the growing influence of private labels. Consumers are increasingly exploring alternatives that offer perceived value, natural ingredients, or direct solutions to specific skin concerns, potentially diverting spending away from Beiersdorf's core offerings.

The rise of clean beauty and a holistic wellness approach means consumers are looking beyond traditional skincare. This shift is significant, as the global wellness market reached approximately $5.6 trillion in 2023, demonstrating a substantial consumer interest in internal health as a driver of skin appearance.

Furthermore, the affordability and functional equivalence of private label brands, which captured around 20% of sales in the German drugstore channel by late 2023, pose a direct competitive challenge. These substitutes appeal to price-sensitive consumers, especially as inflation continues to influence purchasing decisions through 2024.

| Substitute Category | Key Characteristics | Market Data/Trend | Impact on Beiersdorf |

| Clean/Natural Beauty | Fewer synthetic ingredients, sustainable sourcing | Global market valued at ~$50 billion in 2023, with strong projected growth. | Challenges traditional formulations; requires innovation in ingredient sourcing and marketing. |

| DIY Skincare | Homemade remedies, natural ingredients | ~15% of beauty consumers experimented with DIY in 2023. | Low-cost alternative for basic needs; appeals to niche eco-conscious segment. |

| Medical Aesthetics | Dermatological procedures, injectables | Global medical aesthetics market ~$15.2 billion in 2023; non-invasive procedures saw significant 2024 demand increase. | Directly competes for severe skin concerns, potentially bypassing topical solutions. |

| Private Labels | Lower price, functional equivalence | 20% market share in German drugstores by end of 2023; expected 1-2% additional capture in 2024 in some categories. | Erodes market share through price advantage, especially for everyday items. |

| Holistic Wellness | Diet, exercise, stress management for skin health | Global wellness market ~$5.6 trillion in 2023. | Reduces perceived need for topical products by prioritizing internal factors. |

Entrants Threaten

Establishing a significant presence in the global personal care market, especially with a broad product range similar to Beiersdorf's, demands considerable capital. This includes setting up advanced manufacturing plants, investing heavily in research and development for innovative products, and building a resilient global supply chain. For instance, in 2023, Beiersdorf reported €9.35 billion in sales, underscoring the scale of operations required to compete effectively.

These substantial upfront financial commitments create a formidable barrier to entry. Potential new players must have access to significant funding to even begin competing, effectively limiting the number of companies that can realistically challenge established firms like Beiersdorf.

Beiersdorf benefits from decades of brand building, fostering deep-seated consumer trust, particularly with global icons like Nivea. This strong brand loyalty acts as a significant barrier, making it incredibly difficult for newcomers to replicate the same level of recognition and affinity.

New entrants face an immense challenge in cultivating similar brand recognition and loyalty. This requires massive, sustained marketing expenditures and a prolonged period of market presence to even begin to compete with Beiersdorf's established equity.

For instance, Nivea, a flagship Beiersdorf brand, consistently ranks among the top skincare brands globally. In 2024, Nivea's brand value was estimated to be in the billions of dollars, a testament to its enduring heritage and consumer connection, which new entrants cannot easily surmount.

Beiersdorf's established global distribution networks, encompassing major retail chains, pharmacies, and e-commerce platforms, represent a significant barrier to entry. Newcomers find it incredibly challenging to replicate this extensive reach, often needing substantial capital to build similar infrastructure or facing higher costs when relying on third-party logistics.

Securing prime shelf space in crowded retail environments is another hurdle. In 2024, the dominance of established brands like Nivea and Eucerin in key markets means new entrants must invest heavily in marketing and promotional activities to gain visibility and convince retailers to allocate valuable space.

Regulatory Hurdles and Compliance Complexity

The personal care sector faces substantial barriers to entry due to complex and varied regulatory landscapes. Companies must navigate stringent health, safety, and labeling requirements that differ globally, demanding significant investment in legal and compliance expertise. For instance, in 2024, the European Union's Cosmetic Regulation (EC) No 1223/2009 continues to set a high bar for product safety and ingredient disclosure, a process that can take years and substantial resources for new entrants to master.

Obtaining necessary approvals and maintaining ongoing compliance in markets like the United States, under the FDA's purview, or China, with its rigorous NMPA regulations, represents a considerable financial and temporal challenge. This complexity acts as a powerful deterrent, shielding established players like Beiersdorf who possess the infrastructure and experience to manage these requirements effectively.

- Regulatory Complexity: Navigating diverse international health, safety, and labeling laws.

- Approval Processes: Time-consuming and costly procedures for product market entry.

- Compliance Costs: Significant investment needed for legal, testing, and ongoing adherence.

- Expertise Requirement: Deep knowledge of regulatory frameworks is essential for success.

Economies of Scale and Cost Advantages

Large incumbents like Beiersdorf benefit from significant economies of scale in raw material procurement, manufacturing, and global marketing. For instance, Beiersdorf's extensive global distribution network in 2024 allows for bulk purchasing, driving down per-unit costs significantly compared to a new entrant. This cost advantage makes it challenging for newcomers to match Beiersdorf's pricing without incurring substantial initial losses, thus acting as a considerable barrier to entry.

These scale advantages translate into lower per-unit costs across the value chain. Beiersdorf's established manufacturing facilities, operating at high capacity, achieve greater efficiency than smaller, newly built plants. This cost disparity is a major barrier, as new entrants would need to invest heavily to achieve comparable production volumes and cost efficiencies.

- Economies of Scale: Beiersdorf leverages massive production volumes to reduce per-unit manufacturing costs.

- Procurement Power: Bulk purchasing of raw materials provides significant cost savings.

- Marketing Efficiency: Established global marketing reach spreads fixed advertising costs over a larger sales base.

- Competitive Pricing: Lower cost structures enable incumbents to offer more competitive pricing, deterring new entrants.

The threat of new entrants in the personal care market, where Beiersdorf operates, is generally considered moderate. While the industry offers attractive profit margins, significant capital investment for manufacturing, research, and global distribution acts as a substantial barrier. For example, Beiersdorf's 2023 sales of €9.35 billion highlight the scale of operations required. Furthermore, established brands like Nivea, with billions in brand value as of 2024, command strong consumer loyalty, making it difficult for newcomers to gain traction without massive marketing outlays.

Regulatory hurdles, including stringent health and safety standards like the EU's Cosmetic Regulation (EC) No 1223/2009, demand considerable investment in compliance and legal expertise. Navigating these complex requirements across different markets, such as the US FDA and China's NMPA, further deters new players. Economies of scale enjoyed by incumbents like Beiersdorf, particularly in procurement and marketing, also create a cost advantage that new entrants struggle to match, impacting their ability to compete on price.

| Barrier Type | Description | Impact on New Entrants | Beiersdorf Example (2023/2024 Data) |

| Capital Requirements | High costs for manufacturing, R&D, and distribution. | Significant financial hurdle. | €9.35 billion in sales indicates substantial operational scale. |

| Brand Loyalty | Strong consumer trust and recognition for established brands. | Difficult to replicate; requires extensive marketing. | Nivea's brand value in the billions (2024) demonstrates deep consumer connection. |

| Regulatory Complexity | Navigating diverse global health and safety laws. | Demands significant legal and compliance investment. | Adherence to EU Cosmetic Regulation (EC) No 1223/2009 and other international standards. |

| Economies of Scale | Cost advantages from large-scale production and procurement. | New entrants face higher per-unit costs. | Global distribution network enables bulk purchasing and marketing efficiency. |

Porter's Five Forces Analysis Data Sources

Our Beiersdorf Porter's Five Forces analysis is built upon a foundation of diverse and credible data sources, including Beiersdorf's official annual reports, investor presentations, and SEC filings.

We augment this internal data with insights from leading market research firms, industry trade publications, and reputable financial news outlets to provide a comprehensive view of the competitive landscape.